Présentation de l'entreprise

| GMA CAPITAL Résumé de l'examen | |

| Fondé | 2016 |

| Pays/Région Enregistré | Argentine |

| Régulation | Pas de régulation |

| Services | Ventes & Trading, Gestion d'actifs, Finance d'entreprise, Gestion de patrimoine |

| Compte de Démo | ❌ |

| Plateforme de Trading | / |

| Dépôt Minimum | $0 |

| Support Client | Formulaire de contact |

| Téléphone: (+54 11) 5273-1252 | |

| Email: info@gmacap.com | |

| Adresse: MIÑONES 2177, 4° PISO, CP 1428, CABA - Argentine | |

| X, LinkedIn, Instagram | |

GMA CAPITAL est une société financière non réglementée établie en Argentine en 2016. Elle propose divers services financiers, notamment Ventes & Trading, Gestion d'actifs, Finance d'entreprise et Gestion de patrimoine. Cependant, il y a peu d'informations sur son site officiel.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Multiples canaux de support client | Pas de régulation |

| Divers services proposés | Informations limitées sur les comptes |

| Pas de comptes de démonstration | |

| Manque d'informations sur les plateformes de trading |

GMA CAPITAL Est-il Légitime ?

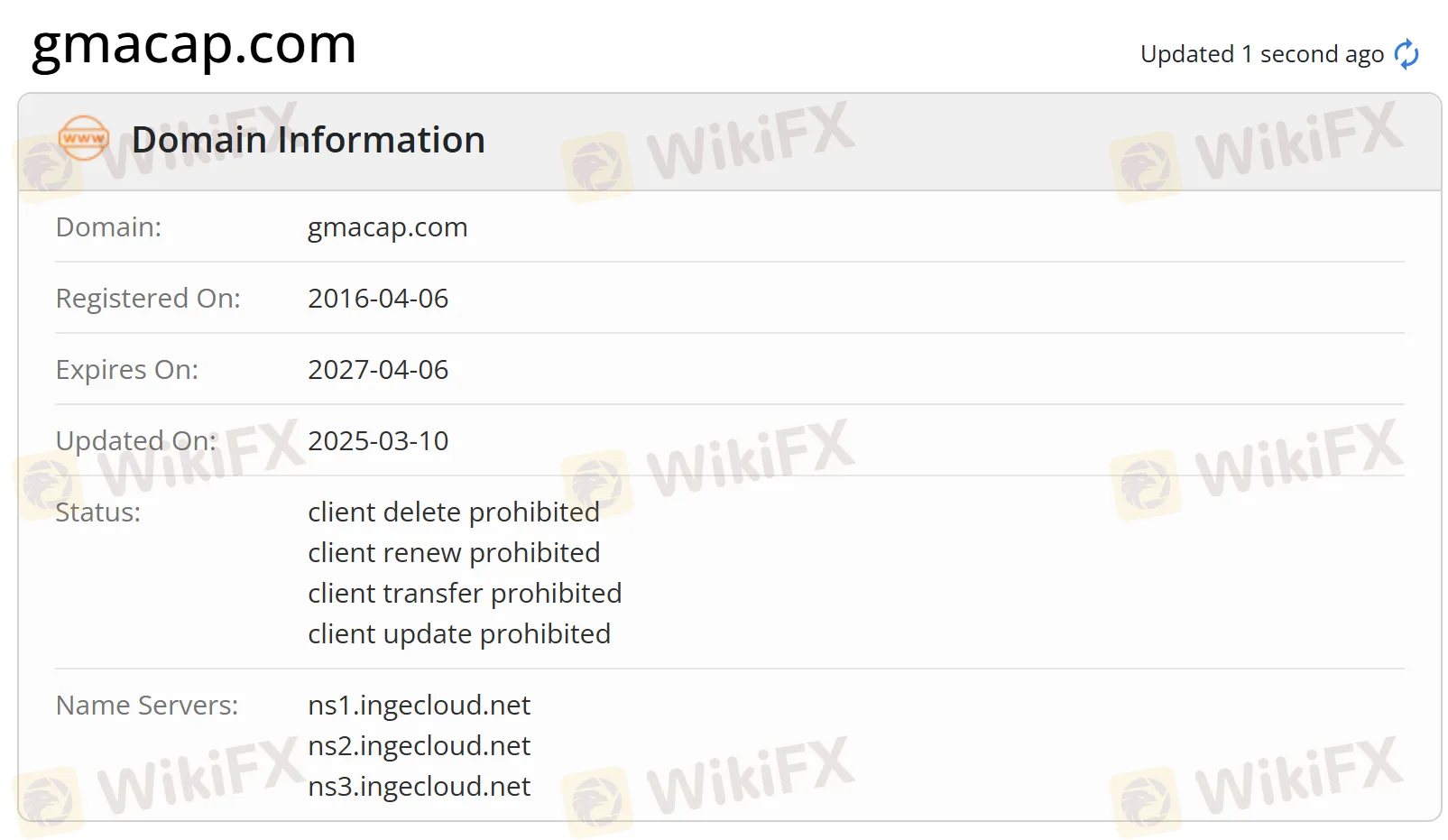

Actuellement, GMA CAPITAL ne dispose pas d'une régulation valide. Son domaine a été enregistré le 6 avril 2016, et son statut actuel est “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”. Nous vous conseillons de rechercher d'autres sociétés réglementées.

Services de GMA CAPITAL

GMA CAPITAL propose des services financiers tels que Ventes & Trading, Gestion d'actifs, Finance d'entreprise et Gestion de patrimoine.

Compte

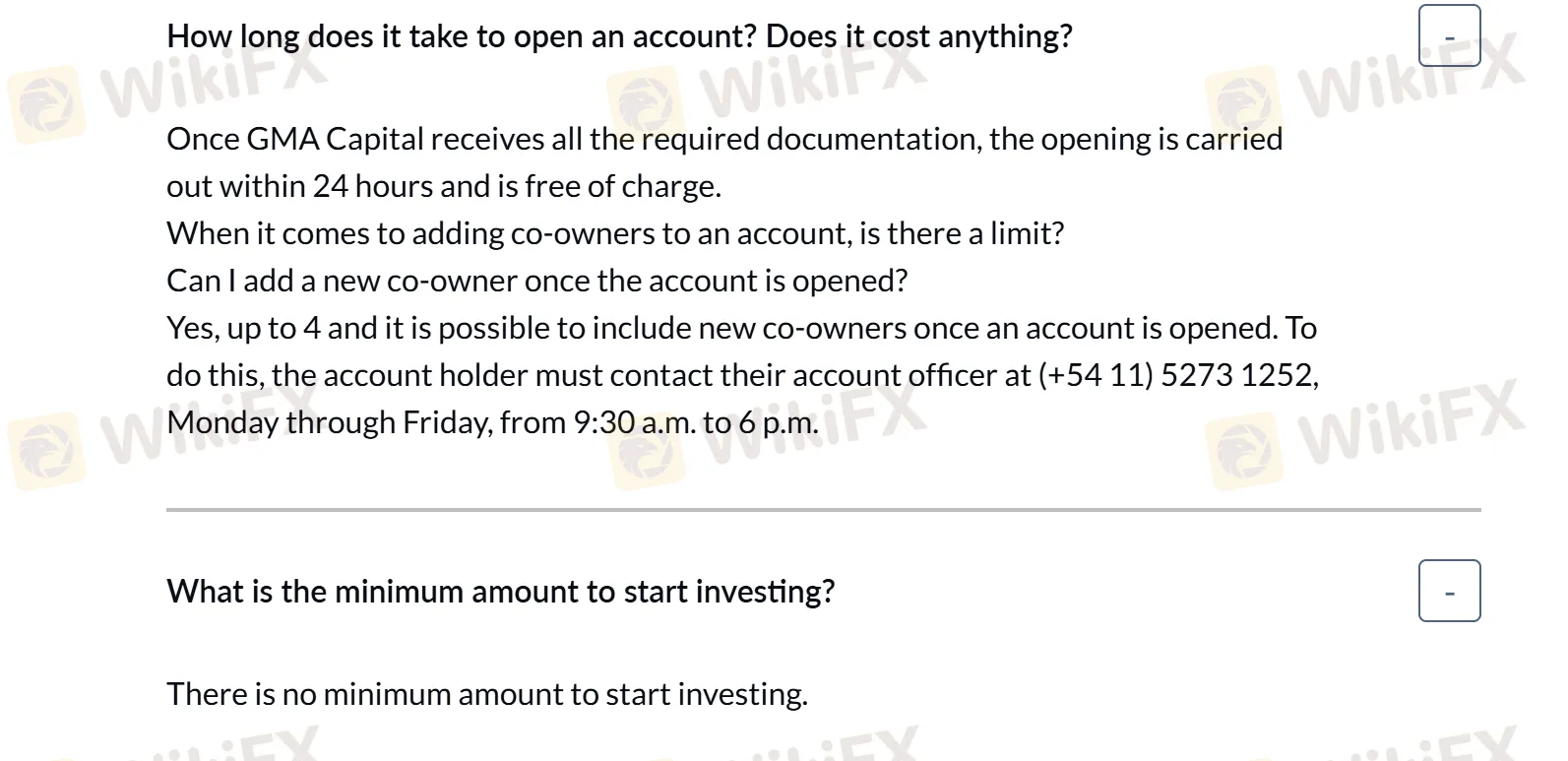

Il n'y a pas d'informations sur les types de compte. La seule chose que nous savons, c'est que l'ouverture de compte se fera dans les 24 heures et est gratuite, et il n'y a aucun montant minimum pour commencer à investir également.

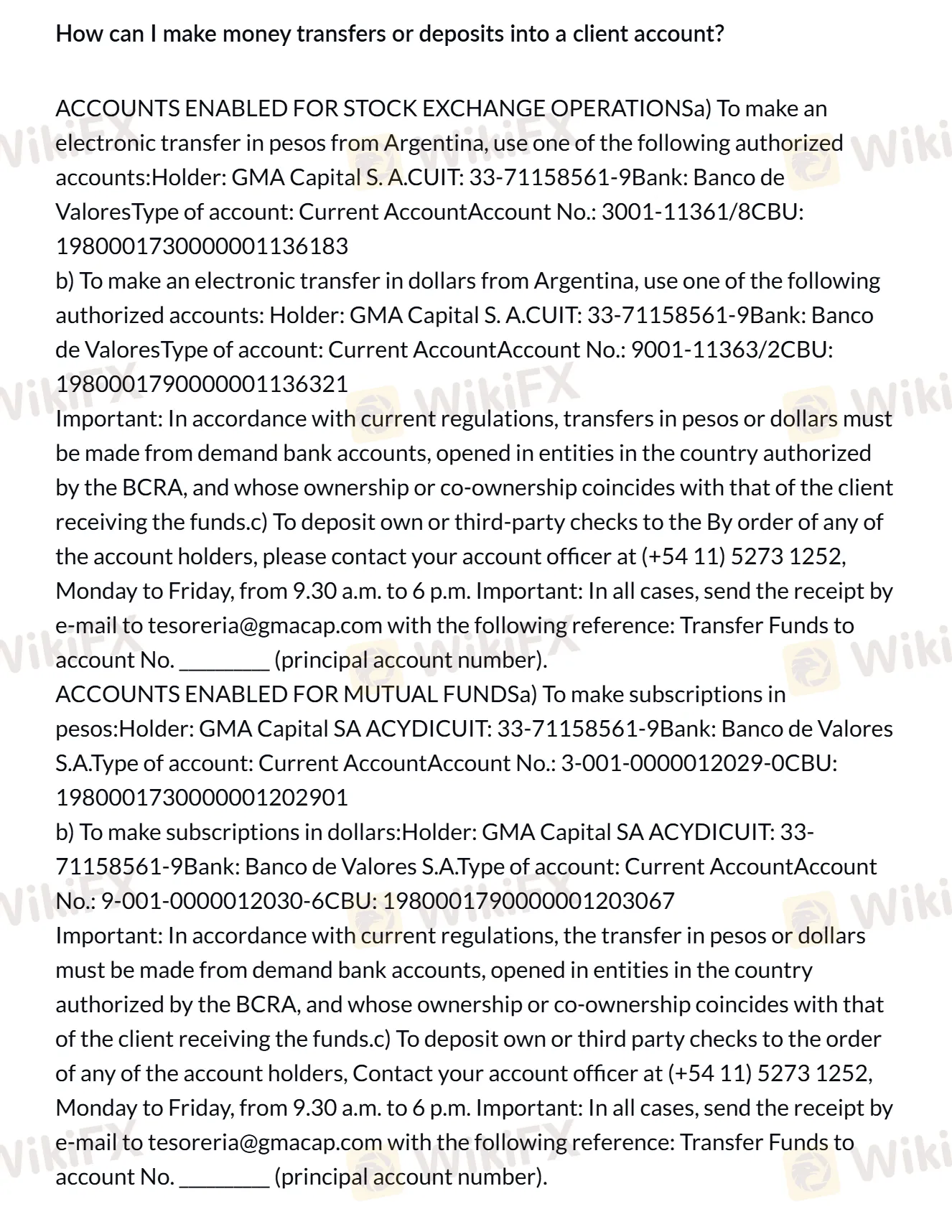

Dépôt et Retrait

Chez GMA Capital, pour les dépôts : Les transferts électroniques en pesos ou en dollars depuis l'Argentine peuvent être effectués via des comptes autorisés spécifiques. Les chèques peuvent également être déposés en contactant l'officier de compte et en envoyant le reçu par email. Les dépôts doivent provenir de comptes de demande autorisés par la BCRA avec une propriété correspondante.

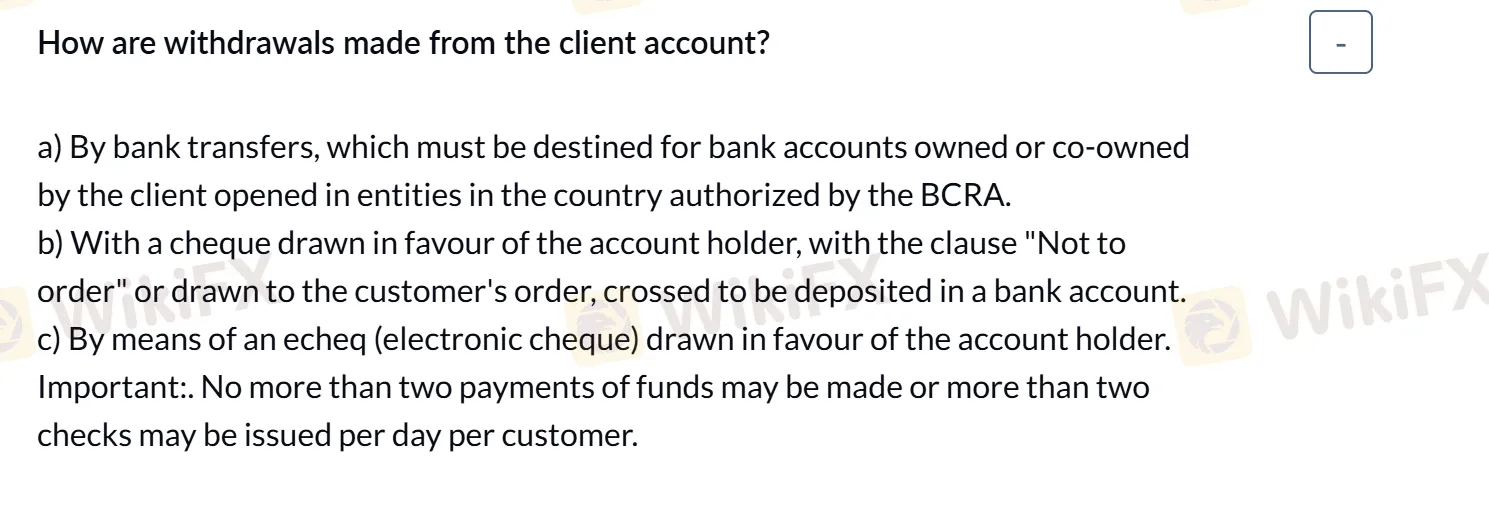

Pour les retraits : Les options incluent les virements bancaires vers les comptes détenus par le client, les chèques émis au nom du titulaire du compte, ou les chèques électroniques (echeq). Une limite quotidienne restreint chaque client à pas plus de deux paiements de fonds ou émissions de chèques.