Unternehmensprofil

| 4e Überprüfungszusammenfassung | |

| Gegründet | 2023 |

| Registriertes Land/Region | Malaysia |

| Regulierung | Unreguliert |

| Marktinstrumente | Digitale Assets, Forex, Rohstoffe, Aktien und Indizes |

| Demokonto | ✅ |

| Hebelwirkung | / |

| Spread | Variabel |

| Handelsplattform | Web, mobile App |

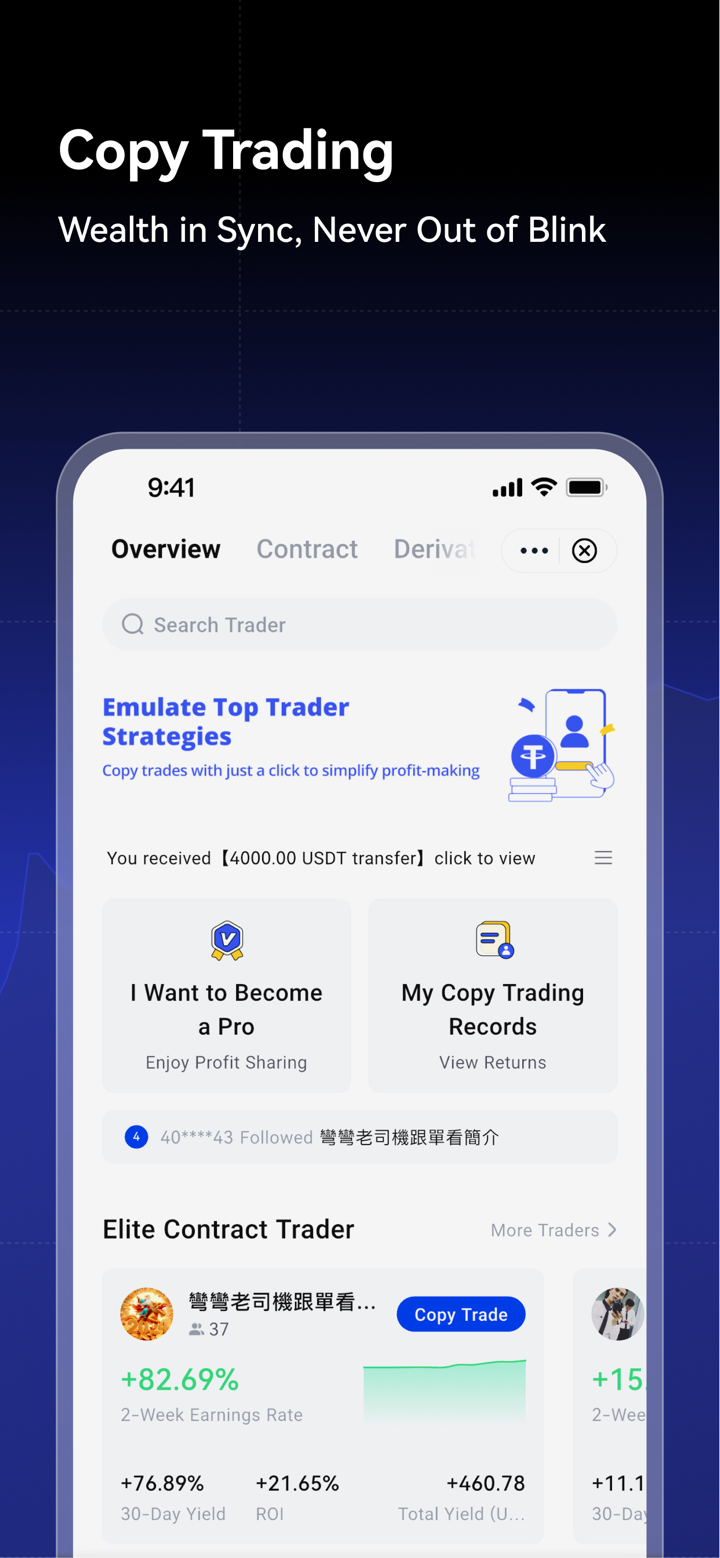

| Kopierhandel | ✅ |

| Mindesteinzahlung | / |

| Kundensupport | 24/7 Live-Chat |

| X: https://twitter.com/4e_Globalt=pskuEUAmV5h_AGEtle08yw&s=09 | |

| Instagram: https://www.instagram.com/global_4e/ | |

| Youtube: https://www.youtube.com/@4E_Global | |

| Regionale Beschränkungen | Nordkorea, Kuba, Syrien, Iran, Venezuela, Sudan, Südsudan, Krim, Russland, Libanon, Irak, Libyen, Vereinigte Staaten, Bangladesch, Indien und Pakistan |

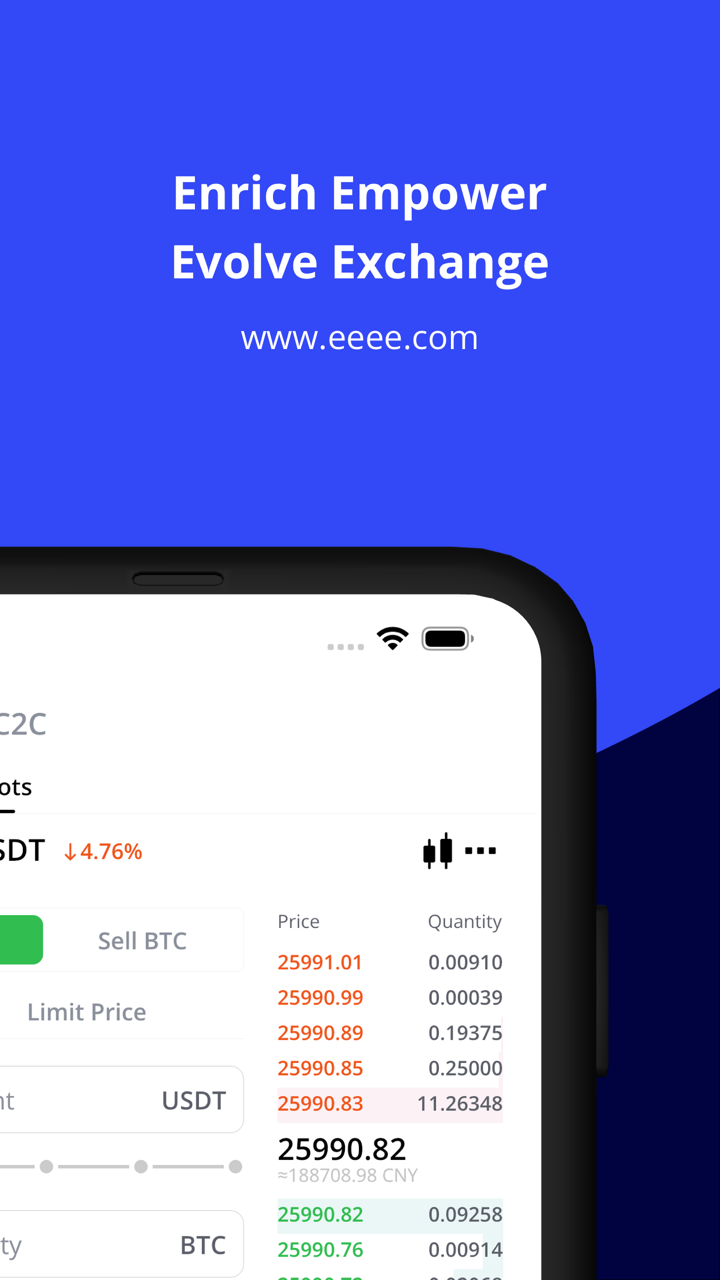

4e ist eine Finanzderivat-Handelsplattform, die 2023 in Malaysia registriert wurde. Sie bietet den Handel mit digitalen Assets, Forex, Rohstoffen, Aktien und Indizes an. Derzeit operiert sie jedoch ohne Aufsicht einer Finanzbehörde.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Handelsmöglichkeiten | Keine Regulierung |

| Demokonten verfügbar | Mangelnde Transparenz |

| Kopierhandel | Hohe Inaktivitätsgebühr |

| 24/7 Live-Chat-Support | Keine zuverlässige Handelsplattform |

| Begrenzte Zahlungsoptionen | |

| Regionale Beschränkungen |

Ist 4e seriös?

Nein, 4e ist kein seriöser Finanzdienstleister. Wir haben keine Informationen über seine Regulierung gefunden und empfehlen daher dringend, den Umgang mit 4e zu vermeiden und stattdessen einen Broker zu wählen, der ordnungsgemäß lizenziert und reguliert ist.

Was kann ich auf 4e handeln?

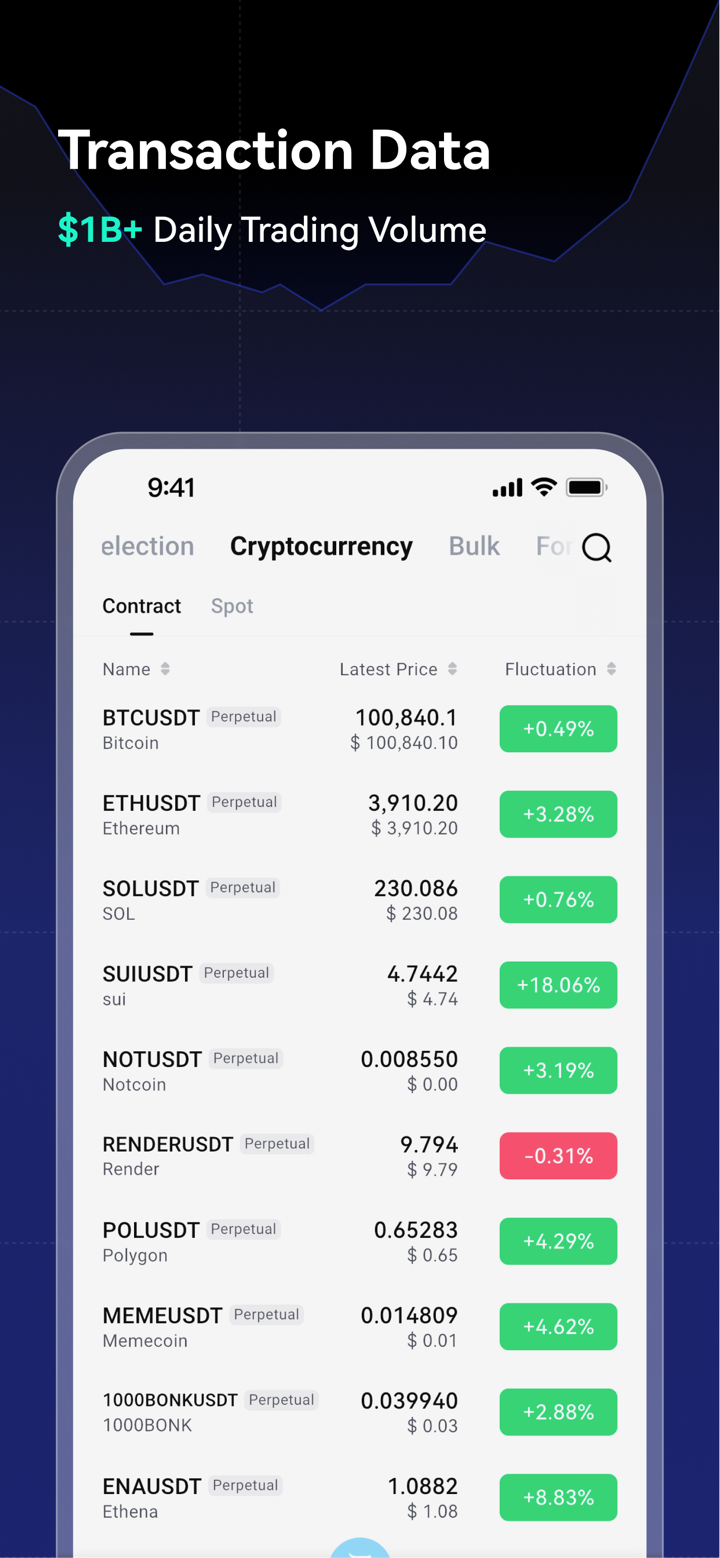

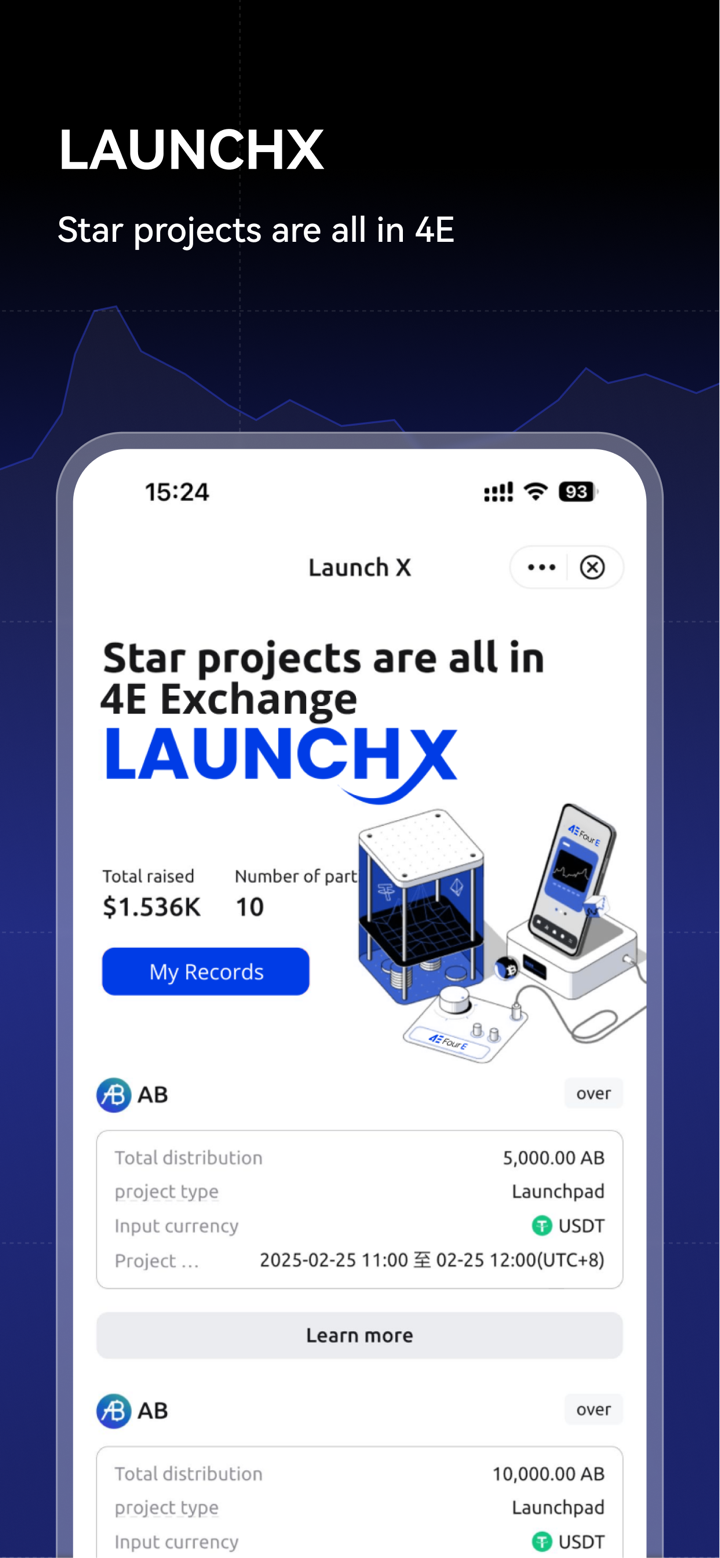

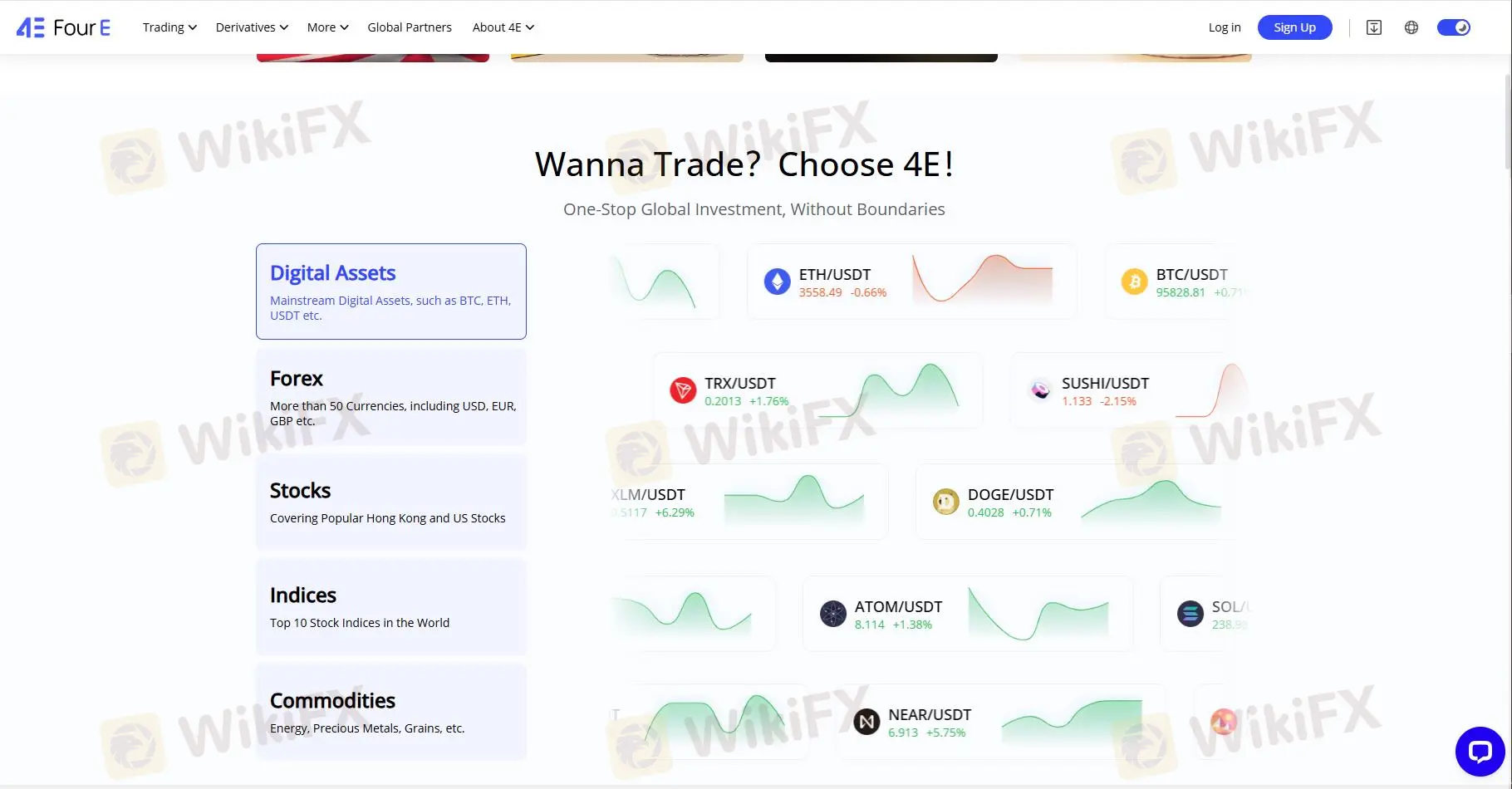

4e bietet verschiedene Handelsmöglichkeiten, darunter digitale Assets, Forex, Rohstoffe, ETFs, Aktien und Indizes.

Digitale Assets: Mainstream-Digitale Assets wie BTC, ETH, USDT usw.

Forex: Über 50 Währungen, darunter USD, EUR, GBP usw.

Aktien: Beliebte Hongkonger und US-Aktien (AAPL, GOOG, Cocacola, KO, MSFT, TSLA...)

Indizes: US30, Japan 225, US 500, US SPX 500, UK 100, US NDAQ 100, Euro 50....

Waren: Energie, Edelmetalle, Getreide, Silber, NGAS...

| Handelbare Instrumente | Unterstützt |

| Forex | ✔ |

| Waren | ✔ |

| Indizes | ✔ |

| Aktien | ✔ |

| Kryptowährungen | ✔ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

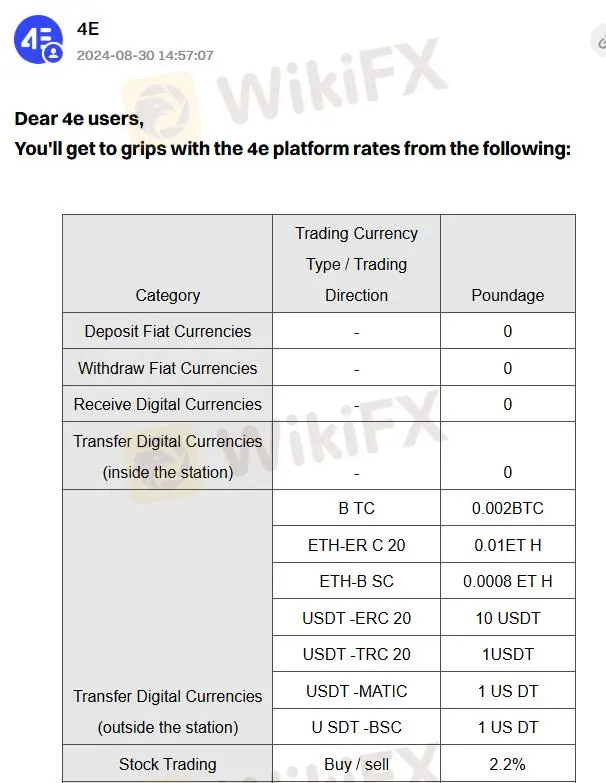

4e Gebühren

4e berechnet eine bestimmte Provision für den Handel mit digitalen Währungen und Aktien. Details entnehmen Sie bitte dem folgenden Formular. Andere Arten von Handelsinstrumenten werden in Bezug auf die Provision nicht erwähnt.

| Kategorie | Handelswährungstyp/Handelsrichtung | Provision |

| Transfer von digitalen Währungen (außerhalb der Plattform) | BTC | 0,002 BTC |

| ETH-ER C 20 | 0,01 ETH | |

| ETH-B SC | 0,0008 ETH | |

| USDT-ERC 20 | 10 USDT | |

| USDT-TRC 20 | 1 USDT | |

| USDT-MATIC | 1 USDT | |

| U SDT -BSC | 1 US DT | |

| Aktienhandel | Kauf / Verkauf | 2,2% |

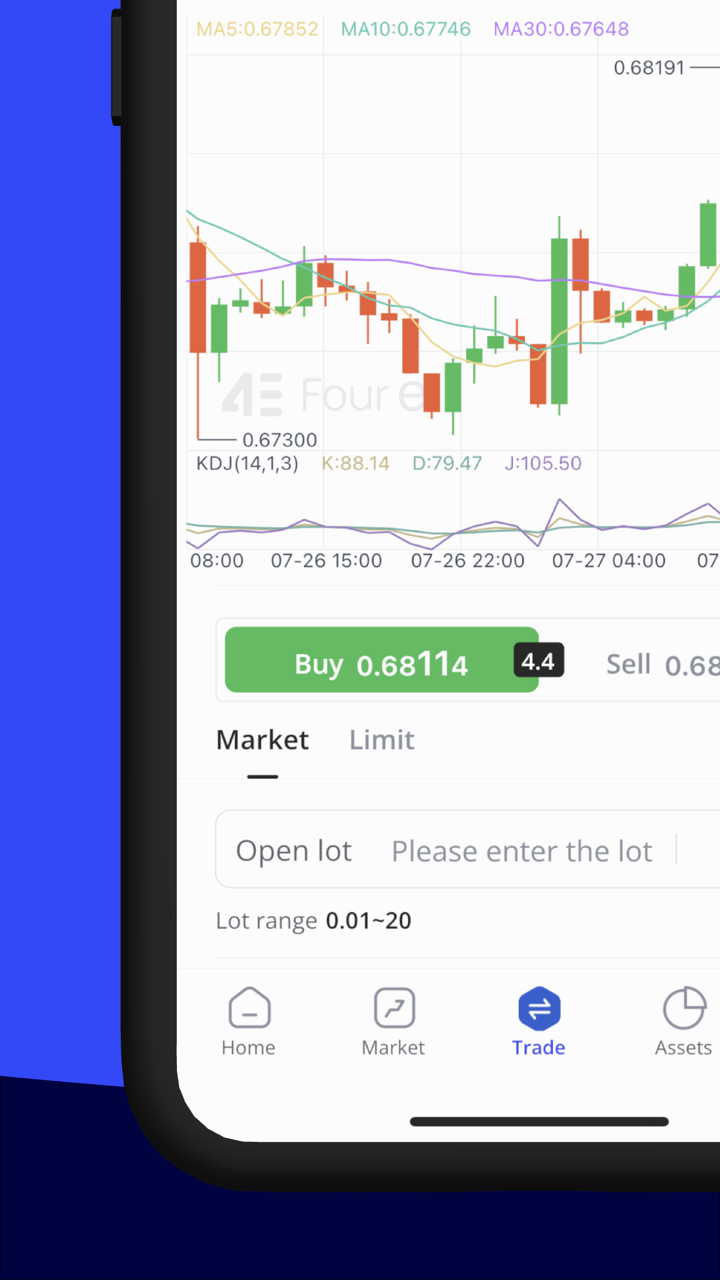

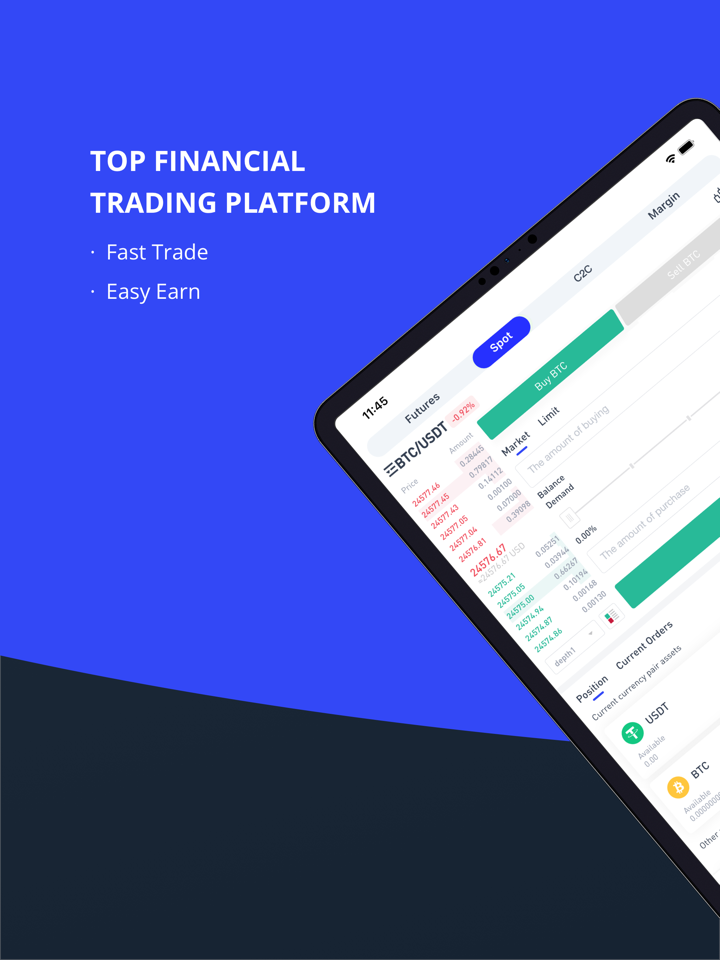

Handelsplattform

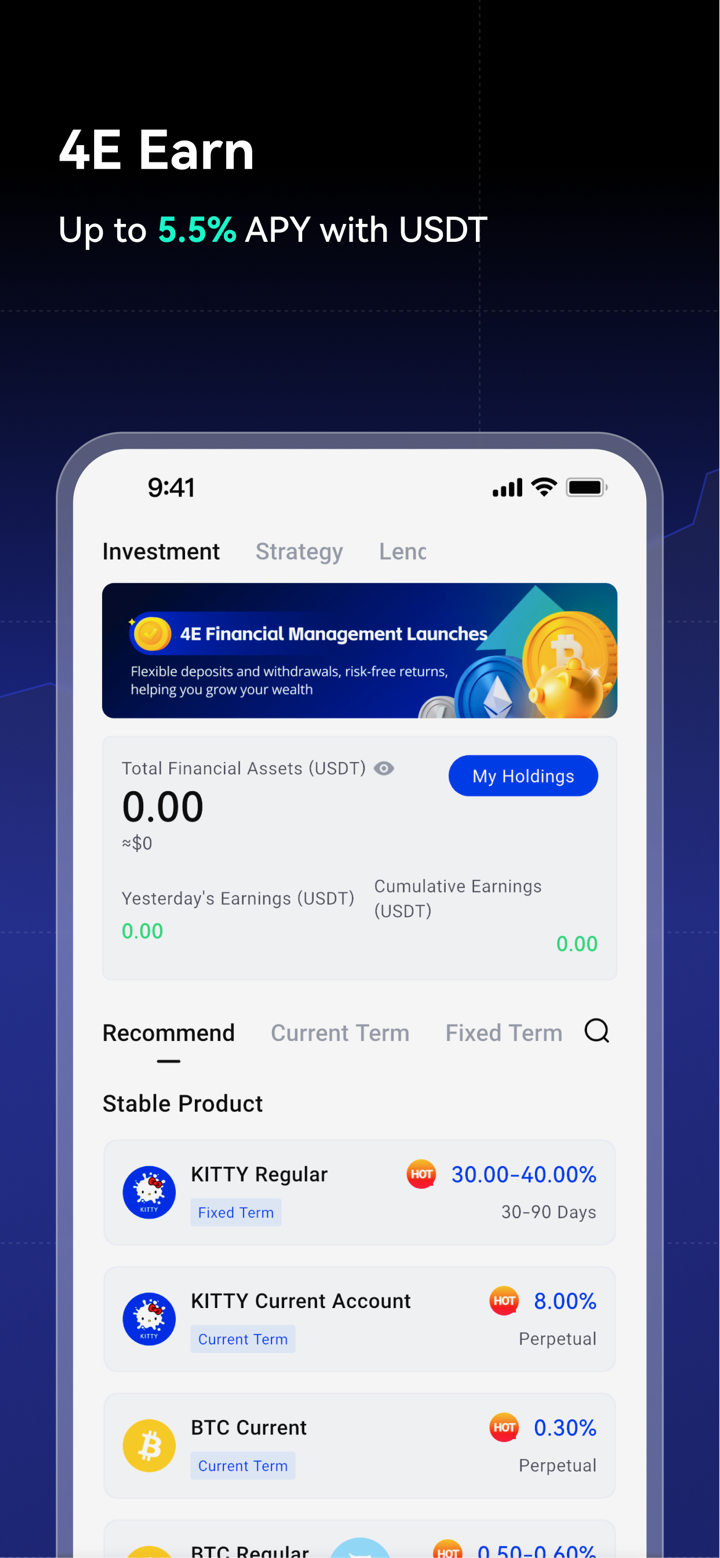

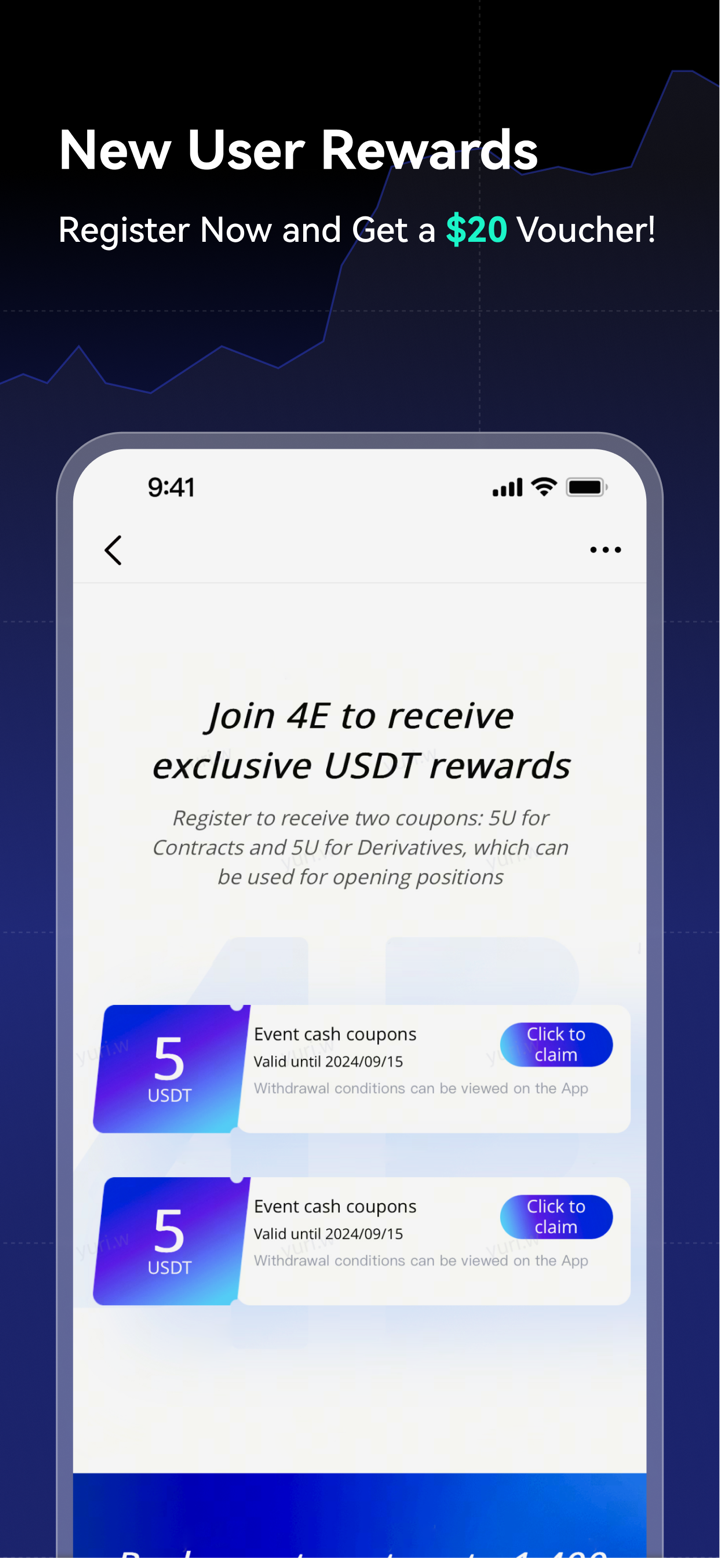

4e bietet eine selbstentwickelte Handelsplattform an, die sowohl als App- als auch als Tablet-Version verfügbar ist. Es behauptet, Ihnen die neuesten Finanztrends zu bieten. Wir empfehlen jedoch weiterhin, einen regulierten Broker mit einer professionellen Handelsplattform wie MT4 oder MT5 zu wählen.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| 4e Mobile | ✔ | Web und mobile App | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Trader |

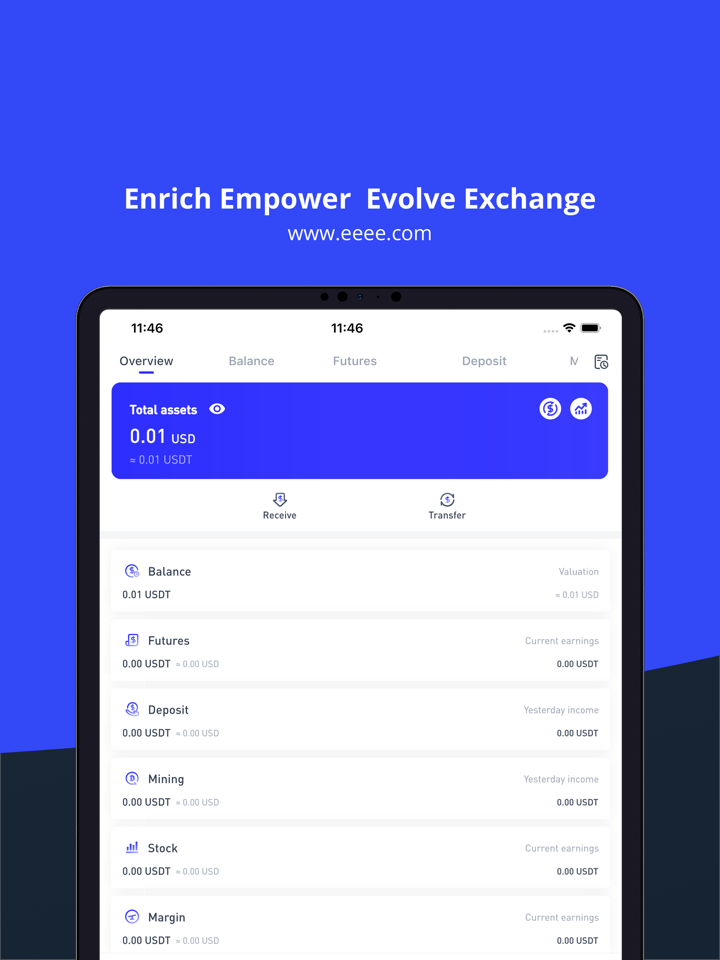

Einzahlung und Auszahlung

4e erwähnt nur, dass Sie Geld über Kryptowährungen und andere Methoden einzahlen und abheben können, aber die genauen Möglichkeiten werden nicht offengelegt. Beachten Sie, dass alle Transaktionen, die über Kryptowährungen getätigt werden, unwiderruflich sind, was mit hohen Risiken verbunden ist, insbesondere bei einem unregulierten Broker wie 4e.