Unternehmensprofil

| Morrison Überprüfungszusammenfassung | |

| Gegründet | 2002 |

| Registriertes Land/Region | Australien |

| Regulierung | Reguliert durch ASIC |

| Marktinstrumente | Bargeldaktien, Aktienoptionen, Optionsscheine, ETFs, XTBs, LICs, LITs und Tracers |

| Demo-Konto | ❌ |

| Handelsplattform | Iress, TradeCentre, TradeFloor, Refintiv, Bloomberg Terminal |

| Mindesteinzahlung | / |

| Kundensupport | Kontaktformular |

| Telefon: 1300 130 545 | |

| E-Mail: contactus@morrisonsecurities.com | |

| Adresse: Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited ist ein vielseitiger Finanzdienstleister. Seit 2002 mit einer Lizenz von australischen Regulierungsbehörden tätig, bietet er viele Handelsplattformen mit verschiedenen Handelsschnittstellen, einschließlich proprietärer und Drittanbieterlösungen.

Hier ist die Homepage der offiziellen Website dieses Brokers:

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch ASIC | Unklare Gebührenstruktur |

| Mehrere Handelsplattformen | |

| Verschiedene Kontaktmöglichkeiten | |

| Bereitgestellte Finanzdienstleistungen |

Ist Morrison seriös?

Morrison wird von der Australian Securities and Investments Commission (ASIC) reguliert, mit Straight Through Processing (STP), Nr. 241737.

| Regulierungsstatus | Reguliert |

| Reguliert durch | Australien |

| Lizenzierte Institution | Morrison Securities Pty Limited |

| Lizenztyp | Straight Through Processing (STP) |

| Lizenznummer | 241737 |

Was kann ich bei Morrison handeln?

Morrison verbindet sich mit den wichtigsten Börsen in Australien für nahtlose Ausführung. Sie sind Mitglied der ASX, Cboe Australia, NSX und SSE Börsen. Sie bieten Barkapital, Aktienoptionen (sowohl Einzelaktien als auch Indexe auf Stufe 1 und Stufe 2), Optionsscheine, ETFs (Exchange Traded Funds), XTBs (Exchange Traded Bonds), LICs (Listed Investment Companies), LITs (Listed Investment Trusts) und Tracers (Cboe Australia US-Aktien - übertragbare Verwahrbelege).

| Handelsinstrumente | Unterstützt |

| Barkapital | ✔ |

| Aktienoptionen | ✔ |

| Optionsscheine | ✔ |

| ETFs | ✔ |

| Anleihen | ✔ |

| Investment Trusts | ✔ |

| Aktien | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

Finanzdienstleistungen

Morrison bietet auch Finanzdienstleistungen wie Finanzberater, Vermögensverwalter, aktive Trader, Fondsmanager und Fintech-Plattformen an, die APIs für die Integration und Entwicklung von maßgeschneiderten Fintech-Anwendungen bereitstellen.

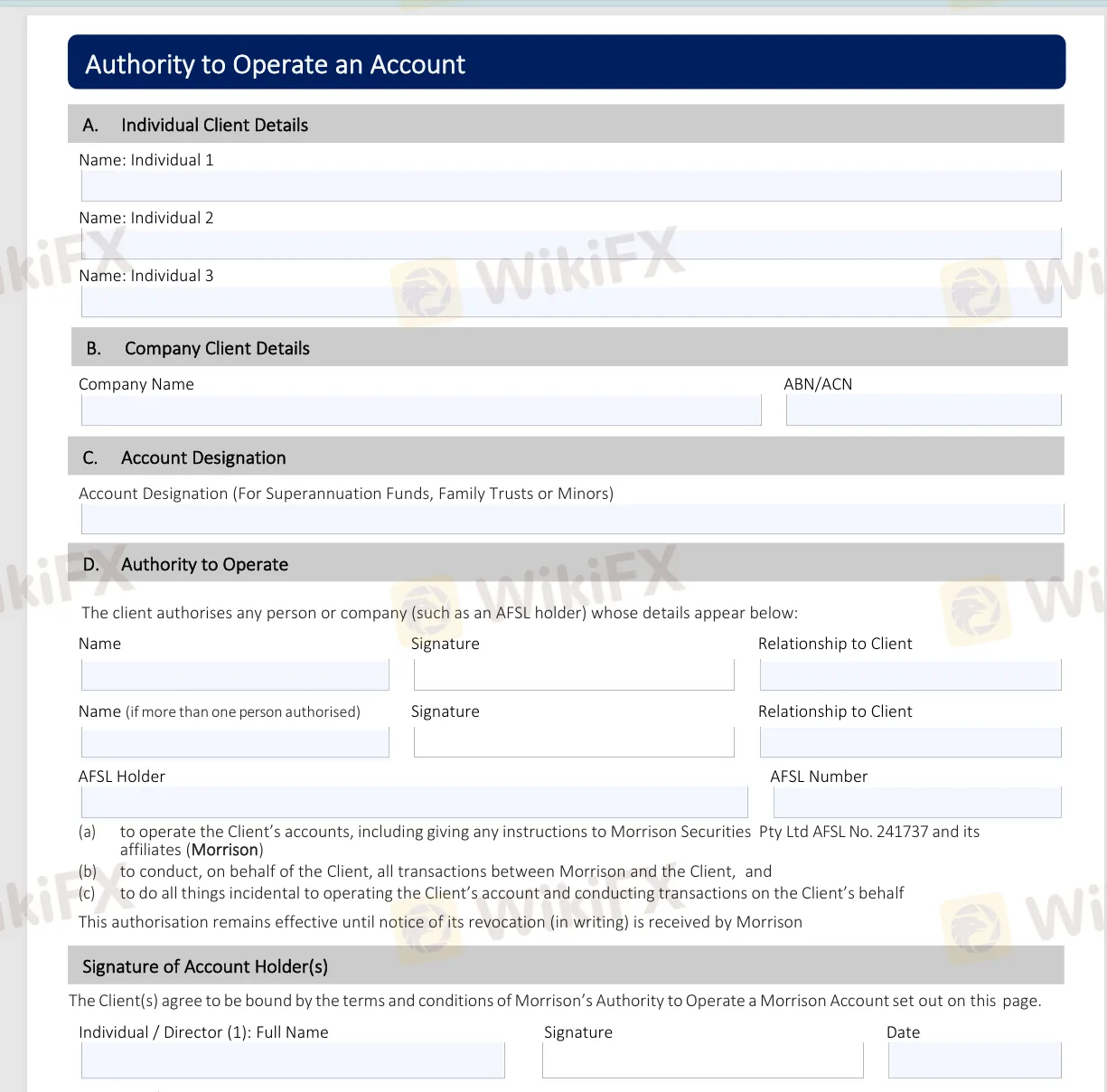

Konto

Um ein Konto bei Morrison zu eröffnen, füllen Sie die erforderlichen Konto-Wartungsformulare auf ihrer Website aus. Diese Formulare umfassen das Formular zur Änderung des Kontonamens, die Berechtigung zur Kontoführung, die Änderung der Kontaktdaten, die Einkommensrichtung, die Einzugsermächtigung und die 100-Punkte-ID-Liste. Nach dem Ausfüllen dieser Formulare senden Sie diese an accounts@morrisonsecurities.com.

Handelsplattform

Morrison bietet verschiedene Handelsplattformen, darunter Software zur Auftragserteilung, Erstellung von Beobachtungslisten, Anzeige von Kundenportfolios und fortschrittliche Charting-Pakete. Sie unterstützen:

| Handelsplattform | Unterstützte Komponenten |

| Iress | Viewpoint, Web, Pro-Versionen |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | Options-Handel und Risikomanagement |

| Refintiv | Eikon-Plattform |

| Bloomberg Terminal | EMSX |

Darüber hinaus bieten sie Kompatibilität durch FIX, Webservices und APIs, wenn Sie Ihre bevorzugte Plattform haben.