公司简介

| 马银证券评论摘要 | |

| 成立时间 | 超过20年 |

| 注册国家/地区 | 香港 |

| 监管 | 受监管 |

| 市场工具 | 香港证券/权证和牛熊证/融资融券/外国股票/全球证券市场/期货和期权/MLB交易/ETF |

| 交易平台 | 马银证券交易(手机版)/Java/ADOBE READER |

| 客户支持(上午9:00至下午6:00(周一至周五),节假日除外) | 客户服务热线:+852 2268 0660 |

| 证券交易热线:+852 2268 0688 | |

| 期货交易热线:+852 2268 0699 | |

| 电子邮件:customerservices@mib.com.hk | |

| 传真:+852 2521 2289 | |

马银证券信息

马银证券是一家跨越全球的证券和投资经纪公司。它提供企业融资、债务市场、股权资本市场、衍生品、零售和机构证券经纪以及研究等服务。

马银证券是否合法?

马银证券经香港证券及期货事务监察委员会(SFC)授权和监管,许可证号为ABH686,比未受监管的经纪商更安全。

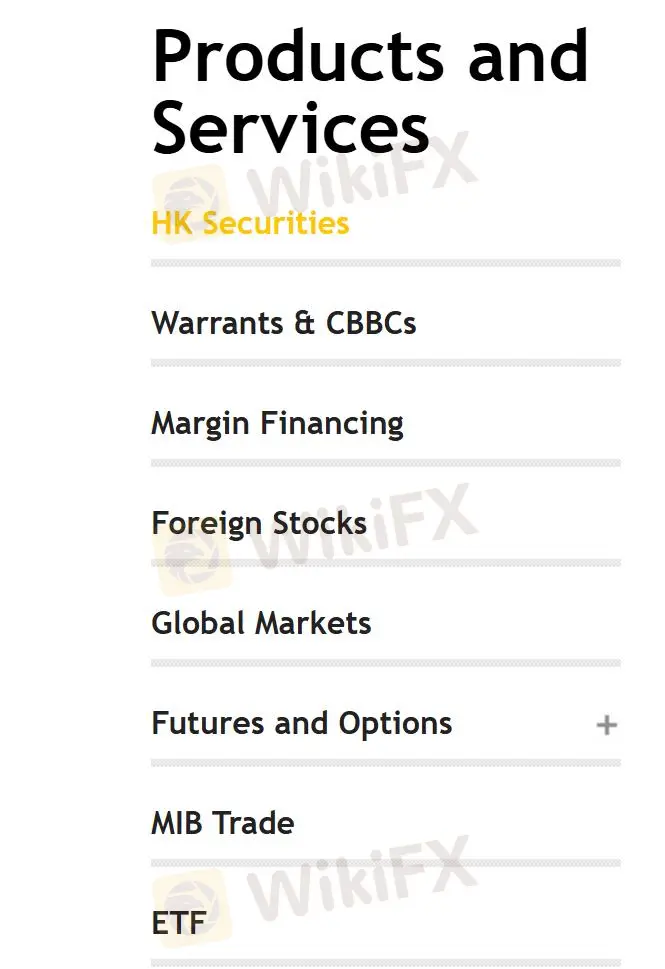

马银证券提供哪些产品和服务?

马银证券提供多种产品和服务,包括香港证券、权证和牛熊证、融资融券、外国股票、全球证券市场、期货和期权、MLB交易和ETF。

账户类型

用户可以开设个人/联名账户或企业账户账户。马银证券交易还提供证券和商品账户。

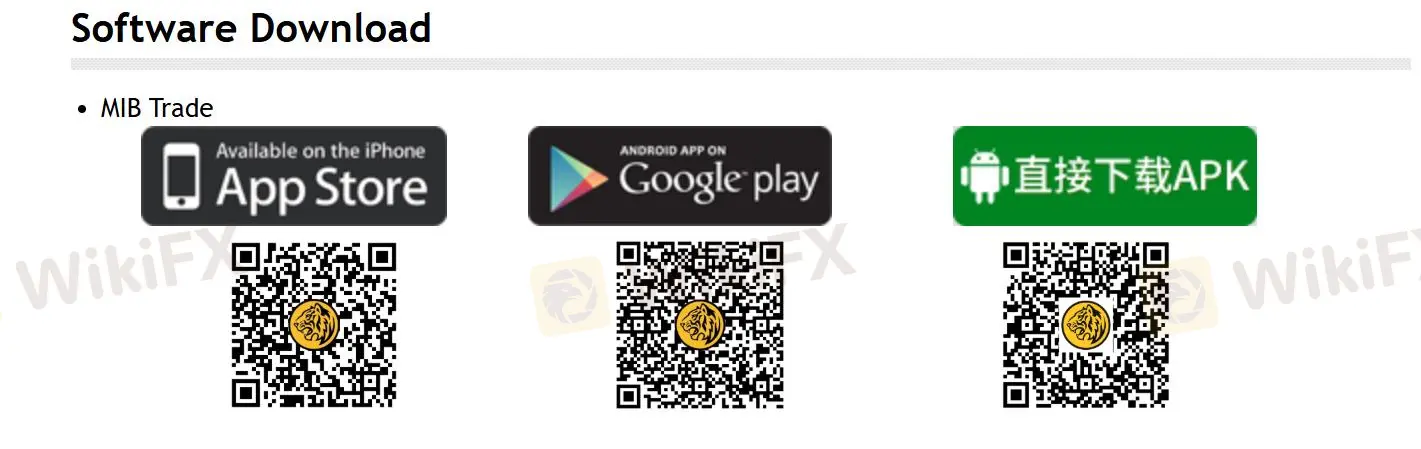

软件

马银证券提供马银证券交易,可在手机上使用或直接下载APK。用户还需要下载Java和ADOBE READER。

存款和取款

客户可以通过以下方式将资金存入马银证券HK账户:银行转账和支票存款(包括通过银行柜台、ATM和支票存款机),电汇(适用于海外客户),更快支付系统(FPS)和马银证券HK指定银行账户。

不支持向任何第三方信用卡账户或银行账户提款,但您可以使用马银证券交易的“提款”功能(仅适用于本地股票交易),联系您的账户经理;或联系客户服务部(热线:+852 2268 0660或电子邮件:customerservices@mib.com.hk)