Company Summary

| ACI TRADING Review Summary | |

| Founded | 2008 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeds) |

| Market Instruments | Forex, Commodities (Gold, Silver, Oil), Indexes, Stocks |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | From 1.5 pips (Standard account), from 0.7 pips (Pro account), from 0.0 pips (ECN account) |

| Trading Platform | Desktop App (Windows), Mobile App (iOS, Android) |

| Min Deposit | $50 |

| Customer Support | +84 91 234 5678 |

| info@acifx.com | |

| L4-11.OT04, Landmark 4, Vinhomes Central Park, Ward 22, Binh Thanh District, Ho Chi Minh City, Vietnam | |

ACI TRADING Information

Founded in 2008, ACI TRADING runs under an FCA Common Business Registration license obtained from the United Kingdom. Supported by mobile and desktop apps, the platform provides several trading products including FX, commodities, indices, and stocks. Nonetheless, the broker goes outside the parameters of its licencing for regulations, which increases the risks for trading.

Pros and Cons

| Pros | Cons |

| Regulated under FCA (non-forex) | Exceeds licensed business scope |

| Offers forex, indices, and metals | Limited asset classes—no crypto or CFDs |

| Three account types with low deposit | Lack of clarity on deposit/withdrawal fees |

| Platforms for mobile and desktop | No support for web-based trading |

Is ACI TRADING Legit?

The United Kingdom Financial Conduct Authority (FCA) via a Common Business Registration license ( License No. 147718) controls ACI Trading. But the broker goes outside the business area allowed by this non-forex license.

September 27, 2008 saw the registration of the domain acifx.com; its registration expires September 26, 2030. December 1, 2024 was the final domain change issued.

What Can I Trade on ACI TRADING?

Bonds, oil, 62 different currency pairs, major international stock indices, precious metals (gold, silver, etc.), and more are all available for trading at ACI TRADING.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Crypto | ❌ |

| CFD | ❌ |

| Indexes | ✔ |

| Stock | ✔ |

| ETF | ❌ |

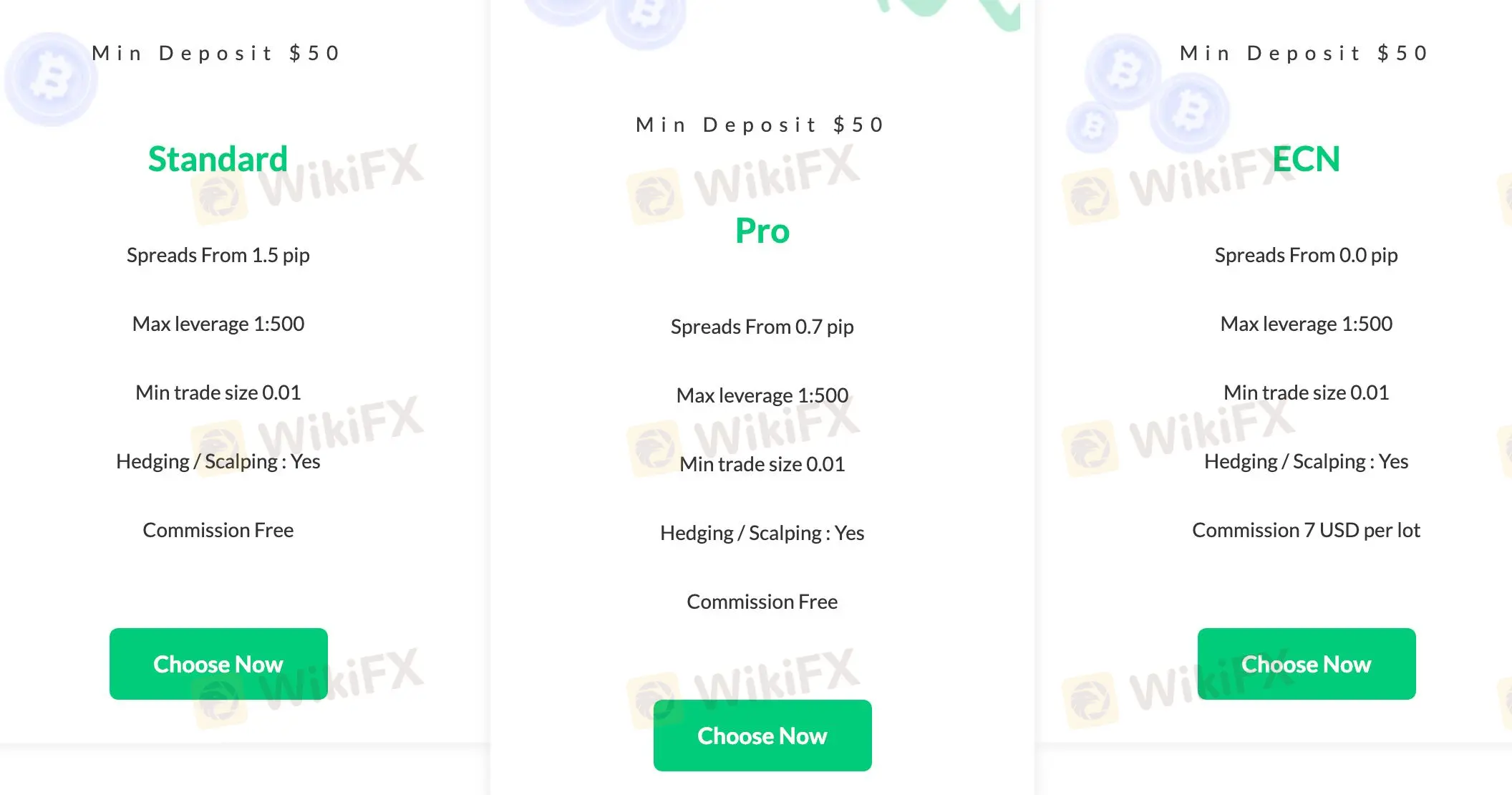

Account Types

ACI TRADING provides three types of live trading accounts: standard, professional, and ECN. All accounts demand a minimum deposit of $50, have leverage of up to 1:500, and feature hedging and scalping.

| Account Type | Standard | Pro | ECN |

| Min Deposit | $50 | $50 | $50 |

| Spreads | From 1.5 pip | From 0.7 pip | From 0.0 pip |

| Max Leverage | 1:500 | 1:500 | 1:500 |

| Min Trade Size | 0.01 | 0.01 | 0.01 |

| Hedging/Scalping | Yes | Yes | Yes |

| Commission | Free | Free | $7 USD per lot |

| Suitable For | Beginners seeking simple, commission-free trading. | Intermediate traders seeking tighter spreads. | Advanced traders needing ultra-tight spreads. |

Leverage

ACI TRADING allows traders to quickly enhance their trading positions with minimal initial commitment with up to 1:500 leverage on all account types. High leverage can boost profits but also increase losses.

ACI TRADING Fees

ACI Trading's price structure is quite normal when compared to industry benchmarks, with varied spreads and charges across account categories.

The Standard account features spreads starting at 1.5 pips and no commission, while the Pro account starts at 0.7 pips and is also commission-free. The ECN account offers tighter spreads starting at 0.0 pips but charges a commission of $7 per lot.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Desktop App | ✔ | Windows | Experienced traders who prefer desktop tools |

| Mobile App | ✔ | iOS, Android | Traders requiring flexibility and mobility |

| Web Trader | ❌ | / | / |

Deposit and Withdrawal

ACI Trading does not specify whether deposit or withdrawal fees apply. The minimum deposit is $50.

| Method | Min. Amount | Fees | Processing Time |

| Bank Transfer | $50 | Not specified | 1-3 business days |

| Credit/Debit Card | $50 | Not specified | Instant |

| E-Wallets (Skrill, Neteller, PayPal) | $50 | Not specified | Instant |