Resumo da empresa

| GMA CAPITAL Resumo da Revisão | |

| Fundação | 2016 |

| País/Região Registrada | Argentina |

| Regulação | Sem Regulação |

| Serviços | Vendas e Negociação, Gestão de Ativos, Finanças Corporativas, Gestão de Patrimônio |

| Conta Demonstrativa | ❌ |

| Plataforma de Negociação | / |

| Depósito Mínimo | $0 |

| Suporte ao Cliente | Formulário de Contato |

| Telefone: (+54 11) 5273-1252 | |

| Email: info@gmacap.com | |

| Endereço: MIÑONES 2177, 4° PISO, CP 1428, CABA - Argentina | |

| X, LinkedIn, Instagram | |

GMA CAPITAL é uma empresa financeira não regulamentada estabelecida na Argentina em 2016. Ela oferece vários serviços financeiros, incluindo Vendas e Negociação, Gestão de Ativos, Finanças Corporativas e Gestão de Patrimônio. No entanto, há poucas informações em seu site oficial.

Prós e Contras

| Prós | Contras |

| Vários canais de suporte ao cliente | Sem regulação |

| Diversos serviços oferecidos | Informações limitadas sobre contas |

| Sem contas de demonstração | |

| Falta de informações sobre plataformas de negociação |

GMA CAPITAL é Legítimo?

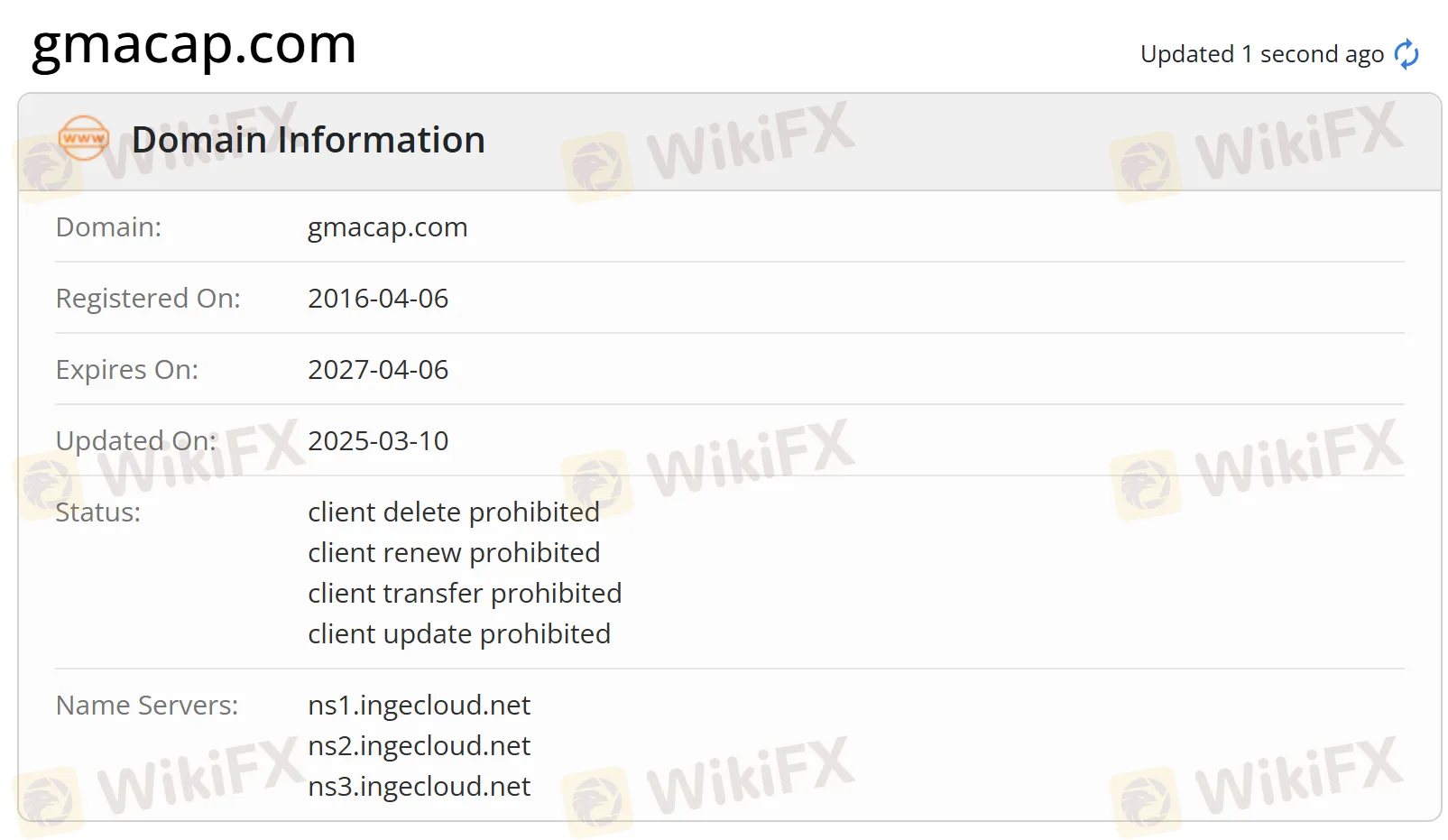

Atualmente, GMA CAPITAL não possui regulação válida. Seu domínio foi registrado em 6 de abril de 2016 e o status atual é “cliente Proibido de Excluir, cliente Proibido de Renovar, cliente Proibido de Transferir, cliente Proibido de Atualizar”. Recomendamos que procure por outras empresas regulamentadas.

Serviços do GMA CAPITAL

GMA CAPITAL oferece serviços financeiros como Vendas e Negociação, Gestão de Ativos, Finanças Corporativas e Gestão de Patrimônio.

Conta

Não há informações sobre tipos de conta. A única coisa que sabemos é que a abertura de conta será realizada em até 24 horas e é gratuita, e não há valor mínimo para começar a investir também.

Depósito e Saque

Na GMA Capital, para depósitos: Transferências eletrônicas em pesos ou dólares da Argentina podem ser feitas através de contas autorizadas específicas. Cheques também podem ser depositados entrando em contato com o oficial da conta e enviando o recibo por email. Os depósitos devem ser provenientes de contas de demanda autorizadas pelo BCRA com titularidade correspondente.

Para levantamentos: As opções incluem transferências bancárias para contas de propriedade do cliente, cheques emitidos para o titular da conta ou cheques eletrônicos (echeq). Um limite diário restringe cada cliente a no máximo dois pagamentos de fundos ou emissões de cheques.