Profil perusahaan

| Angel One Ringkasan Ulasan | |

| Dibentuk | 1996 |

| Negara/Daerah Terdaftar | India |

| Regulasi | Tidak diatur |

| Produk Perdagangan | Saham, IPO, Derivatif (F&O), Reksa Dana, Komoditas |

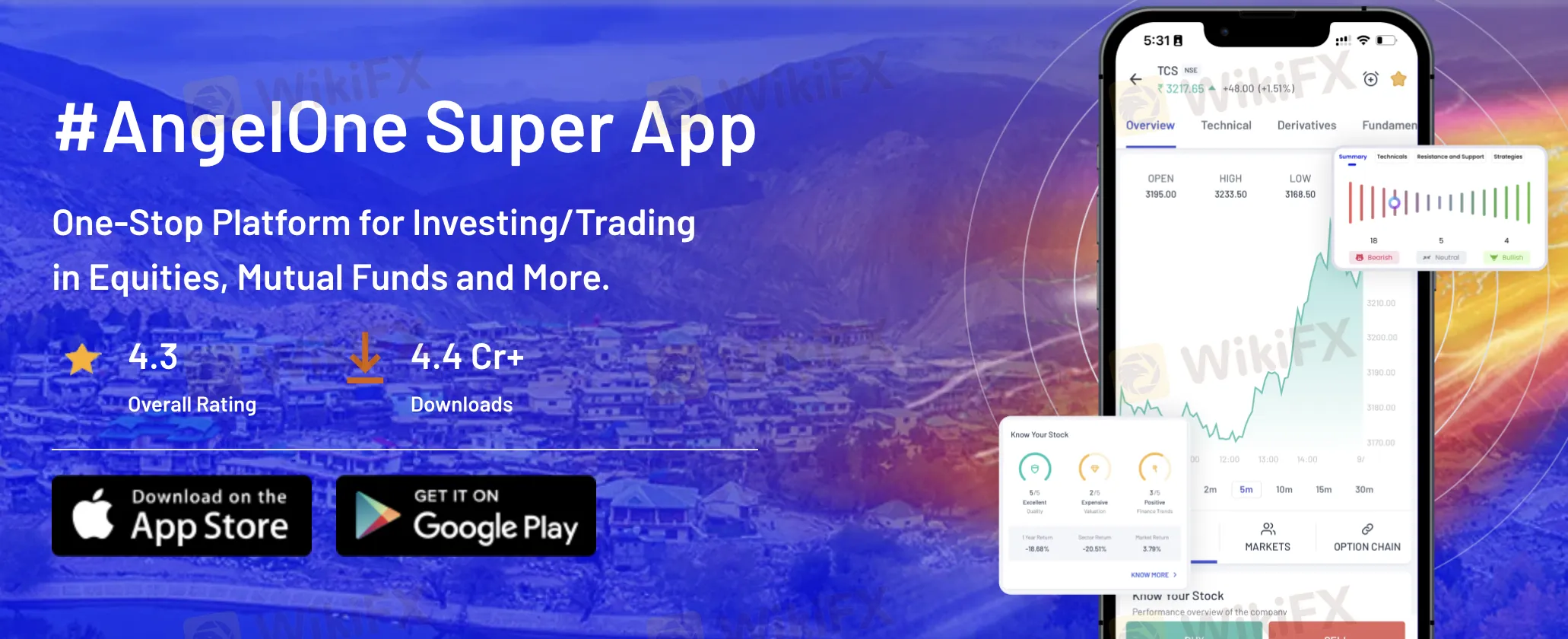

| Platform Perdagangan | Angel One Super App (ponsel), Angel One Trade (web), Smart API (pengembang) |

| Deposit Minimum | ₹0 |

| Dukungan Pelanggan | Email: support@angelone.in |

| Telepon: 18001020 | |

Informasi Angel One

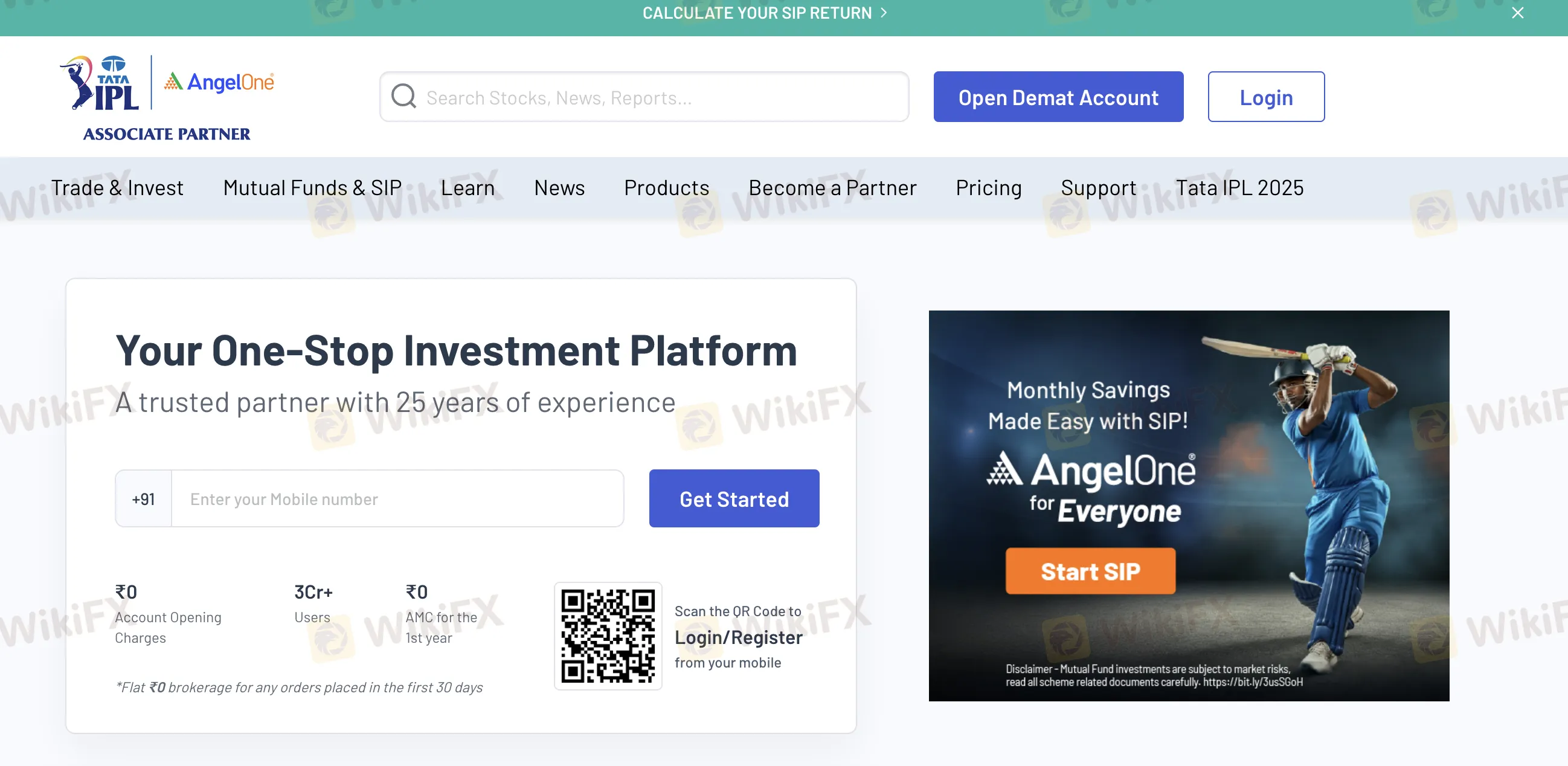

Didirikan pada tahun 1996, Angel One adalah perusahaan pialang India. SEBI atau kekuatan keuangan global manapun tidak mengontrolnya. Di antara banyak kendaraan investasi yang ditawarkan oleh perusahaan ini adalah ekuitas, derivatif, reksa dana, dan saham AS. Ketidakhadiran pengendalian regulasi menimbulkan kekhawatiran meskipun dengan biaya rendah dan platform teknologi yang tangguh.

Pro dan Kontra

| Pro | Kontra |

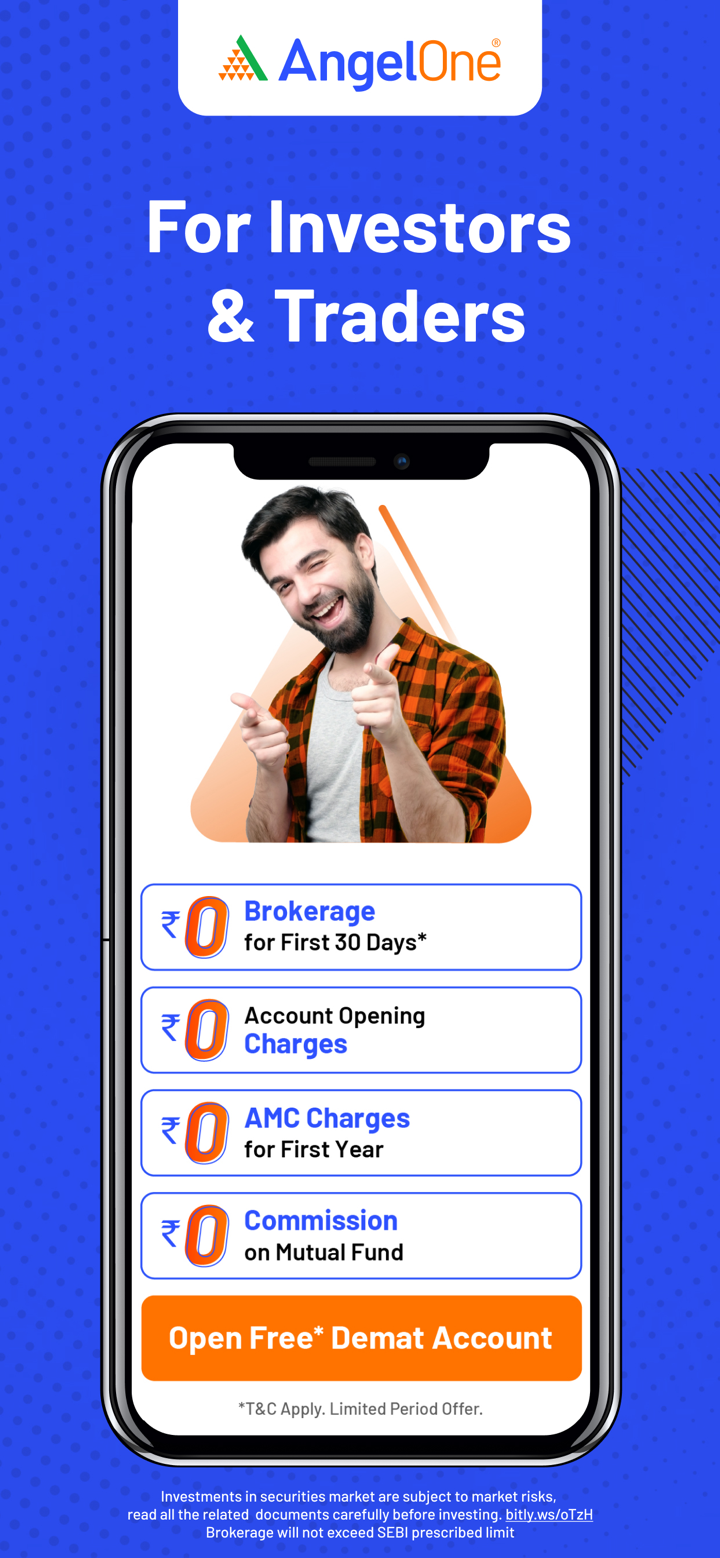

| Nol biaya pialang untuk ₹500 pertama dalam 30 hari | Tidak diatur |

| Beragam produk investasi | Berbagai biaya yang dibebankan |

| Platform yang ramah pengguna | |

| Tidak ada deposit minimum |

Apakah Angel One Legal?

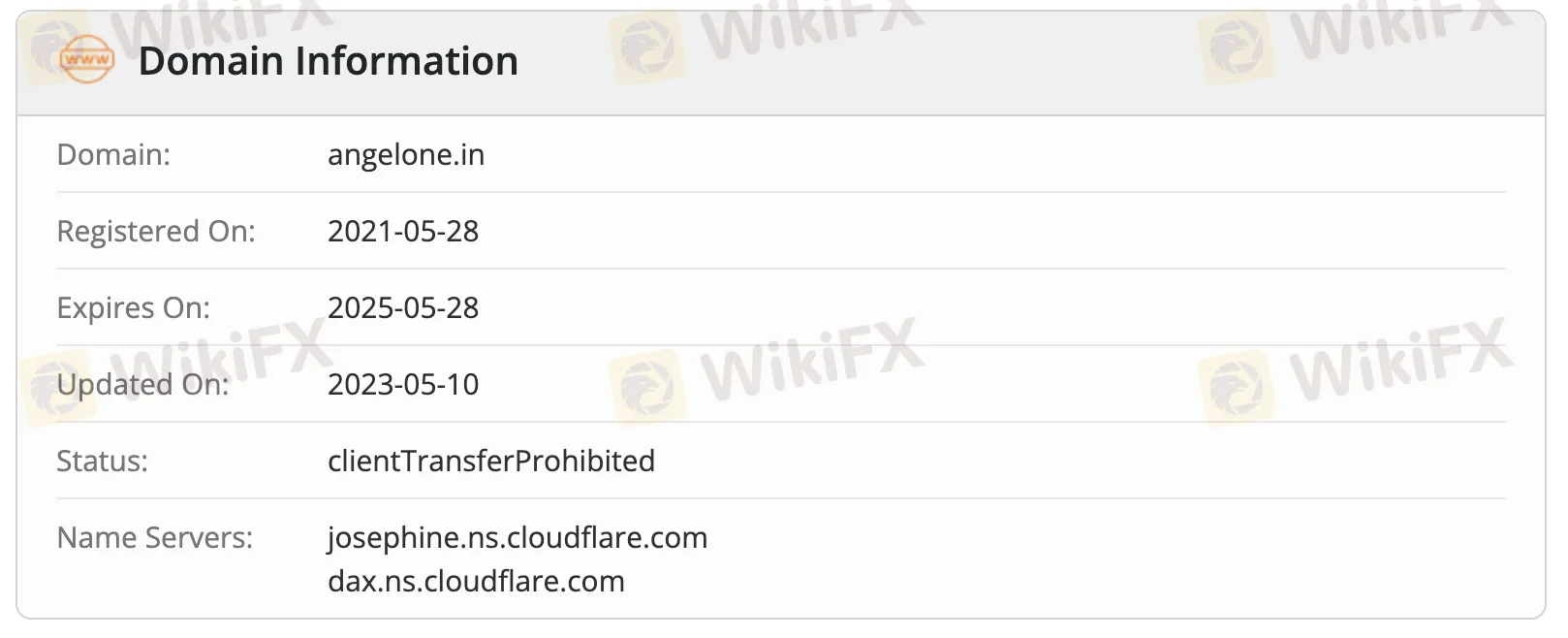

Angel One tidak diatur sebagai pialang. Meskipun berbasis di India, perusahaan ini tidak memiliki lisensi dari SEBI atau regulator global utama seperti FCA, ASIC, atau NFA.

Domain angelone.in didaftarkan pada 28 Mei 2021, diperbarui terakhir pada 10 Mei 2023, dan akan kedaluwarsa pada 28 Mei 2025. Statusnya adalah clientTransferProhibited.

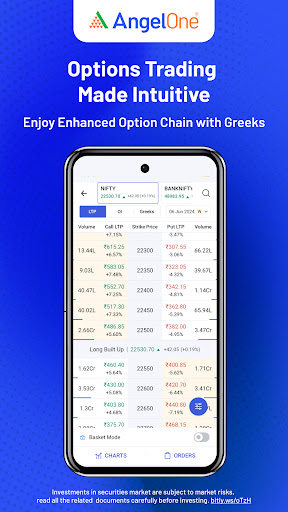

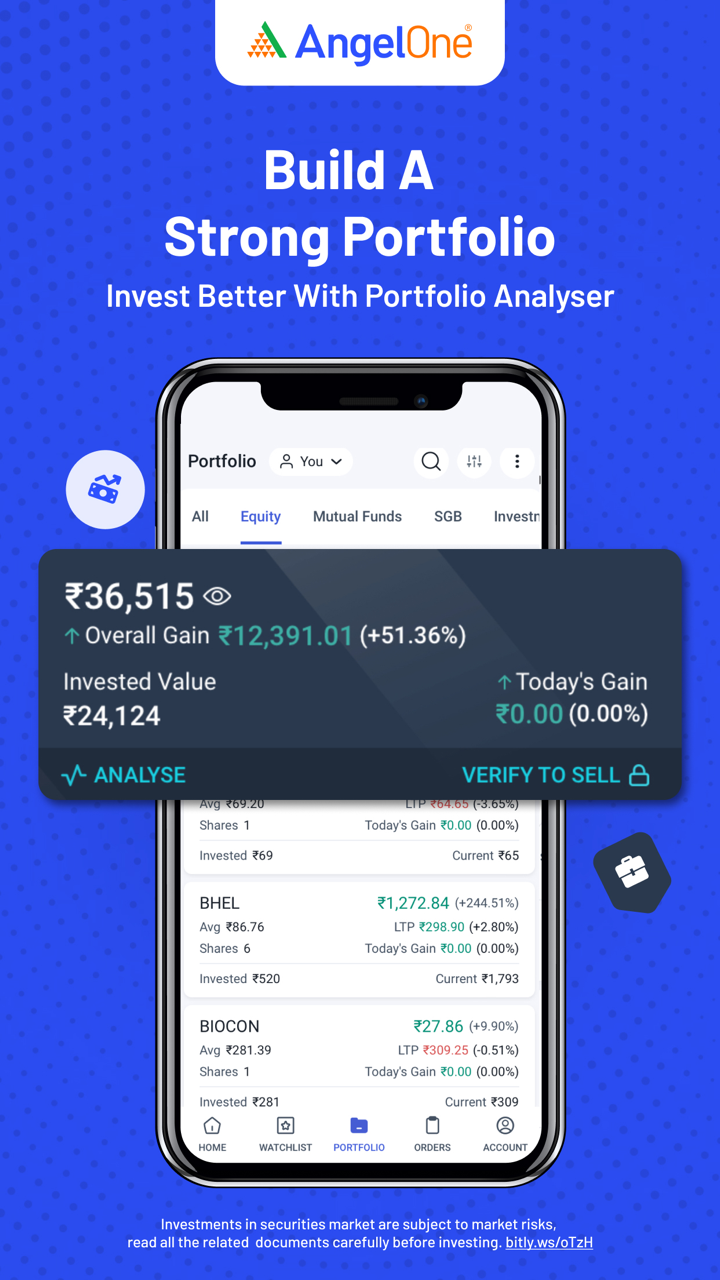

Produk Perdagangan

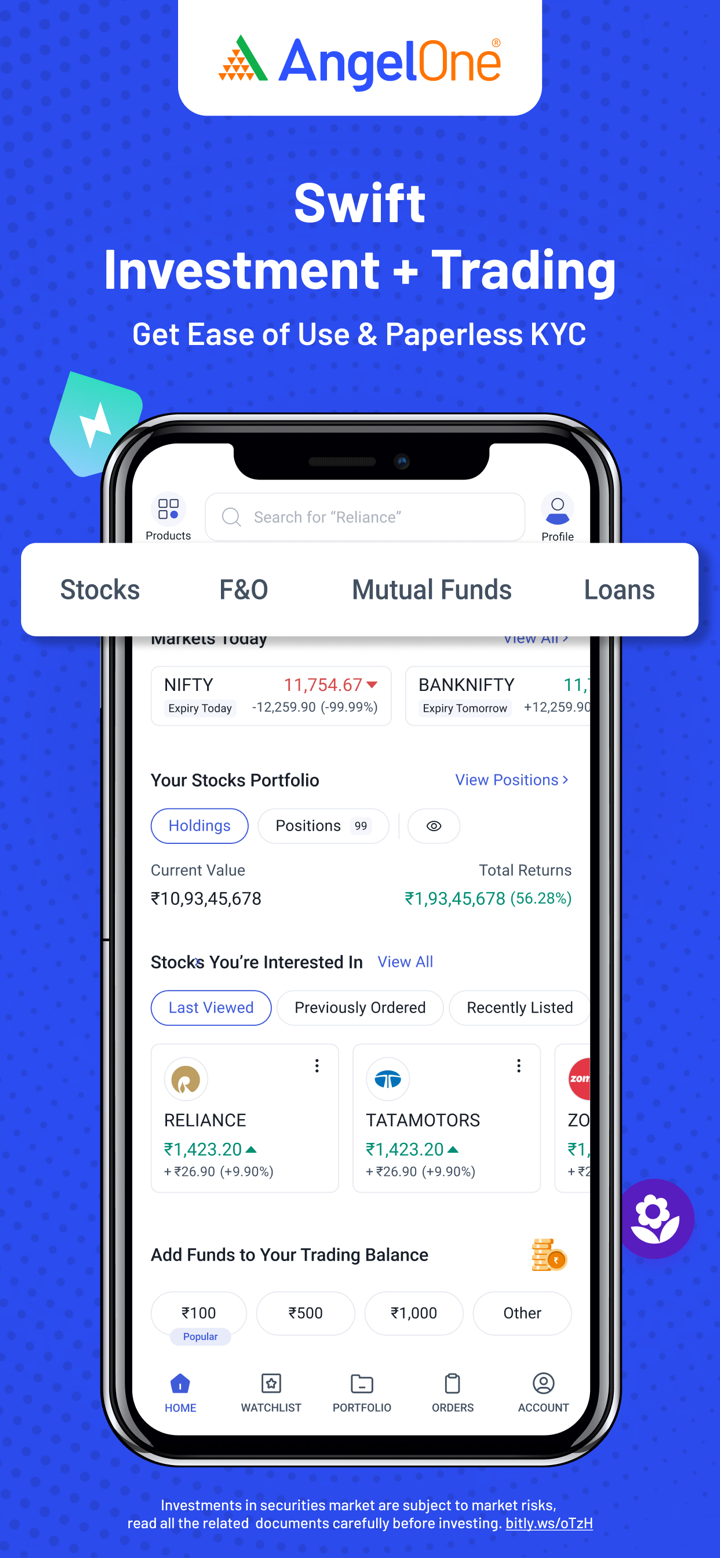

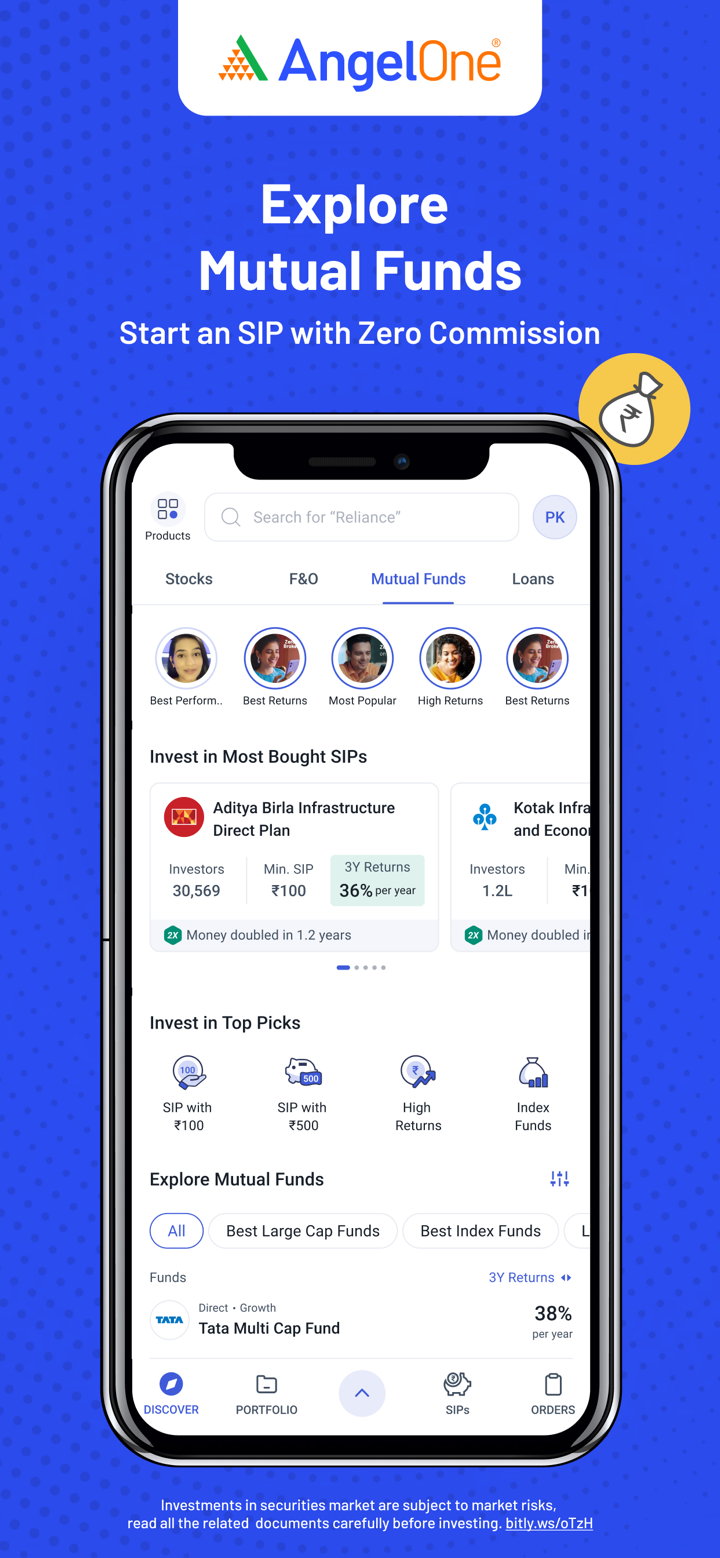

Angel One menawarkan beragam produk investasi termasuk saham, IPO, derivatif, reksa dana, komoditas, dan saham Amerika Serikat.

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| IPO | ✔ |

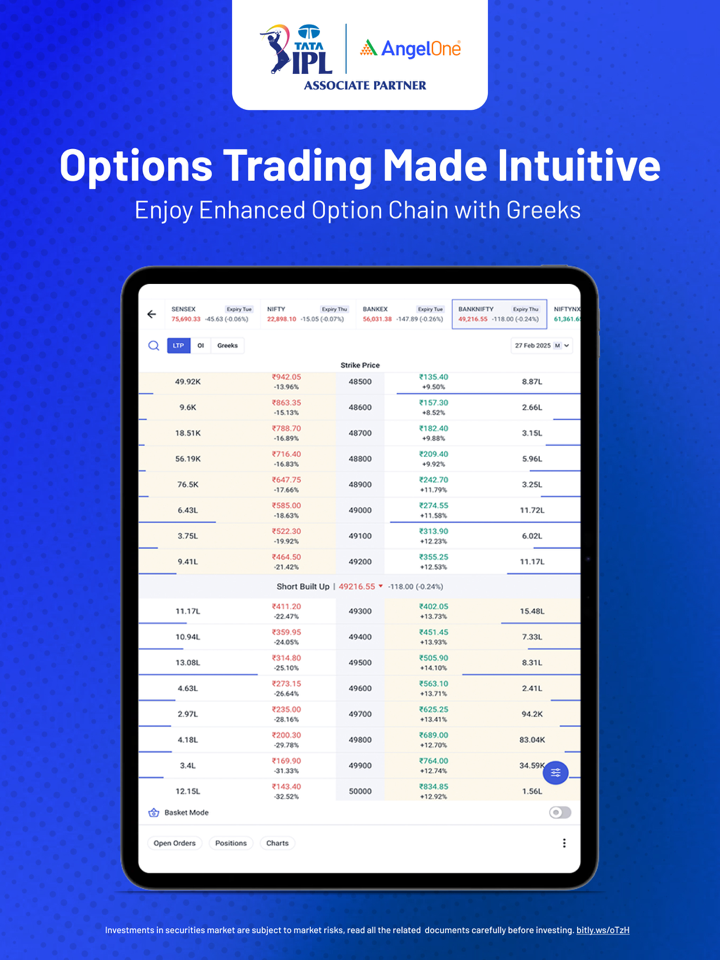

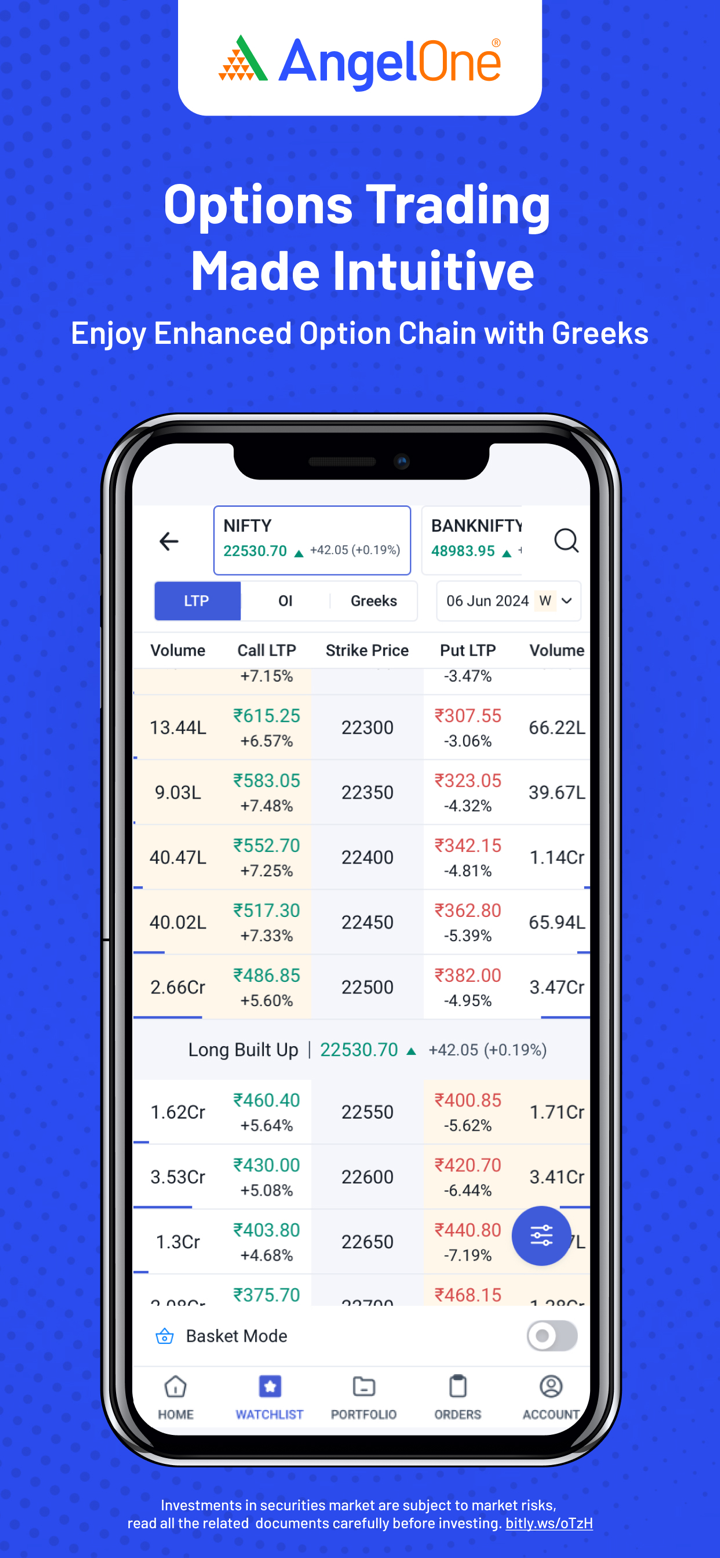

| Derivatif (F&O) | ✔ |

| Reksa Dana | ✔ |

| Komoditas | ✔ |

| Forex | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

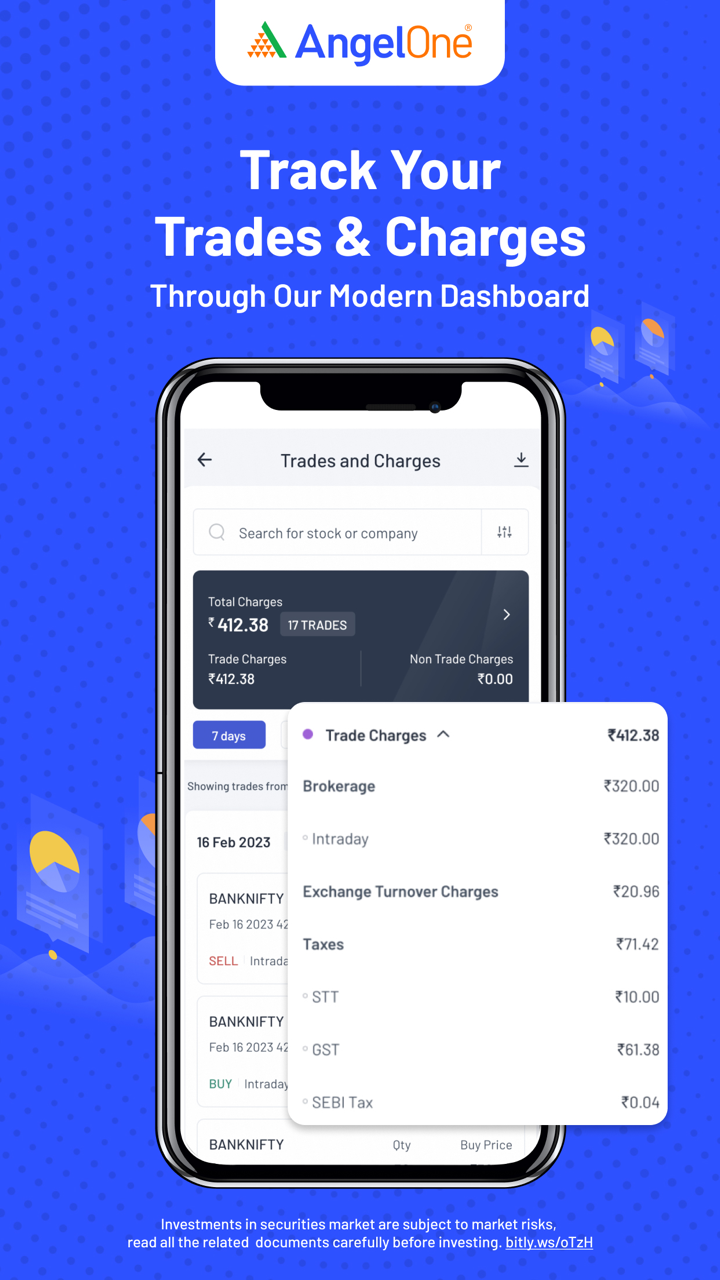

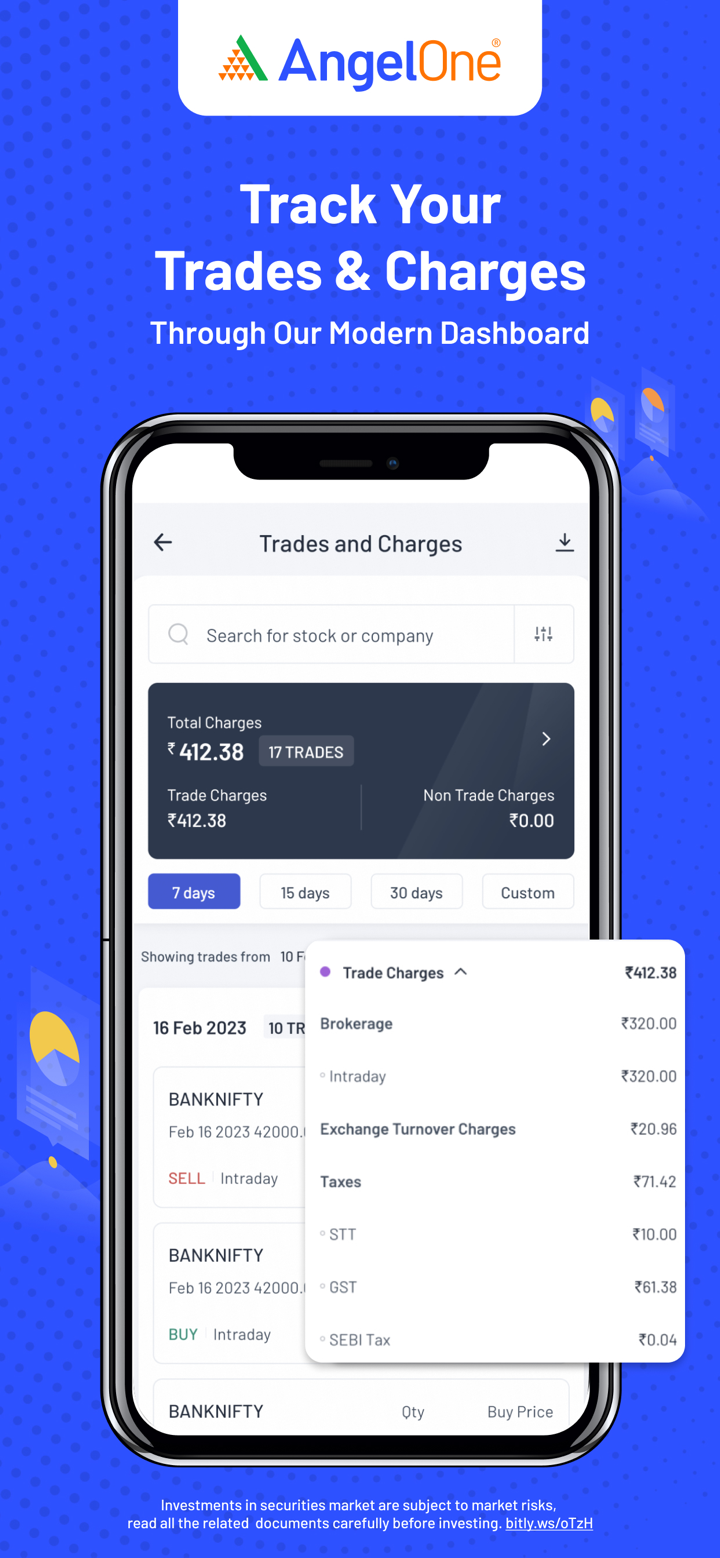

Biaya Angel One

Biaya Angel One umumnya rendah hingga sedang dibandingkan dengan standar industri di India. Ia menawarkan nol biaya pialang selama 30 hari pertama (hingga ₹500), setelah itu biayanya dibatasi dan kompetitif, terutama untuk para pedagang eceran. Biaya tambahan sebagian besar sesuai dengan norma regulasi.

| Jenis Investasi | Penawaran Awal | Biaya Pialang Setelah Penawaran |

| Penyerahan Ekuitas | ₹0 hingga ₹500 dalam 30 hari | Lebih rendah dari ₹20 atau 0,1% per pesanan (min ₹2) |

| Perdagangan Intraday | Lebih rendah dari ₹20 atau 0,03% per pesanan | |

| Masa Depan | ₹20 per pesanan dieksekusi | |

| Opsi |

| Jenis Biaya | Penyerahan Ekuitas | Intraday | Masa Depan | Opsi |

| Biaya Transaksi | NSE: 0,00297% | NSE: 0,00173% | NSE: 0,03503% | |

| STT | 0,1% (Beli/Jual) | 0,025% (Jual) | 0,01% (Jual) | 0,05% (Jual) |

| Pajak GST | 18% | |||

| Biaya SEBI | ₹10/crore | |||

| Biaya Kliring | ₹0 | |||

| Pajak Materai | 0,015% (Beli) | 0,003% (Beli) | 0,002% (Beli) | 0,003% (Beli) |

| Jenis Biaya | Biaya |

| Pembukaan Akun | 0 (kadang-kadang ₹36,48 untuk NRI) |

| AMC (Tahun Pertama) | 0 |

| AMC (Setelah Tahun Pertama) | ₹60/triwulan (non-BSDA), atau ₹450/tahun, atau opsi seumur hidup ₹2950 |

| AMC BSDA | NIL hingga ₹4L; ₹100/tahun untuk kepemilikan ₹4L–₹10L |

| MTF (Peminjaman Margin) | 0,041% per hari |

| Bunga Saldo Debit | 0,049% per hari |

| Biaya Jaminan Tunai | 0,0342%/hari (pada kekurangan > ₹50.000) |

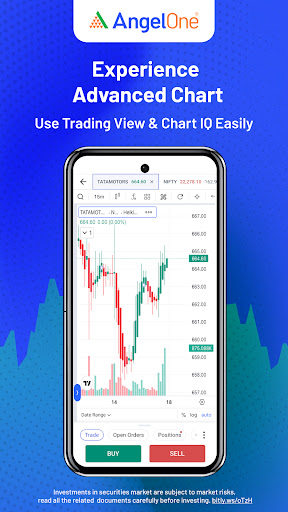

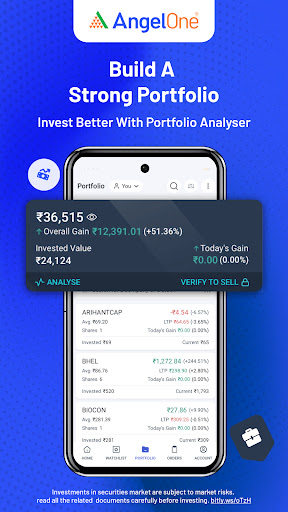

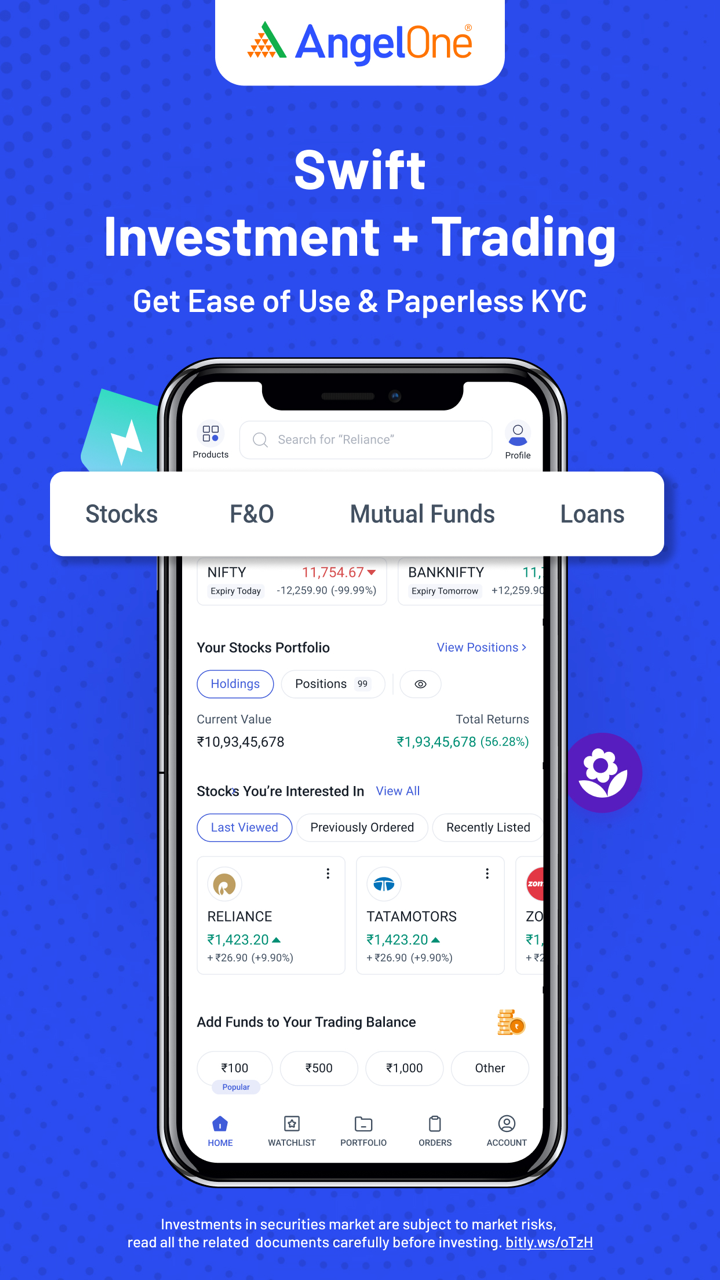

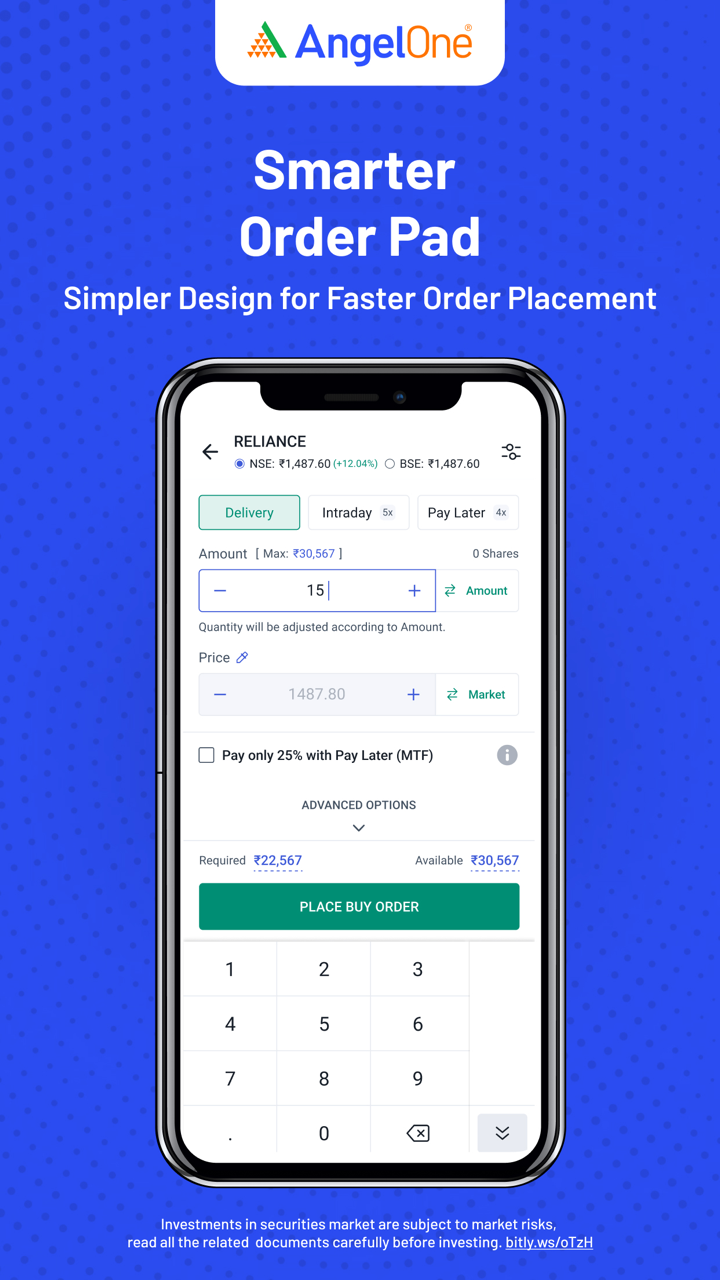

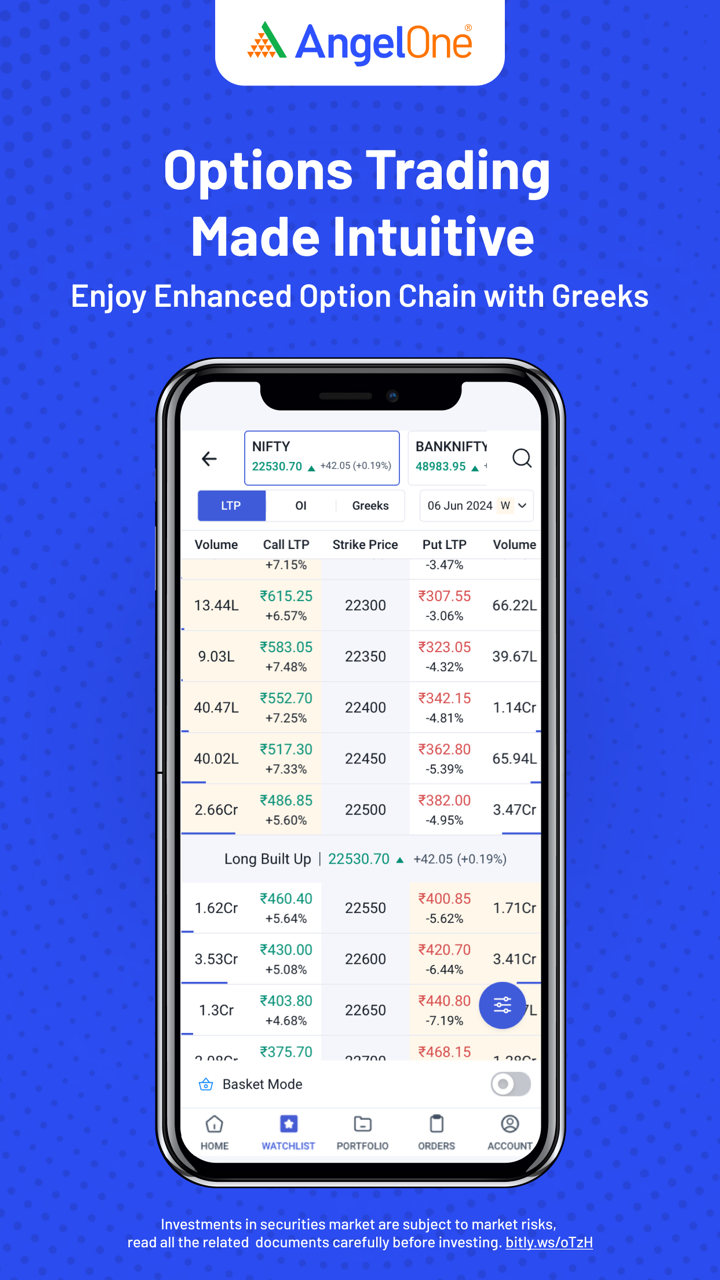

Platform Perdagangan

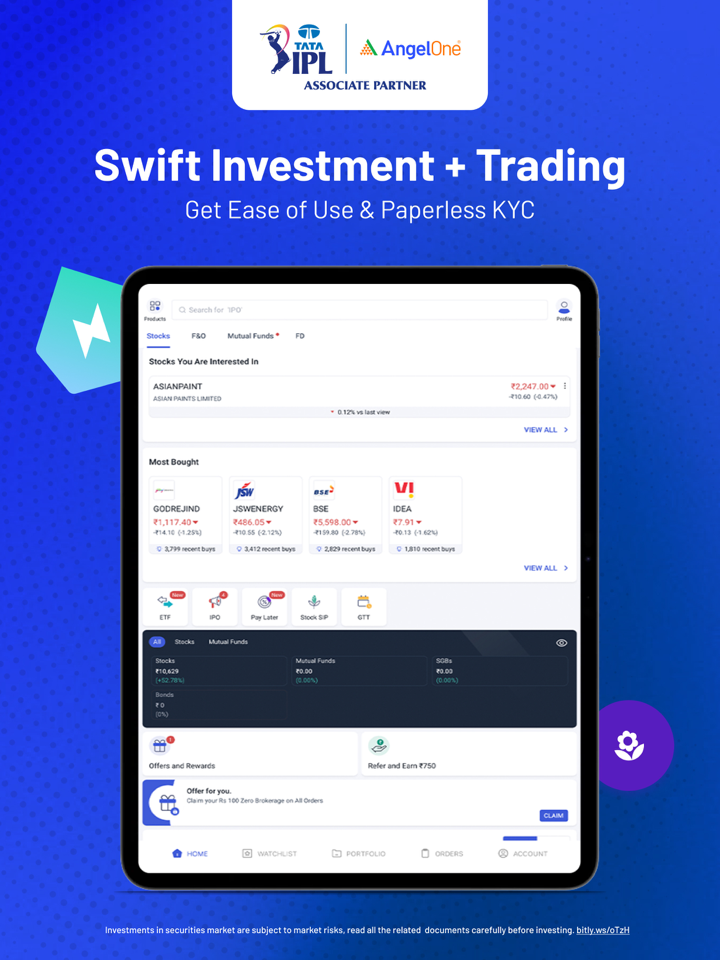

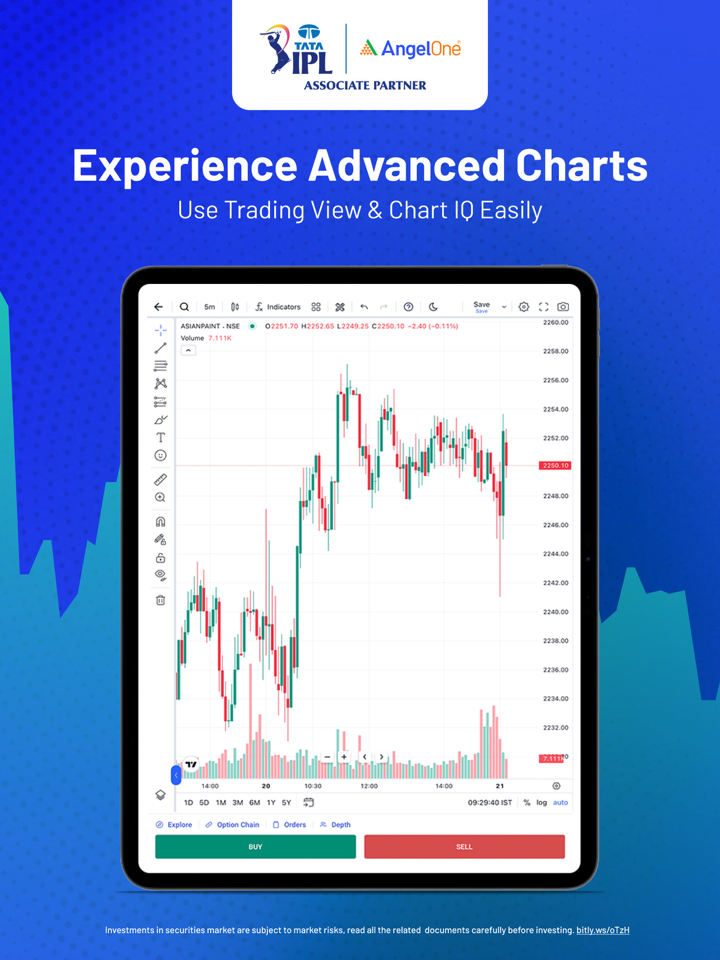

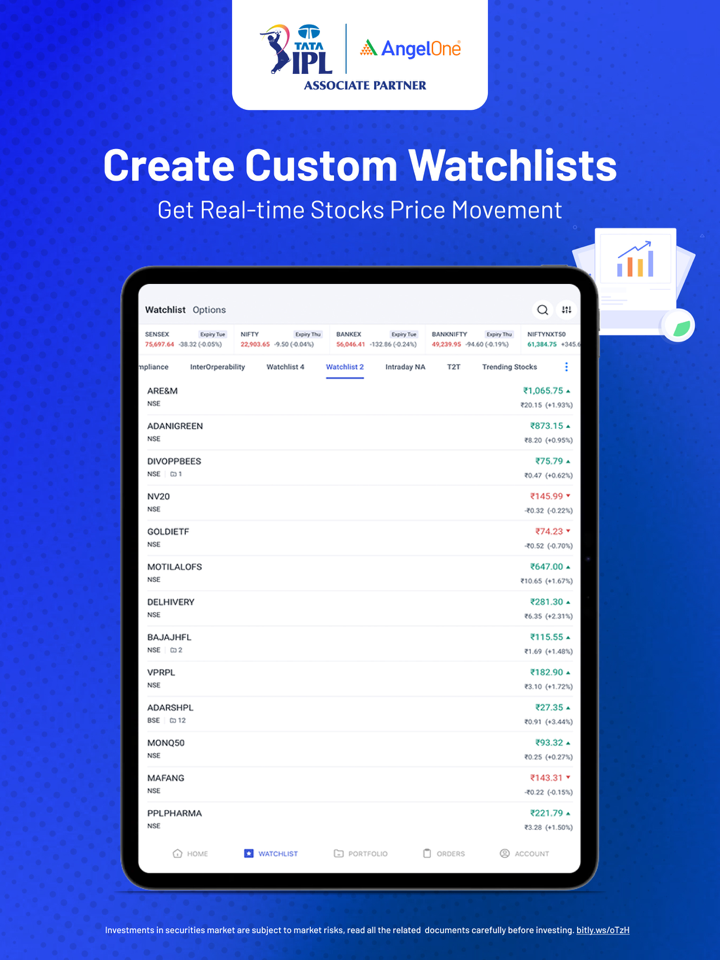

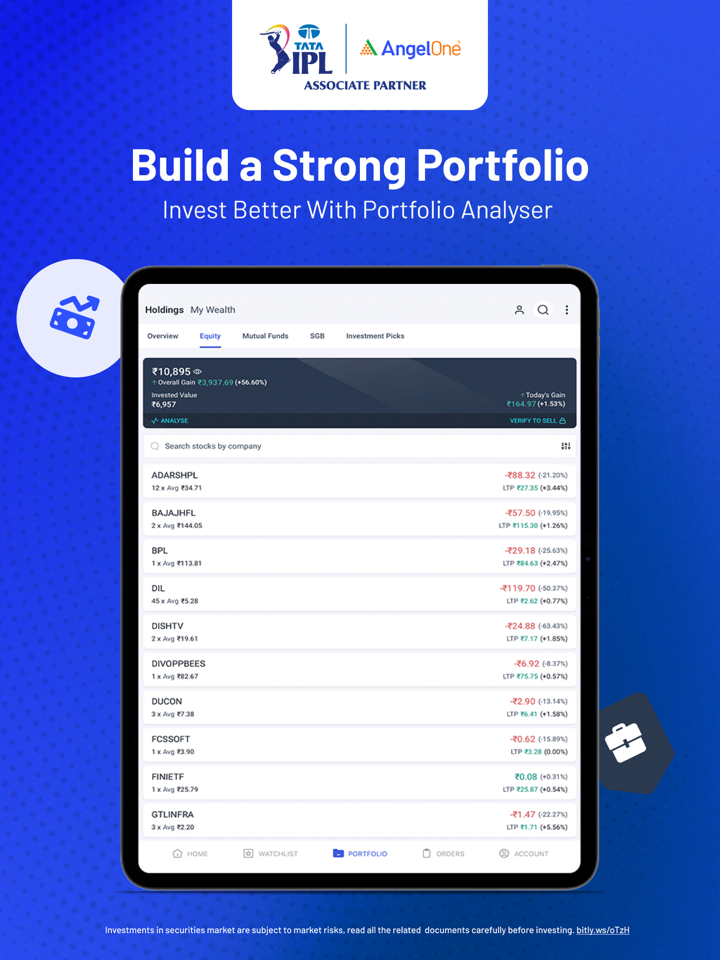

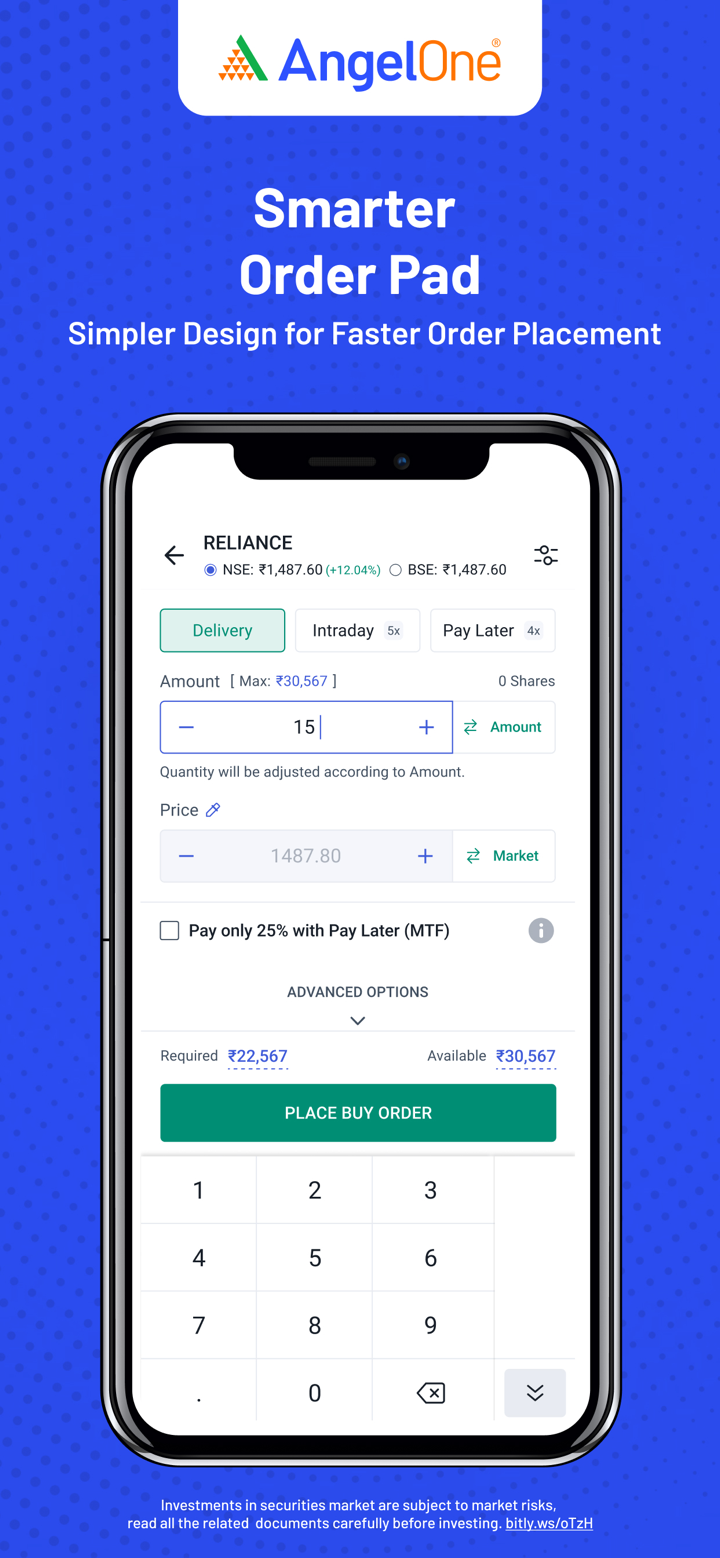

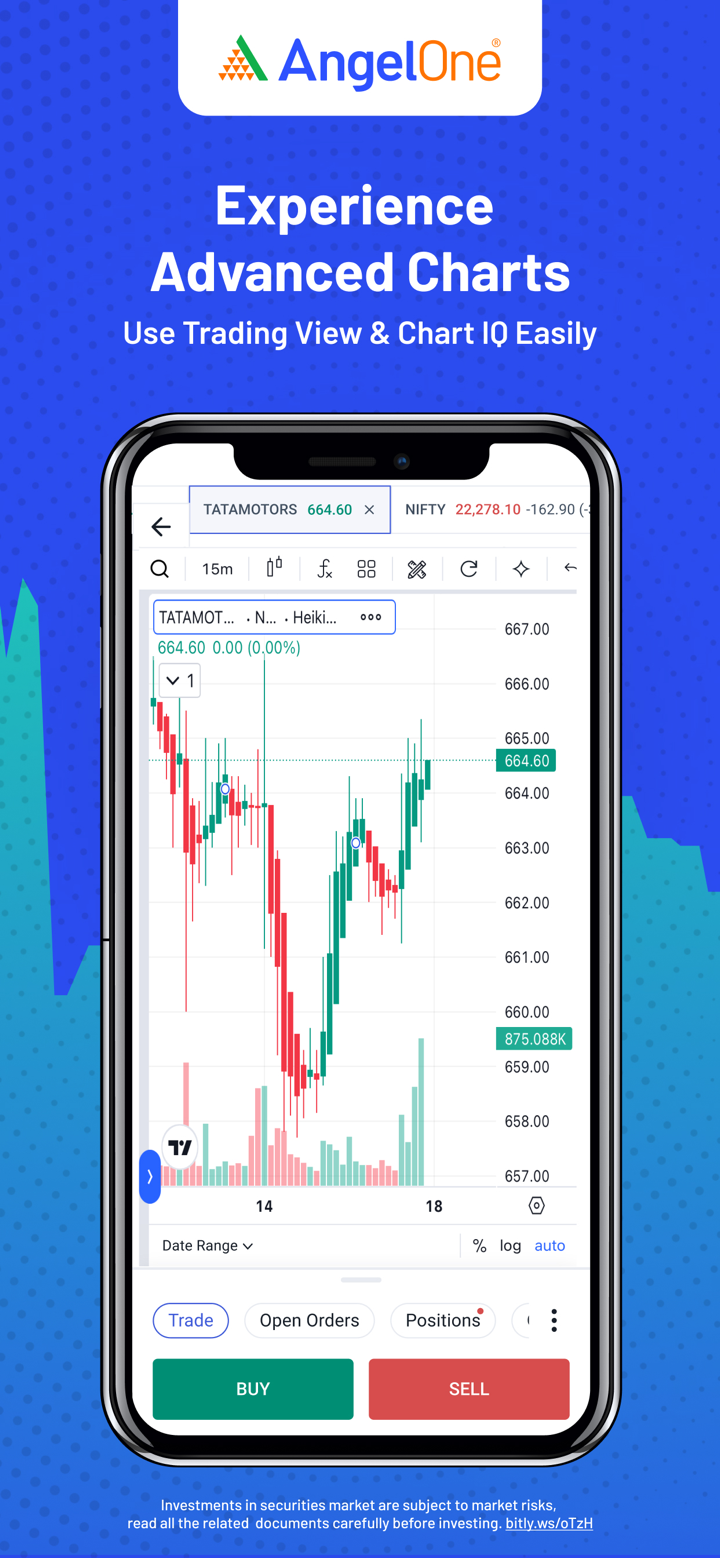

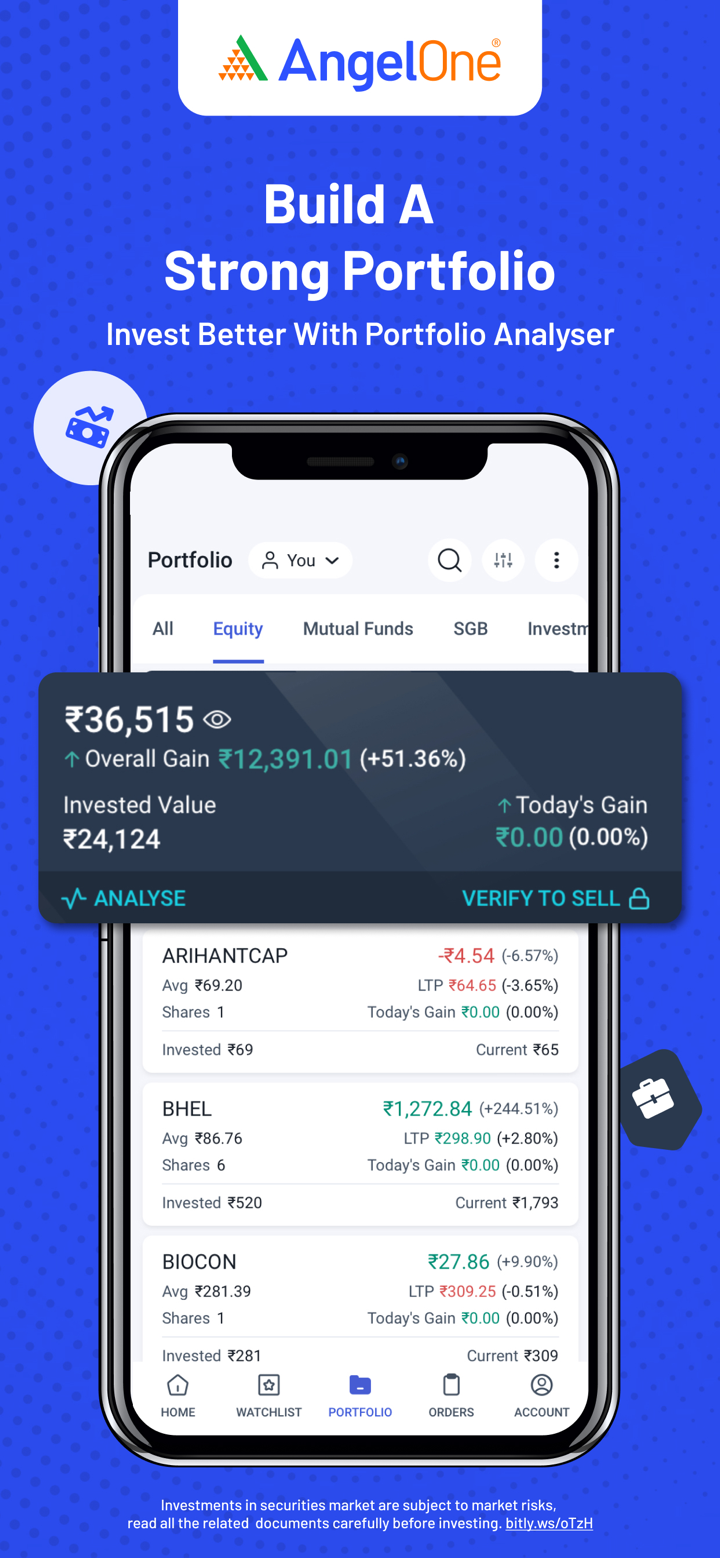

Angel One menawarkan tiga platform perdagangan, aplikasi seluler untuk investor sehari-hari, platform web untuk pedagang profesional, dan API untuk pengembang dan pedagang algoritma.

| Platform | Didukung | Perangkat Tersedia | Cocok untuk |

| Aplikasi Super Angel One | ✔ | Android, iOS | Investor & pedagang pemula hingga menengah |

| Perdagangan Angel One | ✔ | Web (Desktop/Laptop) | Pedagang aktif/profesional |

| API Cerdas | ✔ | Akses API (Integrasi backend Web) | Pengembang, pedagang algoritma, platform fintech |