Buod ng kumpanya

| Angel One Buod ng Pagsusuri | |

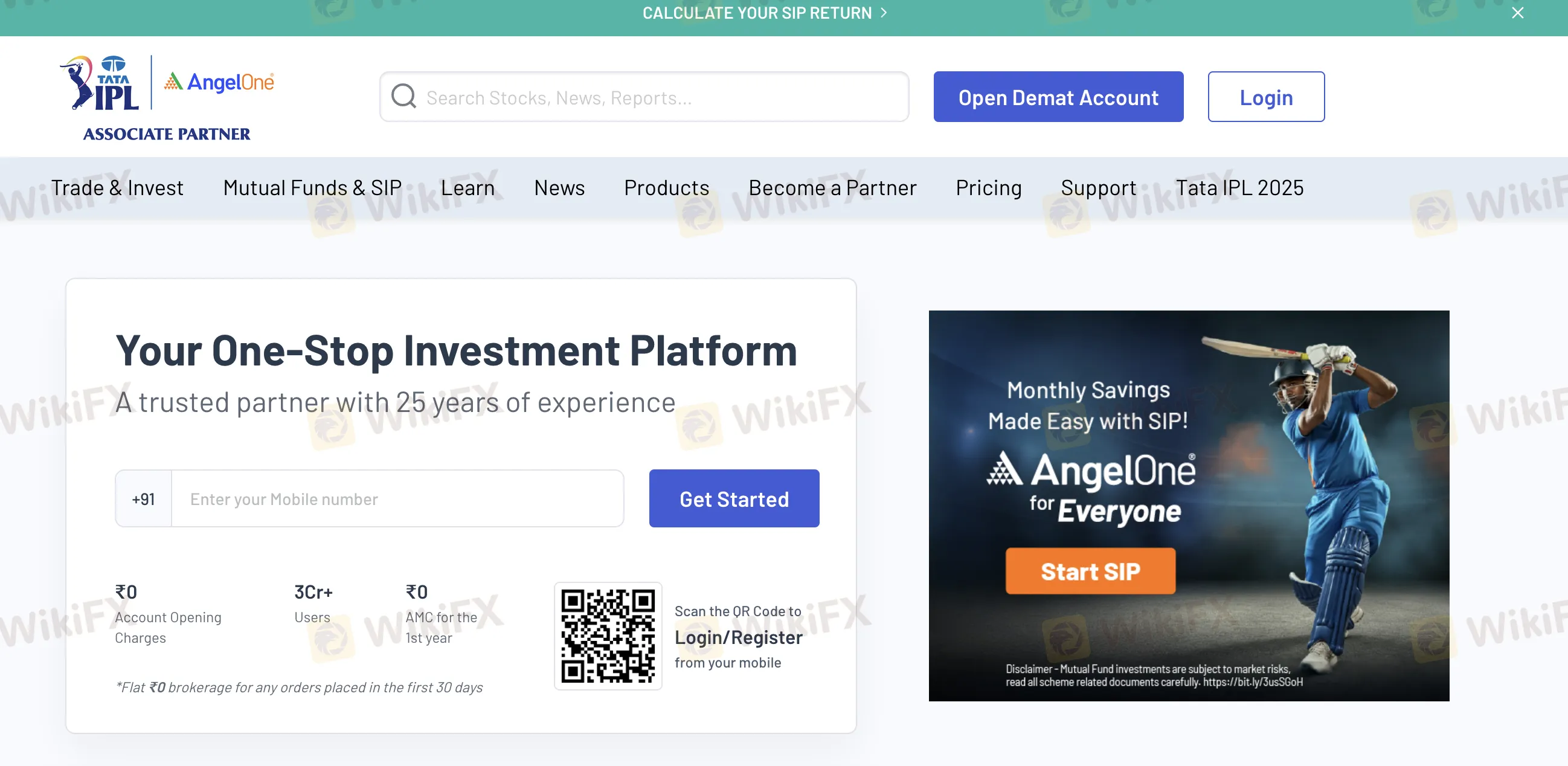

| Itinatag | 1996 |

| Rehistradong Bansa/Rehiyon | India |

| Regulasyon | Walang regulasyon |

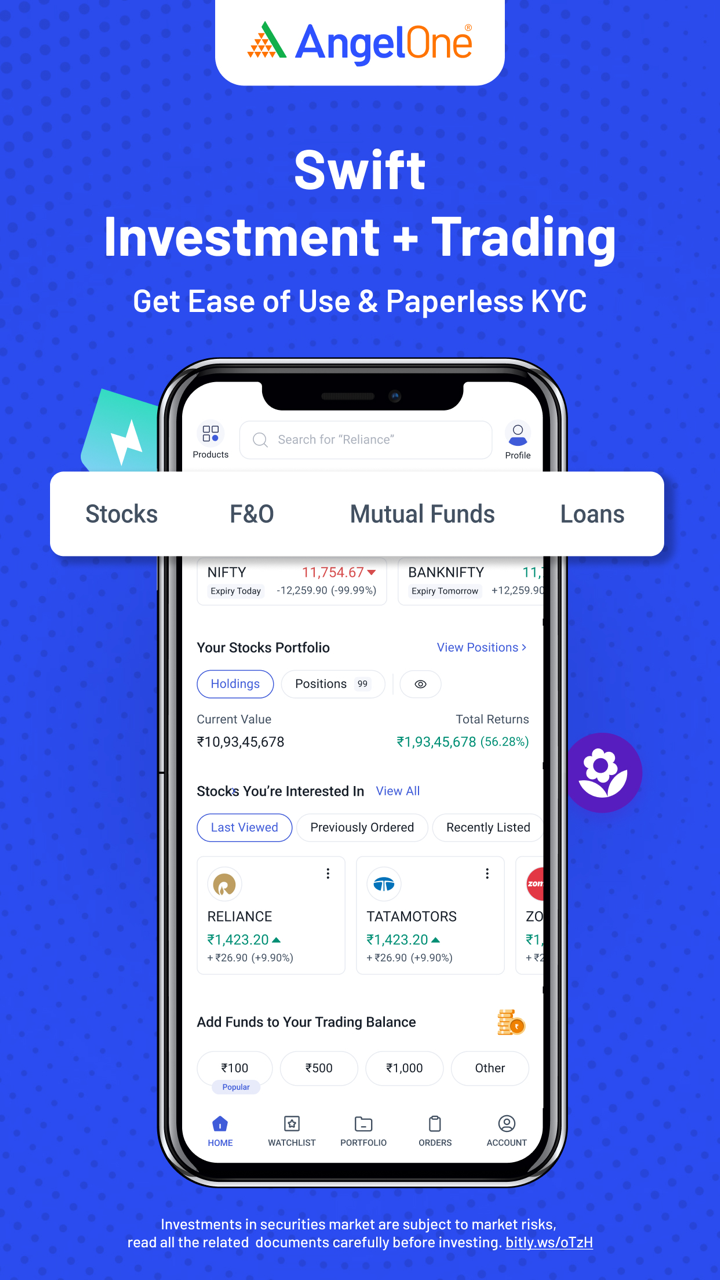

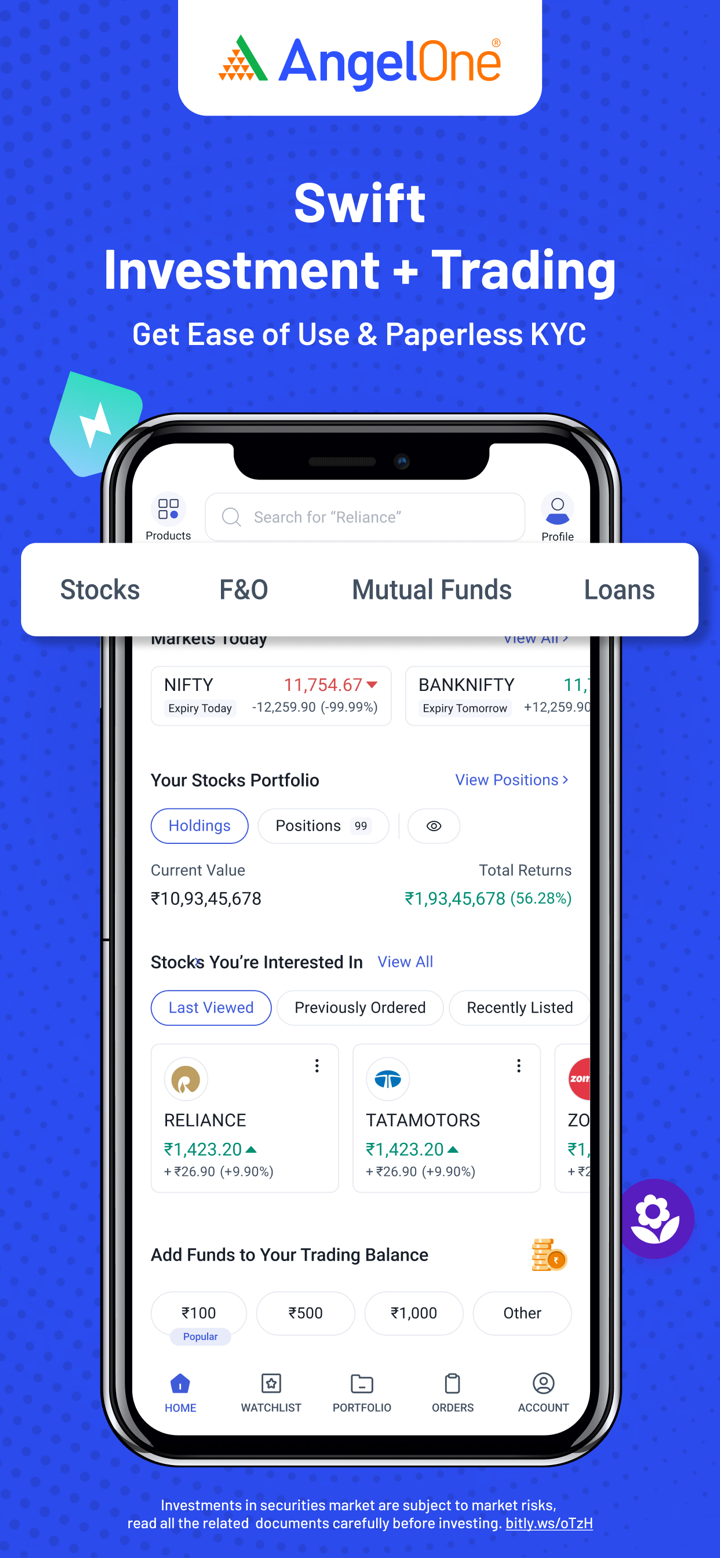

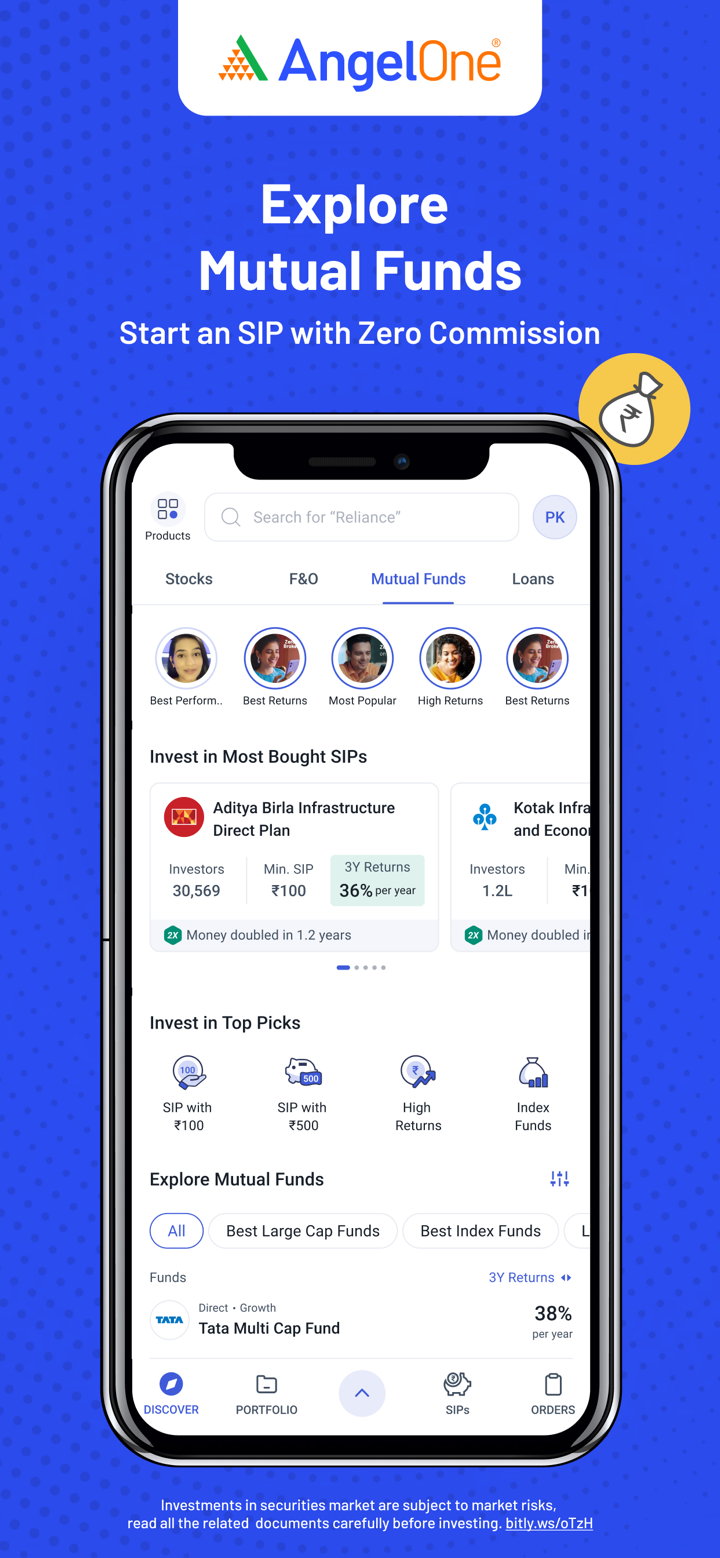

| Mga Produkto sa Paghahalal | Stocks, IPOs, Derivatives (F&O), Mutual Funds, Commodities |

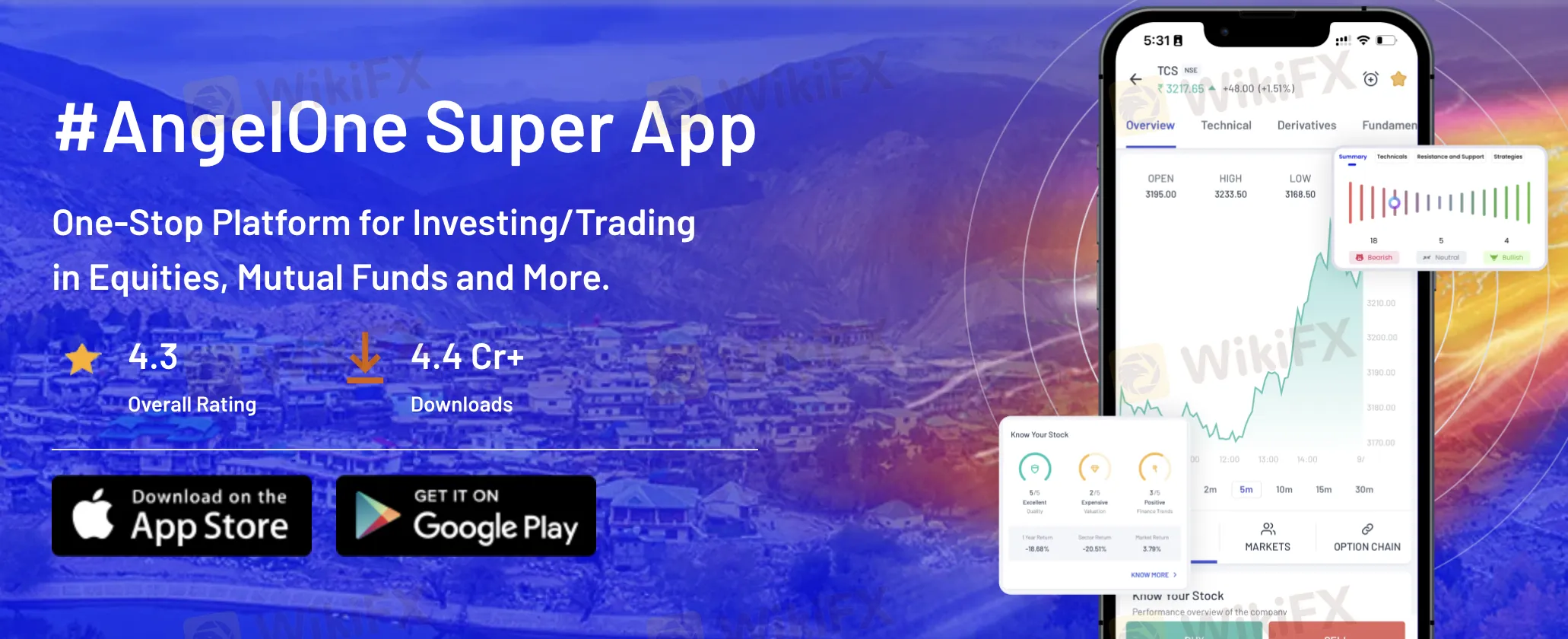

| Platform ng Paghahalal | Angel One Super App (mobile), Angel One Trade (web), Smart API (developer) |

| Minimum na Deposito | ₹0 |

| Suporta sa Customer | Email: support@angelone.in |

| Telepono: 18001020 | |

Impormasyon Tungkol sa Angel One

Itinatag noong 1996, ang Angel One ay isang kumpanyang brokerage sa India. Hindi ito kontrolado ng SEBI o anumang pandaigdigang kapangyarihang pinansyal. Kasama sa maraming investment vehicles na ibinibigay ng kumpanya ay equities, derivatives, mutual funds, at US stocks. Ang kakulangan nito sa regulasyon ay nagdudulot ng alalahanin kahit na may mababang gastos at matatag na mga plataporma sa teknolohiya.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

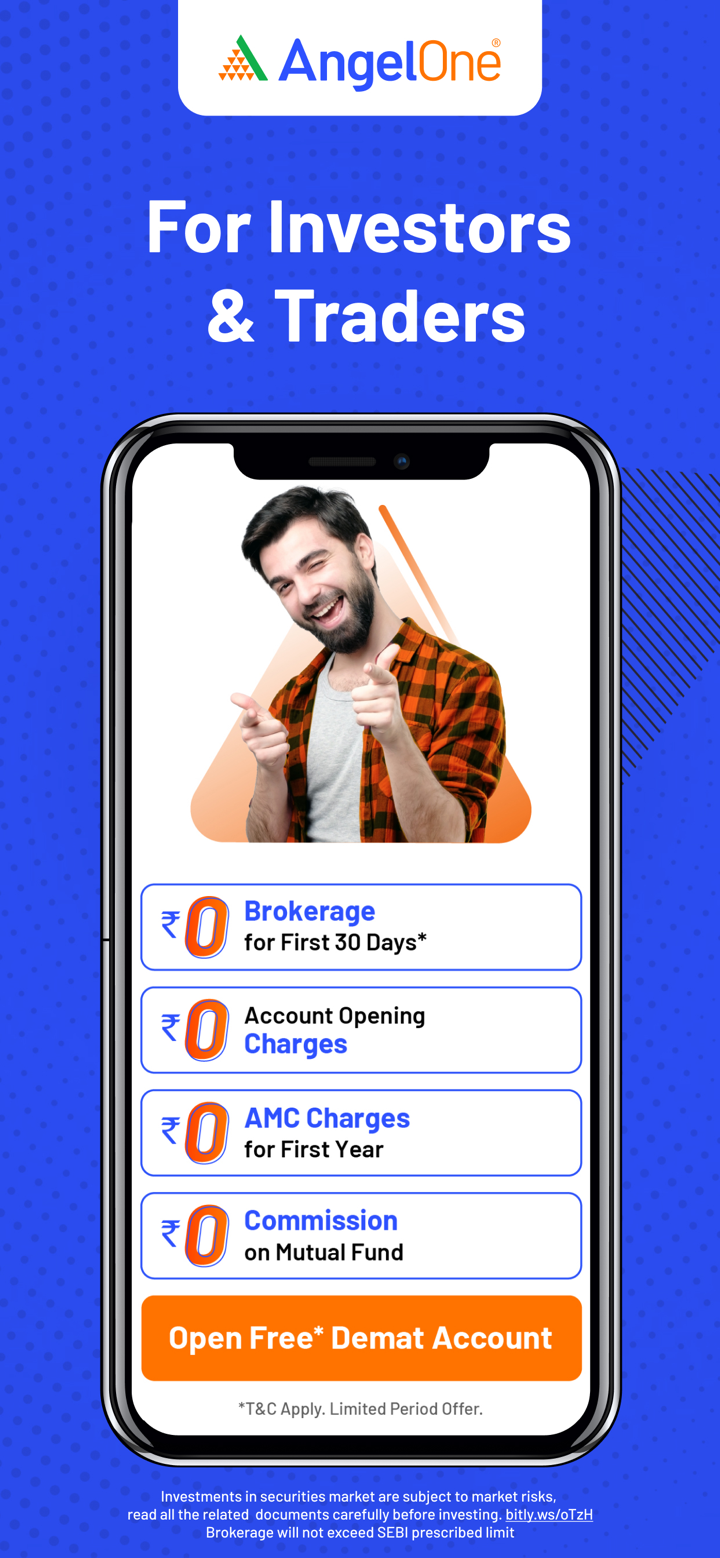

| Zero brokerage para sa unang ₹500 sa loob ng 30 araw | Walang regulasyon |

| Malawak na hanay ng mga produkto sa investment | Iba't ibang bayarin na kinakaltas |

| User-friendly na mga plataporma | |

| Walang minimum na deposito |

Tunay ba ang Angel One?

Ang Angel One ay hindi isang reguladong broker. Bagaman nakabase sa India, hindi ito may lisensya mula sa SEBI o anumang pangunahing global na mga regulator tulad ng FCA, ASIC, o NFA.

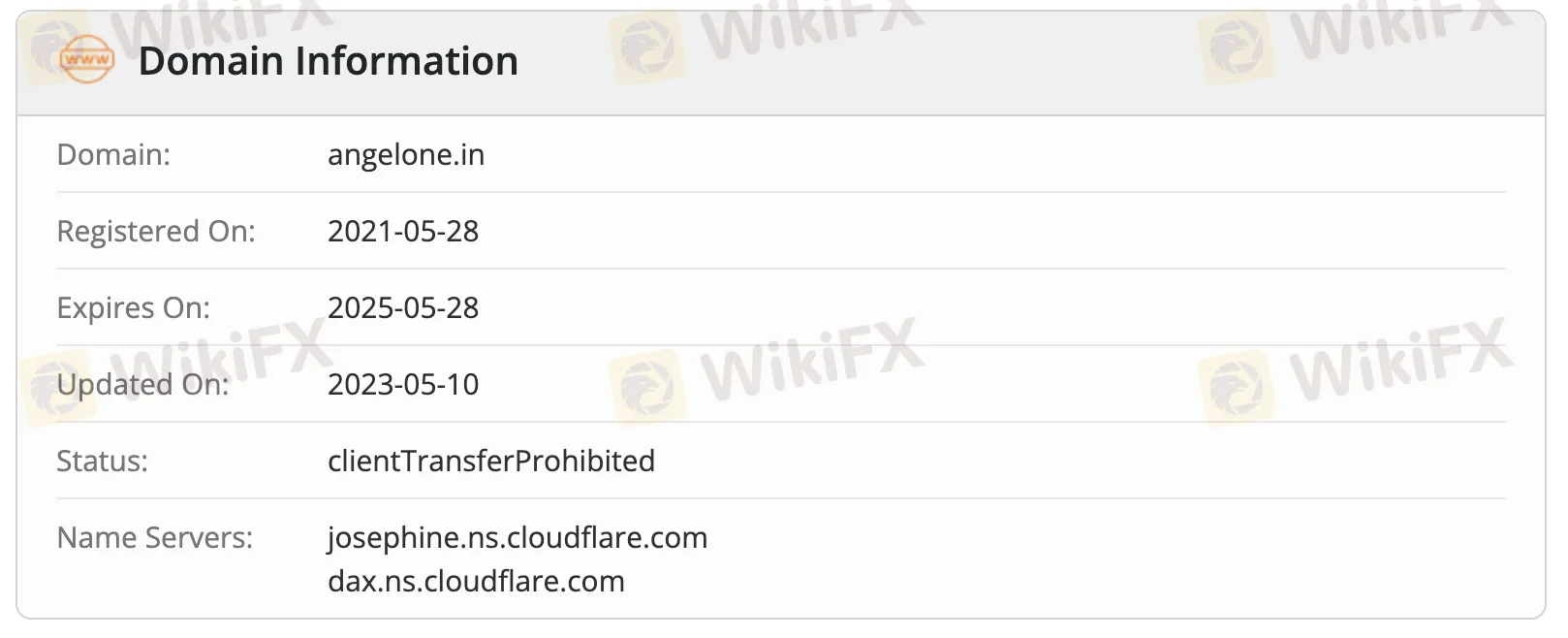

Ang domain na angelone.in ay nirehistro noong Mayo 28, 2021, huling na-update noong Mayo 10, 2023, at mag-e-expire sa Mayo 28, 2025. Ang status nito ay clientTransferProhibited.

Mga Produkto sa Paghahal

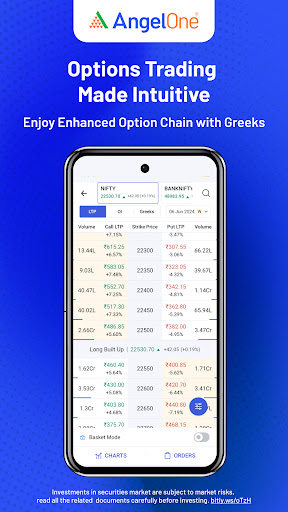

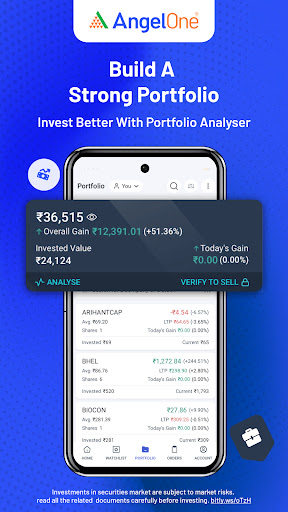

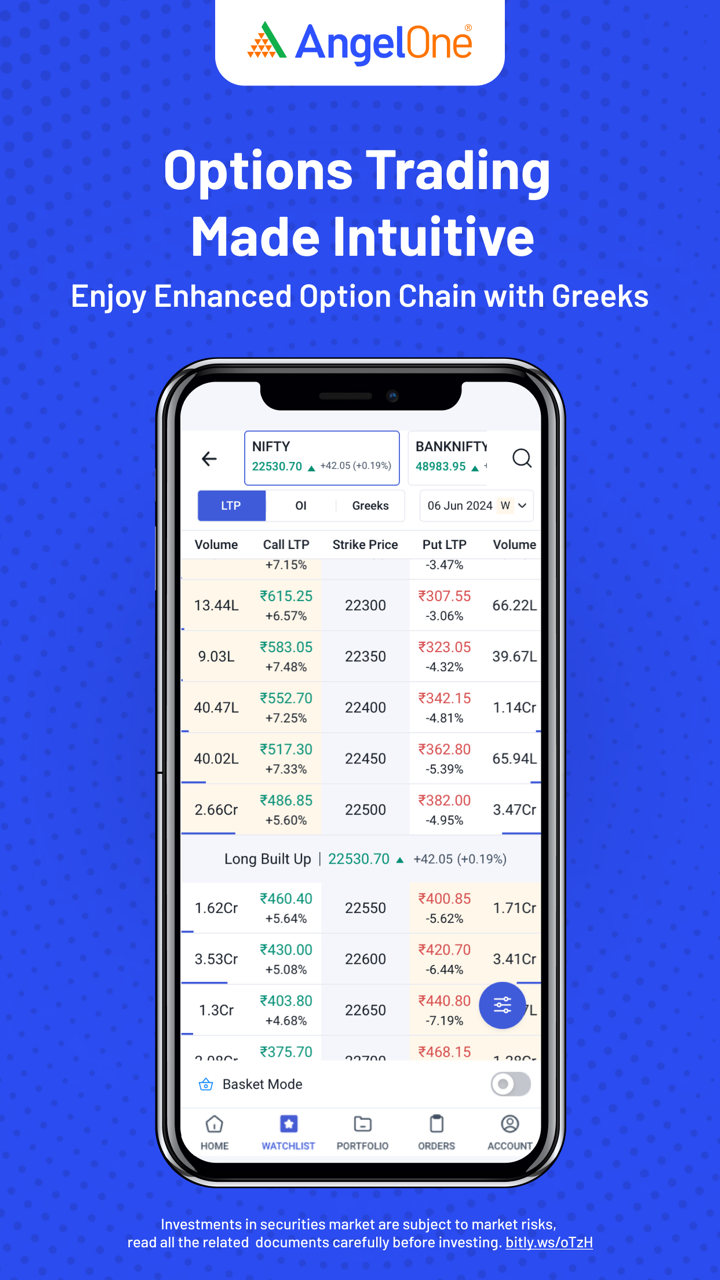

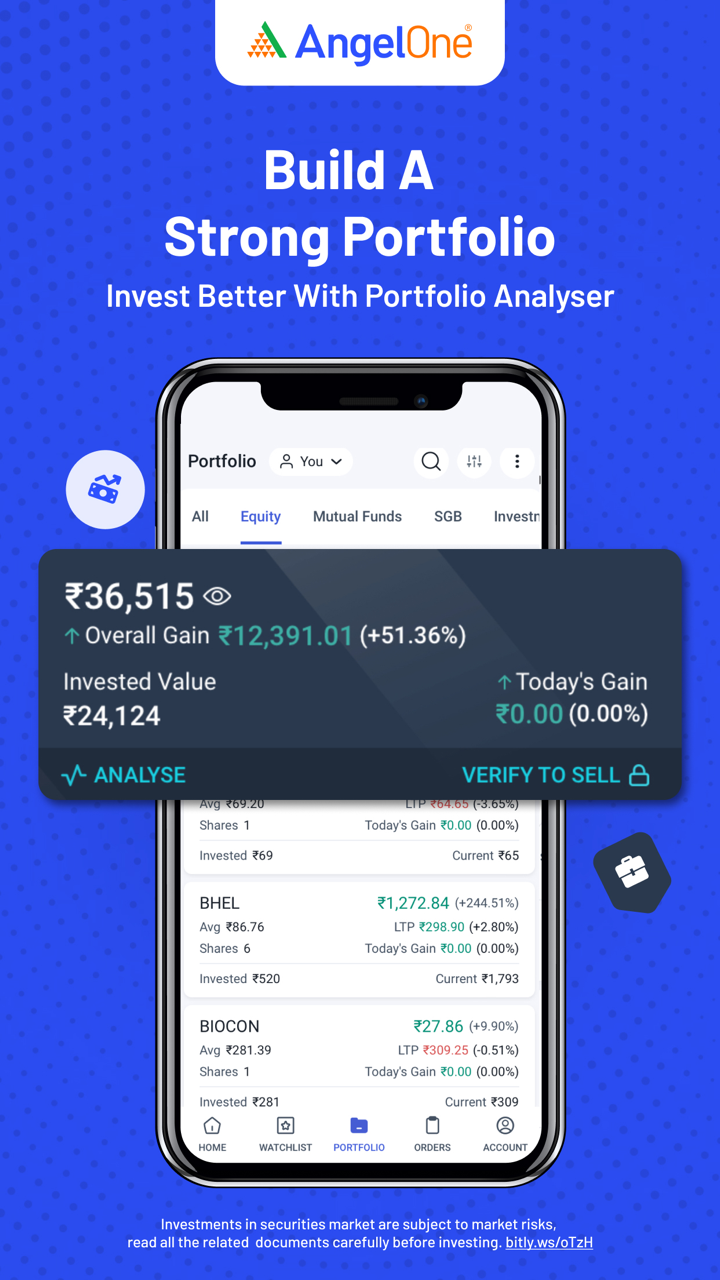

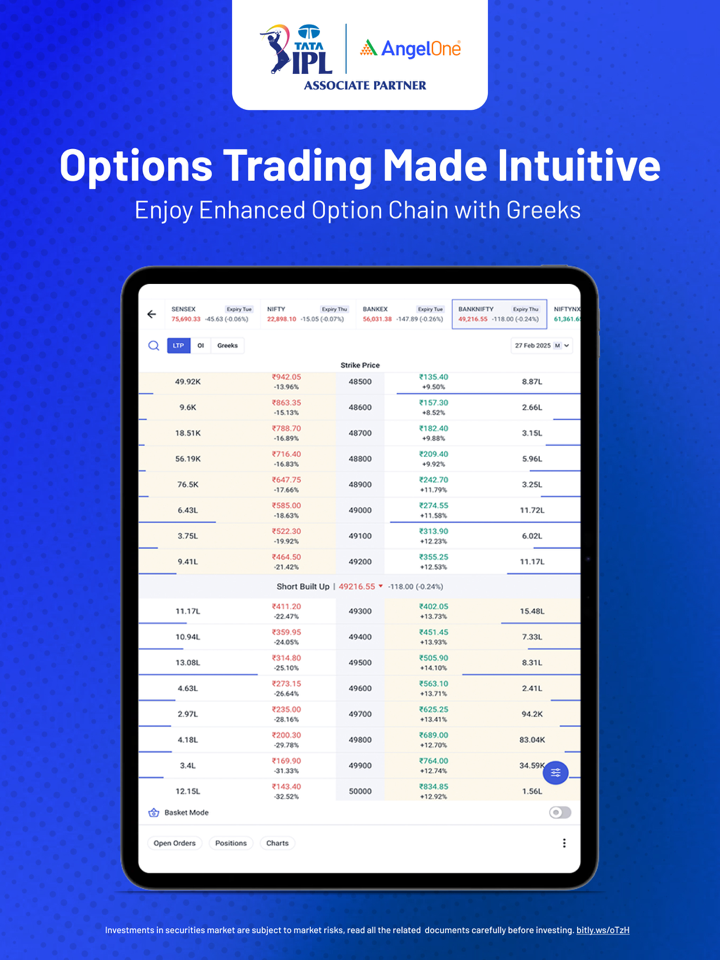

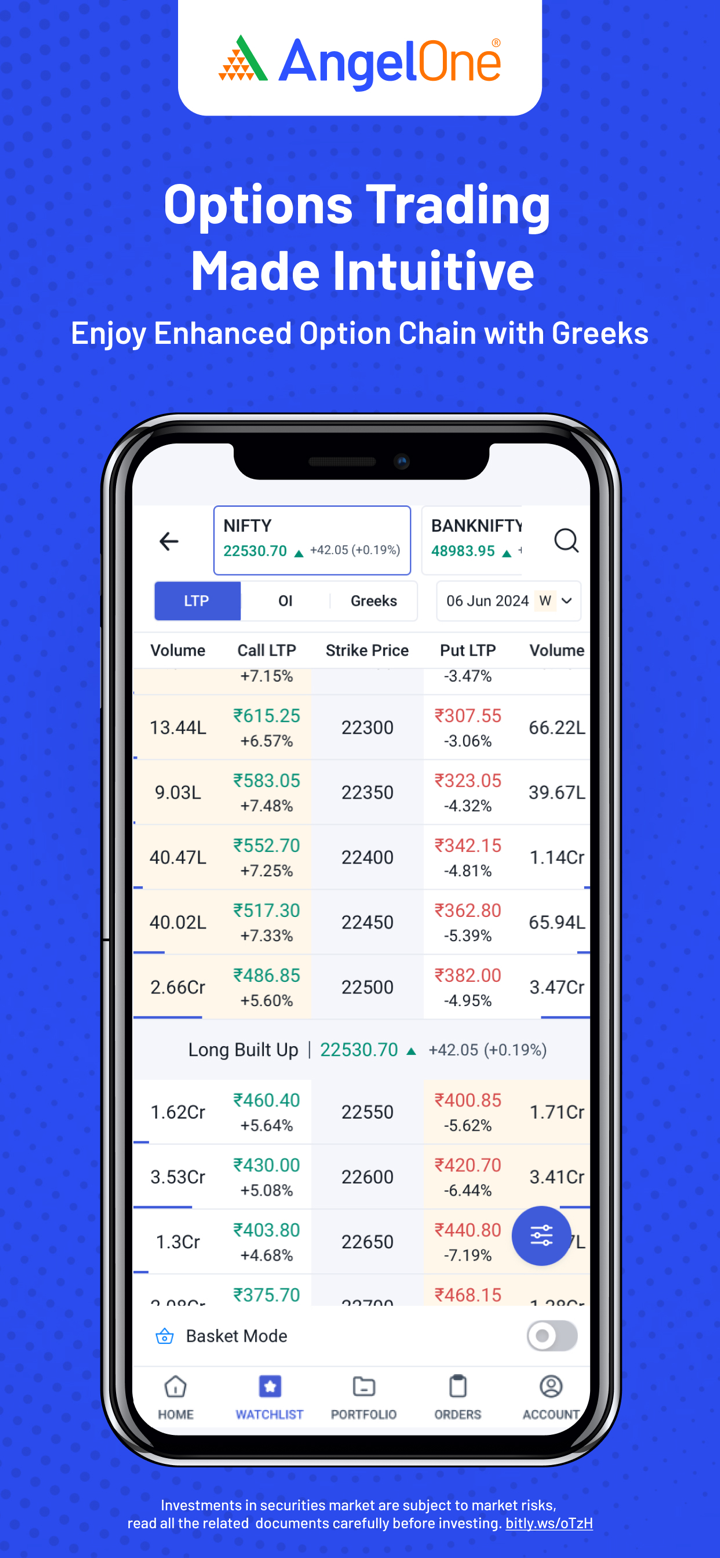

Nag-aalok ang Angel One ng malawak na hanay ng mga produkto sa investment kabilang ang stocks, IPOs, derivatives, mutual funds, commodities, at U.S. equities.

| Mga Kasangkot na Instrumento sa Paghahal | Supported |

| Stocks | ✔ |

| IPOs | ✔ |

| Derivatives (F&O) | ✔ |

| Mutual Funds | ✔ |

| Commodities | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

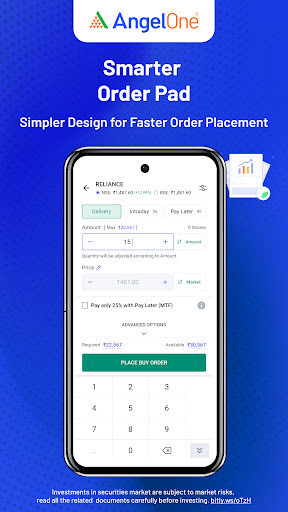

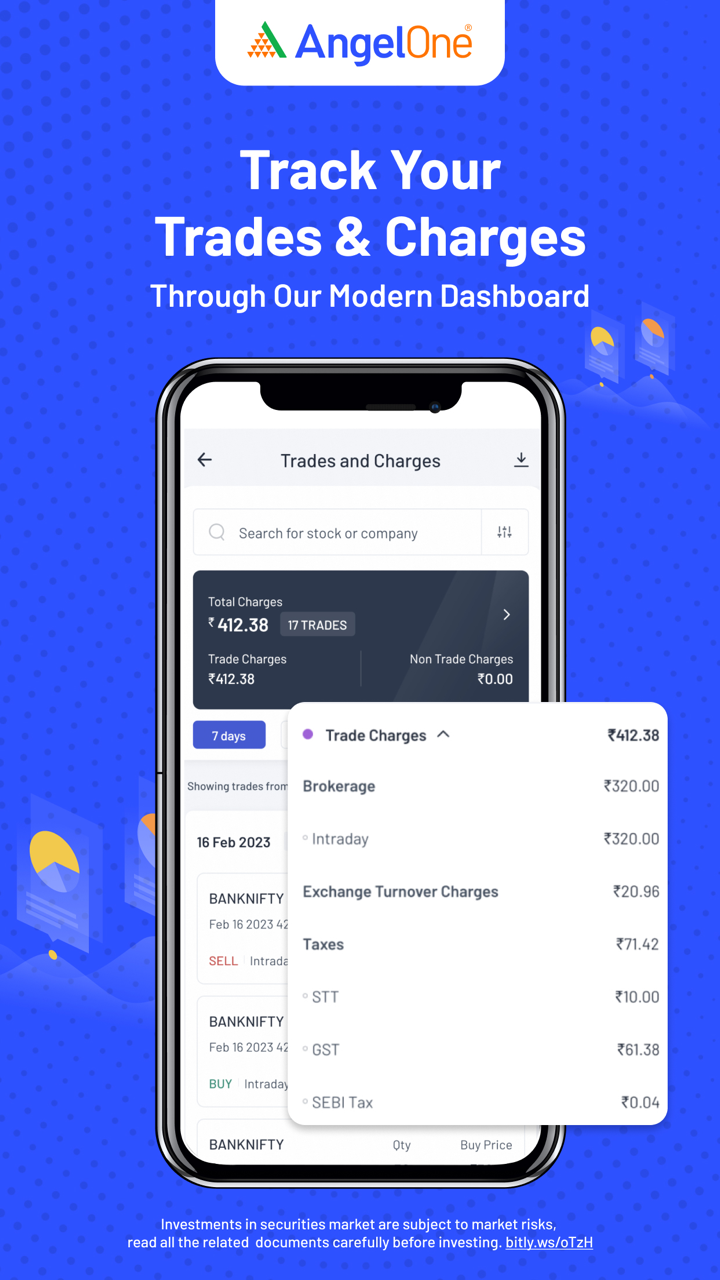

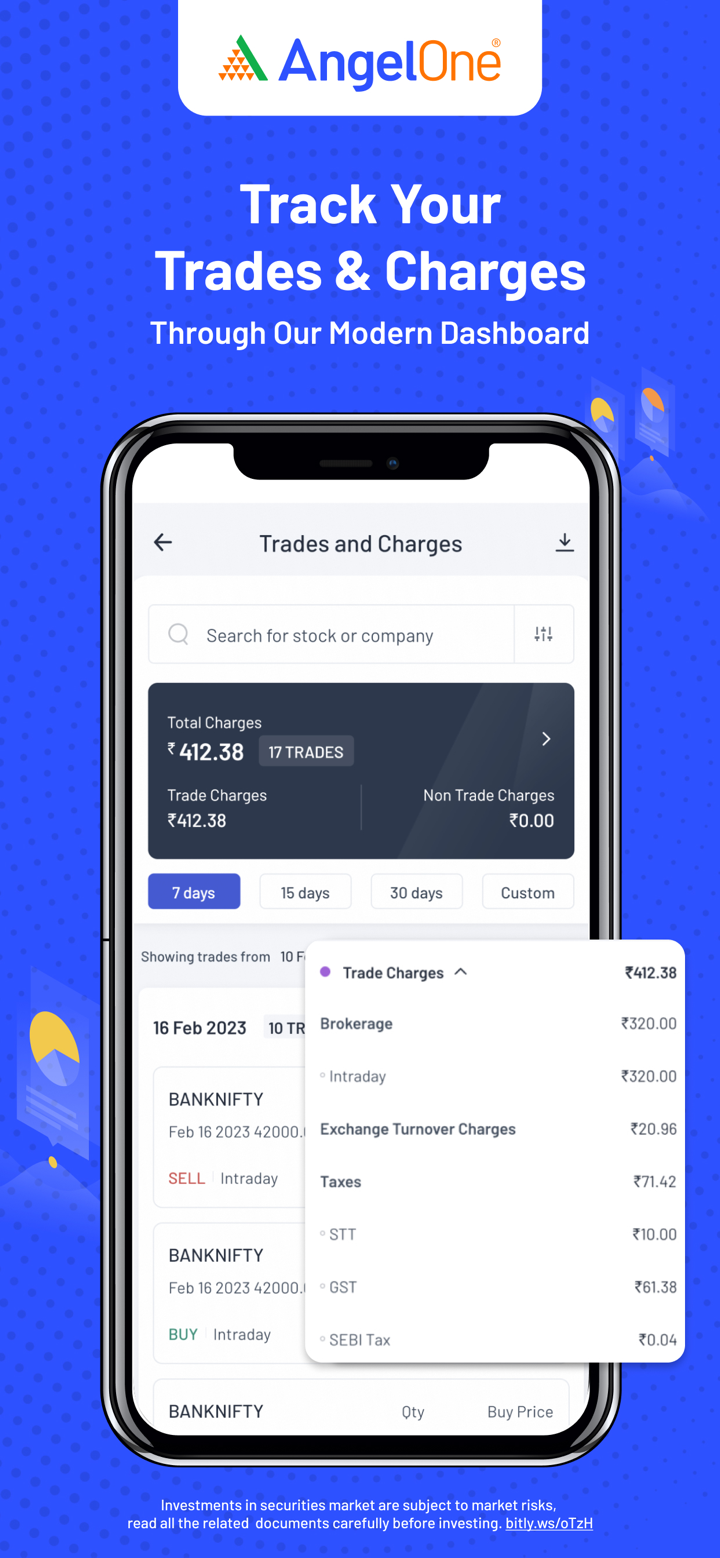

Mga Bayad ng Angel One

Ang mga bayad ng Angel One ay kadalasang mababa hanggang katamtaman kumpara sa pamantayan ng industriya sa India. Nag-aalok ito ng walang bayad sa brokerage sa unang 30 araw (hanggang sa ₹500), pagkatapos nito ang brokerage nito ay may limitasyon at kompetitibo, lalo na para sa mga nagtitinda sa retail. Ang karagdagang bayarin ay karamihan ay naaayon sa mga regulasyon.

| Uri ng Pamumuhunan | Unang Alok | Post-Offer Brokerage |

| Equity Delivery | ₹0 hanggang sa ₹500 sa loob ng 30 araw | Mas mababa sa ₹20 o 0.1% bawat order (min ₹2) |

| Intraday Trading | Mas mababa sa ₹20 o 0.03% bawat order | |

| Futures | ₹20 bawat naipatupad na order | |

| Options |

| Uri ng Bayad | Equity Delivery | Intraday | Futures | Options |

| Mga Bayarin sa Transaksyon | NSE: 0.00297% | NSE: 0.00173% | NSE: 0.03503% | |

| STT | 0.1% (Bumili/Magbenta) | 0.025% (Magbenta) | 0.01% (Magbenta) | 0.05% (Magbenta) |

| GST | 18% | |||

| Mga Bayarin ng SEBI | ₹10/bilyon | |||

| Mga Bayarin sa Clearing | ₹0 | |||

| Stamp Duty | 0.015% (Bumili) | 0.003% (Bumili) | 0.002% (Bumili) | 0.003% (Bumili) |

| Uri ng Bayad | Bayad |

| Pagbubukas ng Account | 0 (kung minsan ay ₹36.48 para sa NRIs) |

| AMC (1st Taon) | 0 |

| AMC (Pagkatapos ng 1st Taon) | ₹60/kwarter (non-BSDA), o ₹450/tahunan, o opsyon sa habambuhay na ₹2950 |

| BSDA AMC | NIL hanggang sa ₹4L; ₹100/tahunan para sa mga ari-arian na nagkakahalaga ng ₹4L–₹10L |

| MTF (Margin Borrowing) | 0.041% kada araw |

| Interes sa Debit Balance | 0.049% kada araw |

| Mga Bayarin sa Cash Collateral | 0.0342%/araw (sa kakulangan > ₹50,000) |

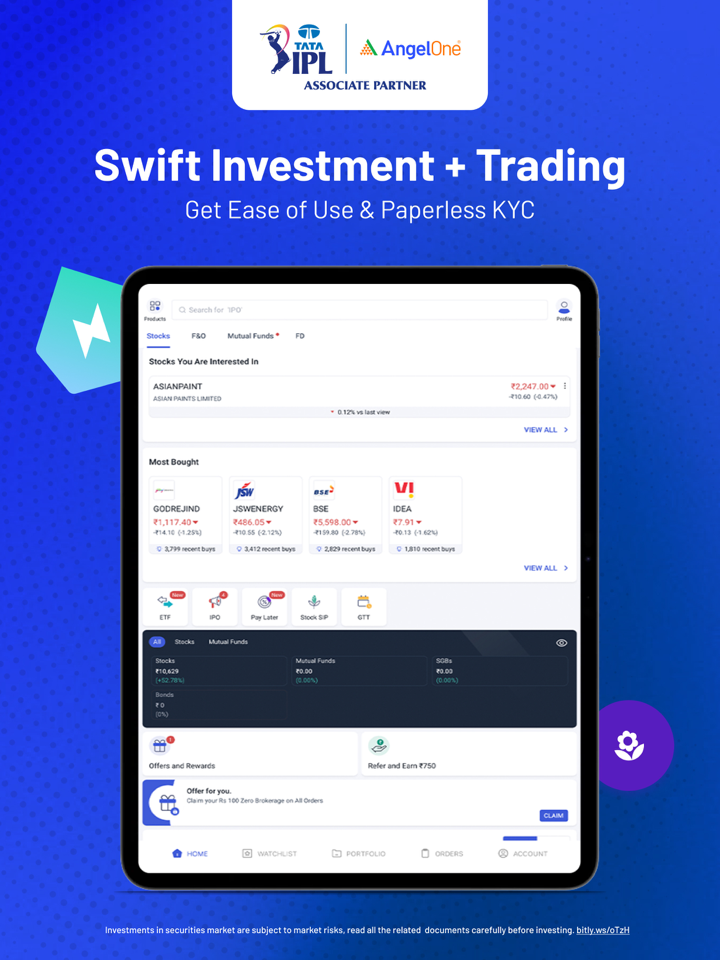

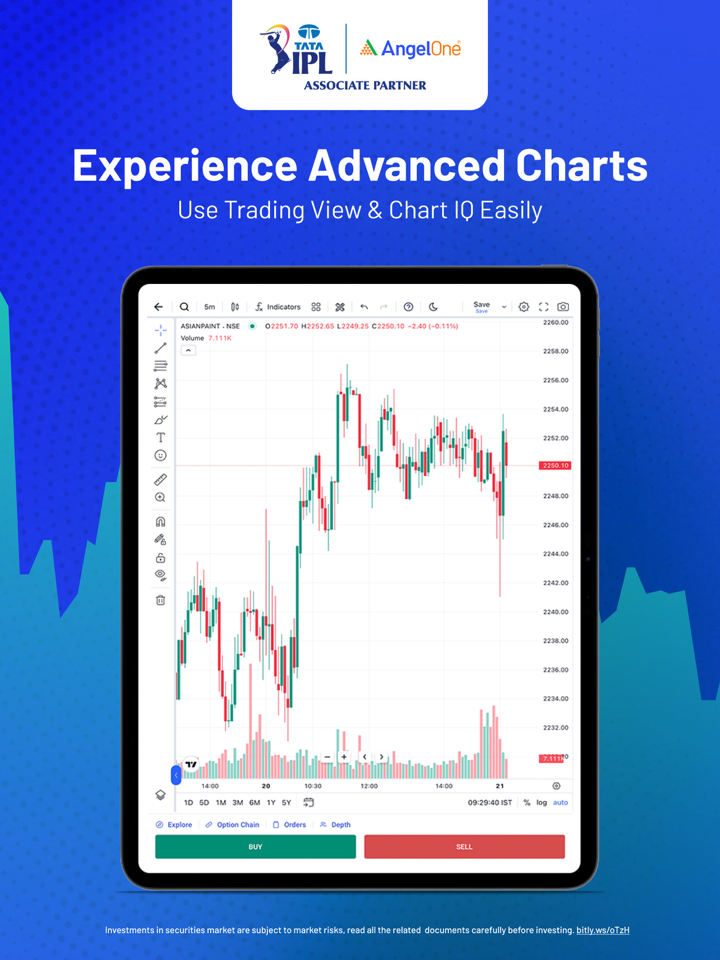

Plataporma ng Pagtitingin

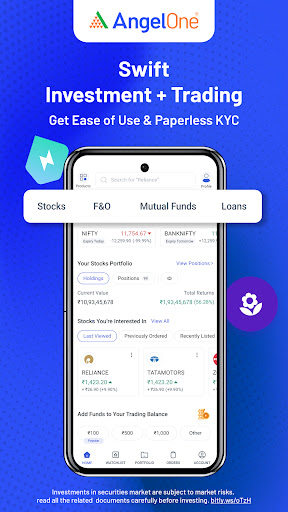

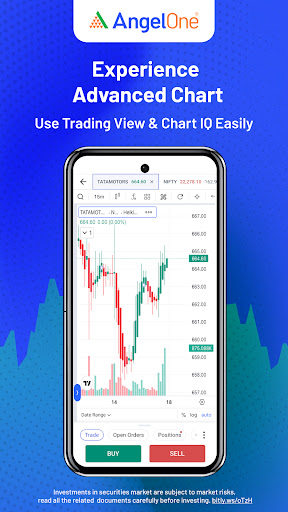

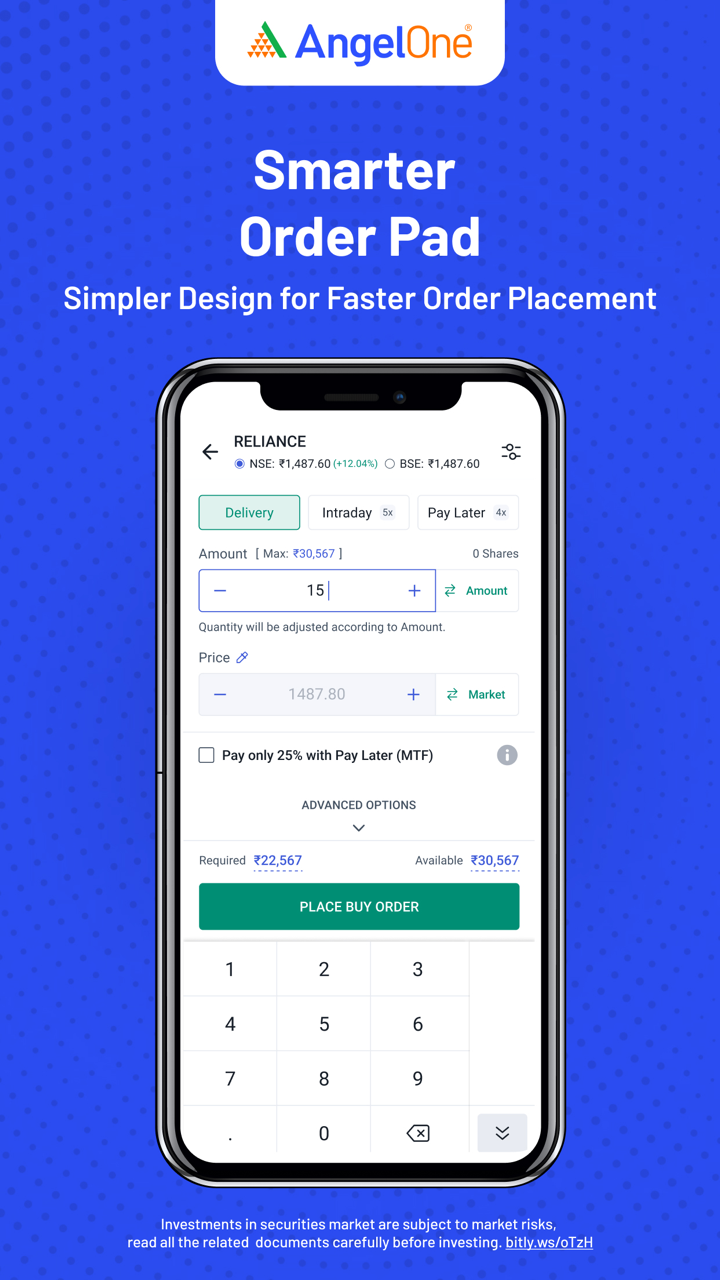

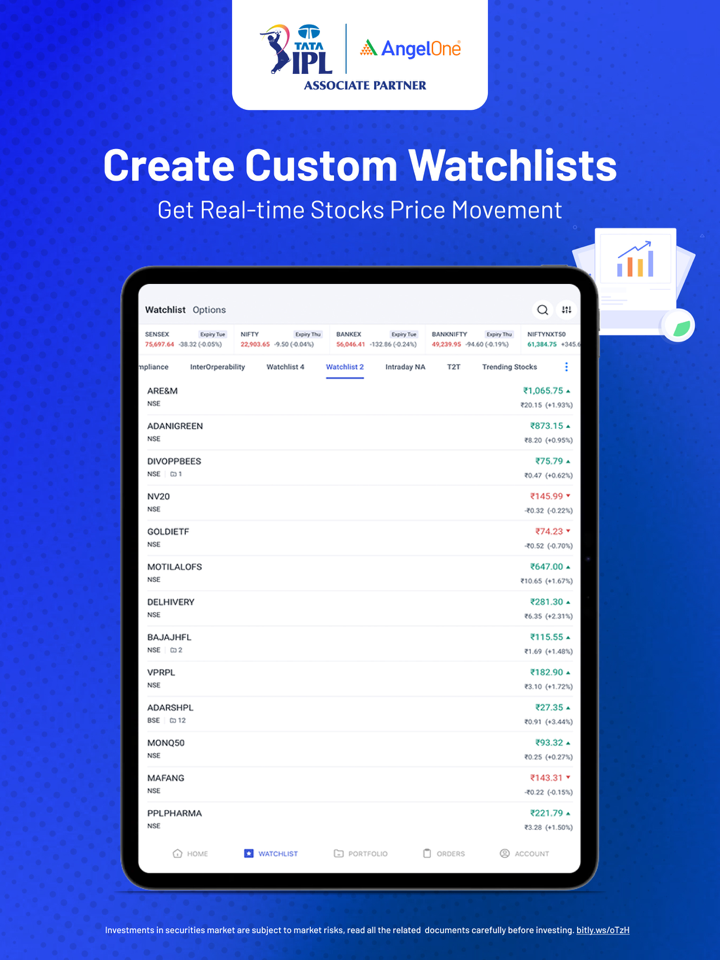

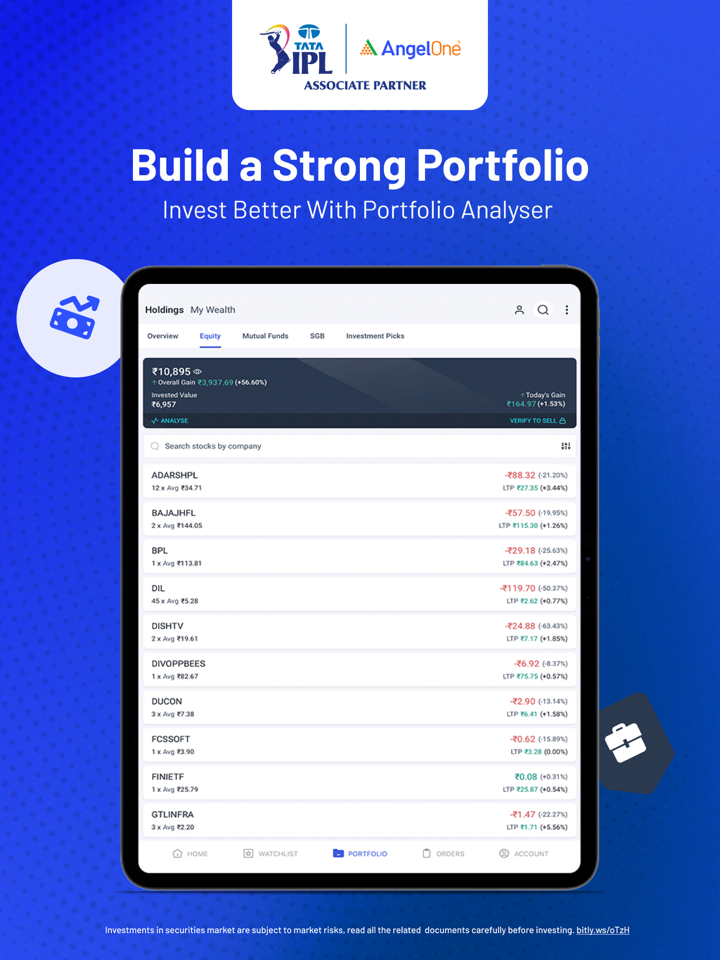

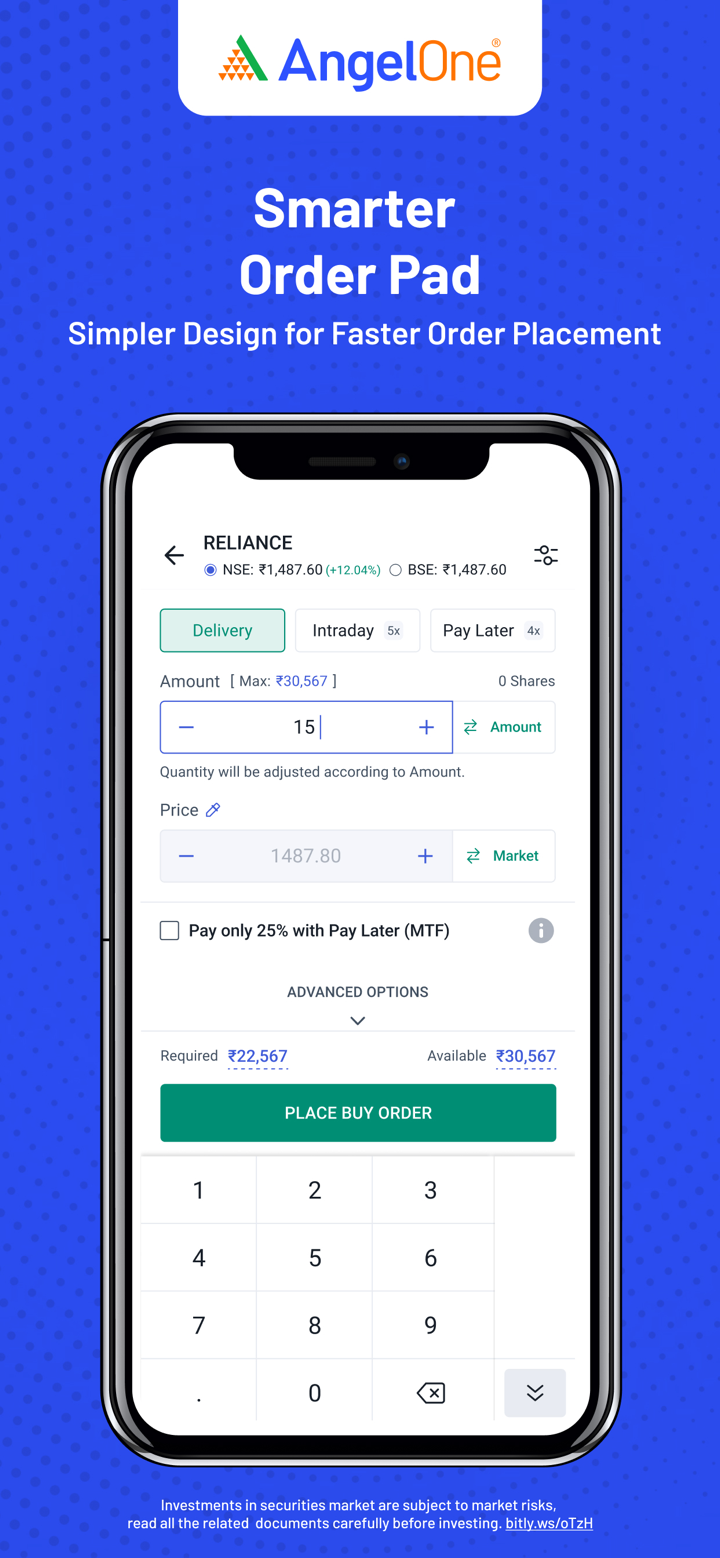

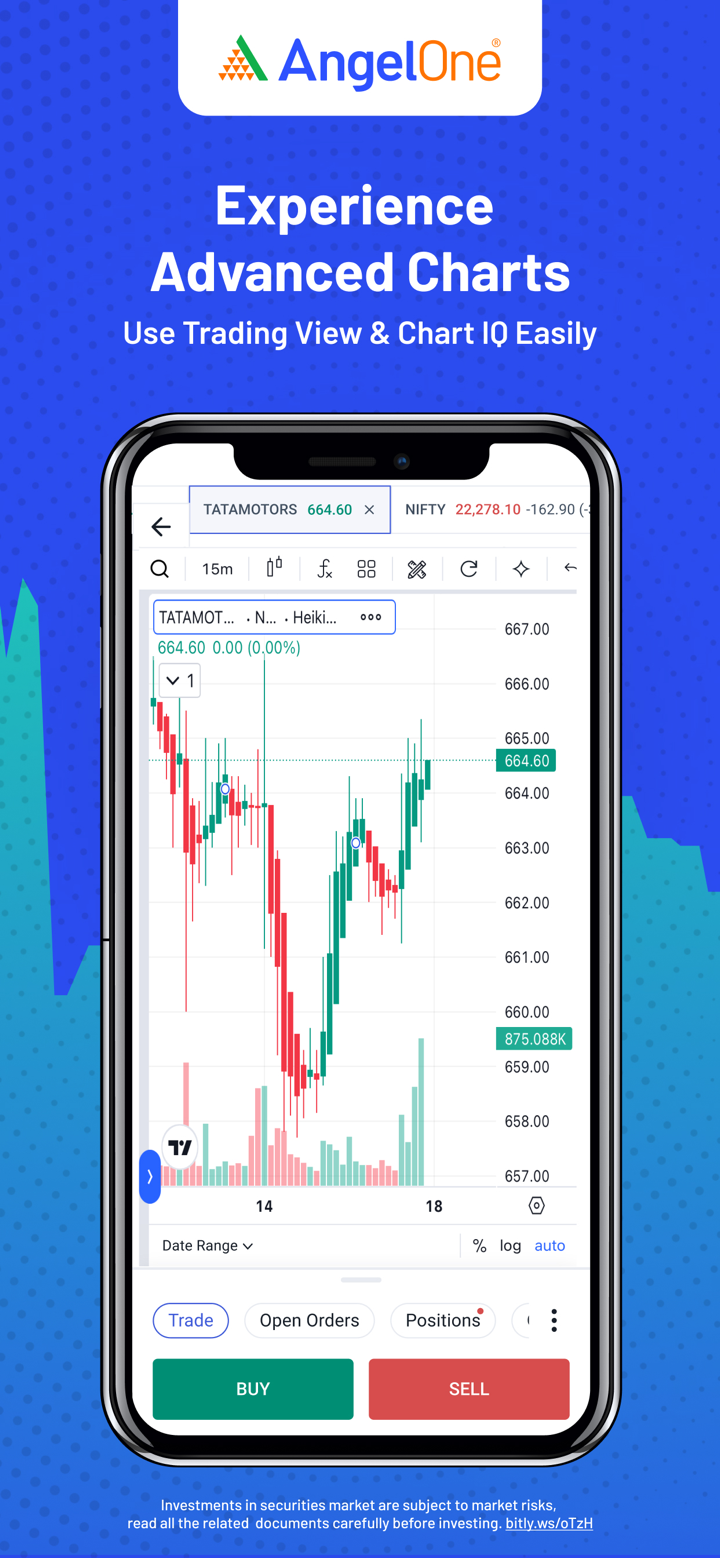

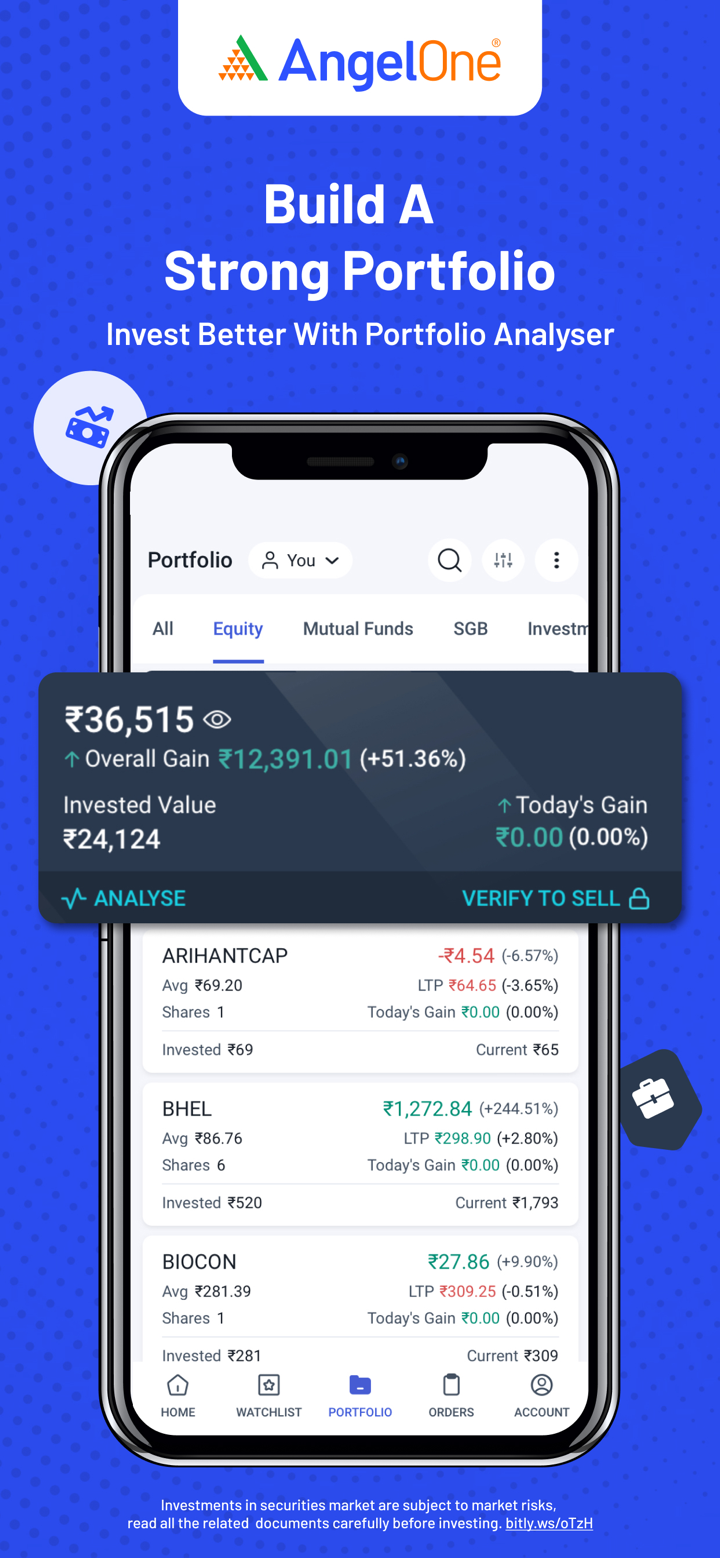

Nag-aalok ang Angel One ng tatlong plataporma ng pagtitingin, isang mobile app para sa pang-araw-araw na mga mamumuhunan, isang web platform para sa mga propesyonal na nagtitinda, at mga API para sa mga developer at algo traders.

| Plataporma | Sinusugan | Available Devices | Angkop para sa |

| Angel One Super App | ✔ | Android, iOS | Mga nagsisimula hanggang sa intermediate na mga mamumuhunan at nagtitinda |

| Angel One Trade | ✔ | Web (Desktop/Laptop) | Mga aktibong/profesyonal na nagtitinda |

| Smart API | ✔ | Access sa API (Web backend integration) | Mga developer, algo traders, mga plataporma ng fintech |