Perfil de la compañía

| Phillip Securities Group Resumen de la reseña | |

| Establecido | 1975 |

| País/Región Registrada | Singapur |

| Regulación | SFC |

| Instrumentos de Mercado | Valores, futuros, divisas, bonos, ETFs, seguros |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Depósito Mínimo | / |

| Soporte al Cliente | Tel: (852) 2277 6555 |

| Fax: (852) 2277 6008 | |

| Email: cs@phillip.com.hk | |

Información de Phillip Securities Group

Establecido en 1975 y con sede en Singapur, Phillip Securities Group es una empresa de servicios financieros multiactivos regulada por la SFC de Hong Kong. Sus propios sistemas de trading ofrecen una amplia gama de opciones de inversión que incluyen futuros, divisas, acciones, bonos y productos de fondos. Aunque las características de la plataforma y la diversidad de cuentas son buenas, actualmente carece de una cuenta demo o islámica.

Pros y Contras

| Pros | Contras |

| Licenciado por la SFC de Hong Kong | Sin cuenta demo o cuentas islámicas |

| Amplia gama de productos que cubren mercados locales y extranjeros | Algunas operaciones en el extranjero incurren en comisiones mínimas altas |

| Múltiples plataformas de trading personalizadas para diferentes necesidades | Depósito mínimo no claramente mencionado |

¿Es Phillip Securities Group Legítimo?

Bajo la Licencia No. AAZ038, Phillip Securities Group está regulado por la Comisión de Valores y Futuros (SFC) de Hong Kong, autorizado para operar contratos de futuros y trading de divisas apalancado desde el 9 de diciembre de 2003.

¿Qué puedo operar en Phillip Securities Group?

Incluyendo valores, futuros, divisas, bonos, seguros y soluciones de gestión de capital, incluidos fondos gestionados y ETF, Phillip Securities ofrece un amplio espectro de servicios de inversión y gestión patrimonial.

| Instrumentos de Trading | Soportados |

| Valores | ✔ |

| Futuros | ✔ |

| Forex | ✔ |

| Bonos | ✔ |

| ETF | ✔ |

| Seguros | ✔ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

Tipo de Cuenta

Phillip Securities (HK) Ltd. ofrece dos tipos principales de cuentas de trading en vivo: Cuenta de Margen y Cuenta de Custodia. La empresa no ofrece cuentas demo ni cuentas islámicas.

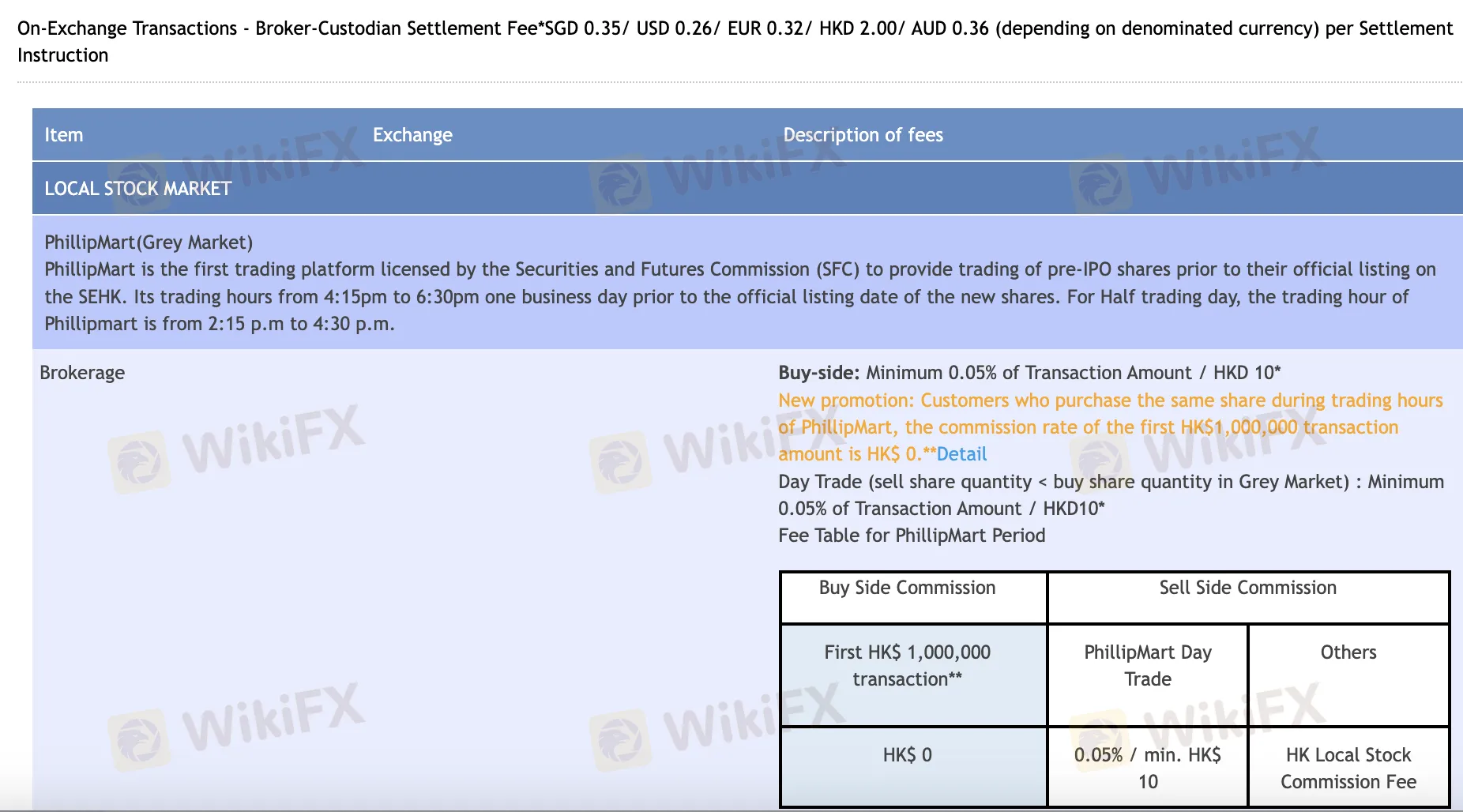

Tarifas de Phillip Securities Group

Especialmente para el comercio en línea y diario, los costos de Phillip Securities Group suelen ser justos y consistentes con los estándares de la industria. Exime de las tarifas de custodia a la mayoría de los consumidores y ofrece acuerdos de comisión cero en artículos seleccionados. Por otro lado, ciertas operaciones en mercados extranjeros, especialmente por teléfono o en bajo volumen, pueden tener mayores tarifas mínimas.

| Mercado/Producto | Corretaje | Impuesto de Timbre | Impuesto de Transacción | Tarifa de Transacción | CCASS/Otras Tarifas | Tarifa de Custodia |

| Acciones de Hong Kong (En línea) | 0.08% (Compra ≤ HKD 30K: $0, Operación Diaria: 0.05%) | 0.10% | 0.00% | 0.01% | 0.01% (Mín HKD 3, Máx HKD 300) | Exento (<5000 lotes de acciones) |

| Warrants y CBBC | 0.03% Operación Diaria / 0.05% después de HKD 50K | Ninguno | 0.00% | 0.01% | 0.01% (Mín HKD 3, Máx HKD 300) | Exento (<5000 lotes de acciones) |

| Acciones Duales en RMB | En línea: 0.08% (Mín CNY 60); Teléfono: 0.25% (Mín CNY 100) | 0.10% | 0.00% | 0.01% | 0.01% (Mín CNY 3, Máx CNY 300) | Exento (<5000 lotes de acciones) |

| Acciones de EE. UU. (En línea) | USD 0.0099/acción (Mín USD 1); Teléfono: 0.25% (Mín USD 20) | Ninguno | Se aplican tarifas de SEC + FINRA + DTC | Incluido arriba | Tarifas de compensación de SEC/FINRA/DTC | ❌ |

| Acciones A de China (Norte) | Compra ≤ ¥30K: ¥0; Compra > ¥30K o Venta: 0.03% (En línea) | 0.05% (Solo VENTA) | Manejo 0.00341%, Gestión 0.002% | ChinaClear 0.001% | 0.002% a través de CCASS | Valor diario de la cartera × 0.008%/365 |

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Hulit City Online | ✔ | Escritorio / Web | Operadores de acciones y futuros que necesitan funcionalidad completa |

| Hulit City Mobile | ✔ | Móvil (iOS/Android) | Operadores de acciones sobre la marcha |

| Stock Easy (SATS) | ✔ | Escritorio | Operadores de acciones principiantes |

| Options Easy (OATS) | ✔ | Escritorio | Operadores de opciones |

| Futures Trading (FATS) | ✔ | Escritorio | Operadores de futuros |