Resumo da empresa

| Angel One Resumo da Revisão | |

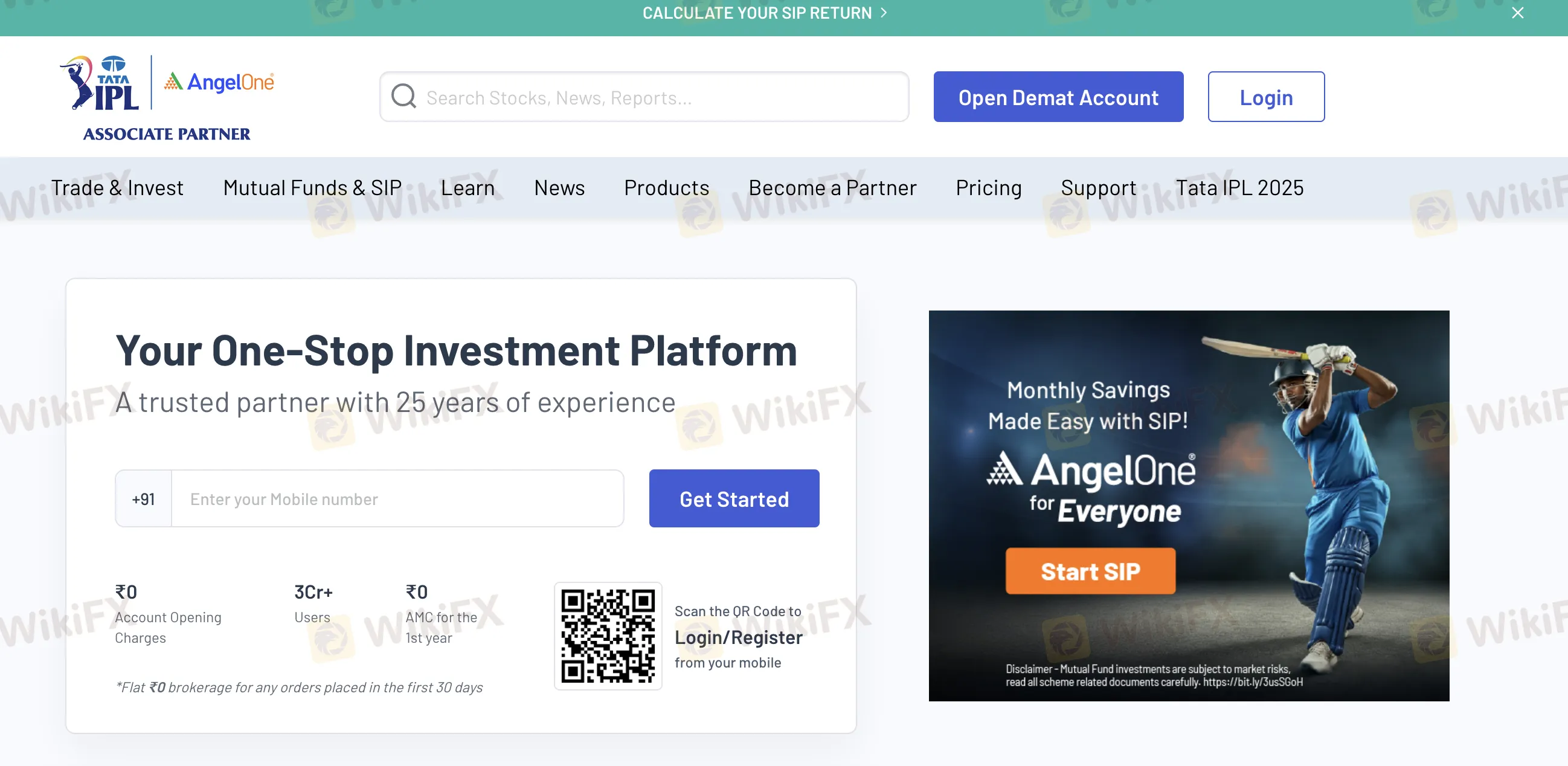

| Fundação | 1996 |

| País/Região Registrada | Índia |

| Regulação | Sem regulação |

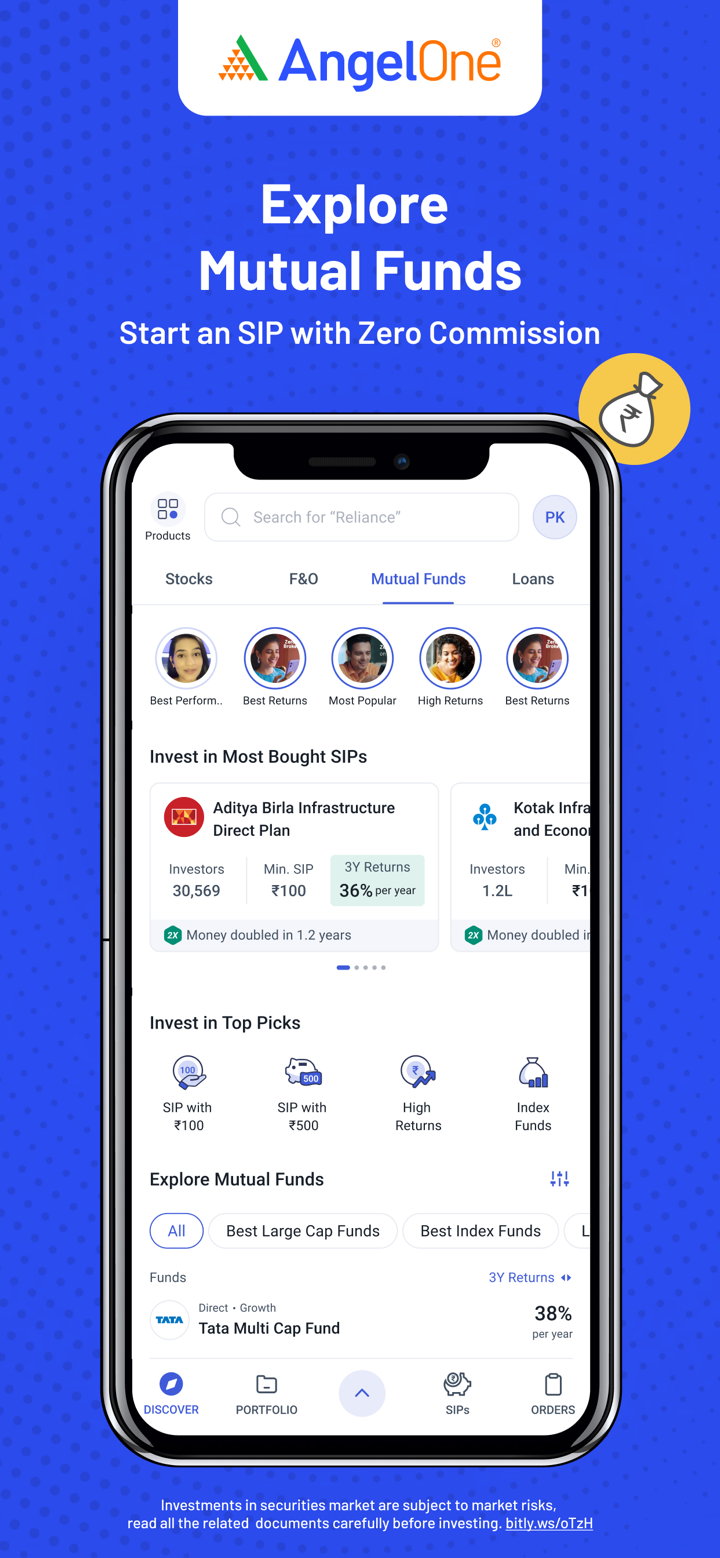

| Produtos de Negociação | Ações, IPOs, Derivativos (F&O), Fundos Mútuos, Commodities |

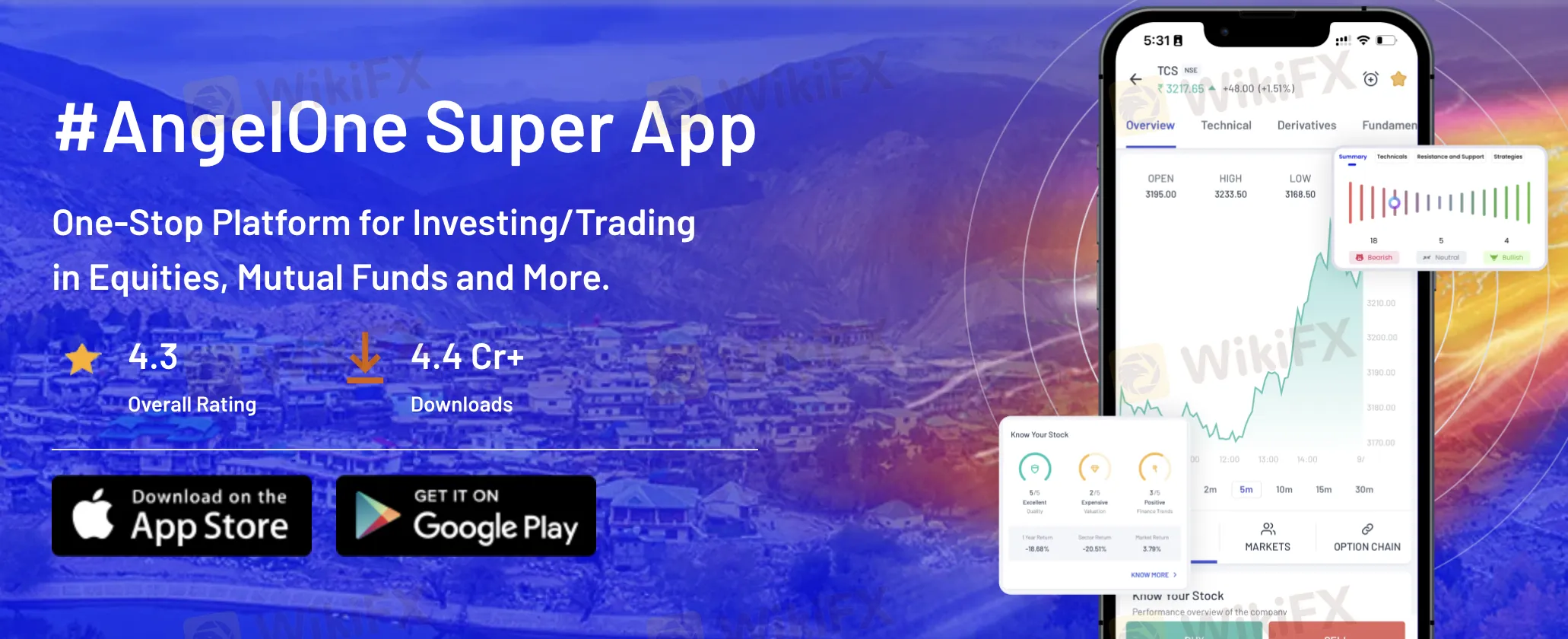

| Plataforma de Negociação | Angel One Super App (mobile), Angel One Trade (web), Smart API (desenvolvedor) |

| Depósito Mínimo | ₹0 |

| Suporte ao Cliente | Email: support@angelone.in |

| Telefone: 18001020 | |

Informações sobre Angel One

Fundada em 1996, Angel One é uma empresa de corretagem indiana. A SEBI ou qualquer poder financeiro mundial não a controla. Entre os muitos veículos de investimento que a empresa oferece estão ações, derivativos, fundos mútuos e ações dos EUA. Sua ausência de controle regulatório gera preocupação, mesmo com seus custos baixos e plataformas tecnológicas robustas.

Prós e Contras

| Prós | Contras |

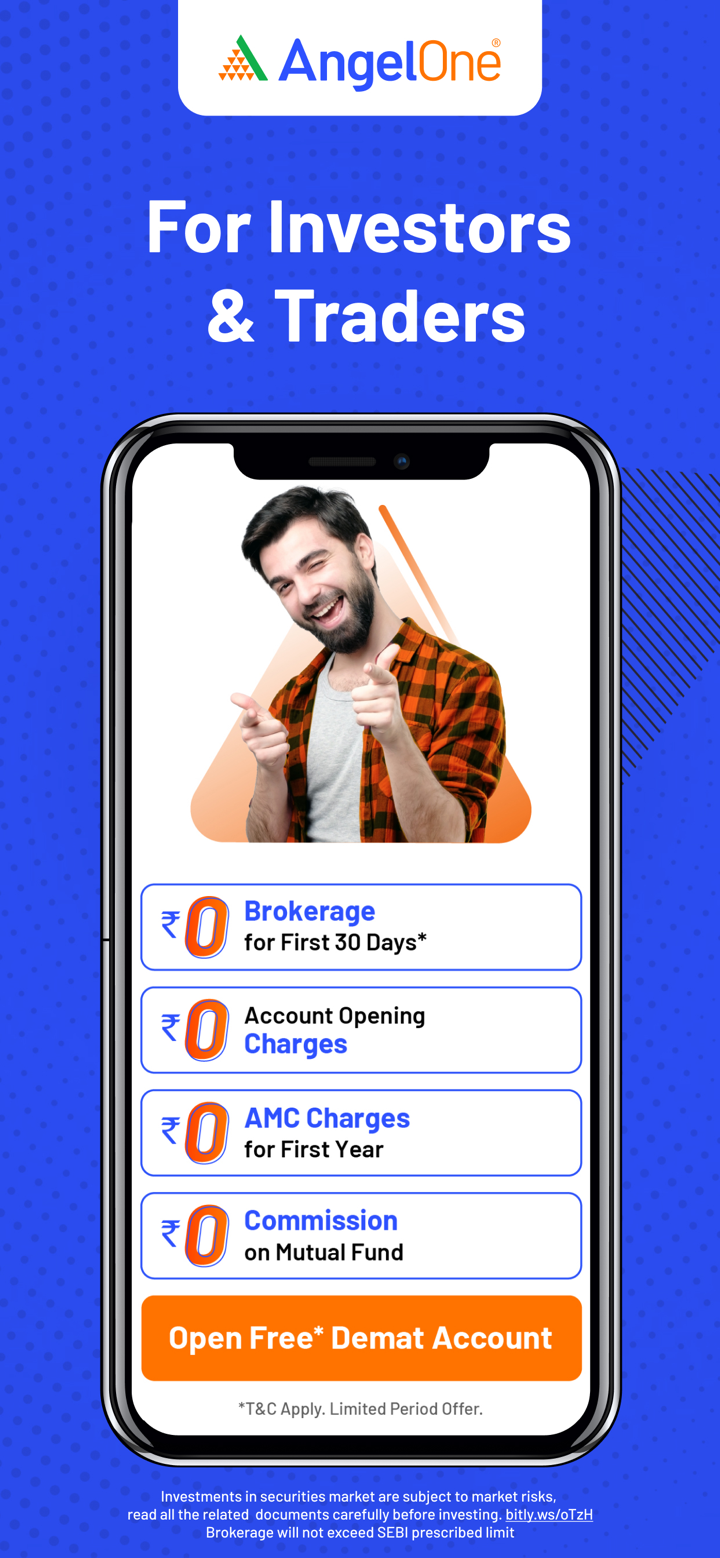

| Corretagem zero nos primeiros ₹500 em 30 dias | Sem regulação |

| Ampla variedade de produtos de investimento | Várias taxas cobradas |

| Plataformas amigáveis ao usuário | |

| Sem depósito mínimo |

Angel One é Legítimo?

Angel One não é um corretor regulamentado. Embora sediada na Índia, não possui licença da SEBI ou de grandes reguladores globais como a FCA, ASIC ou NFA.

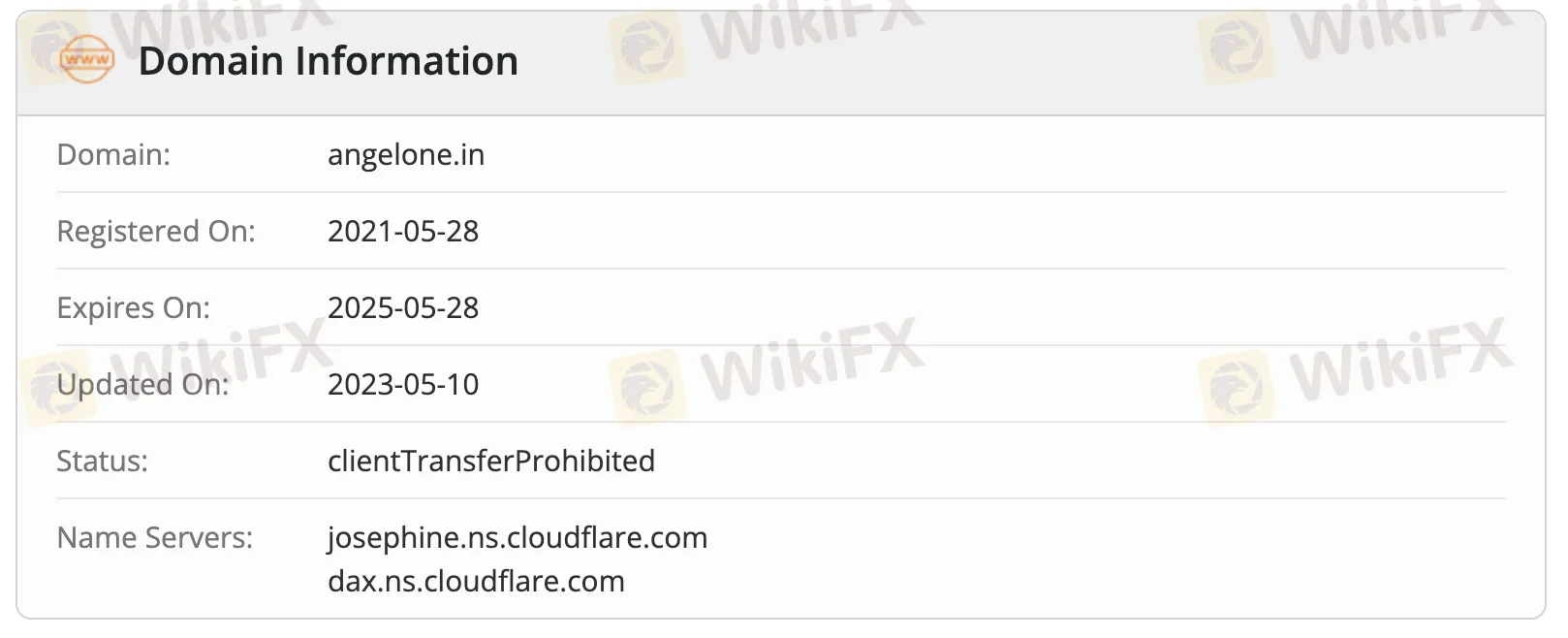

O domínio angelone.in foi registrado em 28 de maio de 2021, atualizado pela última vez em 10 de maio de 2023 e expirará em 28 de maio de 2025. Seu status é clientTransferProhibited.

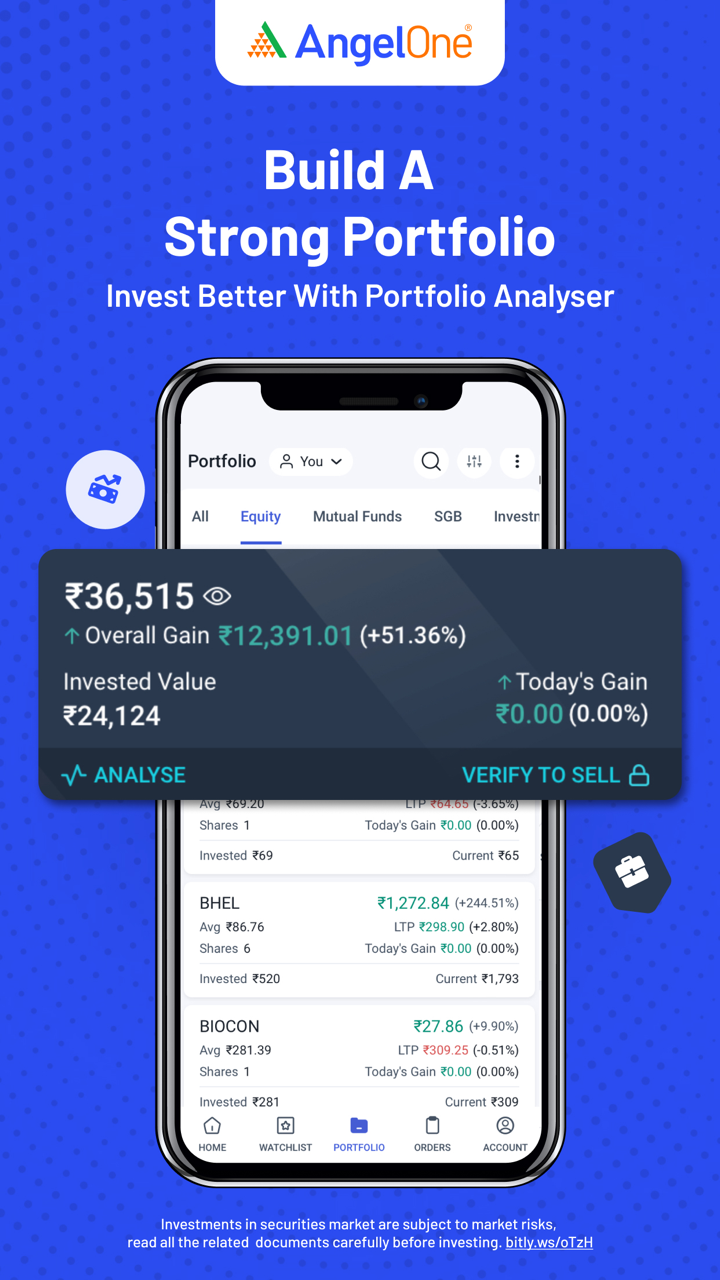

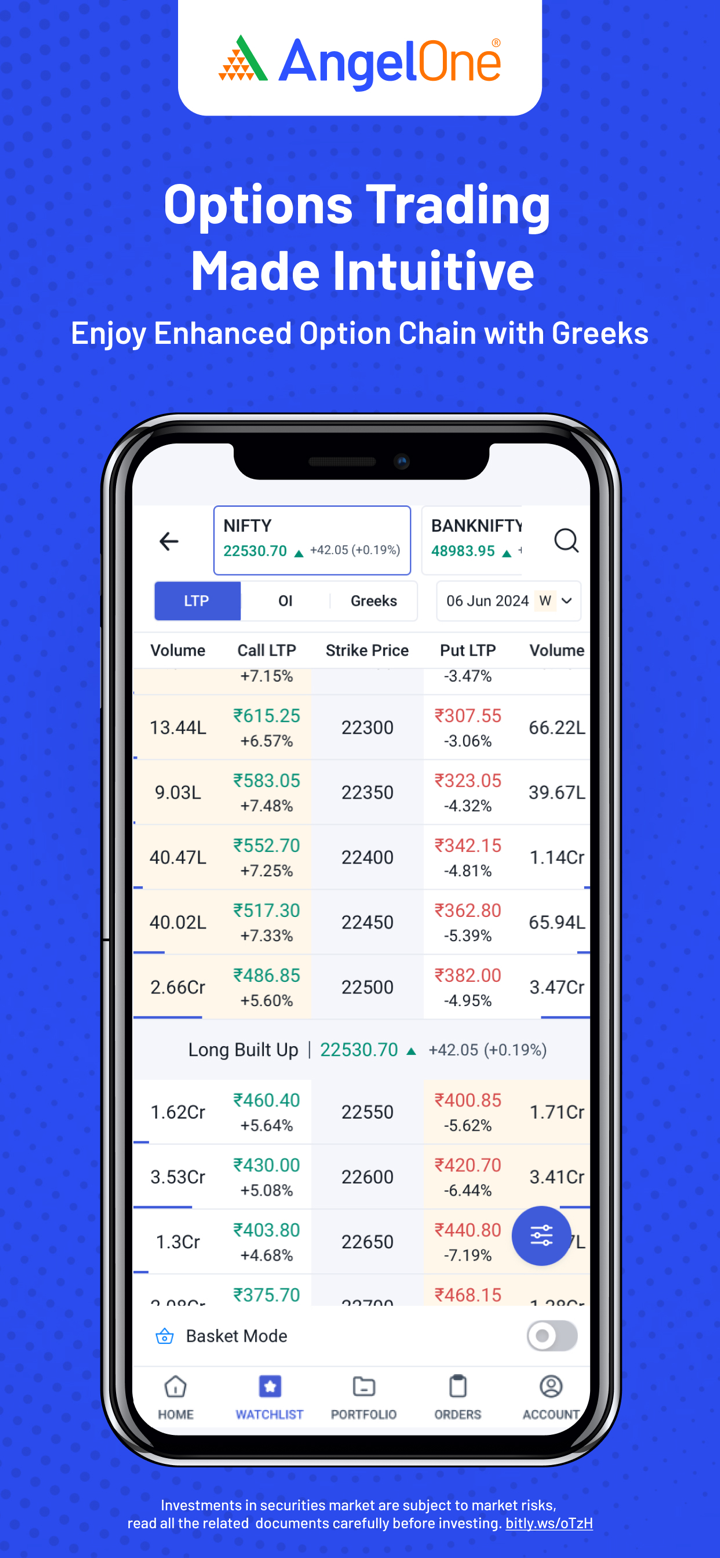

Produtos de Negociação

Angel One oferece uma ampla gama de produtos de investimento, incluindo ações, IPOs, derivativos, fundos mútuos, commodities e ações dos EUA.

| Instrumentos de Negociação | Suportado |

| Ações | ✔ |

| IPOs | ✔ |

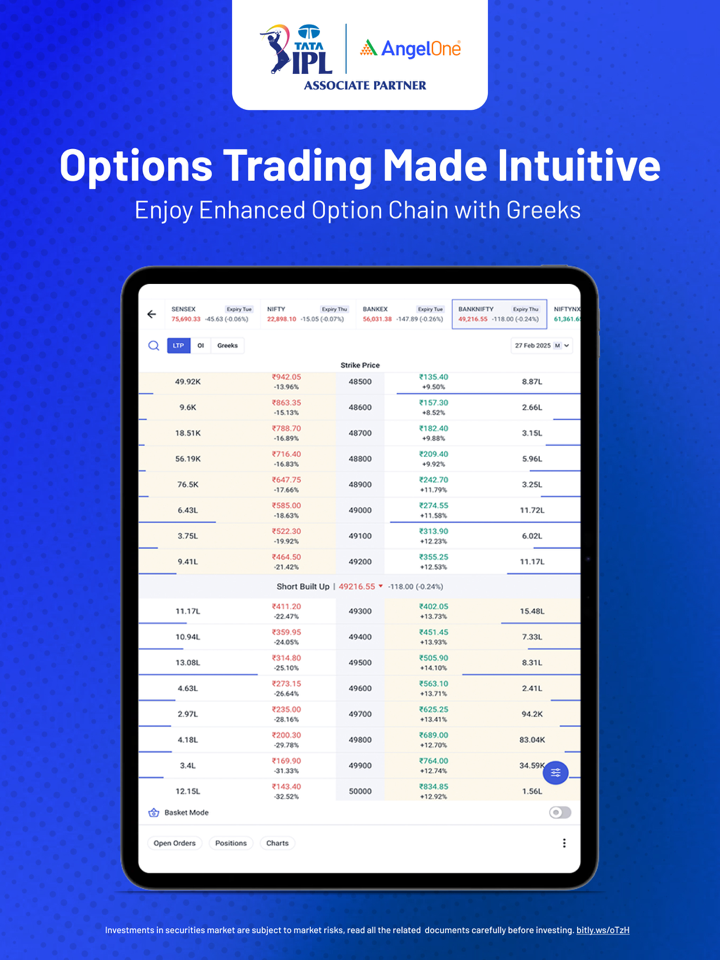

| Derivativos (F&O) | ✔ |

| Fundos Mútuos | ✔ |

| Commodities | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

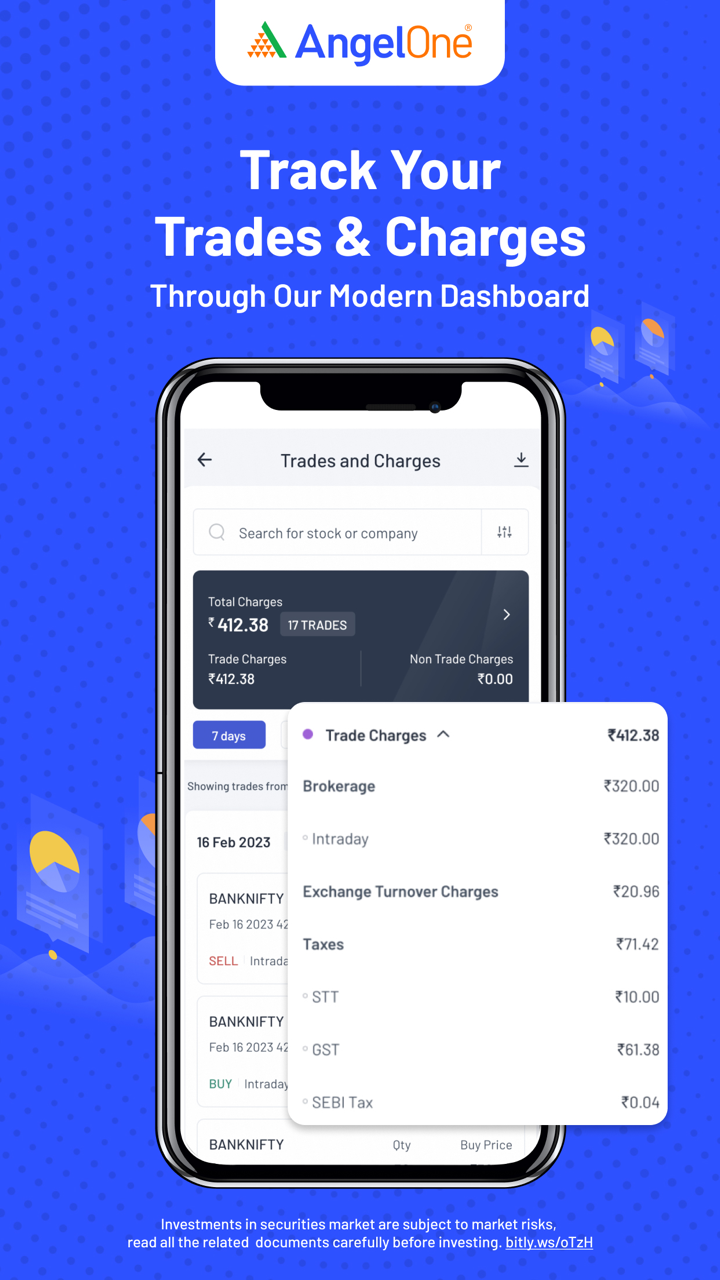

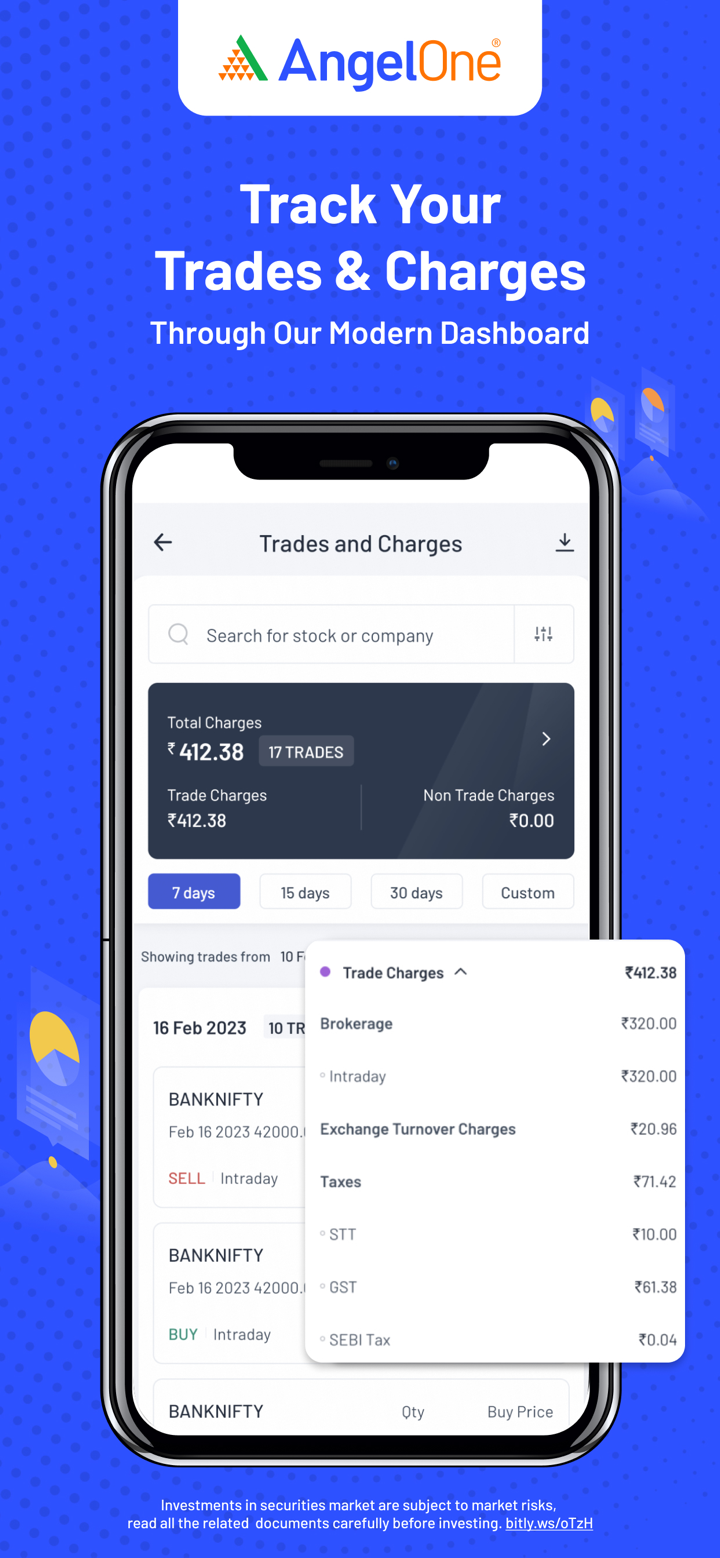

Angel One Taxas

As taxas da Angel One são geralmente baixas a moderadas em comparação com os padrões da indústria na Índia. Oferece corretagem zero nos primeiros 30 dias (até ₹500), após o que sua corretagem é limitada e competitiva, especialmente para traders varejistas. As taxas adicionais estão principalmente em conformidade com as normas regulatórias.

| Tipo de Investimento | Oferta Inicial | Corretagem Pós-Oferta |

| Entrega de Ações | ₹0 até ₹500 em 30 dias | Mínimo de ₹20 ou 0,1% por ordem (mínimo ₹2) |

| Trading Intraday | Mínimo de ₹20 ou 0,03% por ordem | |

| Futuros | ₹20 por ordem executada | |

| Opções |

| Tipo de Taxa | Entrega de Ações | Intraday | Futuros | Opções |

| Taxas de Transação | NSE: 0,00297% | NSE: 0,00173% | NSE: 0,03503% | |

| STT | 0,1% (Compra/Venda) | 0,025% (Venda) | 0,01% (Venda) | 0,05% (Venda) |

| Imposto sobre Valor Agregado | 18% | |||

| Taxas da SEBI | ₹10/crore | |||

| Taxas de Compensação | ₹0 | |||

| Imposto de Selo | 0,015% (Compra) | 0,003% (Compra) | 0,002% (Compra) | 0,003% (Compra) |

| Tipo de Taxa | Taxa |

| Abertura de Conta | 0 (às vezes ₹36,48 para NRIs) |

| AMC (1º Ano) | 0 |

| AMC (Após 1º Ano) | ₹60/trimestre (não-BSDA), ou ₹450/ano, ou opção vitalícia de ₹2950 |

| AMC BSDA | NIL até ₹4L; ₹100/ano para investimentos de ₹4L–₹10L |

| MTF (Empréstimo de Margem) | 0,041% por dia |

| Juros sobre Saldo Devedor | 0,049% por dia |

| Taxas de Colateral em Dinheiro | 0,0342%/dia (em déficit > ₹50.000) |

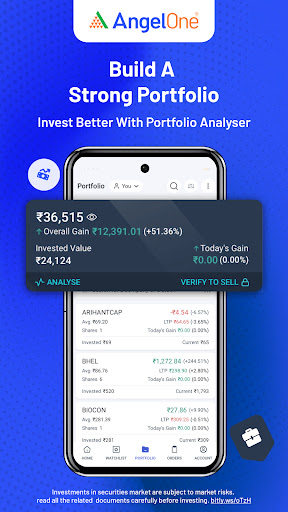

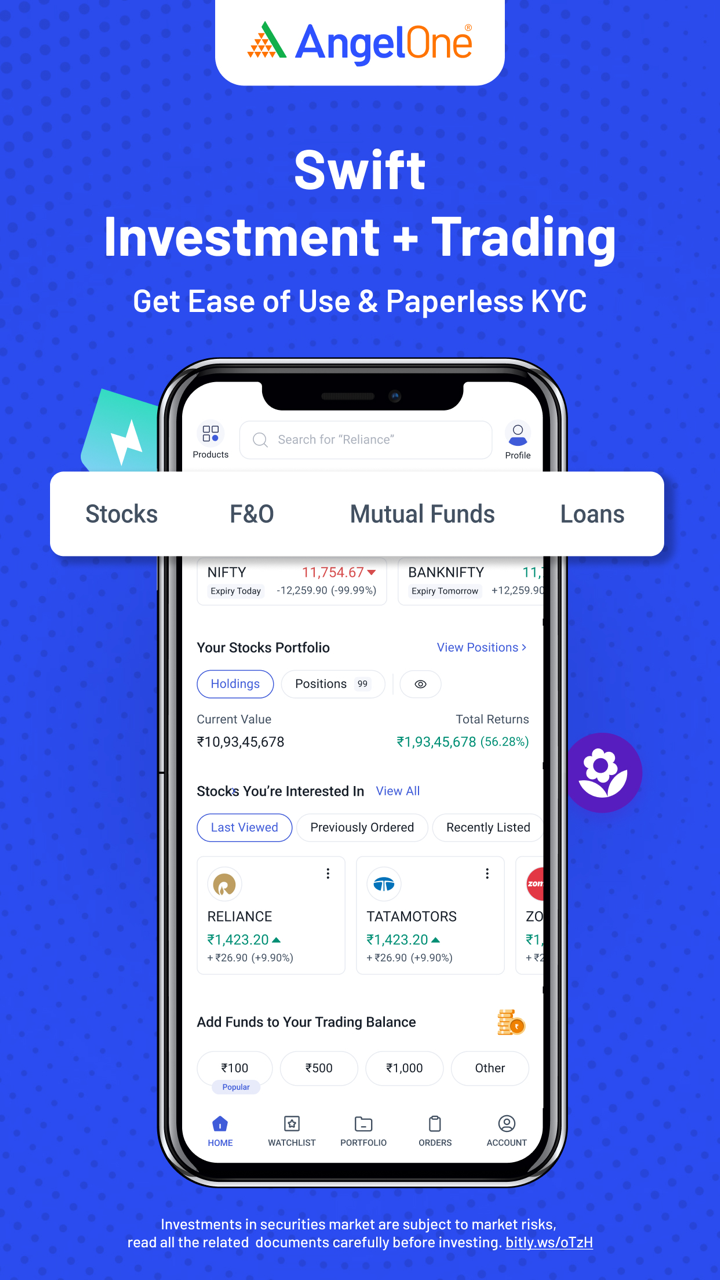

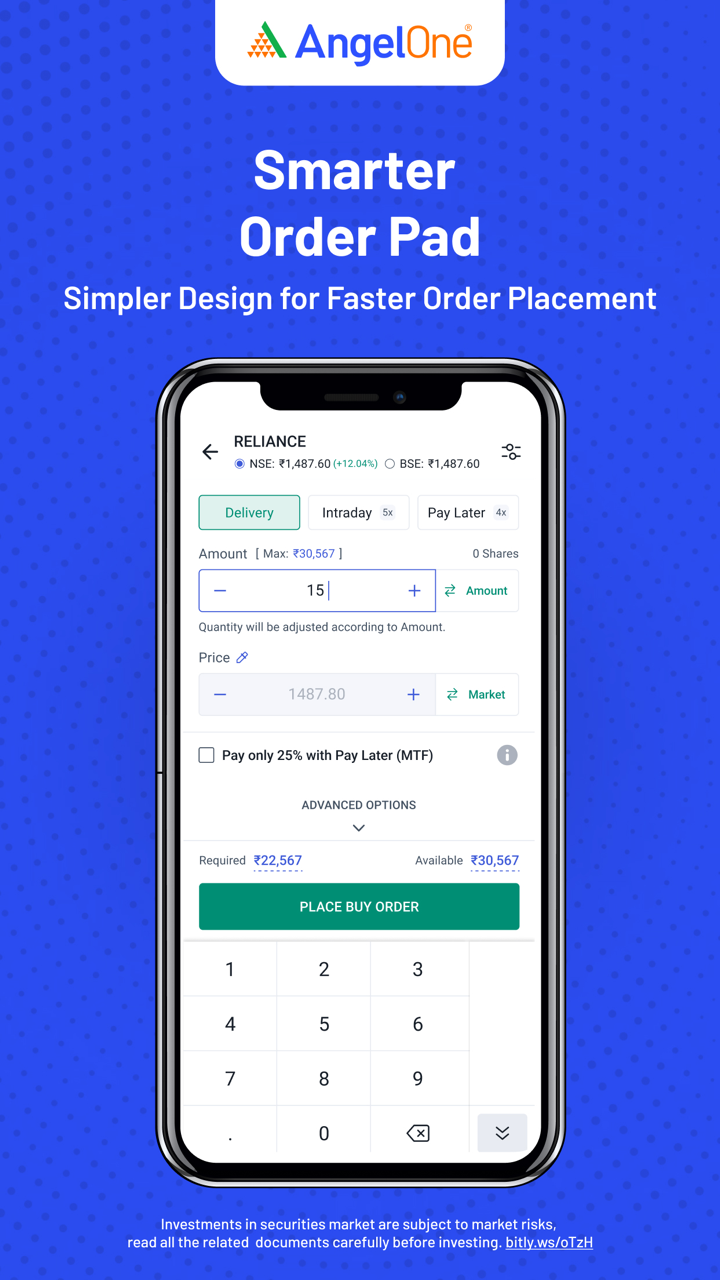

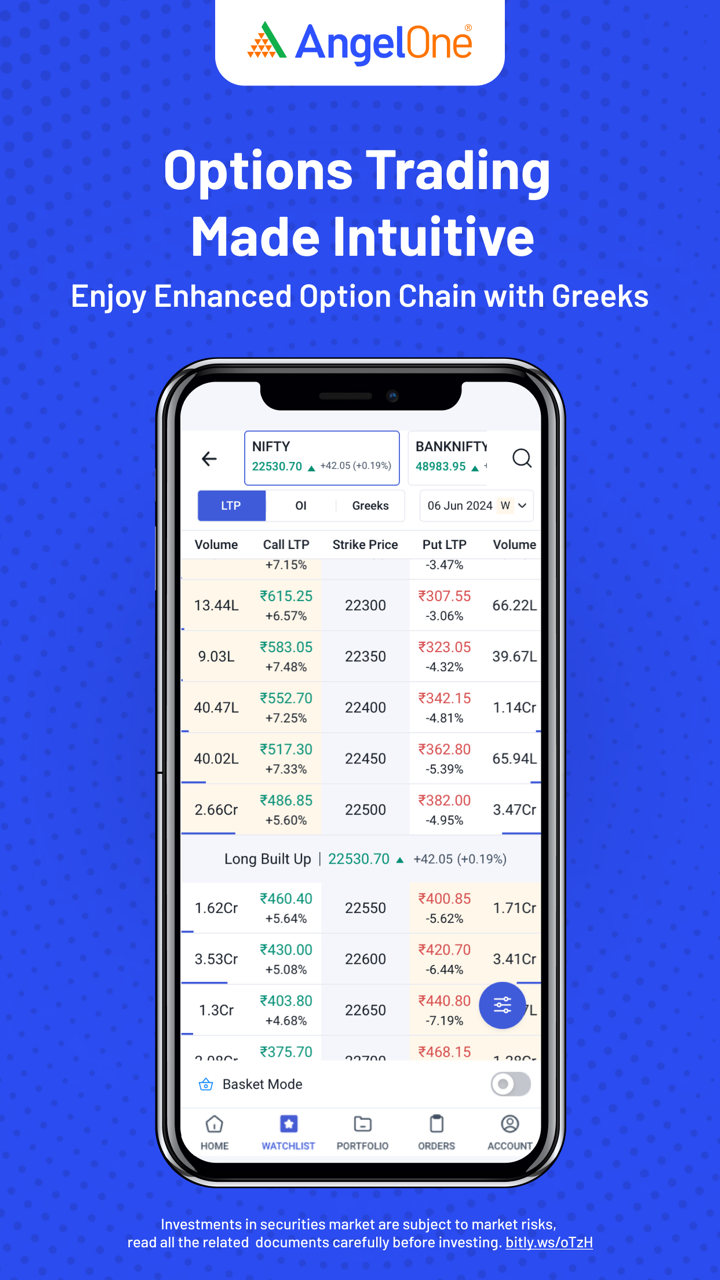

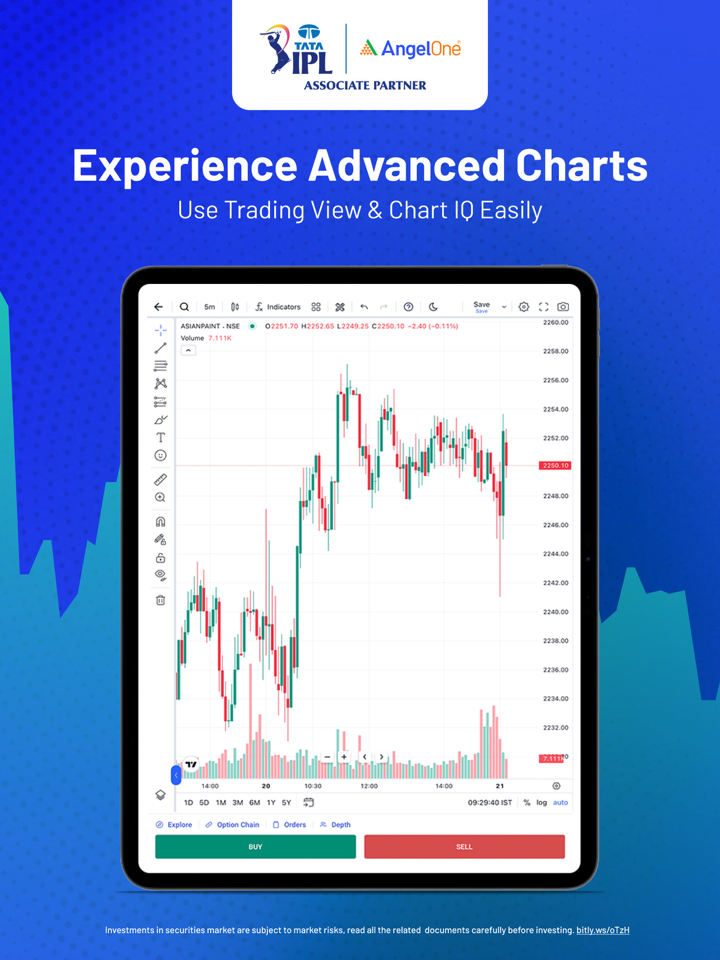

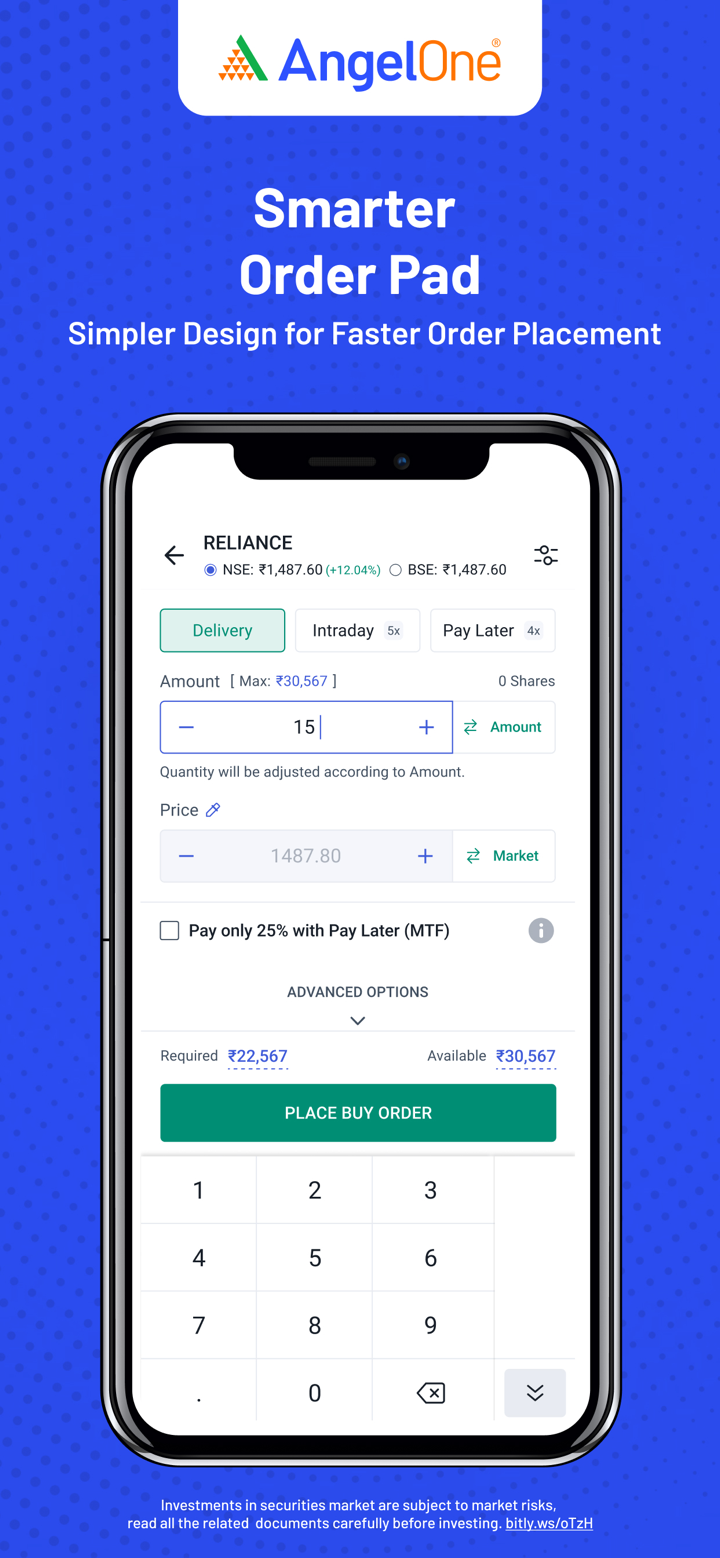

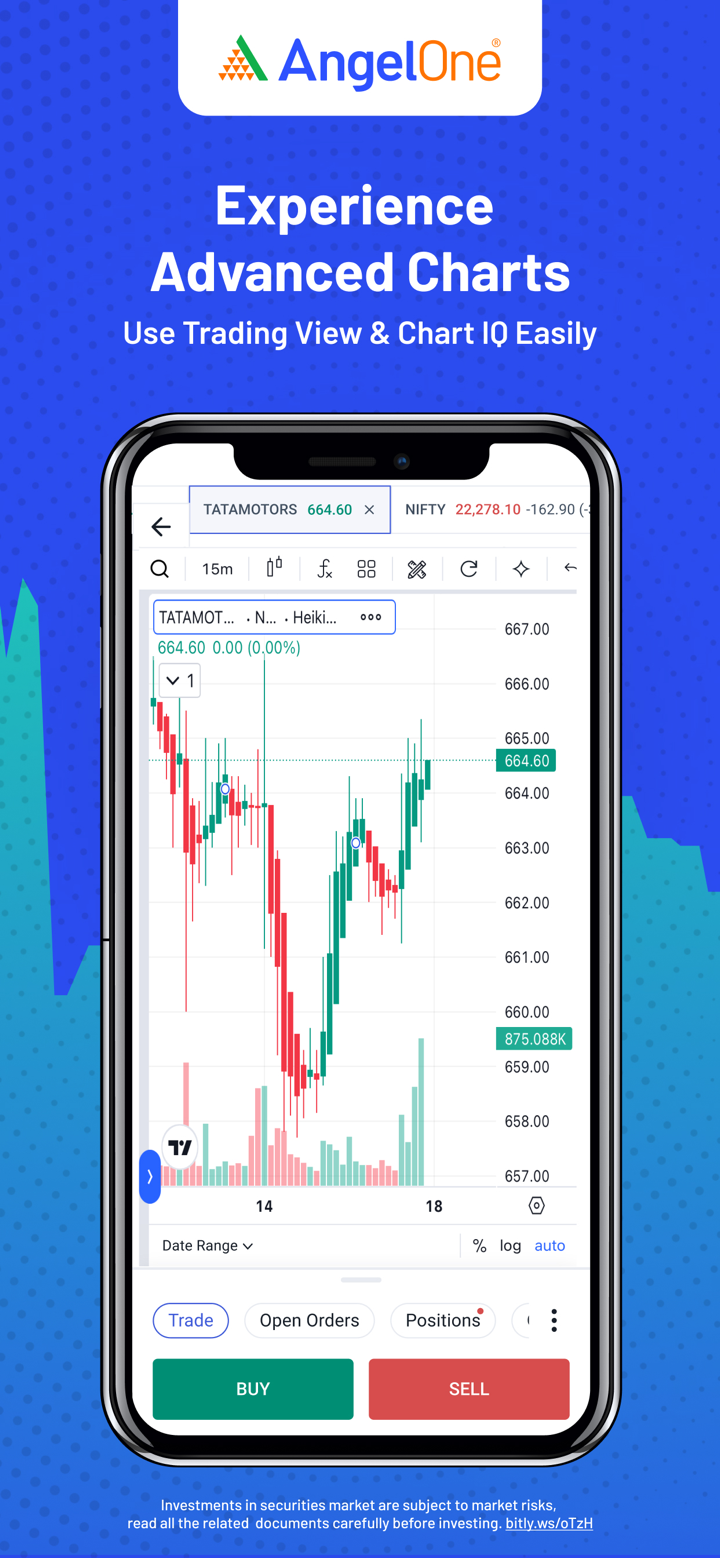

Plataforma de Negociação

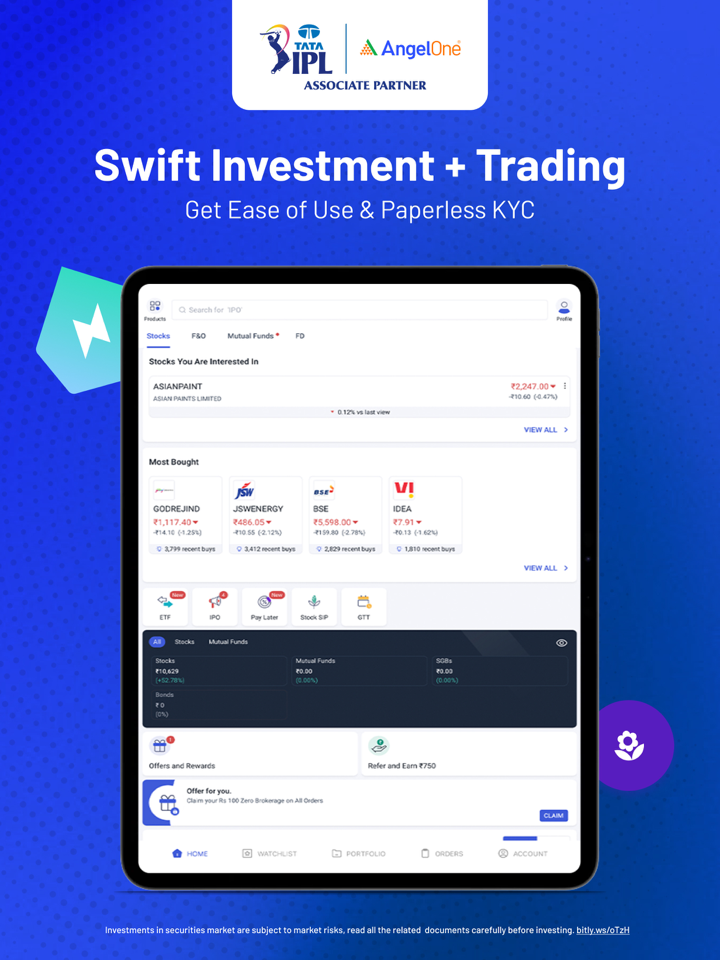

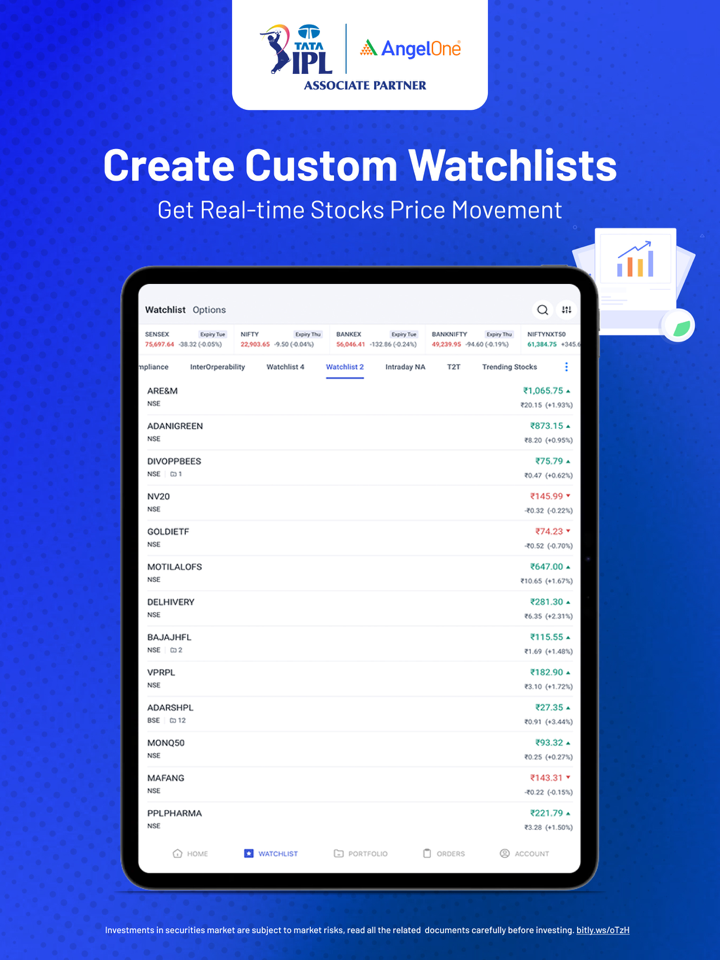

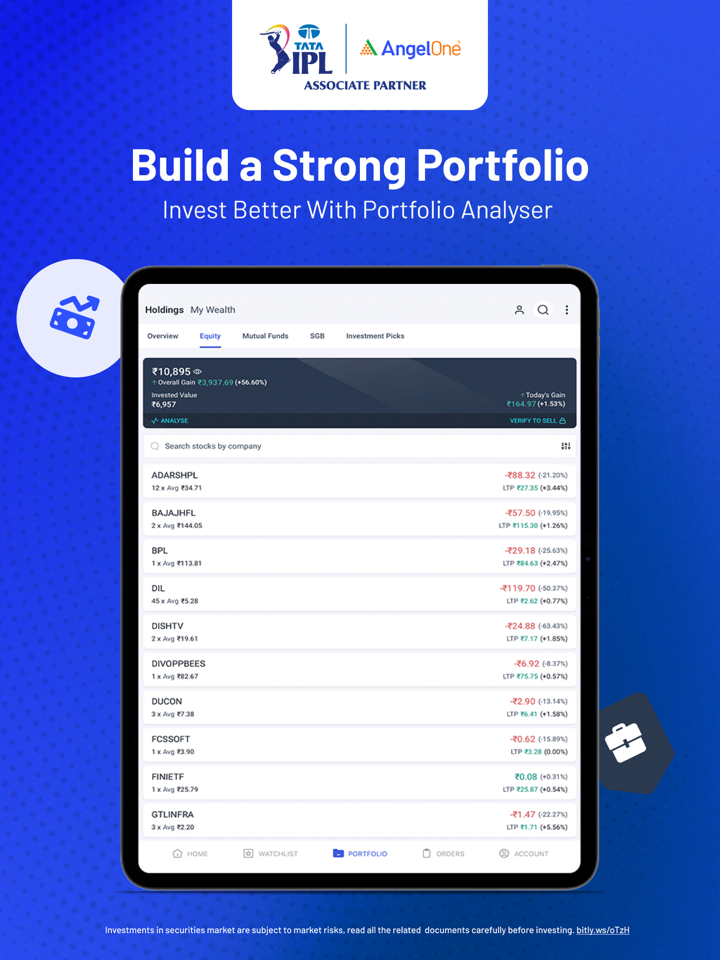

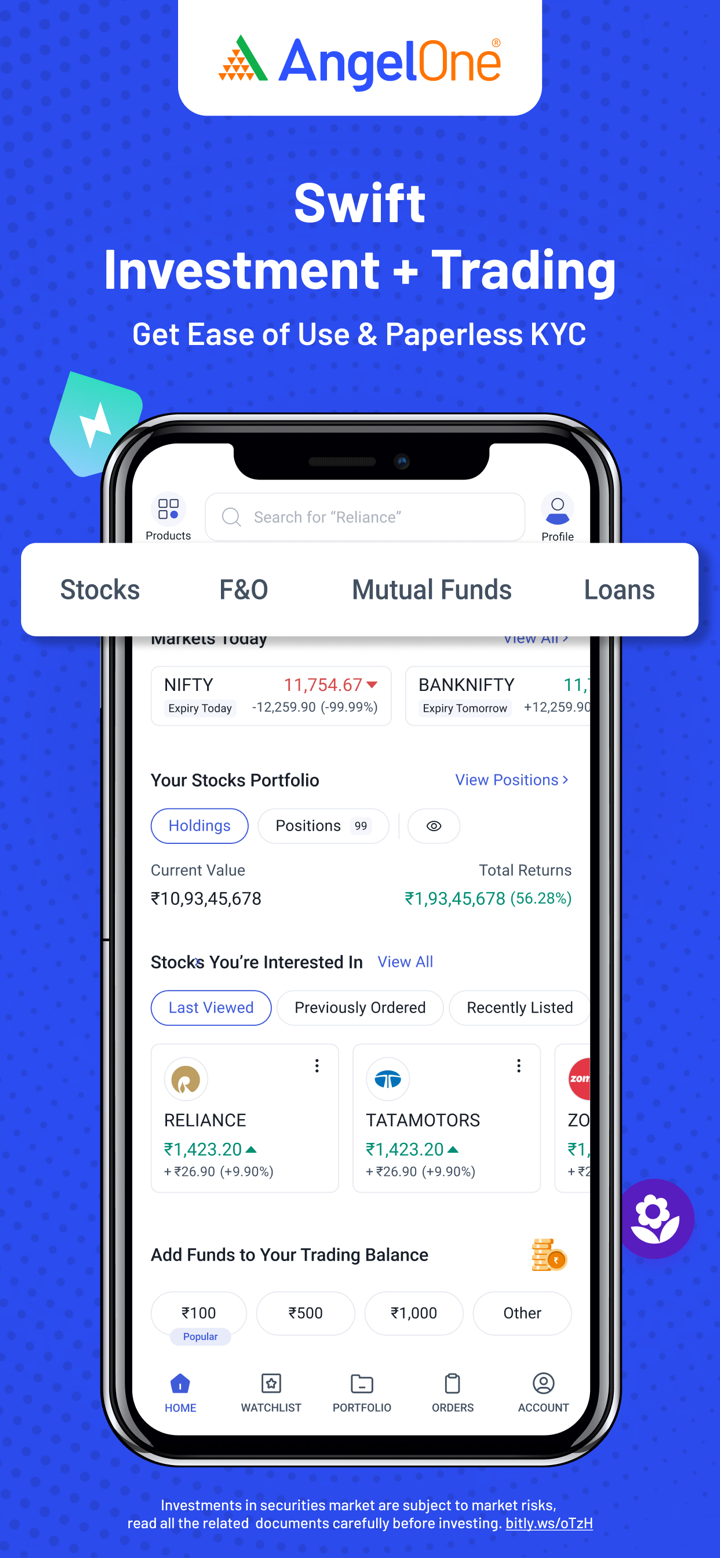

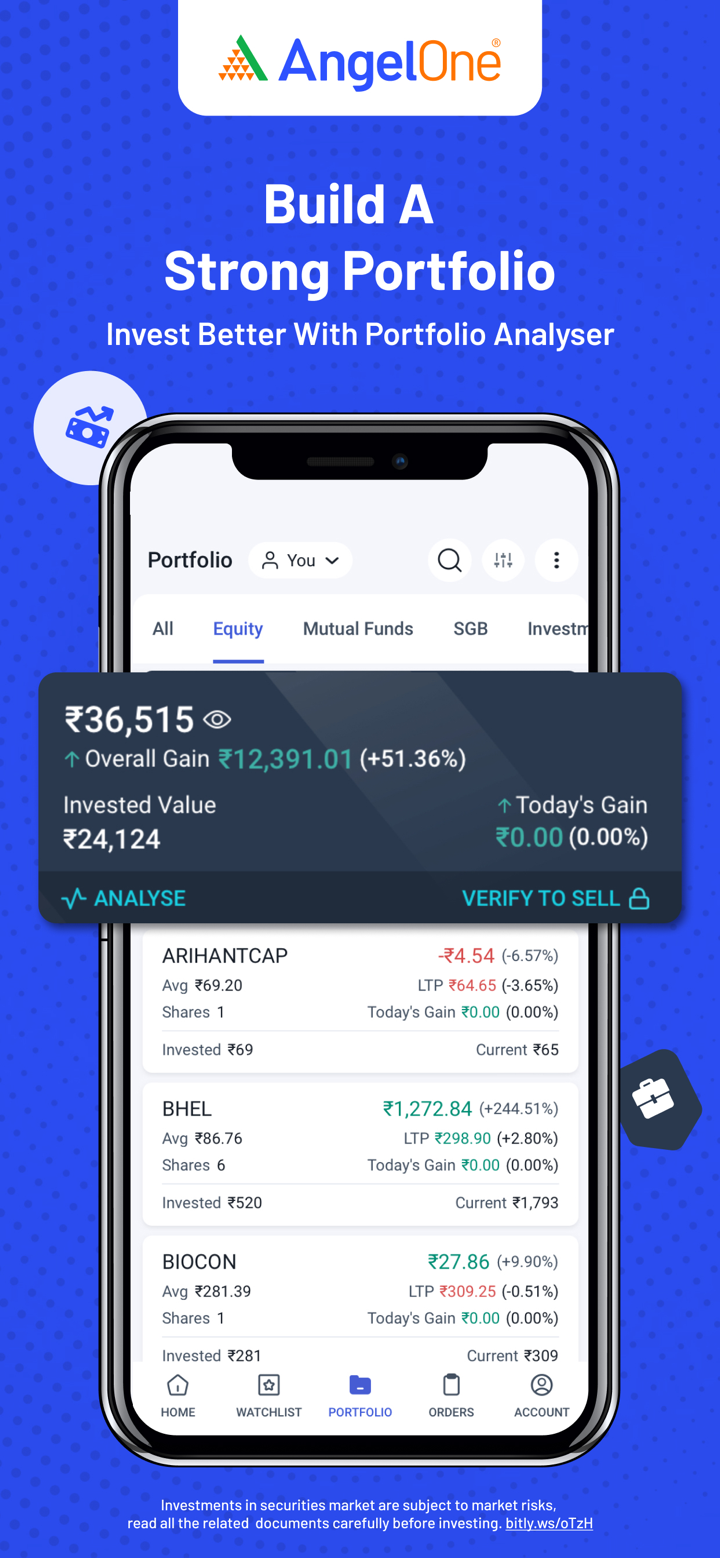

A Angel One oferece três plataformas de negociação, um aplicativo móvel para investidores do dia a dia, uma plataforma web para traders profissionais e APIs para desenvolvedores e traders de algoritmos.

| Plataforma | Suportado | Dispositivos Disponíveis | Adequado para |

| Super App Angel One | ✔ | Android, iOS | Investidores e traders iniciantes a intermediários |

| Negociação Angel One | ✔ | Web (Desktop/Notebook) | Traders ativos/profissionais |

| API Inteligente | ✔ | Acesso à API (Integração de backend web) | Desenvolvedores, traders de algoritmos, plataformas fintech |