Resumo da empresa

| Morrison Resumo da Revisão | |

| Fundado | 2002 |

| País/Região Registrada | Austrália |

| Regulação | Regulado pela ASIC |

| Instrumentos de Mercado | Ações à vista, opções de ações, warrants, ETFs, XTBs, LICs, LITs e Tracers |

| Conta Demonstrativa | ❌ |

| Plataforma de Negociação | Iress, TradeCentre, TradeFloor, Refintiv, Terminal Bloomberg |

| Depósito Mínimo | / |

| Suporte ao Cliente | Formulário de Contato |

| Telefone: 1300 130 545 | |

| Email: contactus@morrisonsecurities.com | |

| Endereço: Suite 38.01, Nível 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited é um provedor de serviços financeiros multifacetado. Operando com uma licença de órgãos reguladores australianos desde 2002, oferece muitas plataformas de negociação que disponibilizam várias interfaces de negociação, incluindo soluções proprietárias e de terceiros.

Aqui está a página inicial do site oficial deste corretor:

Prós e Contras

| Prós | Contras |

| Regulado pela ASIC | Estrutura de taxas pouco clara |

| Múltiplas plataformas de negociação | |

| Diversas formas de contato | |

| Serviços financeiros oferecidos |

Morrison é Legítimo?

Morrison é regulamentado pela Comissão Australiana de Valores Mobiliários e Investimentos (ASIC), com Processamento Direto (STP), Nº 241737.

| Status Regulatório | Regulado |

| Regulado por | Austrália |

| Instituição Licenciada | Morrison Securities Pty Limited |

| Tipo de Licença | Processamento Direto (STP) |

| Número de Licença | 241737 |

O Que Posso Negociar na Morrison?

Morrison conecta-se às principais bolsas na Austrália para execução sem interrupções. Eles são membros das Bolsas ASX, Cboe Australia, NSX e SSE. Eles oferecem ações à vista, opções de ações (tanto de ações individuais quanto de índices nos Níveis 1 e 2), warrants, ETFs (Fundos Negociados em Bolsa), XTBs (Títulos Negociados em Bolsa), LICs (Companhias de Investimento Listadas), LITs (Trustes de Investimento Listados) e Tracers (Ações dos EUA da Cboe Australia - Recibos de Custódia Transferíveis).

| Instrumentos de Negociação | Suportado |

| Ações à vista | ✔ |

| Opções de ações | ✔ |

| Warrants | ✔ |

| ETFs | ✔ |

| Títulos | ✔ |

| Trustes de Investimento | ✔ |

| Ações | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |

Serviços Financeiros

Morrison também oferece serviços financeiros, incluindo consultores financeiros, gestores de patrimônio, traders ativos, gestores de fundos e plataformas fintech, que fornecem APIs para integração e desenvolvimento de aplicativos fintech personalizados.

Conta

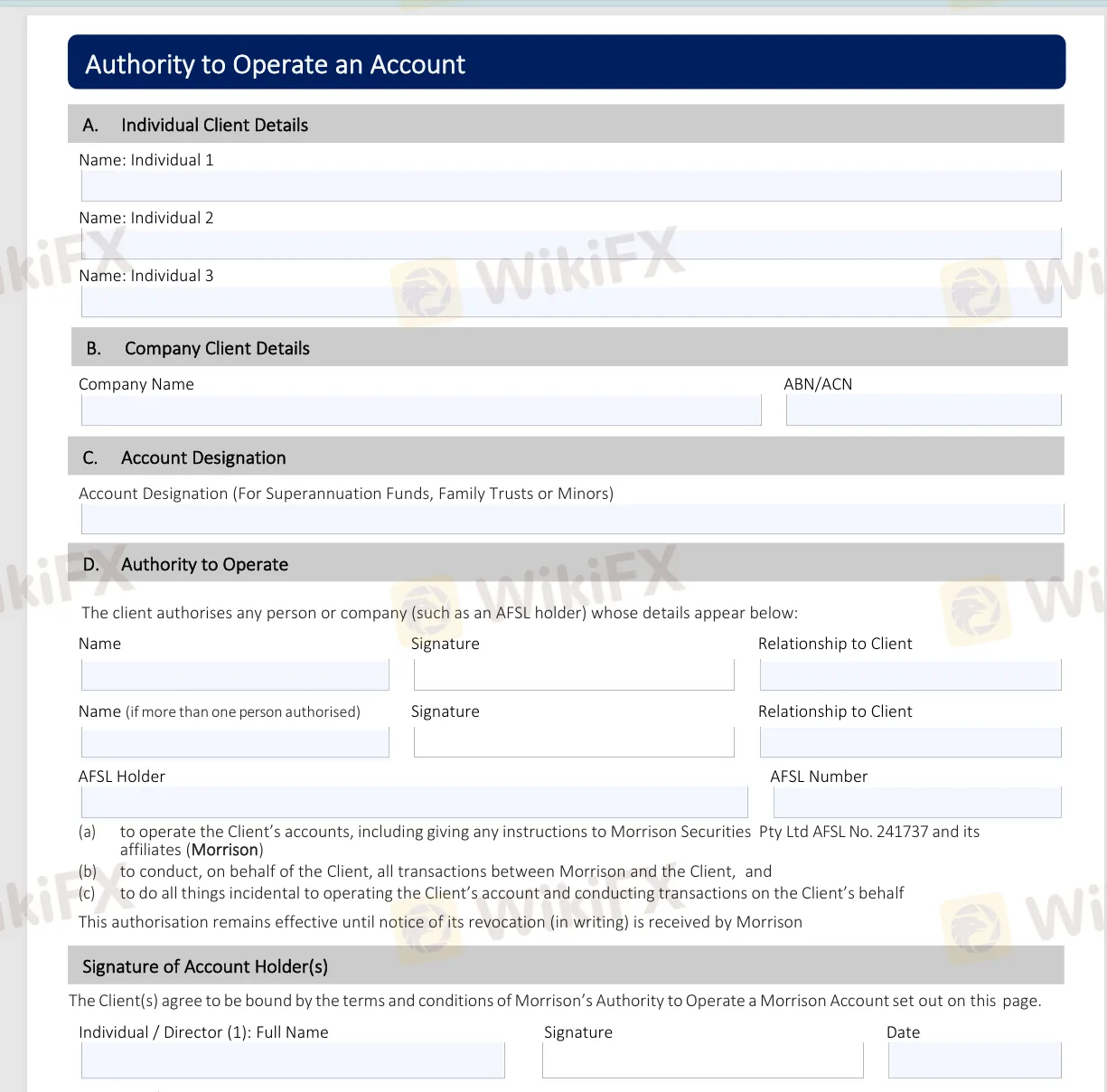

Para abrir uma conta com Morrison, preencha os formulários de manutenção de conta necessários disponíveis em seu site. Esses formulários incluem o Formulário de Alteração de Nome da Conta, Autorização para Operar uma Conta, Alteração de Detalhes de Contato, Direção de Renda, Solicitação de Débito Direto e a Lista de ID de 100 Pontos. Após preencher esses formulários, envie-os para accounts@morrisonsecurities.com.

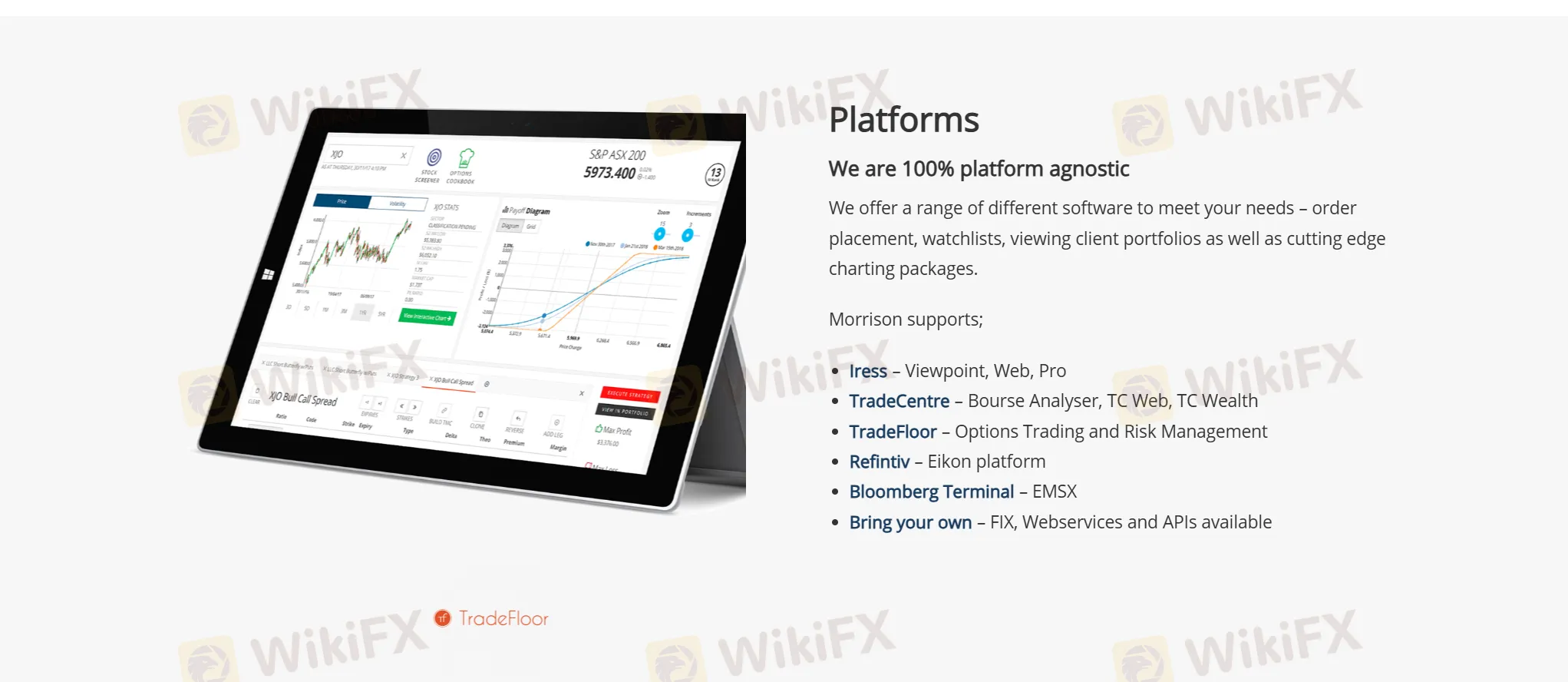

Plataforma de Negociação

Morrison oferece várias plataformas de negociação, incluindo software para realização de pedidos, criação de listas de observação, visualização de portfólios de clientes e pacotes avançados de gráficos. Eles suportam:

| Plataforma de Negociação | Componentes Suportados |

| Iress | Viewpoint, Web, versões Pro |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | Negociação de opções e gestão de riscos |

| Refintiv | Plataforma Eikon |

| Bloomberg Terminal | EMSX |

Além disso, se você tiver sua própria plataforma preferida, eles oferecem compatibilidade por meio de FIX, Webservices e APIs.