Perfil de la compañía

| Morrison Resumen de la reseña | |

| Establecido | 2002 |

| País/Región Registrada | Australia |

| Regulación | Regulado por ASIC |

| Instrumentos de Mercado | Acciones al contado, opciones sobre acciones, warrants, ETF, XTB, LIC, LIT y Tracers |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Iress, TradeCentre, TradeFloor, Refintiv, Terminal Bloomberg |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de contacto |

| Teléfono: 1300 130 545 | |

| Correo electrónico: contactus@morrisonsecurities.com | |

| Dirección: Suite 38.01, Nivel 38, Australia Square Towers, 264 George Street, Sídney, NSW 2000 | |

Morrison Securities Pty Limited es un proveedor de servicios financieros multifacético. Operando con una licencia de los organismos reguladores australianos desde 2002, ofrece muchas plataformas de trading que ofrecen diversas interfaces de trading, incluidas soluciones propietarias y de terceros.

Aquí está la página de inicio del sitio oficial de este bróker:

Pros y Contras

| Pros | Contras |

| Regulado por ASIC | Estructura de tarifas poco clara |

| Múltiples plataformas de trading | |

| Varias formas de contacto | |

| Servicios financieros proporcionados |

¿Es Morrison Legítimo?

Morrison está regulado por la Comisión Australiana de Valores e Inversiones (ASIC), con Procesamiento Directo (STP), No. 241737.

| Estado Regulatorio | Regulado |

| Regulado por | Australia |

| Institución Licenciada | Morrison Securities Pty Limited |

| Tipo de Licencia | Procesamiento Directo (STP) |

| Número de Licencia | 241737 |

¿Qué puedo comerciar en Morrison?

Morrison se conecta a las principales bolsas de Australia para una ejecución sin problemas. Son miembros de las bolsas ASX, Cboe Australia, NSX y SSE. Ofrecen valores de renta variable, opciones sobre acciones (tanto acciones individuales como índices en Nivel 1 y Nivel 2), warrants, ETFs (Fondos Cotizados en Bolsa), XTBs (Bonos Cotizados en Bolsa), LICs (Compañías de Inversión Cotizadas), LITs (Fideicomisos de Inversión Cotizados) y Tracers (Acciones de EE. UU. de Cboe Australia - Recibos de Custodia Transferibles).

| Instrumentos de Trading | Soportado |

| Renta variable | ✔ |

| Opciones sobre acciones | ✔ |

| Warrants | ✔ |

| ETFs | ✔ |

| Bonos | ✔ |

| Fideicomisos de inversión | ✔ |

| Acciones | ✔ |

| Forex | ❌ |

| Productos básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

Servicios Financieros

Morrison también ofrece servicios financieros que incluyen asesores financieros, gestores de patrimonio, traders activos, gestores de fondos y plataformas fintech, que proporcionan APIs para la integración y desarrollo de aplicaciones fintech personalizadas.

Cuenta

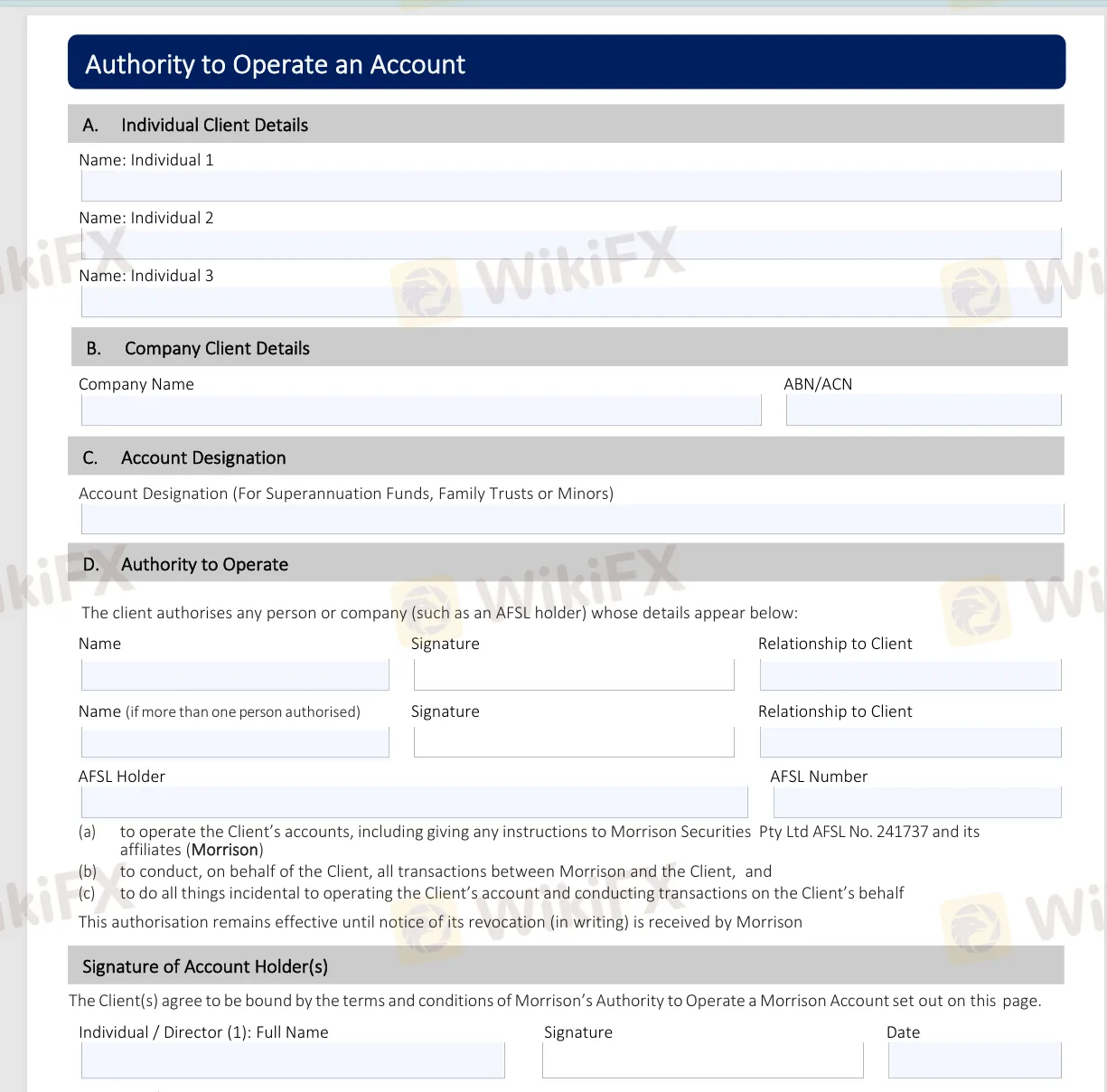

Para abrir una cuenta con Morrison, complete los formularios necesarios de mantenimiento de cuenta disponibles en su sitio web. Estos formularios incluyen el Formulario de Modificación de Nombre de Cuenta, Autorización para Operar una Cuenta, Cambio de Detalles de Contacto, Dirección de Ingresos, Solicitud de Débito Directo y la Lista de ID de 100 Puntos. Una vez completados estos formularios, envíelos a accounts@morrisonsecurities.com.

Plataforma de Trading

Morrison ofrece varias plataformas de trading que incluyen software para realizar pedidos, crear listas de seguimiento, ver carteras de clientes y paquetes avanzados de gráficos. Ellos admiten:

| Plataforma de Trading | Componentes Soportados |

| Iress | Versiones Viewpoint, Web, Pro |

| TradeCentre | Analizador de Bolsa, TC Web, TC Wealth |

| TradeFloor | Trading de opciones y gestión de riesgos |

| Refintiv | Plataforma Eikon |

| Bloomberg Terminal | EMSX |

Además, si tienes tu propia plataforma preferida, ofrecen compatibilidad a través de FIX, Webservices y APIs.