Perfil de la compañía

| Angel One Resumen de la reseña | |

| Establecido | 1996 |

| País/Región Registrada | India |

| Regulación | Sin regulación |

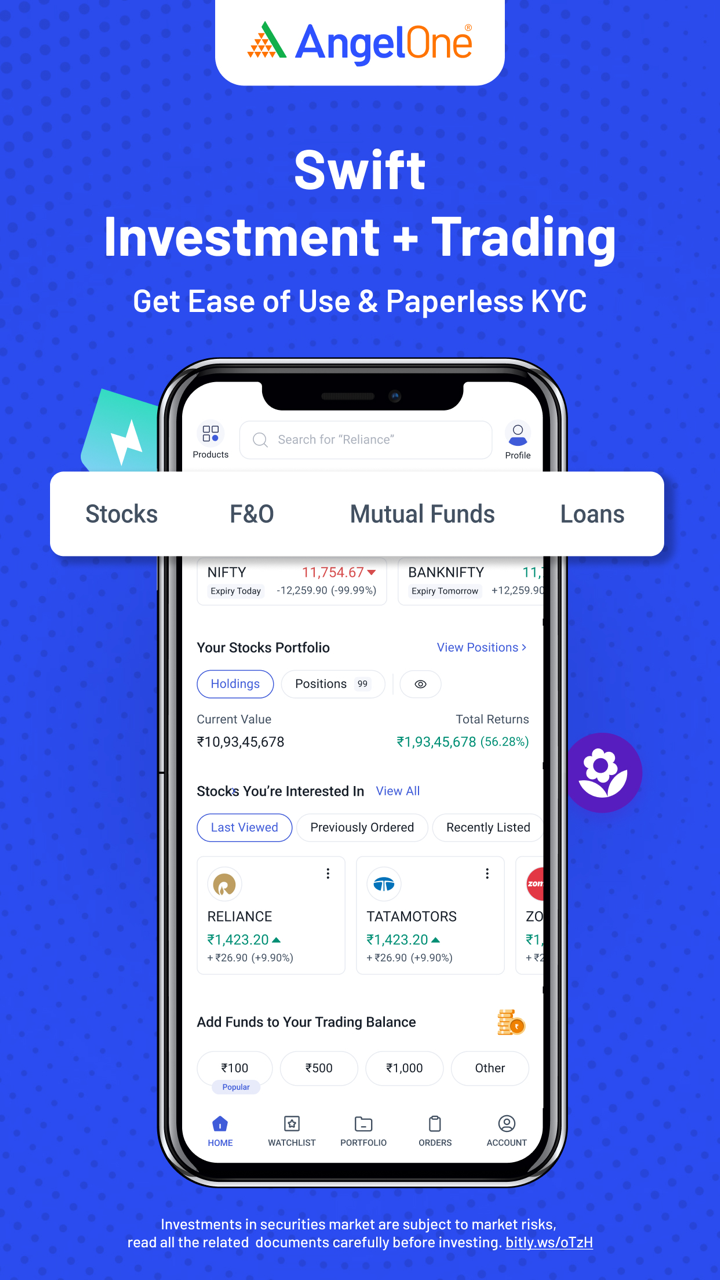

| Productos de Trading | Acciones, IPOs, Derivados (F&O), Fondos Mutuos, Materias Primas |

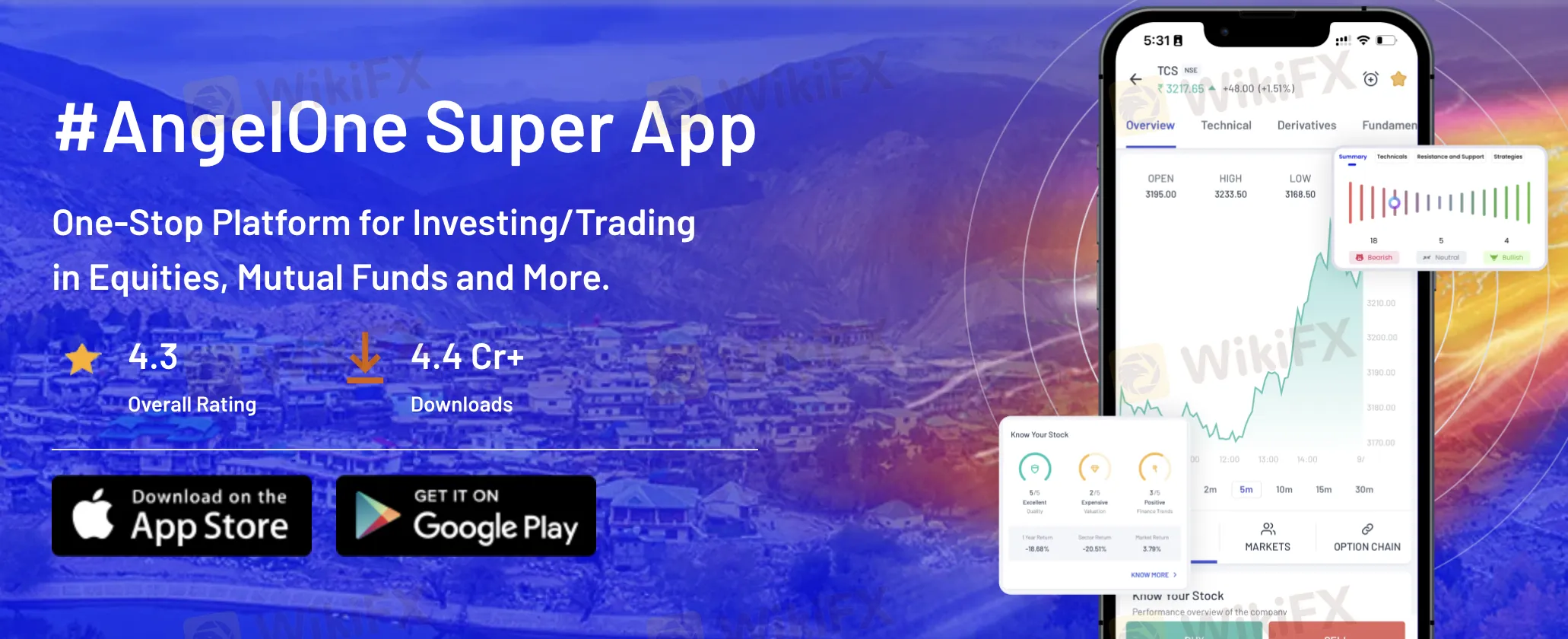

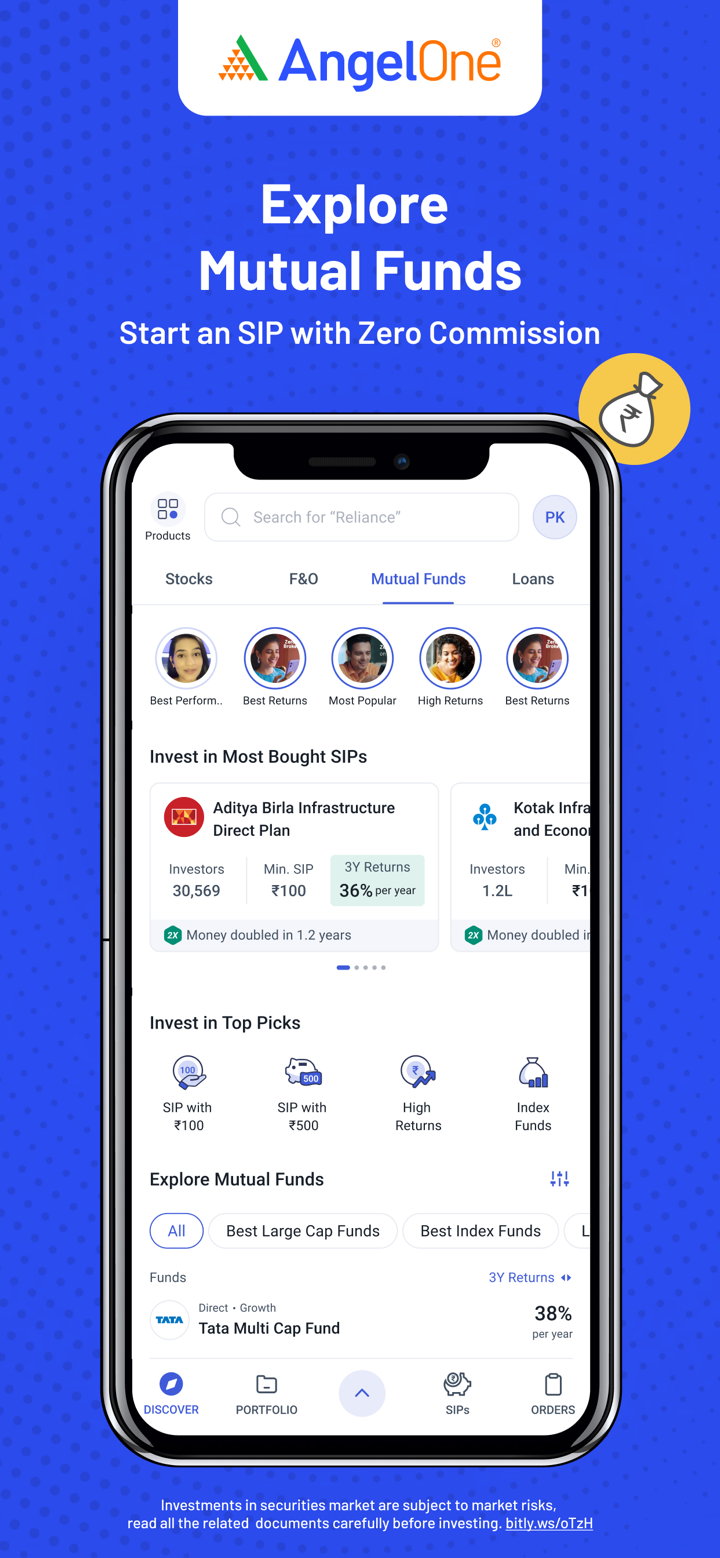

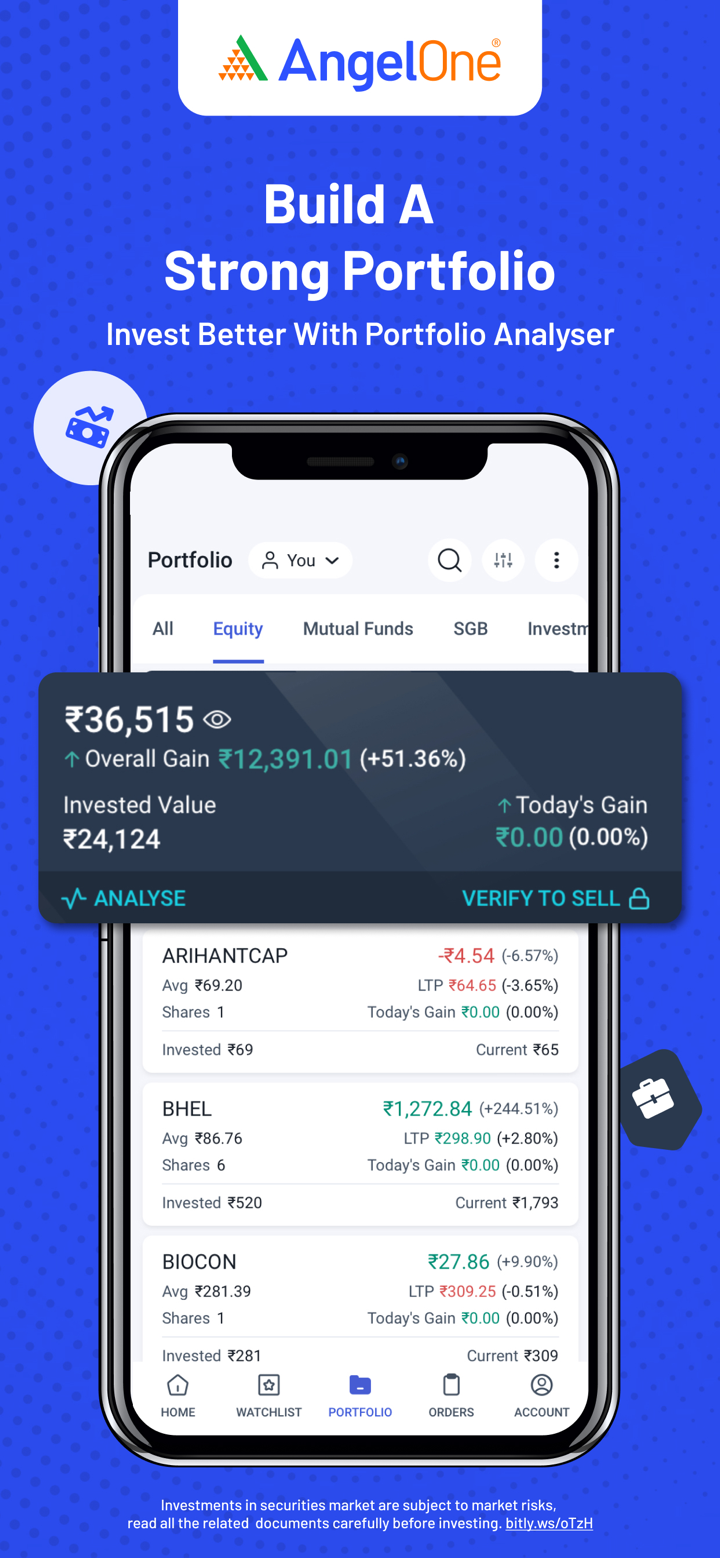

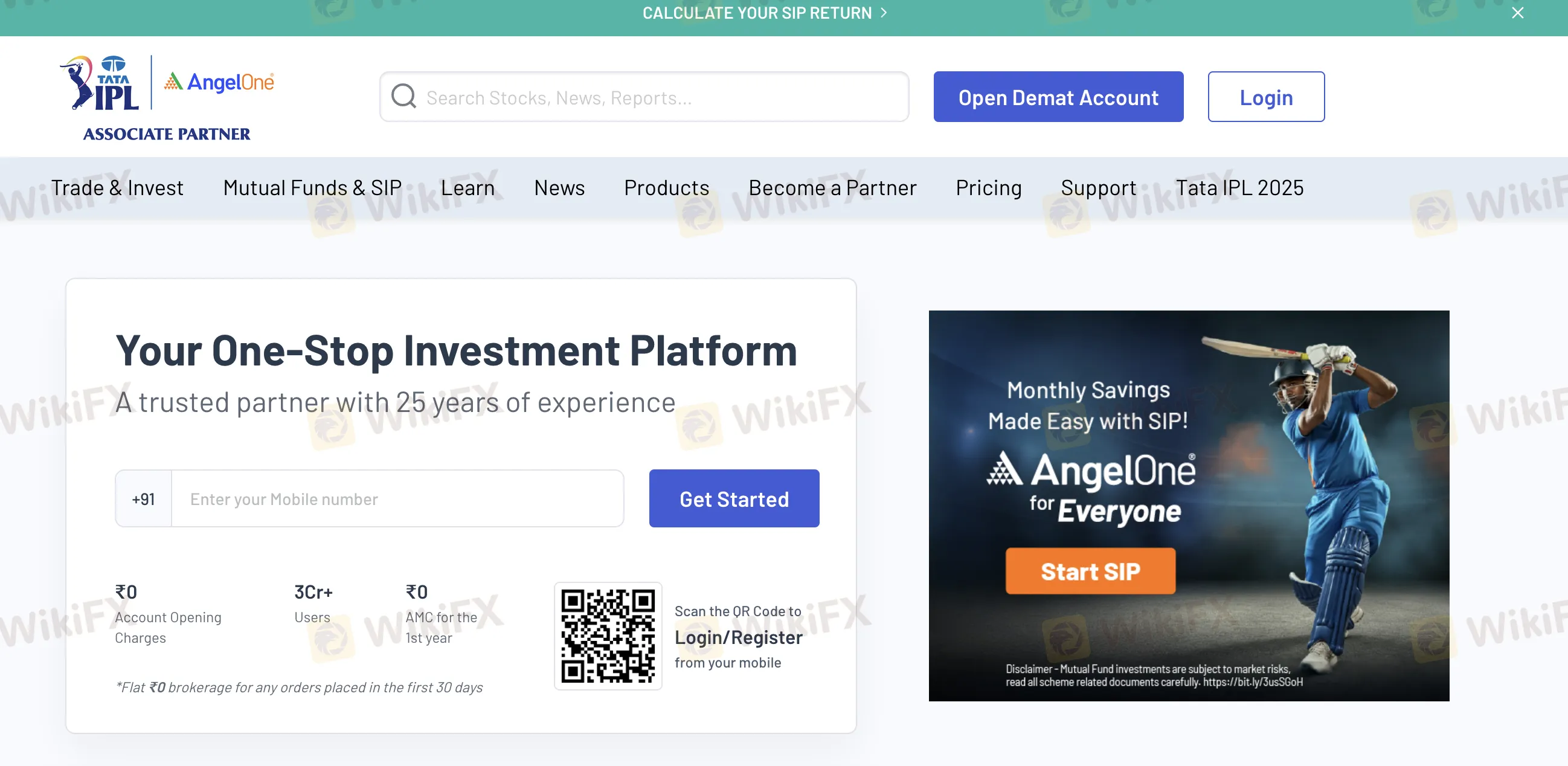

| Plataforma de Trading | Angel One Super App (móvil), Angel One Trade (web), Smart API (desarrollador) |

| Depósito Mínimo | ₹0 |

| Soporte al Cliente | Email: support@angelone.in |

| Teléfono: 18001020 | |

Información de Angel One

Fundada en 1996, Angel One es una empresa de corretaje india. No está controlada por SEBI ni por ninguna autoridad financiera mundial. Entre los muchos vehículos de inversión que la empresa ofrece se encuentran acciones, derivados, fondos mutuos y acciones de EE. UU. Su falta de control regulatorio genera preocupación incluso con sus bajos costos y plataformas tecnológicas sólidas.

Pros y Contras

| Pros | Contras |

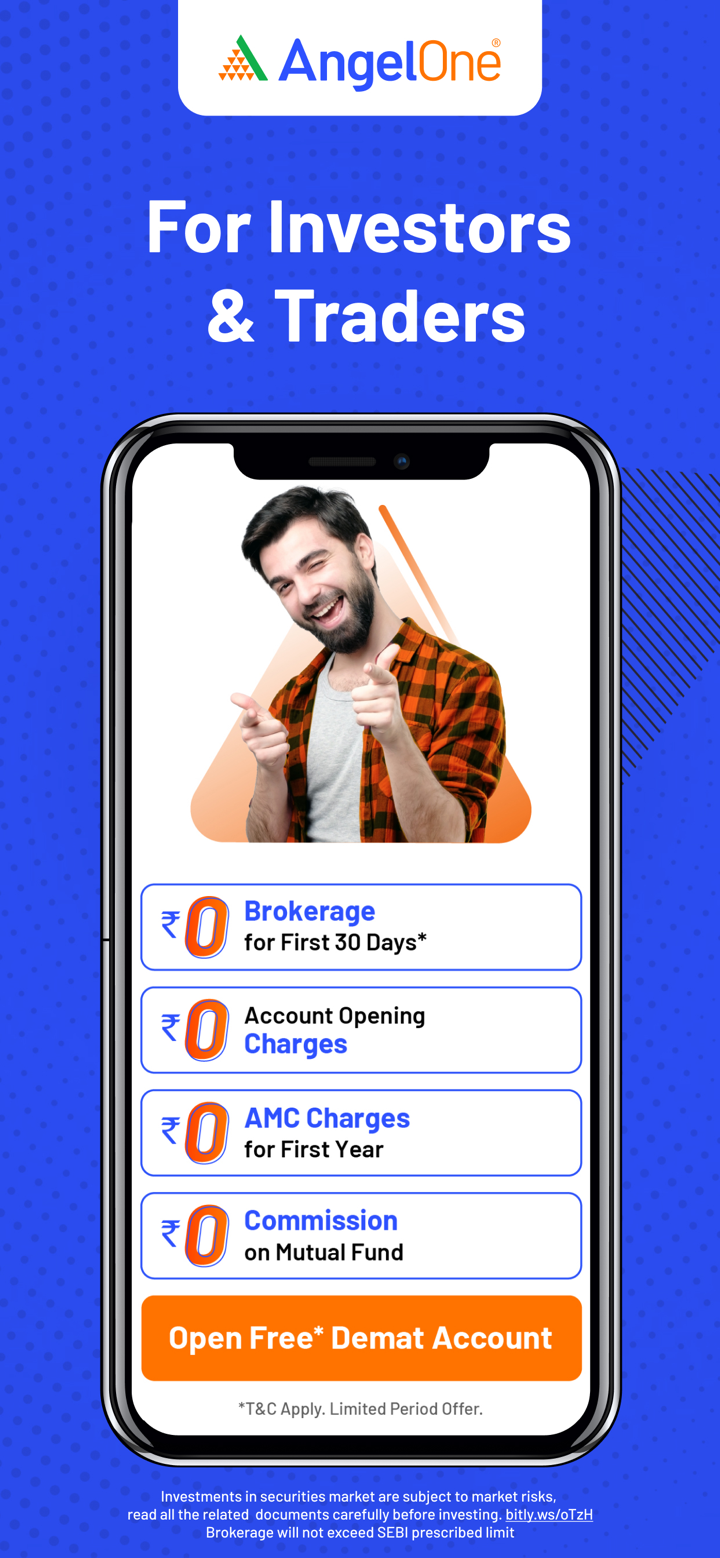

| Corretaje gratuito para los primeros ₹500 en 30 días | Sin regulación |

| Amplia gama de productos de inversión | Se aplican diversas tarifas |

| Plataformas fáciles de usar | |

| Sin depósito mínimo |

¿Es Angel One Legítimo?

Angel One no es un broker regulado. Aunque tiene su sede en India, no cuenta con licencia de SEBI ni de importantes reguladores globales como la FCA, ASIC o NFA.

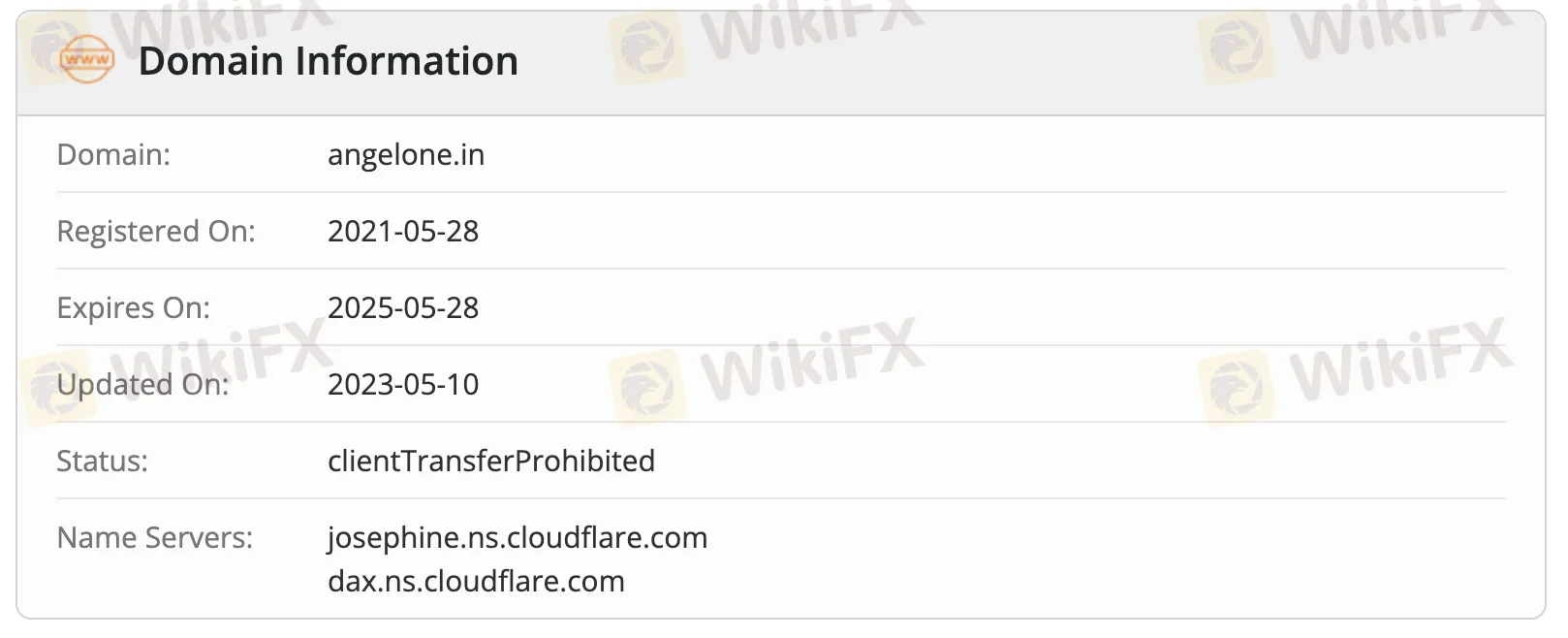

El dominio angelone.in fue registrado el 28 de mayo de 2021, actualizado por última vez el 10 de mayo de 2023 y caducará el 28 de mayo de 2025. Su estado es clientTransferProhibited.

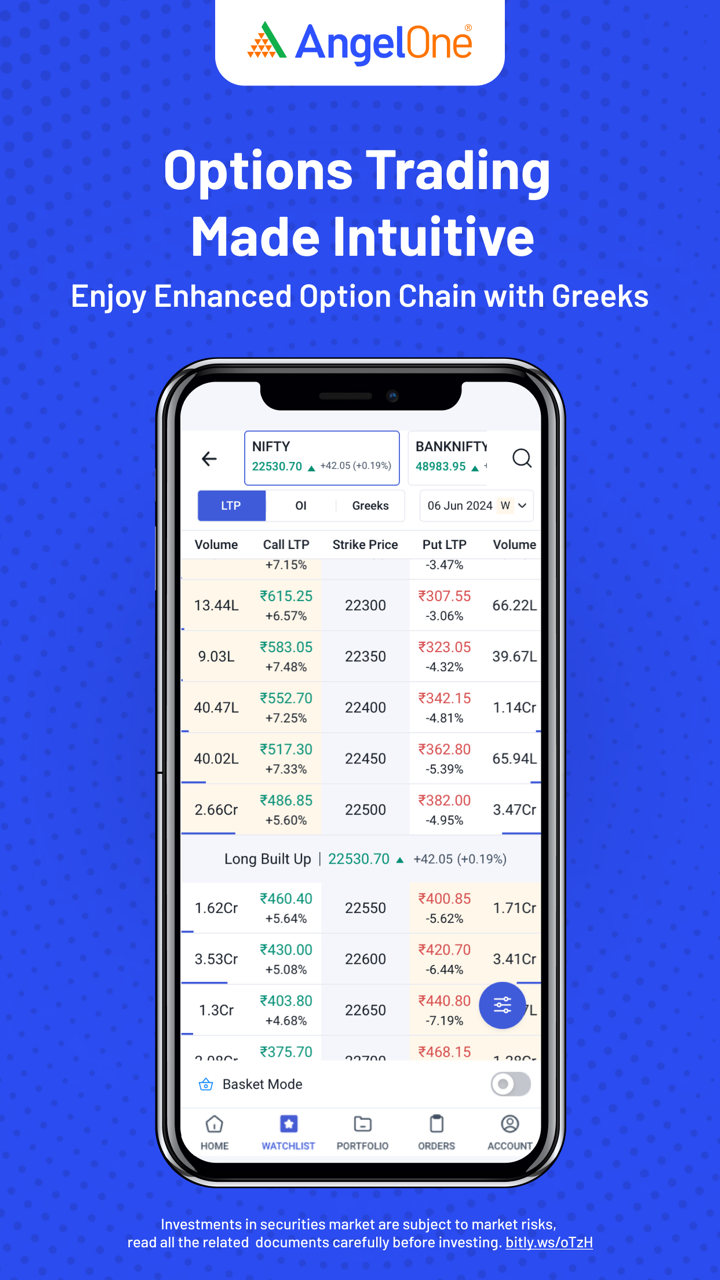

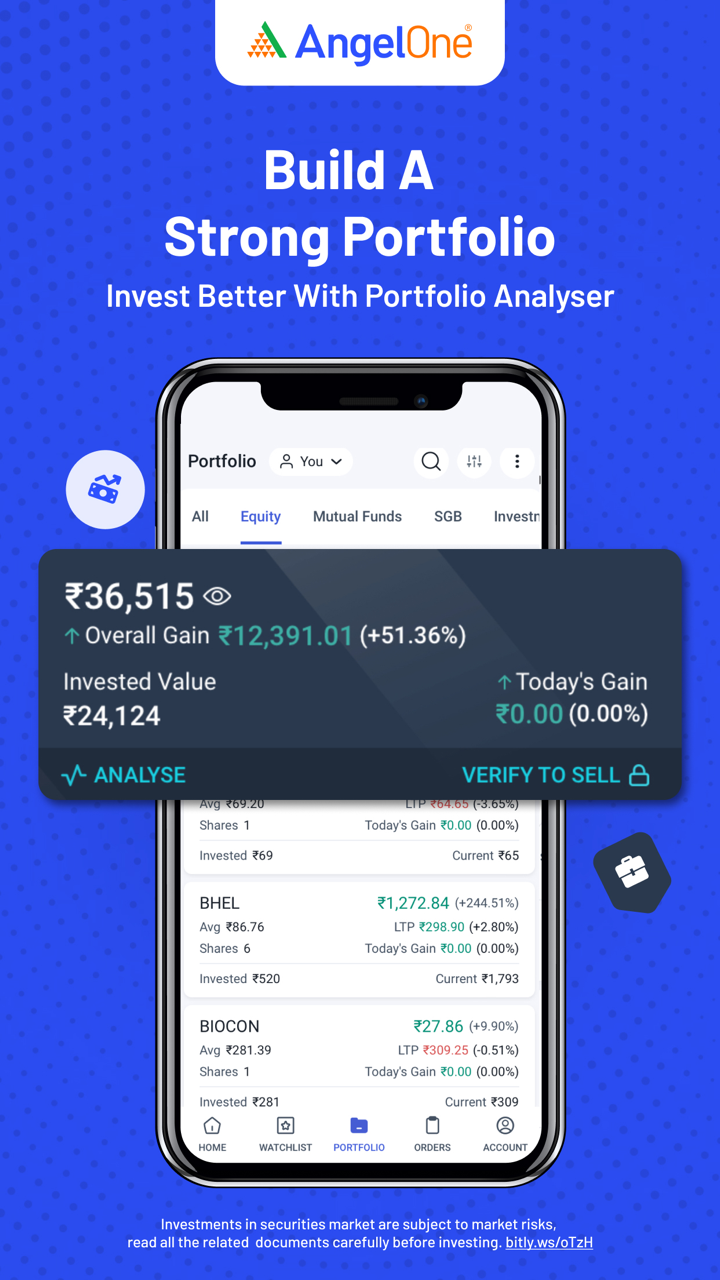

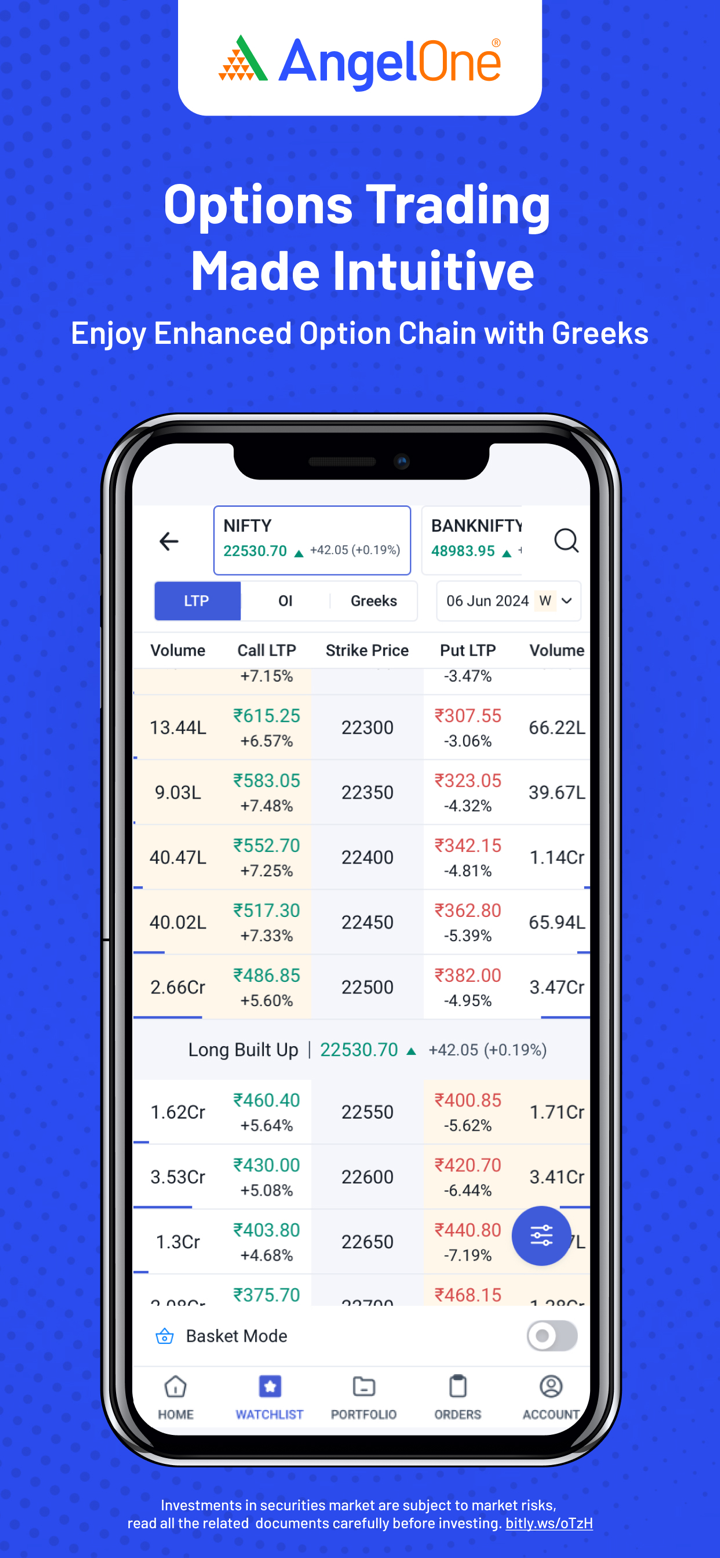

Productos de Trading

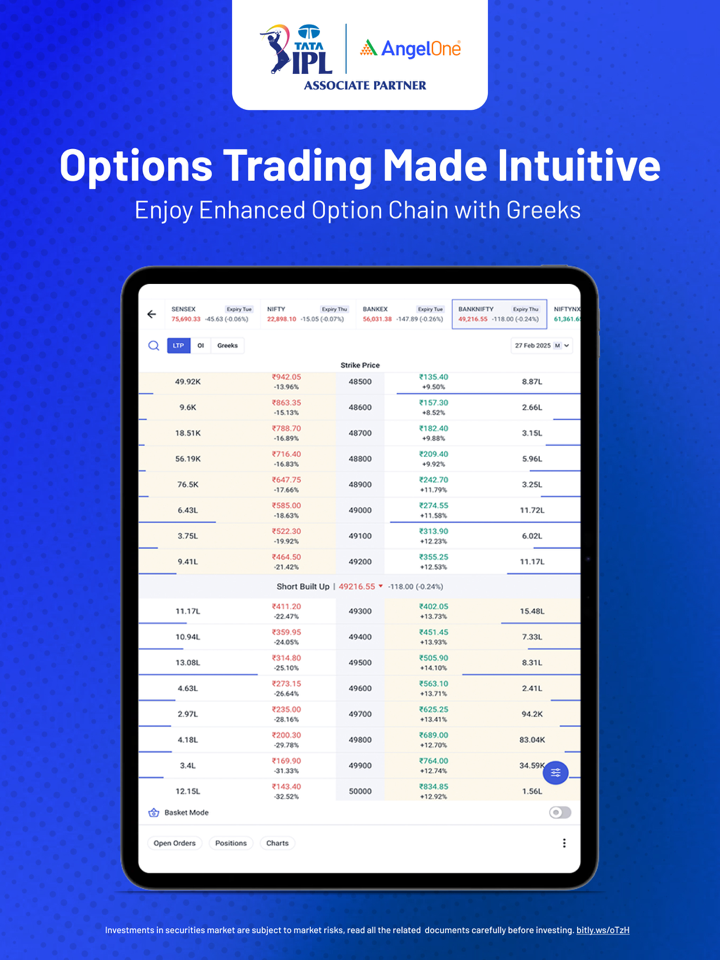

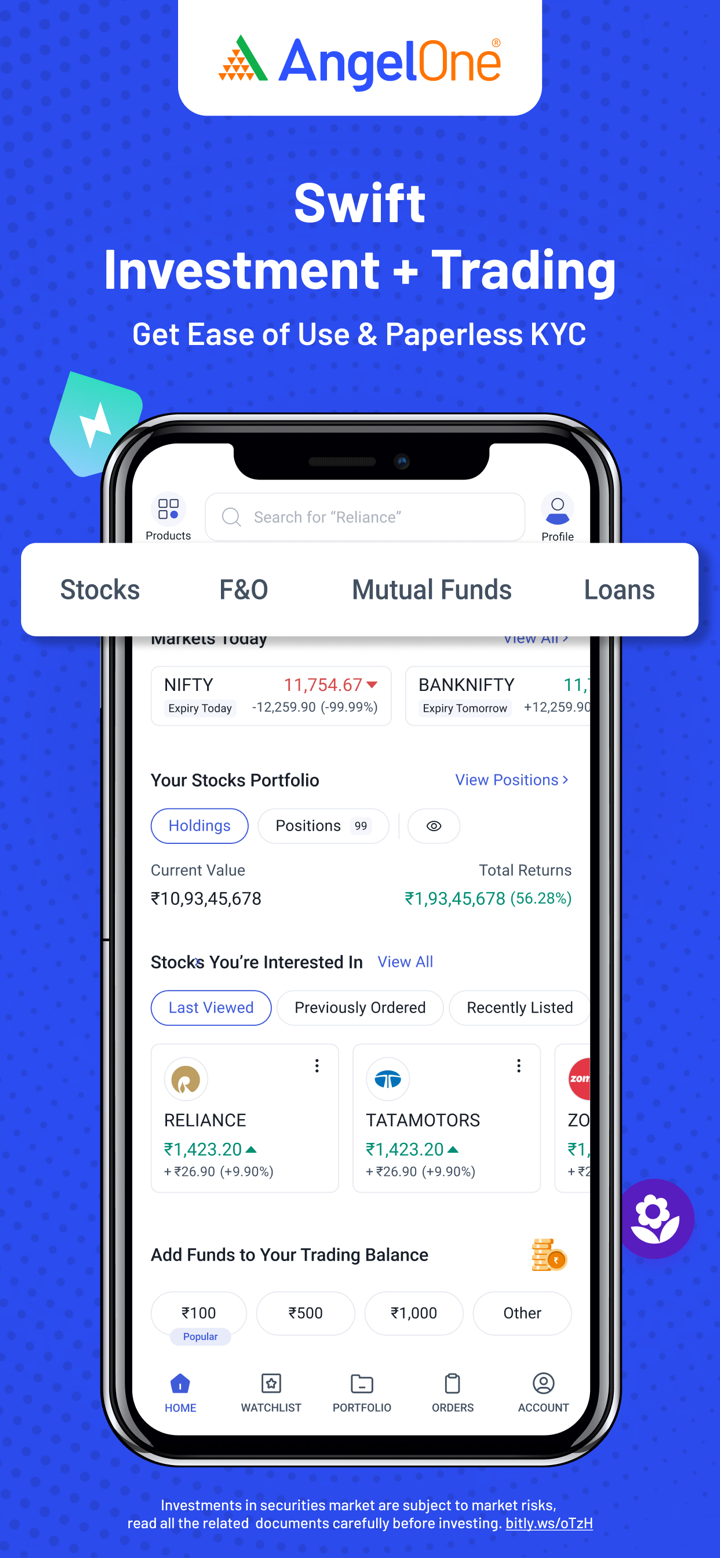

Angel One ofrece una amplia gama de productos de inversión que incluyen acciones, IPOs, derivados, fondos mutuos, materias primas y acciones de EE. UU.

| Instrumentos de Trading | Soportados |

| Acciones | ✔ |

| IPOs | ✔ |

| Derivados (F&O) | ✔ |

| Fondos Mutuos | ✔ |

| Materias Primas | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

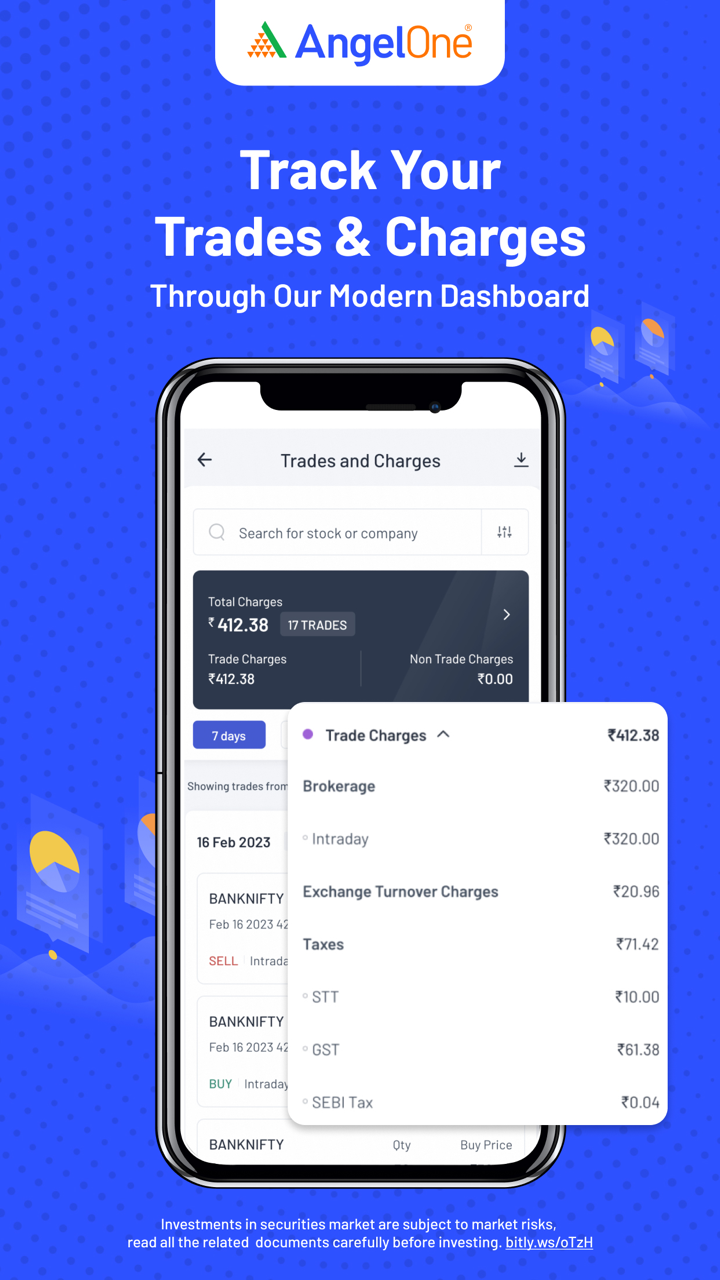

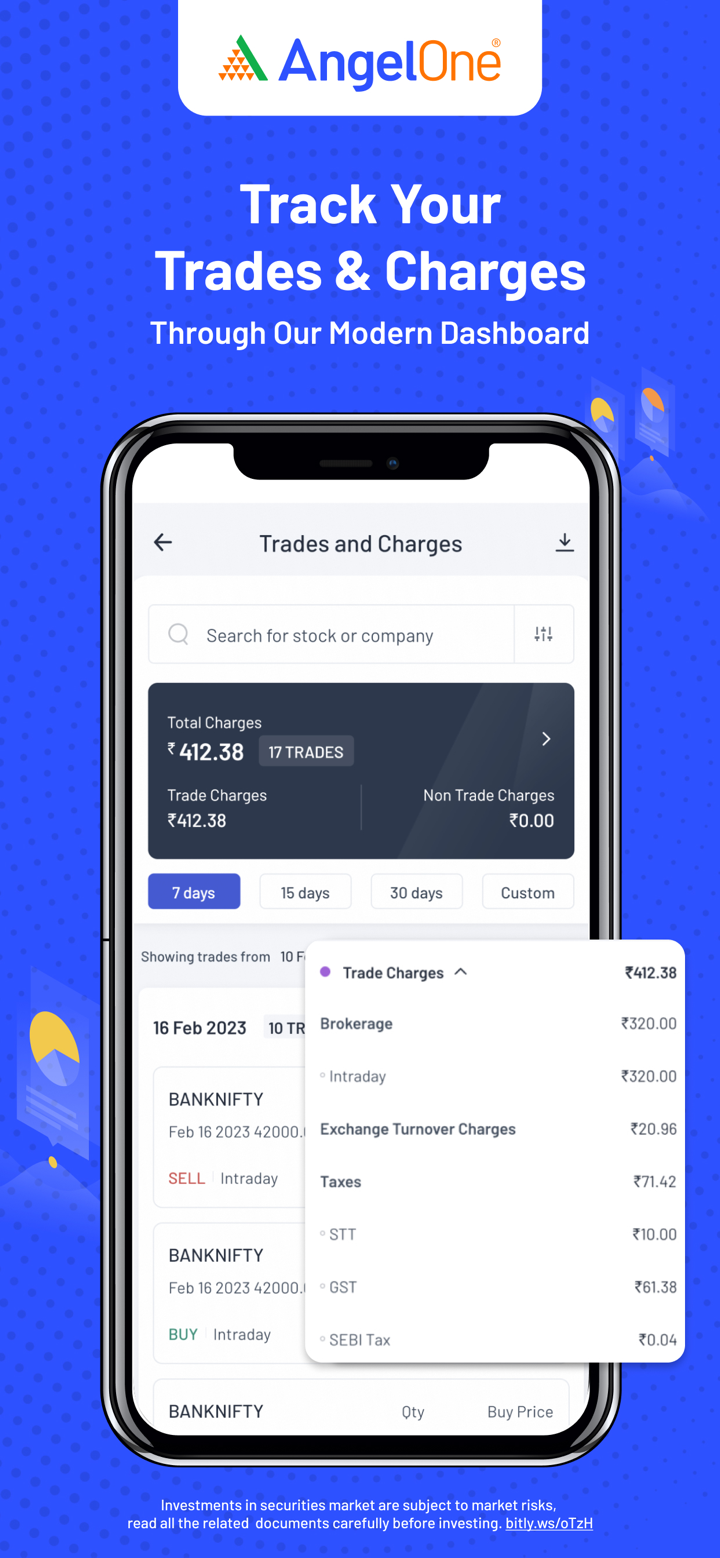

Angel One Tarifas

Las tarifas de Angel One son generalmente bajas a moderadas en comparación con los estándares de la industria en India. Ofrece corretaje cero durante los primeros 30 días (hasta ₹500), después de lo cual su corretaje está limitado y es competitivo, especialmente para los traders minoristas. Los cargos adicionales están en su mayoría en línea con las normas regulatorias.

| Tipo de Inversión | Oferta Inicial | Corretaje Posterior a la Oferta |

| Entrega de Acciones | ₹0 hasta ₹500 en 30 días | Menor de ₹20 o 0.1% por orden (mín ₹2) |

| Trading Intradía | Menor de ₹20 o 0.03% por orden | |

| Futuros | ₹20 por orden ejecutada | |

| Opciones |

| Tipo de Cargo | Entrega de Acciones | Intradía | Futuros | Opciones |

| Cargos de Transacción | NSE: 0.00297% | NSE: 0.00173% | NSE: 0.03503% | |

| STT | 0.1% (Compra/Venta) | 0.025% (Venta) | 0.01% (Venta) | 0.05% (Venta) |

| IVA | 18% | |||

| Cargos SEBI | ₹10/cr | |||

| Cargos de Compensación | ₹0 | |||

| Impuesto de Timbre | 0.015% (Compra) | 0.003% (Compra) | 0.002% (Compra) | 0.003% (Compra) |

| Tipo de Cargo | Costo |

| Apertura de Cuenta | 0 (a veces ₹36.48 para NRIs) |

| AMC (1er Año) | 0 |

| AMC (Después del 1er Año) | ₹60/trimestre (no-BSDA), o ₹450/año, o opción de por vida ₹2950 |

| AMC BSDA | NIL hasta ₹4L; ₹100/año para tenencias de ₹4L–₹10L |

| MTF (Préstamo de Margen) | 0.041% por día |

| Interés por Saldo Deudor | 0.049% por día |

| Cargos de Colateral en Efectivo | 0.0342%/día (en déficit > ₹50,000) |

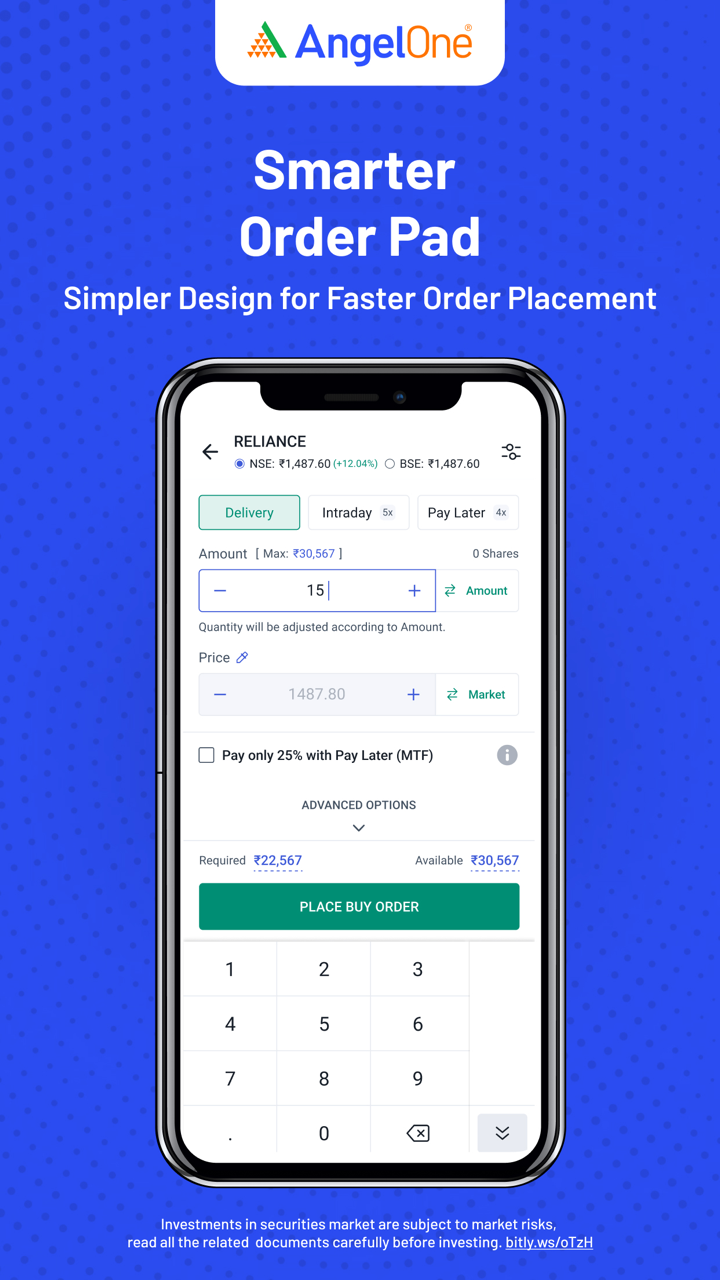

Plataforma de Trading

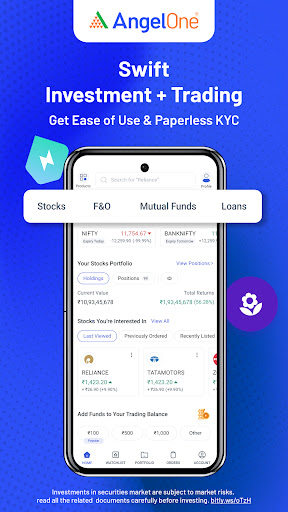

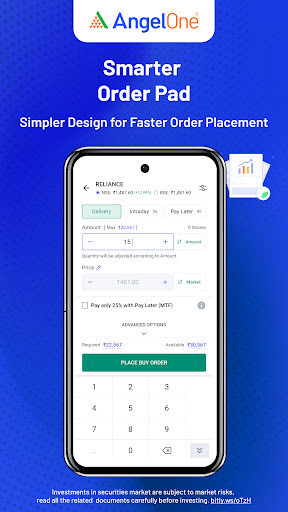

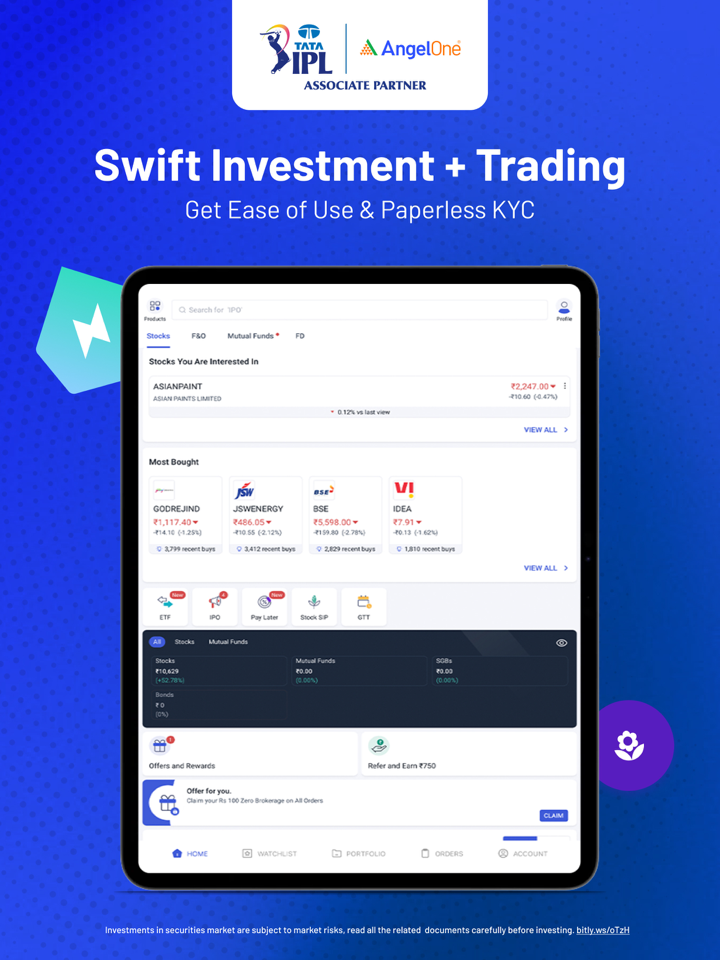

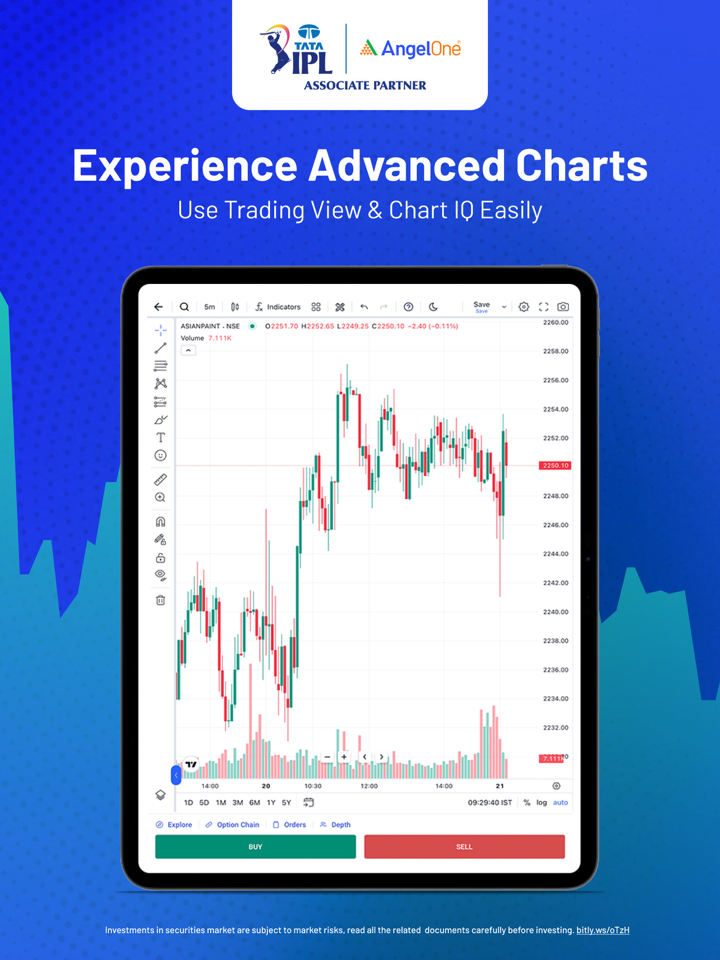

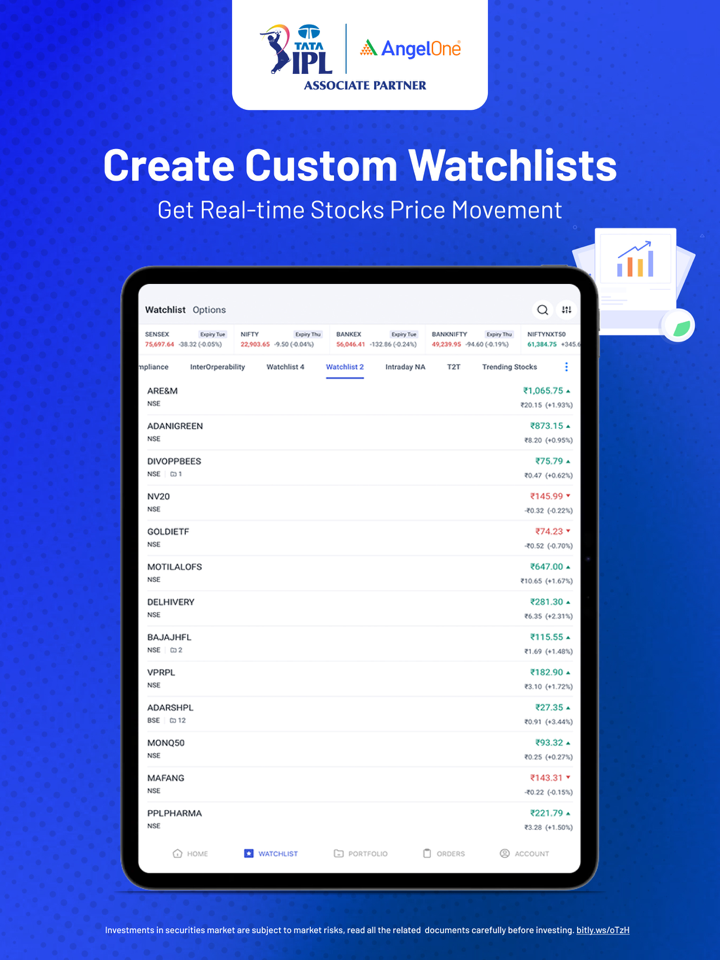

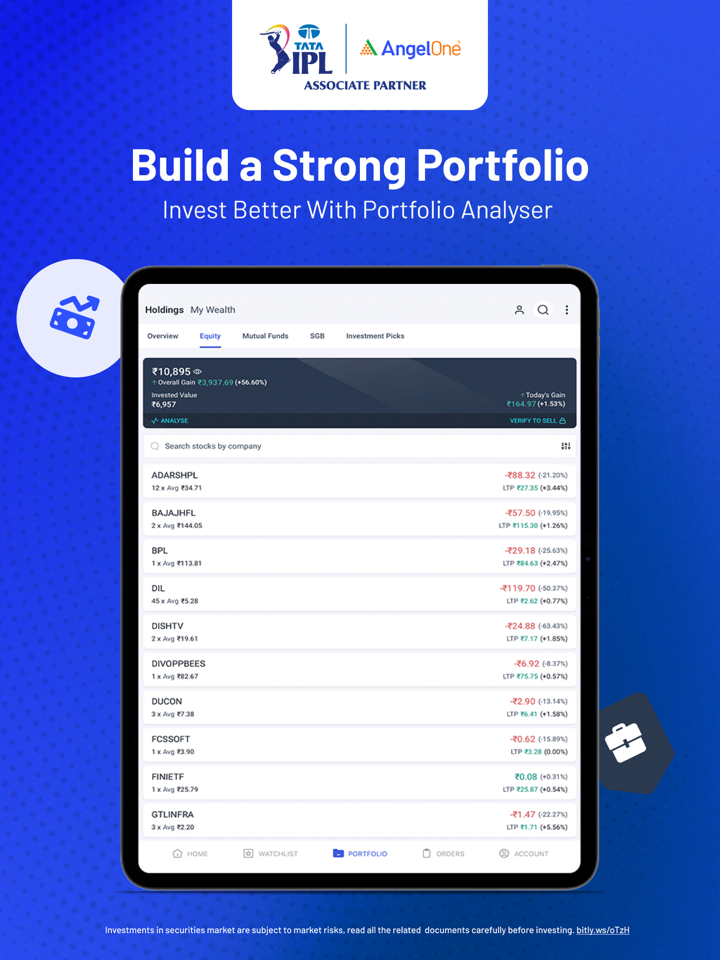

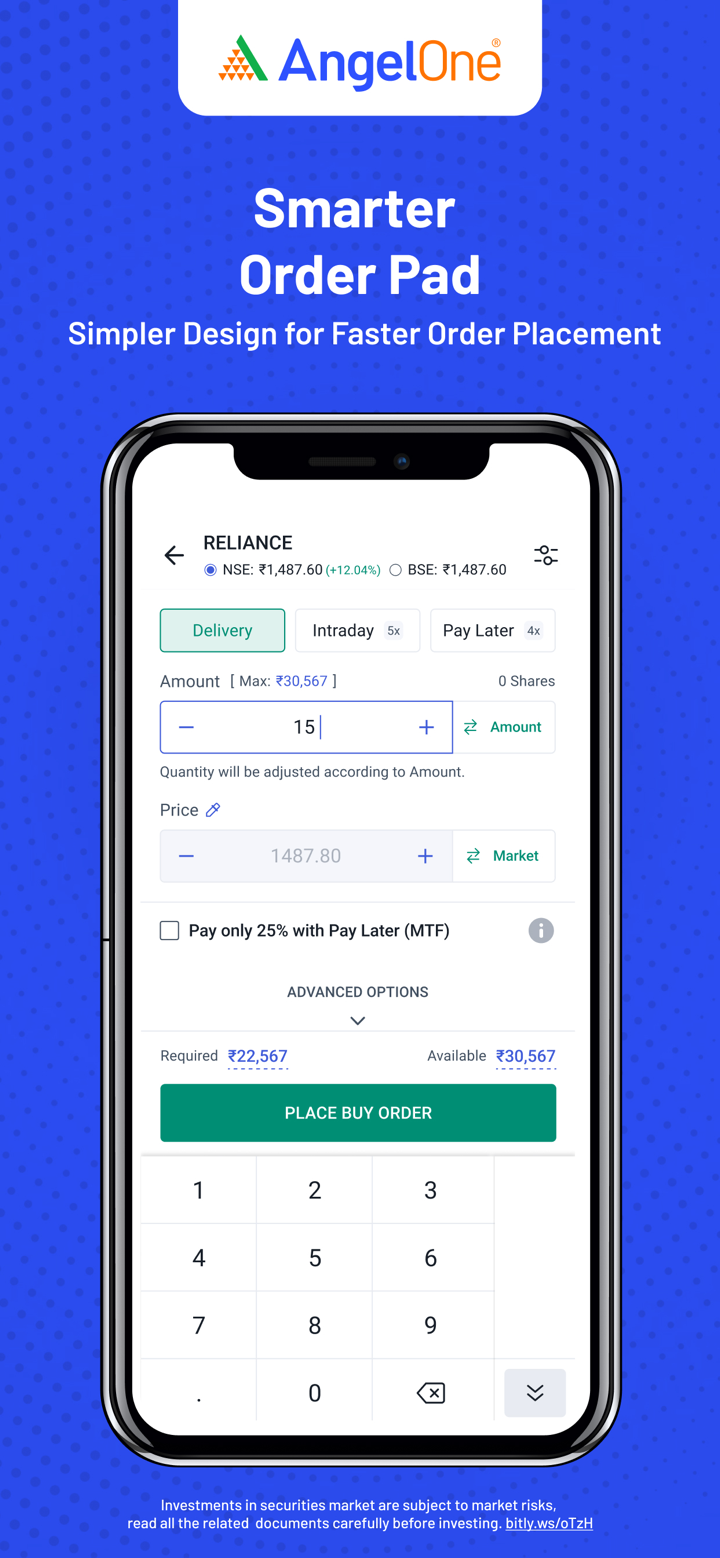

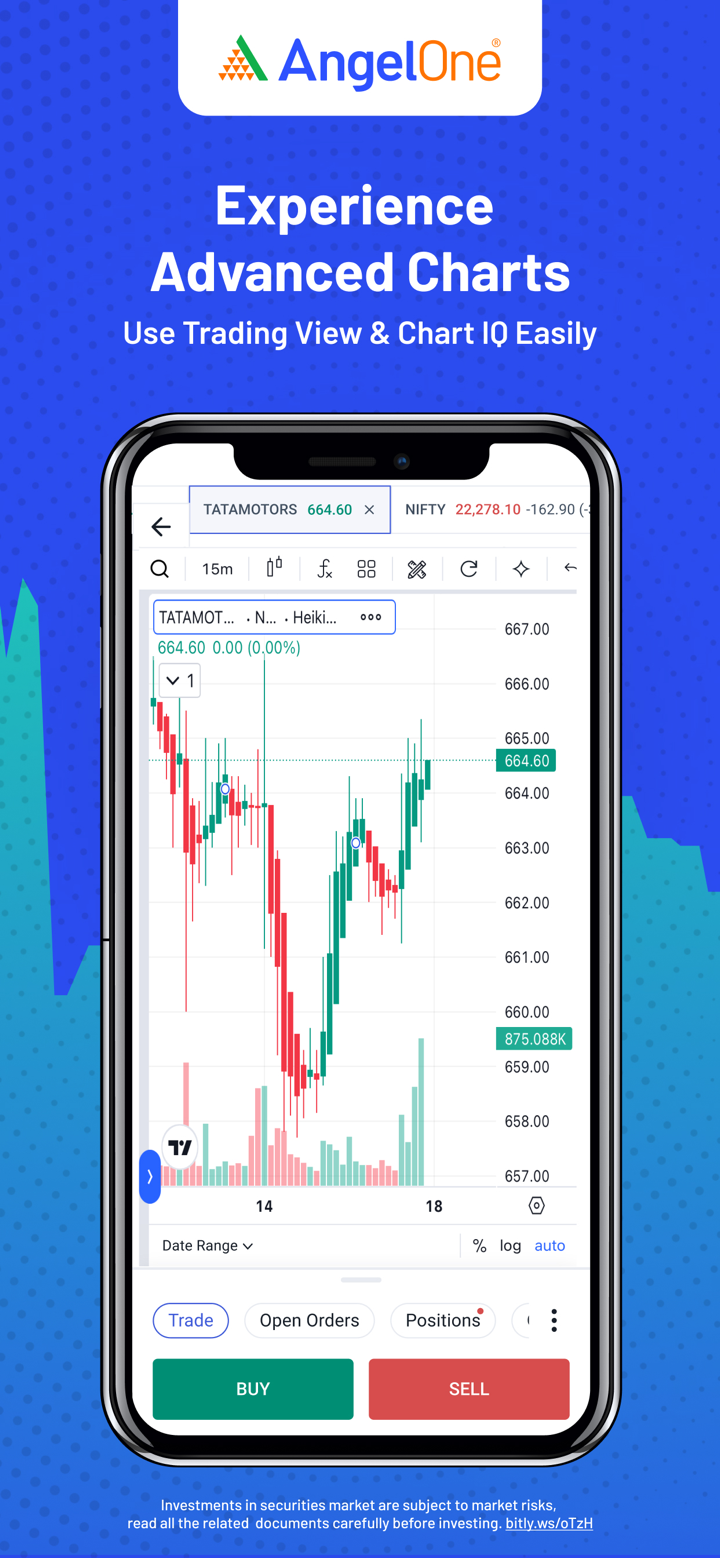

Angel One ofrece tres plataformas de trading, una aplicación móvil para inversores cotidianos, una plataforma web para traders profesionales y APIs para desarrolladores y traders algorítmicos.

| Plataforma | Compatible | Dispositivos Disponibles | Adecuado para |

| Super App Angel One | ✔ | Android, iOS | Inversores y traders principiantes a intermedios |

| Trade Angel One | ✔ | Web (Escritorio/Portátil) | Traders activos/profesionales |

| API Inteligente | ✔ | Acceso a API (Integración web backend) | Desarrolladores, traders algorítmicos, plataformas fintech |