公司簡介

| 輝立証券集團 評論摘要 | |

| 成立年份 | 1975 |

| 註冊地區 | 新加坡 |

| 監管 | SFC |

| 市場工具 | 證券、期貨、外匯、債券、ETF、保險 |

| 模擬帳戶 | ❌ |

| 交易平台 | Hulit City Online、Hulit City Mobile、Stock Easy (SATS)、Options Easy (OATS)、Futures Trading (FATS) |

| 最低存款 | / |

| 客戶支援 | 電話:(852) 2277 6555 |

| 傳真:(852) 2277 6008 | |

| 電郵:cs@phillip.com.hk | |

輝立証券集團 資訊

成立於1975年,總部設於新加坡,輝立証券集團 是一家多元資產金融服務公司,受香港SFC監管。其自家交易系統提供完整的投資選擇,包括期貨、外匯、股票、債券和基金產品。儘管平台功能和帳戶多樣性良好,但目前缺乏模擬帳戶或伊斯蘭帳戶。

優缺點

| 優點 | 缺點 |

| 香港SFC許可 | 沒有模擬帳戶或伊斯蘭帳戶 |

| 廣泛的產品範圍涵蓋本地和海外市場 | 部分海外交易收取高最低佣金 |

| 多個定製交易平台,滿足不同需求 | 未明確提及最低存款 |

輝立証券集團 是否合法?

根據牌照號碼AAZ038,輝立証券集團 受香港證券及期貨事務監察委員會(SFC)監管,自2003年12月9日起獲准進行期貨合約和槓桿外匯交易。

我可以在 輝立証券集團 交易什麼?

包括證券、期貨、外匯、債券、保險和資本管理解決方案,包括管理基金和ETF,Phillip Securities提供全面的投資和財富管理服務。

| 交易工具 | 支援 |

| 證券 | ✔ |

| 期貨 | ✔ |

| 外匯 | ✔ |

| 債券 | ✔ |

| ETF | ✔ |

| 保險 | ✔ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

帳戶類型

Phillip Securities (HK) Ltd. 提供兩種主要的實時交易帳戶:保證金帳戶和托管帳戶。 該公司沒有模擬帳戶或伊斯蘭帳戶。

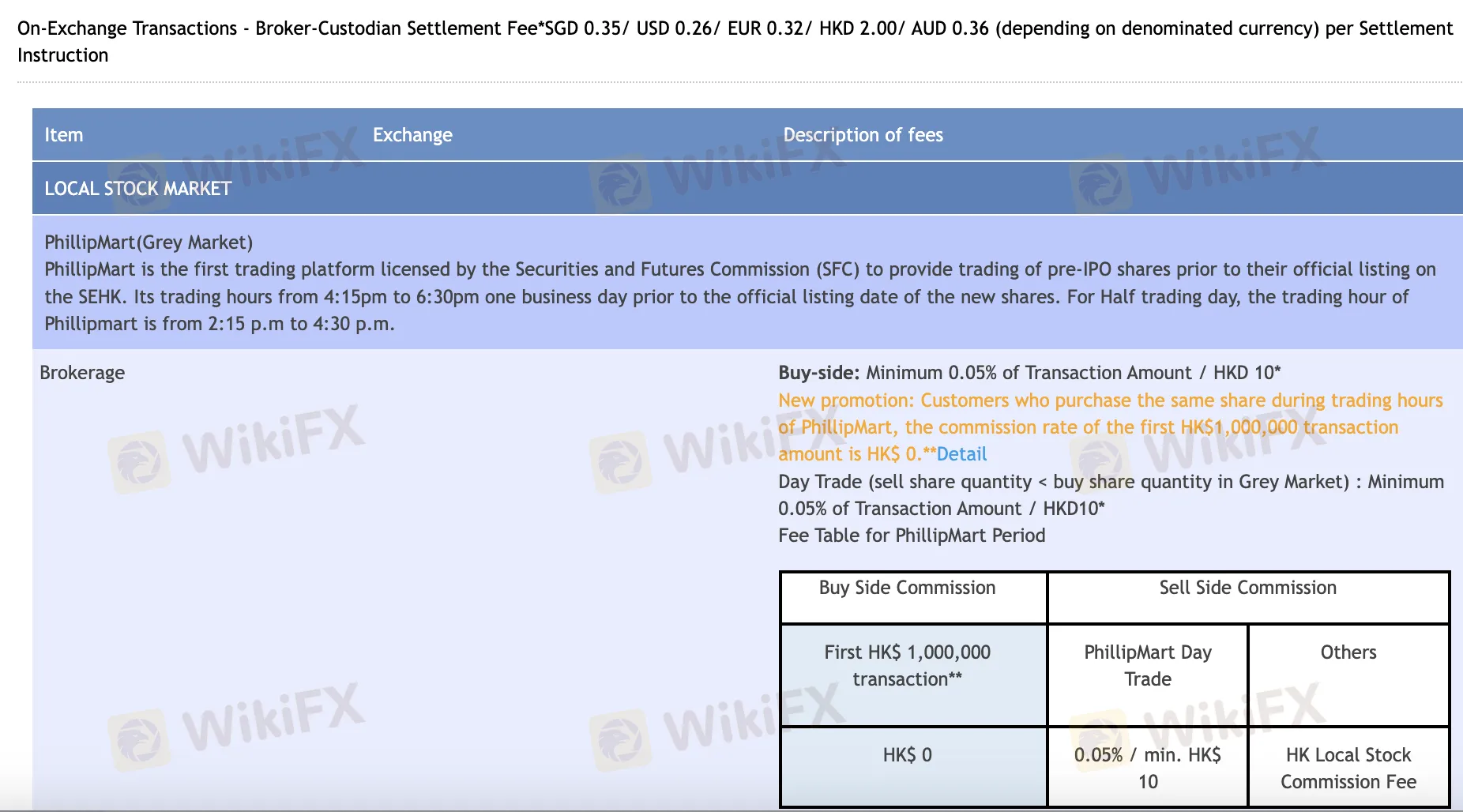

輝立証券集團 費用

對於網上和日內交易,輝立証券集團的費用通常公平且符合行業標準。它為大多數客戶免除了保管費,並在選定的項目上提供零佣金交易。另一方面,某些外國市場交易,特別是通過電話或低交易量的交易,可能會有較高的最低費用。

| 市場/產品 | 佣金 | 印花稅 | 交易徵費 | 交易費 | CCASS/其他費用 | 保管費 |

| 港股(網上) | 0.08%(買入 ≤ HKD 30K:$0,日內交易:0.05%) | 0.10% | 0.00% | 0.01% | 0.01%(最低 HKD 3,最高 HKD 300) | 豁免(<5000手) |

| 認股證及牛熊證 | 0.03% 日內交易 / 0.05% 超過 HKD 50K | 無 | 0.00% | 0.01% | 0.01%(最低 HKD 3,最高 HKD 300) | 豁免(<5000手) |

| 人民幣雙重計價股票 | 網上:0.08%(最低 CNY 60);電話:0.25%(最低 CNY 100) | 0.10% | 0.00% | 0.01% | 0.01%(最低 CNY 3,最高 CNY 300) | 豁免(<5000手) |

| 美股(網上) | USD 0.0099/股(最低 USD 1);電話:0.25%(最低 USD 20) | 無 | SEC + FINRA + DTC費用適用 | 包括在內 | SEC/FINRA/DTC結算費用 | ❌ |

| 中國A股(北向) | 買入 ≤ ¥30K:¥0;買入 > ¥30K 或賣出:0.03%(網上) | 0.05%(僅限賣出) | 處理費 0.00341%,管理費 0.002% | ChinaClear 0.001% | 通過CCASS的0.002% | 每日投資組合價值 × 0.008%/365 |

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| 華立城網上 | ✔ | 桌面 / 網頁 | 需要完整功能的股票和期貨交易者 |

| 華立城手機版 | ✔ | 手機(iOS/Android) | 在外出時進行股票交易 |

| 股票易(SATS) | ✔ | 桌面 | 初學者股票交易者 |

| 期權易(OATS) | ✔ | 桌面 | 期權交易者 |

| 期貨交易(FATS) | ✔ | 桌面 | 期貨交易者 |