Unternehmensprofil

| Angel One Überprüfungszusammenfassung | |

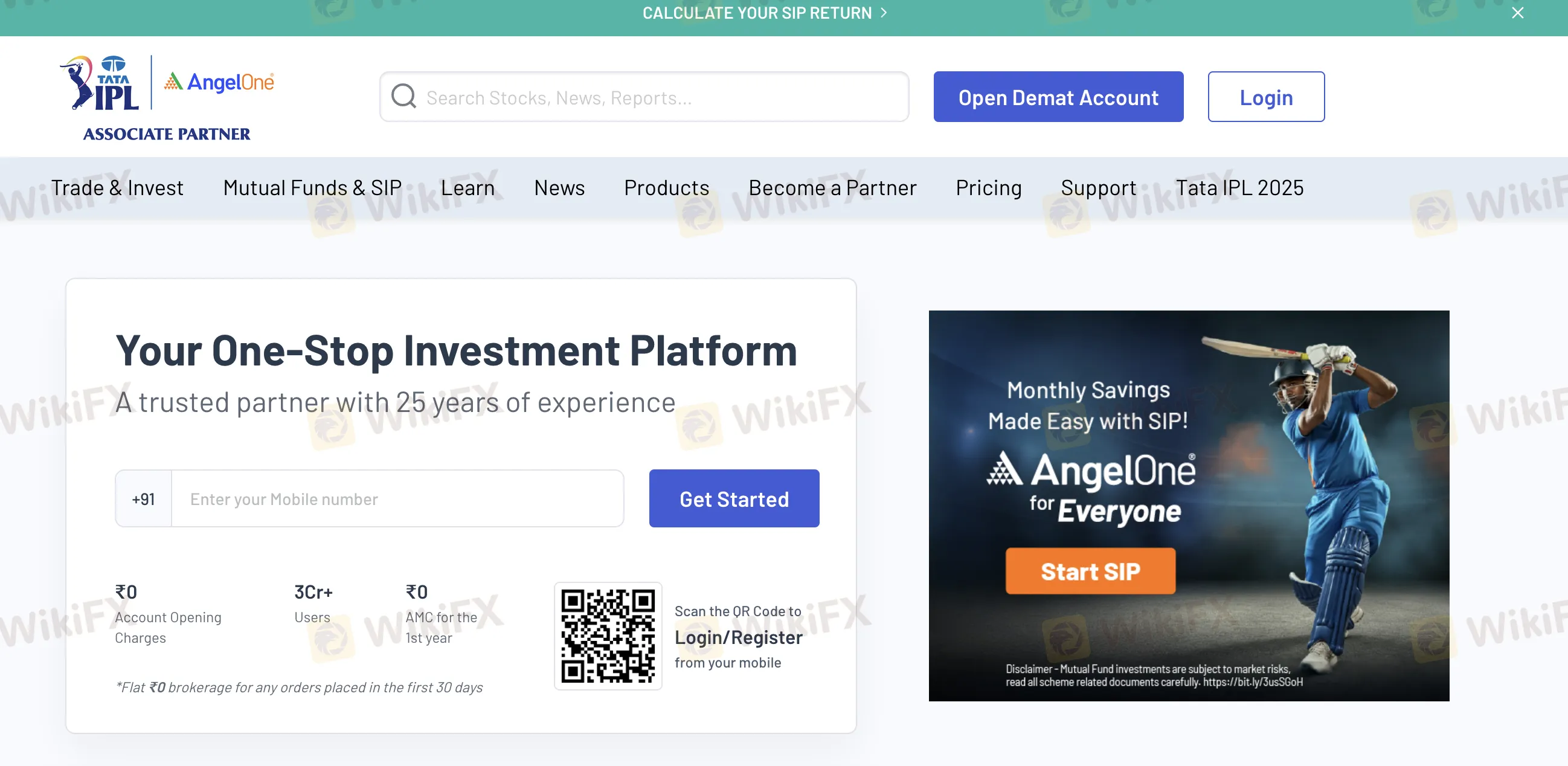

| Gegründet | 1996 |

| Registriertes Land/Region | Indien |

| Regulierung | Keine Regulierung |

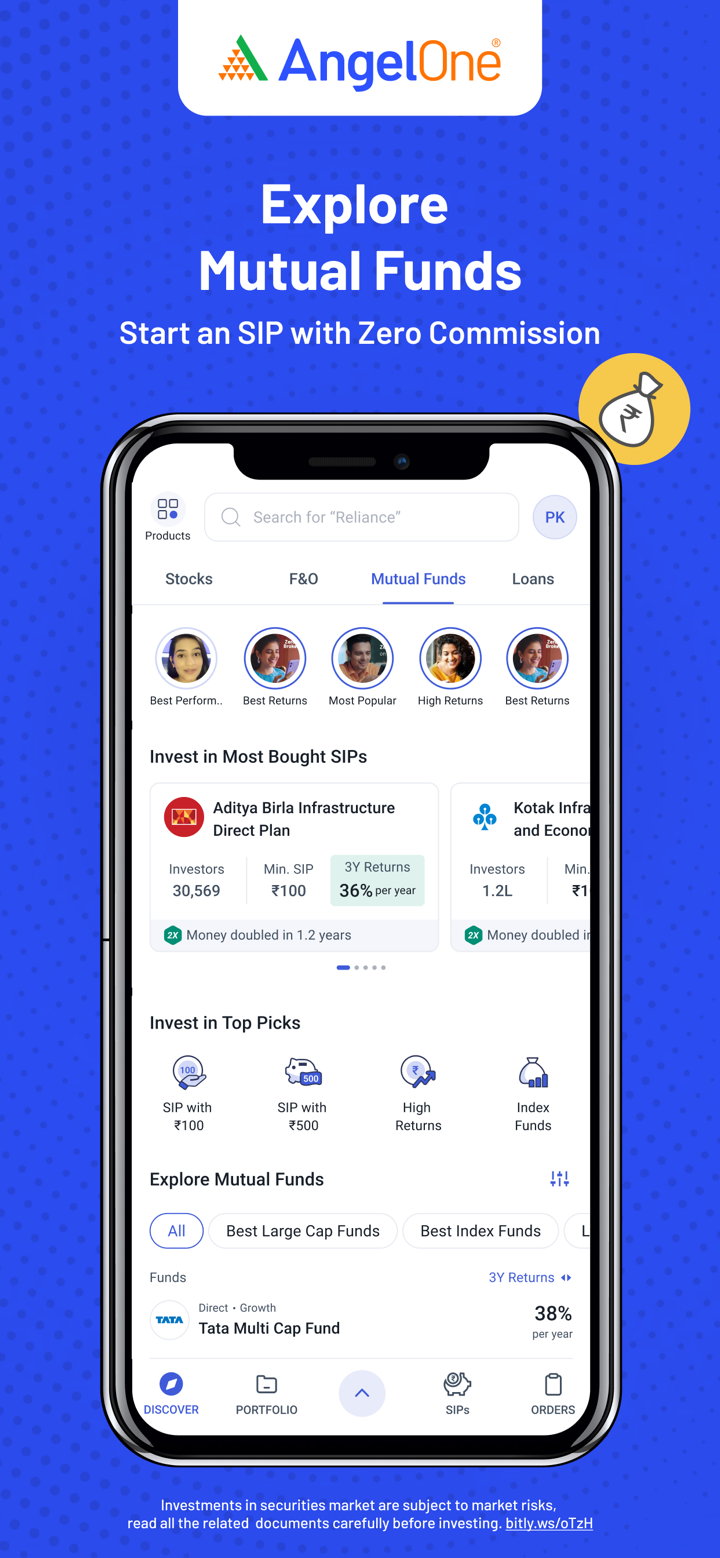

| Handelsprodukte | Aktien, IPOs, Derivate (F&O), Investmentfonds, Rohstoffe |

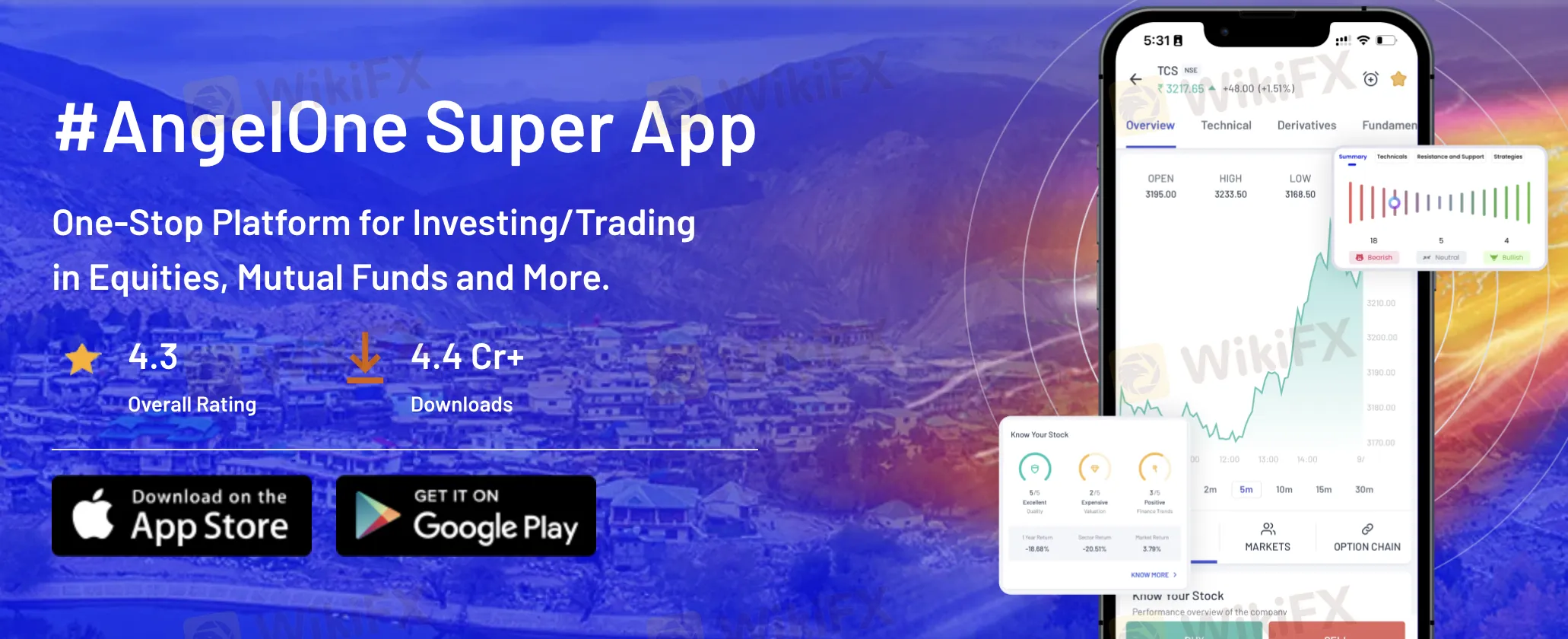

| Handelsplattform | Angel One Super App (mobil), Angel One Trade (Web), Smart API (Entwickler) |

| Mindesteinzahlung | ₹0 |

| Kundensupport | E-Mail: support@angelone.in |

| Telefon: 18001020 | |

Angel One Informationen

Gegründet im Jahr 1996, ist Angel One ein indisches Brokerunternehmen. Es wird weder von der SEBI noch von einer weltweiten Finanzmacht kontrolliert. Zu den vielen Anlageprodukten, die das Unternehmen anbietet, gehören Aktien, Derivate, Investmentfonds und US-Aktien. Die fehlende regulatorische Kontrolle verursacht Bedenken, auch bei den niedrigen Kosten und den robusten Technologieplattformen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Null Maklergebühren für die ersten ₹500 in 30 Tagen | Keine Regulierung |

| Breites Spektrum an Anlageprodukten | Verschiedene Gebühren |

| Benutzerfreundliche Plattformen | |

| Keine Mindesteinzahlung |

Ist Angel One seriös?

Angel One ist kein regulierter Broker. Obwohl es seinen Sitz in Indien hat, besitzt es keine Lizenz von der SEBI oder anderen wichtigen globalen Regulierungsbehörden wie der FCA, ASIC oder NFA.

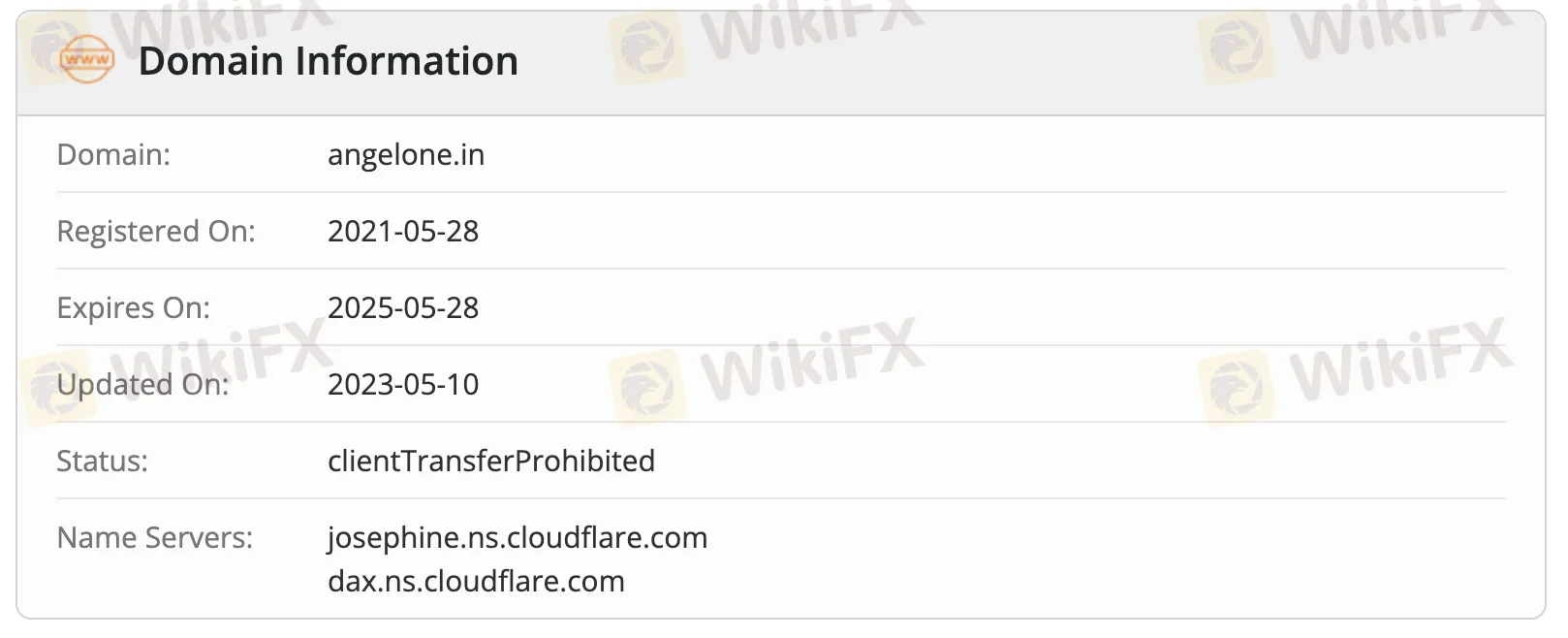

Die Domain angelone.in wurde am 28. Mai 2021 registriert, zuletzt am 10. Mai 2023 aktualisiert und läuft am 28. Mai 2025 ab. Ihr Status ist clientTransferProhibited.

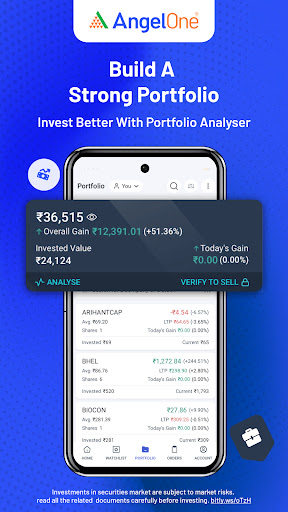

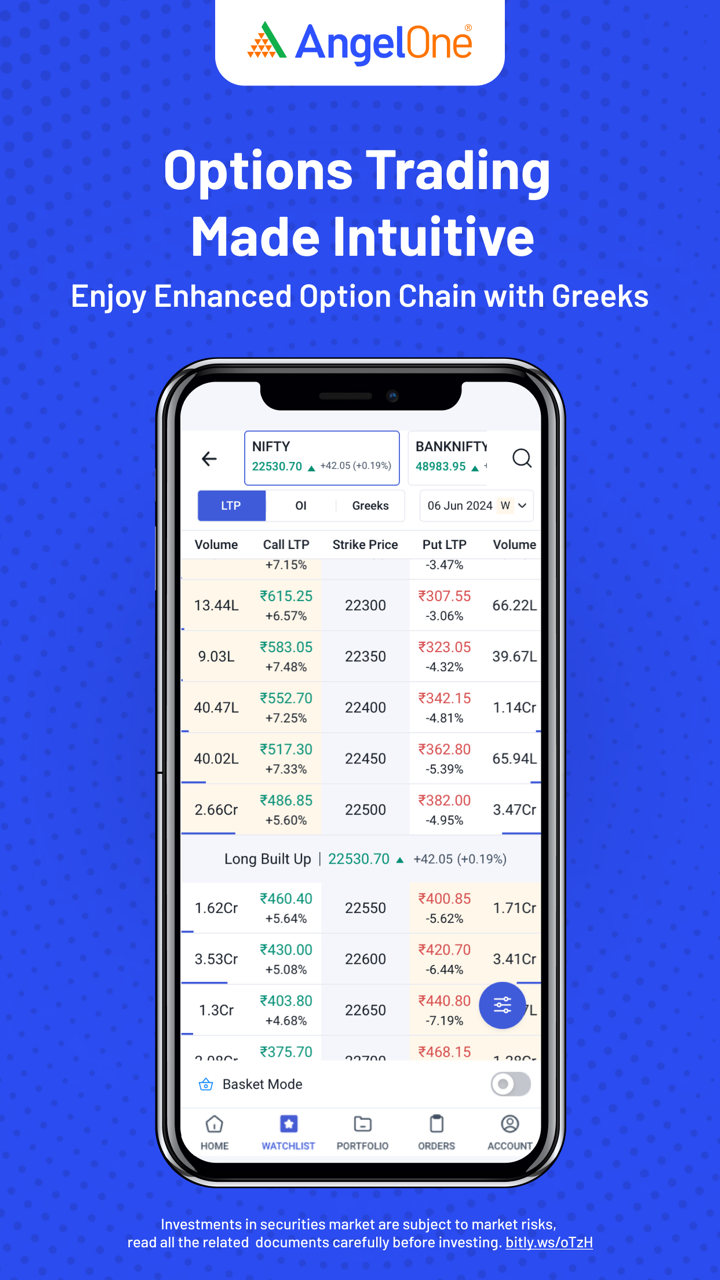

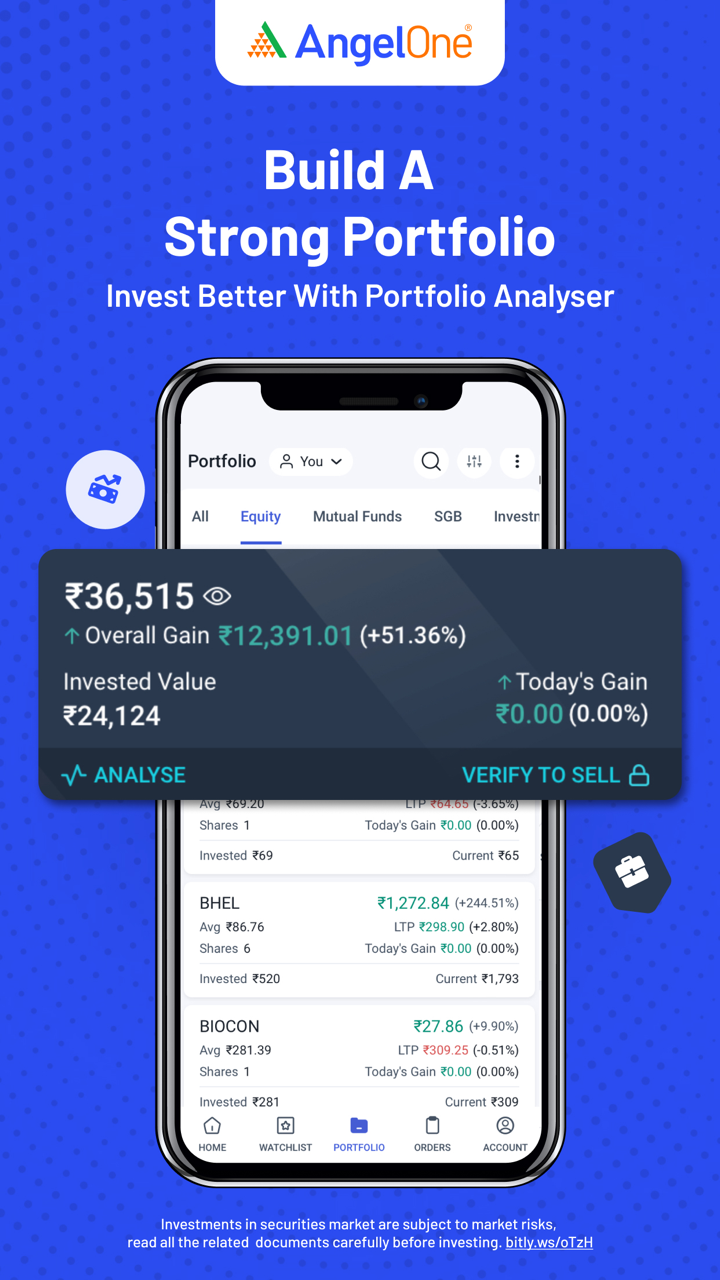

Handelsprodukte

Angel One bietet eine Vielzahl von Anlageprodukten, darunter Aktien, IPOs, Derivate, Investmentfonds, Rohstoffe und US-Aktien.

| Handelsinstrumente | Unterstützt |

| Aktien | ✔ |

| IPOs | ✔ |

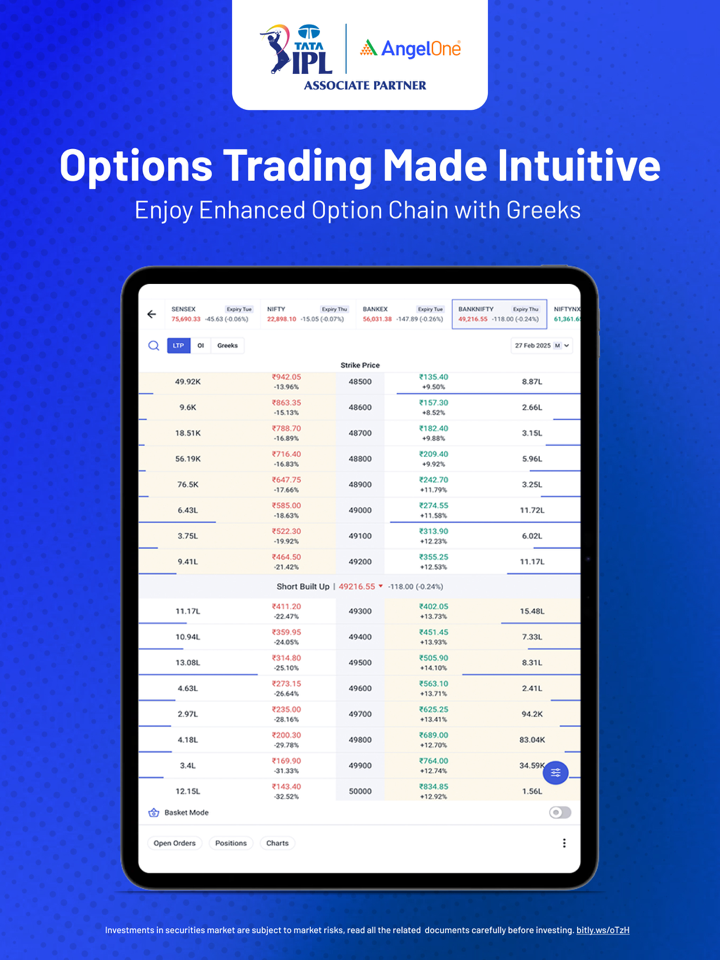

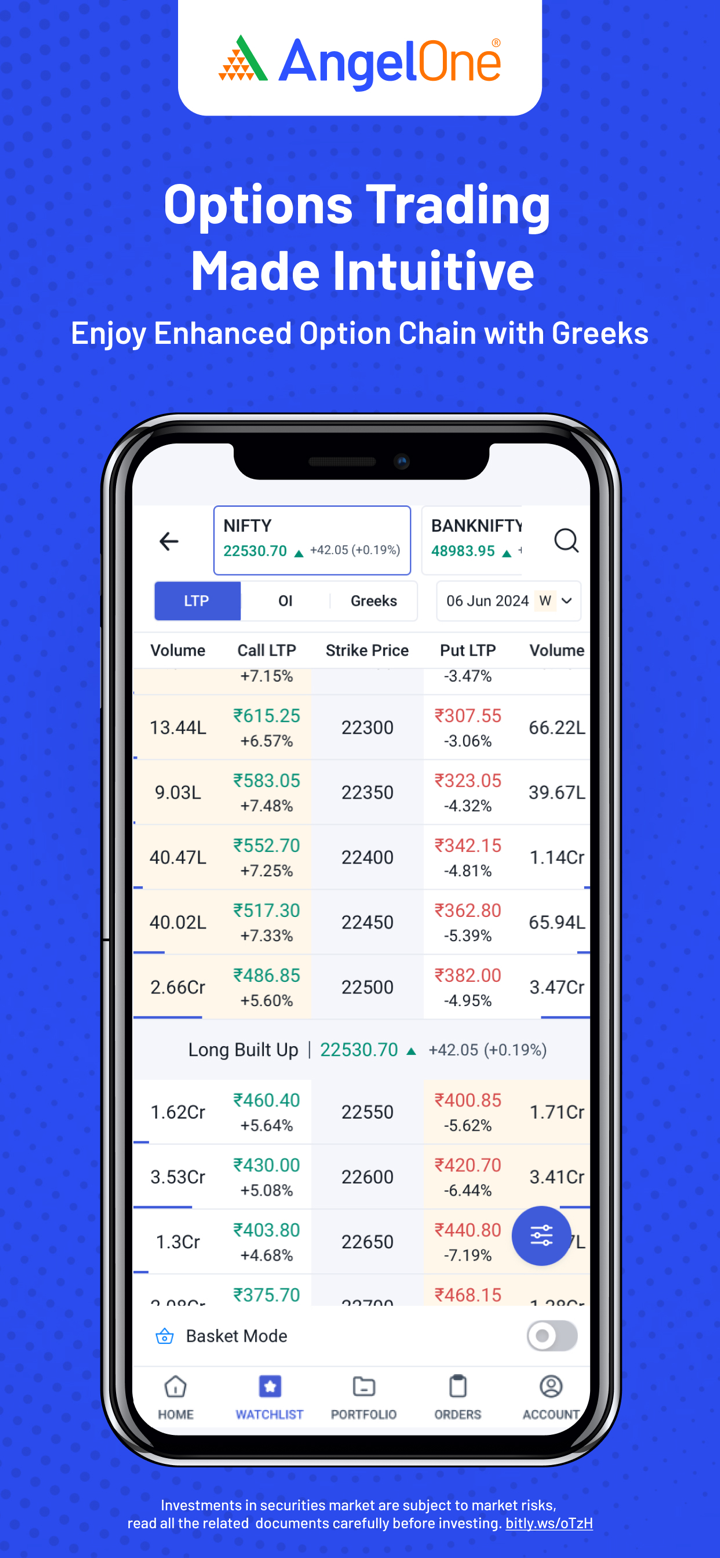

| Derivate (F&O) | ✔ |

| Investmentfonds | ✔ |

| Rohstoffe | ✔ |

| Forex | ❌ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

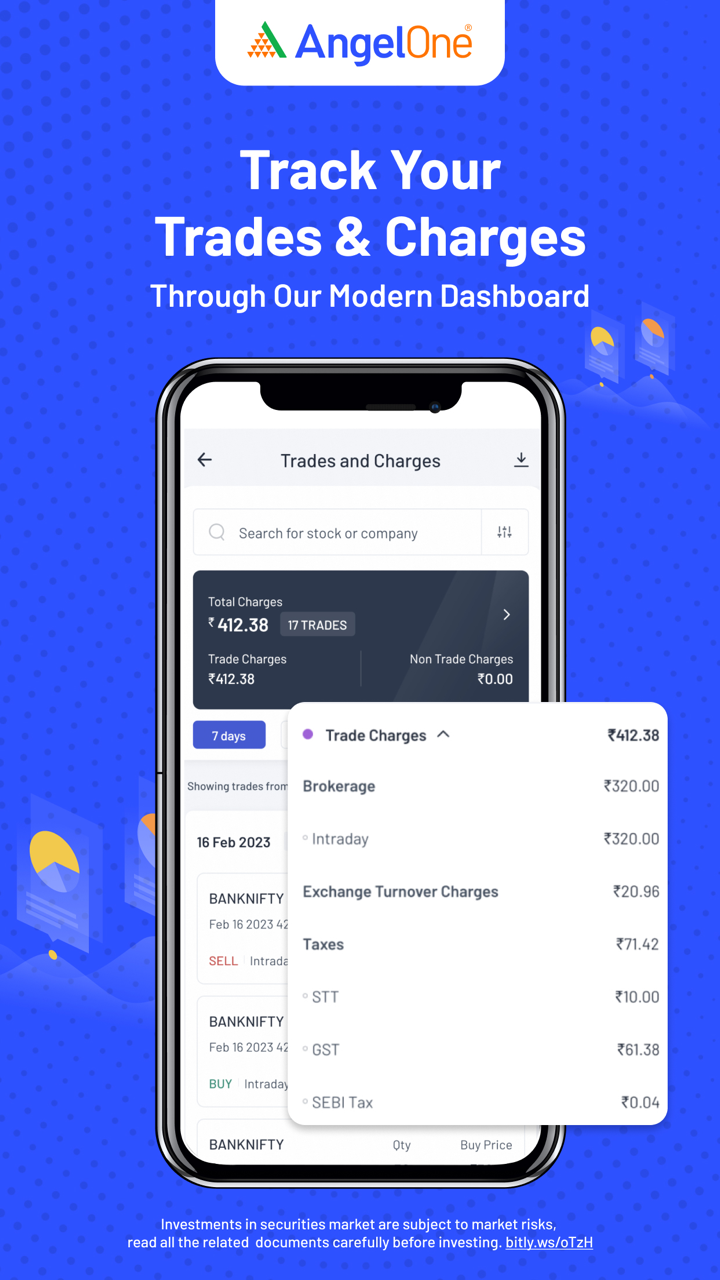

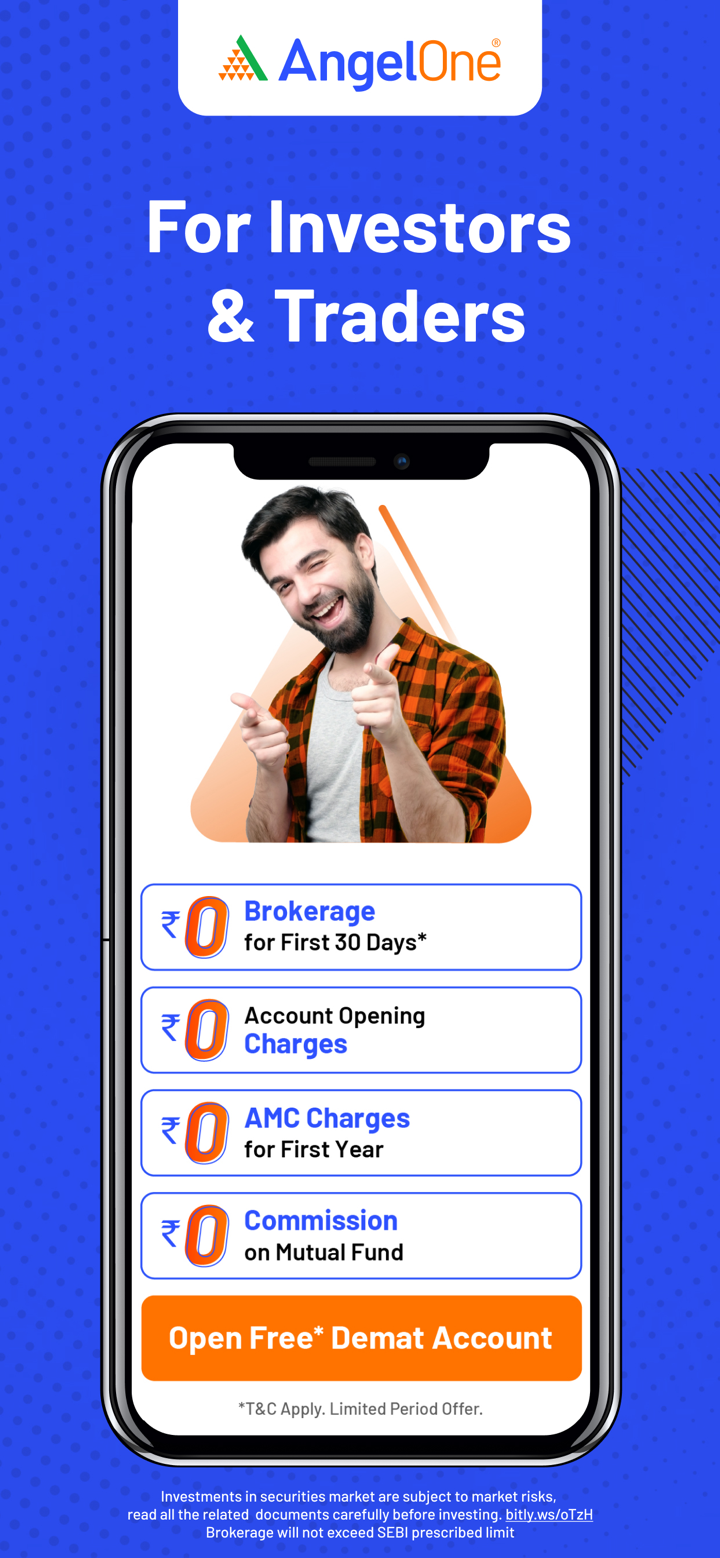

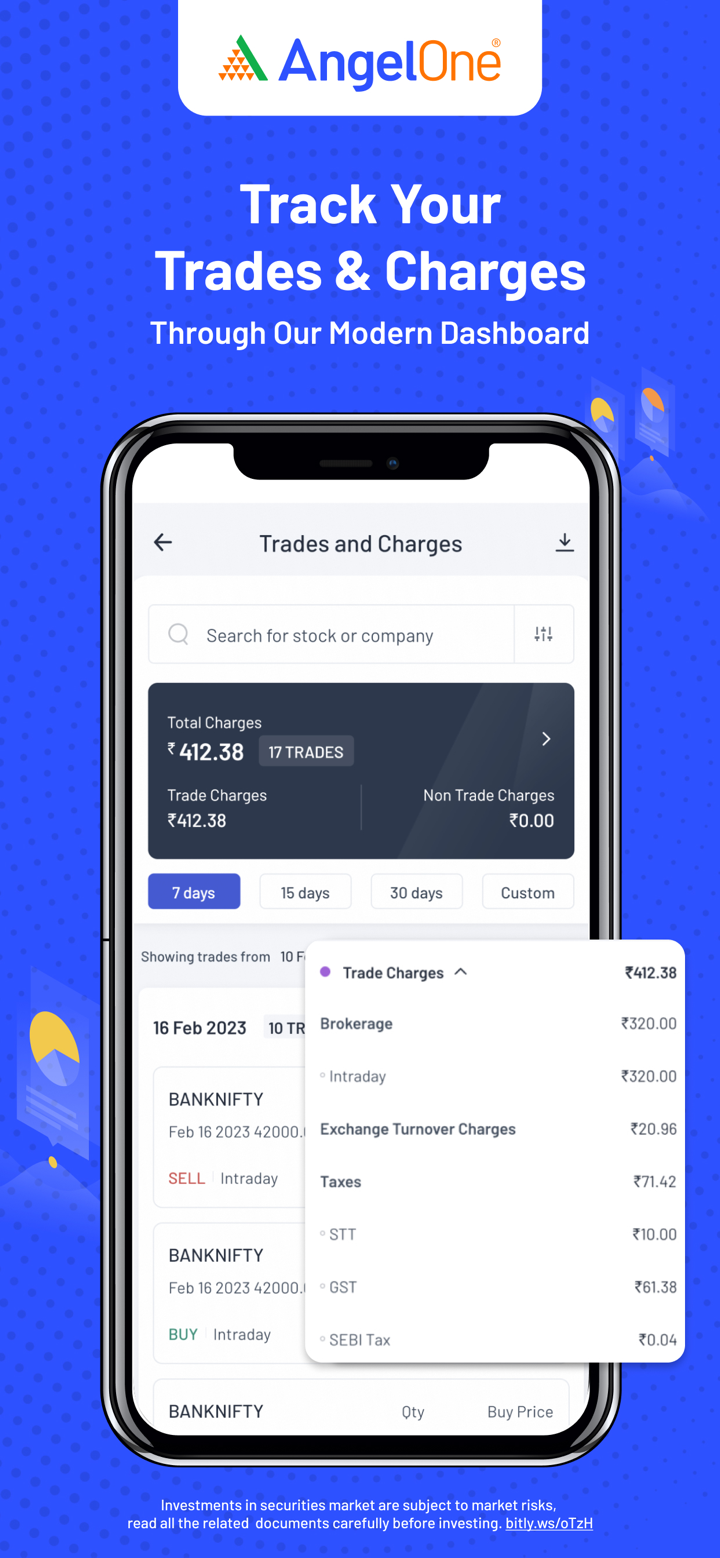

Angel One Gebühren

Die Gebühren von Angel One sind im Vergleich zu den Branchenstandards in Indien generell niedrig bis moderat. Es bietet keine Maklergebühren für die ersten 30 Tage (bis zu ₹500), danach sind die Maklergebühren begrenzt und wettbewerbsfähig, insbesondere für Einzelhändler. Zusätzliche Gebühren entsprechen größtenteils den behördlichen Normen.

| Investitionstyp | Anfangsangebot | Nach-Angebot Maklergebühren |

| Aktienlieferung | ₹0 bis zu ₹500 in 30 Tagen | Niedriger von ₹20 oder 0,1% pro Auftrag (min ₹2) |

| Tageshandel | Niedriger von ₹20 oder 0,03% pro Auftrag | |

| Zukünfte | ₹20 pro ausgeführtem Auftrag | |

| Optionen |

| Gebührentyp | Aktienlieferung | Tageshandel | Zukünfte | Optionen |

| Transaktionsgebühren | NSE: 0,00297% | NSE: 0,00173% | NSE: 0,03503% | |

| STT | 0,1% (Kauf/Verkauf) | 0,025% (Verkauf) | 0,01% (Verkauf) | 0,05% (Verkauf) |

| GST | 18% | |||

| SEBI-Gebühren | ₹10/Crore | |||

| Clearing-Gebühren | ₹0 | |||

| Stempelsteuer | 0,015% (Kauf) | 0,003% (Kauf) | 0,002% (Kauf) | 0,003% (Kauf) |

| Gebührentyp | Gebühr |

| Kontoeröffnung | 0 (manchmal ₹36,48 für NRIs) |

| AMC (1. Jahr) | 0 |

| AMC (Nach dem 1. Jahr) | ₹60/Quartal (nicht-BSDA), oder ₹450/Jahr, oder ₹2950 lebenslange Option |

| BSDA-AMC | NULL bis zu ₹4L; ₹100/Jahr für Bestände von ₹4L–₹10L |

| MTF (Margin Borrowing) | 0,041% pro Tag |

| Debitzinsen | 0,049% pro Tag |

| Bareinlagegebühren | 0,0342%/Tag (bei einem Defizit > ₹50.000) |

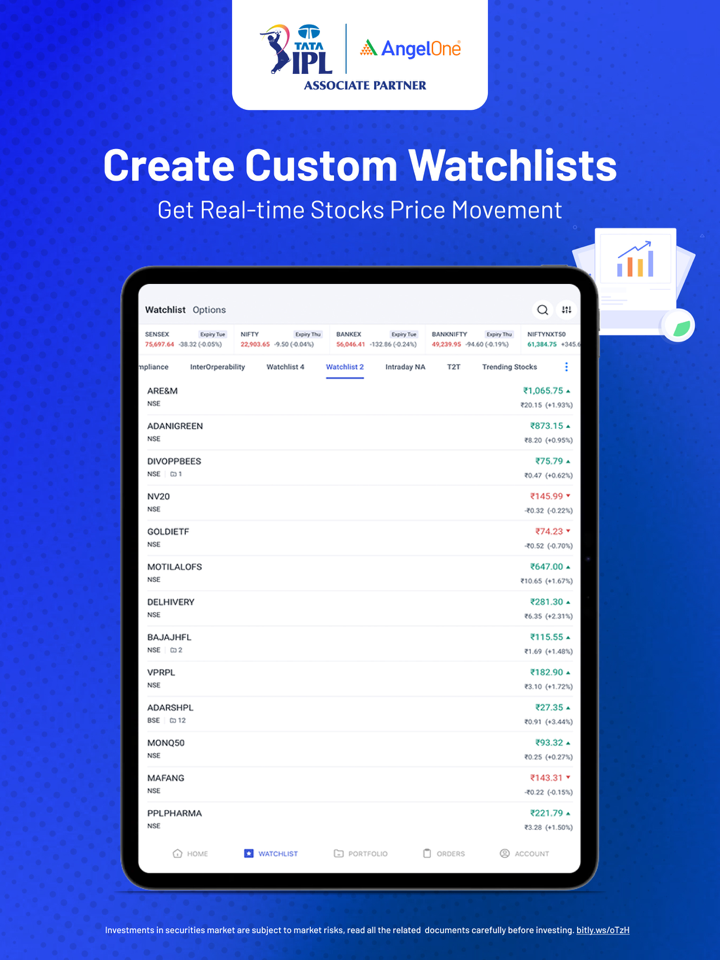

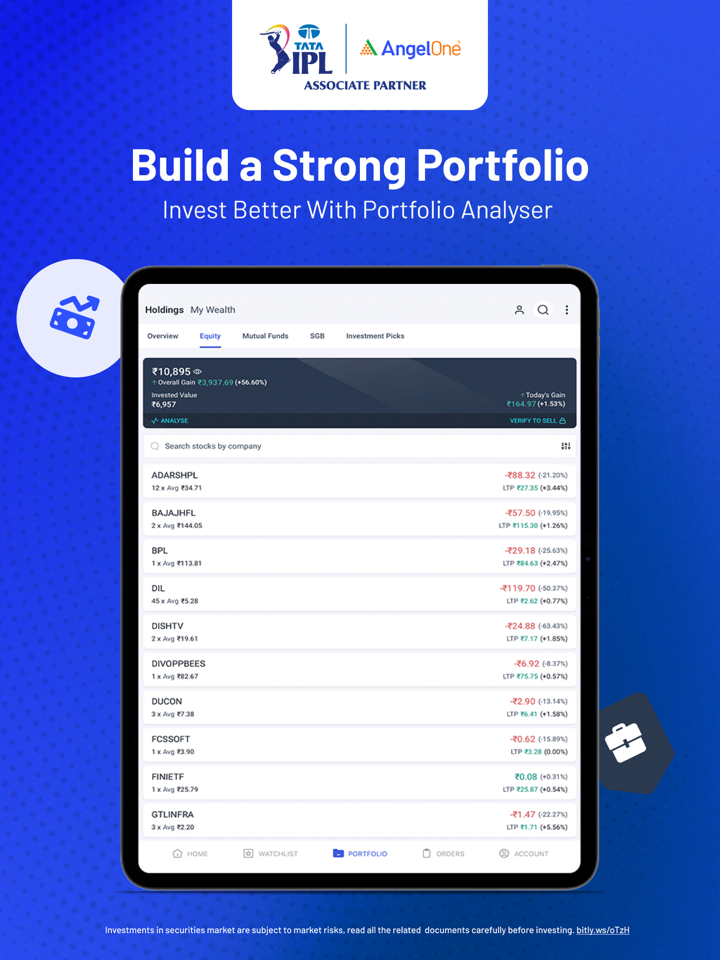

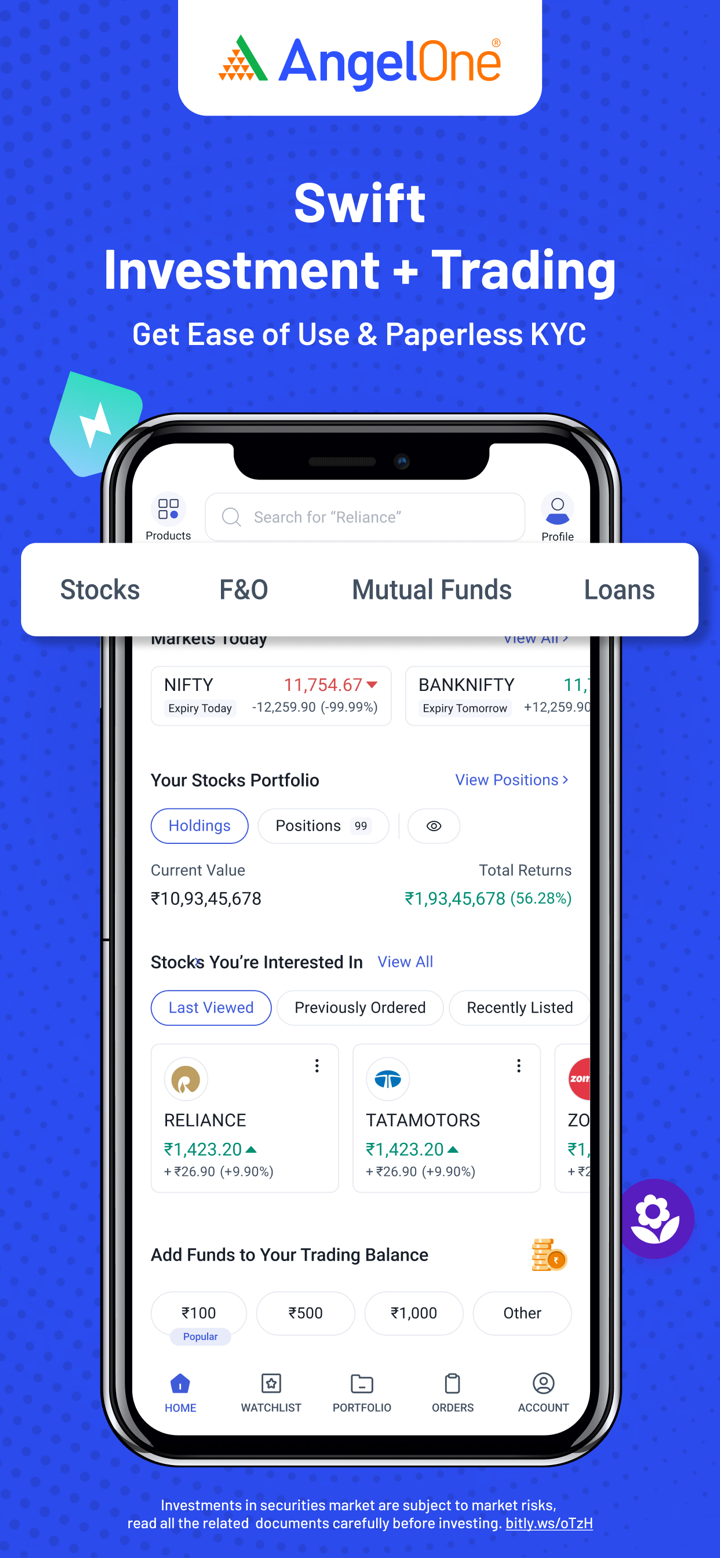

Handelsplattform

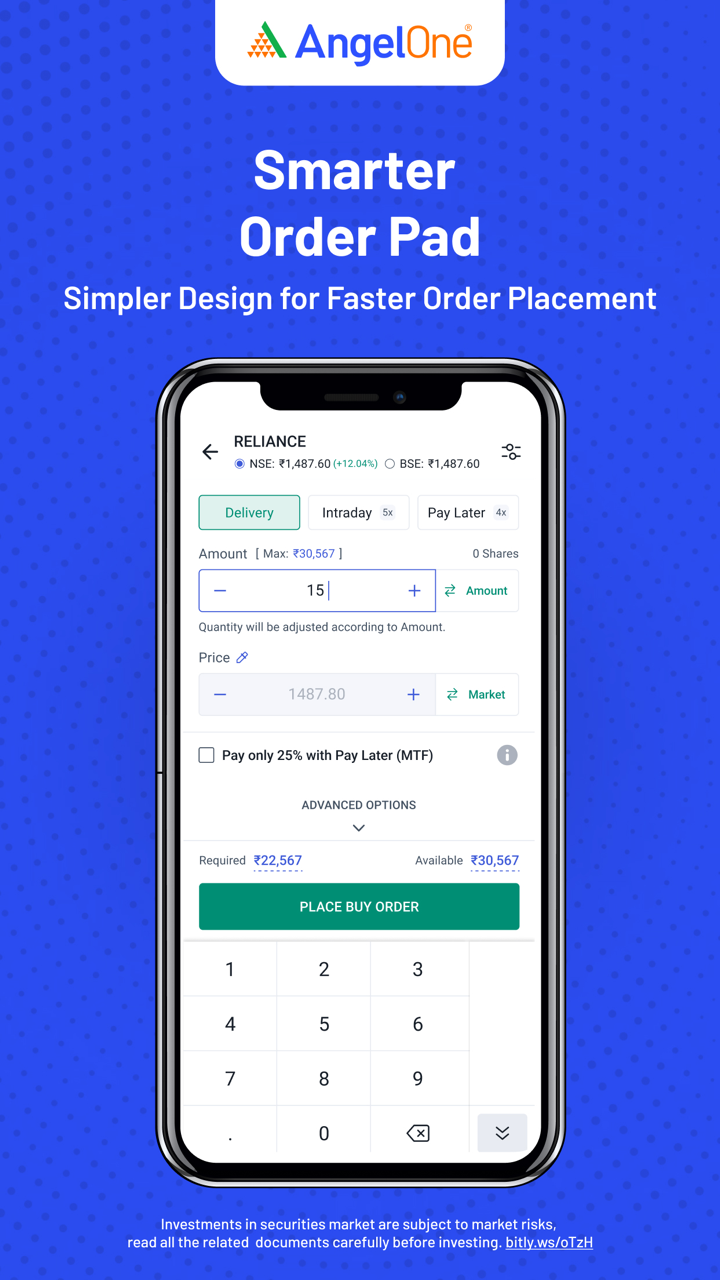

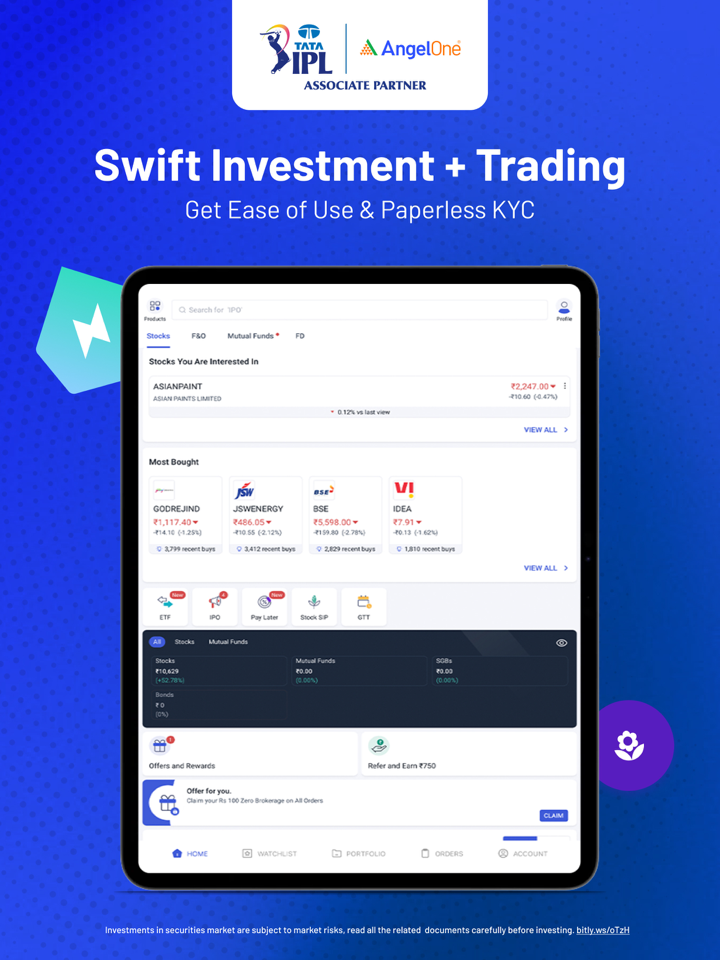

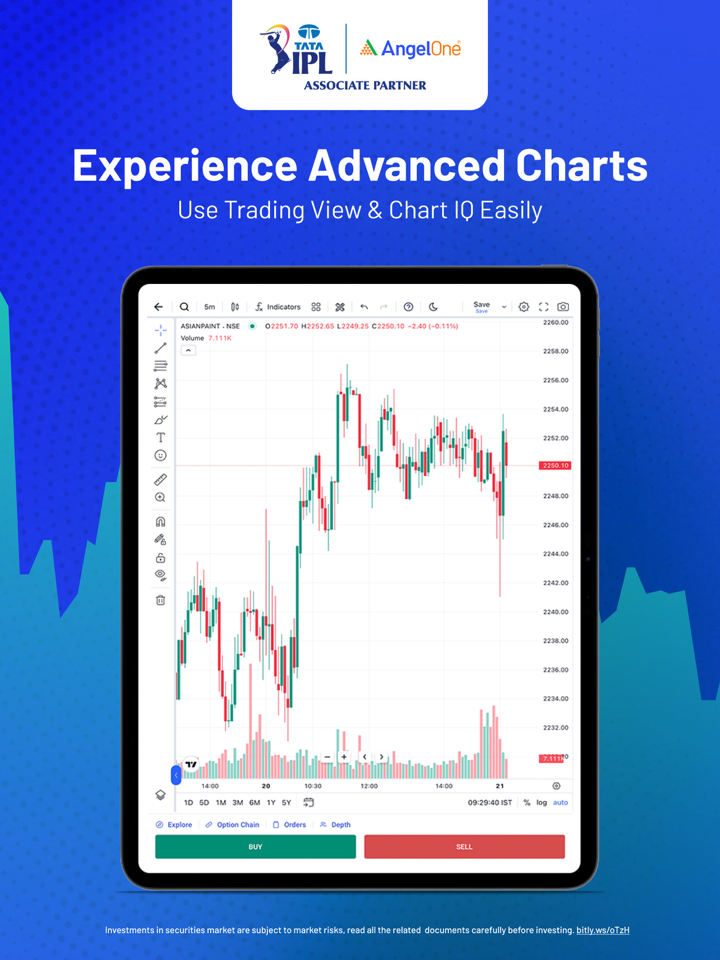

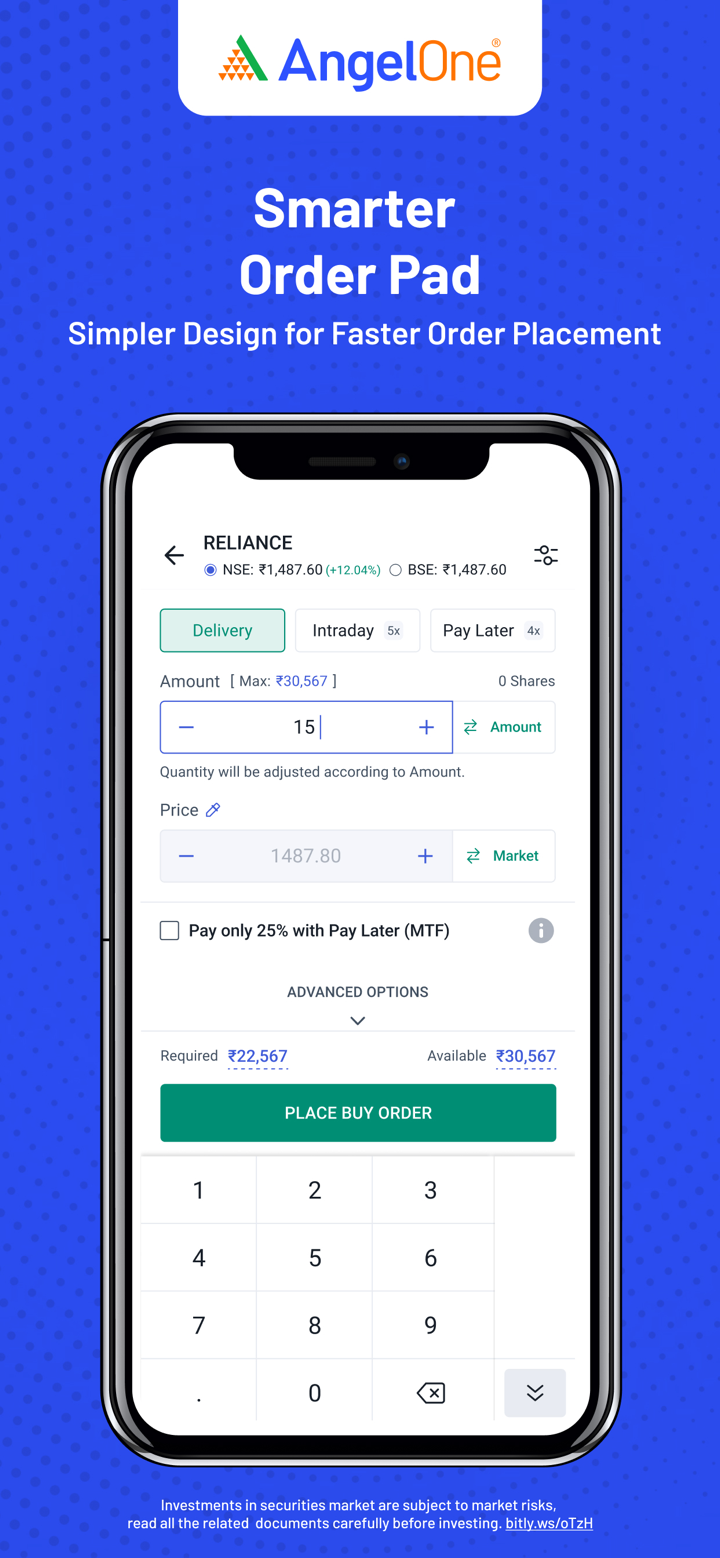

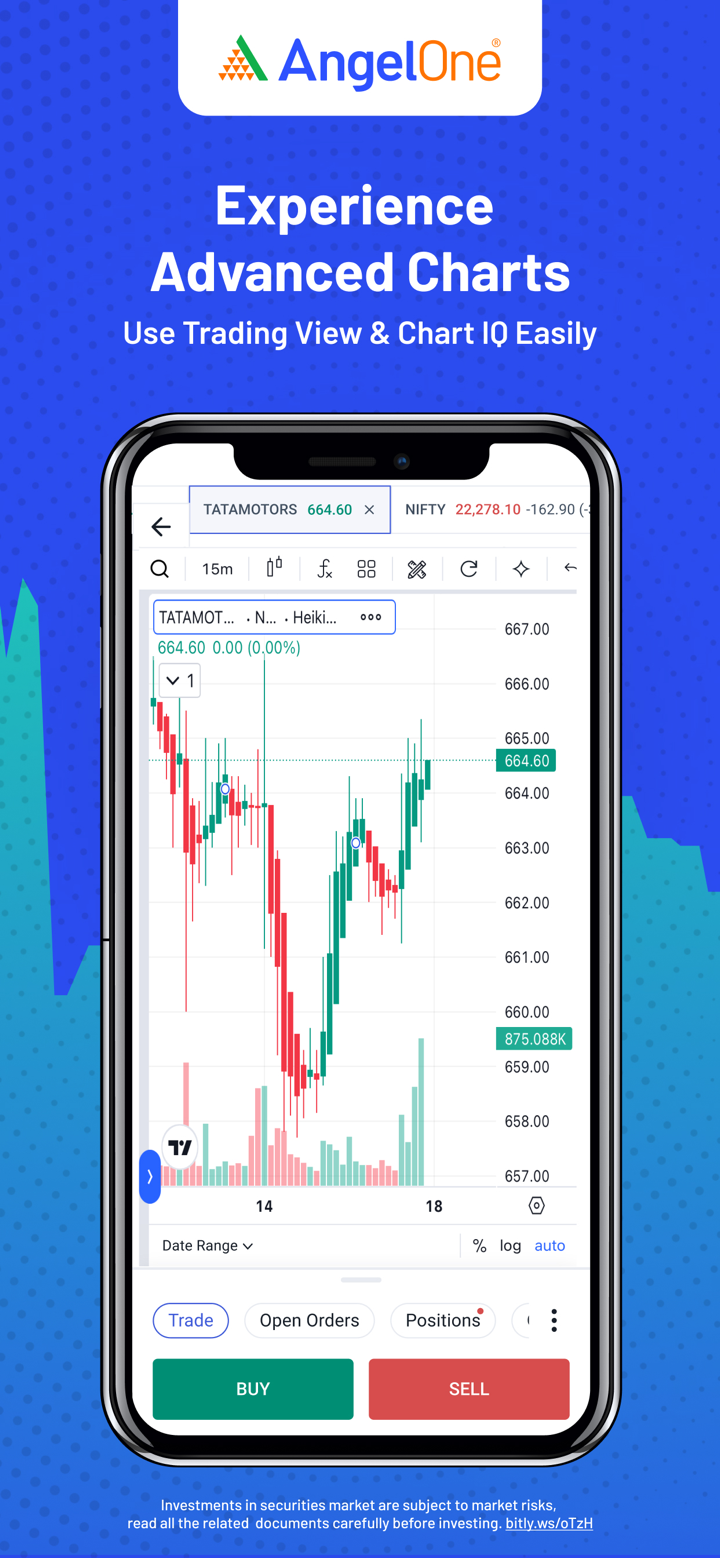

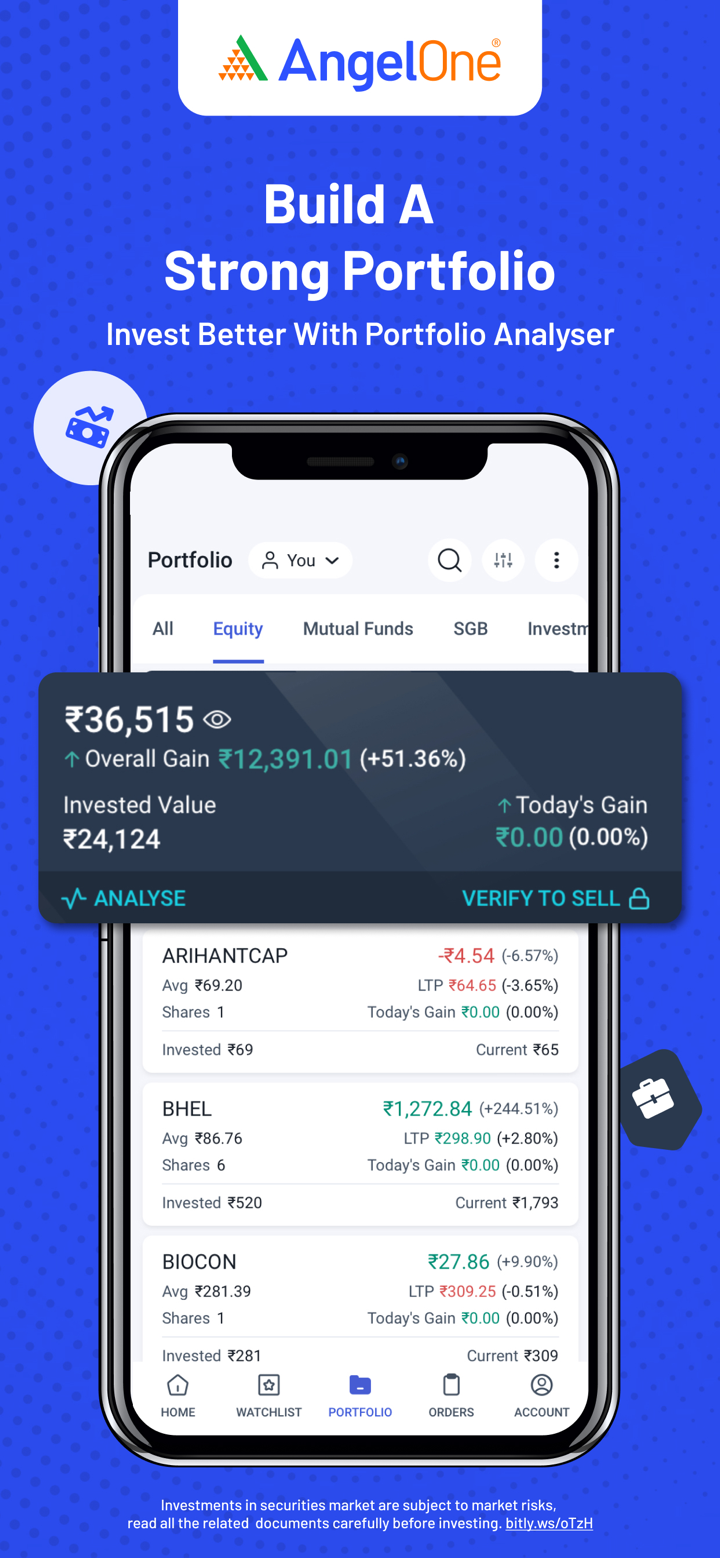

Angel One bietet drei Handelsplattformen, eine mobile App für alltägliche Anleger, eine Webplattform für professionelle Händler und APIs für Entwickler und Algo-Trader.

| Plattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Angel One Super App | ✔ | Android, iOS | Anfänger bis fortgeschrittene Anleger & Händler |

| Angel One Trade | ✔ | Web (Desktop/Laptop) | Aktive/professionelle Händler |

| Smart API | ✔ | API-Zugriff (Web-Backend-Integration) | Entwickler, Algo-Trader, Fintech-Plattformen |