Profil perusahaan

| Phillip Securities Group Ringkasan Ulasan | |

| Dibentuk | 1975 |

| Negara/Daerah Terdaftar | Singapura |

| Regulasi | SFC |

| Instrumen Pasar | Saham, futures, forex, obligasi, ETF, asuransi |

| Akun Demo | ❌ |

| Platform Perdagangan | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Deposit Minimum | / |

| Dukungan Pelanggan | Tel: (852) 2277 6555 |

| Fax: (852) 2277 6008 | |

| Email: cs@phillip.com.hk | |

Informasi Phillip Securities Group

Didirikan pada tahun 1975 dan bermarkas di Singapura, Phillip Securities Group adalah perusahaan layanan keuangan multi-aset yang diatur oleh SFC Hong Kong. Sistem perdagangannya sendiri menawarkan berbagai pilihan investasi termasuk futures, FX, saham, obligasi, dan produk dana. Meskipun fitur platform dan keragaman akun bagus, saat ini tidak memiliki akun demo atau akun Islami.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Dilisensikan oleh SFC Hong Kong | Tidak ada akun demo atau akun Islami |

| Rentang produk luas yang mencakup pasar lokal dan luar negeri | Beberapa perdagangan luar negeri mengenakan komisi minimum tinggi |

| Beberapa platform perdagangan kustom untuk kebutuhan yang berbeda | Deposit minimum tidak disebutkan dengan jelas |

Apakah Phillip Securities Group Legal?

Di bawah Lisensi No. AAZ038, Phillip Securities Group diatur oleh Komisi Sekuritas dan Futures Hong Kong (SFC), diizinkan untuk bertransaksi dalam kontrak futures dan perdagangan valuta asing berleverage sejak 9 Desember 2003.

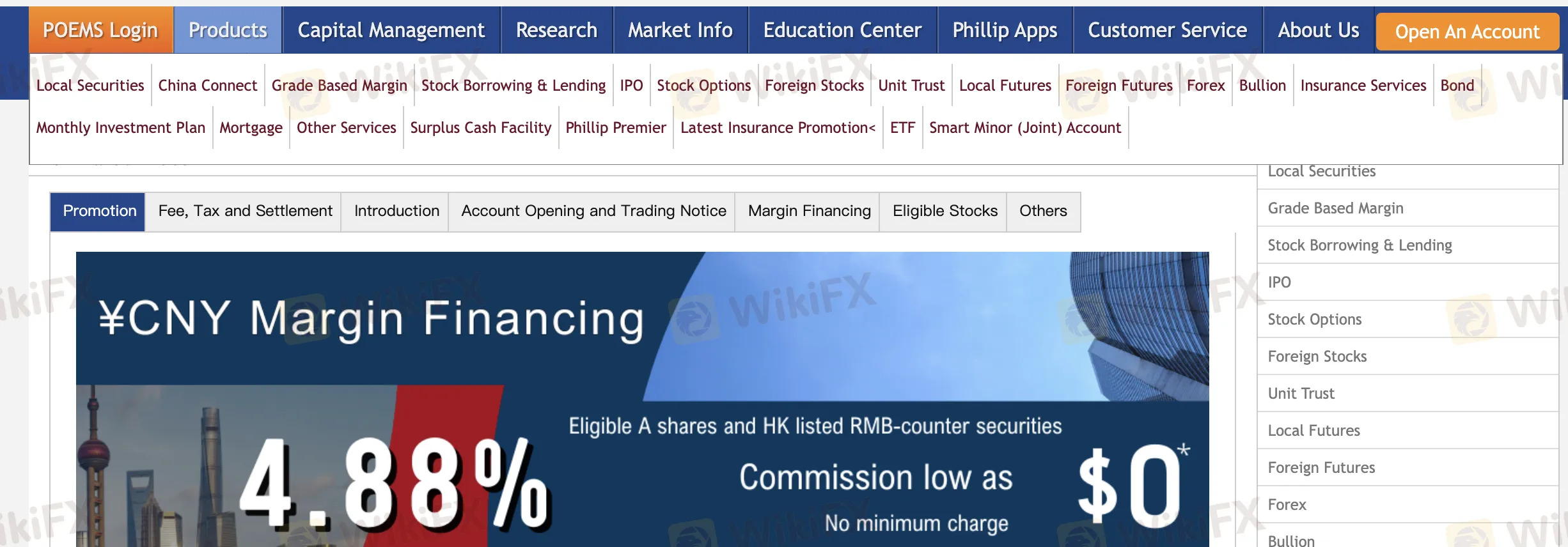

Apa yang Bisa Saya Perdagangkan di Phillip Securities Group?

Termasuk sekuritas, futures, mata uang, obligasi, asuransi, dan solusi manajemen modal termasuk dana kelolaan dan ETF, Phillip Securities menawarkan spektrum layanan investasi dan manajemen kekayaan yang komprehensif.

| Instrumen Perdagangan | Didukung |

| Sekuritas | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Obligasi | ✔ |

| ETF | ✔ |

| Asuransi | ✔ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Opsi | ❌ |

Jenis Akun

Phillip Securities (HK) Ltd. menyediakan dua jenis akun perdagangan langsung utama: Akun Margin dan Akun Penyimpanan. Perusahaan tidak memiliki akun demo atau akun Islami.

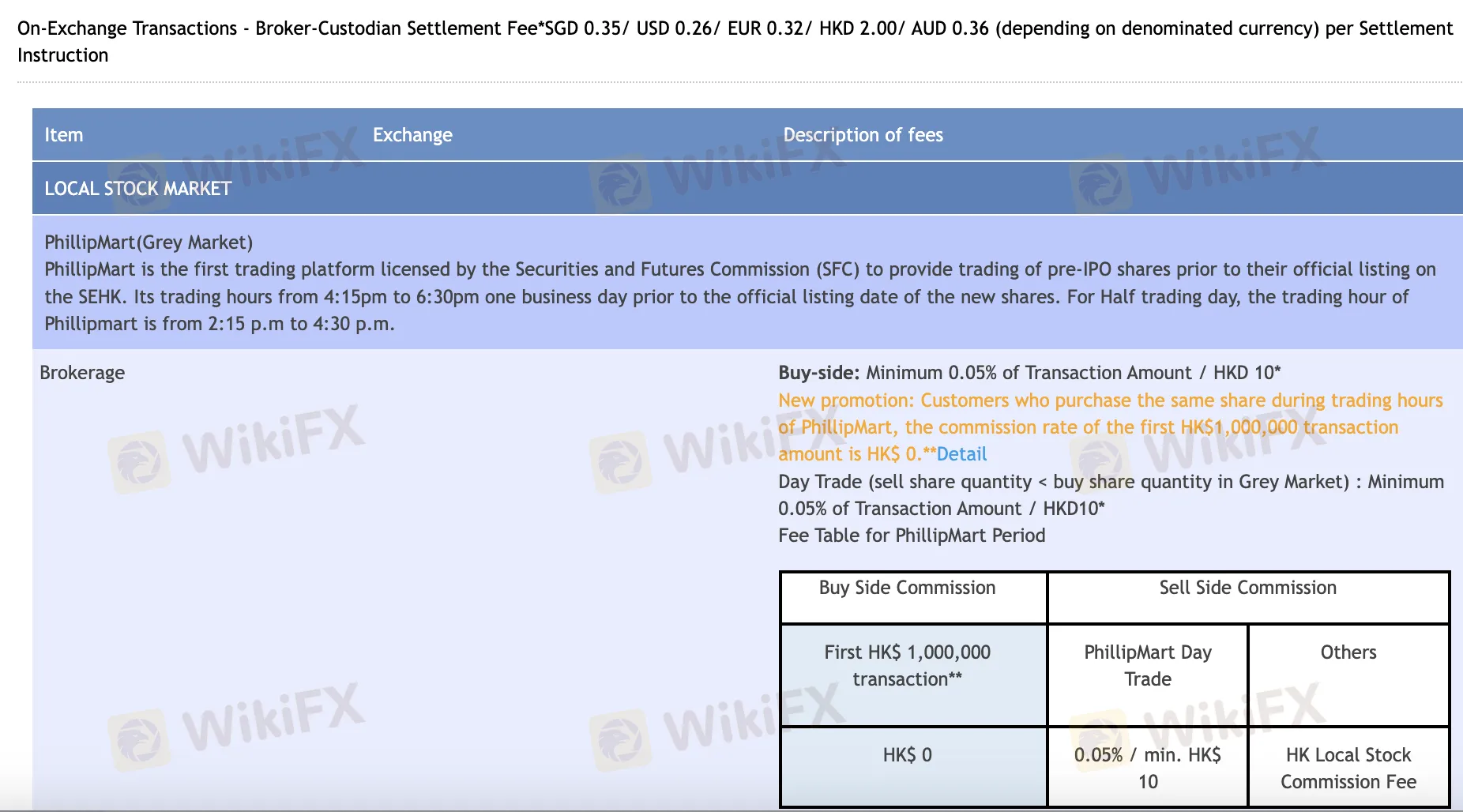

Biaya Phillip Securities Group

Khusus untuk perdagangan online dan harian, biaya Phillip Securities Group biasanya adil dan konsisten dengan standar industri. Perusahaan ini menghapus biaya kustodian bagi sebagian besar konsumen dan memberikan penawaran komisi nol untuk item tertentu. Di sisi lain, perdagangan pasar asing tertentu—terutama melalui telepon atau dalam volume rendah—mungkin memiliki biaya minimum yang lebih tinggi.

| Pasar/Produk | Biaya Makelar | Pajak Materai | Levy Transaksi | Biaya Transaksi | Biaya CCASS/Lainnya | Biaya Penyimpanan |

| Saham HK (Online) | 0,08% (Beli ≤ HKD 30K: $0, Harian: 0,05%) | 0,10% | 0,00% | 0,01% | 0,01% (Min HKD 3, Maks HKD 300) | Dikecualikan (<5000 lot saham) |

| Waran & CBBC | 0,03% Harian / 0,05% setelah HKD 50K | Tidak ada | 0,00% | 0,01% | 0,01% (Min HKD 3, Maks HKD 300) | Dikecualikan (<5000 lot saham) |

| Saham Dual Counter RMB | Online: 0,08% (Min CNY 60); Telepon: 0,25% (Min CNY 100) | 0,10% | 0,00% | 0,01% | 0,01% (Min CNY 3, Maks CNY 300) | Dikecualikan (<5000 lot saham) |

| Saham AS (Online) | USD 0,0099/saham (Min USD 1); Telepon: 0,25% (Min USD 20) | Tidak ada | Biaya SEC + FINRA + DTC berlaku | Termasuk di atas | Biaya kliring SEC/FINRA/DTC | ❌ |

| Saham A China (Arah Utara) | Beli ≤ ¥30K: ¥0; Beli > ¥30K atau Jual: 0,03% (Online) | 0,05% (HANYA JUAL) | Penanganan 0,00341%, Manajemen 0,002% | ChinaClear 0,001% | 0,002% melalui CCASS | Nilai portofolio harian × 0,008%/365 |

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| Hulit City Online | ✔ | Desktop / Web | Pedagang saham & futures yang membutuhkan fungsionalitas penuh |

| Hulit City Mobile | ✔ | Mobile (iOS/Android) | Pedagang saham yang selalu bergerak |

| Stock Easy (SATS) | ✔ | Desktop | Pedagang saham pemula |

| Options Easy (OATS) | ✔ | Desktop | Pedagang opsi |

| Futures Trading (FATS) | ✔ | Desktop | Pedagang futures |