Company Summary

| Fubon SecuritiesReview Summary | |

| Founded | 5-10 years |

| Registered Country/Region | Hong Kong |

| Regulation | Unregulated |

| Services | Securities Trading and Futures Business |

| Demo Account | Not mentioned |

| Trading Platform | Fubon Trading Treasure(iOS/Android/Windows/PC) |

| Customer Support | Tel: (852)28814500 |

| Email: hkeb.sec@fubon.com | |

| Fax: (852)28126269 | |

Fubon Securities Information

Fubon Securities is a regulated securities company that provides securities investment analysis and consulting services.

Pros and Cons

| Pros | Cons |

| Regulated | MT4/MT5 unavailable |

| Services involve multiple assets | No educational resources |

Is Fubon Securities Legit?

TPEx regulates Fubon Securities, which makes it safer than unregulated brokers. However, trading risks cannot be completely avoided.

Services

Fubon Securities provides securities trading and futures business for indices, forex, commodities, and metals.

| Services | Supported |

| Securities Trading | ✔ |

| Futures Business | ✔ |

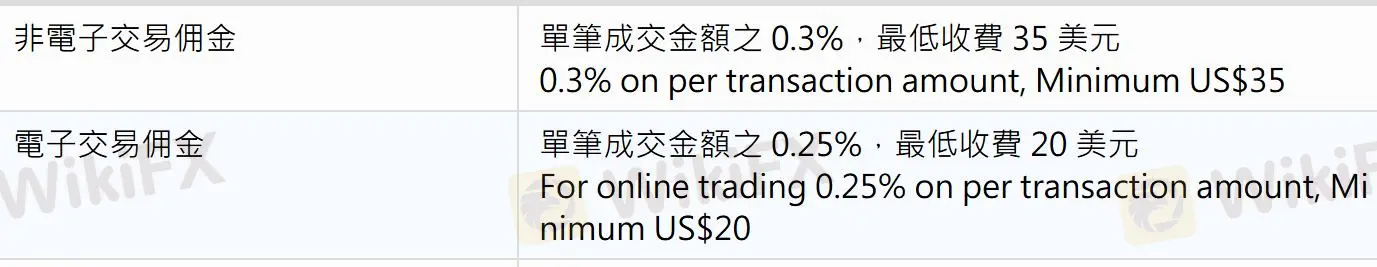

Fubon Securities Fees

The minimum commission is $20.

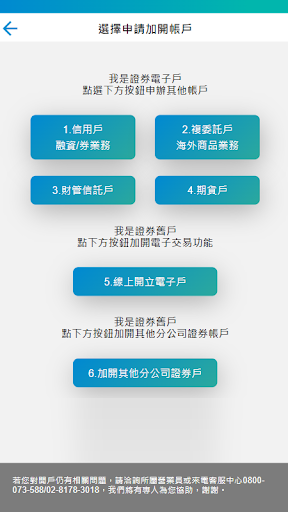

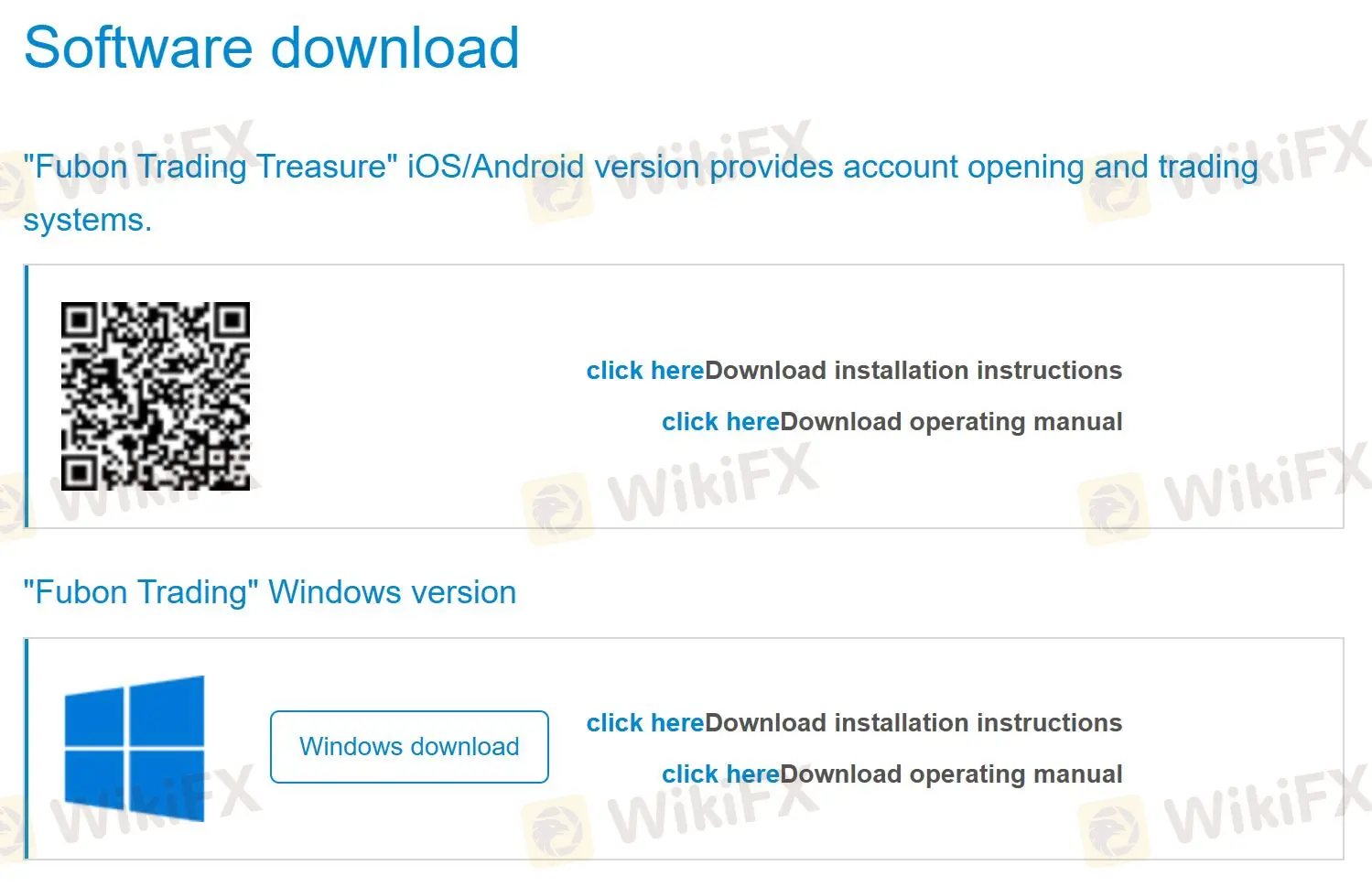

Trading Platform

Fubon Securities provides a built-in platform for iOS, Android, Windows, and PC versions.

| Trading Platform | Supported | Available Devices |

| Fubon Trading Treasure | ✔ | iOS/Android/Windows/PC |

Deposit and Withdrawal

The minimum deposit is unspecific. Fubon Securities offers bank accounts for deposit and withdrawal. The cooperative banks include Hong Kong AndShanghaiBanking CorporationLimited (HSBCHKHHHKH), Standard Chartered Bank(Hong Kong) Limited(SCBLHKHHXXX), Fubon Bank (Hong Kong)Limited(IBALHKHHXXX), and Taipei Fubon CommercialBank Co., Ltd., Hong KongBranch (TPBKHKHHXXX).

Customer Support Options

Traders can contact Fubon Securities via Tel, email, and fax.

| Contact Options | Details |

| Tel | (852)28814500 |

| hkeb.sec@fubon.com | |

| Fax | (852)28126269 |

| Supported Language | Chinese simplified, Chinese traditional |

| Website Language | Chinese simplified, Chinese traditional |

| Physical Address | Room 1002, 10th Floor, Li-Ning Building, Hong Kong, 218 Electric Road, North Point, Hong Kong |