Unternehmensprofil

| tobu-sec Überprüfungszusammenfassung | |

| Gegründet | 2004 |

| Registriertes Land/Region | Japan |

| Regulierung | FSA |

| Investitionsprodukte | Aktien, Anleihen, Investmentfonds, Futures, Optionen |

| Handelsplattform | / |

| Kundensupport | Servicezeiten: Werktage 9:00 - 17:00 Uhr |

| Tel: 048-760-1826 | |

tobu-sec Informationen

tobu-sec ist ein japanisches Finanzunternehmen, das von der FSA reguliert wird und verschiedene Produkte anbietet, darunter Aktien, verschiedene Anleihen, Investmentfonds und Derivate.

Vor- und Nachteile

| Vorteile | Nachteile |

| Langjährige Geschichte | Keine Informationen zur Handelsplattform |

| Reguliert durch FSA | Keine Informationen zu Ein- und Auszahlungen |

| Verschiedene Anlageprodukte | |

| Transparenz bei Provisionen |

Ist tobu-sec legitim?

tobu-sec verfügt über eine Retail-Forex-Lizenz, die von der Financial Services Agency (FSA) in Japan reguliert wird, mit der Lizenznummer 関東財務局長(金商)第120号.

| Regulierungsbehörde | Aktueller Status | Reguliertes Land | Lizenztyp | Lizenzierte Einheit | Lizenznummer |

| Financial Services Agency (FSA) | Reguliert | Japan | Retail-Forex-Lizenz | tobu-sec株式会社 | 関東財務局長(金商)第120号 |

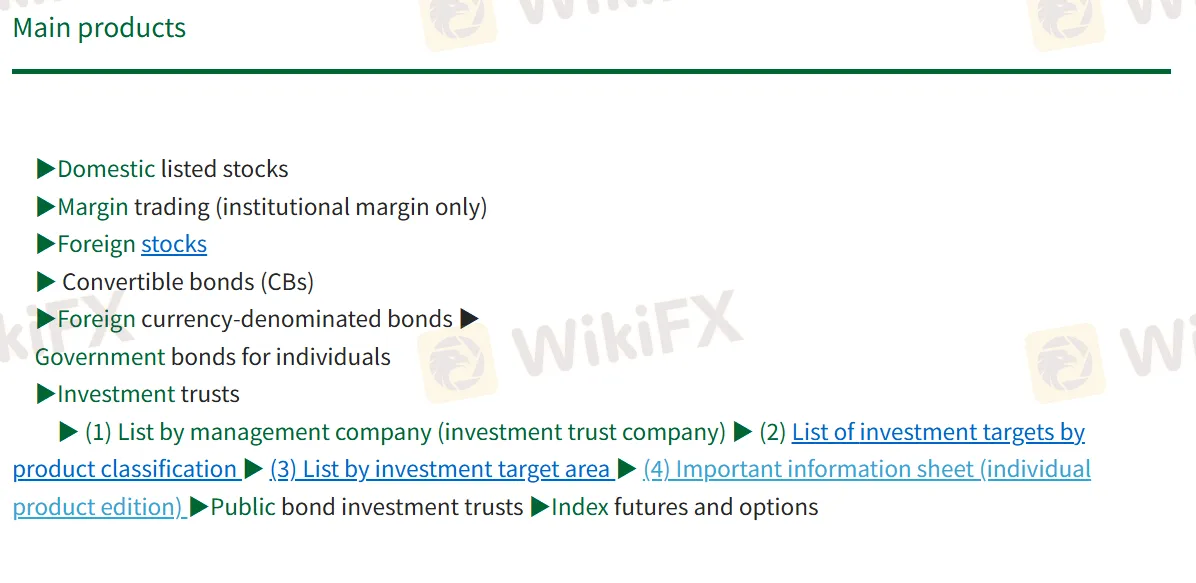

Produkte

Die Produkte von Tobu-sec umfassen verschiedene Wertpapiere wie inländische und ausländische Aktien, verschiedene Arten von Anleihen, Investmentfonds und Derivate wie Indexfutures und Optionen sowie institutionelles Margengeschäft.

| Produkte | Unterstützt |

| Aktien | ✔ |

| Anleihen | ✔ |

| Investmentfonds | ✔ |

| Futures | ✔ |

| Optionen | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| ETFs | ❌ |

Provisionen

Aktien Maklerprovisionsstruktur - Grundlegende Aktien Maklerprovisionsrate

| Vertragsbetrag | Provisionsgebühr (inkl. 10% Steuer) |

| Weniger als 1 Million Yen | 1,265% des Vertragspreises (Min. 2.750 Yen) |

| 1M bis 3M Yen | 0,935% des Vertragspreises + 3.300 Yen |

| 3M bis 5M Yen | 0,880% des Vertragspreises + 4.840 Yen |

| 5M bis 10M Yen | 0,660% des Vertragspreises + 15.840 Yen |

| 10M bis 30M Yen | 0,550% des Vertragspreises + 26.840 Yen |

| 30M bis 50M Yen | 0,330% des Vertragspreises + 92.840 Yen |

| Über 50 Millionen Yen | 257.840 Yen |

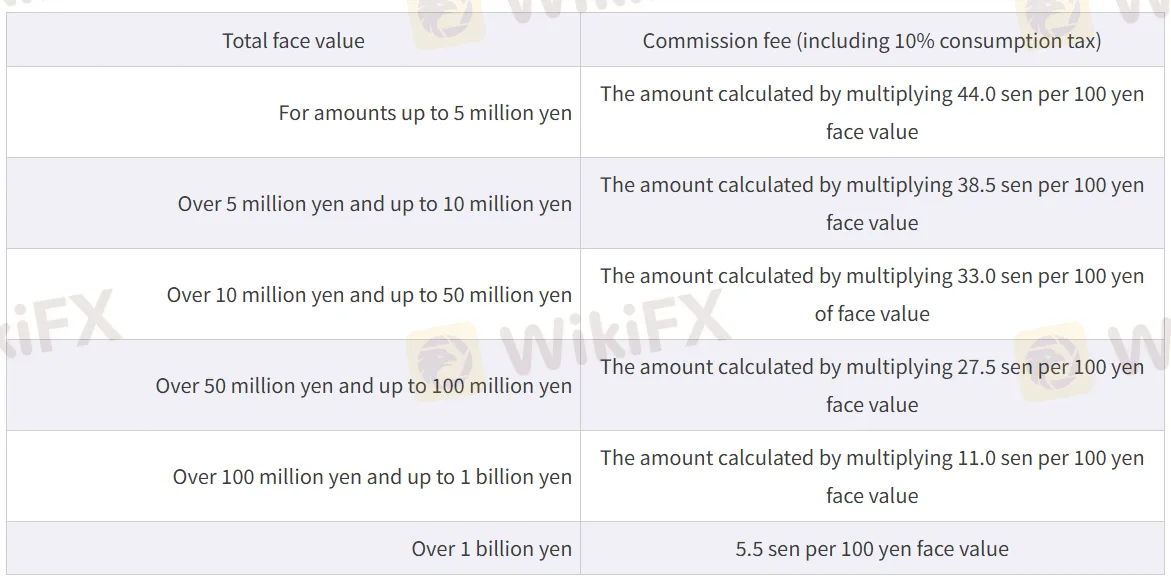

Anleihenmaklerprovisionsraten - Regierungs- Anleihen

| Gesamtnennwert | Provisionsgebühr (inkl. 10% Steuer) |

| Bis zu 5 Millionen Yen | 44,0 Sen pro 100 Yen Nennwert |

| Über 5M bis 10M Yen | 38,5 Sen pro 100 Yen Nennwert |

| Über 10M bis 50M Yen | 33,0 Sen pro 100 Yen Nennwert |

| Über 50M bis 100M Yen | 27,5 Sen pro 100 Yen Nennwert |

| Über 100M Yen bis 1 Milliarde Yen | 11,0 Sen pro 100 Yen Nennwert |

| Über 1 Milliarde Yen | 5,5 Sen pro 100 Yen Nennwert |

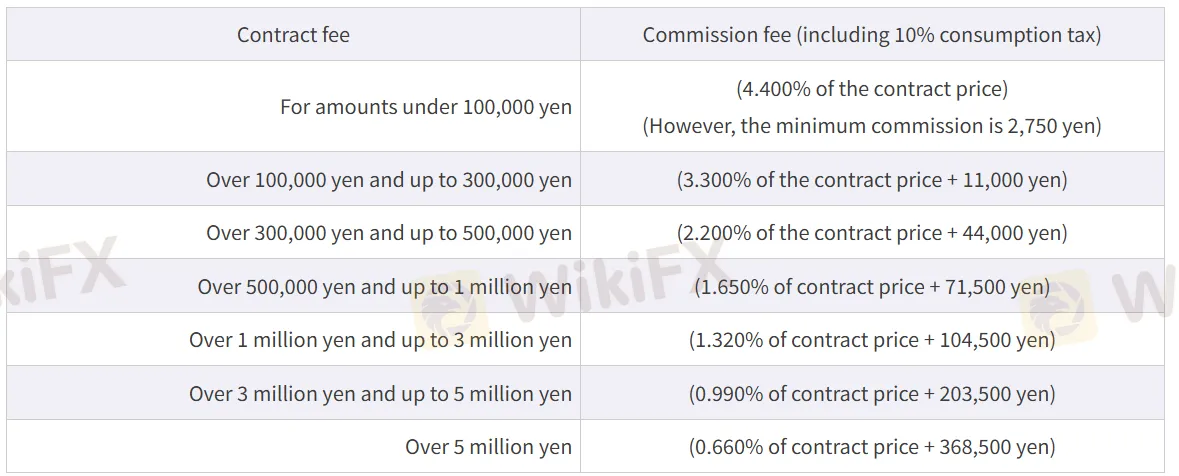

Wertpapier- Options- Handel Kommission Gebühren

| Vertragsbetrag | Provision (inkl. 10% Steuer) |

| Unter 100.000 Yen | 4,400% des Vertragspreises (Min. 2.750 Yen) |

| 100.000 bis 300.000 Yen | 3,300% des Vertragspreises + 11.000 Yen |

| 300.000 bis 500.000 Yen | 2,200% des Vertragspreises + 44.000 Yen |

| 500.000 bis 1M Yen | 1,650% des Vertragspreises + 71.500 Yen |

| 1M bis 3M Yen | 1,320% des Vertragspreises + 104.500 Yen |

| 3M bis 5M Yen | 0,990% des Vertragspreises + 203.500 Yen |

| Über 5 Millionen Yen | 0,660% des Vertragspreises + 368.500 Yen |