Şirket özeti

| MIB Securitiesİnceleme Özeti | |

| Kuruluş | 20 yıldan fazla |

| Kayıtlı Ülke/Bölge | Hong Kong |

| Düzenleme | Düzenlenmiş |

| Piyasa Araçları | HK Menkul Kıymetler/Bono & CBBC/Marjin Finansman/Yabancı Hisse Senetleri/Küresel Menkul Kıymetler Piyasaları/Vadeli İşlemler ve Opsiyonlar/MlB Ticareti/ETF |

| İşlem Platformu | MIB Securities Ticareti (Mobil)/Java/ADOBE READER |

| Müşteri Desteği (9:00 - 18:00 (Pzt - Cuma), tatiller hariç) | Müşteri Hizmetleri Hattı: +852 2268 0660 |

| Menkul Kıymetler Ticareti Hattı: +852 2268 0688 | |

| Vadeli İşlemler Ticareti Hattı: +852 2268 0699 | |

| E-posta: customerservices@mib.com.hk | |

| Faks: +852 2521 2289 | |

MIB Securities Bilgileri

MIB Securities, dünya çapında faaliyet gösteren bir Menkul Kıymetler ve Yatırım Aracıdır. Kurumsal finans, borç piyasaları, öz sermaye piyasaları, türevler, perakende ve kurumsal menkul kıymetler aracılığı, ve araştırma hizmetleri sunmaktadır.

MIB Securities Güvenilir mi?

MIB Securities, Hong Kong Menkul Kıymetler ve Vadeli İşlemler Komisyonu (SFC) tarafından lisans NO.ABH686 ile yetkilendirilmiş ve düzenlenmiştir, bu da düzenlenmemiş brokerlardan daha güvenlidir.

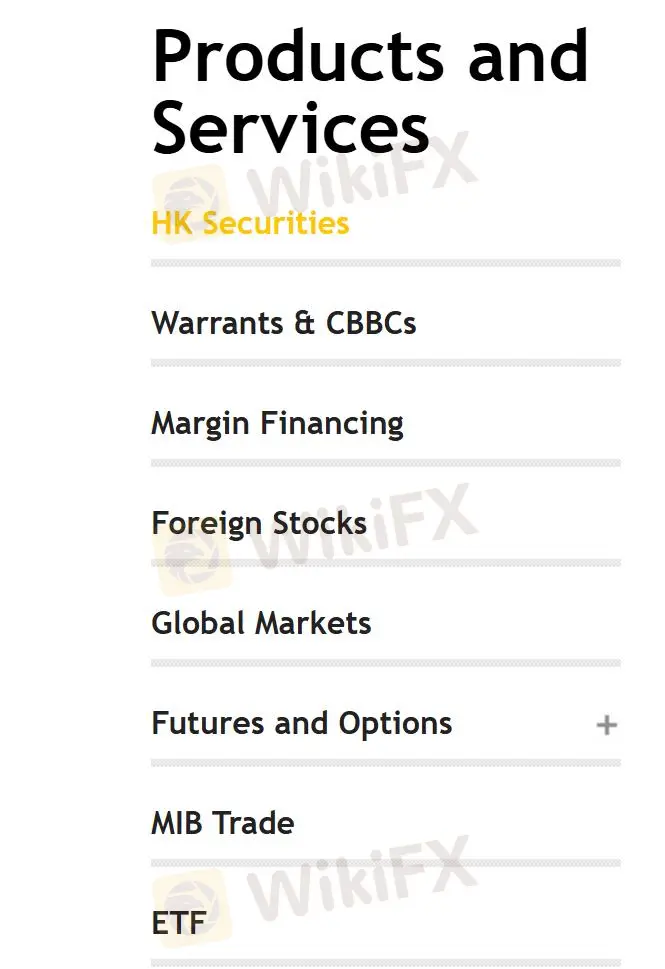

MIB Securities Hangi Ürün ve Hizmetleri Sunar?

MIB Securities, HK Menkul Kıymetler, Bono & CBBC, Marjin Finansman, Yabancı Hisse Senetleri, Küresel Menkul Kıymetler Piyasaları, Vadeli İşlemler ve Opsiyonlar, MlB Ticareti ve ETF dahil olmak üzere çeşitli ürün ve hizmetlere erişim sağlar.

Hesap Türü

Kullanıcılar bireysel/ortak hesaplar veya kurumsal hesaplar açabilirler. MIB Securities Ticareti ayrıca Menkul Kıymetler ve Emtia Hesapları sağlar.

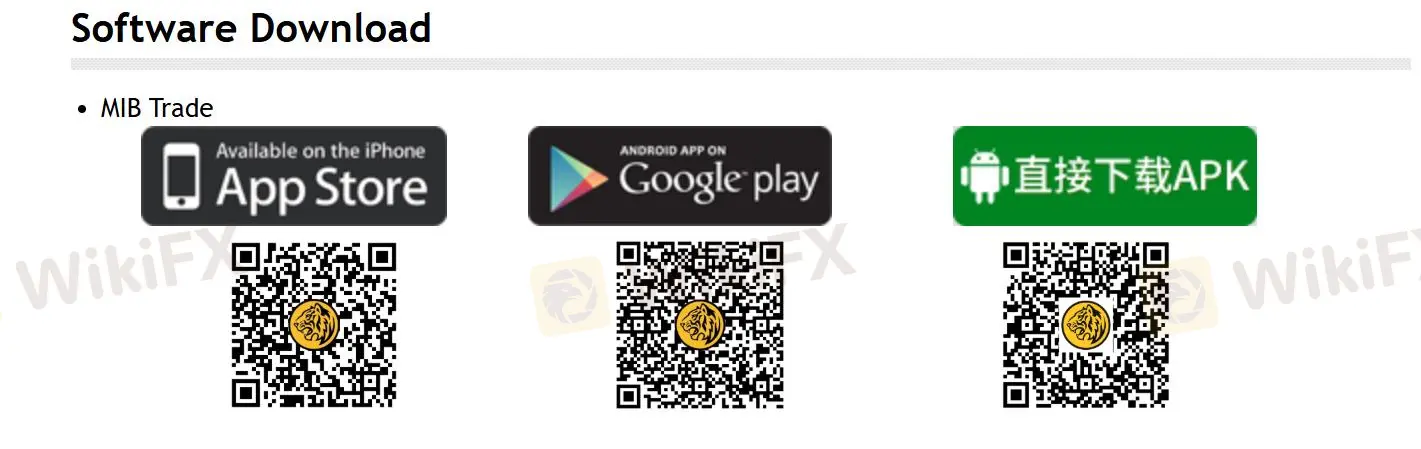

Yazılım

MIB Securities, mobil veya doğrudan APK olarak indirilebilen MIB Securities Ticareti sağlar. Kullanıcılar ayrıca Java ve ADOBE READER'ı indirmelidir.

Para Yatırma ve Çekme

Müşteriler, MIB SecuritiesHK hesaplarına aşağıdaki yöntemlerle fon yatırabilirler: banka transferi ve çek yatırma (banka şubeleri, ATM'ler ve çek yatırma makineleri aracılığıyla), telegrafik transfer (yurtdışı müşteriler için), Daha Hızlı Ödeme Sistemi (FPS) ve MIB SecuritiesHK belirlenen banka hesapları.

Üçüncü taraf kredi kartı hesaplarına veya banka hesaplarına çekim yapılamaz, ancak MIB Securities Ticareti'nin "Çekim" işlevini kullanabilirsiniz (yalnızca yerel hisse senedi ticareti için geçerlidir), hesap yöneticinize başvurabilirsiniz; veya Müşteri Hizmetleri Departmanı'na başvurabilirsiniz (telefon hattı: +852 2268 0660 veya e-posta: customerservices@mib.com.hk)