Présentation de l'entreprise

| Angel One Résumé de l'examen | |

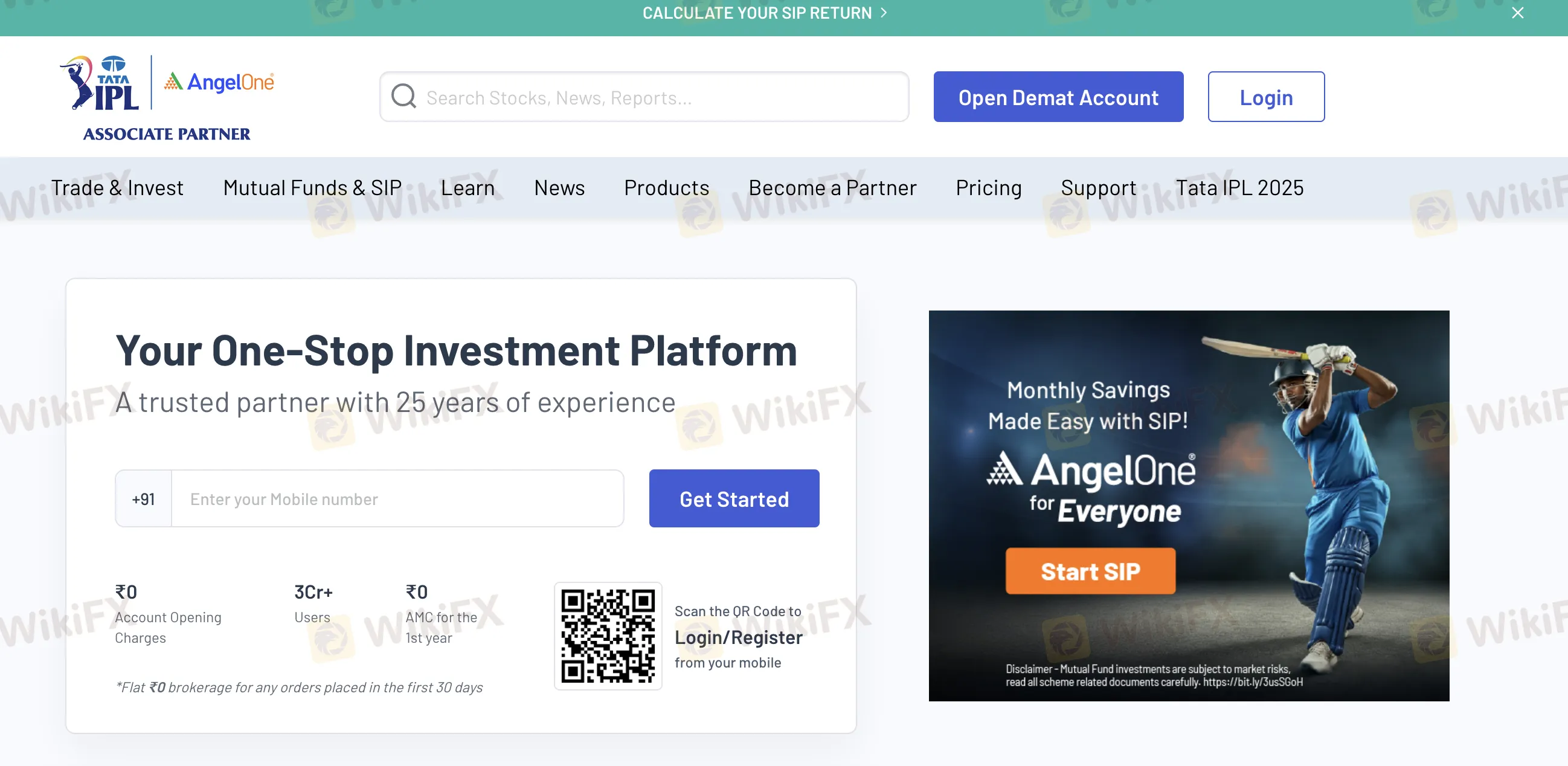

| Fondé | 1996 |

| Pays/Région Enregistré | Inde |

| Régulation | Pas de régulation |

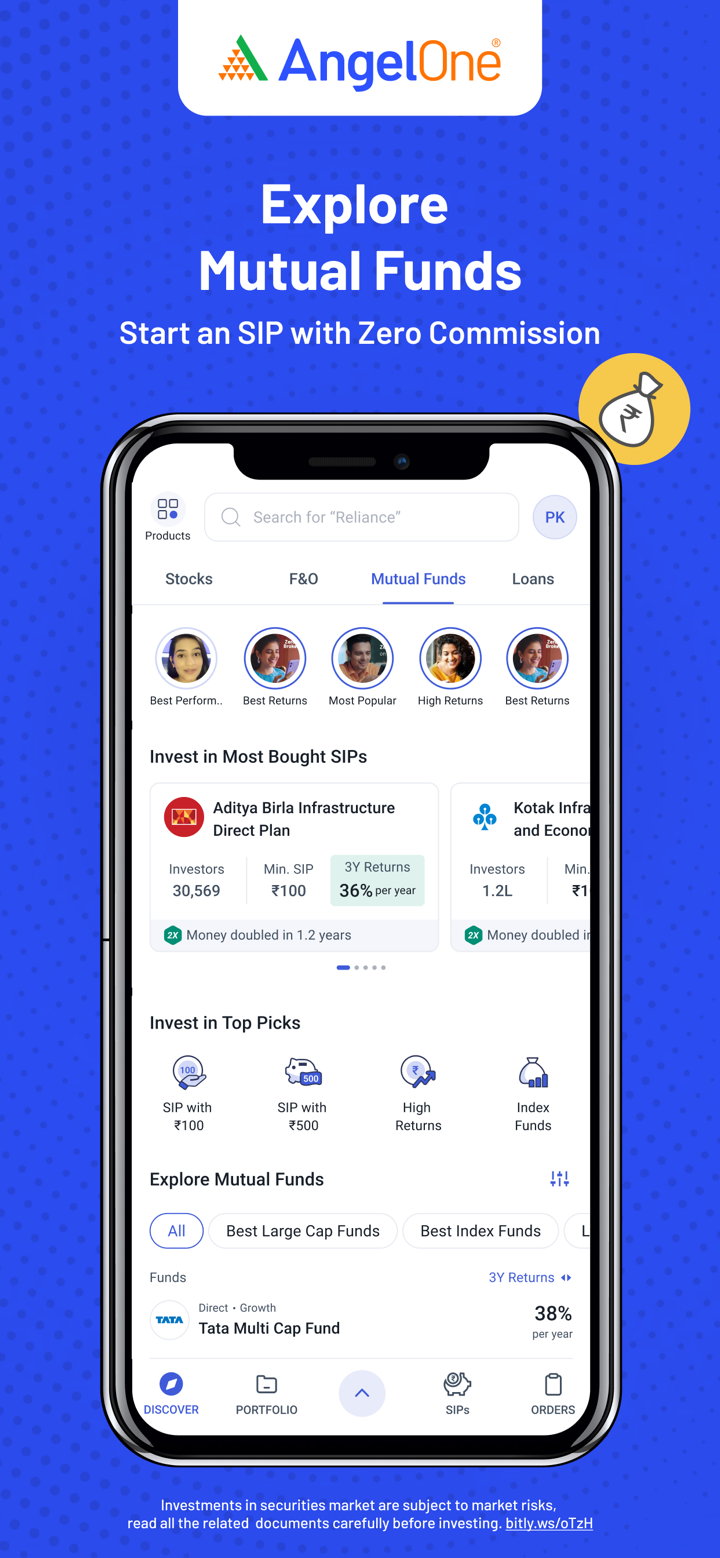

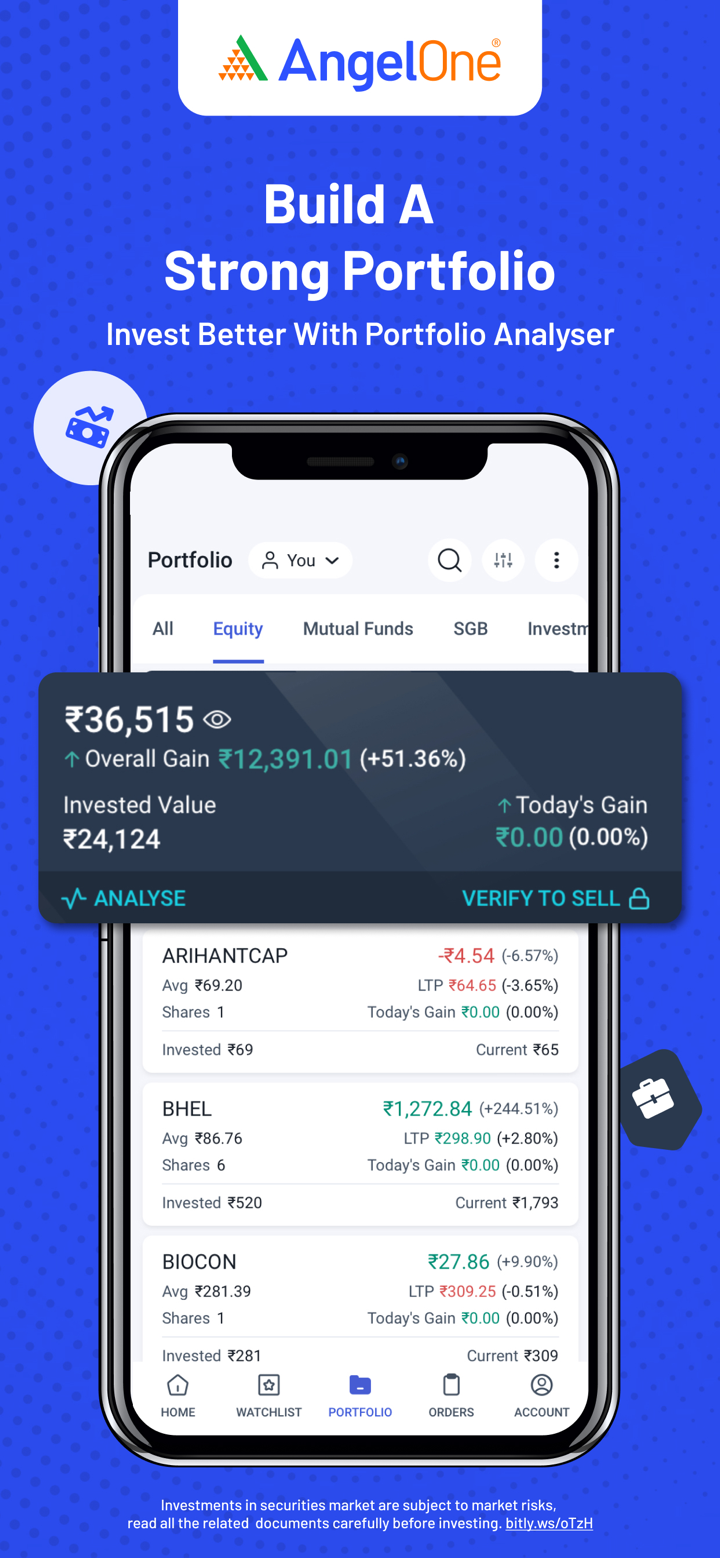

| Produits de Trading | Actions, IPO, Dérivés (F&O), Fonds Communs de Placement, Matières Premières |

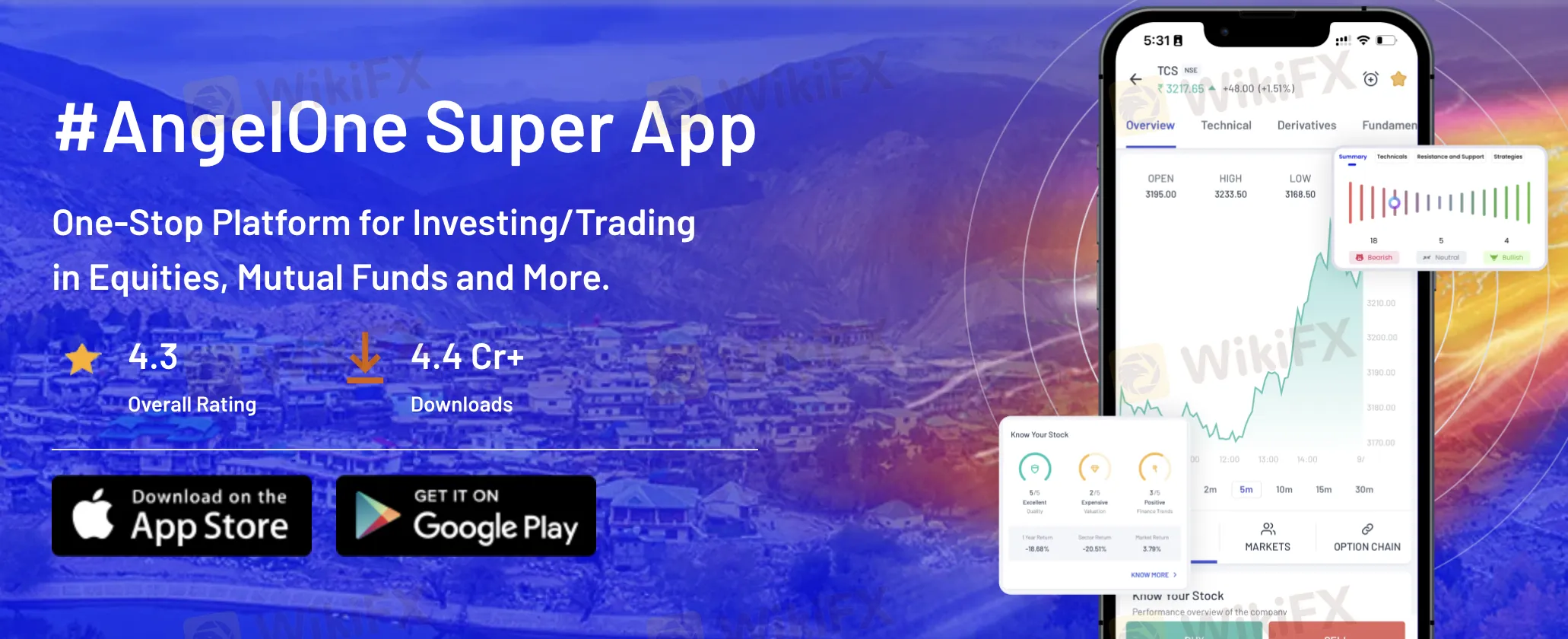

| Plateforme de Trading | Angel One Super App (mobile), Angel One Trade (web), Smart API (développeur) |

| Dépôt Minimum | ₹0 |

| Support Client | Email: support@angelone.in |

| Téléphone: 18001020 | |

Informations sur Angel One

Fondée en 1996, Angel One est une société de courtage indienne. Elle n'est pas contrôlée par la SEBI ou une autorité financière mondiale. Parmi les nombreux véhicules d'investissement proposés par la société, on trouve des actions, des dérivés, des fonds communs de placement et des actions américaines. Son absence de contrôle réglementaire suscite des inquiétudes même avec ses coûts réduits et ses plates-formes technologiques robustes.

Avantages et Inconvénients

| Avantages | Inconvénients |

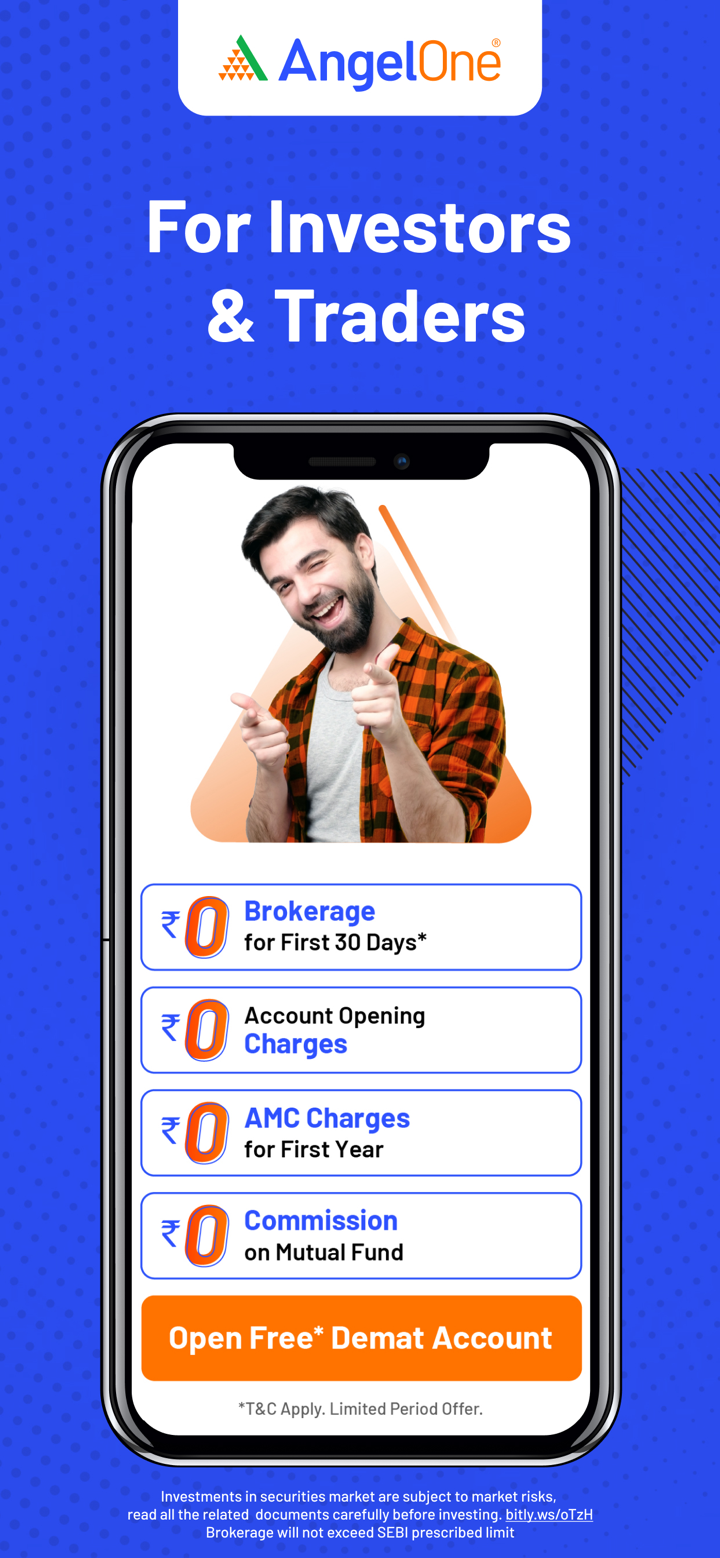

| Zéro frais de courtage pour les premiers ₹500 en 30 jours | Pas de régulation |

| Large gamme de produits d'investissement | Frais divers facturés |

| Plateformes conviviales | |

| Aucun dépôt minimum |

Angel One Est-il Légitime ?

Angel One n'est pas un courtier réglementé. Bien que basée en Inde, elle ne détient pas de licence de la SEBI ou d'autres régulateurs mondiaux majeurs tels que la FCA, l'ASIC ou la NFA.

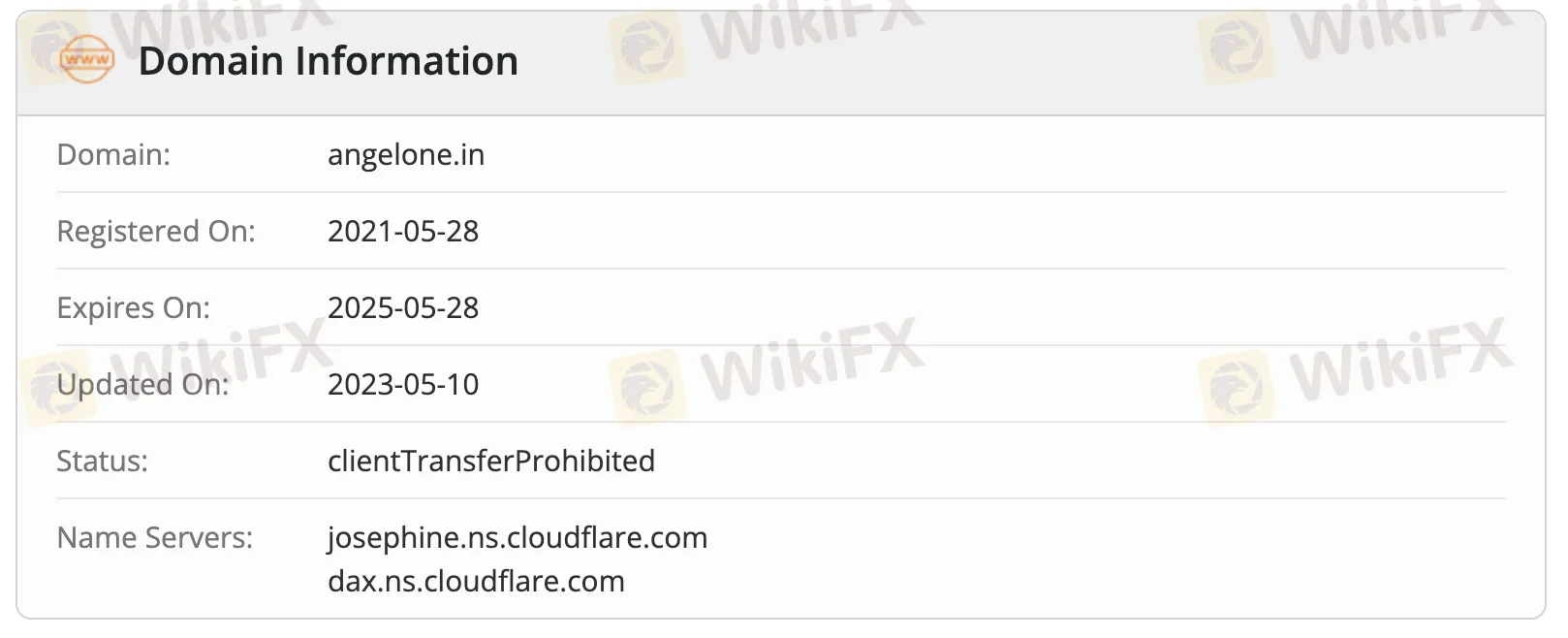

Le domaine angelone.in a été enregistré le 28 mai 2021, mis à jour pour la dernière fois le 10 mai 2023 et expirera le 28 mai 2025. Son statut est clientTransferProhibited.

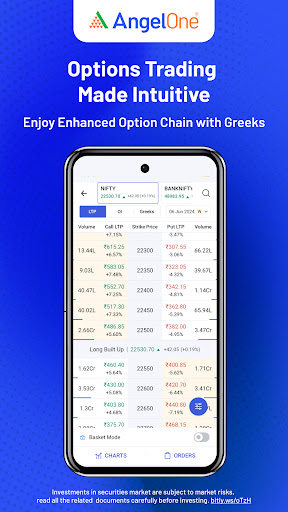

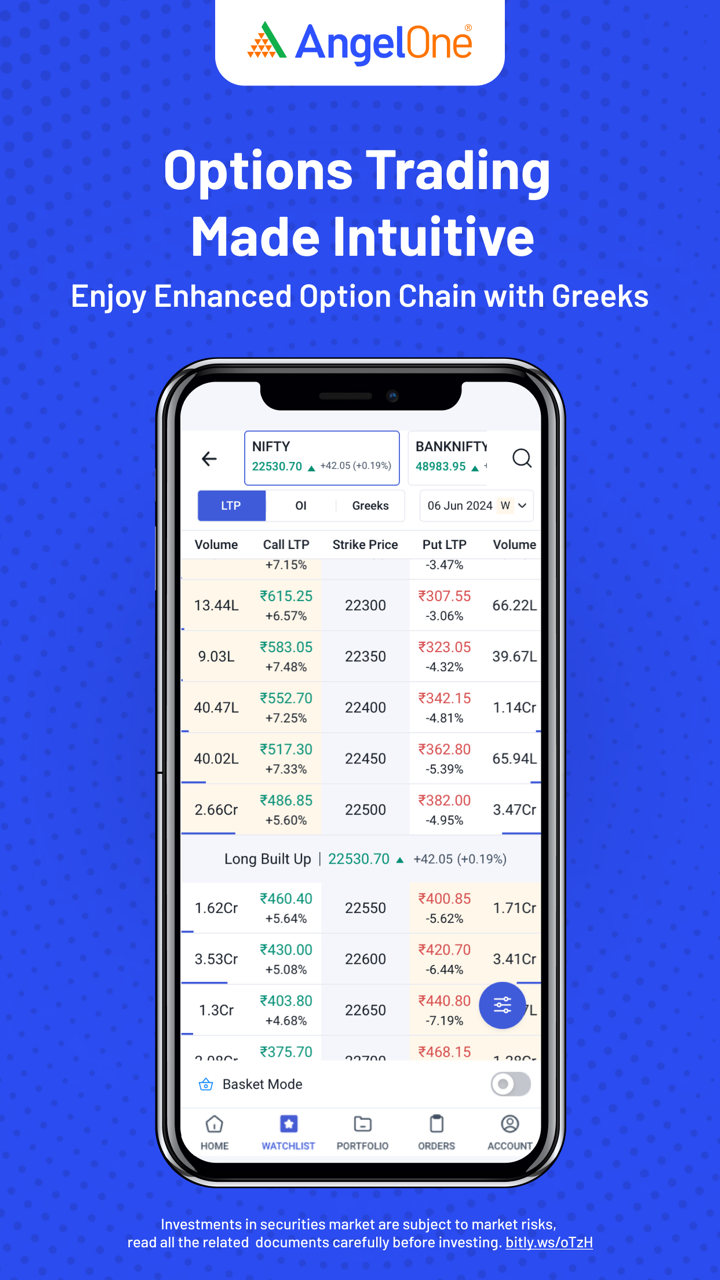

Produits de Trading

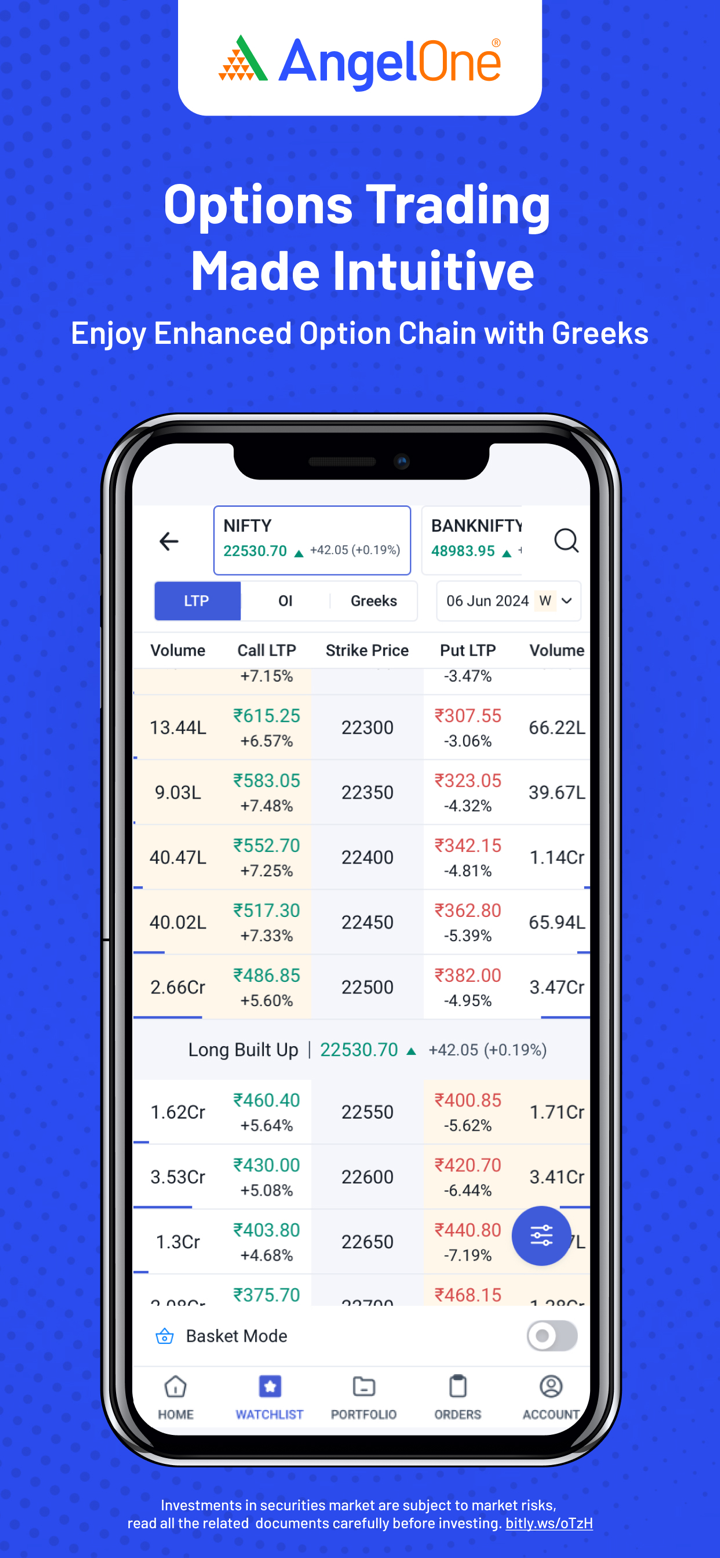

Angel One propose une large gamme de produits d'investissement, y compris des actions, des IPO, des dérivés, des fonds communs de placement, des matières premières et des actions américaines.

| Instruments de Trading | Pris en Charge |

| Actions | ✔ |

| IPO | ✔ |

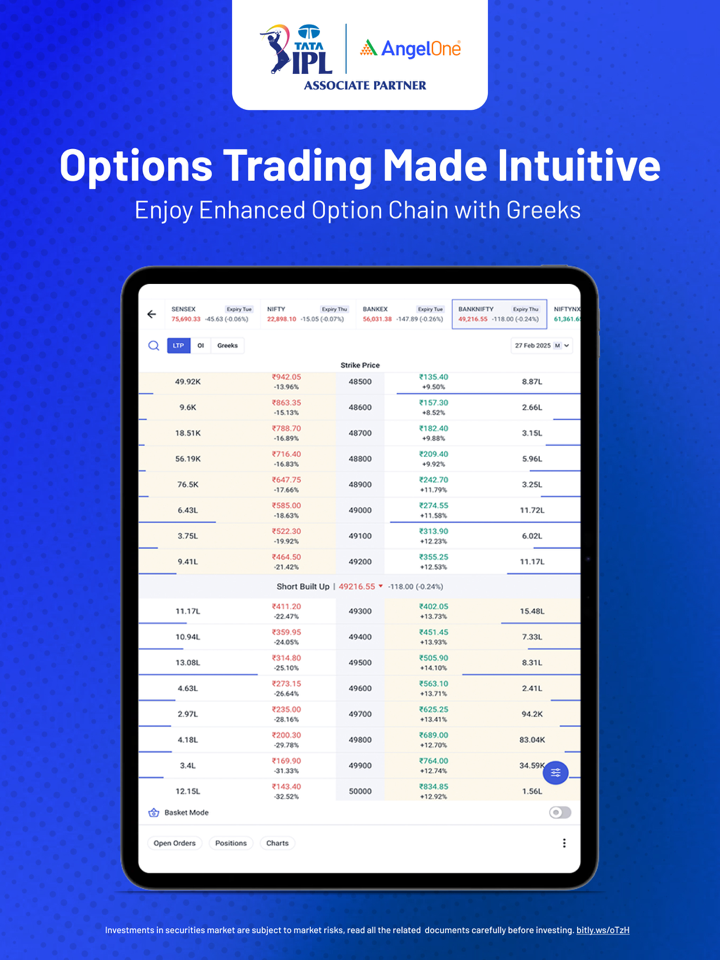

| Dérivés (F&O) | ✔ |

| Fonds Communs de Placement | ✔ |

| Matières Premières | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

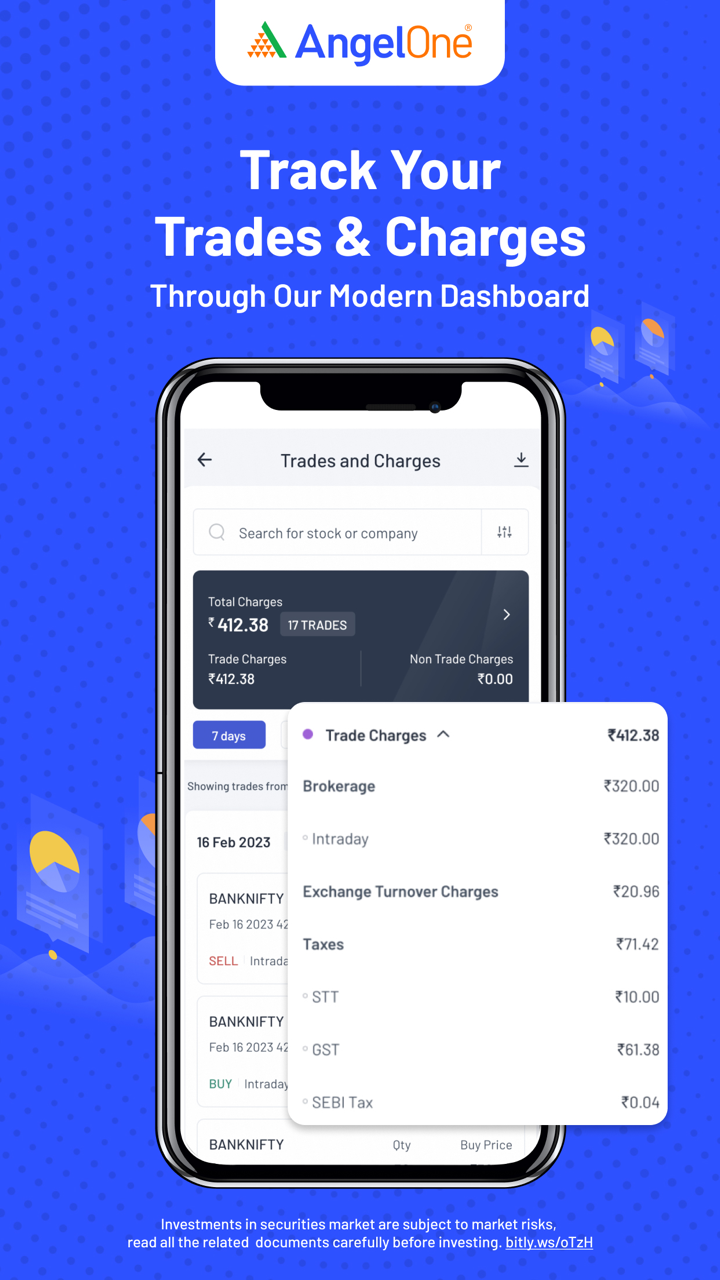

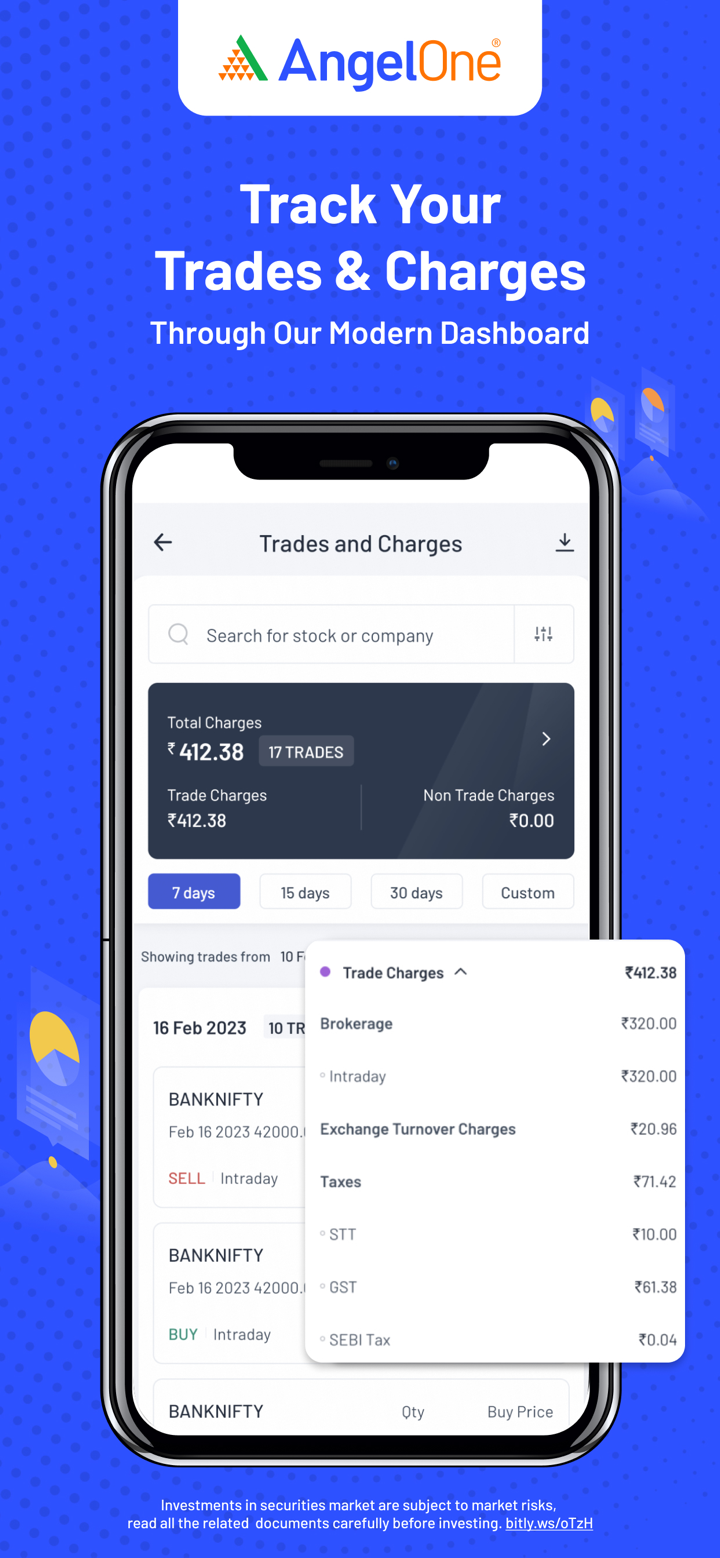

Angel One Frais

Les frais de Angel One sont généralement bas à modérés par rapport aux normes de l'industrie en Inde. Il offre zéro courtage pendant les 30 premiers jours (jusqu'à ₹500), après quoi son courtage est plafonné et compétitif, surtout pour les traders particuliers. Les frais supplémentaires sont principalement conformes aux normes réglementaires.

| Type d'investissement | Offre initiale | Courtage post-offre |

| Remise d'actions | ₹0 jusqu'à ₹500 en 30 jours | Le moins élevé entre ₹20 ou 0,1% par ordre (min ₹2) |

| Trading intraday | Le moins élevé entre ₹20 ou 0,03% par ordre | |

| Futures | ₹20 par ordre exécuté | |

| Options |

| Type de frais | Remise d'actions | Intraday | Futures | Options |

| Frais de transaction | NSE : 0,00297% | NSE : 0,00173% | NSE : 0,03503% | |

| STT | 0,1% (Achat/Vente) | 0,025% (Vente) | 0,01% (Vente) | 0,05% (Vente) |

| TVA | 18% | |||

| Frais SEBI | ₹10/crore | |||

| Frais de compensation | ₹0 | |||

| Droit de timbre | 0,015% (Achat) | 0,003% (Achat) | 0,002% (Achat) | 0,003% (Achat) |

| Type de frais | Frais |

| Ouverture de compte | 0 (parfois ₹36,48 pour les non-résidents indiens) |

| AMC (1ère année) | 0 |

| AMC (Après la 1ère année) | ₹60/trimestre (hors BSDA), ou ₹450/an, ou option à vie ₹2950 |

| AMC BSDA | NIL jusqu'à ₹4L ; ₹100/an pour des avoirs de ₹4L à ₹10L |

| MTF (Emprunt sur marge) | 0,041% par jour |

| Intérêt sur solde débiteur | 0,049% par jour |

| Frais de garantie en espèces | 0,0342%/jour (en cas de déficit > ₹50,000) |

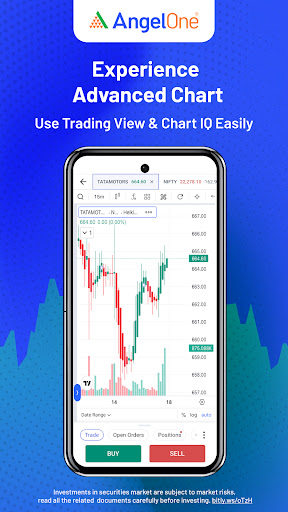

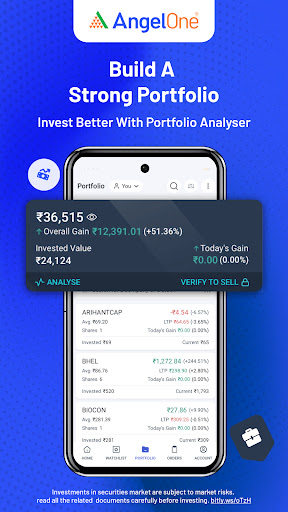

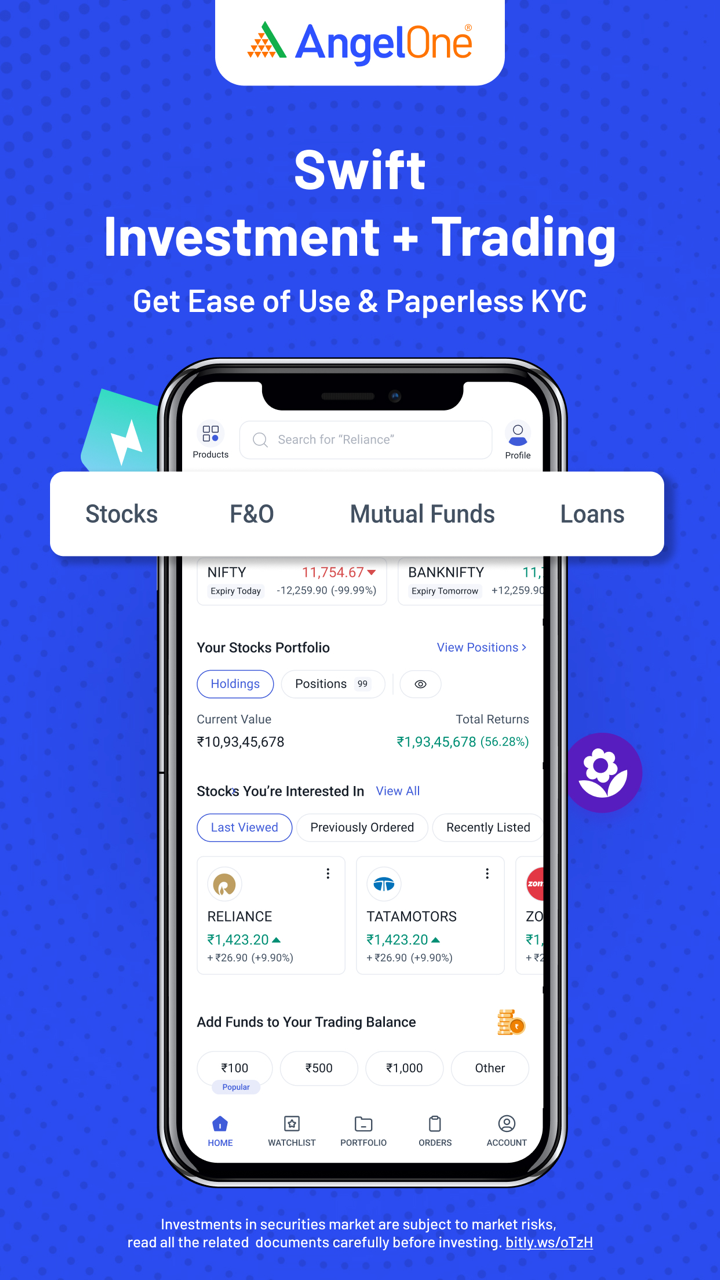

Plateforme de trading

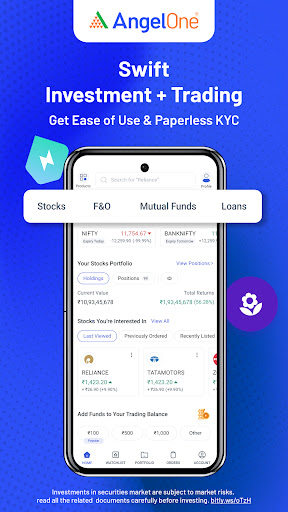

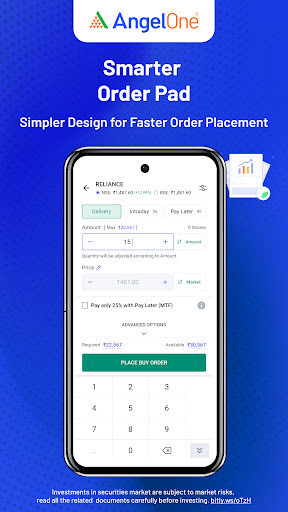

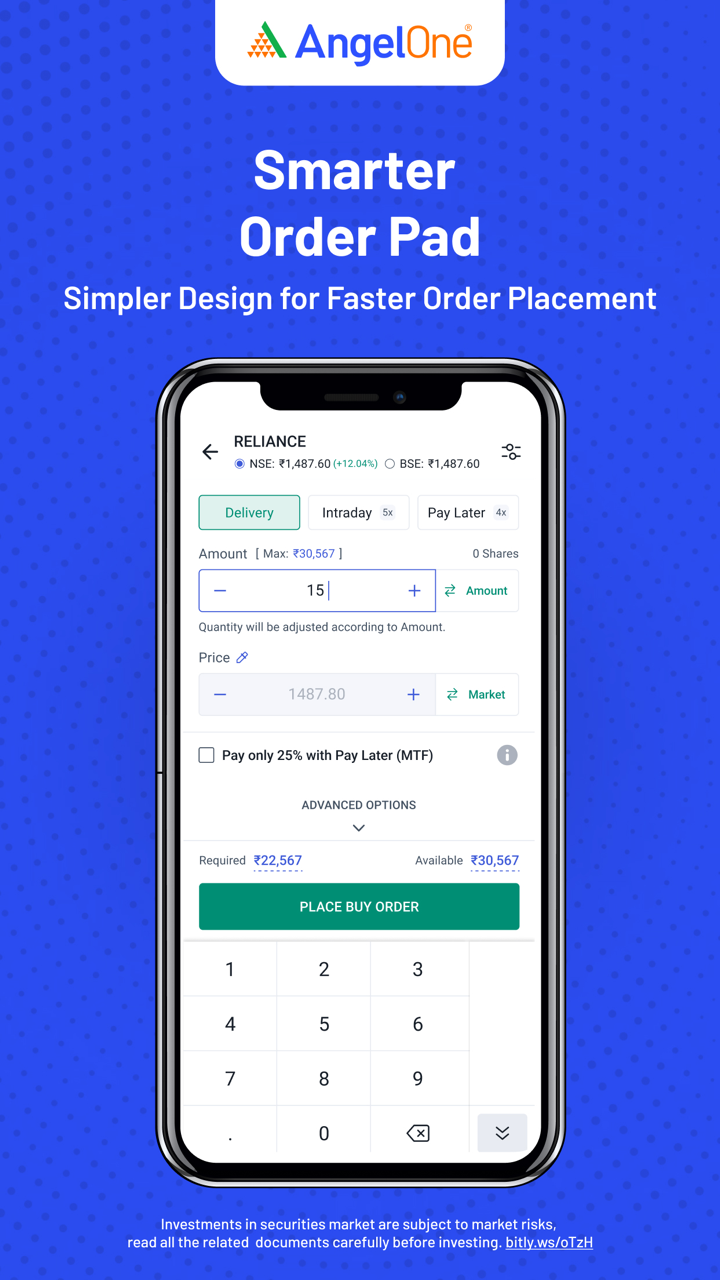

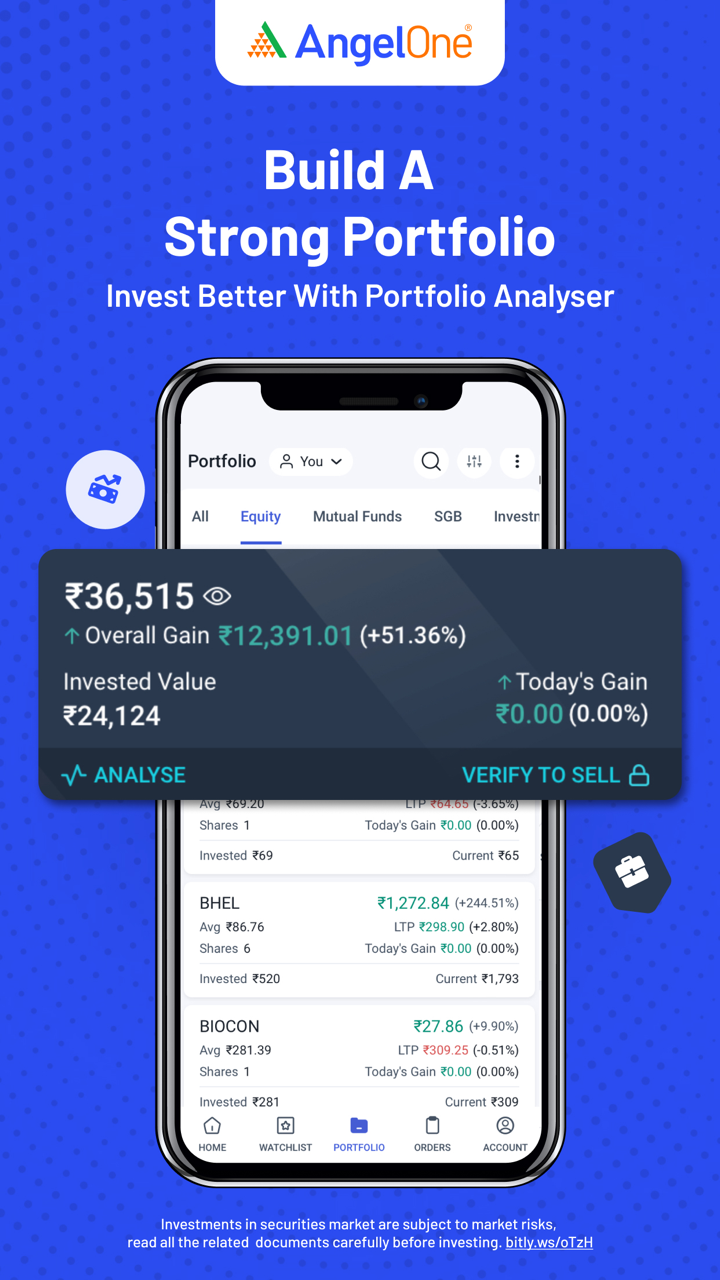

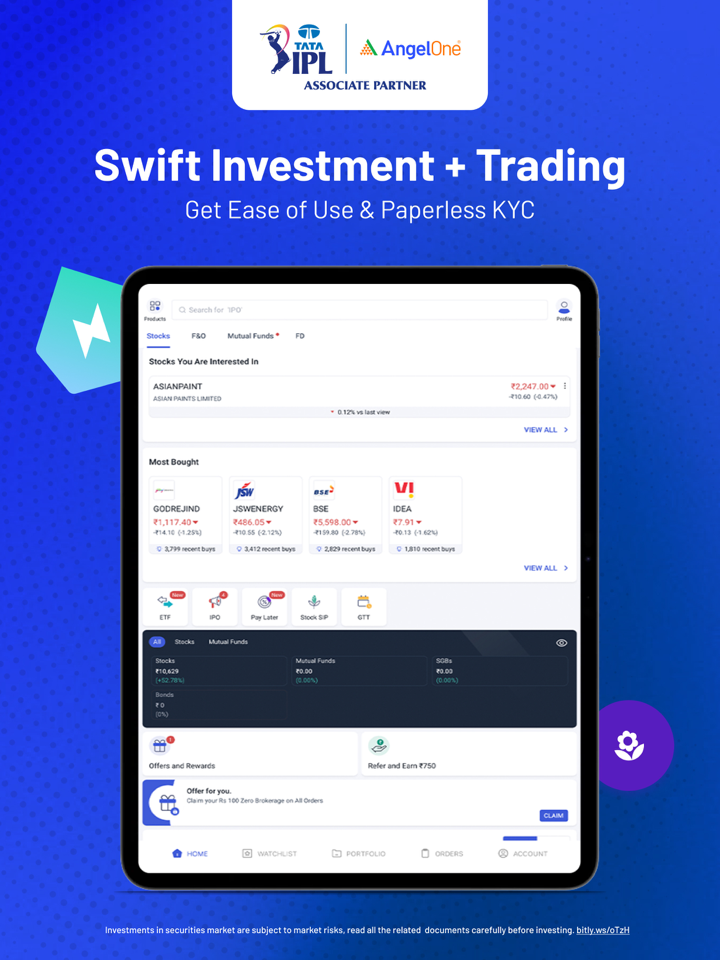

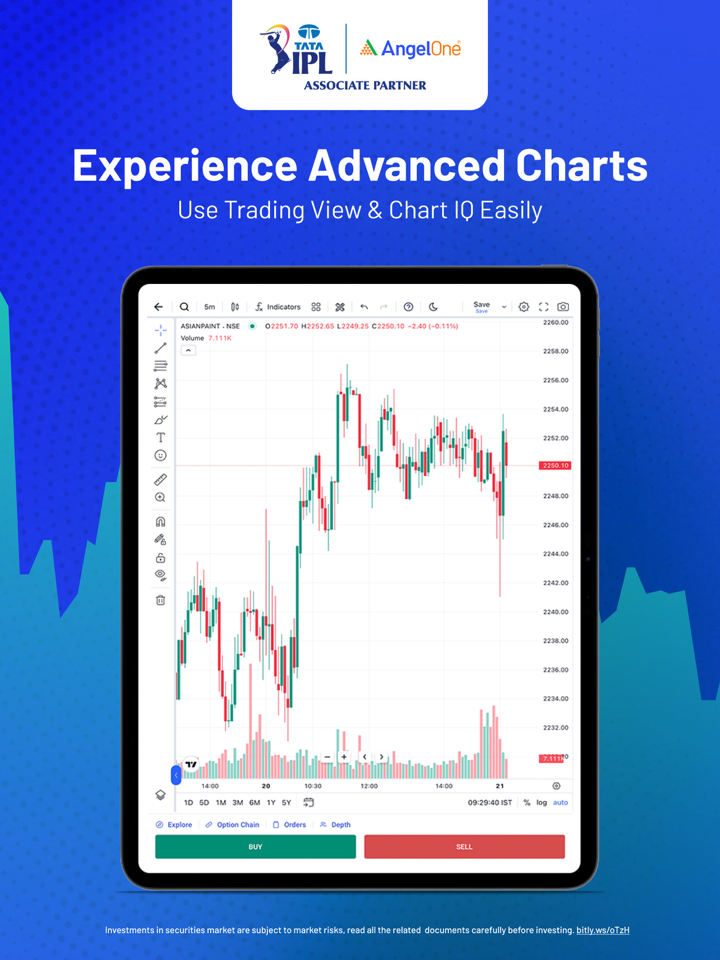

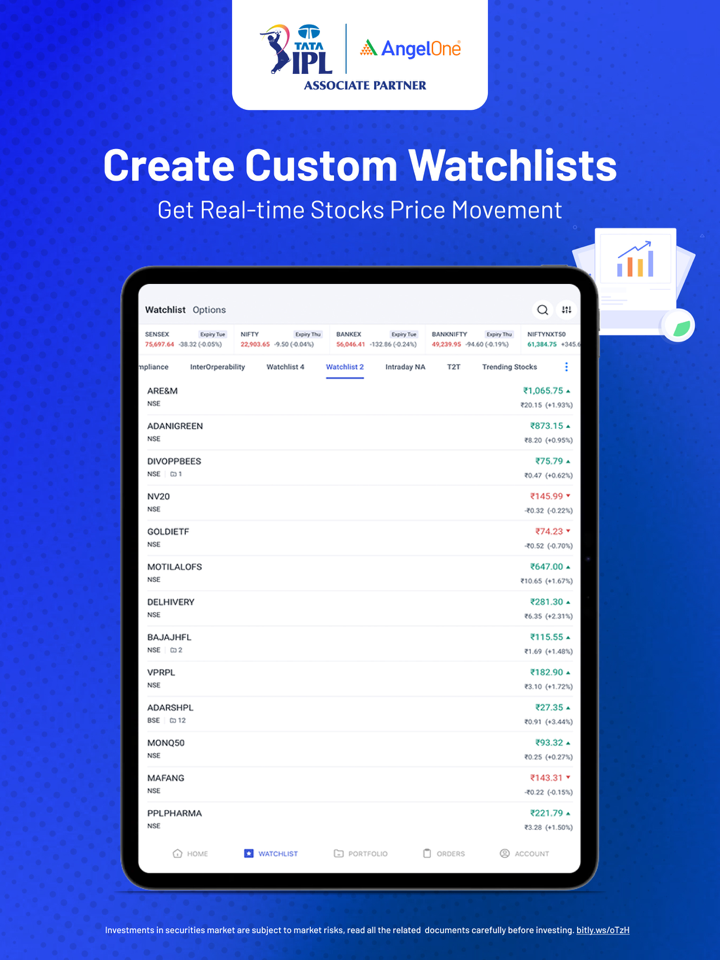

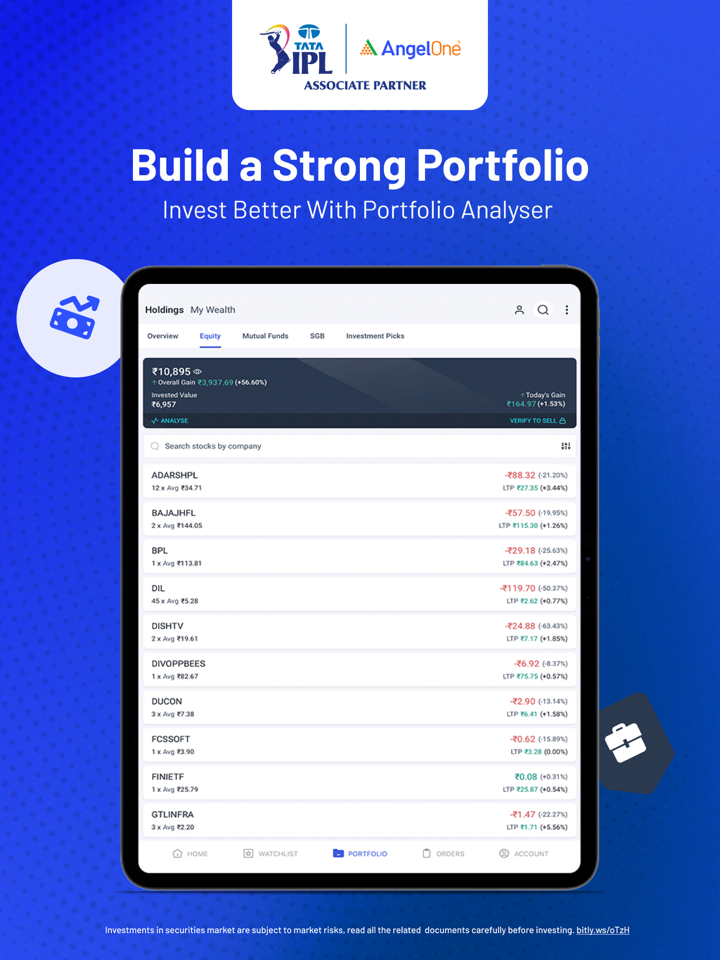

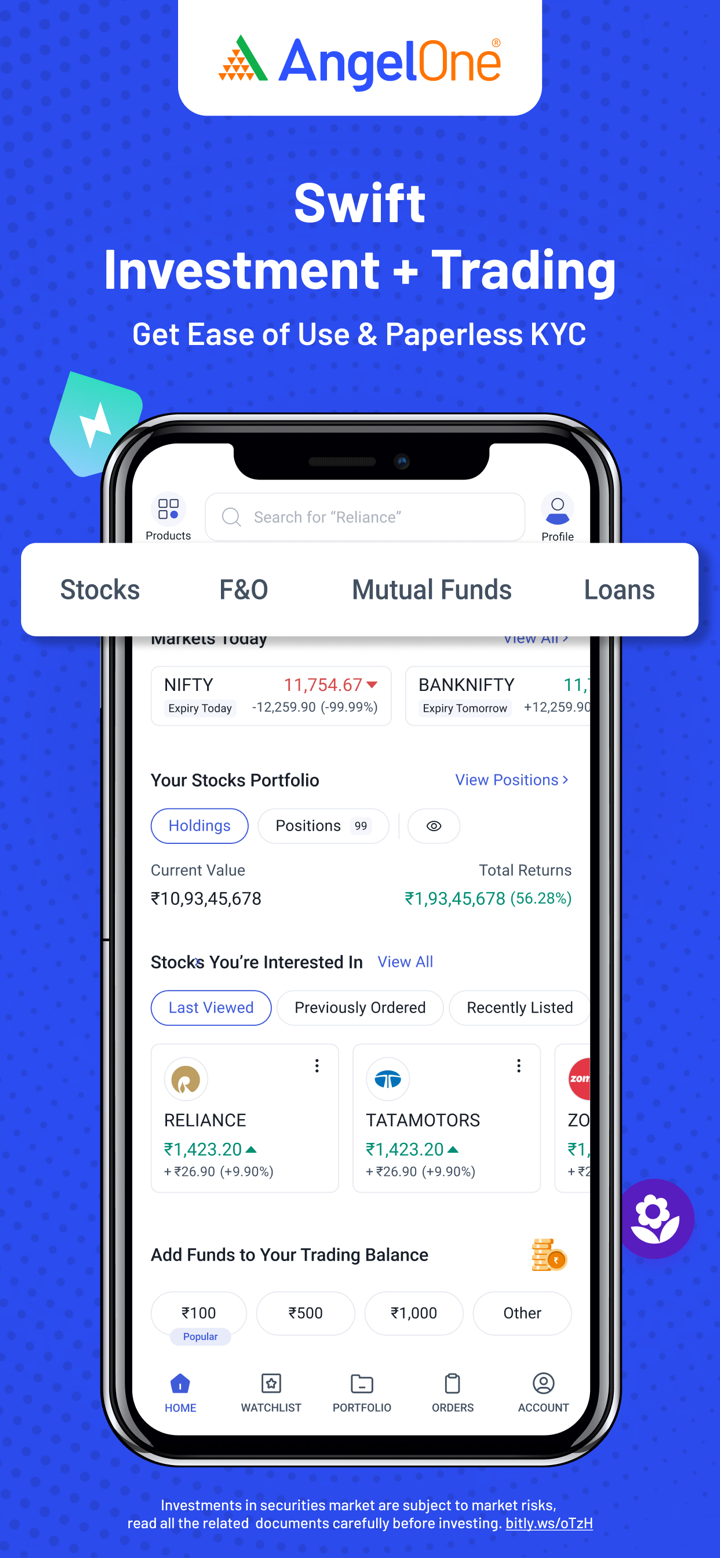

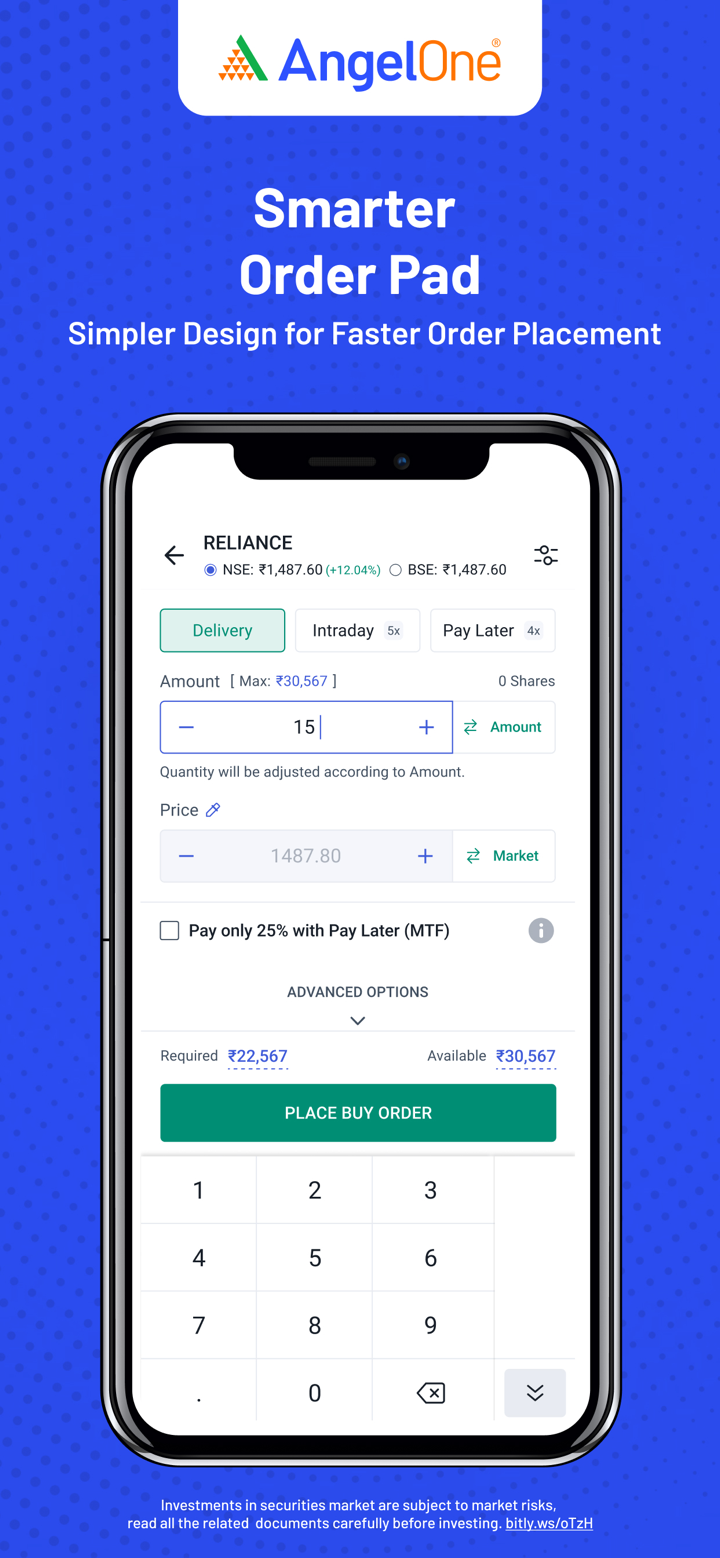

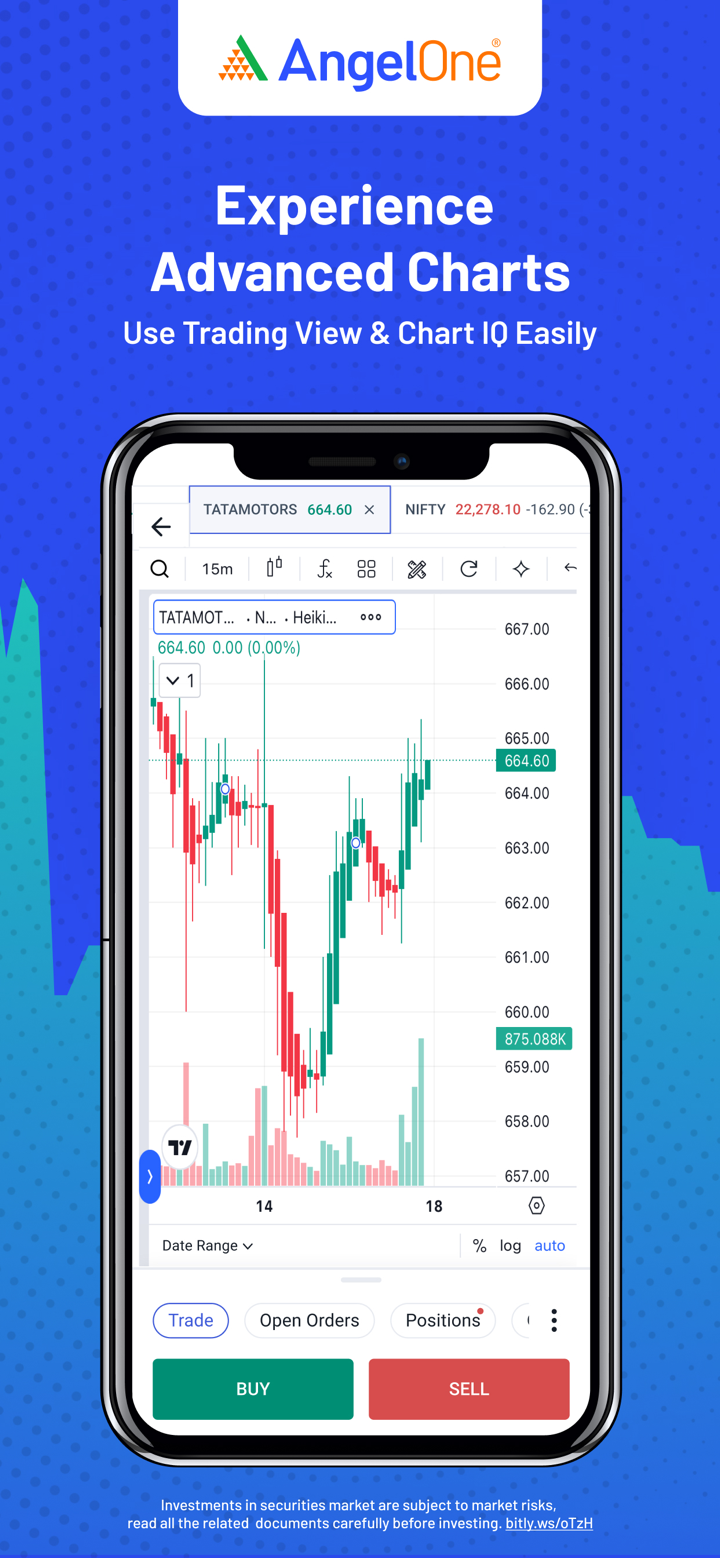

Angel One propose trois plateformes de trading, une application mobile pour les investisseurs du quotidien, une plateforme web pour les traders professionnels, et des APIs pour les développeurs et les traders algorithmiques.

| Plateforme | Pris en charge | Appareils disponibles | Convient à |

| Super App Angel One | ✔ | Android, iOS | Investisseurs et traders débutants à intermédiaires |

| Trade Angel One | ✔ | Web (Ordinateur de bureau/Portable) | Traders actifs/professionnels |

| API intelligente | ✔ | Accès API (Intégration backend Web) | Développeurs, traders algorithmiques, plateformes fintech |