회사 소개

| Morrison 리뷰 요약 | |

| 설립 연도 | 2002 |

| 등록 국가/지역 | 호주 |

| 규제 | ASIC 규제 |

| 시장 상품 | 현금 주식, 주식 옵션, 워런트, ETF, XTB, LIC, LIT 및 추적자 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | Iress, TradeCentre, TradeFloor, Refintiv, Bloomberg Terminal |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: 1300 130 545 | |

| 이메일: contactus@morrisonsecurities.com | |

| 주소: Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited는 다양한 금융 서비스를 제공하는 공급업체입니다. 2002년 이후 호주 규제 기관으로부터 라이선스를 취득하여, 독점 및 제3자 솔루션을 포함한 다양한 거래 인터페이스를 제공하는 많은 거래 플랫폼을 제공합니다.

이 중개업체의 공식 사이트 홈페이지는 다음과 같습니다:

장단점

| 장점 | 단점 |

| ASIC 규제 | 수수료 구조 불명확 |

| 다양한 거래 플랫폼 | |

| 연락 방법 다양 | |

| 제공되는 금융 서비스 |

Morrison은 신뢰할 만한가요?

Morrison은 호주 증권 거래 위원회 (ASIC)에 의해 규제되었으며, 직접 처리 (STP) 제도, 번호 241737을 보유하고 있습니다.

| 규제 상태 | 규제됨 |

| 규제 기관 | 호주 |

| 라이선스 기관 | Morrison Securities Pty Limited |

| 라이선스 유형 | 직접 처리 (STP) |

| 라이선스 번호 | 241737 |

Morrison에서 무엇을 거래할 수 있나요?

Morrison은 호주의 주요 거래소에 연결되어 원활한 거래를 지원합니다. ASX, Cboe Australia, NSX 및 SSE 거래소의 회원입니다. 현금 주식, 주식 옵션 (단일 주식 및 지수의 1단계 및 2단계), 워런트, ETFs (상장 지수 펀드), XTBs (상장 채권), LICs (상장 투자 회사), LITs (상장 투자 신탁) 및 Tracers (Cboe Australia 미국 주식 - 양도 가능한 보관 영수증)을 제공합니다.

| 거래 상품 | 지원 |

| 현금 주식 | ✔ |

| 주식 옵션 | ✔ |

| 워런트 | ✔ |

| ETFs | ✔ |

| 채권 | ✔ |

| 투자 신탁 | ✔ |

| 주식 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

금융 서비스

Morrison은 금융 고문, 자산 관리자, 능동적 거래자, 펀드 관리자 및 핀테크 플랫폼을 포함한 금융 서비스도 제공하며, 이는 통합 및 맞춤형 핀테크 애플리케이션 개발을 위한 API를 제공합니다.

계정

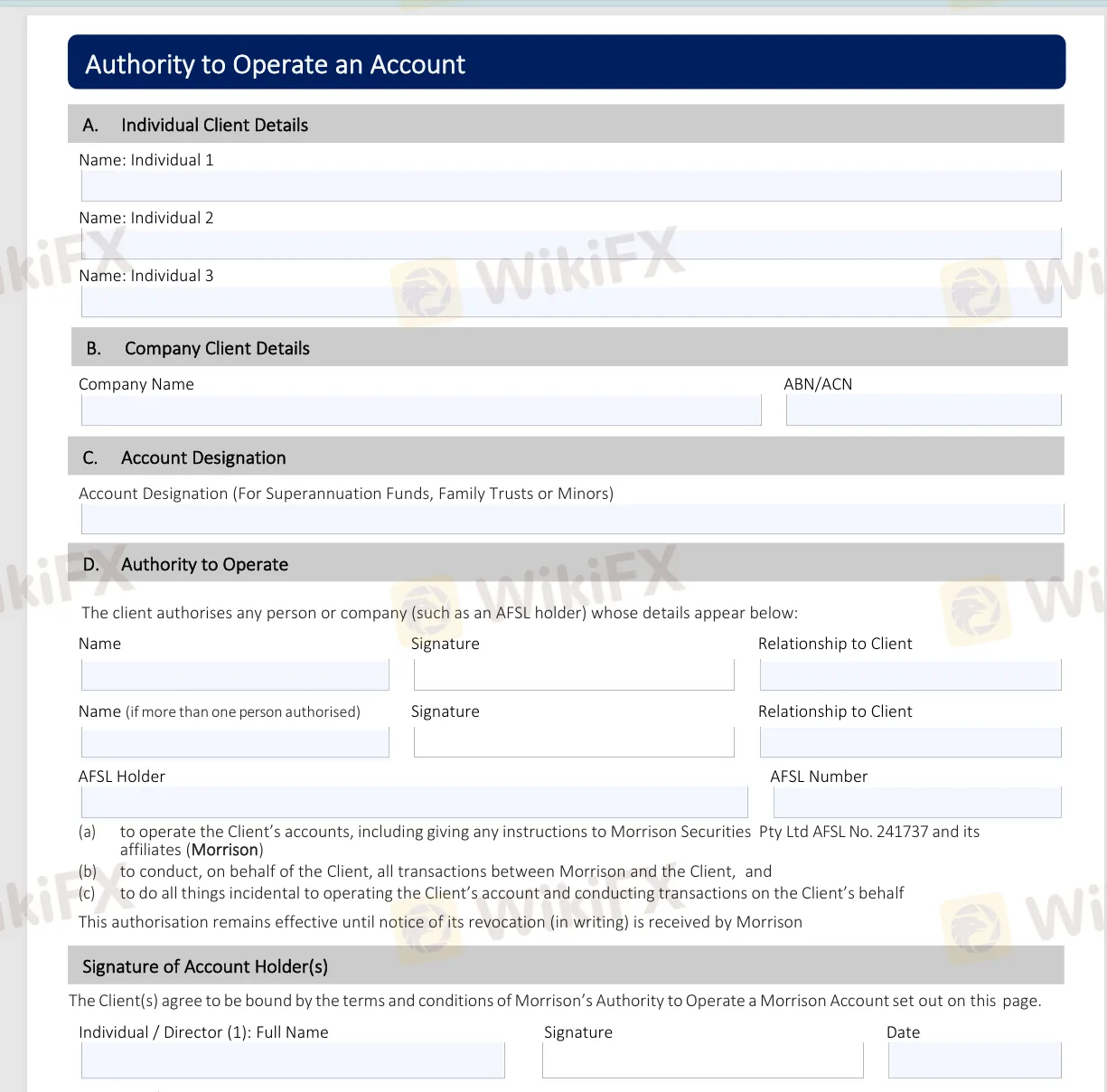

Morrison과 계정을 개설하려면, 웹 사이트에서 제공되는 필요한 계정 유지 관리 양식을 작성하십시오. 이 양식에는 계정명 변경 양식, 계정 운영 권한, 연락처 변경, 수입 방향, 직불 요청 및 100포인트 신분증 목록이 포함됩니다. 이 양식을 작성한 후 accounts@morrisonsecurities.com으로 보내주십시오.

거래 플랫폼

Morrison은 주문 배치, 관심종목 작성, 고객 포트폴리오 보기 및 고급 차트 패키지용 소프트웨어를 포함한 다양한 거래 플랫폼을 제공합니다. 다음을 지원합니다:

| 거래 플랫폼 | 지원되는 구성 요소 |

| Iress | Viewpoint, Web, Pro 버전 |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | 옵션 거래 및 리스크 관리 |

| Refintiv | Eikon 플랫폼 |

| Bloomberg Terminal | EMSX |

또한, 사용자가 선호하는 플랫폼이 있는 경우, FIX, 웹서비스 및 API를 통해 호환성을 제공합니다.