Company Summary

| TF SECURITIES Review Summary | |

| Founded | 2003-11-19 |

| Registered Country/Region | China |

| Regulation | Unregulated |

| Services and Products | Research Services, Investment Banking, Wealth Management, Asset Management, Overseas Business, Proprietary Trading, Private Equity and Venture Capital, Alternative Investment, and Futures |

| Customer Support | 95391; 400-800-5000 |

| Online Chat | |

TF SECURITIES Information

TF SECURITIES was established in 2000, with its headquarters located in Wuhan, Hubei Province. As a comprehensive financial institution, it offers a rich, diverse, and distinctive service system.

It provides various enterprises with equity financing, mergers and acquisitions, restructuring, bond financing, and diversified financial advisory services. Its business scope not only includes traditional projects such as initial public offerings of stocks, private placements, corporate bonds, enterprise bonds, and major asset acquisitions, but also involves innovative businesses such as private bonds for small and medium-sized enterprises, asset securitization, and preferred stocks.

Pros and Cons

| Pros | Cons |

| Diverse Business Scope | Unregulated |

| Government-related Background | Intense Market Competition |

Is TF SECURITIES Legit?

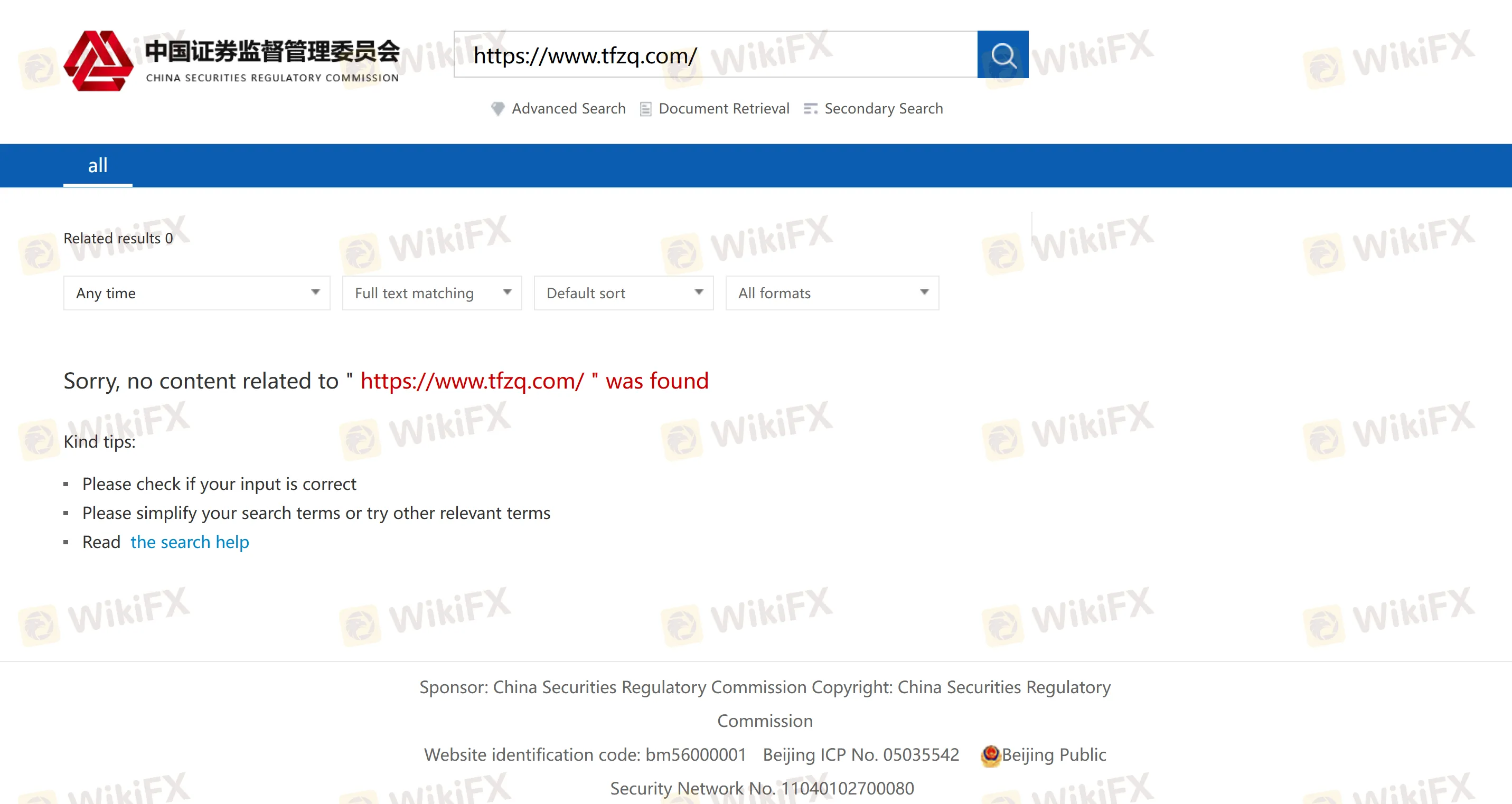

There are doubts about the legitimacy of TF SECURITIES. The company is listed on the Shanghai Stock Exchange. Although the securities company claims to meet strict listing requirements and is supervised by the China Securities Regulatory Commission (CSRC) and other regulatory authorities, no relevant information can be found on the official website of the CSRC.

What Services does TF SECURITIES provide?

TF SECURITIES provides a variety of services, including research services, investment banking, wealth management, asset management, overseas business, proprietary trading, private equity and venture capital, alternative investment, and futures business.

How to Open an Account?

TF SECURITIES allows mobile phone account opening. You can either take photos of your ID card with your mobile phone or go through video verification. The ID card photos will be automatically read, and this can be done under a Wi-Fi or 4G network.