회사 소개

| Tasman FX 리뷰 요약 | |

| 설립일 | 2009-03-05 |

| 등록 국가/지역 | 호주 |

| 규제 | 규제됨 |

| 서비스 | 외환 제품, 수신 송금, 리스크 관리, 시장 주문 및 글로벌 결제 |

| 고객 지원 | 시드니: (02) 8011 1846멜버른: (03) 9111 0310브리즈번: (07) 3733 1913퍼스: (08) 9468 2705애들레이드: (08) 7111 0807 |

| (02) 9098 8217 | |

| Facebook, LinkedIn, Instagram, Twitter | |

| The Commons, Level 1, 285a Crown St, Surry Hills, NSW 2010, 호주 | |

Tasman FX 정보

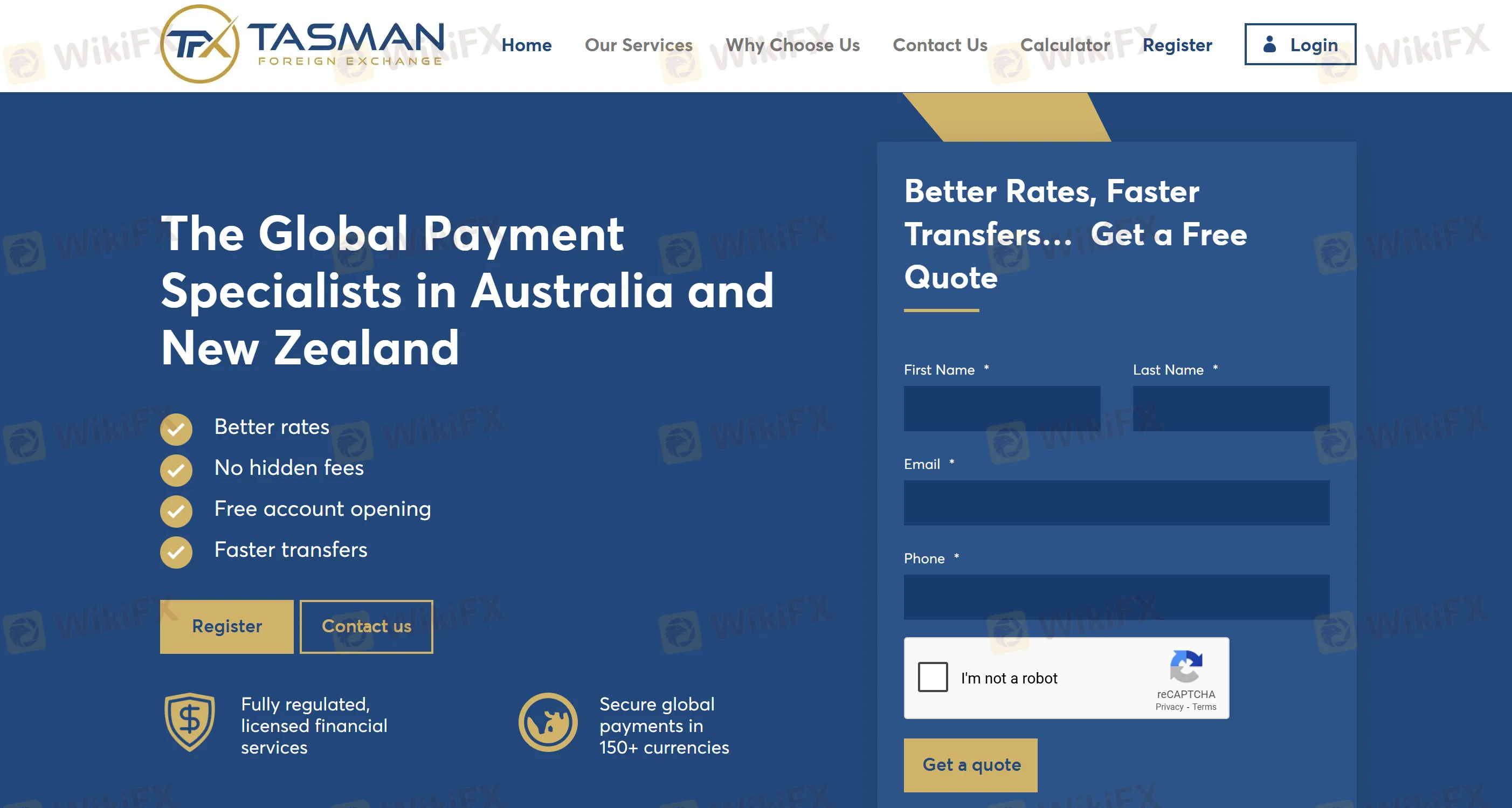

2009년 설립된 Tasman FX은 호주와 뉴질랜드에서 선도적인 라이선스를 보유한 외환 및 글로벌 결제 서비스 제공업체입니다. Tasman FX은 150가지 이상의 통화로 50개 이상의 국가 및 지역에서 안전한 결제를 지원하며 개인 및 기업을 위한 국경을 넘는 자금 솔루션을 제공합니다.

장단점

| 장점 | 단점 |

| 규제됨 | 서비스 범위 제한 (호주 및 뉴질랜드 시장에 초점) |

| 다양한 서비스 | 단일 제품 유형 |

| 150가지 이상의 통화로 글로벌 결제 | 레버리지 서비스 부족 |

Tasman FX이 신뢰할 만한가요?

예. Tasman FX은 호주 금융 서비스 라이선스 (AFSL)를 보유하고 뉴질랜드에서 법적으로 등록 및 규제되었습니다. ASIC 라이선스 번호는 000337970입니다.

Tasman FX은 어떤 서비스를 제공하나요?

Tasman FX은 스폿 외환 거래 및 선물 외환 계약(FEC)과 같은 외환 제품을 제공합니다. 투자자는 전신 이체, ACH 및 SEPA를 포함한 다양한 자금 이체 방법을 선택할 수 있으며 50가지 이상의 통화를 지원합니다.

계정 유형

Tasman FX은 개인 계정과 기업 계정을 무료로 개설할 수 있습니다. 국경을 넘는 송금, 외환 환전 및 맞춤형 리스크 관리 솔루션과 같은 서비스를 지원합니다.

小芯

대만

이 플랫폼을 사용하면 계좌를 개설하고 무료로 직접 투자할 수 있습니다. 초보자에게 매우 적합합니다. 더 중요한 것은 처리 수수료가 저렴하고 출금 속도가 빠르다는 것입니다. 서비스 태도가 매우 좋습니다.

좋은 평가

FX3660481217

홍콩

떨리는 마음으로 이 플랫폼에 입장했습니다. 한동안 사용해 보니 아주 좋은 플랫폼이라는 것을 알게 되었습니다. 나는 여기서 추가 수입을 얻었고 계속 사용할 것입니다.

좋은 평가

FX1349771962

뉴질랜드

저는 Tasman FX에 무료 계정을 등록하는 과정이 시간이 많이 걸리고 지루하다는 것을 알았습니다. 또한 고객 서비스 응답 시간이 매우 느려 중요한 질문에 대한 답변을 얻기가 어려웠습니다. 전반적으로 나는 이 회사에 대한 경험이 좋지 않았으며 앞으로 그들의 서비스를 사용하는 것을 고려하지 않을 것입니다.

중간 평가

FX1299232315

호주

나는 수년 동안 TASMAN의 고객이었고 그들이 업계 최고라고 말해야 합니다. 고객 서비스는 최고입니다. 그들의 플랫폼은 투자를 매우 간단하게 만듭니다!

좋은 평가