Buod ng kumpanya

| Phillip Securities Group Buod ng Pagsusuri | |

| Itinatag | 1975 |

| Nakarehistrong Bansa/Rehiyon | Singapore |

| Regulasyon | SFC |

| Mga Instrumento sa Merkado | Securities, futures, forex, bonds, ETFs, insurance |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Minimum Deposit | / |

| Suporta sa Customer | Tel: (852) 2277 6555 |

| Fax: (852) 2277 6008 | |

| Email: cs@phillip.com.hk | |

Impormasyon Tungkol sa Phillip Securities Group

Itinatag noong 1975 at may punong tanggapan sa Singapore, ang Phillip Securities Group ay isang kumpanya ng multi-asset na serbisyo sa pinansyal na pinamamahalaan ng Hong Kong SFC. Ang kanilang sariling mga sistema ng kalakalan ay nag-aalok ng kumpletong hanay ng mga pagpipilian sa pamumuhunan kabilang ang futures, FX, mga stock, bonds, at mga produkto ng pondo. Bagaman ang mga tampok ng plataporma at ang pagkakaiba-iba ng account ay maganda, kulang ito ng demo o Islamic account sa ngayon.

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Lisensyado ng Hong Kong SFC | Walang demo account o Islamic accounts |

| Malawak na hanay ng produkto na sumasaklaw sa lokal at dayuhang merkado | May ilang dayuhang kalakalan na may mataas na minimum na komisyon |

| Maraming pasadyang mga plataporma ng kalakalan para sa iba't ibang pangangailangan | Minimum deposit hindi malinaw na binanggit |

Tunay ba ang Phillip Securities Group?

Sa ilalim ng Lisensya Numero AAZ038, ang Phillip Securities Group ay pinamamahalaan ng Securities and Futures Commission (SFC) ng Hong Kong, pinapayagan para sa pakikipagkalakalan sa mga kontrata ng hinaharap at leveraged foreign exchange trading mula Disyembre 9, 2003.

Ano ang Maaari Kong Itrade sa Phillip Securities Group?

Kasama ang mga securities, futures, currency, bonds, insurance, at mga solusyon sa pamamahala ng puhunan kabilang ang mga pinamamahalaang pondo at ETFs, nag-aalok ang Phillip Securities ng isang komprehensibong spectrum ng mga serbisyo sa pamumuhunan at pamamahala ng yaman.

| Mga Kasangkapan sa Paghahalal | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Insurance | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Uri ng Account

Ang Phillip Securities (HK) Ltd. ay nagbibigay ng dalawang pangunahing uri ng mga live trading account: Margin Account at Custodian Account. Ang kumpanya ay walang demo accounts o Islamic accounts.

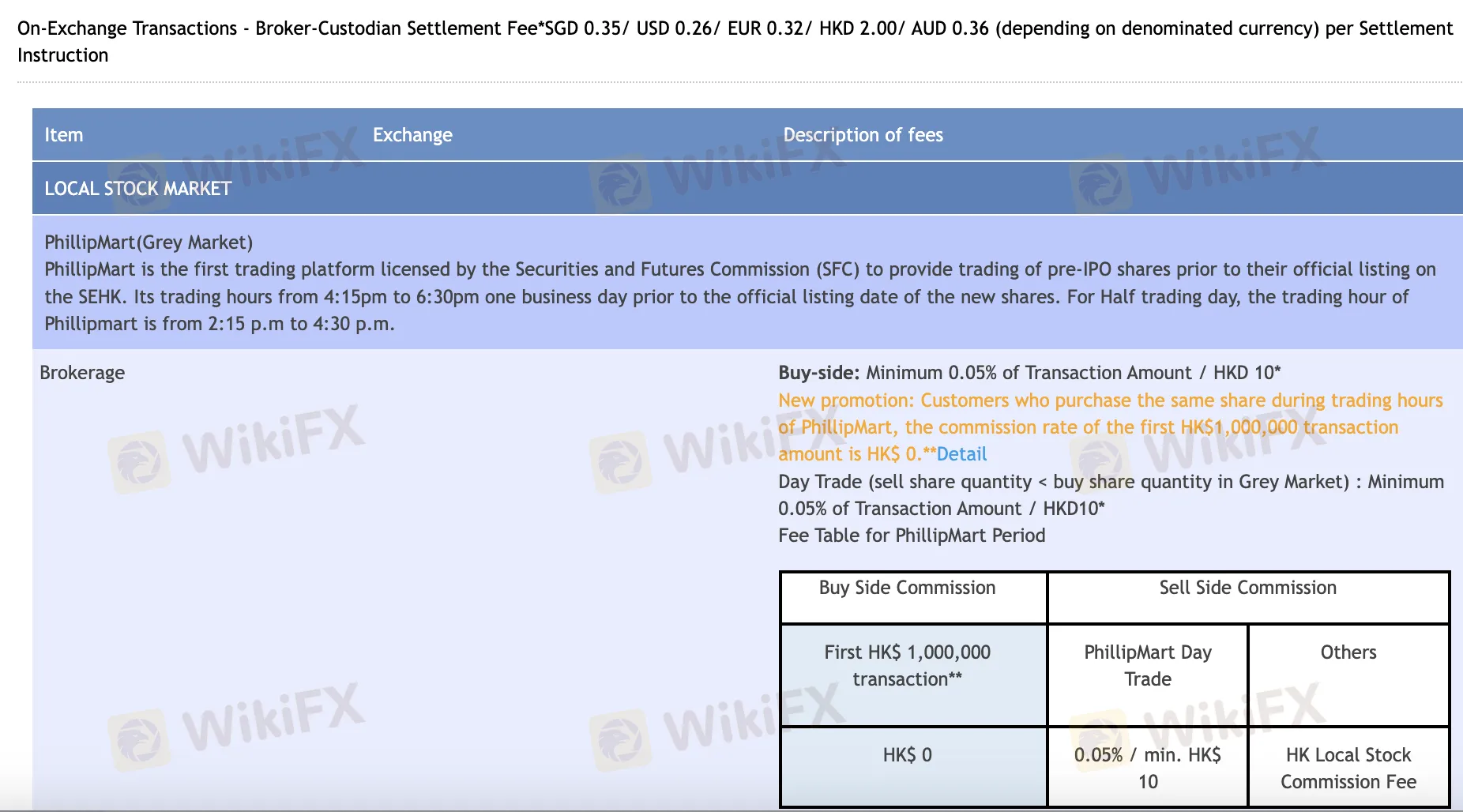

Mga Bayad sa Phillip Securities Group

Lalo na para sa online at araw-araw na trading, ang mga gastos ng Phillip Securities Group ay karaniwang makatarungan at kasuwato ng mga pamantayan ng industriya. Ito ay nagpapatawad ng mga bayad sa custodial para sa karamihan ng mga mamimili at nagbibigay ng zero commission deals sa napiling mga item. Sa kabilang banda, ang ilang mga kalakal sa dayuhang merkado—lalo na sa pamamagitan ng telepono o sa mababang dami—ay maaaring magkaroon ng mas mataas na minimum na bayad.

| Pamilihan/Produkto | Brokerage | Stamp Duty | Transaction Levy | Transaction Fee | CCASS/Iba pang mga Bayad | Custody Fee |

| HK Stocks (Online) | 0.08% (Bumili ≤ HKD 30K: $0, Arawang Kalakal: 0.05%) | 0.10% | 0.00% | 0.01% | 0.01% (Min HKD 3, Max HKD 300) | Waived (<5000 board lots) |

| Warrants & CBBC | 0.03% Arawang Kalakal / 0.05% pagkatapos ng HKD 50K | Wala | 0.00% | 0.01% | 0.01% (Min HKD 3, Max HKD 300) | Waived (<5000 board lots) |

| RMB Dual Counter Stocks | Online: 0.08% (Min CNY 60); Telepono: 0.25% (Min CNY 100) | 0.10% | 0.00% | 0.01% | 0.01% (Min CNY 3, Max CNY 300) | Waived (<5000 board lots) |

| US Stocks (Online) | USD 0.0099/bahagi (Min USD 1); Telepono: 0.25% (Min USD 20) | Wala | Ang mga bayad ng SEC + FINRA + DTC ay naaangkop | Kasama sa itaas | Mga bayad sa paglilinaw ng SEC/FINRA/DTC | ❌ |

| China A-shares (Northbound) | Bumili ≤ ¥30K: ¥0; Bumili > ¥30K o Magbenta: 0.03% (Online) | 0.05% (PAGBENTA lamang) | Pag-handle 0.00341%, Pamamahala 0.002% | ChinaClear 0.001% | 0.002% sa pamamagitan ng CCASS |

Plataforma ng Trading

| Plataforma ng Trading | Supported | Available Devices | Angkop para sa |

| Hulit City Online | ✔ | Desktop / Web | Mga stock & futures trader na nangangailangan ng buong kakayahan |

| Hulit City Mobile | ✔ | Mobile (iOS/Android) | Mga stock trader na palaging nasa paggalaw |

| Stock Easy (SATS) | ✔ | Desktop | Mga nagsisimula sa stock trading |

| Options Easy (OATS) | ✔ | Desktop | Mga nagtitinda ng options |

| Futures Trading (FATS) | ✔ | Desktop | Mga nagtitinda ng futures |