公司簡介

一般信息和法規

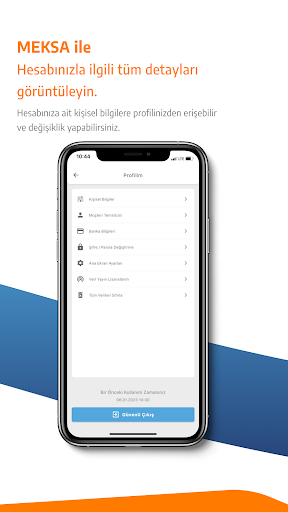

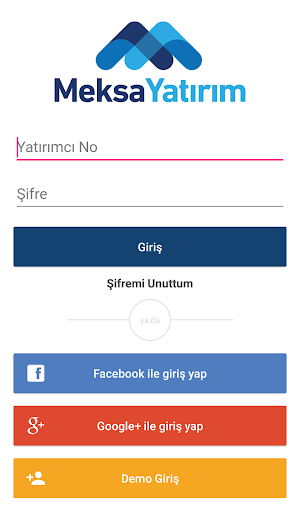

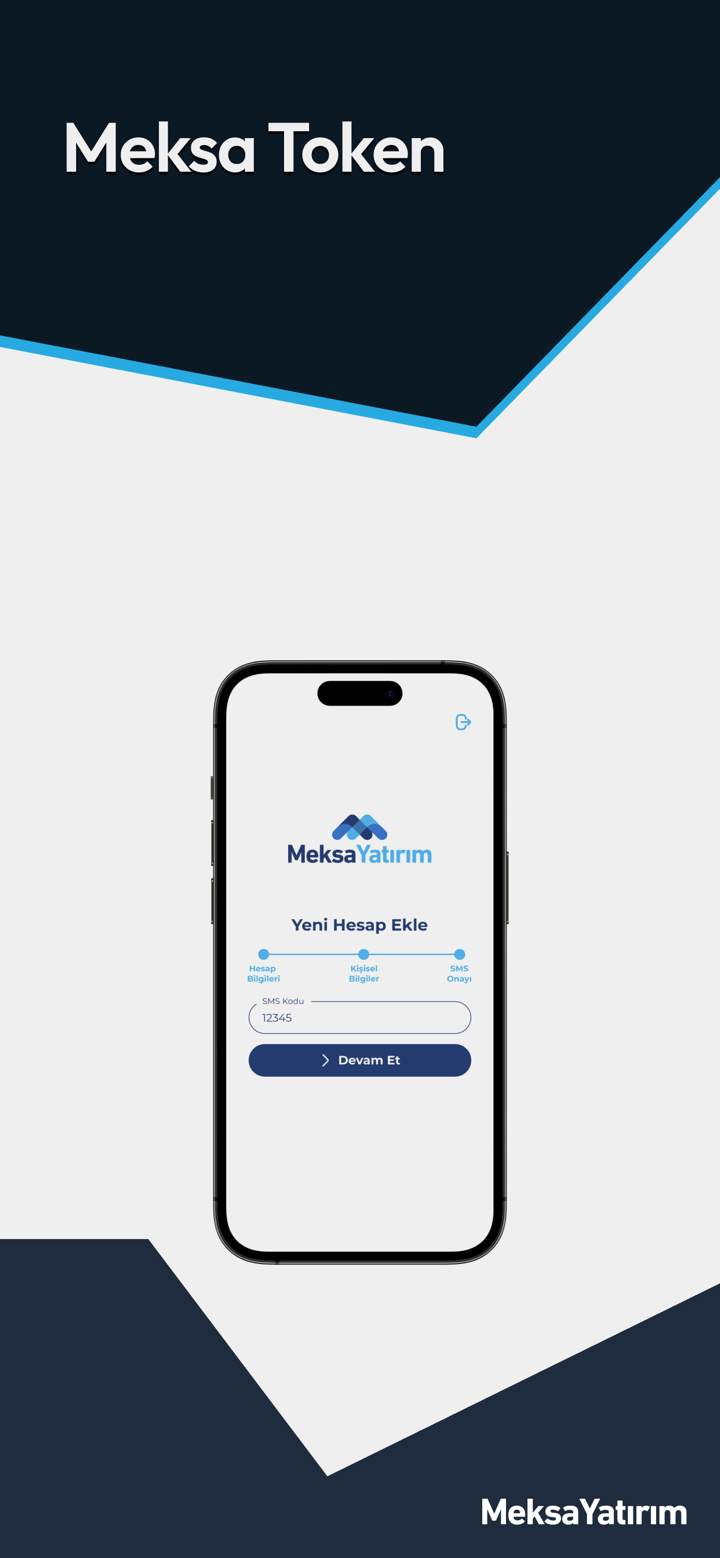

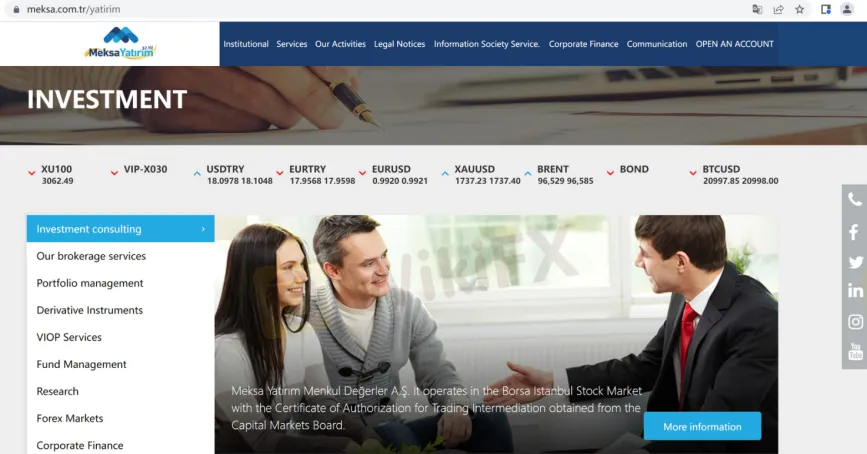

MEKSA, 商品名稱 Meksa Yatırım Menkul Değerler A.Ş,據稱是一家成立於1990年6月28日並在土耳其註冊的金融經紀公司。該經紀商表示,其在伊斯坦布爾證券交易所的股票市場開展業務,並持有從資本市場委員會獲得的交易中介授權證書,並聲稱為其個人和企業客戶提供各種金融服務。這是該經紀人官方網站的主頁:

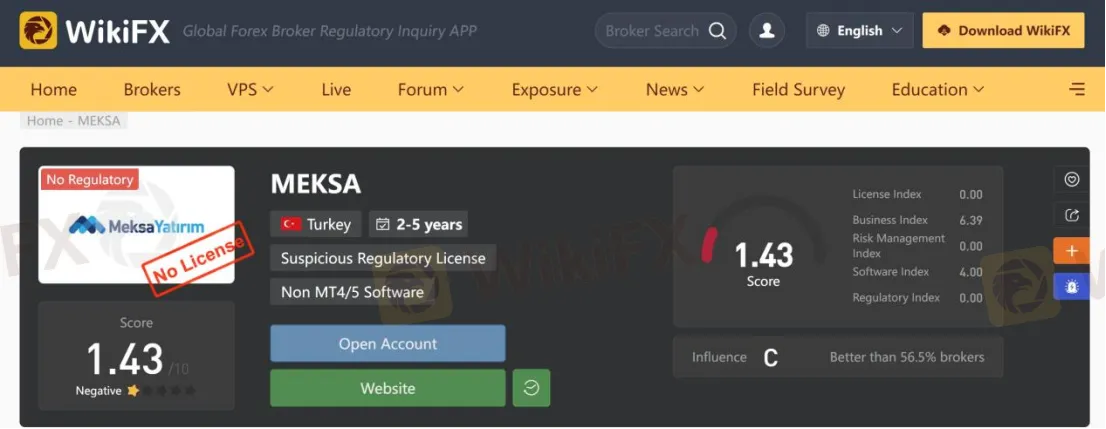

至於監管,已經核實 MEKSA不受任何有效法規的約束。這就是為什麼它在 wikifx 上的監管狀態被列為“無牌照”並且它獲得了 1.43/10 的相對較低的分數。請注意風險。

差評

一位交易員分享了他可怕的交易經歷 MEKSA平台在wikifx。他說過 MEKSA是一個詐騙經紀人,當日期到來時他沒有收到承諾的 50% 定金。交易者在選擇外匯經紀商之前,有必要閱讀一些用戶留下的評論,以防被騙。

服務

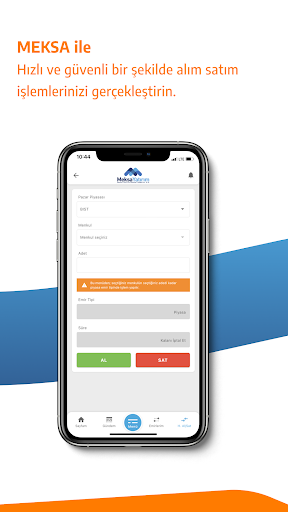

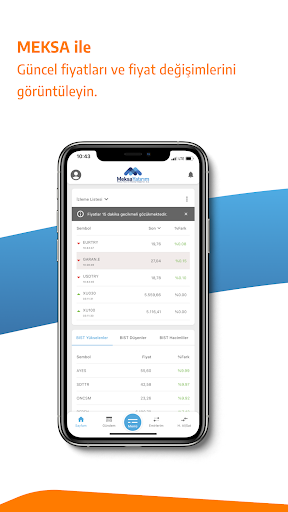

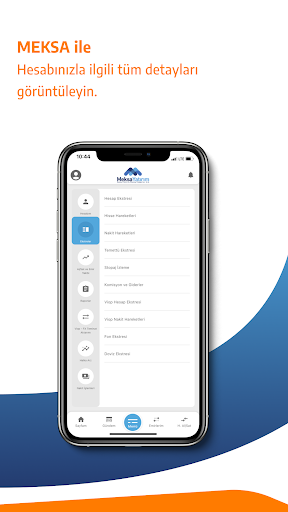

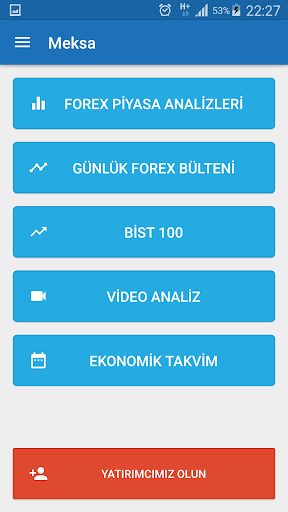

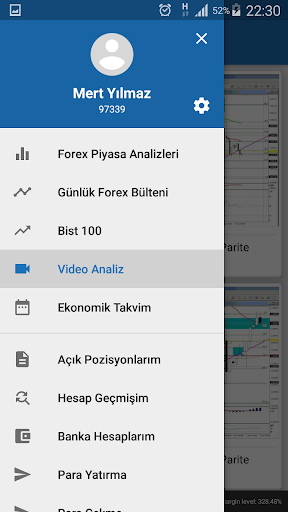

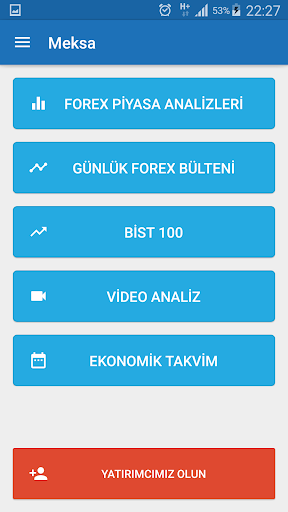

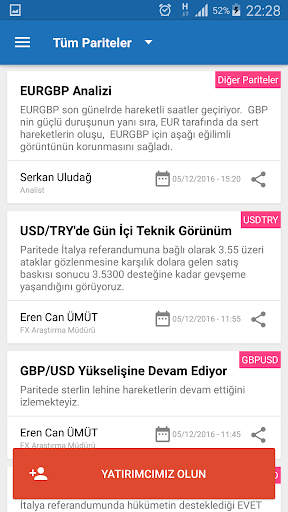

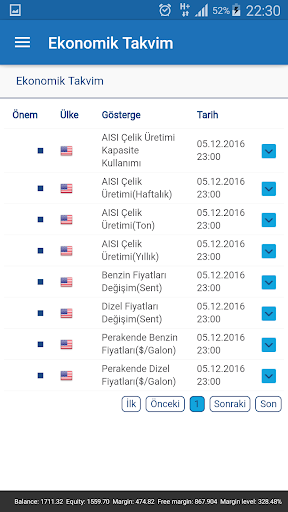

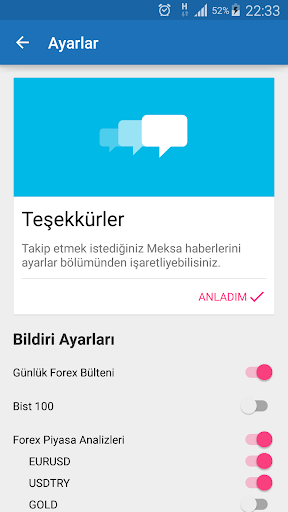

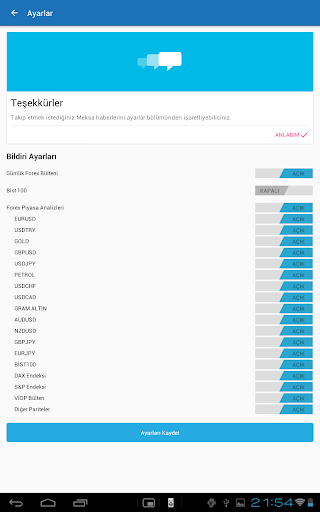

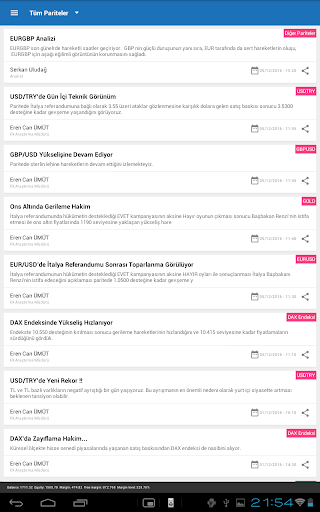

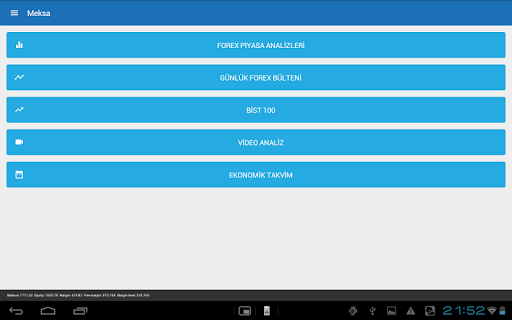

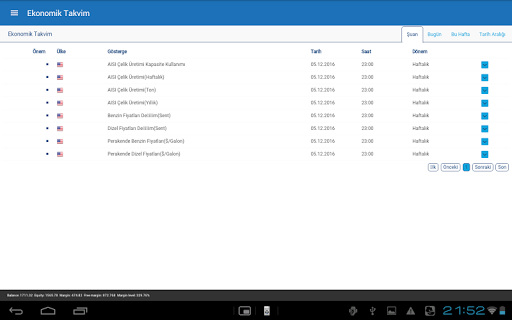

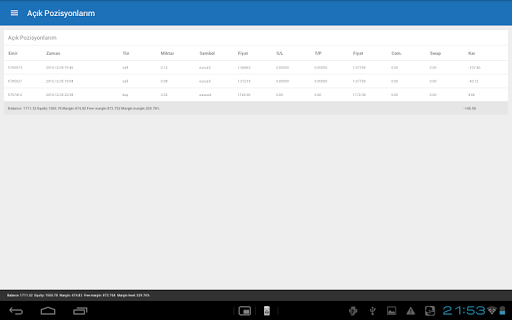

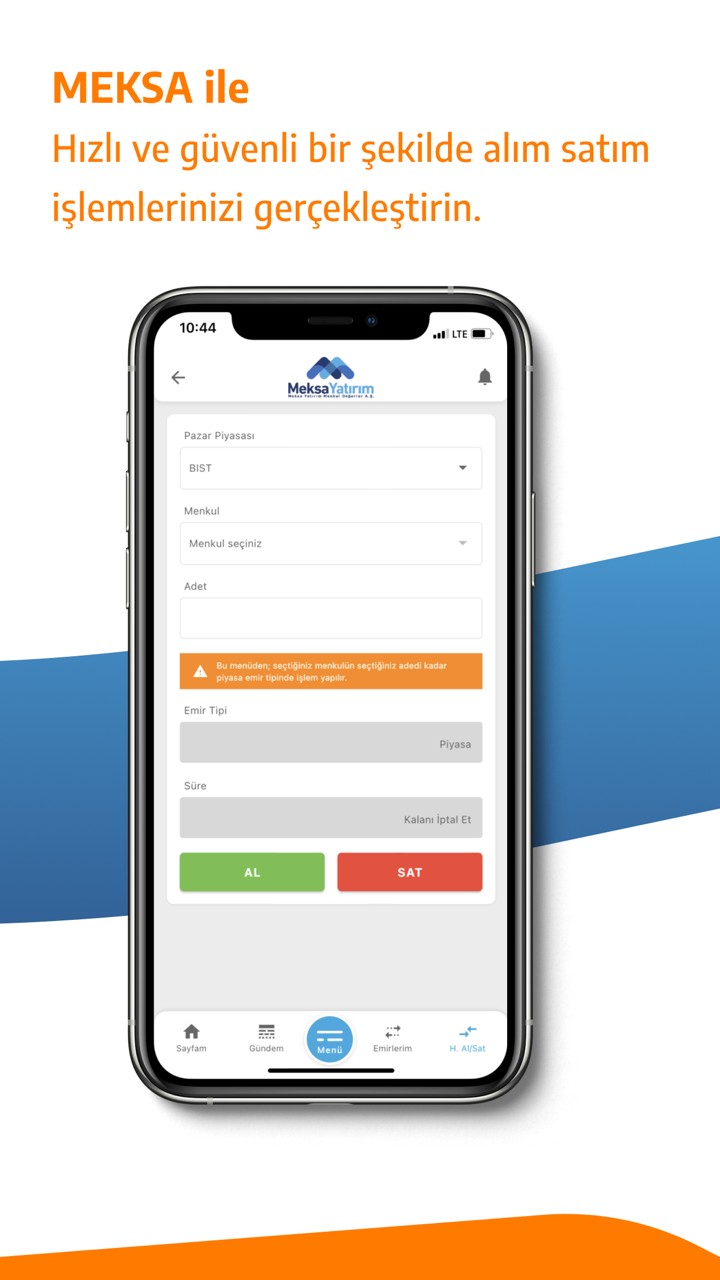

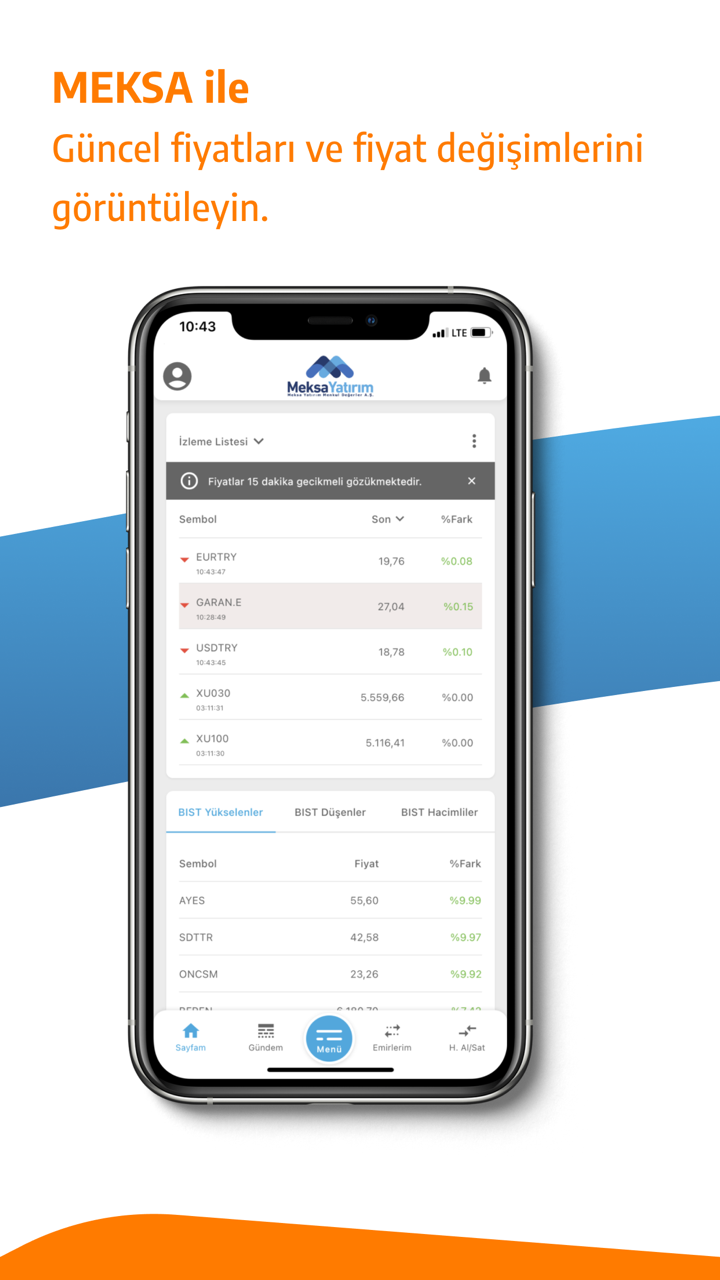

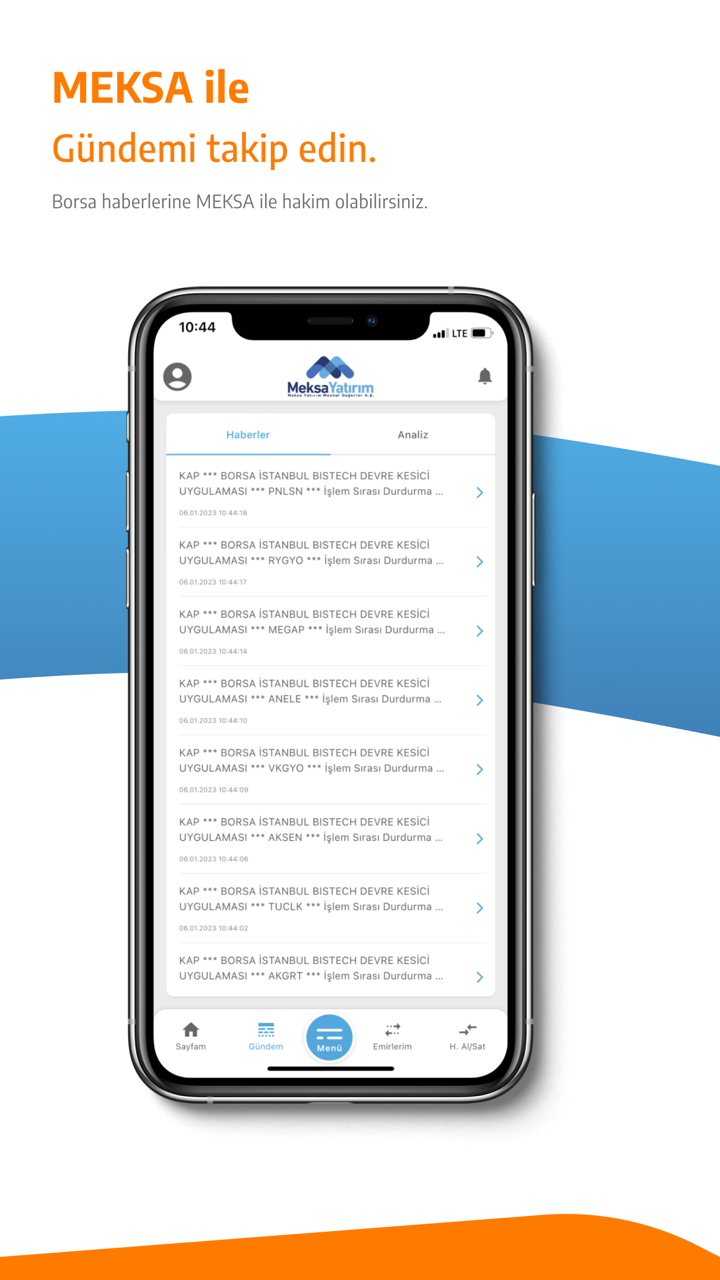

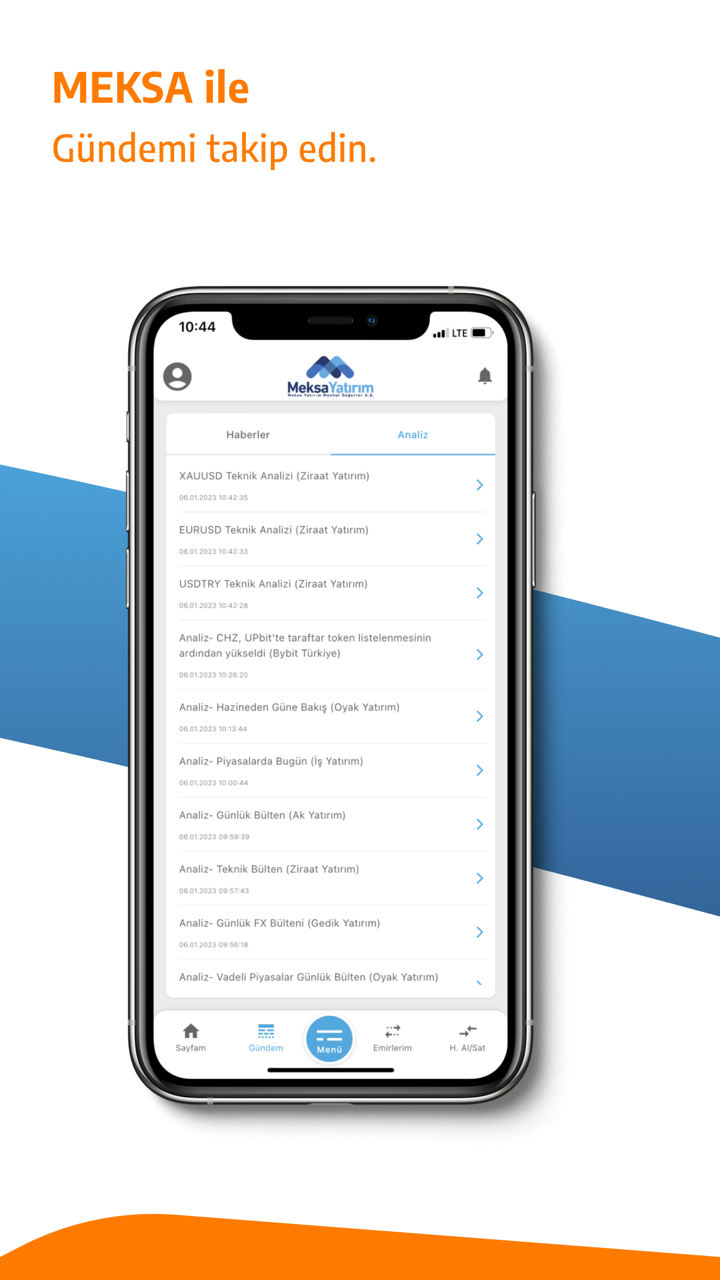

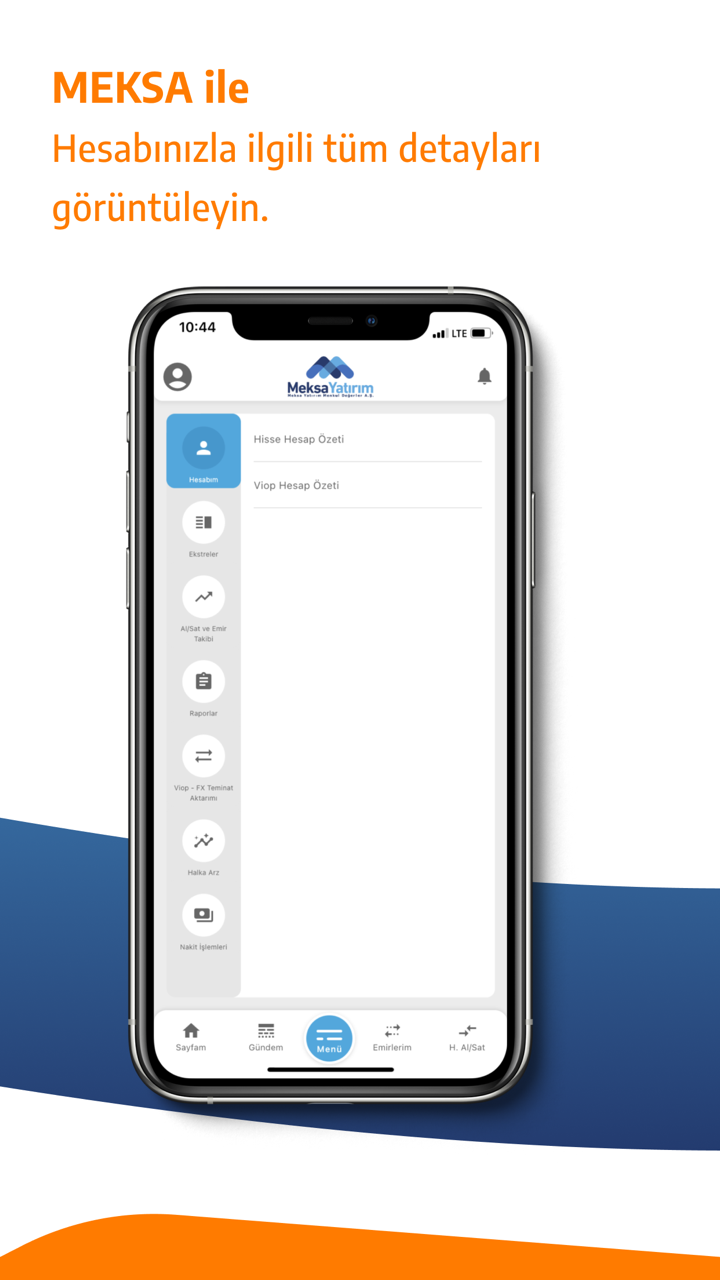

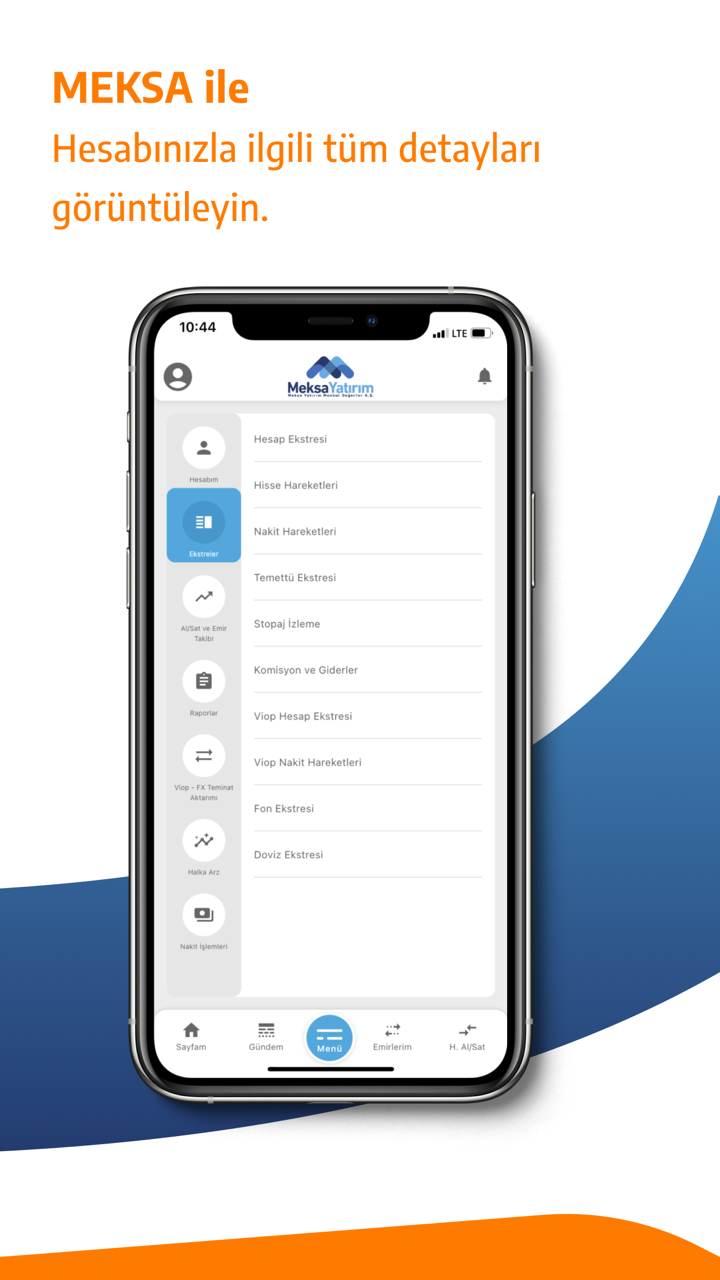

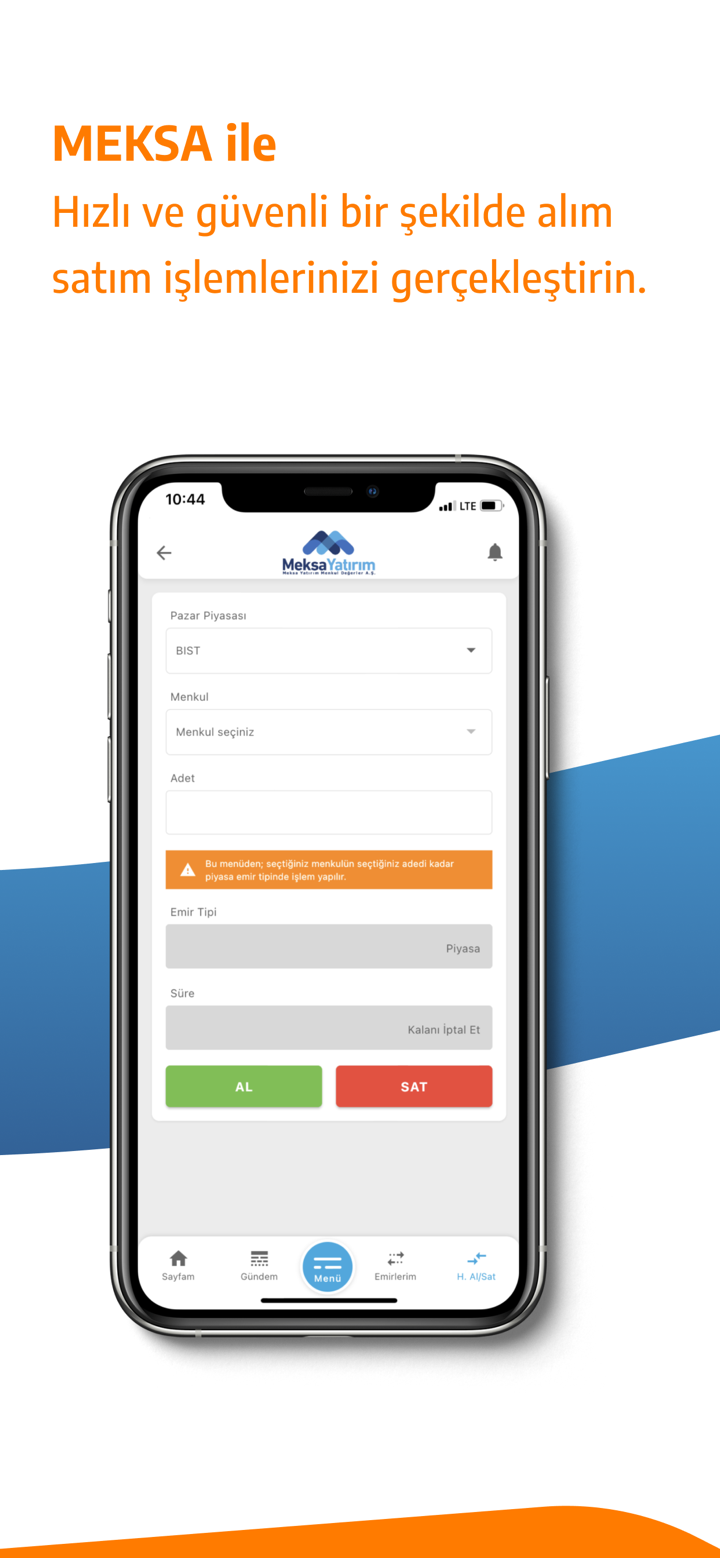

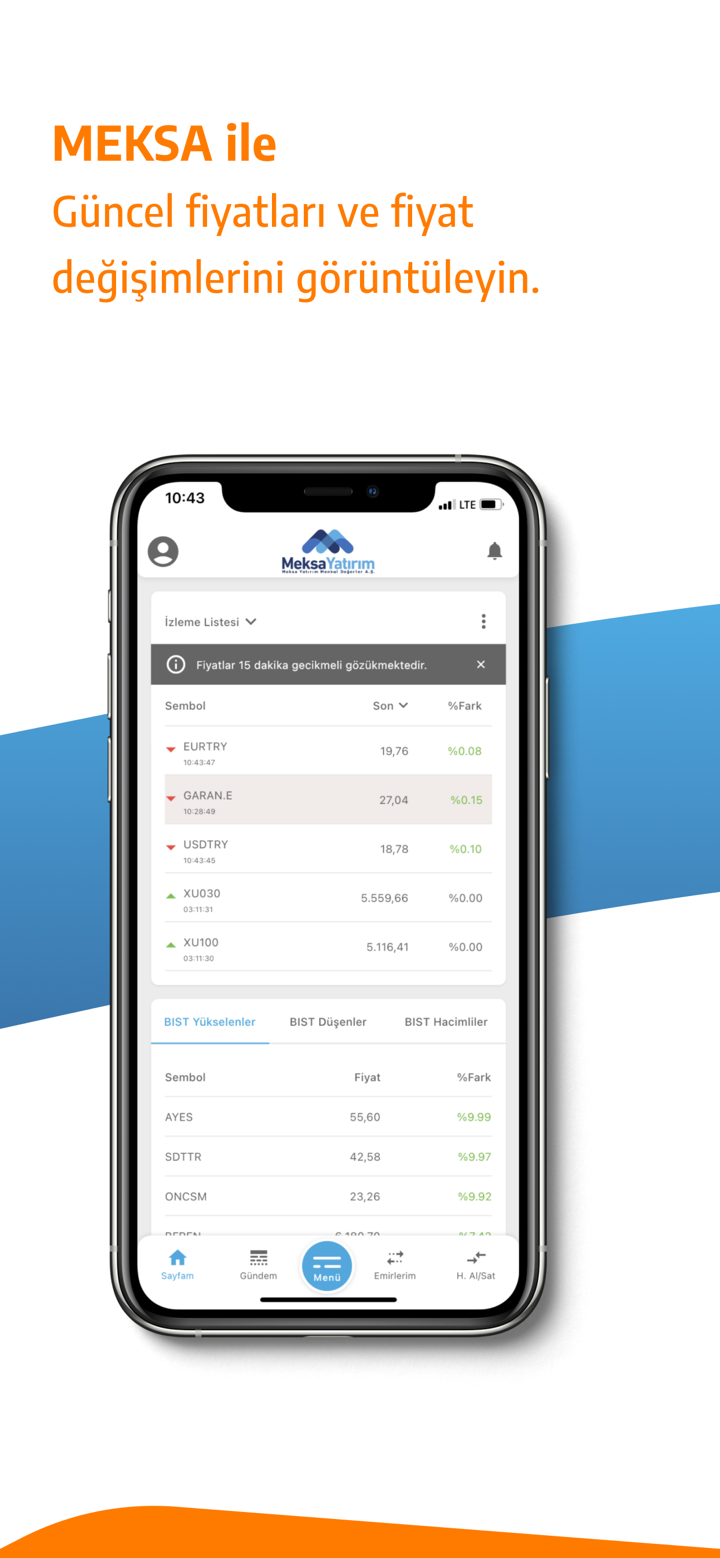

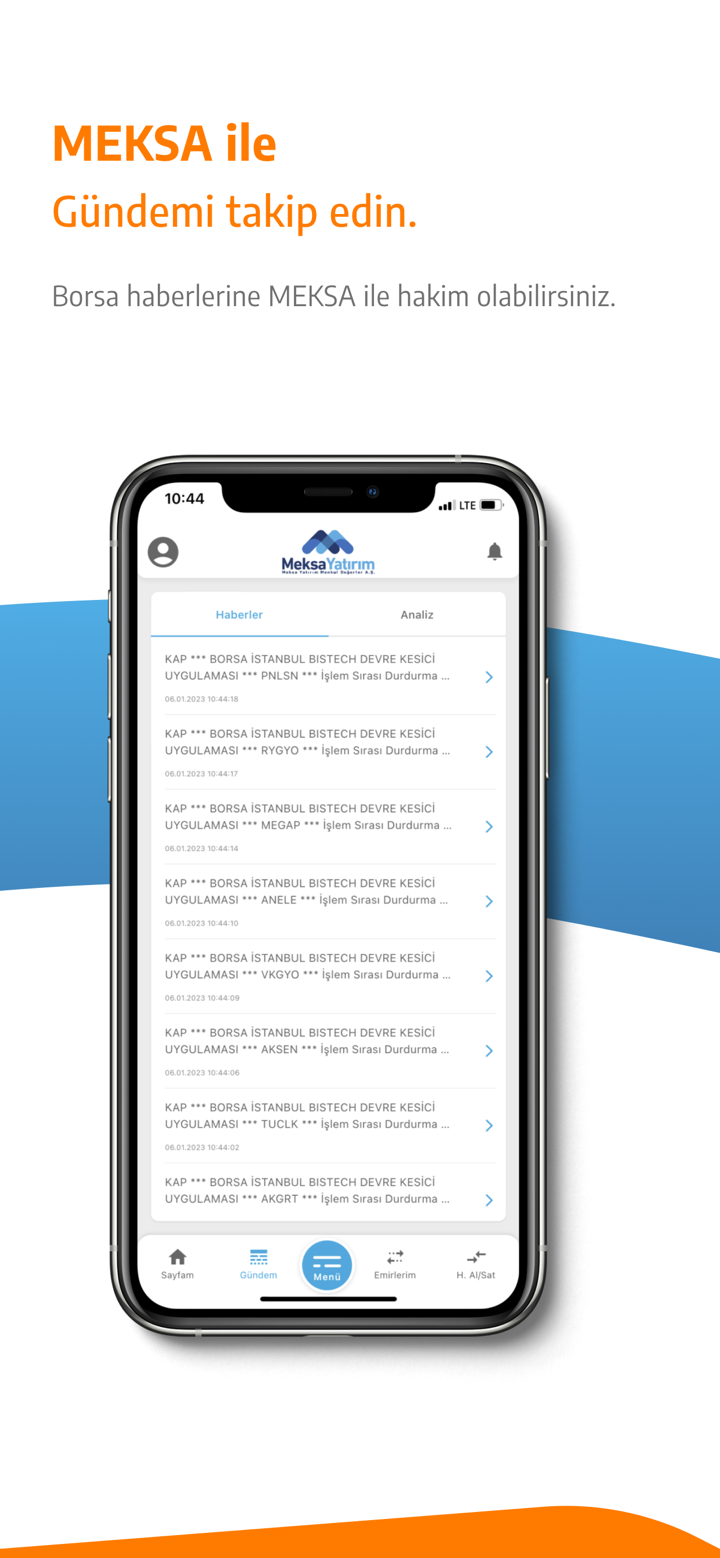

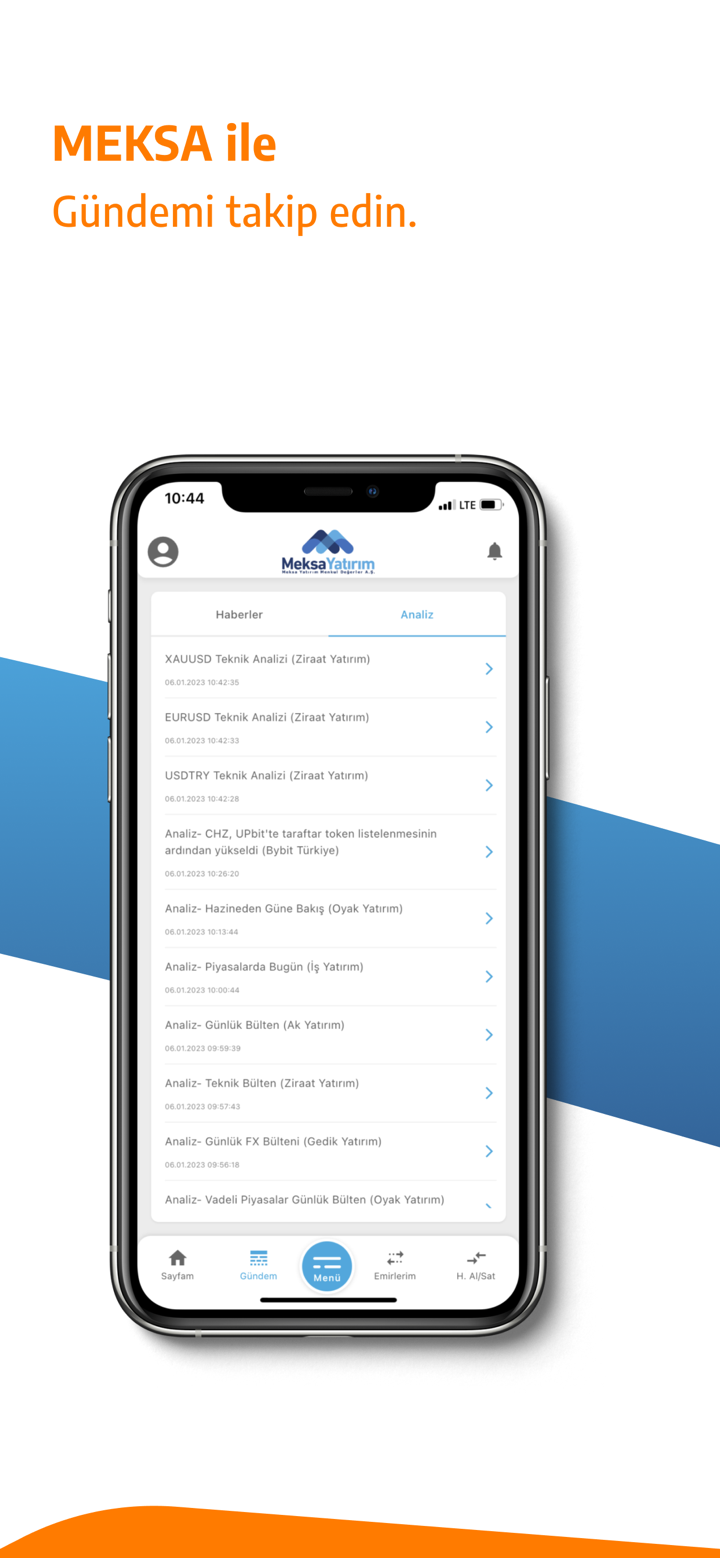

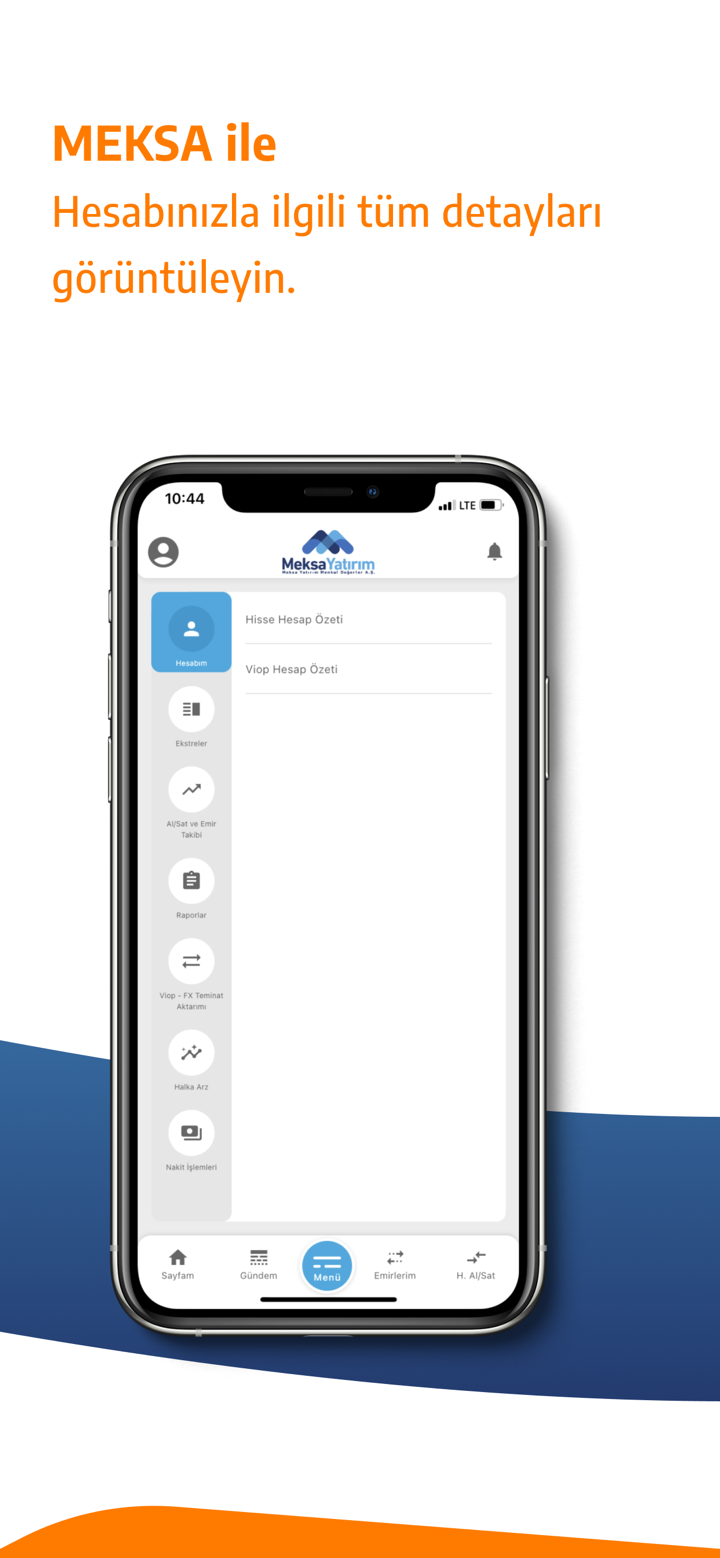

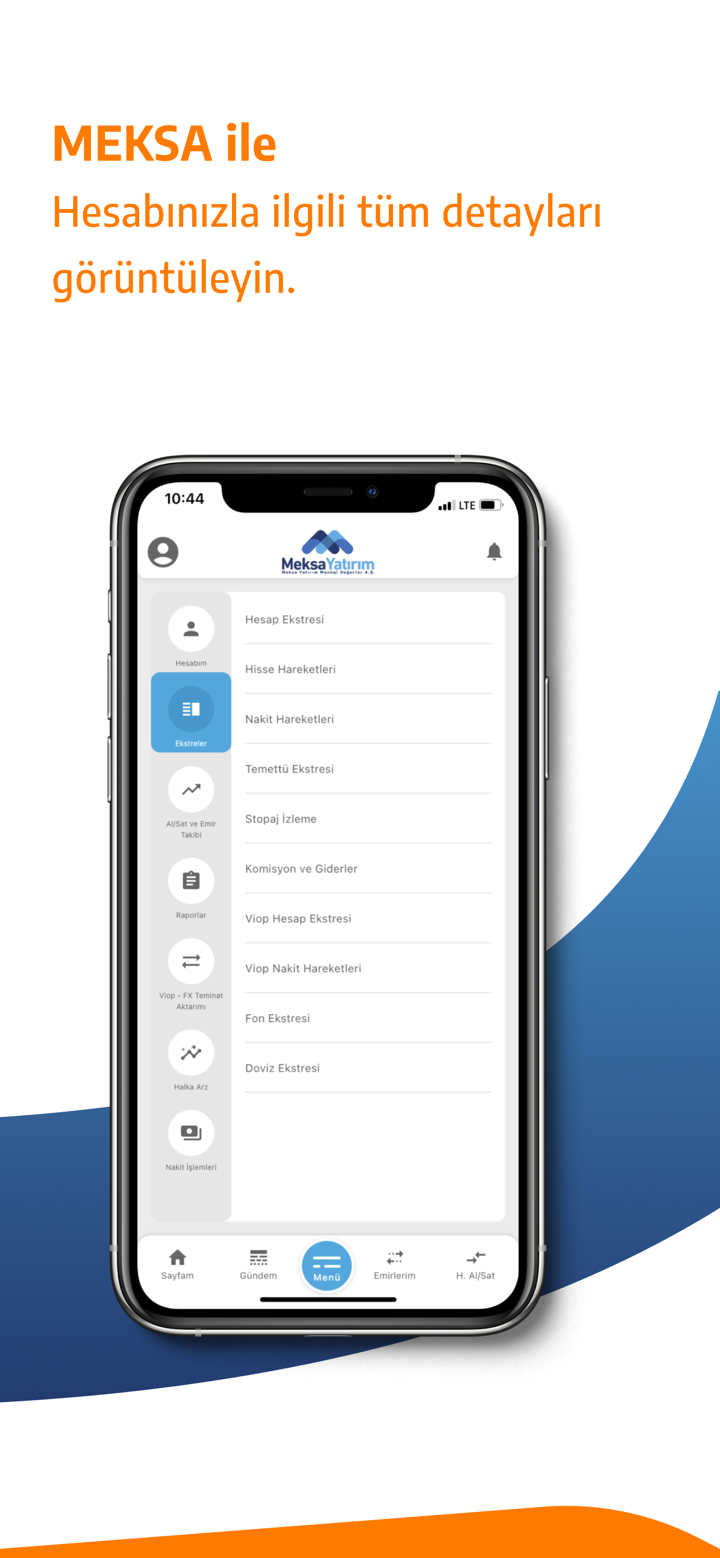

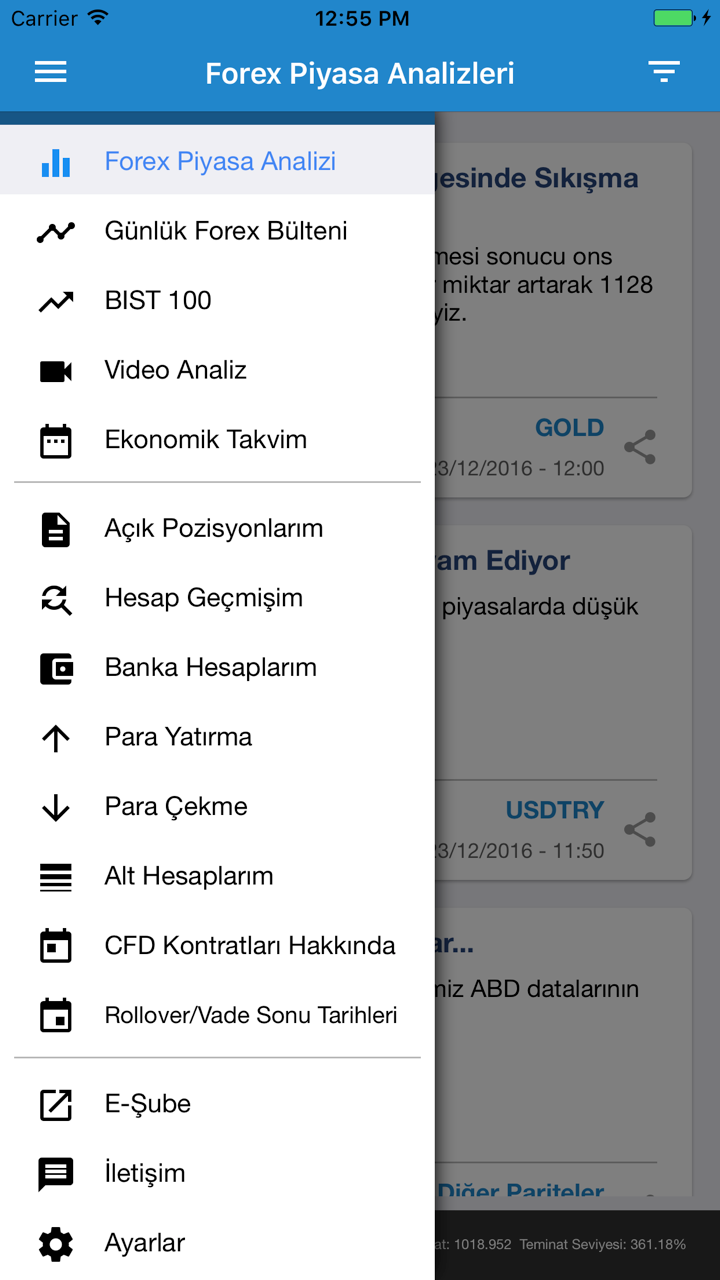

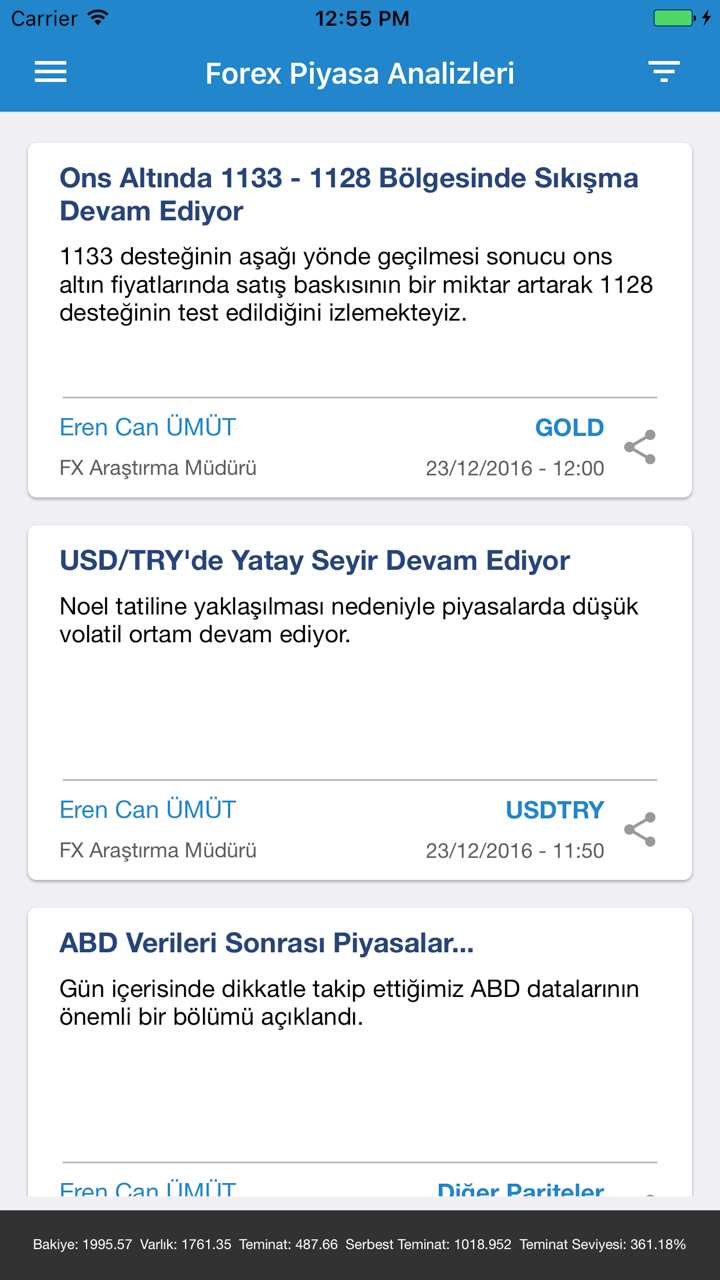

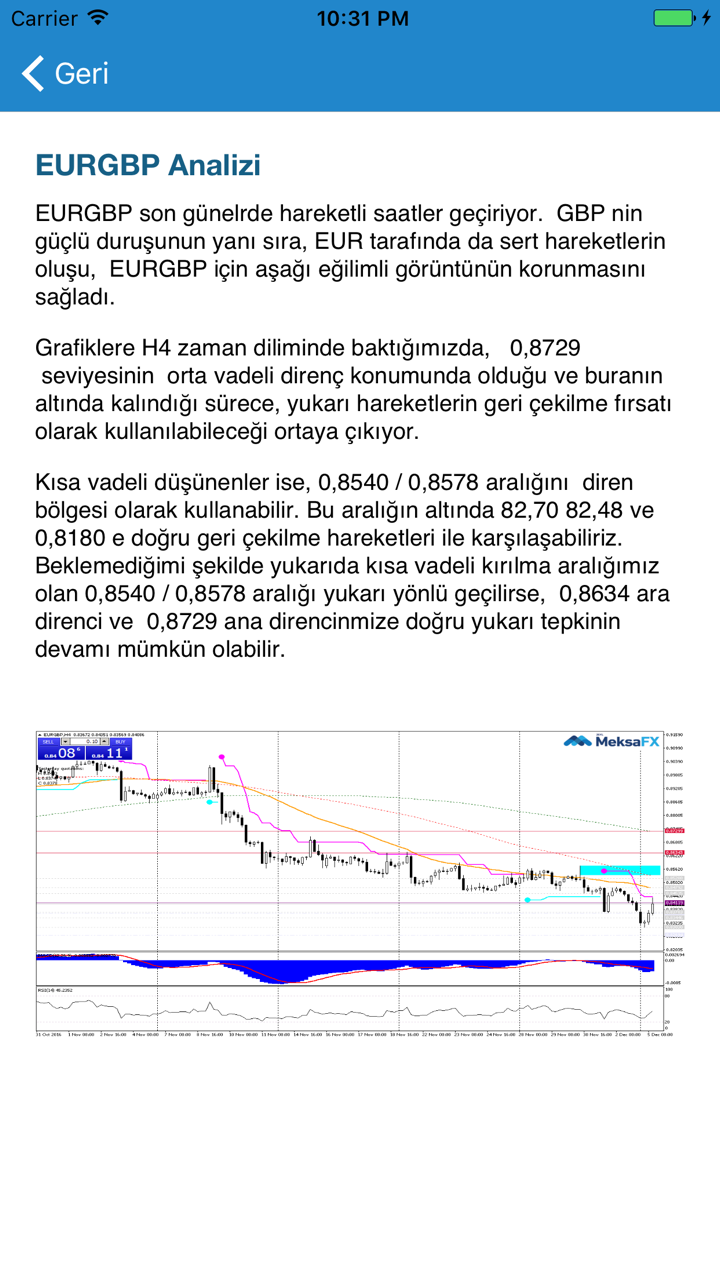

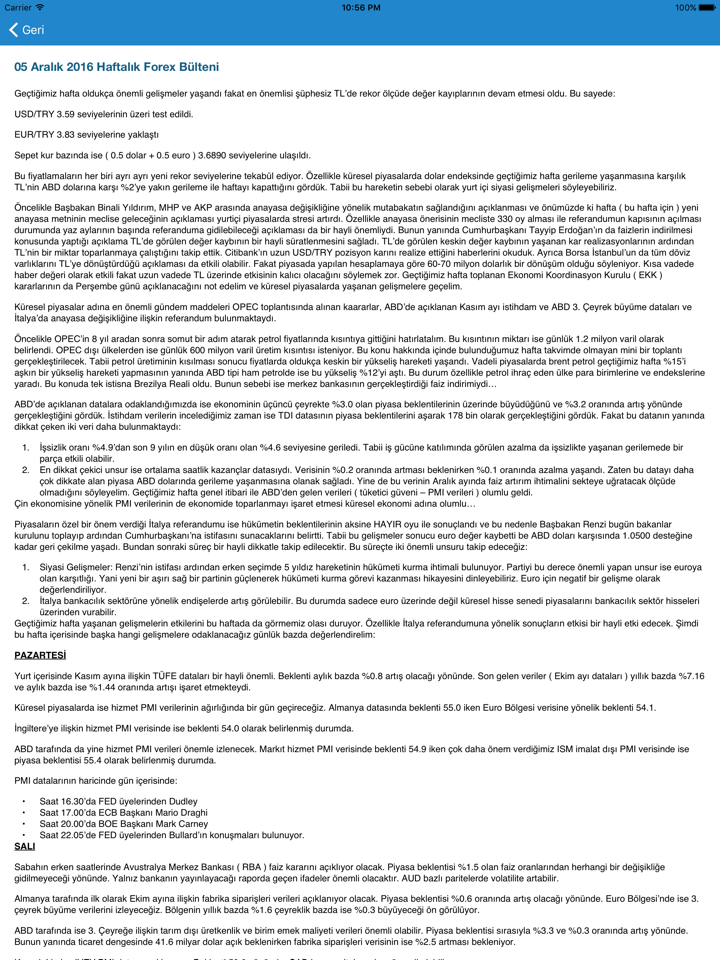

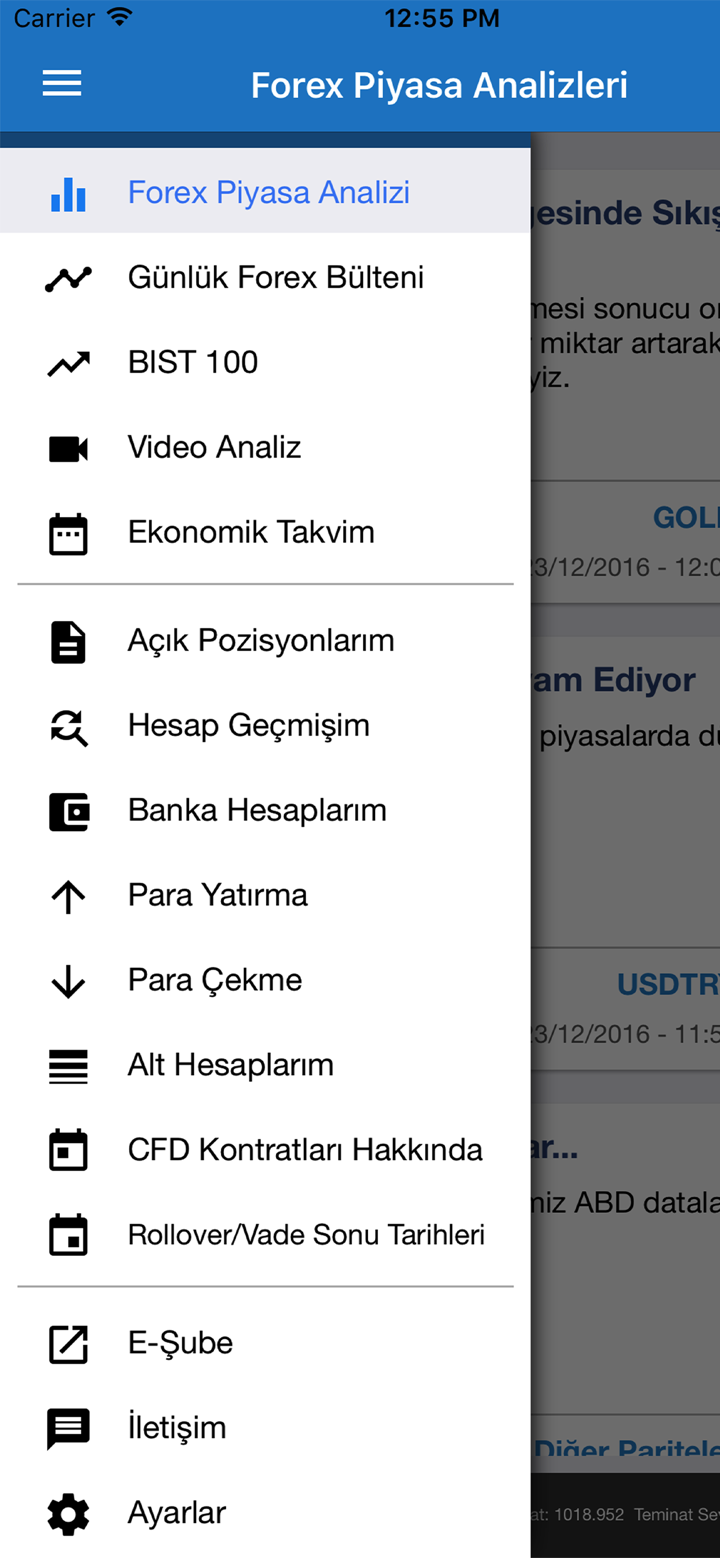

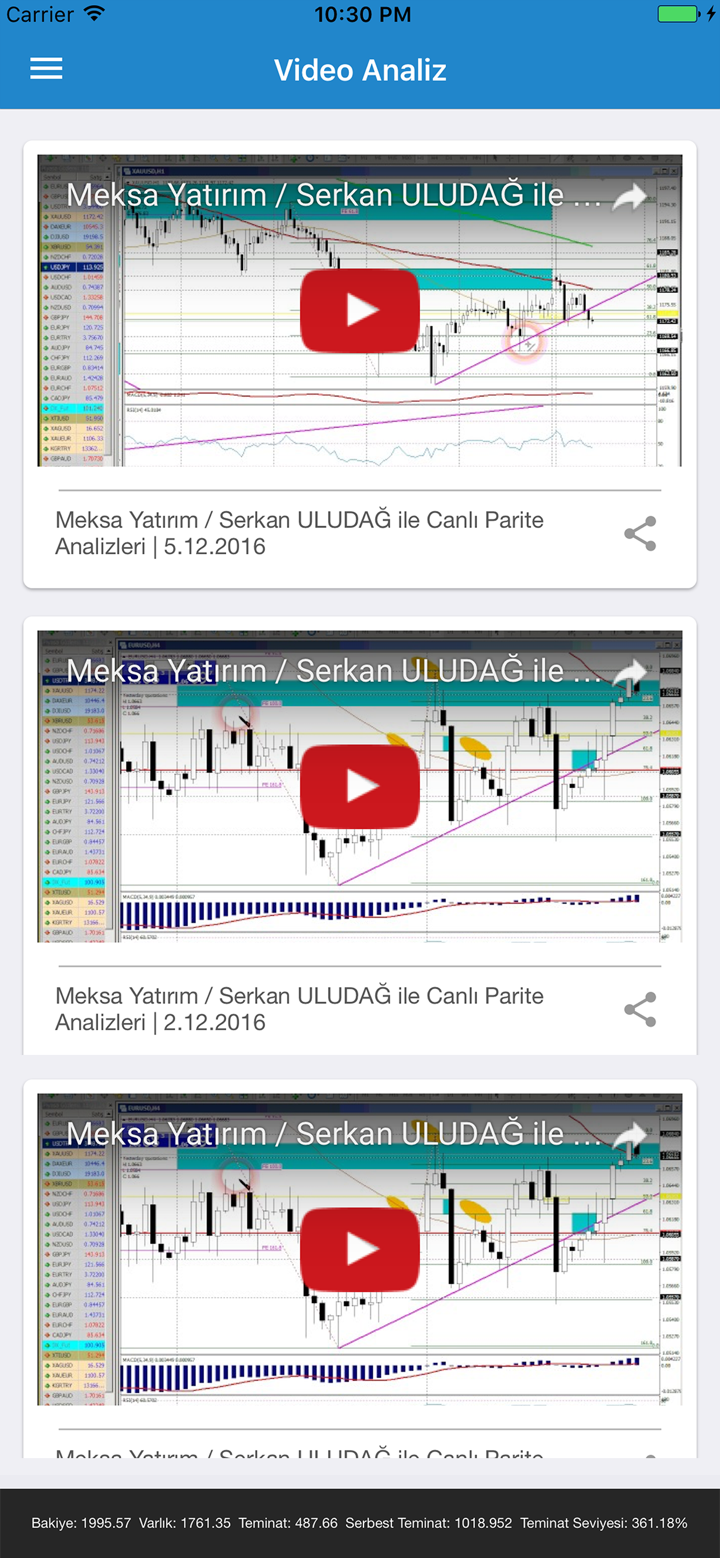

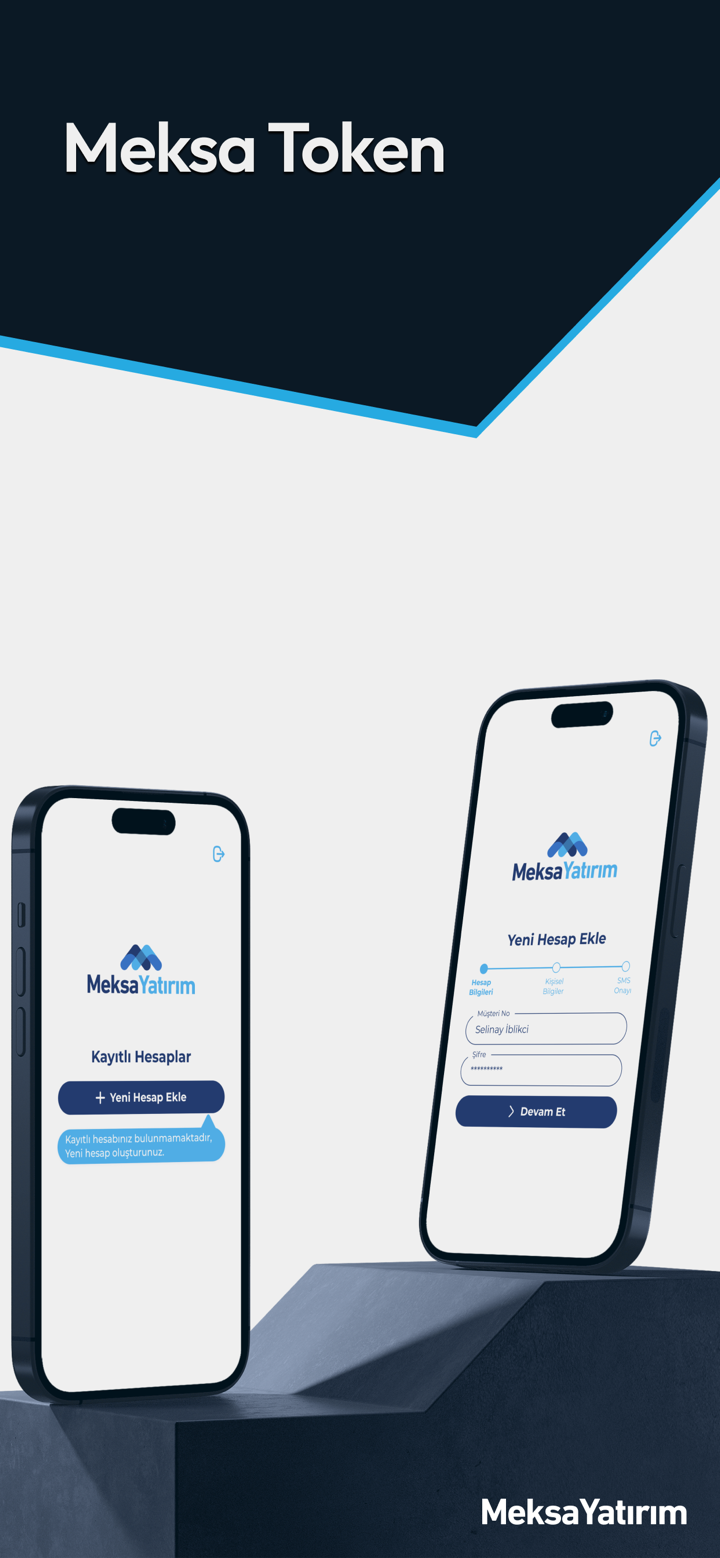

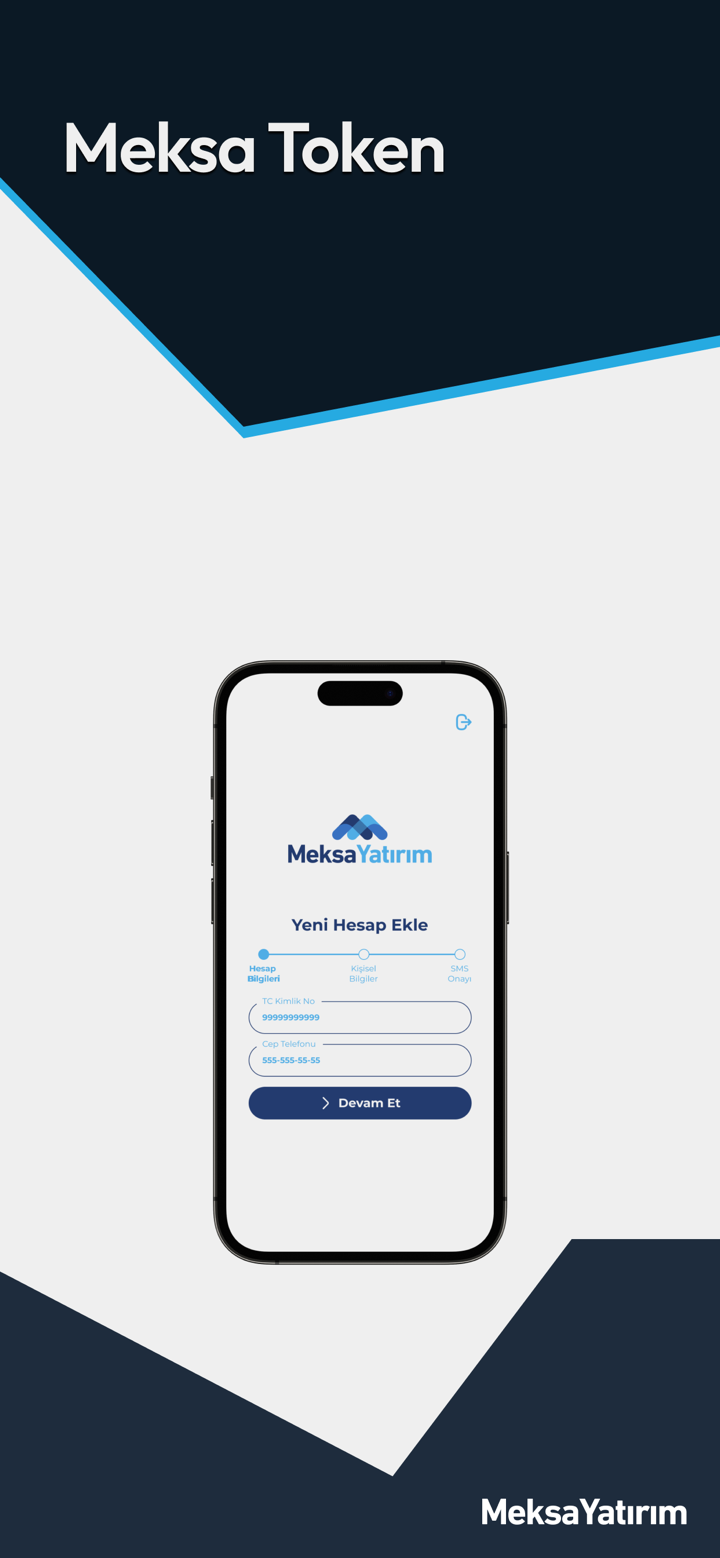

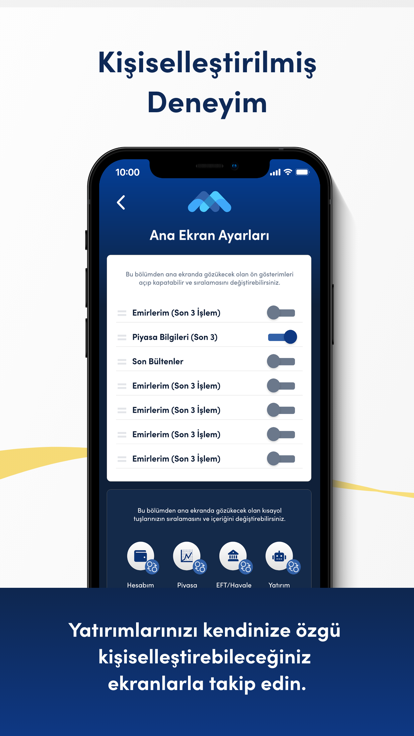

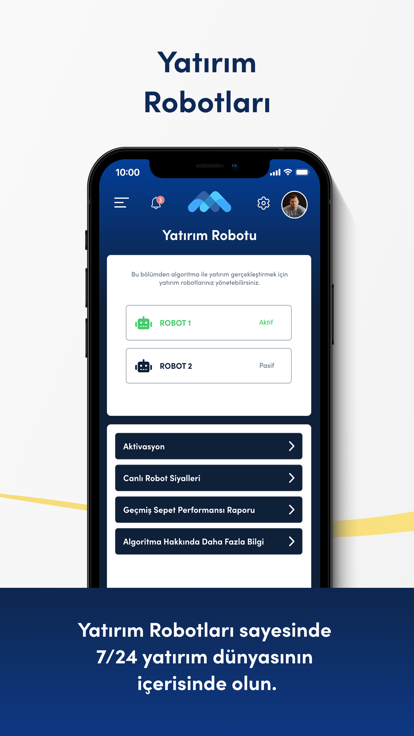

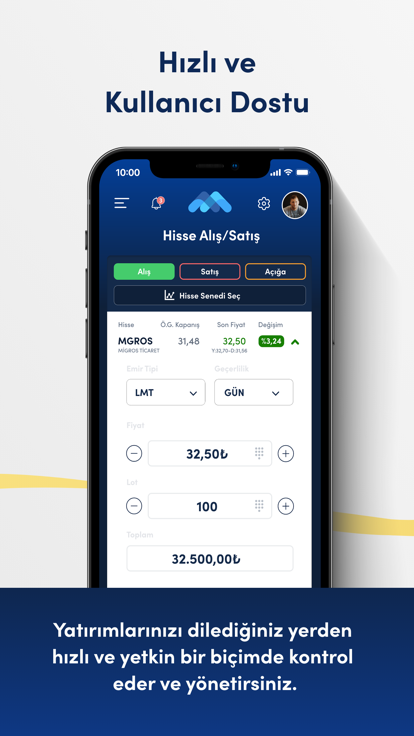

MEKSA宣傳其提供多種服務,包括投資諮詢、經紀服務、投資組合管理、衍生工具、viop 服務、基金管理、研究、外匯市場和企業融資。

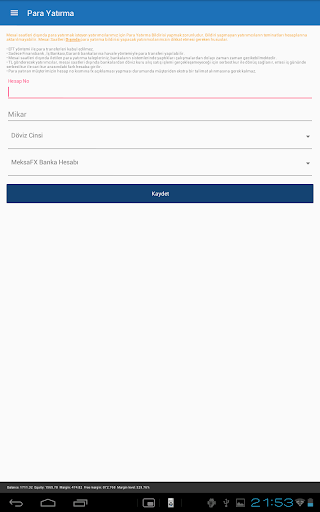

存取款

實現外匯投資的最低入金金額 MEKSAcmb 說是 50,000 tl。但是,經紀人沒有透露有關可接受的存款和取款方式的任何信息。

客戶支持

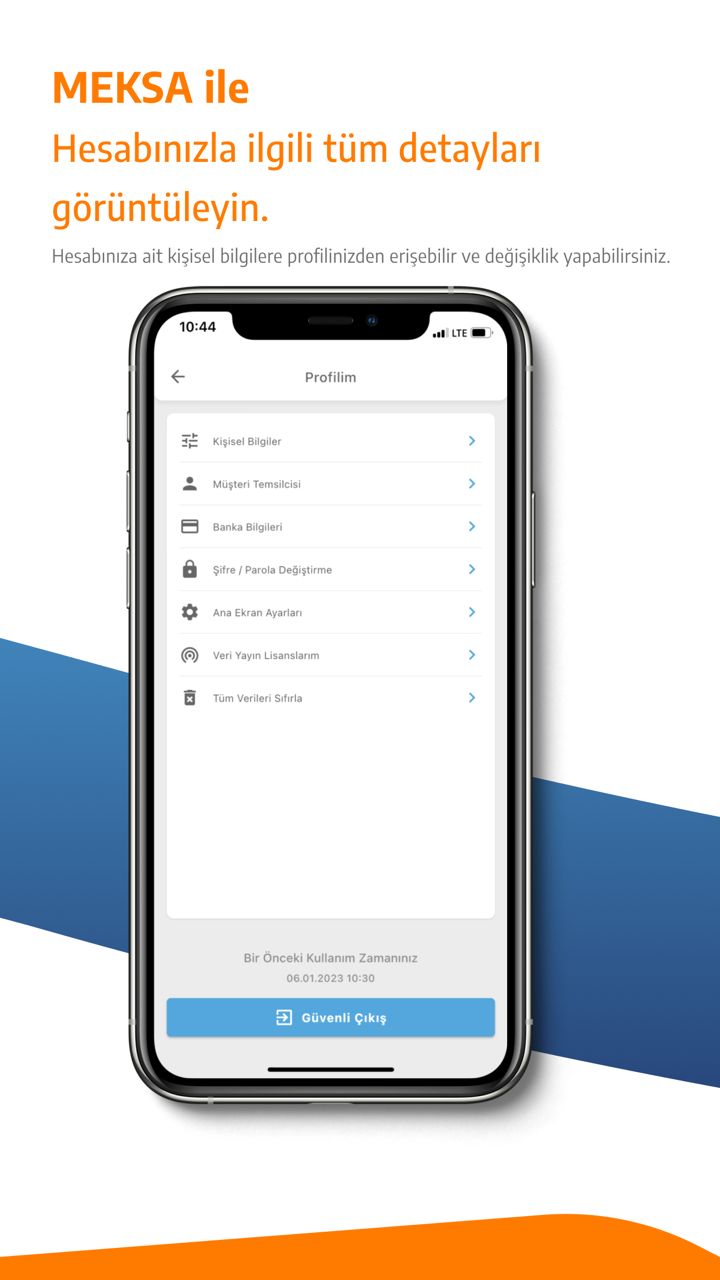

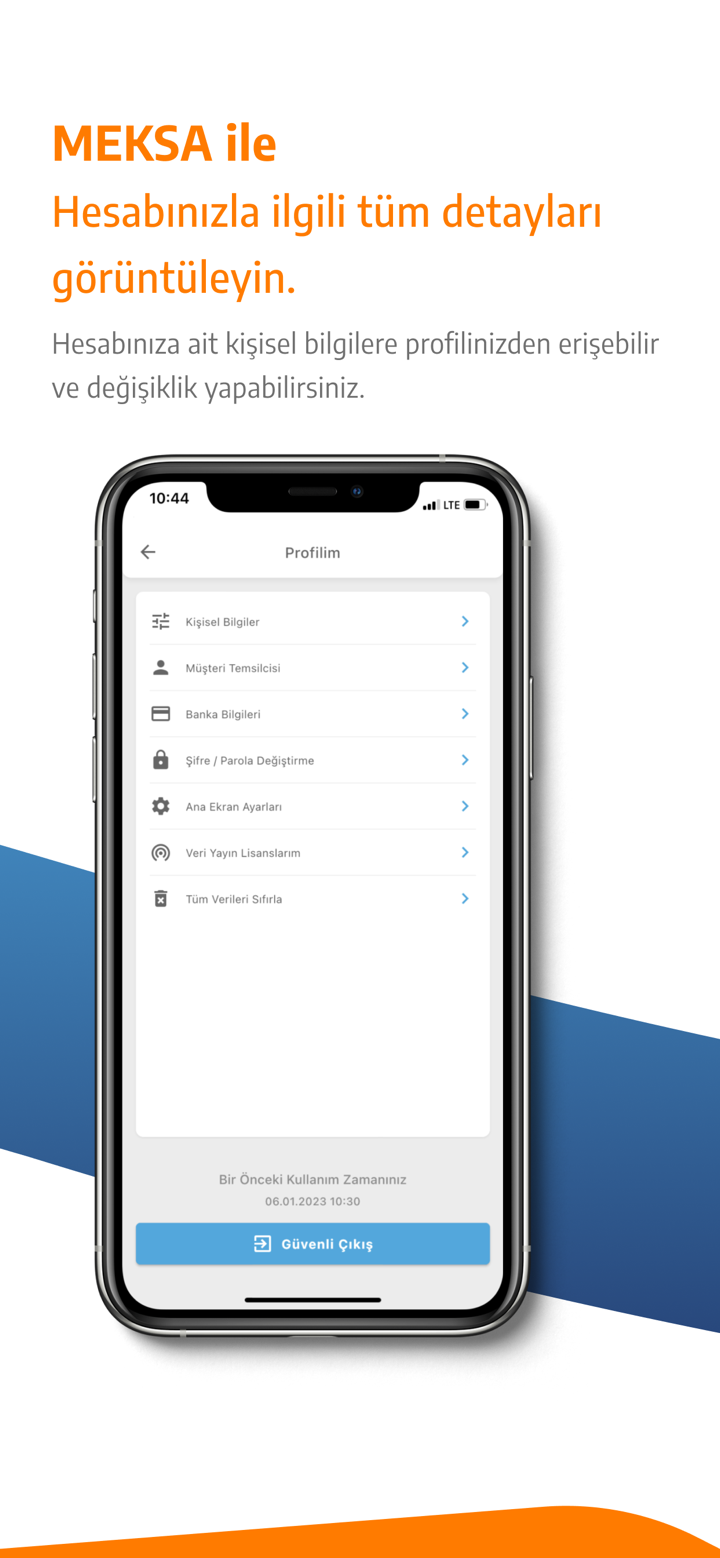

MEKSA可以通過以下方式聯繫客戶支持:電話:02166813400,傳真:+90 (216) 6930570、+90 (216) 6930571、+90 (216) 6930572,電子郵件:destek@ MEKSA fx.com 或在線發送消息以取得聯繫。您還可以在社交媒體平台上關注該經紀人,例如推特、臉書、instagram、youtube 和 linkedin。公司地址:şehit teğmen ali yılmaz sok。 güven sazak plaza a blok no:13 kat: 3-4 34810 kavacık - beykoz / istanbul.

風險提示

在線交易涉及高風險,您可能會損失所有投資資金。它並不適合所有交易者或投資者。請確保您了解所涉及的風險,並註意本文中包含的信息僅供一般參考。