Grundlegende Informationen

China

ChinaBewertung

China

|

5-10 Jahre

|

China

|

5-10 Jahre

| http://www.cdfco.com.cn

Website

Bewertungsindex

Einfluss

D

Einflussindex NO.1

Taiwan 2.37

Taiwan 2.37 Lizenzen

LizenzenLizenzierte Einheit:中衍期货有限公司

Lizenznummer:0197

China

China cdfco.com.cn

cdfco.com.cn China

China

| China-Derivatives FuturesBerichtszusammenfassung | |

| Gegründet | 1996 |

| Registriertes Land/Region | China |

| Regulierung | CFFEX |

| Produkte & Dienstleistungen | Futures, Brokerage, Investment, Consulting, Asset Management, Fund |

| Demokonto | ✅ |

| Hebel | / |

| Spread | / |

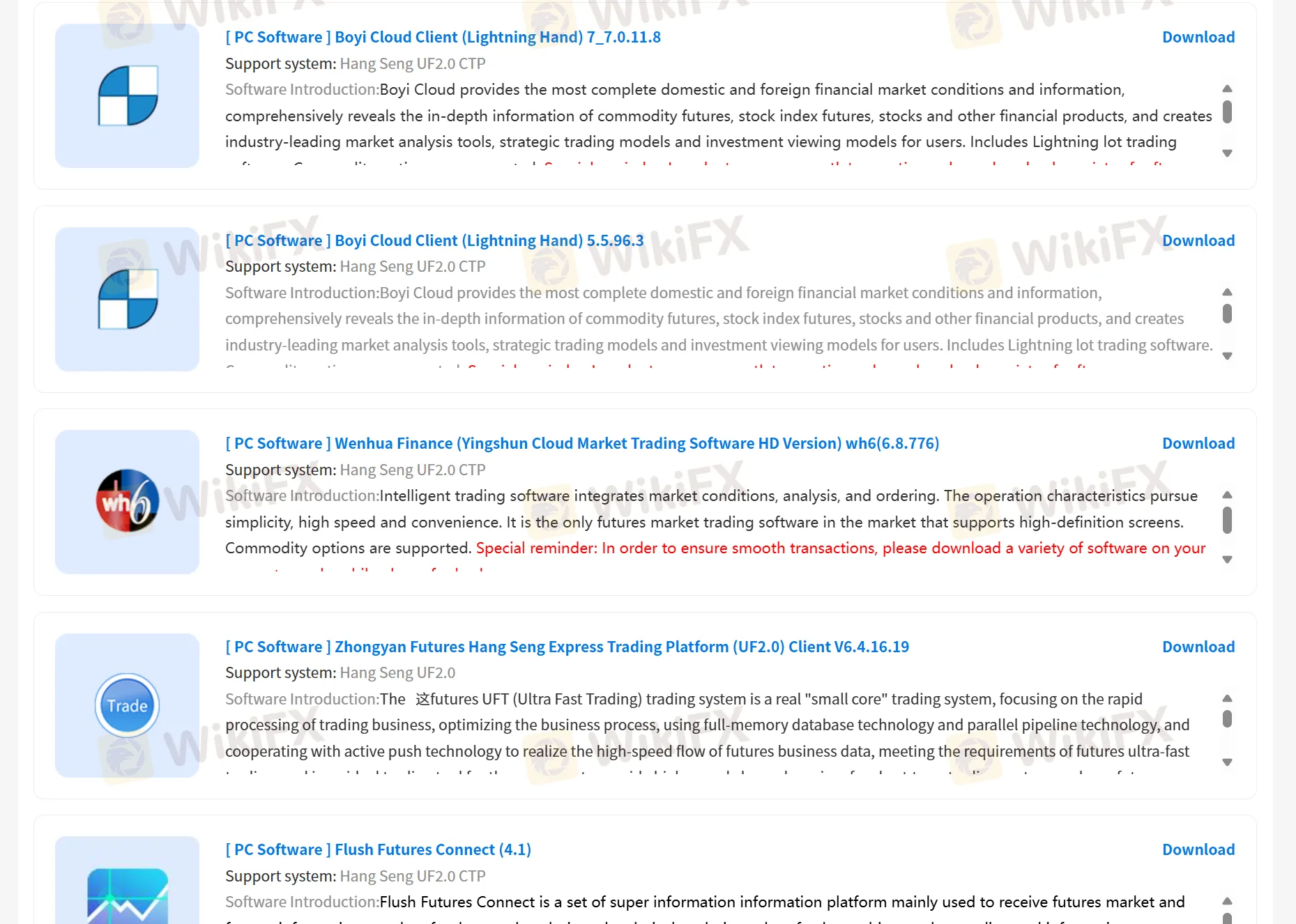

| Handelsplattform | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, und TradeBlazer |

| Mindesteinzahlung | / |

| Kundensupport | Live-Chat |

| E-Mail: office@cdfco.com.cn | |

| Telefon: 400-688-1117 | |

| Adresse: Zhongyan Futures Co., Ltd., 7. Stock, Gebäude B, Jinchang'an-Gebäude, Nr. 82 Dongsi Vierte Ringstraße, Stadtbezirk Chaoyang, Peking | |

1996 gegründet, ist China-Derivatives Futures Co., Ltd. ein reguliertes Unternehmen unter der Aufsicht der China Financial Futures Exchange (CFFEX). Es bedient jedoch nur Kunden innerhalb Chinas und ist ein bedeutender Akteur auf dem heimischen Derivatemarkt. Es handelt sich um ein umfassendes Finanzunternehmen, das von der China Securities Regulatory Commission (CSRC) genehmigt wurde und sich auf inländische Waren-Futures-Brokerage, Finanz-Futures-Brokerage, Futures-Handelsberatung, Vermögensverwaltung und den öffentlichen Verkauf von Wertpapierinvestmentfonds spezialisiert hat.

| Vorteile | Nachteile |

| Reguliert durch CFFEX | Mangelnde Transparenz |

| Spezialisiert auf Futures-Handel | |

| Unterstützung für Demo-Handel | |

| Verschiedene Handelsplattformen | |

| Langjährige Betriebshistorie |

China-Derivatives Futures wird von CFFEX unter den Lizenznummern 0197 reguliert.

| Reguliertes Land | Regulierungsbehörde | Regulierungsstatus | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| China | China Financial Futures Exchange (CFFEX) | Reguliert | China Commodity Futures Co., Ltd. | Futures-Lizenz | 0197 |

China-Derivatives Futures konzentriert sich hauptsächlich auf den Handel mit Futures und bietet auch eine umfassende Palette von Anlage-Dienstleistungen wie Maklerdienste, Investitionen, Beratung, Vermögensverwaltung und Fonds an.

| Produkte & Dienstleistungen | Unterstützt |

| Futures | ✔ |

| Fonds | ✔ |

| Maklerdienste | ✔ |

| Investitionen | ✔ |

| Beratung | ✔ |

| Vermögensverwaltung | ✔ |

China Derivatives Futures unterstützt den Handel über eigene Plattformen, China-Derivatives Futures App, und Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star und TradeBlazer. Darüber hinaus bietet es Kunden die Möglichkeit, den Handel zu simulieren.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| China-Derivatives Futures App | ✔ | PC, Mobile | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

Based on my experience as a trader and after reviewing the details about China-Derivatives Futures, I believe it's essential to approach this broker with a cautious mindset. While it is regulated in China by the CFFEX and has a long business history, I noticed some important factors that warrant attention. First, there is mention of a "suspicious scope of business," which, for me, raises concerns about full regulatory coverage and the broker’s activities outside its core offerings. Clarity about exactly what is regulated versus what is not is vital, as unregulated operations may expose clients to unexpected risks. Additionally, customer experiences appear mixed, with one significant exposure highlighting issues such as withdrawal delays and vague explanations from support staff. While some clients report positive experiences and transparent fees, the negative report regarding withdrawal difficulty cannot be disregarded. In my view, consistently reliable fund withdrawals are non-negotiable for trust in any broker. Another point I weigh heavily is that China-Derivatives Futures predominantly serves domestic Chinese clients. For non-residents, access to customer support, regulatory recourse, and platform familiarity could be limited or challenging. Furthermore, as the platforms offered are proprietary or locally focused, traders who are used to international standards like MT4/MT5 may find adaptation difficult. Ultimately, while regulation and long operational history are positives, I only proceed with brokers after thorough due diligence, an understanding of all withdrawal policies, and confirmation that all activities are properly licensed. Personal vigilance is key in safeguarding my capital.

As an independent trader with a strong focus on due diligence, I always prioritize transparency when evaluating brokers. In my detailed review of China-Derivatives Futures, I found that while the company has a long operating history and is officially regulated in China under CFFEX, specific trading conditions for standard forex pairs like EUR/USD, such as spreads, are not explicitly disclosed in available materials. My experience tells me that any reputable broker should clearly publish critical metrics like average spreads, especially since these costs significantly impact trading outcomes. For China-Derivatives Futures, the emphasis is primarily on futures trading and related financial instruments rather than traditional spot forex products. Their product range and platforms appear tailored for domestic futures markets, not global forex, with no direct mention of specific spreads or leverage on major currency pairs. Whenever I encounter this kind of information gap, particularly for something as fundamental as the EUR/USD spread, I prefer a cautious approach and recommend that potential clients contact the broker directly for precise trading details. This lack of transparency makes it difficult for me to properly assess trading costs and risk, which, from a risk management perspective, is essential before committing any funds. If transparency on standard spreads is lacking, I always consider it a significant limitation.

In my experience with China-Derivatives Futures, I found that their primary focus is on futures trading rather than the broad array of instruments commonly offered by offshore forex brokers. As someone always seeking transparency and regulatory clarity, I note that China-Derivatives Futures operates under a CFFEX futures license and is supervised by Chinese authorities, strictly serving mainland clients. Their specialty lies in domestic commodity futures and financial futures, so for traders like me aiming for exposure to global spot forex, international stocks, or cryptocurrencies, this broker does not meet those needs. Through their proprietary platforms, including their own app and several desktop solutions such as Boyi Client Cloud and Wenhua Finance, I was able to access instruments tied to China’s futures markets. Besides futures, they advertise additional services like investment consulting, asset management, and brokerage for funds, but I did not see access to individual stocks, spot forex pairs, indices, or digital assets. For me, the appeal of China-Derivatives Futures is their established presence and their clear regulatory status in China, but I have to stress this broker’s product offering is highly specialized. Anyone considering them should be seeking exposure to mainland China’s futures and perhaps fund products, not broader global markets. As always, I view specialization as a double-edged sword; it brings depth in one area, but also limits diversification opportunities for a trader’s portfolio.

As someone who values the ability to evaluate a broker before committing real funds, the availability of a demo account is a significant factor in my decision-making process. With China-Derivatives Futures, I found that they do indeed offer demo trading—an important resource for both beginners and experienced traders seeking to familiarize themselves with the broker’s proprietary platforms and functionalities, such as the China-Derivatives Futures App and several desktop solutions. This demo access allowed me to simulate trades and understand the user interface, which I believe helps minimize initial trading errors and builds confidence before moving to live markets. However, while the context confirms that demo trading is supported, I was unable to find any specific mention regarding restrictions like a time limit or capped virtual funds. In my experience, prudent traders should always clarify such terms directly with the broker, as some platforms may introduce limitations on demo accounts that can affect the learning experience. For me, this cautious approach is essential, especially when dealing with derivatives trading, where risk management and platform familiarity are critical. Overall, having demo access influenced my perception positively, allowing for safer skill development, but I would advise anyone to verify any potential demo account restrictions through official channels before relying on this feature extensively.

Bitte eingeben...

TOP

TOP

Chrome

Chrome Plug-In

Aufsichtsrechtliche Anfrage zu globalen Forex-Brokern

Es durchsucht die Forex-Broker-Websites und identifiziert die legitimen und betrügerischen Broker genau

Jetzt installieren

扶众法援

China

In diesem März erhielt ich eine Freundschaftsanfrage, von der ich dachte, dass es sich um einen Aktienfreund handeln könnte. Dann wurde ich in eine Vorbereitungsgruppe gezogen, in der Mitglieder Gewinn-Screenshots zeigten. Ich wurde für eine Weile bewegt und beobachtet. Später wurde ich auch registriert und folgte den Anweisungen des Lehrers. Der Lehrer bat mich, die Kaution auf 500.000 als Schwellenwert zu bringen, und behauptete, dass professionelle Lehrer für mich arbeiten könnten. Es gab Gewinne und Verluste. Als nur noch 100.000 übrig waren, habe ich versucht, die Auszahlung zu beantragen. Der Finanzierungskanal war jedoch aufgrund der Existenz von Risiken nicht verfügbar. Der Lehrer wehrte sich weiter und bemerkte, dass die Ein- / Auszahlung möglicherweise verschoben wurde. Die Auszahlung ist für eine Woche nicht möglich.

Exposition

Cris Men

Ecuador

Ich hatte noch nie Probleme mit Abhebungen oder ähnlichem

Positive

Maximilian 111

Nigeria

Ich handle hier die ganze Zeit mit Rohstoffen. Es bietet transparente Gebühren und einen großartigen Kundenservice, was immer meine solide Wahl ist.

Positive

Vegas

Kolumbien

China-Derivatives Futures co,.LTD. bietet eine Vielzahl von Handels-Apps an, für den Fall von Handelsfehlern, sehr intim. Und das Unternehmen hat eine formale Regulierungsbehörde, Handelsinformationen sind offen und transparent, ich bin sehr beruhigt.

Positive