Unternehmensprofil

| Phillip Securities Group Überprüfungszusammenfassung | |

| Gegründet | 1975 |

| Registriertes Land/Region | Singapur |

| Regulierung | SFC |

| Marktinstrumente | Wertpapiere, Futures, Devisen, Anleihen, ETFs, Versicherungen |

| Demo-Konto | ❌ |

| Handelsplattform | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Mindesteinzahlung | / |

| Kundensupport | Tel: (852) 2277 6555 |

| Fax: (852) 2277 6008 | |

| E-Mail: cs@phillip.com.hk | |

Phillip Securities Group Informationen

Gegründet im Jahr 1975 und mit Hauptsitz in Singapur ist Phillip Securities Group ein Multi-Asset-Finanzdienstleistungsunternehmen, das von der Hong Kong SFC reguliert wird. Seine eigenen Handelssysteme bieten eine vollständige Palette von Anlagemöglichkeiten, einschließlich Futures, Devisen, Aktien, Anleihen und Fondsprodukten. Obwohl die Plattformfunktionen und die Kontenvielfalt gut sind, fehlt es derzeit an einem Demo- oder Islamischen Konto.

Vor- und Nachteile

| Vorteile | Nachteile |

| Lizenziert von der Hong Kong SFC | Kein Demo-Konto oder Islamische Konten |

| Breites Produktsortiment für lokale und internationale Märkte | Einige ausländische Handelsgeschäfte verursachen hohe Mindestprovisionen |

| Mehrere benutzerdefinierte Handelsplattformen für unterschiedliche Anforderungen | Mindesteinzahlung nicht klar angegeben |

Ist Phillip Securities Group legitim?

Unter Lizenz Nr. AAZ038 wird Phillip Securities Group von der Securities and Futures Commission (SFC) Hongkongs reguliert und ist seit dem 9. Dezember 2003 für den Handel mit Futures-Kontrakten und gehebeltem Devisenhandel zugelassen.

Was kann ich bei Phillip Securities Group handeln?

Einschließlich Wertpapiere, Futures, Währungen, Anleihen, Versicherungen und Kapitalmanagementlösungen einschließlich verwalteter Fonds und ETFs bietet Phillip Securities ein breites Spektrum an Anlage- und Vermögensverwaltungsdienstleistungen.

| Handelsinstrumente | Unterstützt |

| Wertpapiere | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Anleihen | ✔ |

| ETFs | ✔ |

| Versicherungen | ✔ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |

Kontotyp

Phillip Securities (HK) Ltd. bietet zwei Hauptarten von Live-Handelskonten: Marginkonto und Treuhandkonto. Das Unternehmen bietet keine Demokonten oder islamischen Konten an.

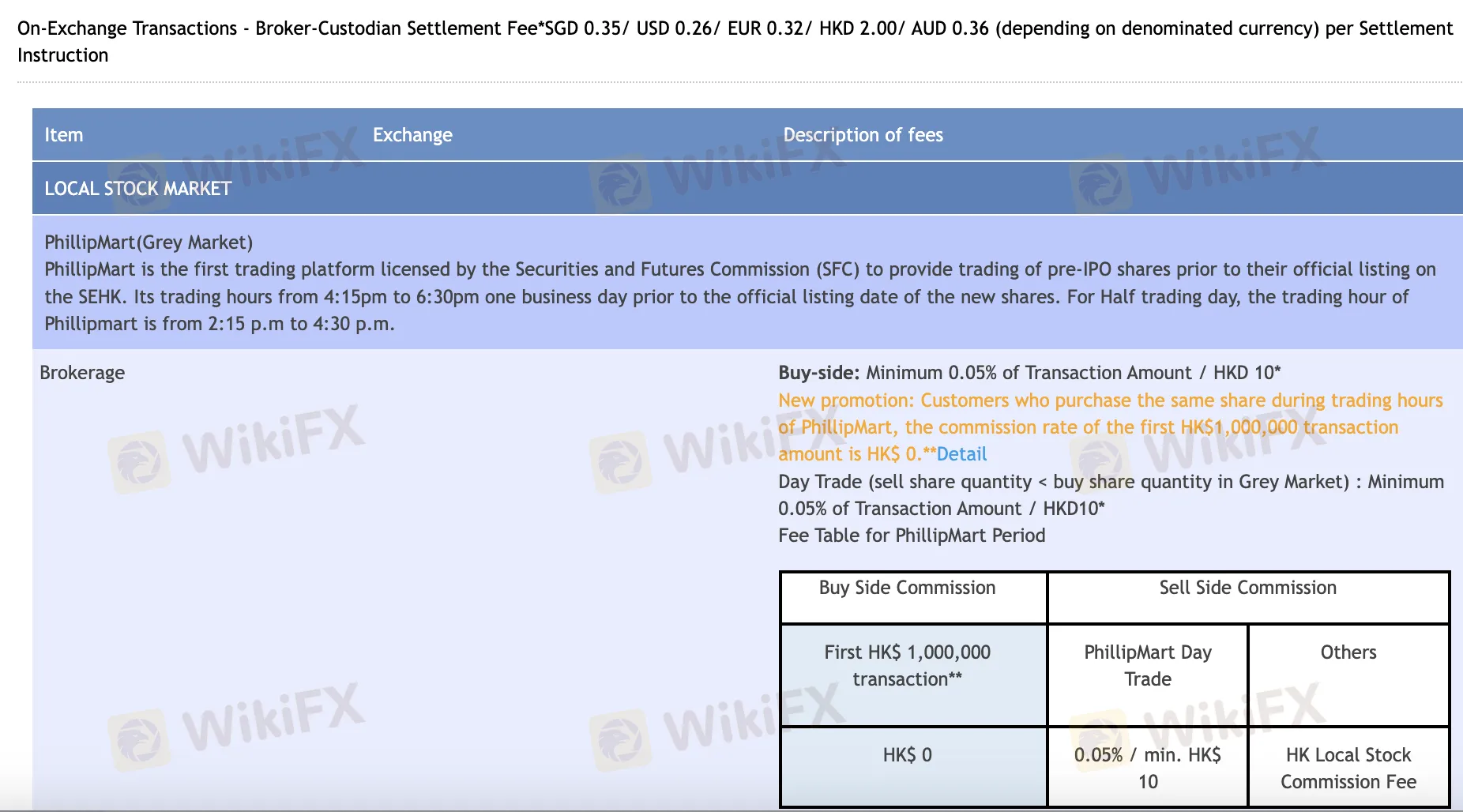

Phillip Securities Group Gebühren

Insbesondere für Online- und Day-Trading sind die Kosten von Phillip Securities Group in der Regel fair und entsprechen den Branchenstandards. Es erlässt Verwaltungsgebühren für die meisten Verbraucher und bietet Null-Kommissionsdeals für ausgewählte Artikel an. Andererseits können bestimmte ausländische Markthandelsgeschäfte - insbesondere per Telefon oder bei geringem Volumen - höhere Mindestgebühren haben.

| Markt/Produkt | Maklergebühr | Stempelsteuer | Transaktionsabgabe | Transaktionsgebühr | CCASS/Andere Gebühren | Verwahrungsgebühr |

| HK-Aktien (Online) | 0,08% (Kauf ≤ HKD 30K: 0 $, Day Trade: 0,05%) | 0,10% | 0,00% | 0,01% | 0,01% (Min HKD 3, Max HKD 300) | Verzichtet (<5000 Stück) |

| Optionsscheine & CBBC | 0,03% Day Trade / 0,05% nach HKD 50K | Keine | 0,00% | 0,01% | 0,01% (Min HKD 3, Max HKD 300) | Verzichtet (<5000 Stück) |

| RMB Dual Counter-Aktien | Online: 0,08% (Min CNY 60); Telefon: 0,25% (Min CNY 100) | 0,10% | 0,00% | 0,01% | 0,01% (Min CNY 3, Max CNY 300) | Verzichtet (<5000 Stück) |

| US-Aktien (Online) | USD 0,0099/Aktie (Min USD 1); Telefon: 0,25% (Min USD 20) | Keine | SEC + FINRA + DTC Gebühren anfallen | Oben enthalten | SEC/FINRA/DTC Clearing-Gebühren | ❌ |

| China A-Aktien (Nordwärts) | Kauf ≤ ¥30K: ¥0; Kauf > ¥30K oder Verkauf: 0,03% (Online) | 0,05% (NUR VERKAUF) | Abwicklung 0,00341%, Verwaltung 0,002% | ChinaClear 0,001% | 0,002% über CCASS | Täglicher Portfoliowert × 0,008%/365 |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Hulit City Online | ✔ | Desktop / Web | Aktien- und Futures-Händler, die volle Funktionalität benötigen |

| Hulit City Mobile | ✔ | Mobilgeräte (iOS/Android) | Aktienhändler unterwegs |

| Stock Easy (SATS) | ✔ | Desktop | Anfänger-Aktienhändler |

| Options Easy (OATS) | ✔ | Desktop | Options-Trader |

| Futures Trading (FATS) | ✔ | Desktop | Futures-Händler |