基础信息

澳大利亚

澳大利亚天眼评分

澳大利亚

|

20年以上

|

澳大利亚

|

20年以上

| https://www.morrisonsecurities.com/

官方网址

评分指数

影响力

C

影响力指数 NO.1

澳大利亚 2.98

澳大利亚 2.98 监管信息

监管信息持牌机构:Morrison Securities Pty Limited

监管证号:241737

单核

1G

40G

1M*ADSL

澳大利亚

澳大利亚 morrisonsecurities.com

morrisonsecurities.com 澳大利亚

澳大利亚 未开通VIP

未开通VIP

| Morrison评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | ASIC监管 |

| 市场工具 | 现金股票、股票期权、权证、ETF、XTB、LIC、LIT和Tracers |

| 模拟账户 | ❌ |

| 交易平台 | Iress、TradeCentre、TradeFloor、Refintiv、Bloomberg Terminal |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:1300 130 545 | |

| 电子邮件:contactus@morrisonsecurities.com | |

| 地址:Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison证券有限公司是一家多元化的金融服务提供商。自2002年以来,凭借澳大利亚监管机构的许可,它提供了许多交易平台,提供各种交易界面,包括专有和第三方解决方案。

这是该经纪商官方网站的首页:

| 优点 | 缺点 |

| ASIC监管 | 费用结构不清晰 |

| 多个交易平台 | |

| 多种联系方式 | |

| 提供的金融服务 |

Morrison受澳大利亚证券和投资委员会(ASIC)监管,具有直通处理(STP)编号241737。

| 监管状态 | 已监管 |

| 监管机构 | 澳大利亚 |

| 许可机构 | Morrison证券有限公司 |

| 许可类型 | 直通处理(STP) |

| 许可编号 | 241737 |

Morrison 连接到澳大利亚的主要交易所,以实现无缝执行。他们是ASX、Cboe Australia、NSX和SSE交易所的成员。他们提供现金股票、股票期权(单支股票和指数在一级和二级)、认股权证、ETFs(交易所交易基金)、XTBs(交易所交易债券)、LICs(上市投资公司)、LITs(上市投资信托)和跟踪者(Cboe Australia美国股票 - 可转让托管收据)。

| 交易工具 | 支持 |

| 现金股票 | ✔ |

| 股票期权 | ✔ |

| 认股权证 | ✔ |

| ETFs | ✔ |

| 债券 | ✔ |

| 投资信托 | ✔ |

| 股票 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

Morrison 还提供金融服务,包括财务顾问、财富管理者、活跃交易者、基金经理和金融技术平台,为定制金融技术应用程序的集成和开发提供应用程序接口。

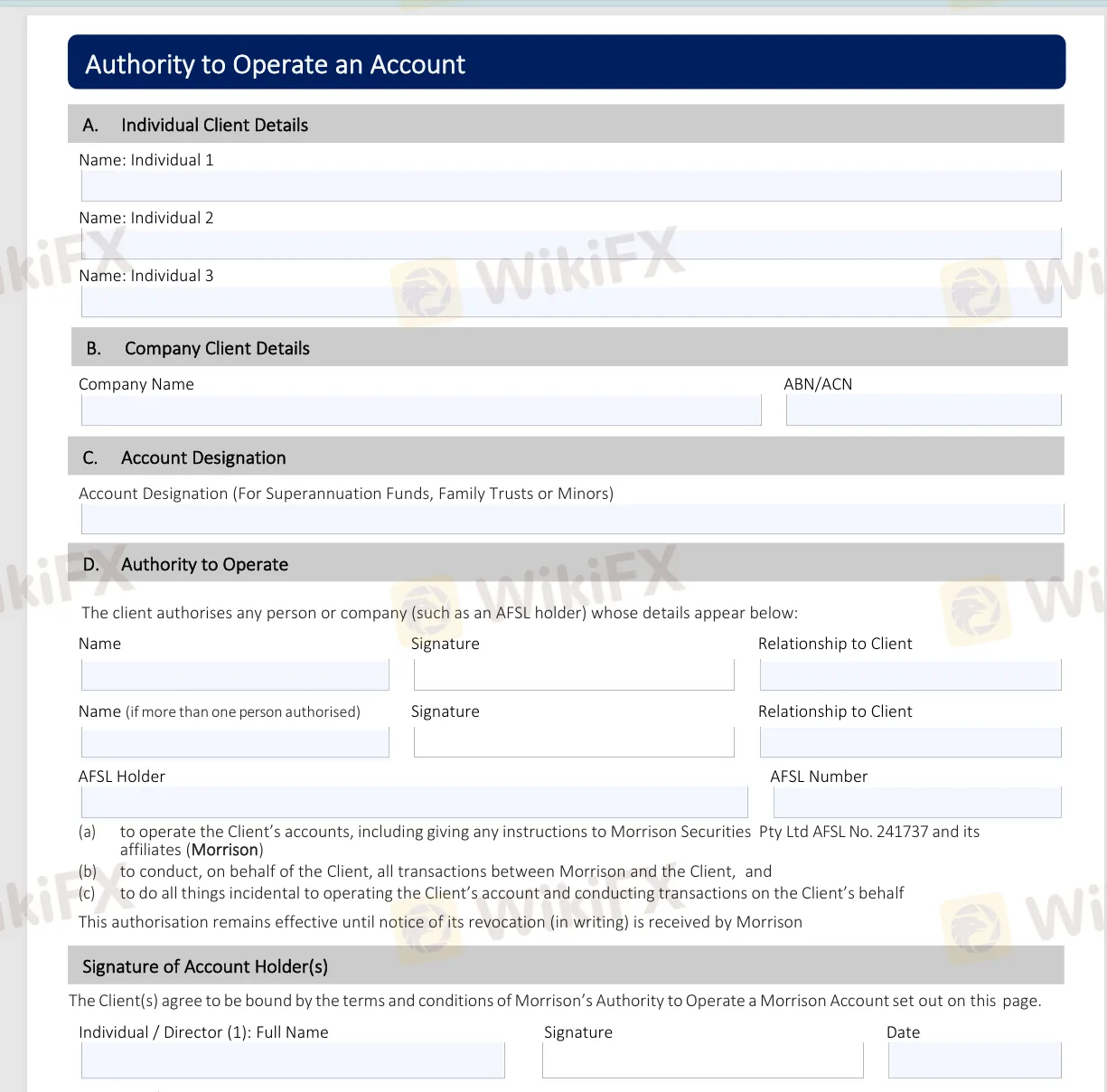

要在Morrison开设账户,请填写他们网站上提供的必要账户维护表格。这些表格包括账户名称修改表格、操作账户的授权、联系方式更改、收入指示、直接借记请求和100点身份证明清单。填写完这些表格后,请发送至账户@morrisonsecurities.com。

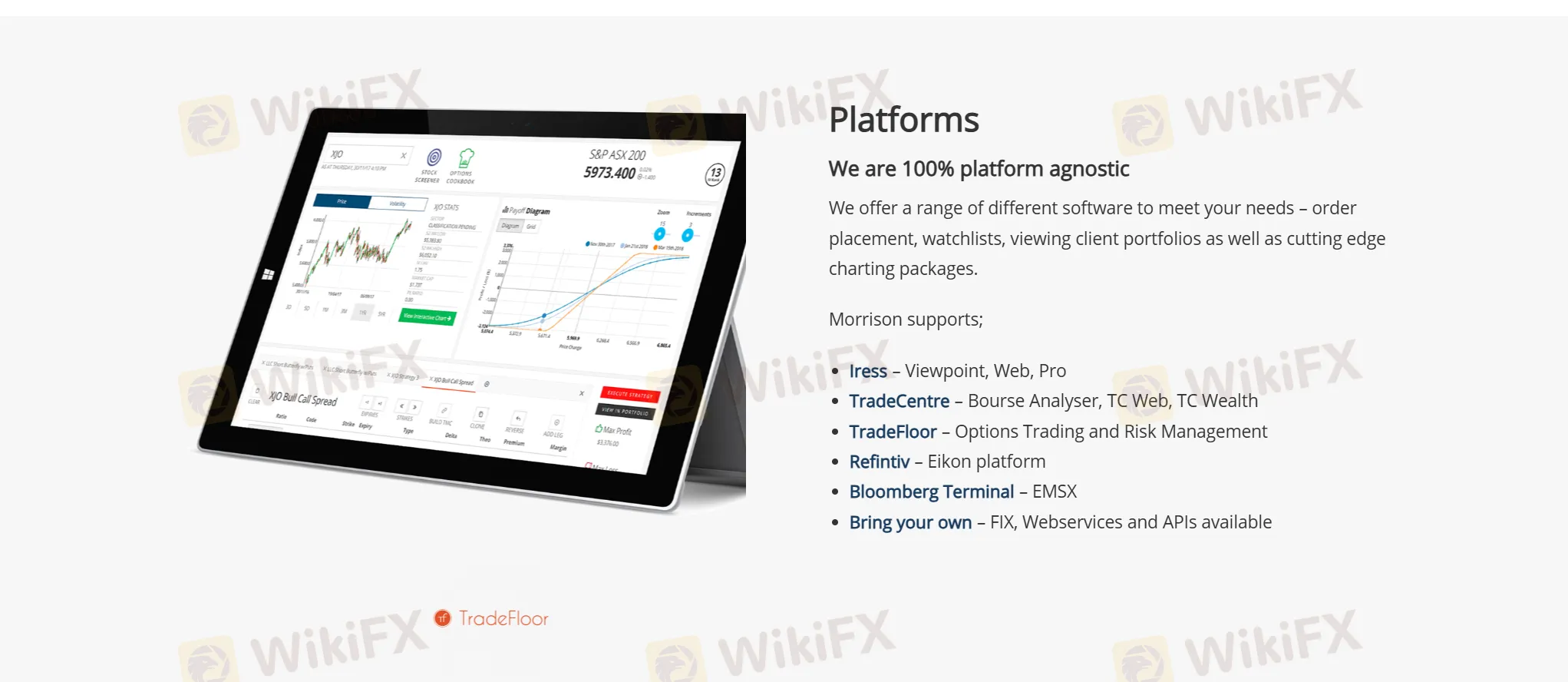

Morrison 提供各种交易平台,包括用于下单、创建监视列表、查看客户投资组合和高级图表包的软件。他们支持:

| 交易平台 | 支持的组件 |

| Iress | Viewpoint、Web、Pro版本 |

| TradeCentre | Bourse Analyser、TC Web、TC Wealth |

| TradeFloor | 期权交易和风险管理 |

| Refintiv | Eikon平台 |

| Bloomberg Terminal | EMSX |

此外,如果您有自己偏好的平台,他们通过FIX、Webservices和应用程序接口提供兼容性。

From my experience evaluating brokers, Morrison differs from many typical forex or CFD brokers by not offering standard retail account types such as "Standard," "Pro," or "ECN." Instead, opening an account requires filling out detailed forms addressing account maintenance, naming, operational authority, and identity verification. This process is much more formal than I'm used to and signals that Morrison primarily caters to professional market participants or institutions rather than casual individual traders. Because Morrison operates under strict Australian regulation (ASIC) and boasts over two decades in business, I am reassured by their procedures for account setup and compliance. However, I found no explicit breakdown of different tiered accounts with varied features, minimum deposits, or commission structures. The focus is instead on providing robust market access and relevant interfaces—like Iress, TradeCentre, and Bloomberg Terminal—rather than differentiating retail accounts. For me, this structure means less emphasis on promotional account perks and more on compliance, market connectivity, and institutional-grade tools. I would advise that anyone interested in Morrison should expect a more hands-on onboarding process and potentially fewer consumer-focused features compared to mainstream retail forex brokers. This approach suits professional or institutional clients, but those seeking distinct retail account types may not find what they're looking for here.

As a trader with a focus on due diligence and regulatory transparency, I always pay close attention to minimum deposit requirements before opening an account. For Morrison Securities, after thoroughly examining all available information, I could not identify a specific minimum deposit amount explicitly listed on either their official documentation or in their publicly available materials. This absence of clear guidance on the minimum funding required concerns me because transparent fee and deposit structures are important for informed decision-making and risk management. In my experience, brokers regulated by the Australian Securities and Investments Commission (ASIC), like Morrison, typically follow strict client fund protection rules. However, the lack of a published minimum deposit means I would need to reach out directly to their support to obtain factual, up-to-date information before considering account opening. This step is critical to avoid unexpected hurdles or misalignment with my trading capital plans. Overall, for traders who, like me, require clarity and certainty before committing funds, I recommend contacting Morrison directly through their published communication channels to confirm the minimum deposit requirement prior to account application. This approach aligns with a cautious and responsible attitude toward starting any trading relationship.

Based on my research and direct examination of Morrison's available information, I have not been able to establish the presence of an ECN or raw spread account structure typical to many forex-focused brokers. Morrison operates as a licensed and regulated entity under ASIC and utilizes Straight Through Processing (STP) execution, which speaks well for its transparency in order flows. However, from the data I reviewed, Morrison does not explicitly specialize in forex trading nor offer the familiar tiers of forex-specific accounts such as ECN or raw spread models. The instruments supported are primarily Australian cash equities, equity options, ETFs, bonds, investment trusts, and related securities—not forex pairs. Furthermore, their fee structure is not clearly laid out on public channels, which introduces some ambiguity regarding per-trade costs. This lack of transparency, especially around commissions or spreads for any account type, is something I always view cautiously. In my experience, for any broker catering to active traders, clear information about commission per lot or per trade is crucial for planning and risk management. Without explicit reference to these account types or commission schedules, I cannot confirm the existence or terms of ECN or raw spread accounts with Morrison. For anyone considering opening an account with them, I would strongly advise reaching out to their client service to seek written clarification and demand full disclosure of fees before making any funding decisions. This kind of due diligence is important for safeguarding trading capital.

From my experience scrutinizing brokers, transparency around fees—especially on deposits and withdrawals—is essential for trust. With Morrison, my research found that their fee structure is not clearly outlined, which raises a caution flag for me. The available official and regulatory information highlights Morrison’s long-standing ASIC regulation and over two decades in business, factors that often suggest a decent operational standard. However, when it comes to specifics about funding and withdrawal fees, there is a notable lack of detailed disclosure. As a trader, I always want to know in advance the complete cost structure I will face, including any hidden or unexpected charges related to moving money in or out of my trading account. Unfortunately, Morrison’s documentation does not provide clear answers about these potential fees. That ambiguity means I cannot definitively say whether undisclosed fees exist, but the lack of clarity itself is something I approach with caution. In my experience, reputable brokers are usually upfront about all charges, so I would recommend contacting their support directly and requesting explicit information on all associated funding and withdrawal fees before proceeding. For me, this level of due diligence is important in protecting my capital and maintaining trust in my brokerage relationships.

请输入...