Company Summary

| Angel One Review Summary | |

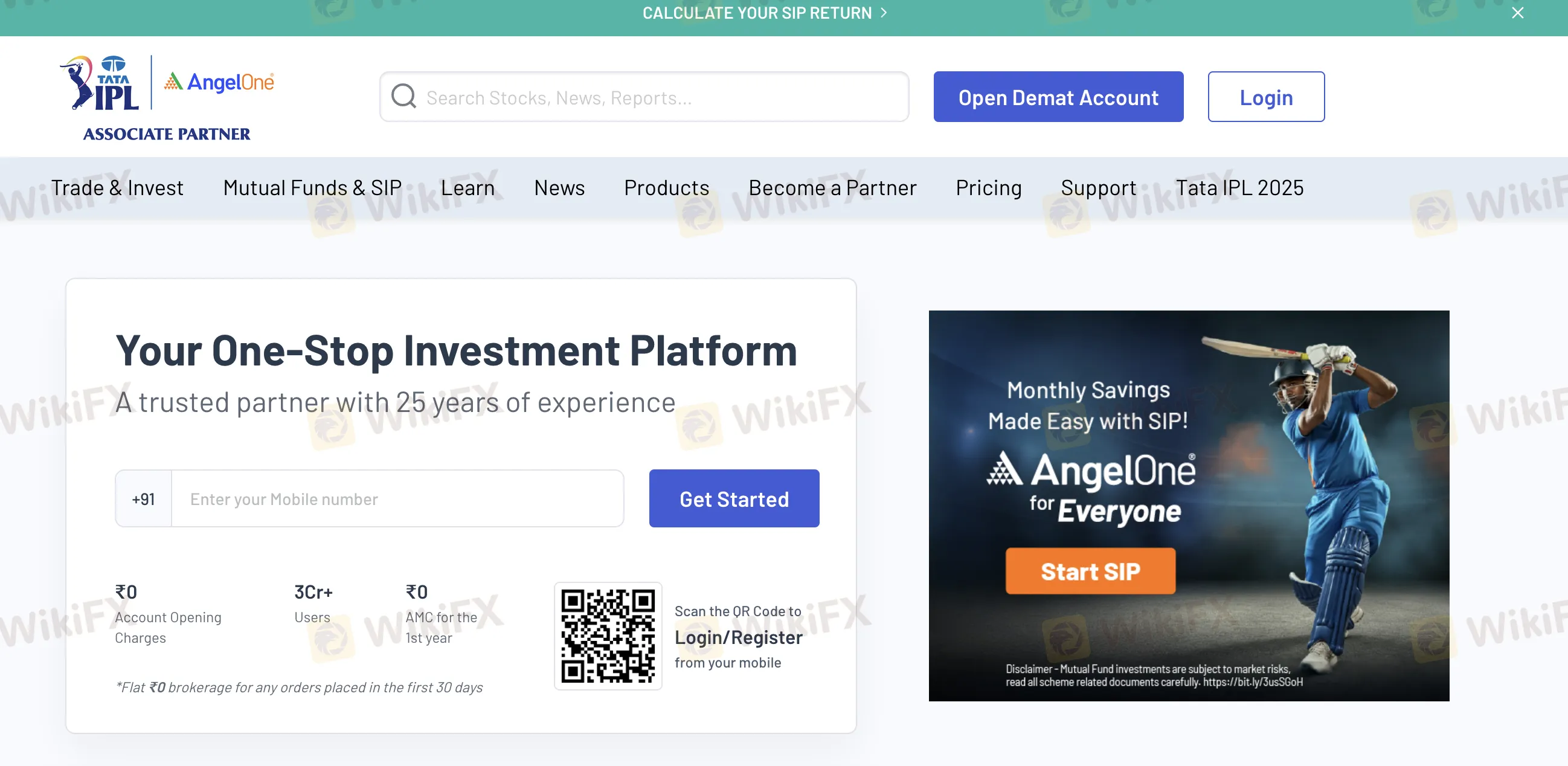

| Founded | 1996 |

| Registered Country/Region | India |

| Regulation | No regulation |

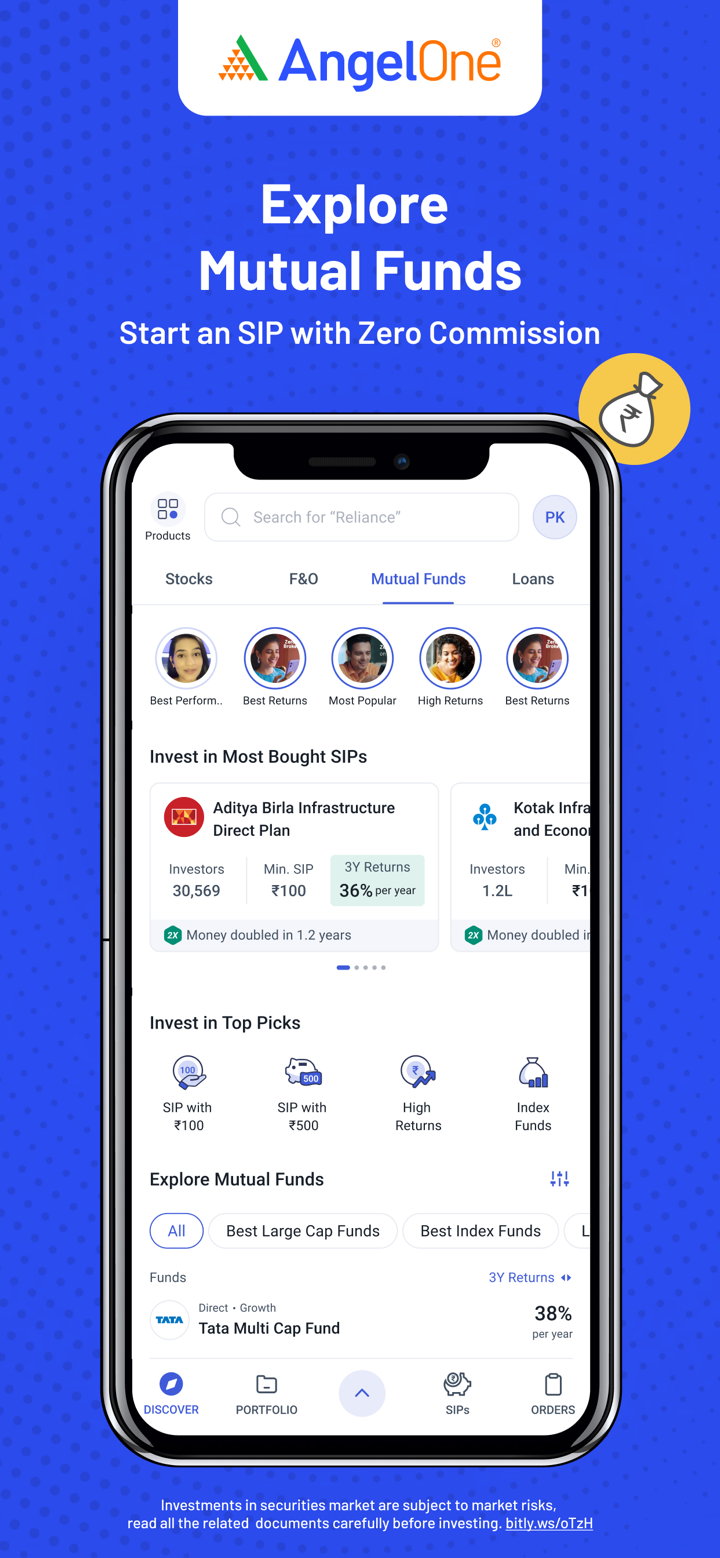

| Trading Products | Stocks, IPOs, Derivatives (F&O), Mutual Funds, Commodities |

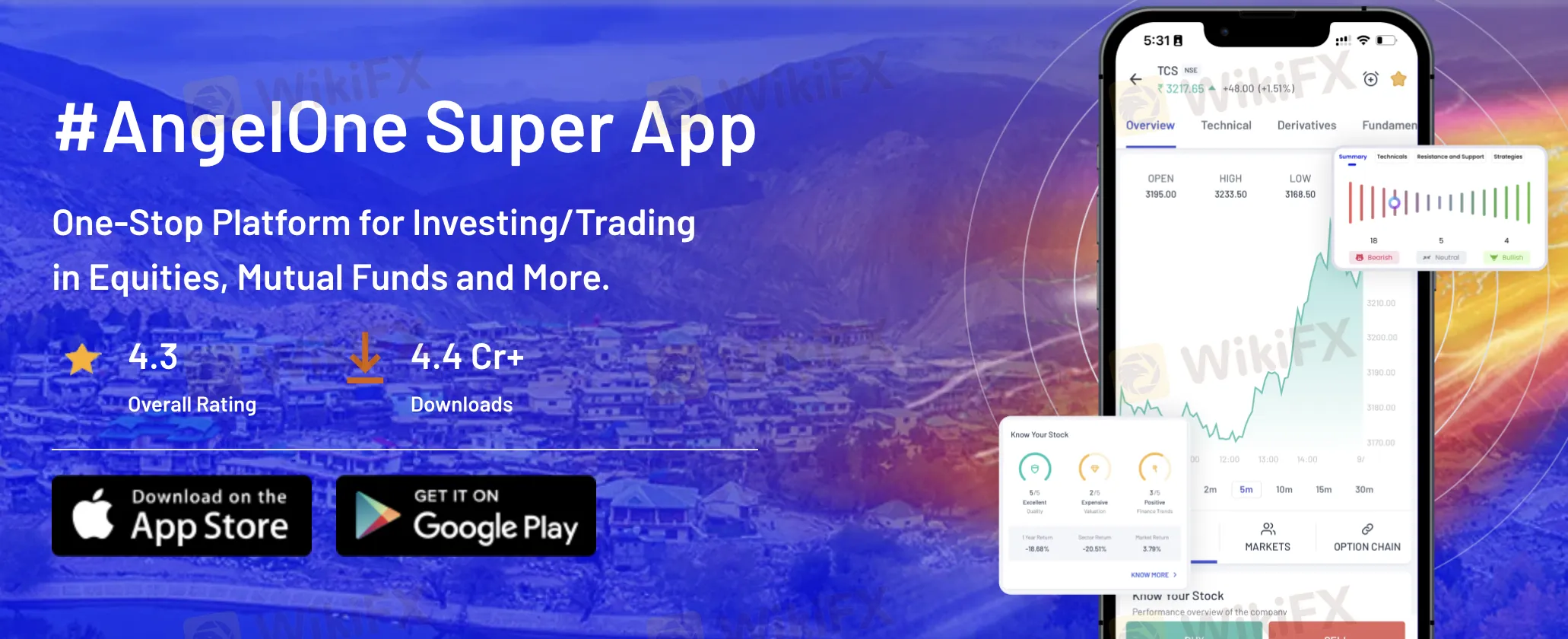

| Trading Platform | Angel One Super App (mobile), Angel One Trade (web), Smart API (developer) |

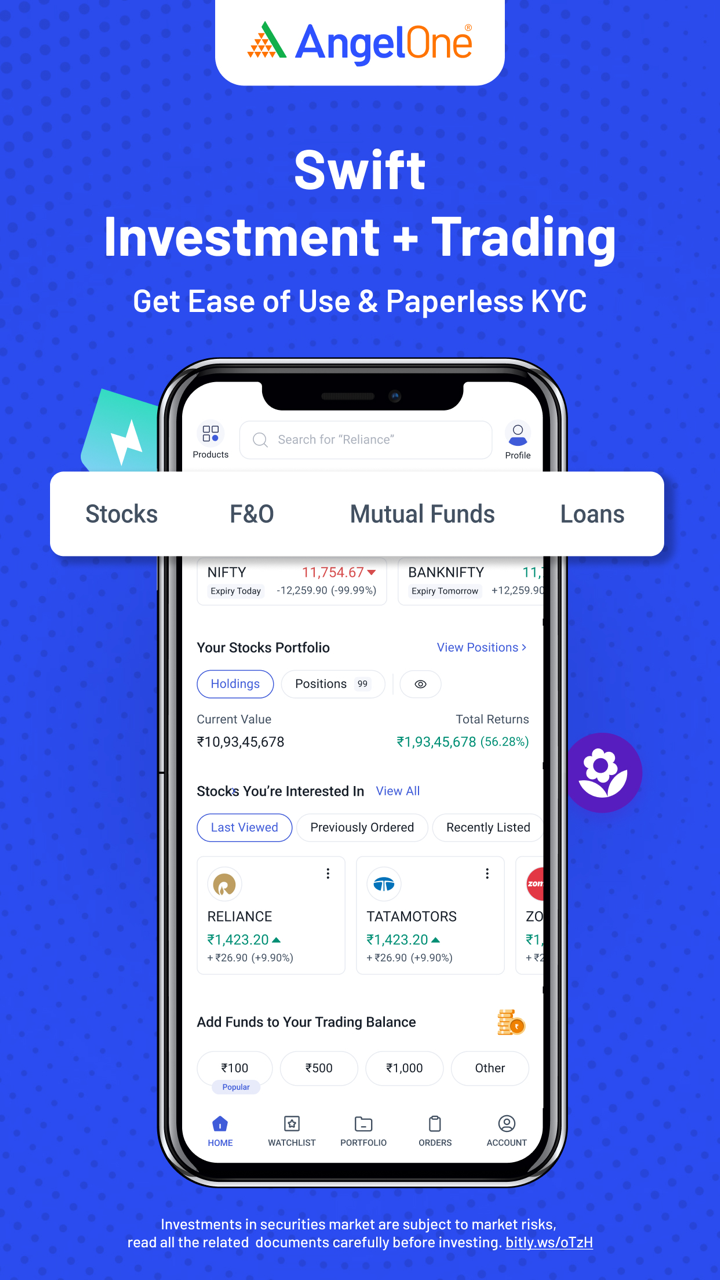

| Minimum Deposit | ₹0 |

| Customer Support | Email: support@angelone.in |

| Phone: 18001020 | |

Angel One Information

Founded in 1996, Angel One is an Indian brokerage company. SEBI or any worldwide financial power does not control it. Among the many investment vehicles the firm provides are equities, derivatives, mutual funds, and US stocks. Its absence of regulatory control causes concern even with its low costs and robust technology platforms.

Pros and Cons

| Pros | Cons |

| Zero brokerage for first ₹500 in 30 days | No regulation |

| Wide range of investment products | Various fees charged |

| User-friendly platforms | |

| No minimum deposit |

Is Angel One Legit?

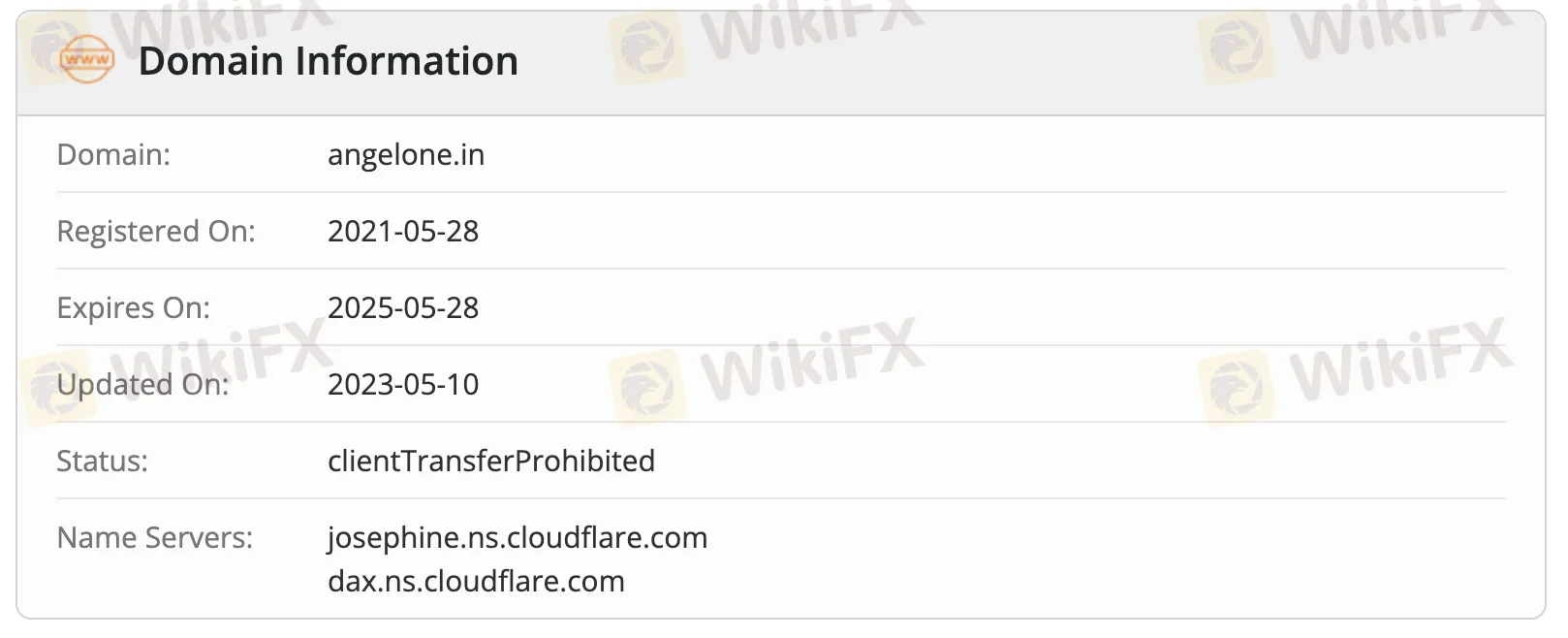

Angel One is not a regulated broker. Although based in India, it does not hold a license from SEBI or any major global regulators like the FCA, ASIC, or NFA.

The domain angelone.in was registered on May 28, 2021, last updated on May 10, 2023, and will expire on May 28, 2025. Its status is clientTransferProhibited.

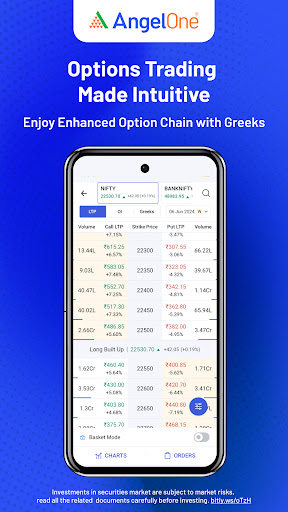

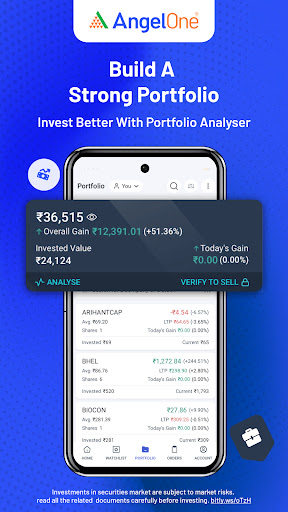

Trading Products

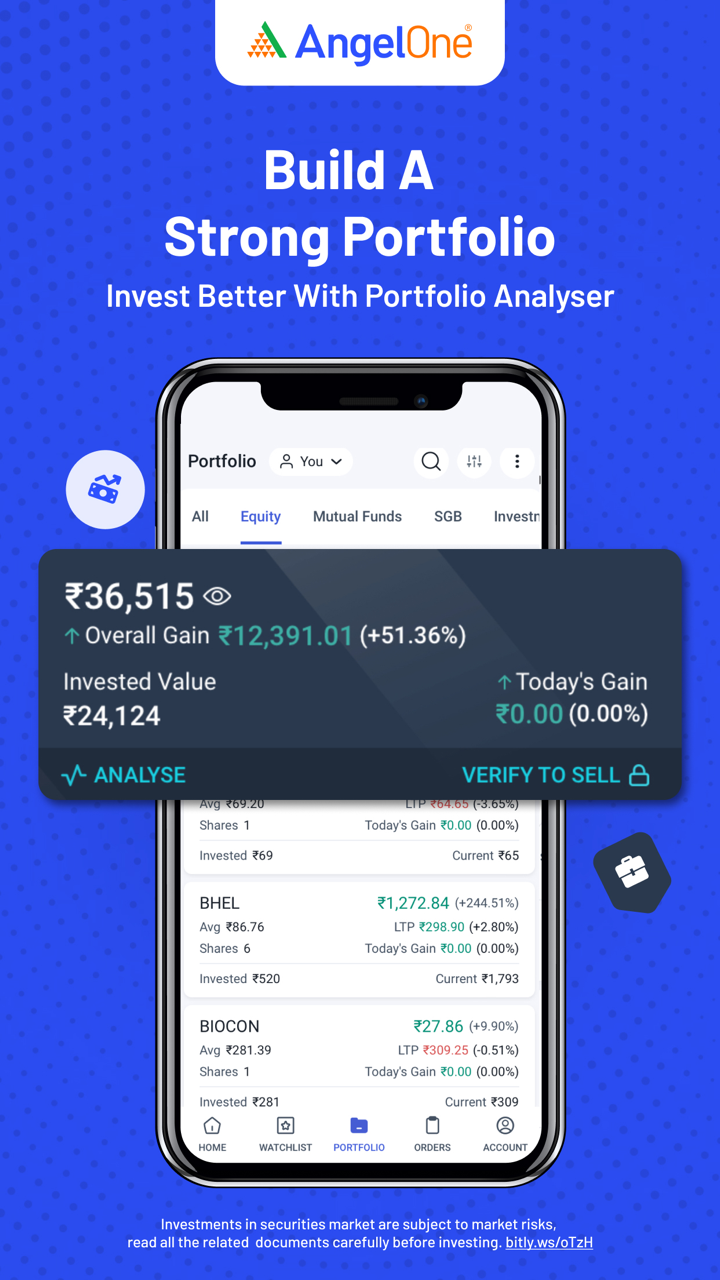

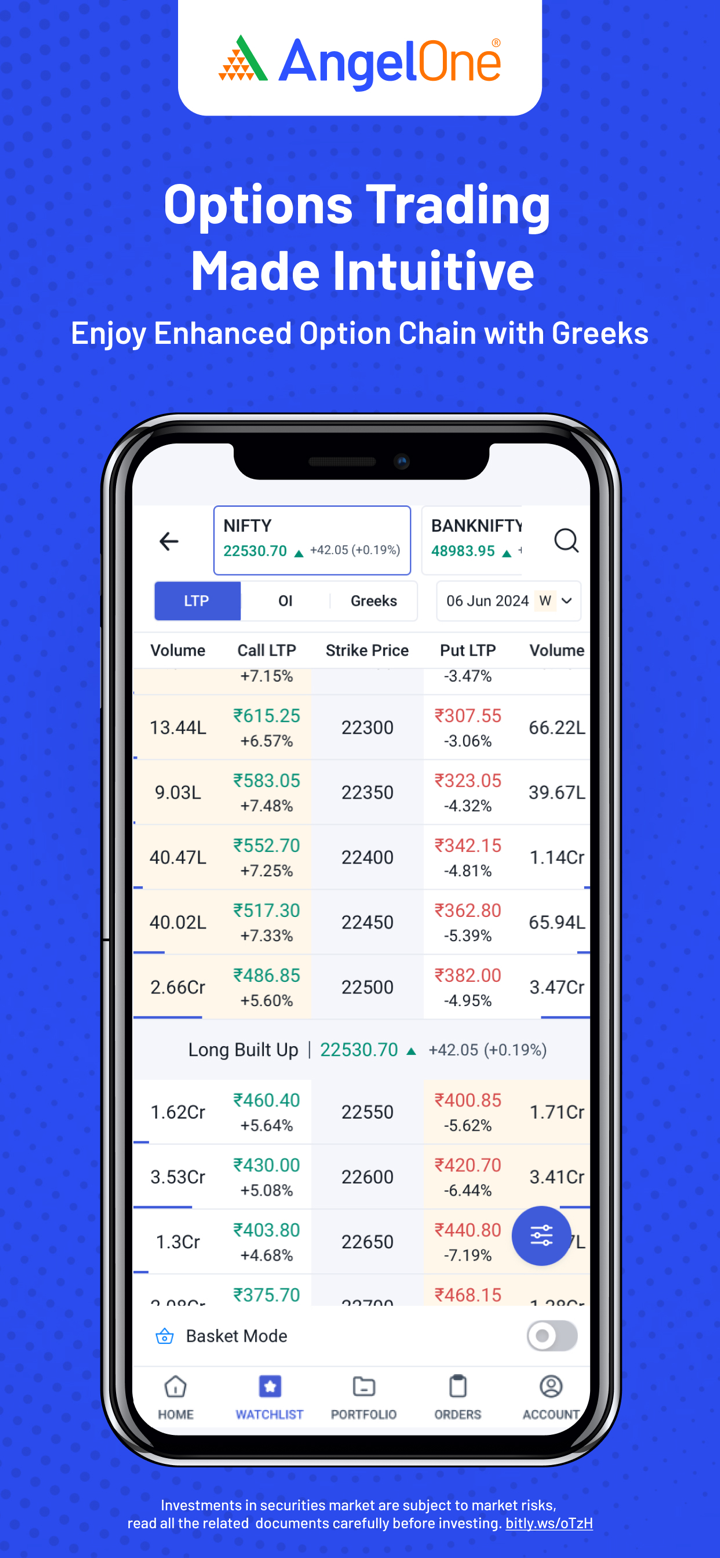

Angel One offers a wide range of investment products including stocks, IPOs, derivatives, mutual funds, commodities, and U.S. equities.

| Trading Instruments | Supported |

| Stocks | ✔ |

| IPOs | ✔ |

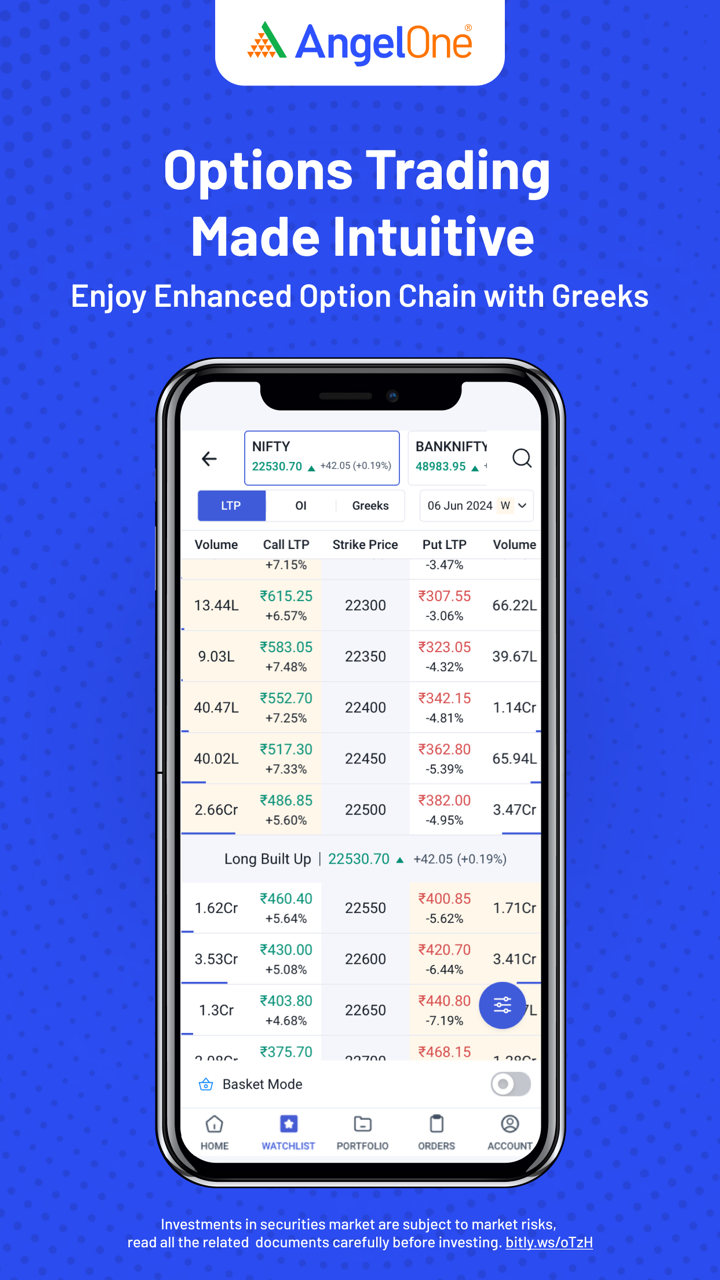

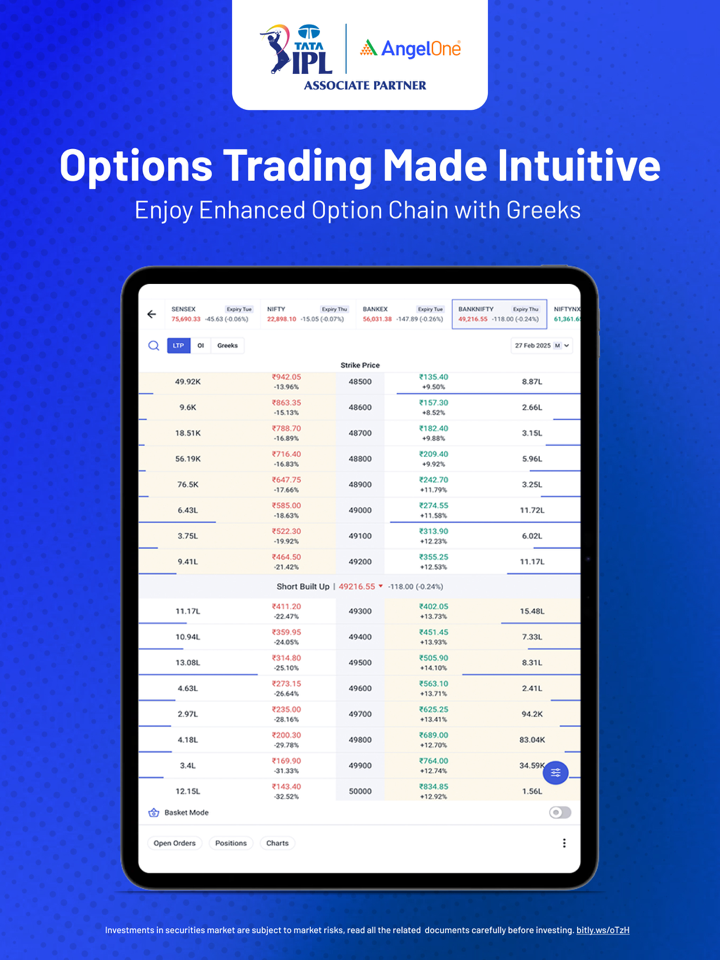

| Derivatives (F&O) | ✔ |

| Mutual Funds | ✔ |

| Commodities | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

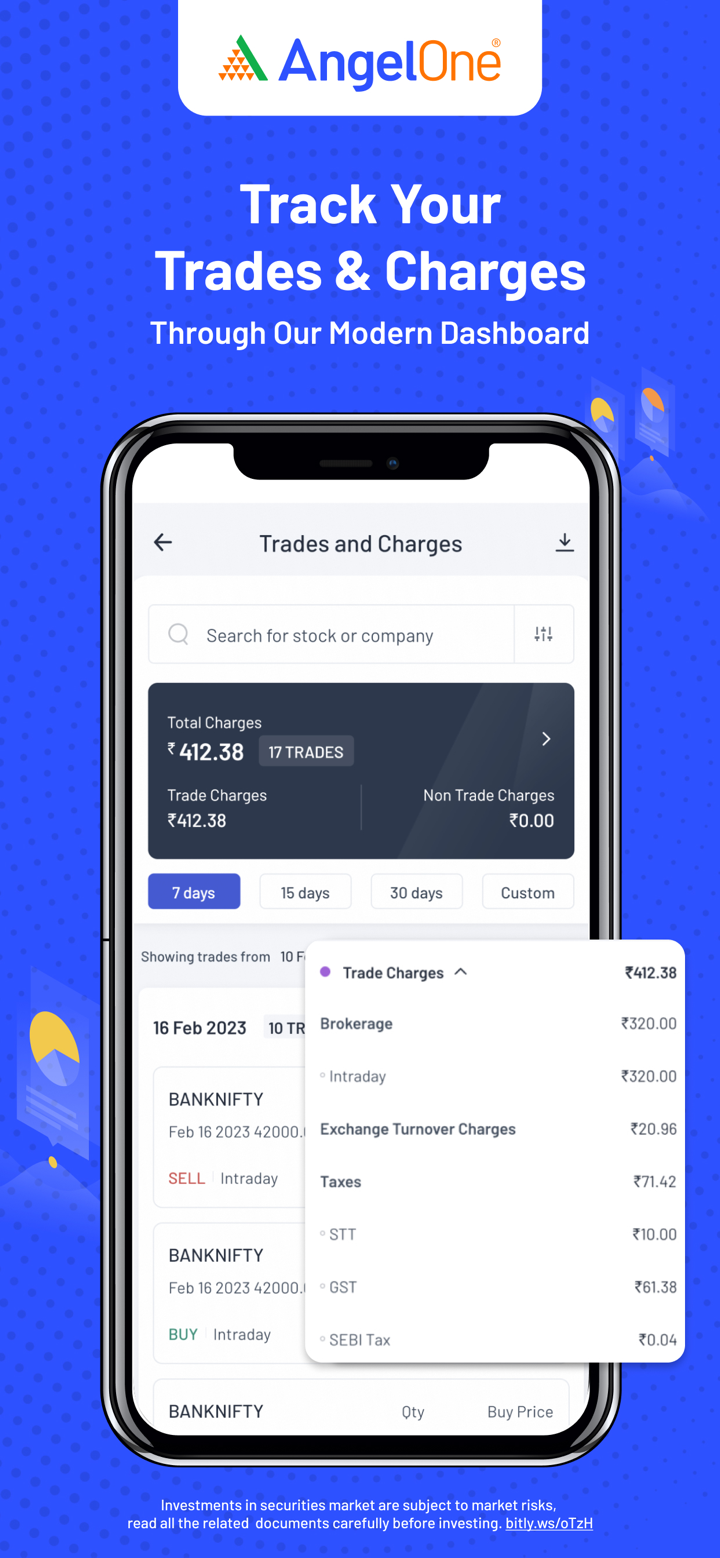

Angel One Fees

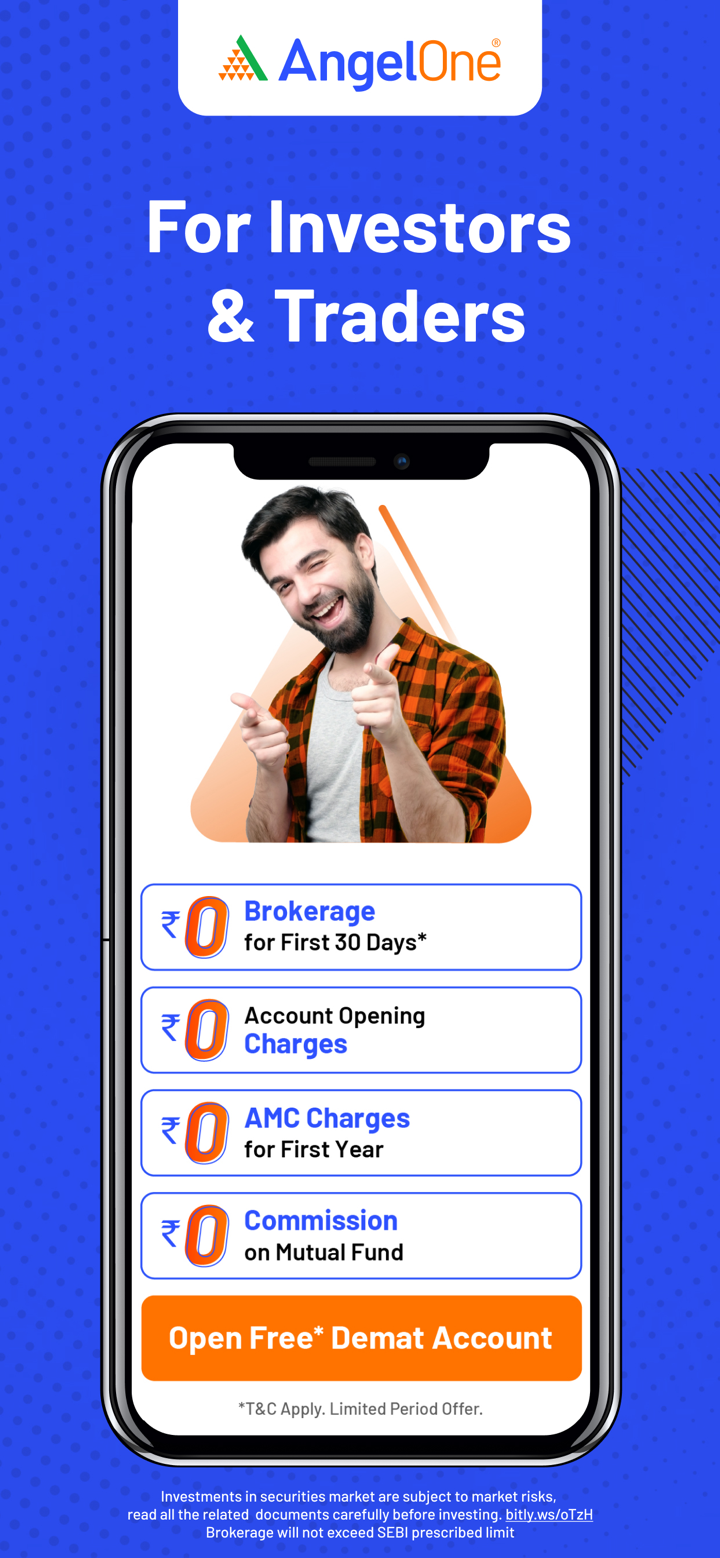

Angel One's fees are generally low to moderate compared to industry standards in India. It offers zero brokerage for the first 30 days (up to ₹500), after which its brokerage is capped and competitive, especially for retail traders. Additional charges are mostly in line with regulatory norms.

| Investment Type | Initial Offer | Post-Offer Brokerage |

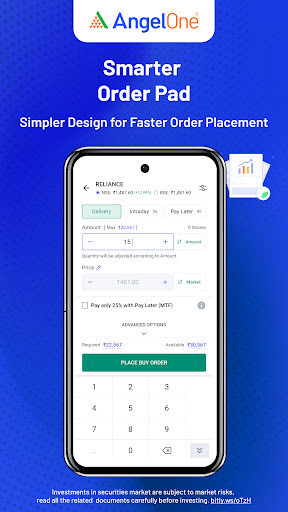

| Equity Delivery | ₹0 up to ₹500 in 30 days | Lower of ₹20 or 0.1% per order (min ₹2) |

| Intraday Trading | Lower of ₹20 or 0.03% per order | |

| Futures | ₹20 per executed order | |

| Options |

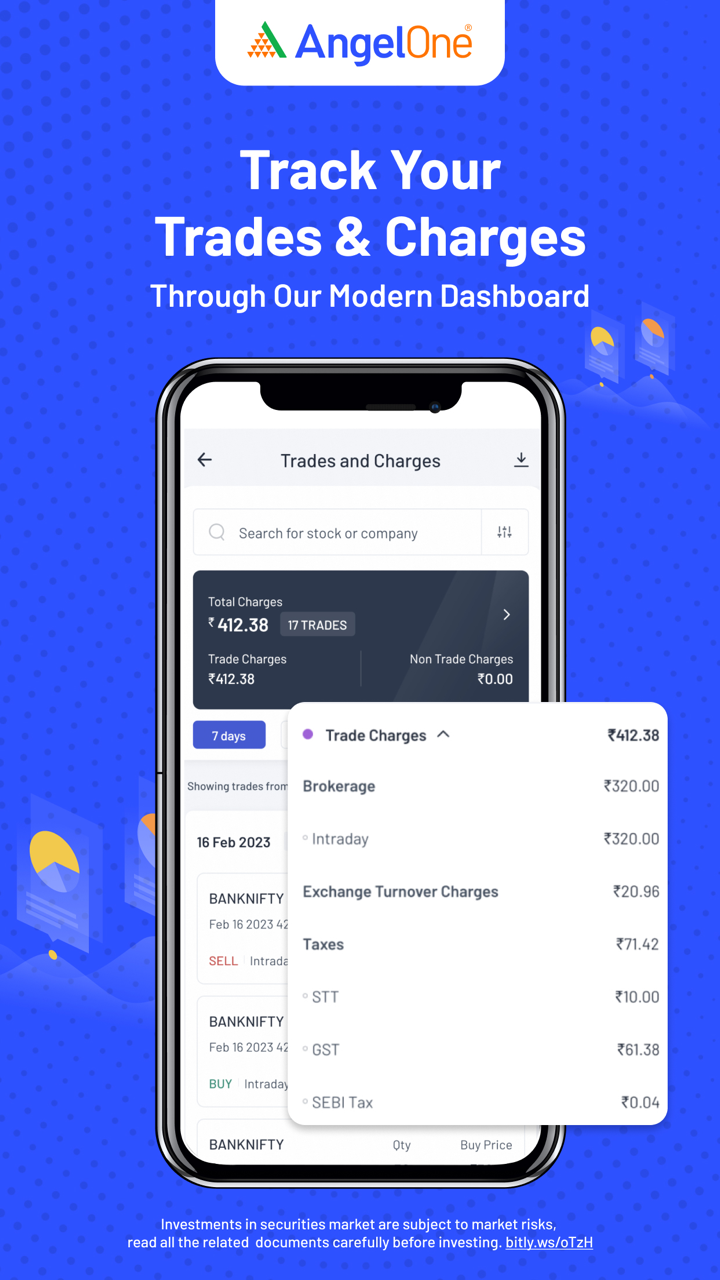

| Charge Type | Equity Delivery | Intraday | Futures | Options |

| Transaction Charges | NSE: 0.00297% | NSE: 0.00173% | NSE: 0.03503% | |

| STT | 0.1% (Buy/Sell) | 0.025% (Sell) | 0.01% (Sell) | 0.05% (Sell) |

| GST | 18% | |||

| SEBI Charges | ₹10/crore | |||

| Clearing Charges | ₹0 | |||

| Stamp Duty | 0.015% (Buy) | 0.003% (Buy) | 0.002% (Buy) | 0.003% (Buy) |

| Charge Type | Fee |

| Account Opening | 0 (sometimes ₹36.48 for NRIs) |

| AMC (1st Year) | 0 |

| AMC (After 1st Year) | ₹60/quarter (non-BSDA), or ₹450/year, or ₹2950 lifetime option |

| BSDA AMC | NIL up to ₹4L; ₹100/year for ₹4L–₹10L holdings |

| MTF (Margin Borrowing) | 0.041% per day |

| Debit Balance Interest | 0.049% per day |

| Cash Collateral Charges | 0.0342%/day (on shortfall > ₹50,000) |

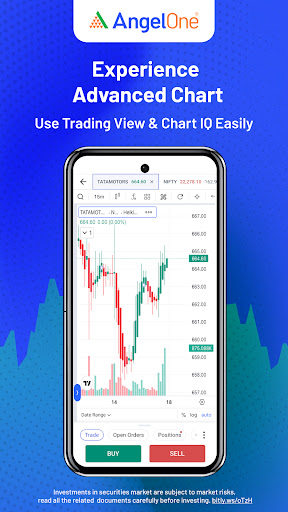

Trading Platform

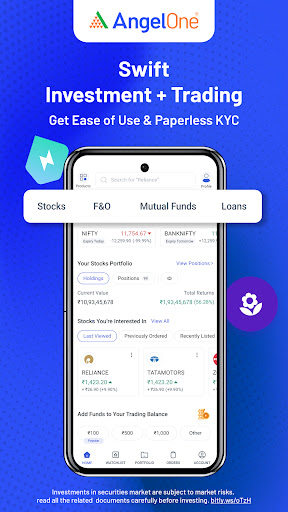

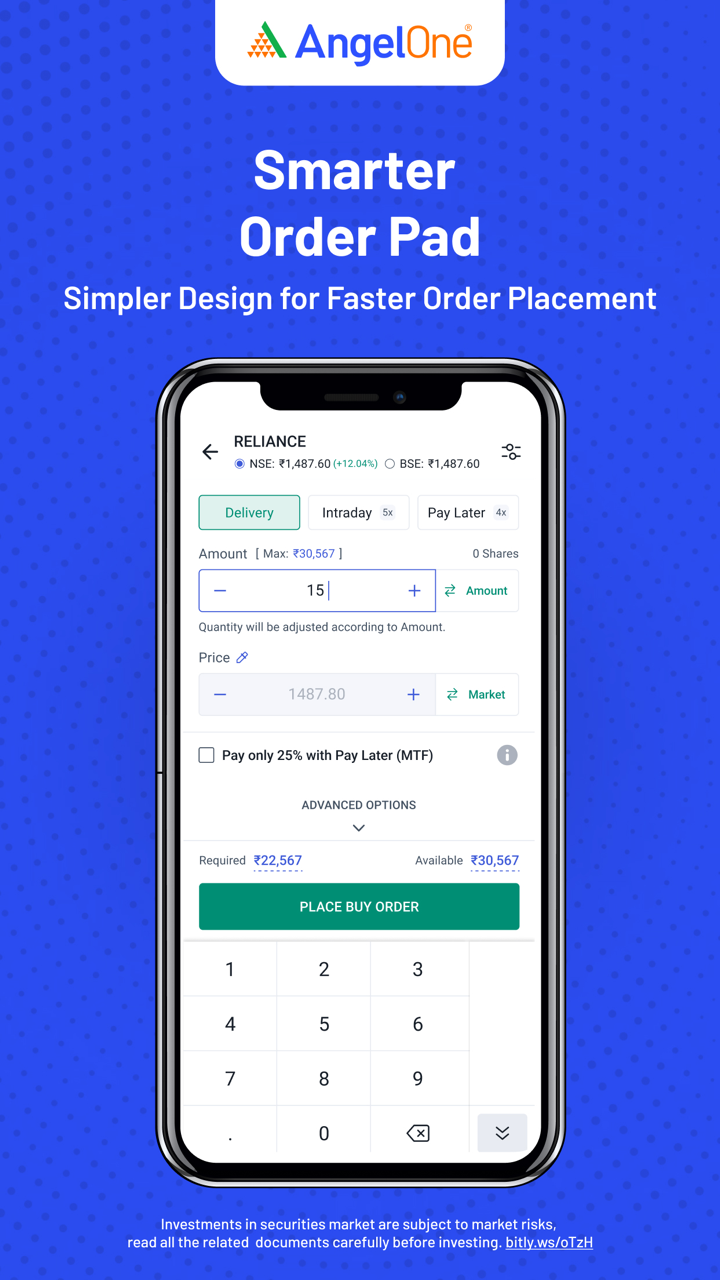

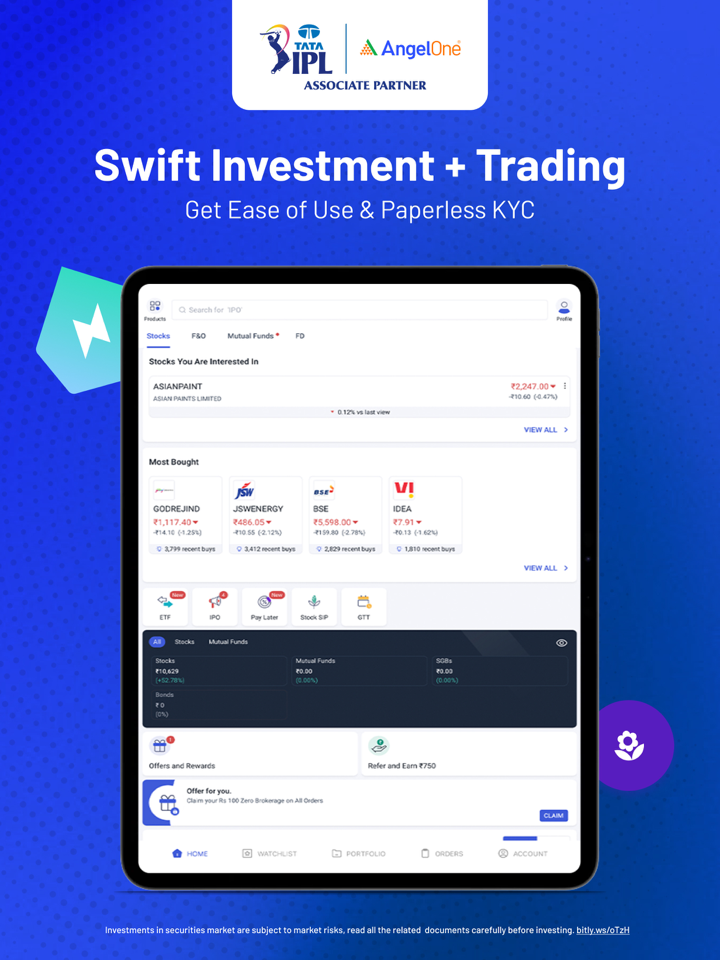

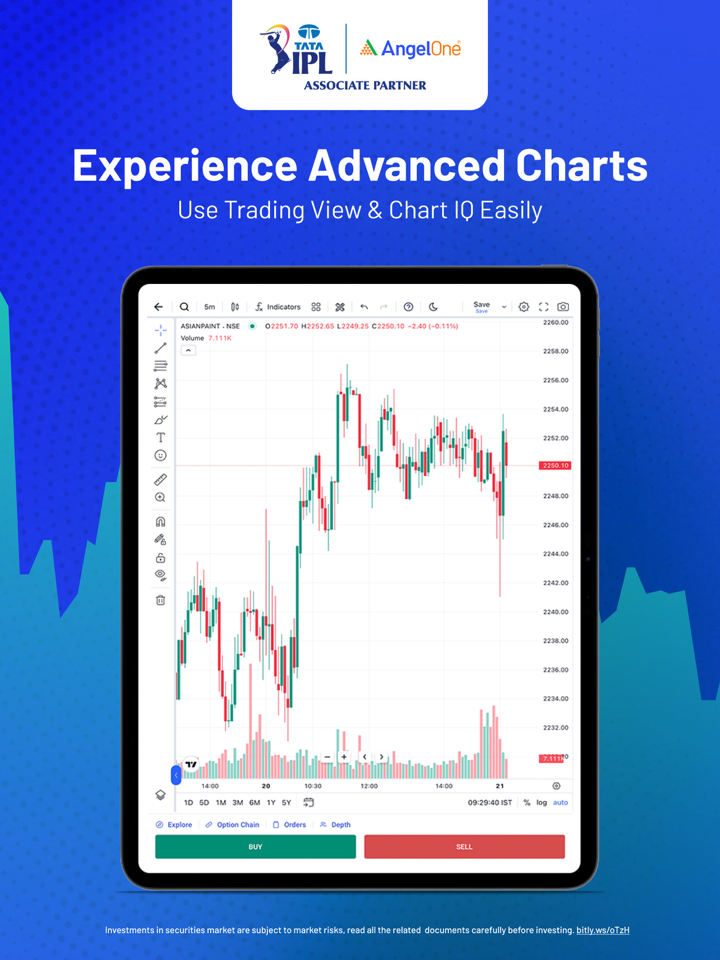

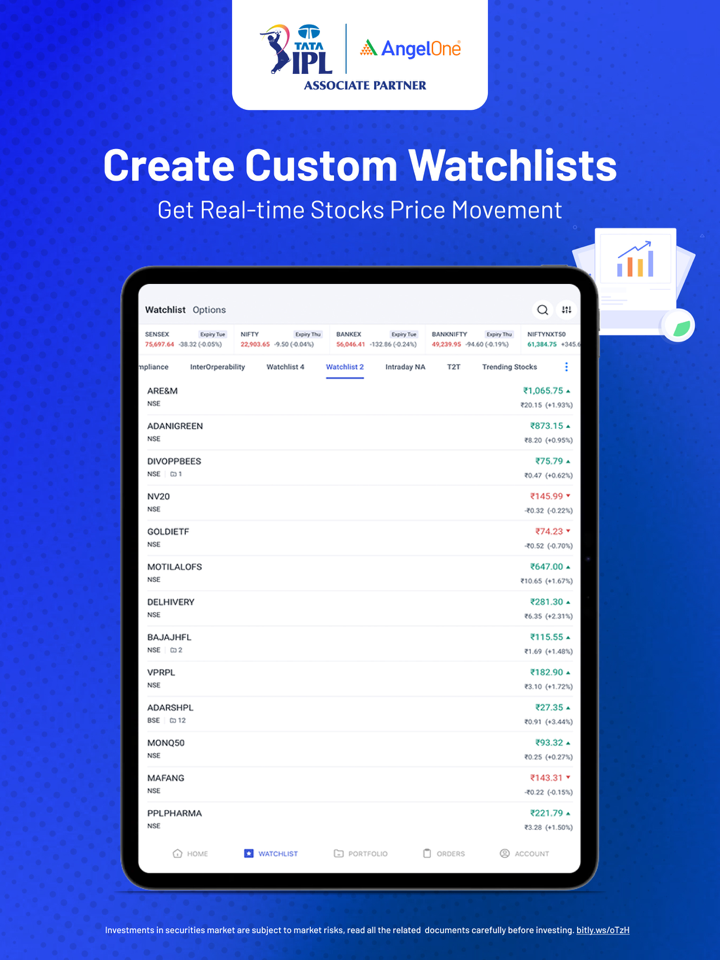

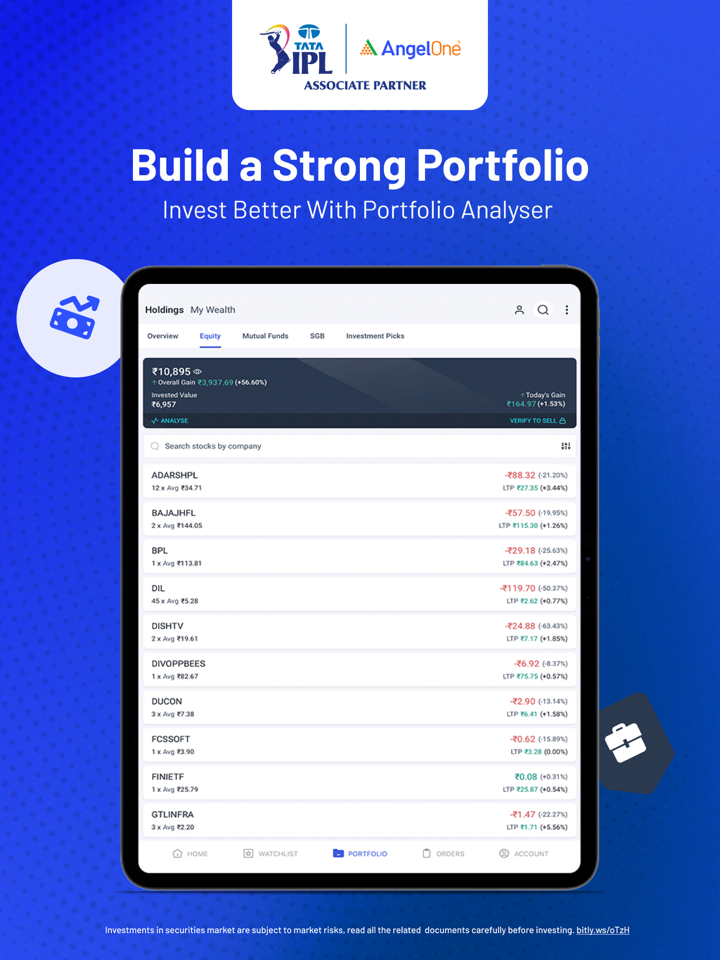

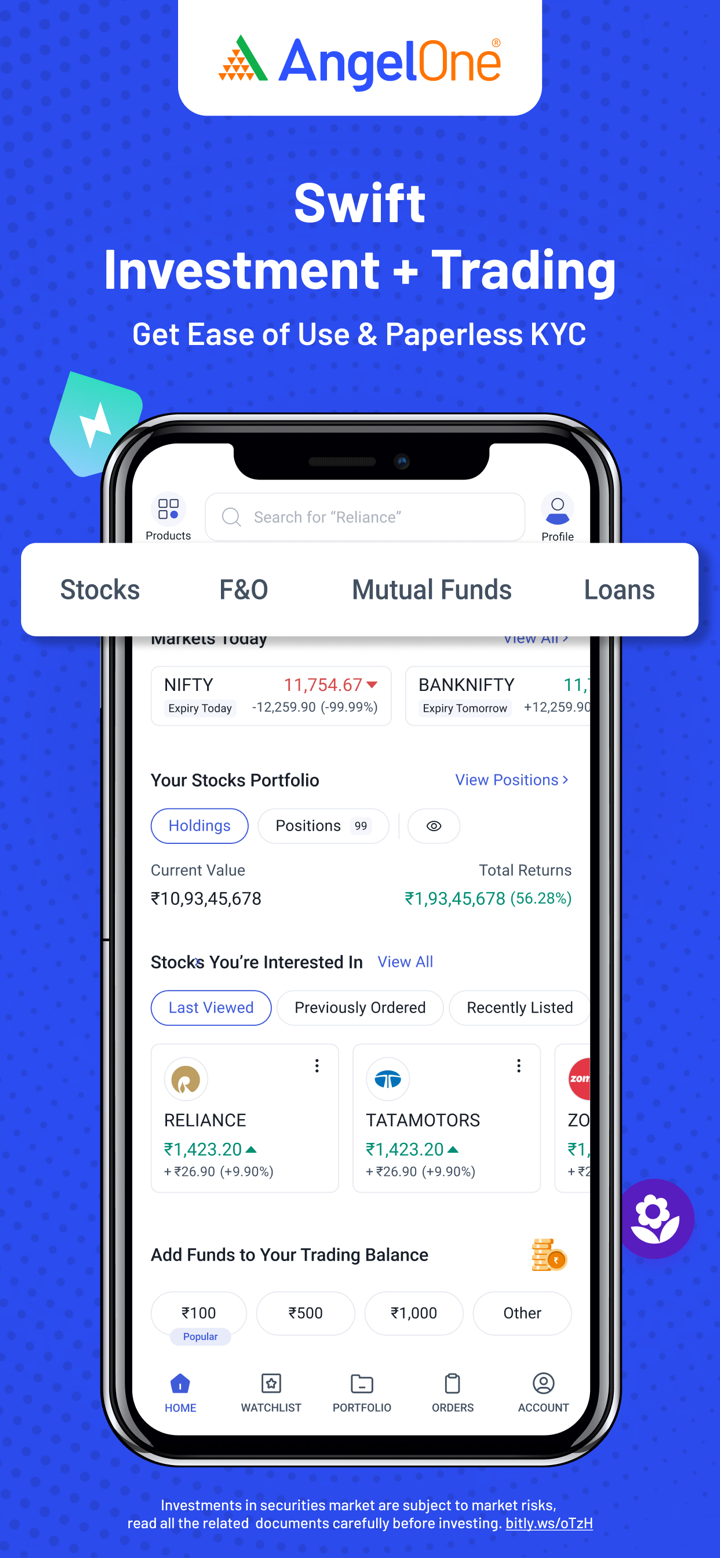

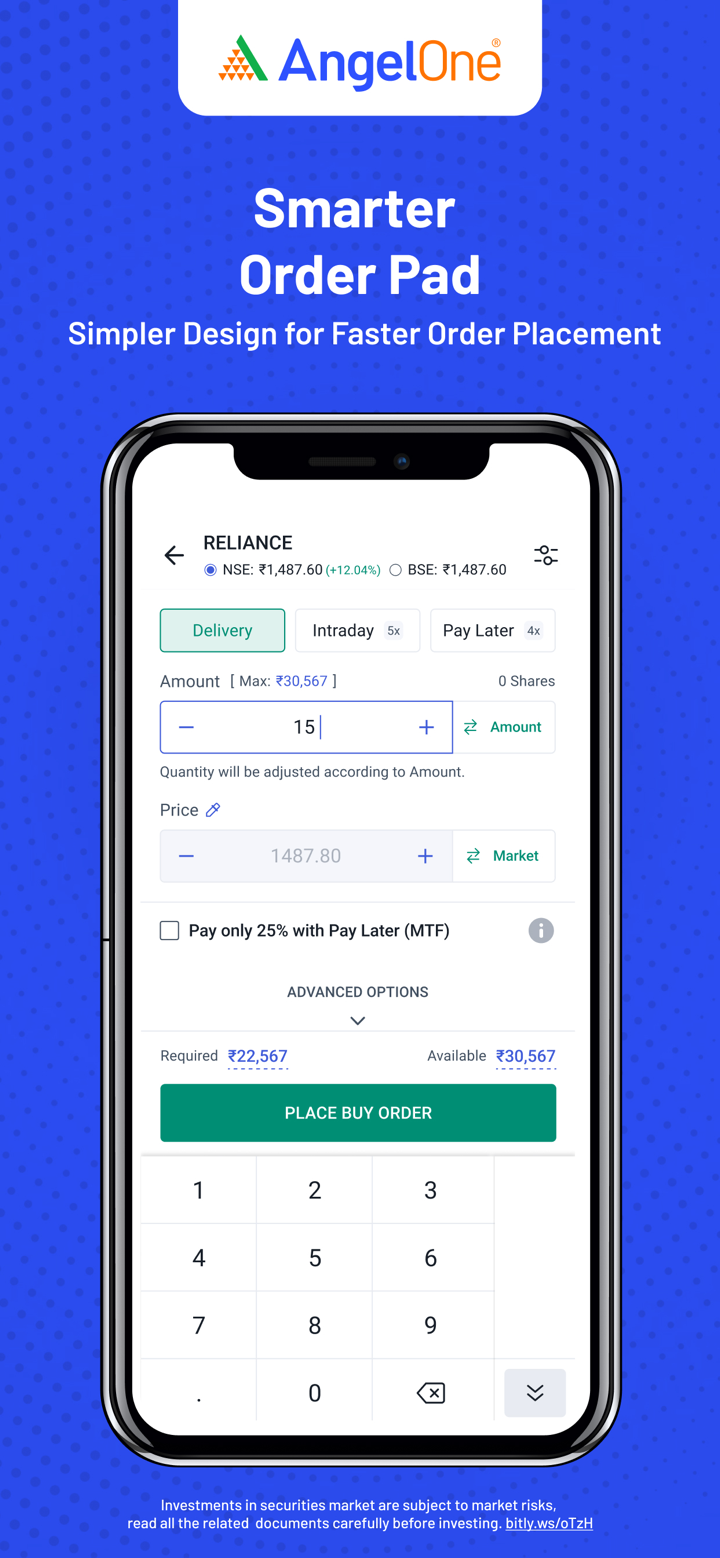

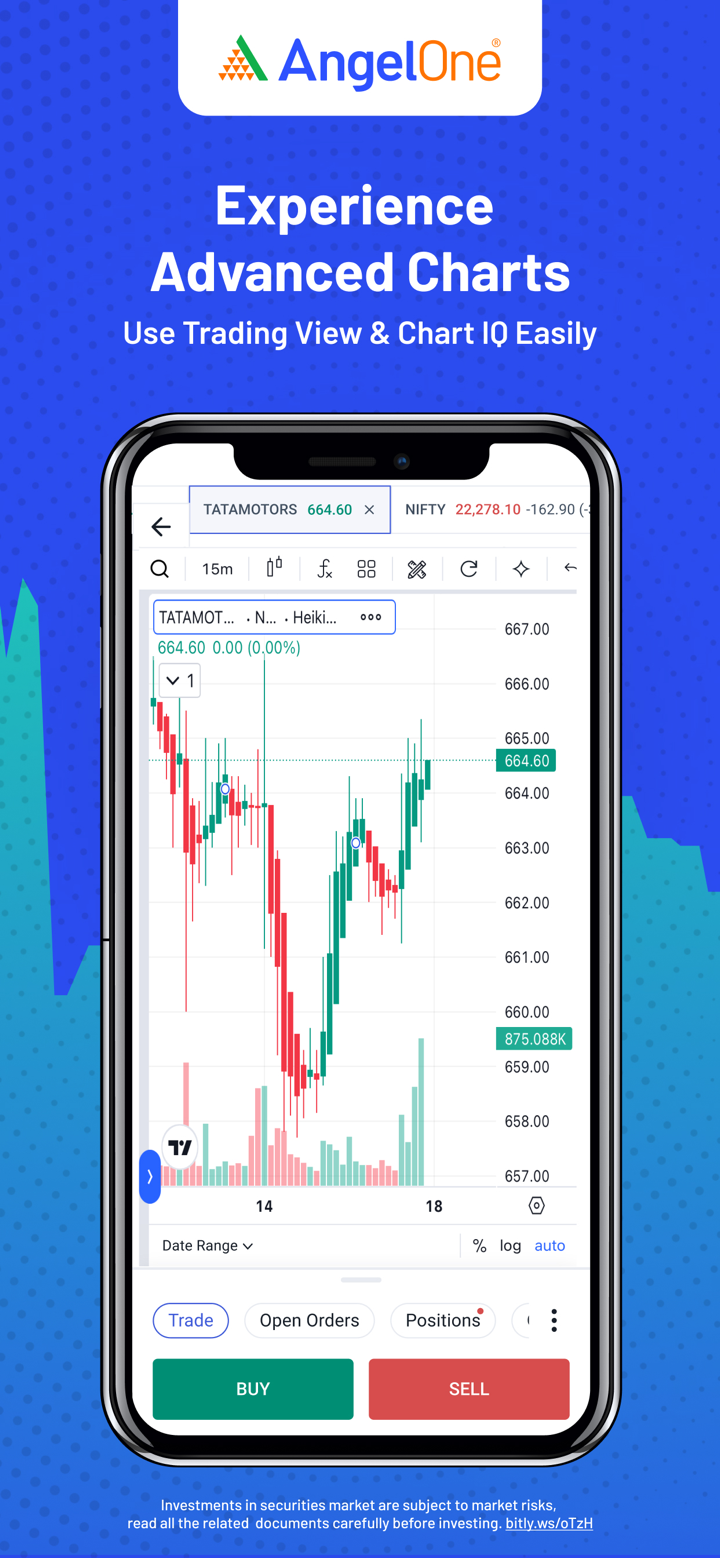

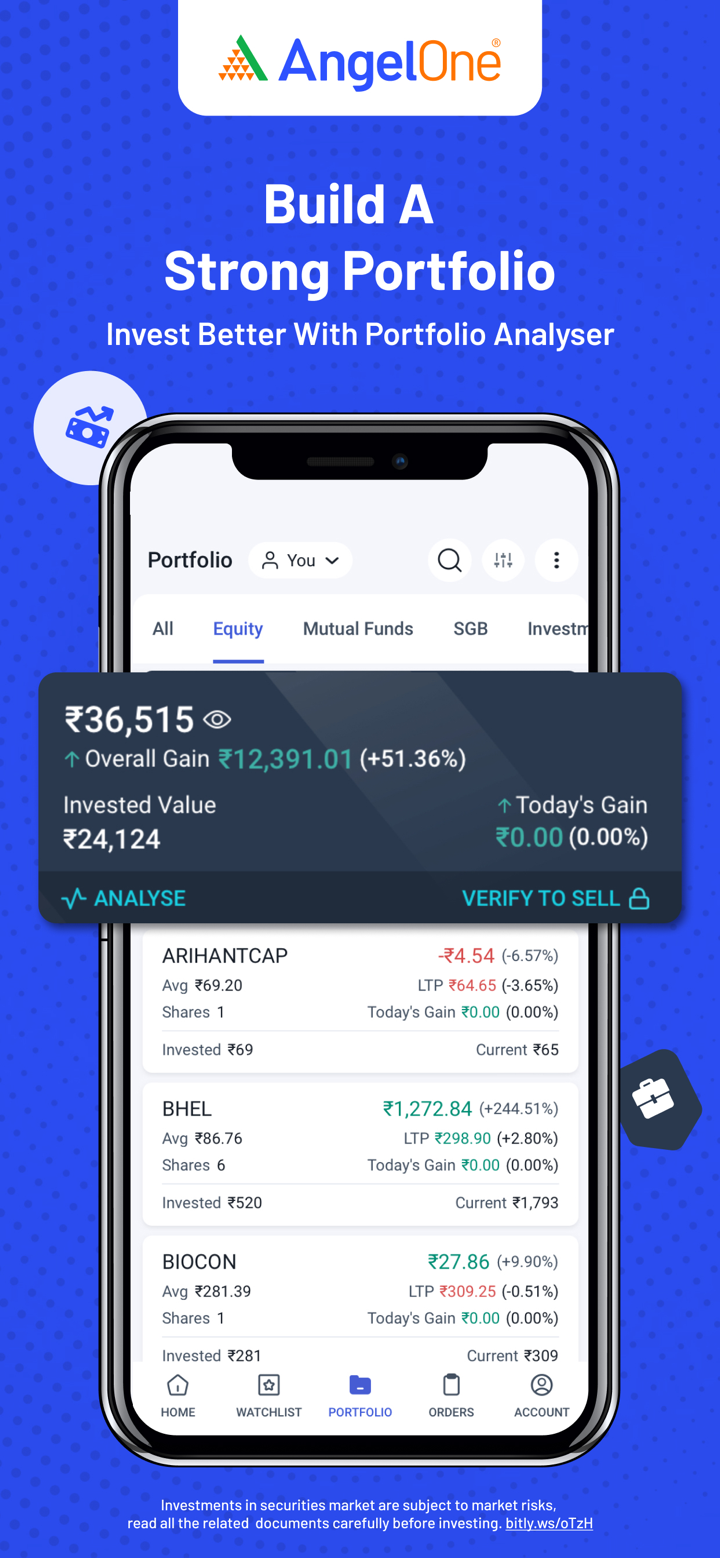

Angel One offers three trading platforms, a mobile app for everyday investors, a web platform for pro traders, and APIs for developers and algo traders.

| Platform | Supported | Available Devices | Suitable for |

| Angel One Super App | ✔ | Android, iOS | Beginner to intermediate investors & traders |

| Angel One Trade | ✔ | Web (Desktop/Laptop) | Active/professional traders |

| Smart API | ✔ | API access (Web backend integration) | Developers, algo traders, fintech platforms |