회사 소개

| Phillip Securities Group 리뷰 요약 | |

| 설립 연도 | 1975 |

| 등록 국가/지역 | 싱가포르 |

| 규제 | SFC |

| 시장 상품 | 증권, 선물, 외환, 채권, ETF, 보험 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | 후리트 시티 온라인, 후리트 시티 모바일, 주식 이지 (SATS), 옵션 이지 (OATS), 선물 거래 (FATS) |

| 최소 입금액 | / |

| 고객 지원 | 전화: (852) 2277 6555 |

| 팩스: (852) 2277 6008 | |

| 이메일: cs@phillip.com.hk | |

Phillip Securities Group 정보

1975년에 설립되어 본사를 싱가포르에 둔 Phillip Securities Group은 홍콩 SFC에 의해 규제되는 다자산 금융 서비스 회사입니다. 자체 거래 시스템을 통해 선물, 외환, 주식, 채권 및 펀드 제품을 포함한 다양한 투자 옵션을 제공합니다. 플랫폼 기능과 계정 다양성은 좋지만 현재 데모 계정이나 이슬람 계정이 없습니다.

장단점

| 장점 | 단점 |

| 홍콩 SFC 라이선스 보유 | 데모 계정 또는 이슬람 계정 없음 |

| 국내외 시장을 아우르는 다양한 상품 라인업 | 해외 거래 중 일부는 최소 수수료가 높음 |

| 다양한 Bedding 플랫폼 제공 | 최소 입금액이 명확히 명시되지 않음 |

Phillip Securities Group은 합법적인가요?

라이선스 번호 AAZ038에 따라 Phillip Securities Group은 2003년 12월 9일 이후 선물 계약 및 레버리지 외환 거래를 할 수 있도록 홍콩의 증권 및 선물 위원회 (SFC)에 의해 규제를 받고 있습니다.

Phillip Securities Group에서 무엇을 거래할 수 있나요?

주식, 선물, 통화, 채권, 보험 및 관리된 펀드 및 ETF를 포함한 자본 관리 솔루션을 제공하는 필립 증권은 투자 및 자산 관리 서비스의 폭넓은 스펙트럼을 제공합니다.

| 거래 상품 | 지원 |

| 주식 | ✔ |

| 선물 | ✔ |

| 외환 | ✔ |

| 채권 | ✔ |

| ETFs | ✔ |

| 보험 | ✔ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |

계정 유형

필립 증권 (HK) Ltd.은 마진 계정 및 보관 계정 두 가지 주요 실시간 거래 계정을 제공합니다. 회사는 데모 계정이나 이슬람 계정을 제공하지 않습니다.

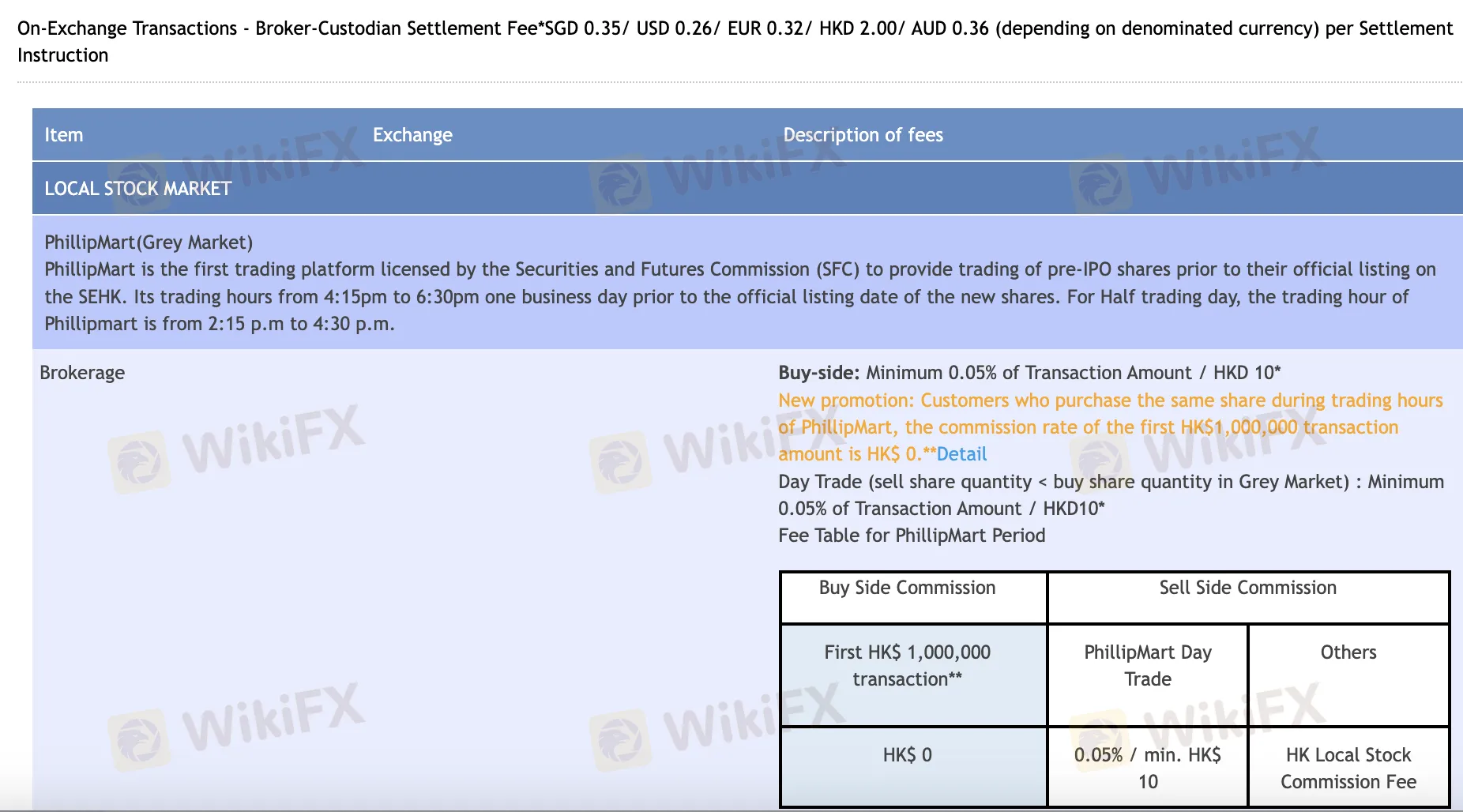

Phillip Securities Group 수수료

온라인 및 데이 트레이딩에 특히 Phillip Securities Group의 비용은 일반적으로 공정하며 산업 표준과 일관성이 있습니다. 대부분의 고객에게 보유료를 면제하고 선택한 품목에 대해 수수료를 부과하지 않습니다. 반면에 일부 외국 시장 거래는 특히 전화로 하거나 거래량이 적을 때 최소 수수료가 더 높을 수 있습니다.

| 시장/상품 | 중개 수수료 | 스탬프 세금 | 거래 세금 | 거래 수수료 | CCASS/기타 수수료 | 보관료 |

| 홍콩 주식 (온라인) | 0.08% (매수 ≤ HKD 30K: $0, 데이 트레이드: 0.05%) | 0.10% | 0.00% | 0.01% | 0.01% (최소 HKD 3, 최대 HKD 300) | 면제 (<5000 보드 로트) |

| 워런트 & CBBC | 0.03% 데이 트레이드 / 0.05% HKD 50K 이상 | 없음 | 0.00% | 0.01% | 0.01% (최소 HKD 3, 최대 HKD 300) | 면제 (<5000 보드 로트) |

| RMB 이중 계좌 주식 | 온라인: 0.08% (최소 CNY 60); 전화: 0.25% (최소 CNY 100) | 0.10% | 0.00% | 0.01% | 0.01% (최소 CNY 3, 최대 CNY 300) | 면제 (<5000 보드 로트) |

| 미국 주식 (온라인) | USD 0.0099/주 (최소 USD 1); 전화: 0.25% (최소 USD 20) | 없음 | SEC + FINRA + DTC 수수료 적용 | 상기 포함 | SEC/FINRA/DTC 청산 수수료 | ❌ |

| 중국 A주식 (북방) | 매수 ≤ ¥30K: ¥0; 매수 > ¥30K 또는 매도: 0.03% (온라인) | 0.05% (매도 전용) | 처리 0.00341%, 관리 0.002% | ChinaClear 0.001% | CCASS를 통한 0.002% | 일일 포트폴리오 가치 × 0.008%/365 |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Hulit City Online | ✔ | 데스크톱 / 웹 | 전체 기능이 필요한 주식 및 선물 트레이더 |

| Hulit City Mobile | ✔ | 모바일 (iOS/Android) | 이동 중인 주식 트레이더 |

| Stock Easy (SATS) | ✔ | 데스크톱 | 초보 주식 트레이더 |

| Options Easy (OATS) | ✔ | 데스크톱 | 옵션 트레이더 |

| Futures Trading (FATS) | ✔ | 데스크톱 | 선물 트레이더 |