公司簡介

| Morrison 評論摘要 | |

| 成立年份 | 2002 |

| 註冊國家/地區 | 澳洲 |

| 監管 | 由ASIC監管 |

| 市場工具 | 現金股票、股票期權、認股權證、ETF、XTB、LIC、LIT和Tracers |

| 模擬帳戶 | ❌ |

| 交易平台 | Iress、TradeCentre、TradeFloor、Refintiv、Bloomberg Terminal |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:1300 130 545 | |

| 電郵:contactus@morrisonsecurities.com | |

| 地址:Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited 是一家多元化的金融服務提供商。自2002年以來,憑藉澳洲監管機構的許可證,它提供了許多交易平台,提供各種交易界面,包括專有和第三方解決方案。

這是該經紀商官方網站的首頁:

優點和缺點

| 優點 | 缺點 |

| 由ASIC監管 | 費用結構不清晰 |

| 多個交易平台 | |

| 多種聯絡方式 | |

| 提供的金融服務 |

Morrison 是否合法?

Morrison 受澳洲證券及投資委員會(ASIC)監管,具有直通處理(STP)許可證編號241737。

| 監管狀態 | 已監管 |

| 監管機構 | 澳洲 |

| 許可機構 | Morrison Securities Pty Limited |

| 許可類型 | 直通處理(STP) |

| 許可證號碼 | 241737 |

我可以在 Morrison 上交易什麼?

Morrison 連接澳大利亞主要交易所,以實現無縫執行。他們是ASX、Cboe Australia、NSX和SSE交易所的成員。他們提供現金股票、股票期權(單支股票和指數在一級和二級)、認股權證、ETF(交易所交易基金)、XTB(交易所交易債券)、LIC(上市投資公司)、LIT(上市投資信託)和Tracers(Cboe Australia美國股票 - 可轉讓保管收據)。

| 交易工具 | 支援 |

| 現金股票 | ✔ |

| 股票期權 | ✔ |

| 認股權證 | ✔ |

| ETF | ✔ |

| 債券 | ✔ |

| 投資信託 | ✔ |

| 股票 | ✔ |

| 外匯 | ❌ |

| 商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

金融服務

Morrison 還提供金融服務,包括財務顧問、財富管理者、活躍交易員、基金經理和金融科技平台,提供API以整合和開發定制的金融科技應用程式。

帳戶

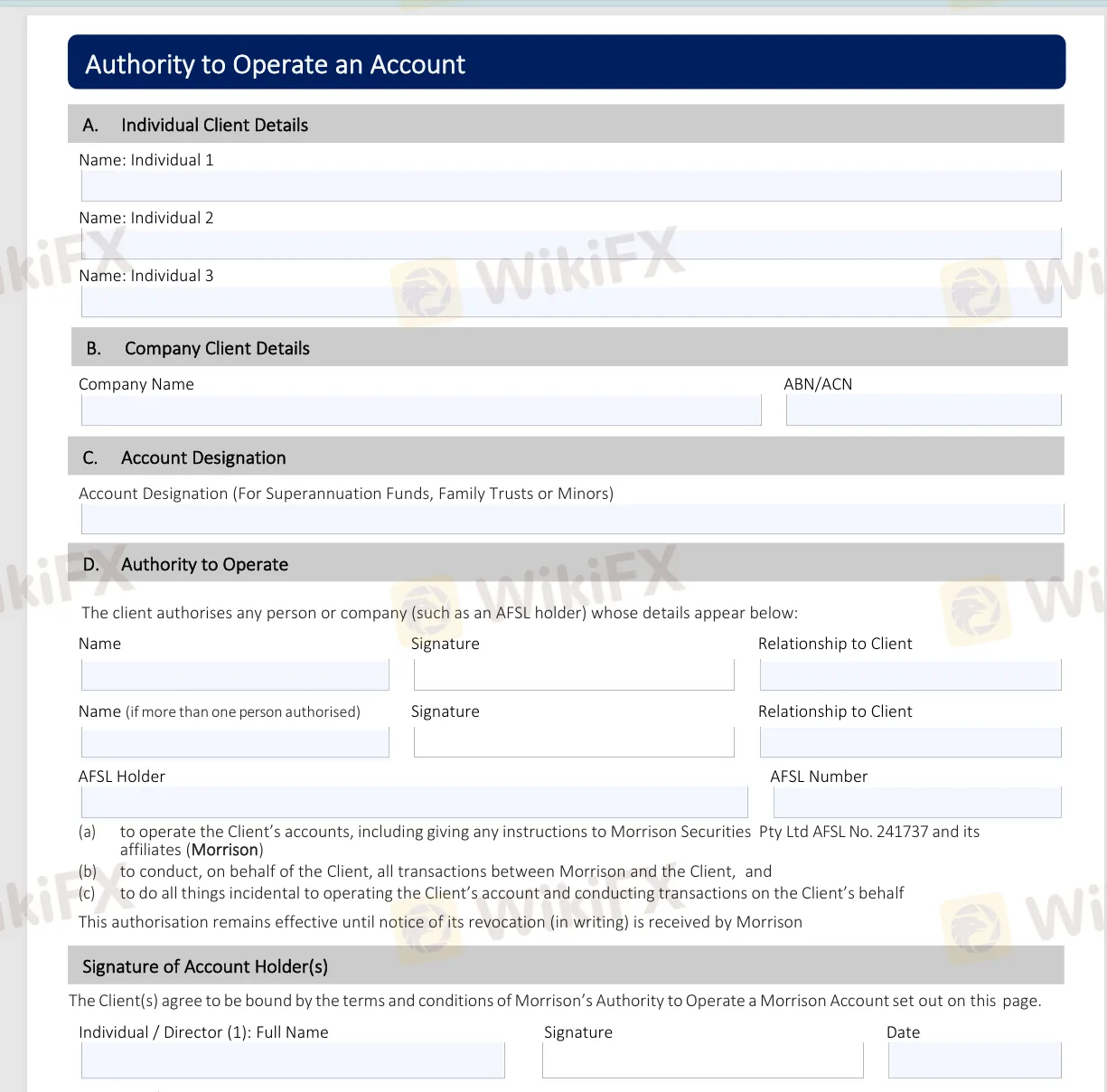

要在Morrison開立帳戶,請填妥他們網站上提供的必要帳戶維護表格。這些表格包括帳戶名稱修改表格、操作帳戶的授權、聯絡詳情更改、收入指示、直接借記請求和100分身份證明清單。填妥表格後,請將其發送至accounts@morrisonsecurities.com。

交易平台

Morrison 提供各種交易平台,包括用於下單、建立監視列表、查看客戶投資組合和高級圖表套件的軟件。他們支援:

| 交易平台 | 支援的組件 |

| Iress | Viewpoint、Web、Pro 版本 |

| TradeCentre | Bourse Analyser、TC Web、TC Wealth |

| TradeFloor | 期權交易和風險管理 |

| Refintiv | Eikon 平台 |

| Bloomberg Terminal | EMSX |

此外,如果您有自己喜歡的平台,他們通過FIX、Web服務和API提供兼容性。