Company Summary

| Phillip Securities Group Review Summary | |

| Founded | 1975 |

| Registered Country/Region | Singapore |

| Regulation | SFC |

| Market Instruments | Securities, futures, forex, bonds, ETFs, insurance |

| Demo Account | ❌ |

| Trading Platform | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Minimum Deposit | / |

| Customer Support | Tel: (852) 2277 6555 |

| Fax: (852) 2277 6008 | |

| Email: cs@phillip.com.hk | |

Phillip Securities Group Information

Established in 1975 and headquartered in Singapore, Phillip Securities Group is a multi-asset financial services company governed by the Hong Kong SFC. Its own trading systems offer a complete range of investment options including futures, FX, stocks, bonds, and fund products. Although platform features and account diversity are good, it lacks a demo or Islamic account right now.

Pros and Cons

| Pros | Cons |

| Licensed by Hong Kong SFC | No demo account or Islamic accounts |

| Wide product range covering local and overseas markets | Some overseas trading incurs high minimum commission |

| Multiple custom trading platforms for different needs | Minimum deposit not clearly mentioned |

Is Phillip Securities Group Legit?

Under License No. AAZ038, Phillip Securities Group is governed by Hong Kong's Securities and Futures Commission (SFC), permitted for dealing in futures contracts and leveraged foreign exchange trading since December 9, 2003.

What Can I Trade on Phillip Securities Group?

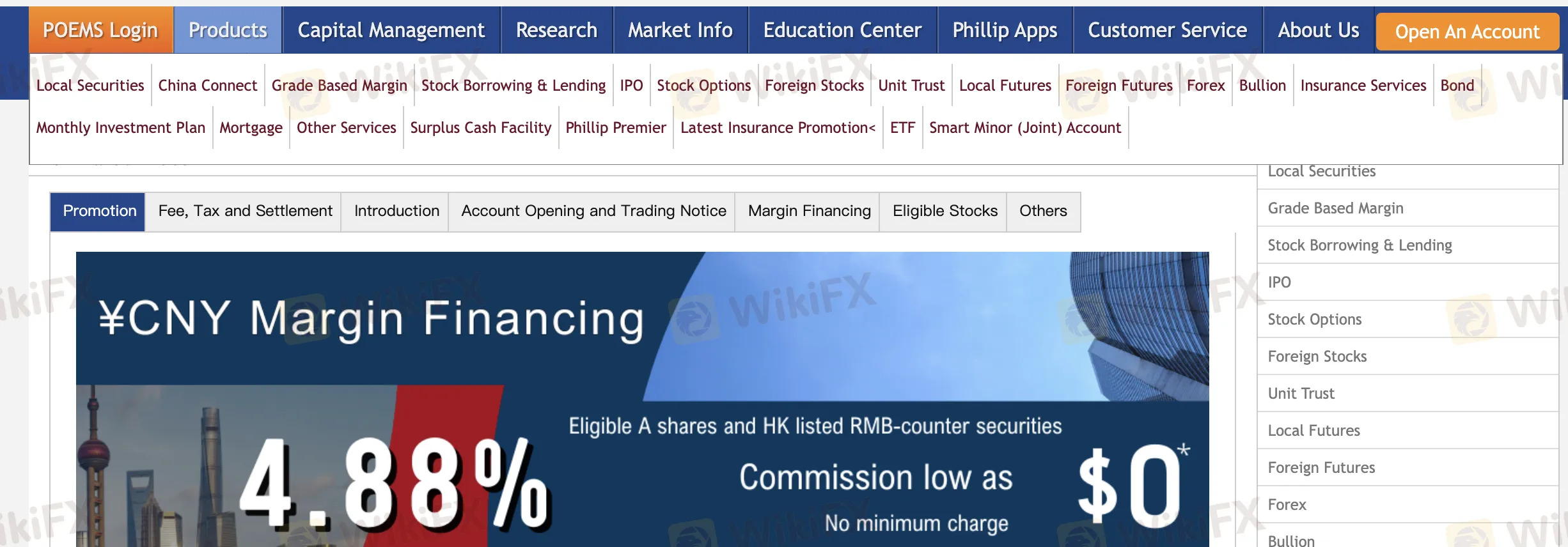

Including securities, futures, currency, bonds, insurance, and capital management solutions including managed funds and ETFs, Phillip Securities offers a thorough spectrum of investment and wealth management services.

| Trading Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Insurance | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Account Type

Phillip Securities (HK) Ltd. provides two primary kinds of live trading accounts: Margin Account and Custodian Account. The company lacks demo accounts or Islamic accounts.

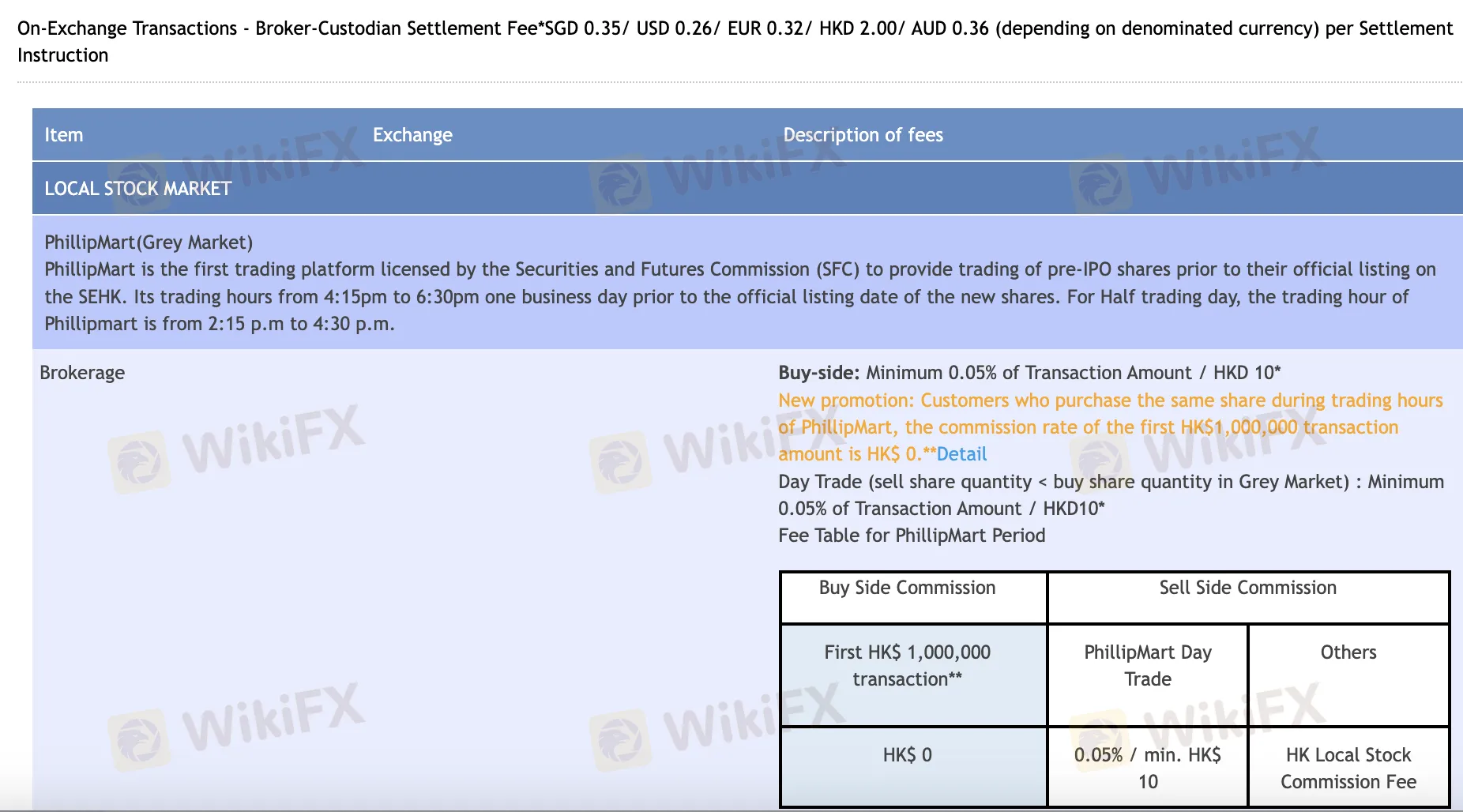

Phillip Securities Group Fees

Especially for online and day trading, Phillip Securities Group's costs are usually fair and consistent with industry standards. It waives custodial fees for most consumers and gives zero commission deals on chosen items. On the other hand, certain foreign market trades—especially by phone or in low-volume—may have greater minimum fees.

| Market/Product | Brokerage | Stamp Duty | Transaction Levy | Transaction Fee | CCASS/Other Fees | Custody Fee |

| HK Stocks (Online) | 0.08% (Buy ≤ HKD 30K: $0, Day Trade: 0.05%) | 0.10% | 0.00% | 0.01% | 0.01% (Min HKD 3, Max HKD 300) | Waived (<5000 board lots) |

| Warrants & CBBC | 0.03% Day Trade / 0.05% after HKD 50K | None | 0.00% | 0.01% | 0.01% (Min HKD 3, Max HKD 300) | Waived (<5000 board lots) |

| RMB Dual Counter Stocks | Online: 0.08% (Min CNY 60); Phone: 0.25% (Min CNY 100) | 0.10% | 0.00% | 0.01% | 0.01% (Min CNY 3, Max CNY 300) | Waived (<5000 board lots) |

| US Stocks (Online) | USD 0.0099/share (Min USD 1); Phone: 0.25% (Min USD 20) | None | SEC + FINRA + DTC fees apply | Included above | SEC/FINRA/DTC clearing fees | ❌ |

| China A-shares (Northbound) | Buy ≤ ¥30K: ¥0; Buy > ¥30K or Sell: 0.03% (Online) | 0.05% (SELL only) | Handling 0.00341%, Mgmt 0.002% | ChinaClear 0.001% | 0.002% via CCASS | Daily portfolio value × 0.008%/365 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Hulit City Online | ✔ | Desktop / Web | Stock & futures traders needing full functionality |

| Hulit City Mobile | ✔ | Mobile (iOS/Android) | On-the-go stock traders |

| Stock Easy (SATS) | ✔ | Desktop | Beginner stock traders |

| Options Easy (OATS) | ✔ | Desktop | Options traders |

| Futures Trading (FATS) | ✔ | Desktop | Futures traders |