Resumo da empresa

| Phillip Securities Group Resumo da Revisão | |

| Fundação | 1975 |

| País/Região Registrada | Singapura |

| Regulação | SFC |

| Instrumentos de Mercado | Ações, futuros, forex, títulos, ETFs, seguros |

| Conta Demonstrativa | ❌ |

| Plataforma de Negociação | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Depósito Mínimo | / |

| Suporte ao Cliente | Tel: (852) 2277 6555 |

| Fax: (852) 2277 6008 | |

| Email: cs@phillip.com.hk | |

Informações sobre Phillip Securities Group

Fundada em 1975 e sediada em Singapura, Phillip Securities Group é uma empresa de serviços financeiros multiativos regulada pela SFC de Hong Kong. Seus próprios sistemas de negociação oferecem uma ampla gama de opções de investimento, incluindo futuros, FX, ações, títulos e produtos de fundos. Embora as características da plataforma e a diversidade de contas sejam boas, atualmente falta uma conta demo ou islâmica.

Prós e Contras

| Prós | Contras |

| Licenciado pela SFC de Hong Kong | Sem conta demo ou contas islâmicas |

| Ampla gama de produtos cobrindo mercados locais e internacionais | Algumas negociações internacionais incorrem em comissão mínima alta |

| Múltiplas plataformas de negociação personalizadas para diferentes necessidades | Depósito mínimo não claramente mencionado |

Phillip Securities Group é Legítimo?

Sob a Licença No. AAZ038, Phillip Securities Group é regulamentado pela Comissão de Valores Mobiliários e Futuros de Hong Kong (SFC), autorizado para negociação de contratos futuros e operações de câmbio alavancado desde 9 de dezembro de 2003.

O Que Posso Negociar na Phillip Securities Group?

Incluindo títulos, futuros, moedas, títulos, seguros e soluções de gestão de capital, incluindo fundos geridos e ETFs, a Phillip Securities oferece um amplo espectro de serviços de investimento e gestão de patrimônio.

| Instrumentos de Negociação | Suportado |

| Títulos | ✔ |

| Futuros | ✔ |

| Forex | ✔ |

| Títulos | ✔ |

| ETFs | ✔ |

| Seguros | ✔ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Opções | ❌ |

Tipo de Conta

A Phillip Securities (HK) Ltd. oferece dois tipos principais de contas de negociação ao vivo: Conta de Margem e Conta de Custódia. A empresa não oferece contas de demonstração ou contas islâmicas.

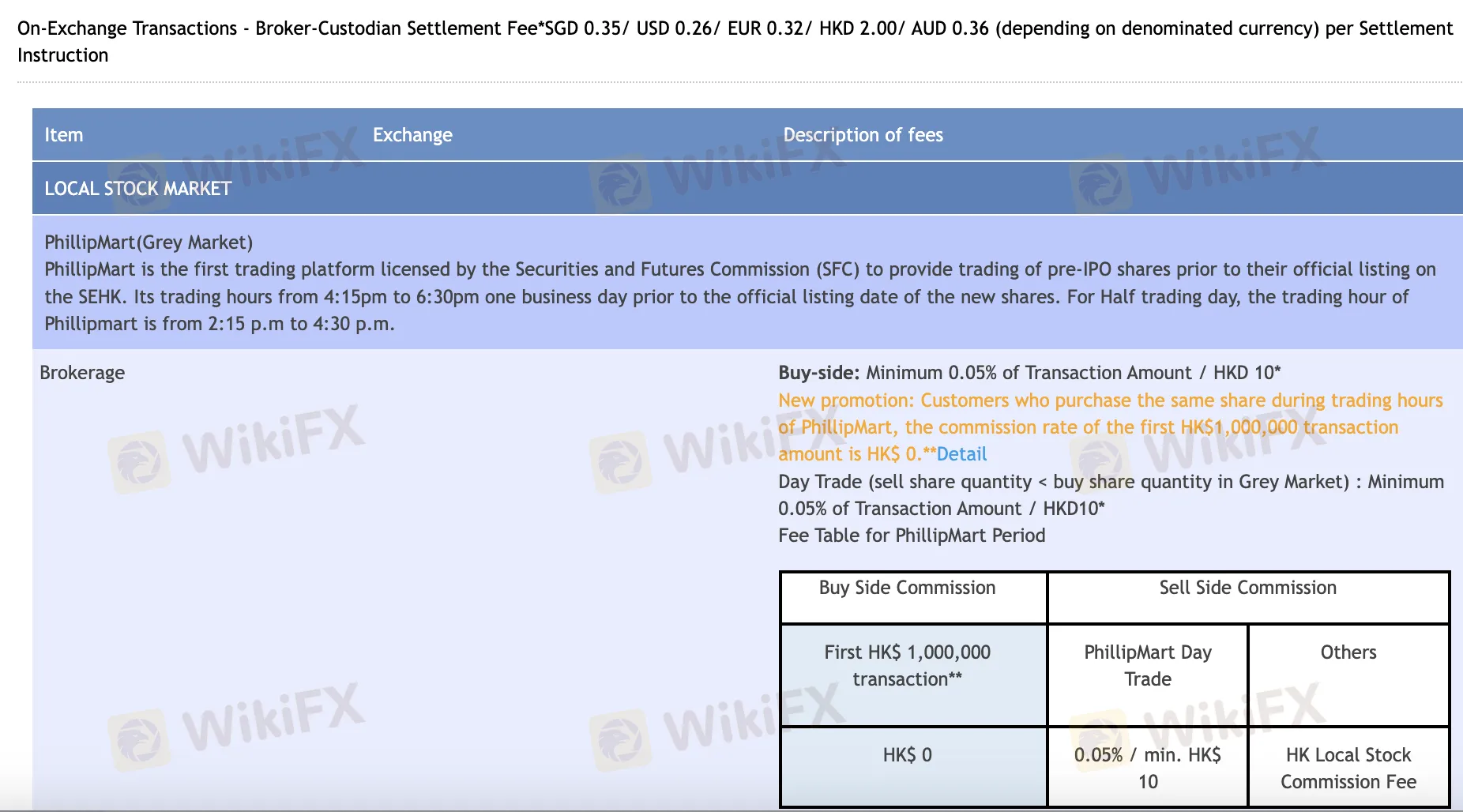

Taxas de Phillip Securities Group

Especialmente para negociação online e diária, os custos da Phillip Securities Group geralmente são justos e consistentes com os padrões da indústria. Ele renuncia às taxas de custódia para a maioria dos consumidores e oferece negociações sem comissão em itens selecionados. Por outro lado, certas negociações em mercados estrangeiros—especialmente por telefone ou em baixo volume—podem ter maiores taxas mínimas.

| Mercado/Produto | Corretagem | Imposto de Selo | Imposto de Transação | Taxa de Transação | CCASS/Outras Taxas | Taxa de Custódia |

| Ações de HK (Online) | 0,08% (Compra ≤ HKD 30K: $0, Day Trade: 0,05%) | 0,10% | 0,00% | 0,01% | 0,01% (Mín HKD 3, Máx HKD 300) | Isento (<5000 lotes de ações) |

| Warrants & CBBC | 0,03% Day Trade / 0,05% após HKD 50K | Nenhum | 0,00% | 0,01% | 0,01% (Mín HKD 3, Máx HKD 300) | Isento (<5000 lotes de ações) |

| Ações de Balcão Dual RMB | Online: 0,08% (Mín CNY 60); Telefone: 0,25% (Mín CNY 100) | 0,10% | 0,00% | 0,01% | 0,01% (Mín CNY 3, Máx CNY 300) | Isento (<5000 lotes de ações) |

| Ações dos EUA (Online) | USD 0,0099/ação (Mín USD 1); Telefone: 0,25% (Mín USD 20) | Nenhum | Aplicam-se taxas SEC + FINRA + DTC | Incluído acima | Taxas de compensação SEC/FINRA/DTC | ❌ |

| Ações A da China (Norte) | Compra ≤ ¥30K: ¥0; Compra > ¥30K ou Venda: 0,03% (Online) | 0,05% (VENDA apenas) | Manuseio 0,00341%, Gerenciamento 0,002% | ChinaClear 0,001% | 0,002% via CCASS | Valor diário da carteira × 0,008%/365 |

Plataforma de Negociação

| Plataforma de Negociação | Compatível | Dispositivos Disponíveis | Adequado para |

| Hulit City Online | ✔ | Desktop / Web | Traders de ações e futuros que precisam de funcionalidade completa |

| Hulit City Mobile | ✔ | Móvel (iOS/Android) | Traders de ações em movimento |

| Stock Easy (SATS) | ✔ | Desktop | Traders iniciantes de ações |

| Options Easy (OATS) | ✔ | Desktop | Traders de opções |

| Futures Trading (FATS) | ✔ | Desktop | Traders de futuros |