Profil perusahaan

| Victory Securities Ringkasan Ulasan | |

| Dibentuk | 1971 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC |

| Layanan | Manajemen Kekayaan, Pasar Modal, Aset Virtual, Manajemen Aset, Asuransi, Layanan Brokerage, dan Rencana Kepemilikan Saham Karyawan (ESOP) |

| Platform Perdagangan | VictoryX, VictorySecurities (Saham), VIC TOKEN, dan Perdagangan Sekuritas (Desktop) |

| Dukungan Pelanggan | Telepon: +852 2523 1709, +86 147 1501 7408, +852 5498 9438 |

| Fax: +852 2810 7616 | |

| Email: cs@victorysec.com.hk | |

| Alamat: 11/F, Yardley Commercial Building, 3 Connaught Road West, Sheung Wan, Hong Kong | |

| Formulir kontak, media sosial | |

Didirikan pada tahun 1971, Victory Securities adalah broker berlisensi yang diatur oleh SFC di Hong Kong. Ia menawarkan berbagai layanan seperti Manajemen Kekayaan, Pasar Modal, Aset Virtual, Manajemen Aset, Asuransi, Layanan Brokerage, dan Rencana Kepemilikan Saham Karyawan (ESOP) melalui beberapa platform perdagangan seperti VictoryX, VictorySecurities (Saham), VIC TOKEN, dan Perdagangan Sekuritas (Desktop).

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh SFC | Struktur biaya yang kompleks |

| Beragam saluran kontak | Tidak ada dukungan obrolan langsung |

| Berbagai layanan | |

| Berbagai jenis akun | |

| Berbagai platform |

Apakah Victory Securities Legal?

| Negara yang Diatur | Otoritas yang Diatur | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| The Securities and Futures Commission (SFC) | Victory Securities Company Limited | Berurusan dengan kontrak berjangka | ABN091 |

Layanan

Victory Securities menyediakan layanan keuangan tradisional seperti Manajemen Kekayaan, Pasar Modal, Aset Virtual, Manajemen Aset, Asuransi, Layanan Brokerage, dan Rencana Kepemilikan Saham Karyawan (ESOP).

Jenis Akun

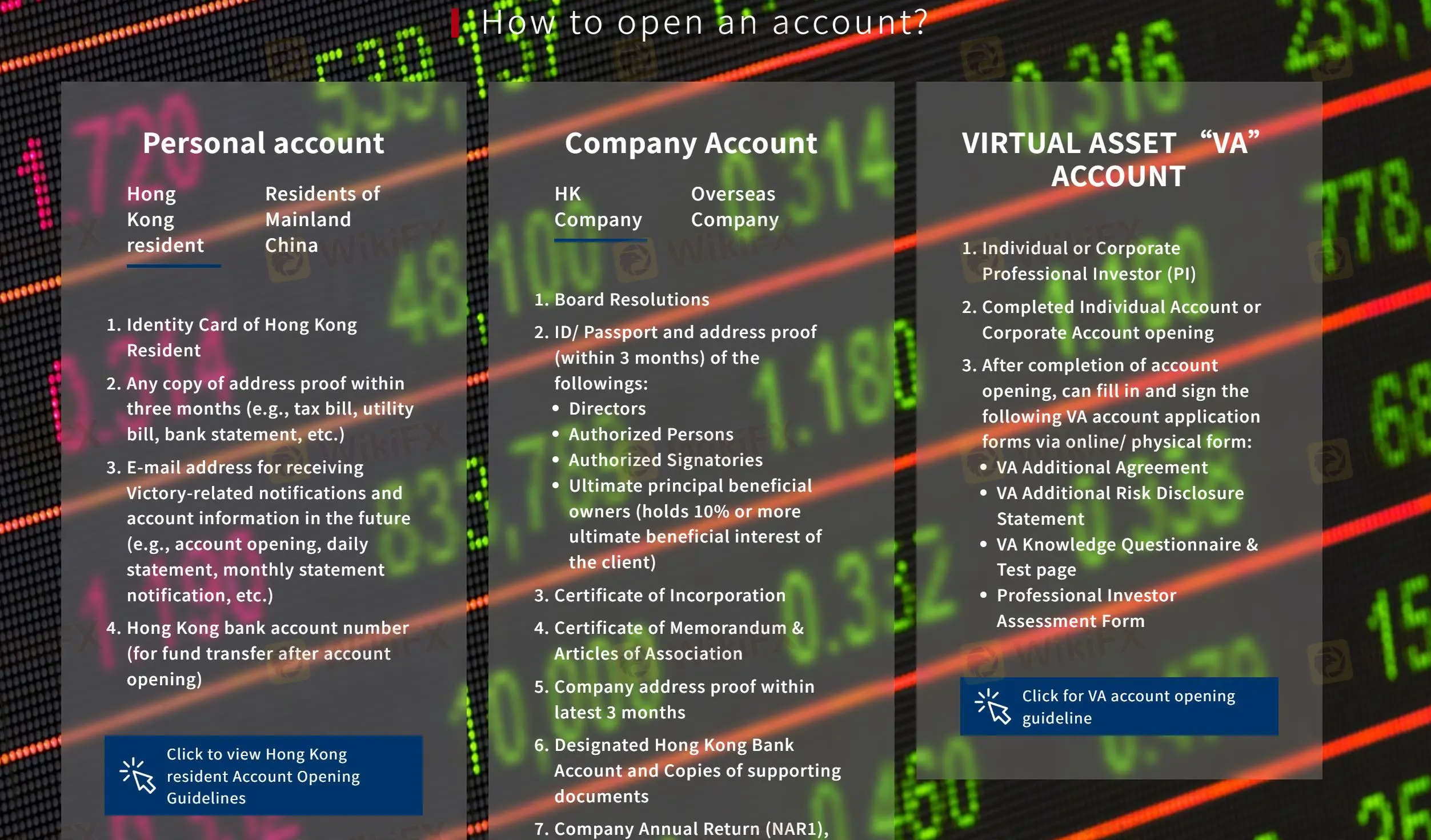

Victory Securities menyediakan tiga jenis akun untuk pengguna.

Akun Personal cocok untuk investor individu yang tinggal di Hong Kong atau Tiongkok Daratan.

Akun Perusahaan dirancang untuk entitas perusahaan, baik perusahaan Hong Kong maupun luar negeri.

Akun Aset Virtual (VA) tersedia untuk investor profesional individu atau perusahaan yang telah membuka akun pribadi atau perusahaan.

Victory Securities menyediakan dua cara untuk membuka akun secara online menggunakan aplikasi seluler "VictoryX" dan membuka akun melalui pos.

Biaya

Biaya Perdagangan

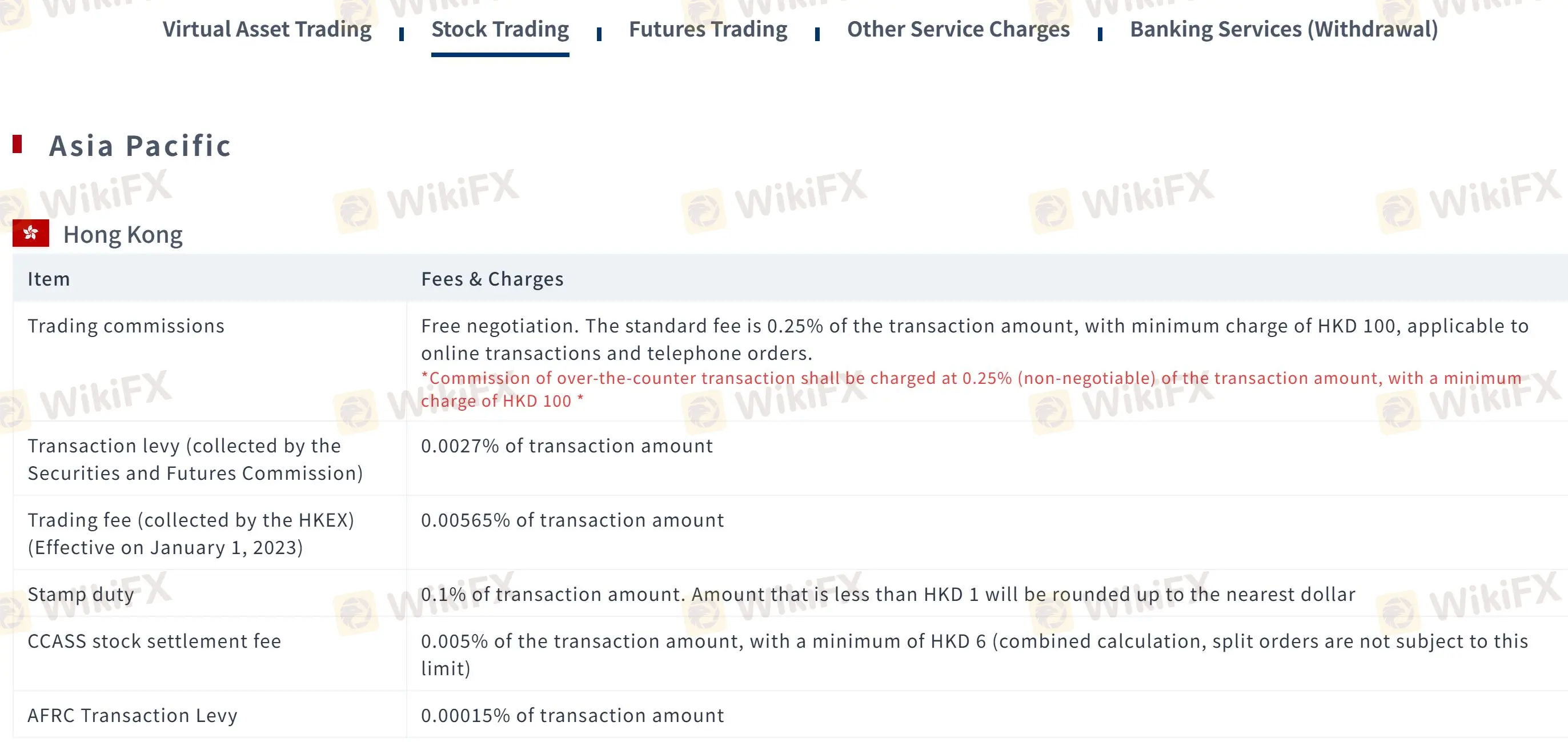

Jumlah komisi spesifik dari Victory Securities tergantung pada pasar, produk, dan jenis transaksi. Misalnya, komisi untuk perdagangan saham biasanya sebesar 0,25% hingga 0,45% dari jumlah transaksi, dan biaya minimum bervariasi dari wilayah ke wilayah.

| Produk | Komisi | Biaya Minimum |

| Saham Hong Kong | 0,25% (dapat dinegosiasikan) | HKD 100 |

| Cina (Shanghai/Shenzhen Connect) | 0,25% | RMB 100 |

| Saham Jepang | 0,30% (online), 0,40% (telepon) | JPY 3.500 |

| Saham Singapura | 0,25% | USD 40 |

| Saham Taiwan | 0,30% | NT$600 |

| Saham Australia | 0,35% | AUD 50 |

| Saham Korea Selatan | 0,30% | KRW 20.000 |

| Saham Amerika Serikat | 0,25% | USD 15 |

Biaya Non Perdagangan

Ada biaya tambahan yang terkait dengan layanan mereka. Biaya ini mencakup berbagai aspek manajemen akun, tindakan perusahaan, dan jenis transaksi tertentu. Beberapa contoh umum termasuk pajak dan biaya transaksi, biaya kliring, biaya penyimpanan, dan biaya layanan lainnya.

| Kategori Biaya | Jumlah |

| Pajak Transaksi | 0,0027% dari jumlah transaksi |

| Biaya Perdagangan | 0,00565% dari jumlah transaksi |

| Pajak Cap | 0,1% dari jumlah transaksi (dibulatkan ke atas) |

| Biaya Penyelesaian Saham CCASS | 0,005% dari jumlah transaksi (minimum HKD 6) |

| Pajak Transaksi AFRC | 0,00015% dari jumlah transaksi |

Untuk informasi lebih lanjut, silakan lihat situs web berikut: https://www.victorysec.com.hk/en/help/fee

Platform Perdagangan

| Platform Perdagangan | Cocok untuk |

| VictoryX | Investor individu yang mencari platform perdagangan yang komprehensif dan mudah digunakan dengan fitur canggih. |

| Victory Securities (Saham) | Investor individu yang tertarik terutama dalam perdagangan saham. |

| VIC TOKEN | Investor yang tertarik dalam perdagangan mata uang kripto. |

| Perdagangan Efek (Desktop) | Investor individu yang lebih memilih platform perdagangan berbasis desktop. |

Deposit dan Penarikan

Deposit

| Opsi Deposit | MinimalDeposit | Biaya | Waktu Proses |

| Transfer Bank (online dan offline) | / | / | Waktu pemotongan pada hari kerja adalah pukul 16:45. Sertifikat transfer yang diajukan setelah waktu ini akan diproses pada hari kerja kedua. |

Penarikan

| Opsi Penarikan | MinimalPenarikan | Biaya | Waktu Proses |

| Transfer Bank (online dan offline) | $0 | Penarikan pertama setiap hari tidak dikenakan biaya, dan penarikan berikutnya sebesar HKD$500 setiap kali. | Aplikasi yang diajukan sebelum pukul 12:00 siang akan diproses pada hari yang sama. |

| Aplikasi yang diajukan setelah pukul 12:00 siang akan diatur untuk diproses pada hari kerja berikutnya. | |||

| Transfer Telegrafis/Transfer Antarbank | $0 | HKD/RMB: Penarikan pertama setiap hari sebesar $/RMB$300, dan penarikan berikutnya sebesar $/RMB$800 setiap kali; | Aplikasi yang diajukan sebelum pukul 12:00 siang akan diproses pada hari yang sama. |

| USD: Penarikan pertama setiap hari sebesar US$25, dan penarikan berikutnya sebesar US$100 setiap kali. | Aplikasi yang diajukan setelah pukul 12:00 siang akan diatur untuk diproses pada hari kerja berikutnya. |