회사 소개

| MTFX 리뷰 요약 | |

| 등록일 | 2016-03-04 |

| 등록 국가/지역 | 캐나다 |

| 규제 | 규제되지 않음 |

| 서비스 | 통화 환전, 국제 송금, 위험 헷지 |

| 거래 플랫폼 | MTFX (iOS 및 Android 앱) |

| 고객 지원 | Facebook, Twitter, Instagram |

MTFX 정보

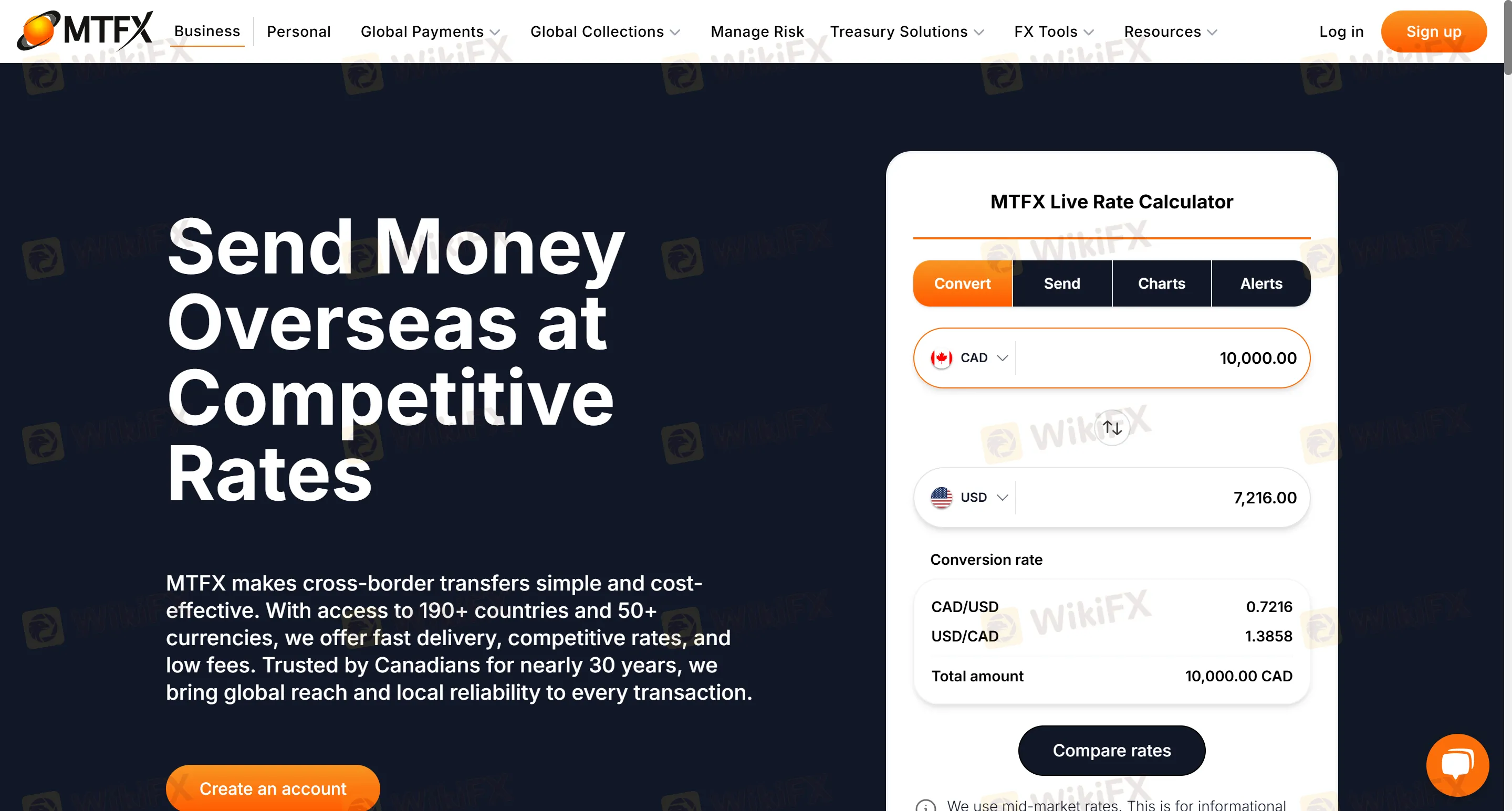

MTFX 은 190개국 이상으로 50가지 이상의 통화를 이체하는 국제 송금에 특화된 성숙한 플랫폼입니다. 개인 및 기업 국제 송금, 전자 상거래 자금 수집, 대액 자금 이체(해외 부동산 구매 및 고급품 획득 등), 다국화 통장 관리 및 화폐 위험 헷지를 지원합니다. 주로 국제 송금이 빈번하고 환율 비용 및 자금 보안에 중요성을 두는 사용자들에게 적합하며 특히 대액 결제 및 기업 시나리오에서 유용합니다.

장단점

| 장점 | 단점 |

| 환율 4% | 규제되지 않음 |

| 온라인 포털 24/7 접속 | 통화 쌍 제한(중요 통화에 초점) |

| 다양한 시나리오 커버리지 | 수수료 정보 불명확 |

MTFX 합법적인가요?

MTFX 은 규제되지 않았으며, FINTRAC(캐나다 금융 거래 및 보고 분석 센터)에 의해 규제되었다고 주장하고 있지만 실제로 규제 문제가 있습니다. 규제된 중개업체를 선택하는 것이 권장됩니다.

MTFX 는 어떤 서비스를 제공하나요?

MTFX 은 주로 국제 자금 이체 및 외환 서비스를 제공하며 전통적인 금융 파생상품 거래 플랫폼은 아닙니다. 제공되는 서비스는 다음과 같습니다:

통화 환전: CAD/USD 및 EUR/GBP와 같은 주요 통화 쌍과 같이 50가지 이상의 통화를 실시간으로 변환합니다.

국제 송금: 개인 송금(등록금, 생활비, 주택 구매 자금) 및 기업 지불(공급업체 결제, 급여, 전자 상거래 수집).

위험 헷지: 환율을 잠그고 맞춤형 헷지 전략을 제공하여 국제 무역 및 투자 시나리오에 적합합니다.

계정 유형

MTFX 은 두 가지 유형의 계정을 제공합니다. 개인 계정은 개인 국제 송금, 국제 등록금 지불 및 월세 및 연금과 같은 정기 송금에 적합하며, 비즈니스 계정은 기업 국제 지불, 공급망 결제, 다국화 자금 관리 및 아마존 및 이베이와 같은 전자 상거래 플랫폼 통합을 위해 설계되었습니다.

거래 플랫폼

온라인 포털은 iOS 및 Android 앱을 포함한 24시간 7일 모바일 애플리케이션을 지원합니다.

입금 및 출금

자금은 수취인의 은행 계좌로 직접 입금됩니다. 기업 송금의 경우 자금은 24-48시간 이내에 도착합니다(당일 와이어 전송이 우선). 대부분의 개인 송금은 당일이나 다음 영업일에 완료됩니다.