公司簡介

| Nissan Securities 評論摘要 | |

| 成立年份 | 1948 |

| 註冊國家/地區 | 日本 |

| 監管 | 受金融廳監管 |

| 市場工具 | 衍生品、商品、外匯 |

| 模擬帳戶 | ❌ |

| 客戶支援 | 聯絡表格 |

| 日本東京都中央區銀座6-10-1,郵編104-0061(總公司) | |

NISSAN SECURITIES 是一家位於日本的金融公司。成立於1948年1月,通過ISV/交易平台提供包括衍生品、商品和外匯在內的交易。目前受金融廳監管。

以下是該經紀商官方網站的首頁:

優點與缺點

| 優點 | 缺點 |

| 受金融廳監管 | 客戶支援選項有限 |

| 多年行業經驗 | 未提及資金方法 |

| 提供ISV/交易平台 |

Nissan Securities 是否合法?

Nissan Securities 受 金融廳 監管。持有零售外匯牌照,編號為関東財務局長(金商)第131号。

| 監管狀態 | 受監管 |

| 監管機構 | 日本 |

| 牌照機構 | Nissan Securities株式会社 |

| 牌照類型 | 零售外匯牌照 |

| 牌照編號 | 関東財務局長(金商)第131号 |

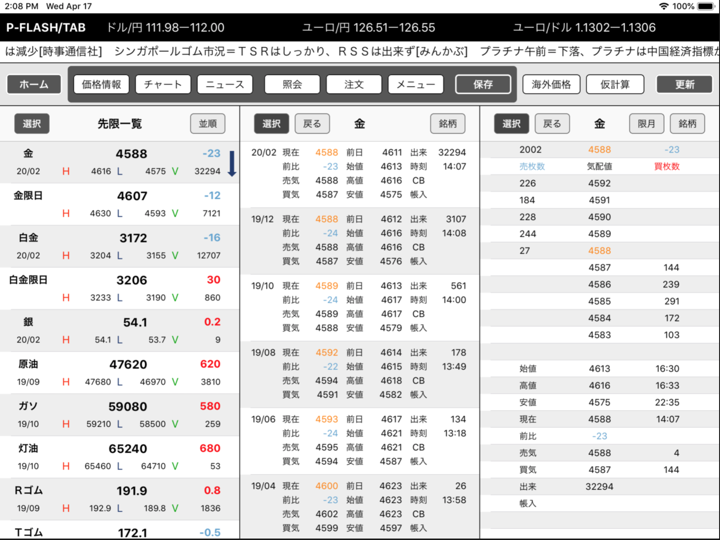

我可以在 Nissan Securities 交易什麼?

Nissan Securities 提供衍生品、商品和外匯。他們的產品可進入日本和全球市場,包括結算、執行和經紀服務。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 商品 | ✔ |

| 衍生品 | ✔ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| 交易所交易基金 | ❌ |

| 共同基金 | ❌ |

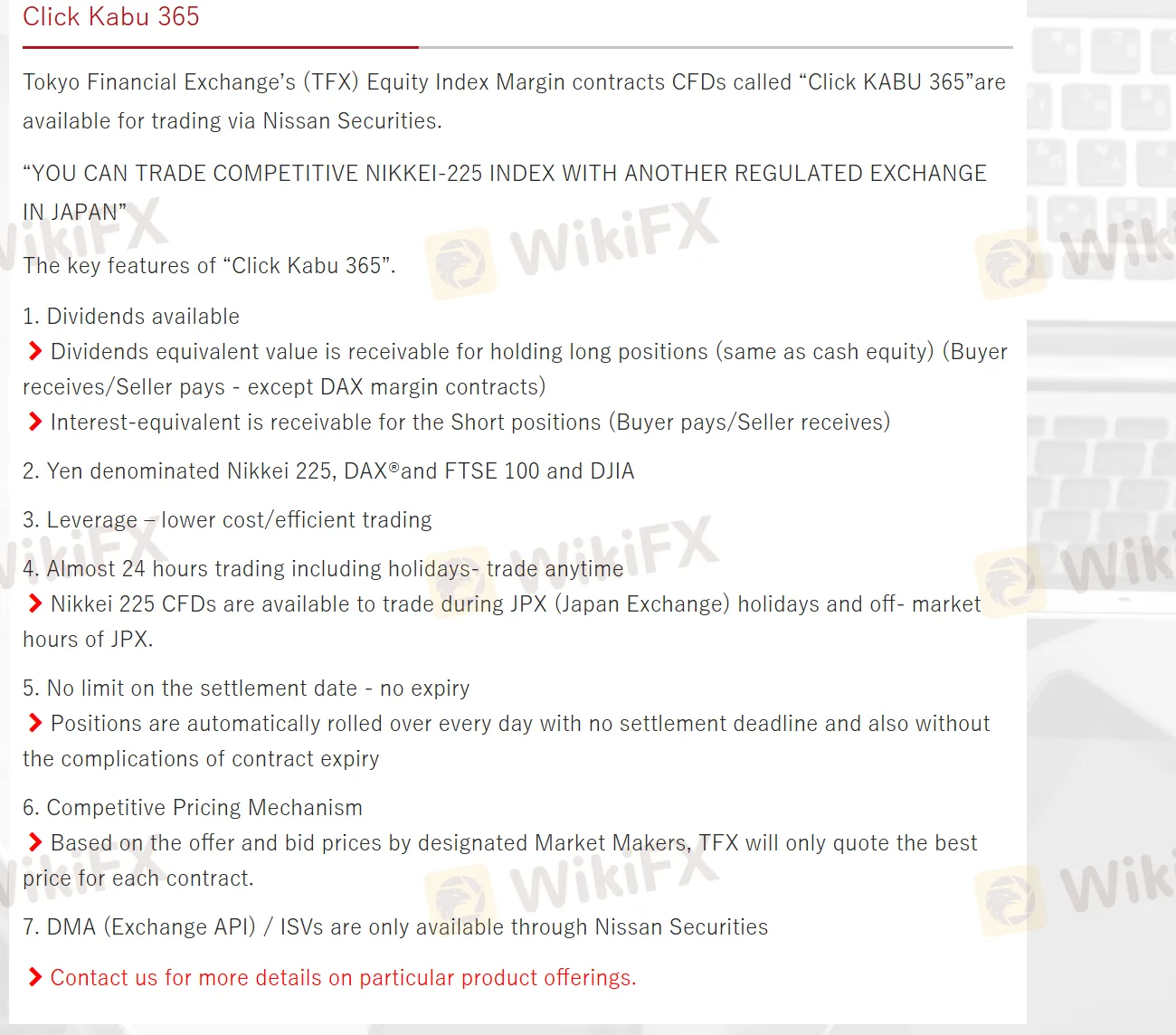

點擊 KABU 365

Nissan Securities 提供了作為東京金融交易所提供的股指保證金合約 CFD 的交易機會,稱為“Click KABU 365”。它提供了對 TFX 的 CFD 交易。對於多頭部位,可以收到股息等值(除 DAX 保證金合約外),對於空頭部位,可以收到等值利息。有槓桿選項進行成本效益交易,幾乎全天候交易,包括假期。日經225 CFD 可在 JPX 假期和非交易時段交易。

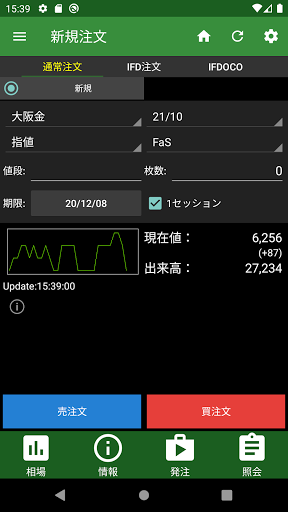

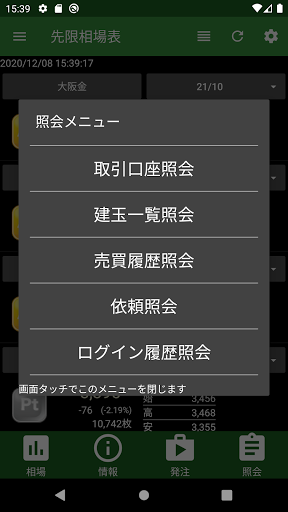

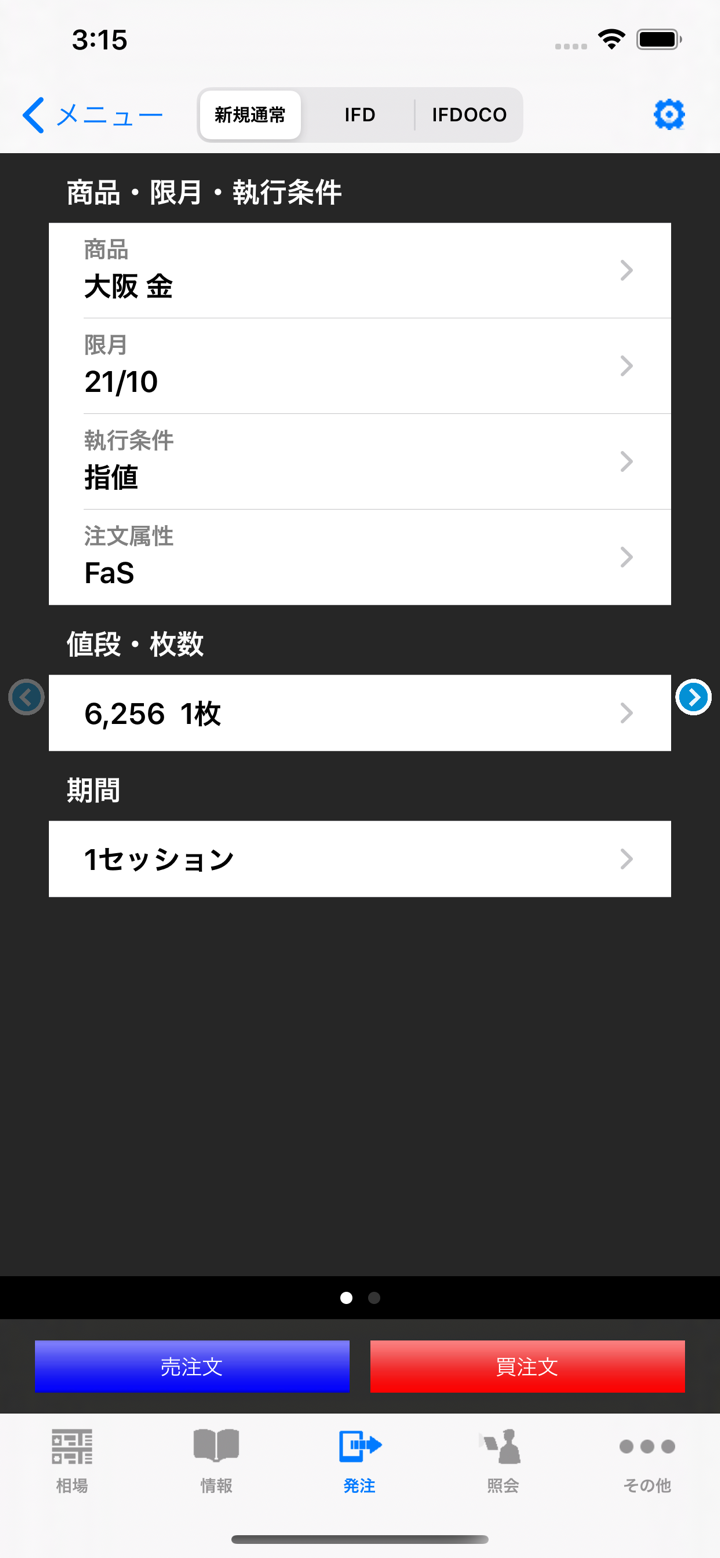

交易平台

除了支援本地 API 和系統外,Nissan Securities 還提供 ISV/交易平台,包括Trading Technologies、Bloomberg、CQG、Stellar 和 TORA。