Resumo da empresa

| MIB SecuritiesResumo da Revisão | |

| Fundada | Mais de 20 anos |

| País/Região Registrada | Hong Kong |

| Regulação | Regulamentado |

| Instrumentos de Mercado | HK Securities/Warrants & CBBCs/Margin Financing/Foreign Stocks/Global Securities Markets/Futures and Options/MlB Trade/ETF |

| Plataforma de Negociação | MIB Securities Trade(Mobile)/Java/ADOBE READER |

| Suporte ao Cliente (9:00 às 18:00 (Seg - Sex), exceto feriados) | Central de Atendimento ao Cliente:+852 2268 0660 |

| Central de Atendimento para Negociação de Valores Mobiliários:+852 2268 0688 | |

| Central de Atendimento para Negociação de Futuros:+852 2268 0699 | |

| Email: customerservices@mib.com.hk | |

| Fax:+852 2521 2289 | |

Informações MIB Securities

MIB Securities é uma Corretora de Valores e Investimentos que abrange negócios em todo o mundo. Ela oferece serviços em finanças corporativas, mercados de dívida, mercados de capitais de ações, derivativos, corretagem de valores mobiliários para varejo e instituições, e pesquisa.

MIB Securities é Legítimo?

MIB Securities é autorizado e regulamentado pela Comissão de Valores Mobiliários e Futuros de Hong Kong (SFC) com a licença NO.ABH686, tornando-o mais seguro do que corretores não regulamentados.

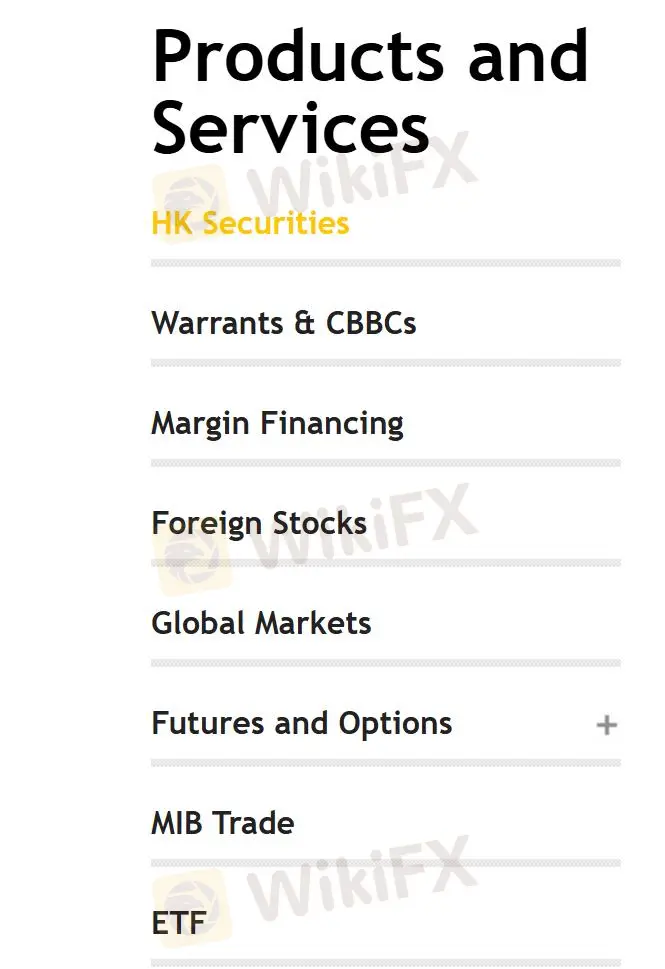

Quais Produtos e Serviços MIB Securities oferece?

MIB Securities oferece acesso a vários produtos e serviços, incluindo Valores Mobiliários de Hong Kong, Warrants & CBBCs, Financiamento de Margem, Ações Estrangeiras, Mercados Globais de Valores Mobiliários, Futuros e Opções, Negociação MlB e ETF.

Tipo de Conta

Os usuários podem abrir contas individuais/ conjuntas ou contas corporativas. MIB Securities Trade também oferece Contas de Valores Mobiliários e Commodities.

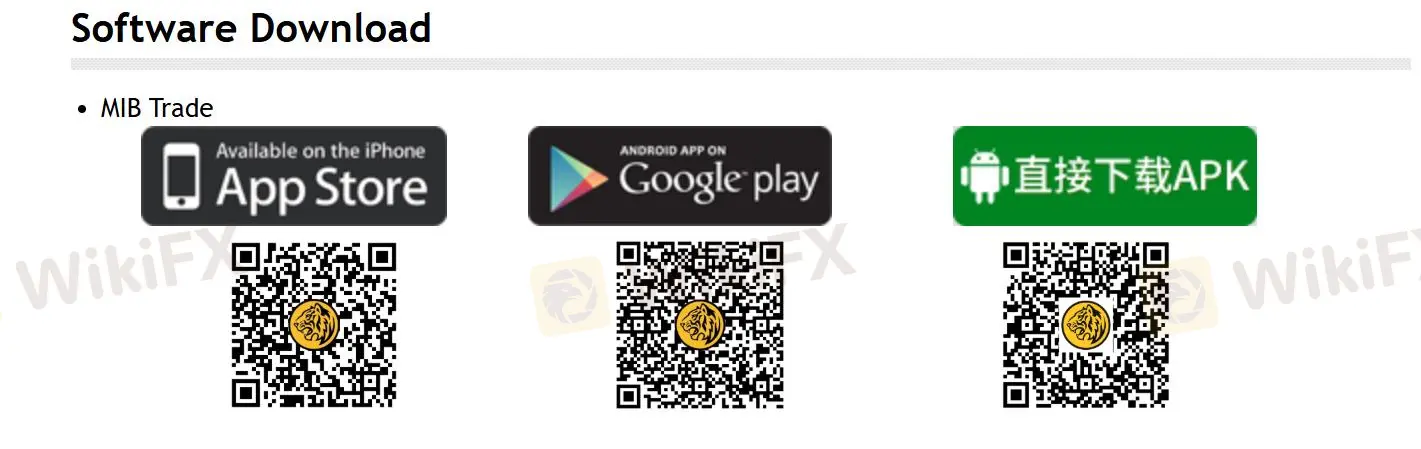

Software

MIB Securities fornece MIB Securities Trade, que está disponível em dispositivos móveis ou pode ser baixado diretamente em APK. Os usuários também precisam baixar Java e ADOBE READER.

Depósito e Retirada

Os clientes podem depositar fundos em sua conta MIB SecuritiesHK por meio dos seguintes métodos: transferência bancária e depósito de cheque (incluindo através de balcões bancários, ATMs e máquinas de depósito de cheques), transferência telegráfica (para clientes no exterior), Sistema de Pagamento Mais Rápido (FPS) e contas bancárias designadas MIB SecuritiesHK.

As retiradas não são suportadas para contas de cartão de crédito de terceiros ou contas bancárias, mas você pode usar a função "Retirar" do MIB Securities Trade (apenas aplicável à negociação de ações local), entrar em contato com seu gerente de conta; ou entrar em contato com o Departamento de Atendimento ao Cliente (central de atendimento: +852 2268 0660 ou email: customerservices@mib.com.hk )