회사 소개

| ABN AMRO Clearing리뷰 요약 | |

| 설립 연도 | 2009 |

| 등록 국가/지역 | 네덜란드 |

| 규제 | 규제 없음 |

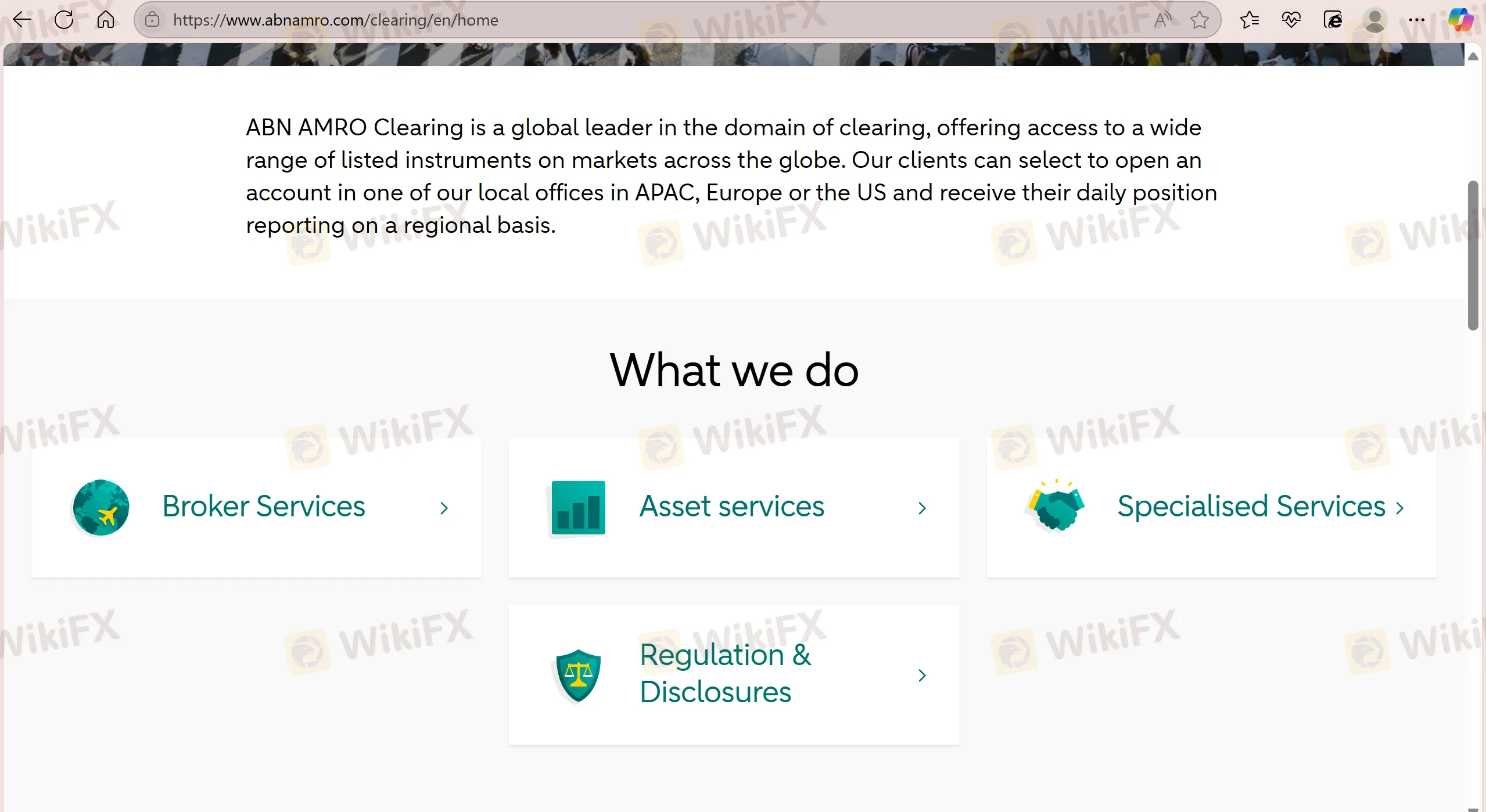

| 제품 및 서비스 | 브로커 서비스, 자산 서비스, 전문 서비스 및 규정 및 공개 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 이메일: ronald.breault@abnamroclearing.com |

| 소셜 미디어: LinkedIn, YouTube | |

| 주소: ABN AMRO Clearing USA LLC 175 W. Jackson Boulevard, Suite 2050, Chicago, IL 60604 USA | |

ABN AMRO Clearing 정보

ABN AMRO Clearing은 2009년에 설립되었으며 네덜란드에 등록되어 있습니다. 브로커 서비스, 자산 서비스, 전문 서비스 및 규정 및 공개 정보를 포함한 다양한 제품 및 서비스를 제공하여 거래, 자산 관리, 맞춤형 솔루션 및 규정 준수에 대한 고객의 요구를 충족합니다. 그러나 회사는 규제를 받지 않고 계정 기능, 입금 및 인출 프로세스에 대한 구체적인 정보가 부족합니다. 서비스 이용 시 자금 안전 및 투명성에 주의해야 합니다.

장단점

| 장점 | 단점 |

| 다양한 서비스 | 규제 없음 |

| 긴 운영 역사 | 거래 세부 정보 없음 |

ABN AMRO Clearing 합법인가요?

ABN AMRO Clearing은 2009년에 설립되었으며 규제를 받지 않습니다. 거래 시 트레이더는 신중히 거래하고 자금을 분별하여 사용해야 합니다.

제품 및 서비스

ABN AMRO Clearing은 거래, 자산 관리, 맞춤형 솔루션 및 규정 준수를 위해 브로커 서비스, 자산 서비스, 전문 서비스 및 규정 및 공개를 포함한 다양한 제품 및 서비스를 제공합니다.

| 제품 & 서비스 | 지원됨 |

| 브로커 서비스 | ✔ |

| 자산 서비스 | ✔ |

| 전문 서비스 | ✔ |

| 규정 및 공개 | ✔ |