Présentation de l'entreprise

| MIB SecuritiesRésumé de l'examen | |

| Fondé | Plus de 20 ans |

| Pays/Région enregistré | Hong Kong |

| Réglementation | Réglementé |

| Instruments de marché | HK Securities/Warrants & CBBCs/Margin Financing/Foreign Stocks/Global Securities Markets/Futures and Options/MlB Trade/ETF |

| Plateforme de trading | MIB Securities Trade(Mobile)/Java/ADOBE READER |

| Assistance clientèle (de 9h00 à 18h00 (du lundi au vendredi), jours fériés exclus) | Hotline du service clientèle : +852 2268 0660 |

| Hotline de trading de titres : +852 2268 0688 | |

| Hotline de trading de contrats à terme : +852 2268 0699 | |

| Email : customerservices@mib.com.hk | |

| Fax : +852 2521 2289 | |

Informations sur MIB Securities

MIB Securities est un courtier en valeurs mobilières et en investissement qui regroupe des activités à travers le monde. Il propose des services dans les domaines de la finance d'entreprise, des marchés de la dette, des marchés des capitaux propres, des produits dérivés, du courtage de valeurs mobilières pour les particuliers et les institutions, ainsi que de la recherche.

MIB Securities est-il légitime ?

MIB Securities est autorisé et réglementé par la Securities and Futures Commission de Hong Kong (SFC) avec le numéro de licence ABH686, ce qui le rend plus sûr que les courtiers non réglementés.

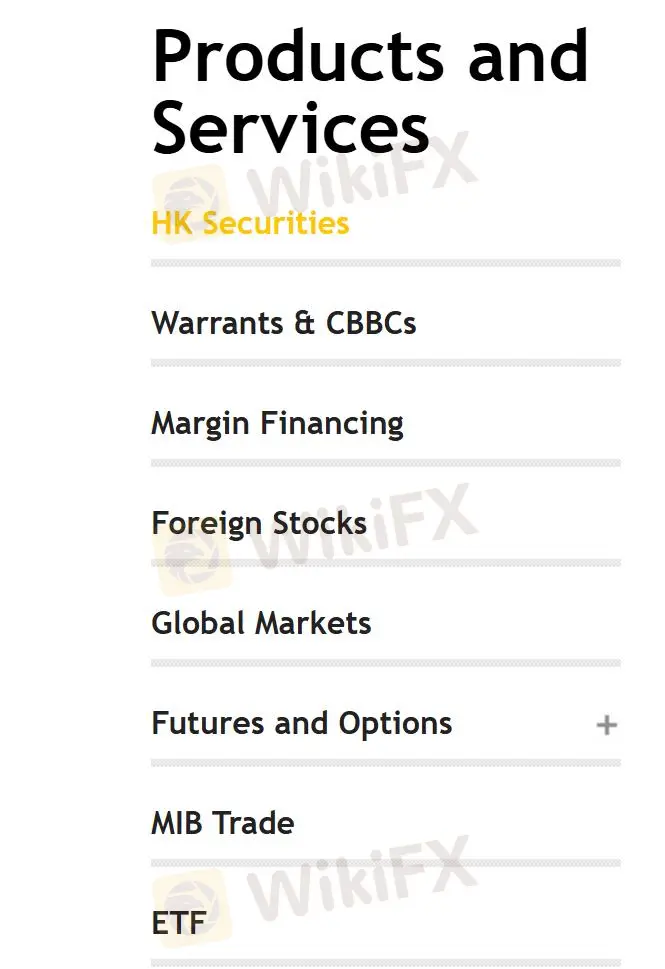

Quels produits et services MIB Securities propose-t-il ?

MIB Securities offre un accès à divers produits et services, notamment des titres HK, des warrants & CBBCs, du financement sur marge, des actions étrangères, des marchés mondiaux de valeurs mobilières, des contrats à terme et des options, des opérations MlB et des ETF.

Type de compte

Les utilisateurs peuvent ouvrir des comptes individuels/communs ou des comptes d'entreprise. MIB Securities Trade propose également des comptes de titres et de matières premières.

Logiciel

MIB Securities propose MIB Securities Trade, disponible sur mobile ou en téléchargement direct de l'APK. Les utilisateurs doivent également télécharger Java et ADOBE READER.

Dépôt et retrait

Les clients peuvent déposer des fonds sur leur compte MIB SecuritiesHK via les méthodes suivantes : dépôt par virement bancaire et chèque (y compris via les guichets bancaires, les distributeurs automatiques de billets (ATM) et les machines de dépôt de chèques), virement télégraphique (pour les clients étrangers), Faster Payment System (FPS) et les comptes bancaires désignés par MIB SecuritiesHK.

Les retraits ne sont pas pris en charge vers des comptes de carte de crédit ou des comptes bancaires de tiers, mais vous pouvez utiliser la fonction "Retrait" de MIB Securities Trade (uniquement applicable au trading d'actions locales), contacter votre gestionnaire de compte ; ou contacter le service clientèle (hotline : +852 2268 0660 ou email : customerservices@mib.com.hk)