기본 정보

인도

인도

점수

인도

|

2-5년

|

인도

|

2-5년

| https://www.angelone.in/

공식 사이트

평점 지수

영향력

AAA

영향력 지수 NO.1

인도 9.81

인도 9.81 라이선스

라이선스효력 있는 규제 정보가 없습니다. 위험에 유의해 주세요!

인도

인도 angelone.in

angelone.in --

-- VIP가 활성화되지 않았습니다.

VIP가 활성화되지 않았습니다.

| Angel One 리뷰 요약 | |

| 설립 연도 | 1996 |

| 등록 국가/지역 | 인도 |

| 규제 | 규제 없음 |

| 거래 제품 | 주식, IPO, 파생상품 (선물 및 옵션), 펀드, 상품 |

| 거래 플랫폼 | Angel One 슈퍼 앱 (모바일), Angel One 트레이드 (웹), 스마트 API (개발자) |

| 최소 입금액 | ₹0 |

| 고객 지원 | 이메일: support@angelone.in |

| 전화: 18001020 | |

1996년 설립된 Angel One은 인도의 중개업체입니다. SEBI나 다른 세계적인 금융 기관의 규제를 받지 않습니다. 회사가 제공하는 다양한 투자 상품에는 주식, 파생상품, 펀드, 미국 주식 등이 포함됩니다. 규제가 없어도 낮은 비용과 견고한 기술 플랫폼으로 인해 우려가 있습니다.

| 장점 | 단점 |

| 첫 30일간 ₹500까지 수수료 면제 | 규제 없음 |

| 다양한 투자 상품 | 다양한 수수료 부과 |

| 사용자 친화적인 플랫폼 | |

| 최소 입금액 없음 |

Angel One은 규제되지 않은 중개업체입니다. 인도에 본사를 두고 있지만 SEBI나 FCA, ASIC, NFA와 같은 주요 세계 규제 기관의 라이선스를 소유하고 있지 않습니다.

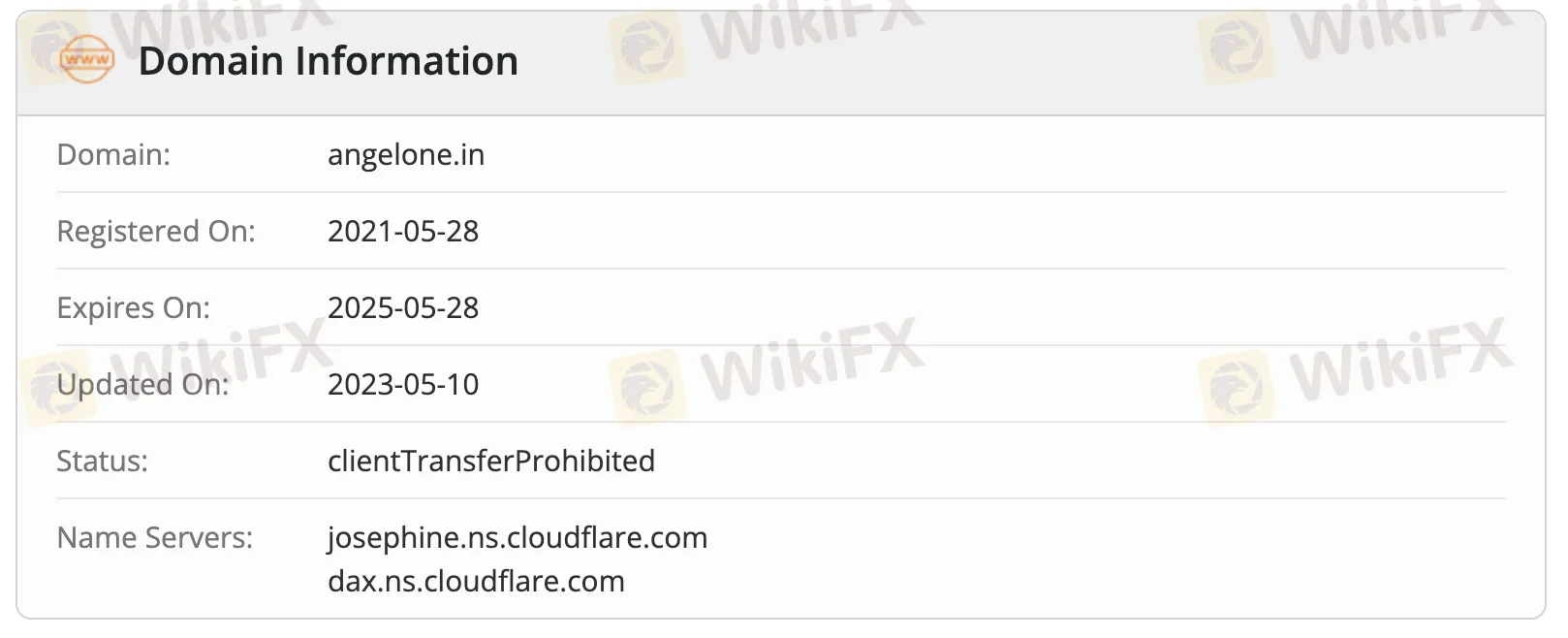

도메인 angelone.in은 2021년 5월 28일 등록되었으며, 2023년 5월 10일에 마지막으로 업데이트되었으며, 2025년 5월 28일에 만료될 예정입니다. 상태는 clientTransferProhibited입니다.

Angel One은 주식, IPO, 파생상품, 펀드, 상품, 미국 주식 등을 포함한 다양한 투자 상품을 제공합니다.

| 거래 도구 | 지원 |

| 주식 | ✔ |

| IPO | ✔ |

| 파생상품 (선물 및 옵션) | ✔ |

| 펀드 | ✔ |

| 상품 | ✔ |

| 외환 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

Angel One의 수수료는 인도의 산업 기준에 비해 일반적으로 낮음에서 보통입니다. 처음 30일간은 영매수 수수료가 제로이며(₹500까지), 그 후에는 수수료가 상한선이 정해지며 소매 거래자들에게 특히 경쟁력이 있습니다. 추가 요금은 대부분 규제 규정에 따라 설정됩니다.

| 투자 유형 | 초기 제공 | 제공 후 수수료 |

| 주식 배달 | 30일간 ₹500까지 ₹0 | 주문 당 ₹20 또는 0.1% 중 낮은 금액(최소 ₹2) |

| 당일 거래 | 주문 당 ₹20 또는 0.03% 중 낮은 금액 | |

| 선물 | 실행 주문당 ₹20 | |

| 옵션 |

| 요금 유형 | 주식 배달 | 당일 거래 | 선물 | 옵션 |

| 거래 수수료 | NSE: 0.00297% | NSE: 0.00173% | NSE: 0.03503% | |

| STT | 0.1% (매수/매도) | 0.025% (매도) | 0.01% (매도) | 0.05% (매도) |

| GST | 18% | |||

| SEBI 요금 | ₹10/억 | |||

| 청산 수수료 | ₹0 | |||

| 스탬프 세 | 매수 0.015% | 매수 0.003% | 매수 0.002% | 매수 0.003% |

| 요금 유형 | 수수료 |

| 계좌 개설 | 0 (가끔 ₹36.48의 경우 NRI) |

| AMC (1년) | 0 |

| AMC (1년 후) | ₹60/분기 (BSDA가 아닌 경우), 또는 ₹450/년, 또는 ₹2950 평생 옵션 |

| BSDA AMC | ₹4L까지 NIL; ₹4L–₹10L 보유량에 대해 ₹100/년 |

| MTF (마진 대출) | 일일 0.041% |

| 대변 잔액 이자 | 일일 0.049% |

| 현금 담보 요금 | 일일 0.0342% (부족금액 > ₹50,000) |

Angel One은 모든 날 투자자를 위한 모바일 앱, 프로 트레이더를 위한 웹 플랫폼, 그리고 개발자 및 알고 트레이더를 위한 API 세 가지 거래 플랫폼을 제공합니다.

| 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Angel One 슈퍼 앱 | ✔ | Android, iOS | 초보부터 중급 투자자 및 트레이더 |

| Angel One 트레이드 | ✔ | 웹 (데스크톱/노트북) | 능동적/전문 트레이더 |

| 스마트 API | ✔ | API 액세스 (웹 백엔드 통합) | 개발자, 알고 트레이더, 핀테크 플랫폼 |

As someone who has spent years evaluating brokers for both personal trading and community guidance, I always prioritize regulatory clarity and transparent policies. With Angel One, I notice a significant risk factor: this broker is not regulated by any top-tier authority, neither SEBI in India nor global bodies like the FCA or ASIC. Such an absence of regulatory oversight means I am especially cautious when it comes to fund transfers—including withdrawals. Regarding the minimum withdrawal amount, the WikiFX report provided comprehensive insights about Angel One’s trading products, fees, and platform features, but it did not specify a minimum withdrawal limit for single transactions. Based on my approach, when a broker omits such essential information publicly, especially in the absence of regulatory oversight, I treat this as a potential red flag. Not all brokers will have the same policies, and unregulated firms can change their withdrawal terms at their discretion, sometimes without investor-friendly notice. For me, this lack of transparency is problematic. Before depositing or trading, I would contact Angel One directly (via their official support channels) to ask for documented withdrawal procedures, including any minimum limits. Unless this information is clear and favorable—and until I see evidence of reliable fund withdrawal from multiple, independent traders—I would remain conservative and only allocate funds I can afford to risk. Transparency on withdrawal conditions is just as critical as trading technology or fees when selecting a broker.

From my own experience navigating broker choices, platform support is a critical factor I always verify before considering any firm. With Angel One, I found their technology geared primarily to equities, options, and mutual funds trading—mainly via their proprietary platforms rather than widely-used third-party software common in global forex circles. Specifically, Angel One offers three platforms: the Angel One Super App (for mobiles), Angel One Trade (a web-based portal), and Smart API (targeted at developers and algo traders). All three are developed in-house. What immediately stood out for me was the lack of support for platforms like MT4, MT5, or cTrader—tools I usually rely on for forex and more specialized execution or analysis workflows. As someone who values transparent order routing and global standard tools, this is a notable limitation. In practical terms, if you’re used to MT4/MT5 for customizing indicators and running expert advisors, you simply won’t find that ecosystem here. While Angel One’s app interface is regarded as intuitive and user-friendly (which I did verify myself), this doesn't substitute the advanced features that traders might expect from established third-party solutions. For me, the absence of industry-standard trading platforms significantly narrows Angel One’s appeal, especially for those coming from international FX or CFD backgrounds. For anyone thinking about algo trading or third-party tool integration, I recommend being especially cautious and thoroughly considering how this may impact your usual routines or strategies.

In my personal experience as a trader who prioritizes regulatory safety above all else, Angel One raises several fundamental concerns regarding legitimacy. The absolute absence of oversight from SEBI or any major international regulator is, to me, a major red flag. Regulatory status isn’t just a bureaucratic checkbox—for those of us trading with real capital, it’s vital for dispute resolution, fund protection, and maintaining a basic level of operational integrity. Although Angel One positions itself as a well-established Indian broker with a decent reputation for technology and offers an array of investment products, this is far overshadowed by their lack of regulatory adherence. I do acknowledge that some users, like the reviewer from Belarus, have found the trading platforms intuitive and user-friendly. However, I must stress that positive app usability does not make up for the risks associated with an unregulated broker, especially in the trading industry where reputation and oversight are everything. The fact that Angel One charges zero brokerage for the first month and maintains low fees might appeal to cost-sensitive traders, but again, these advantages do not offset the absence of verifiable consumer protections. For anyone considering trading here, I would recommend an especially cautious approach and thorough due diligence—my personal standard is never to trade significant funds with any broker lacking recognized regulatory status, regardless of other incentives.

In my experience, evaluating a broker means weighing both product diversity and cost transparency. With Angel One, I noticed the selection of trading instruments is fairly broad for Indian equities market participants. I found they support trading in stocks, derivatives (futures and options), mutual funds, IPOs, commodities, and access to U.S. equities. However, it's important to emphasize that Angel One does not provide forex, indices, cryptocurrencies, bonds, or ETF trading, which could limit flexibility if you want a more global or multi-asset portfolio. For me, this product scope works primarily if my focus is Indian securities and some U.S. exposure—a significant consideration if you trade primarily within these markets. Regarding their fees, I appreciate that Angel One structures charges to be competitive for India. They offer zero brokerage for the first ₹500 in trades within 30 days, which can provide some early cost savings for new users. After this period, I find the rates—capped at ₹20 per executed order or a percentage-based commission—relatively attractive, especially for smaller, retail portfolios. However, it's important to point out that additional regulatory and statutory fees apply, and these can accumulate, especially with frequent trading. While their cost schedule is straightforward, I always recommend reading the fine print and tallying potential charges based on your trading frequency and volume. Overall, Angel One’s strengths in fees and product range suit certain investor profiles, but limitations remain if your needs extend to global or diversified asset classes.

입력해 주세요....