مقدمة عن الشركة

| MIB Securitiesملخص المراجعة | |

| تأسست | أكثر من 20 عامًا |

| البلد/المنطقة المسجلة | هونغ كونغ |

| التنظيم | منظم |

| أدوات السوق | أوراق مالية هونغ كونغ/شهادات الإصدار وشهادات الإصدار المغطاة/تمويل الهامش/الأسهم الأجنبية/أسواق الأوراق المالية العالمية/العقود الآجلة والخيارات/تجارة MLB/ETF |

| منصة التداول | MIB Securities تجارة (الجوال)/جافا/ADOBE READER |

| دعم العملاء (من الساعة 9:00 صباحًا حتى الساعة 6:00 مساءً (من الاثنين إلى الجمعة)، باستثناء العطلات) | خط خدمة العملاء: +852 2268 0660 |

| خط التداول في الأوراق المالية: +852 2268 0688 | |

| خط التداول في العقود الآجلة: +852 2268 0699 | |

| البريد الإلكتروني: customerservices@mib.com.hk | |

| الفاكس: +852 2521 2289 | |

معلومات MIB Securities

MIB Securities هي وسيط للأوراق المالية والاستثمار يضم أعمالًا تمتد حول العالم. يقدم خدمات في التمويل الشركات، وأسواق الديون، وأسواق رأس المال الخاصة، والمشتقات، ووساطة الأوراق المالية للأفراد والمؤسسات، والبحث.

هل MIB Securities شرعي؟

MIB Securities مرخصة ومنظمة من قبل هيئة الأوراق المالية والعقود الآجلة في هونغ كونغ (SFC) برقم ترخيص ABH686، مما يجعلها أكثر أمانًا من الوسطاء غير المنظمين.

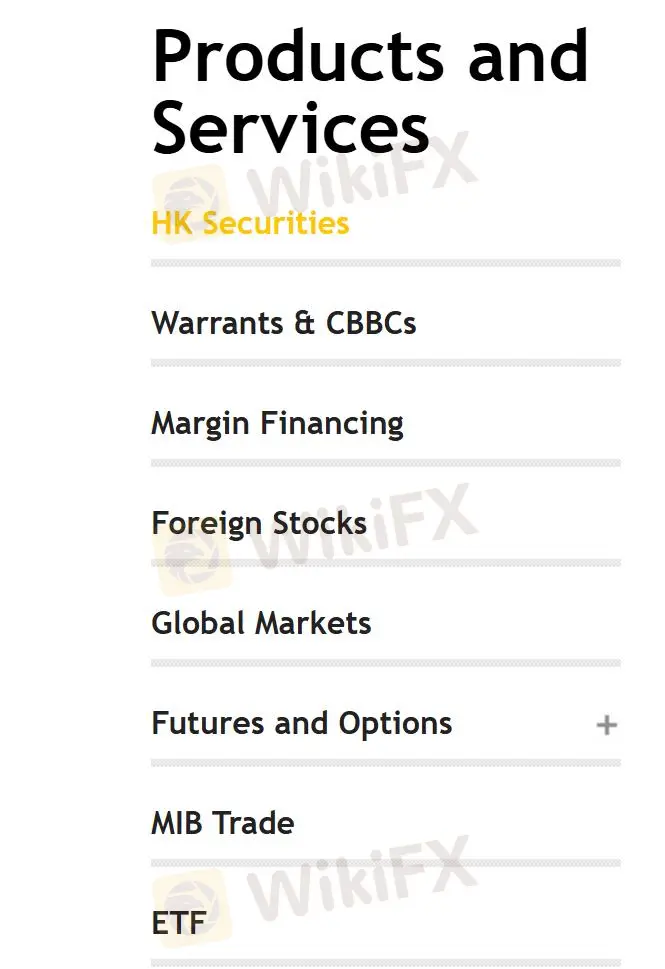

ما هي المنتجات والخدمات التي يقدمها MIB Securities؟

MIB Securities يوفر الوصول إلى مجموعة متنوعة من المنتجات والخدمات، بما في ذلك الأوراق المالية هونغ كونغ، وشهادات الإصدار وشهادات الإصدار المغطاة، وتمويل الهامش، والأسهم الأجنبية، وأسواق الأوراق المالية العالمية، والعقود الآجلة والخيارات، وتجارة MLB، وETF.

نوع الحساب

يمكن للمستخدمين فتح حسابات فردية/مشتركة أو حسابات شركات. توفر MIB Securities تجارة أيضًا حسابات الأوراق المالية والسلع.

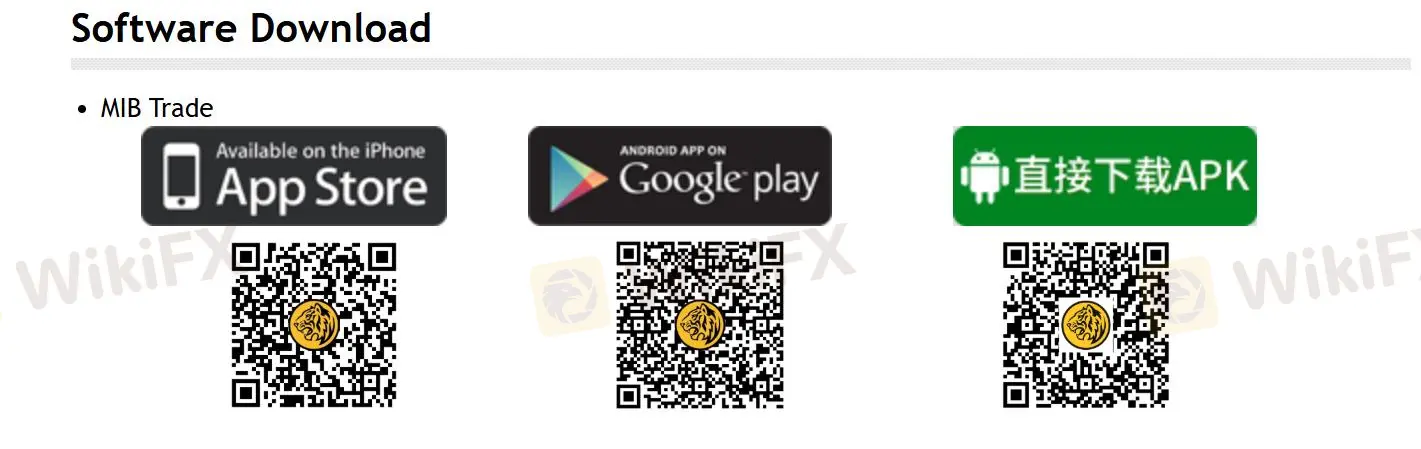

البرمجيات

MIB Securities توفر MIB Securities تجارة، والتي تتوفر على الهاتف المحمول أو يمكن تنزيلها مباشرةً. يحتاج المستخدمون أيضًا إلى تنزيل جافا وADOBE READER.

الإيداع والسحب

يمكن للعملاء إيداع الأموال في حساب MIB SecuritiesHK الخاص بك عن طريق الطرق التالية: تحويل بنكي وإيداع شيك (بما في ذلك من خلال العدادات البنكية، ماكينات الصراف الآلي، وماكينات إيداع الشيكات)، تحويل برقي (للعملاء الأجانب)، نظام الدفع السريع (FPS) وحسابات البنوك المعينة لدى MIB SecuritiesHK البنك.

لا يتم دعم السحب إلى أي حساب بطاقة ائتمان أو حساب بنكي من جهة ثالثة، ولكن يمكنك استخدام وظيفة "السحب" في MIB Securities تجارة (تطبق فقط على التداول المحلي في الأسهم)، اتصل بمدير حسابك؛ أو اتصل بقسم خدمة العملاء (الخط الساخن: +852 2268 0660 أو البريد الإلكتروني: customerservices@mib.com.hk )