Présentation de l'entreprise

| CMCU Résumé de l'examen | |

| Fondé | 2025 |

| Pays/Région Enregistré | Australie |

| Régulation | ASIC (Dépassé) |

| Produits & Services | Épargne, prêts et produits liés aux voyages |

| Compte de Démo | ❌ |

| Plateforme de Trading | / |

| Dépôt Minimum | 5 $ par mois |

| Support Client | Formulaire de contact |

| Téléphone: 03 5744 3713/1800 648 027 | |

| Email: info@centralmurray.bank | |

| Adresse: 58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook, Instagram, Linkedin | |

CMCU, fondé en 2025 en Australie, propose divers services financiers tels que l'épargne, les prêts et les produits liés aux voyages. Il propose différents types de comptes pour les particuliers et les entreprises. Cependant, sa licence ASIC a été dépassée. De plus, sa structure tarifaire complexe et son statut de nouvel entrant peuvent également dissuader certains clients.

Voici la page d'accueil du site officiel de ce courtier:

Avantages et Inconvénients

| Avantages | Inconvénients |

| Différents types de comptes pour des clients ciblés | Licence ASIC dépassée |

| Présence sur les réseaux sociaux | Nouvellement établi |

| Méthodes de sécurité offertes | Structure tarifaire complexe |

CMCU Est-il Légitime ?

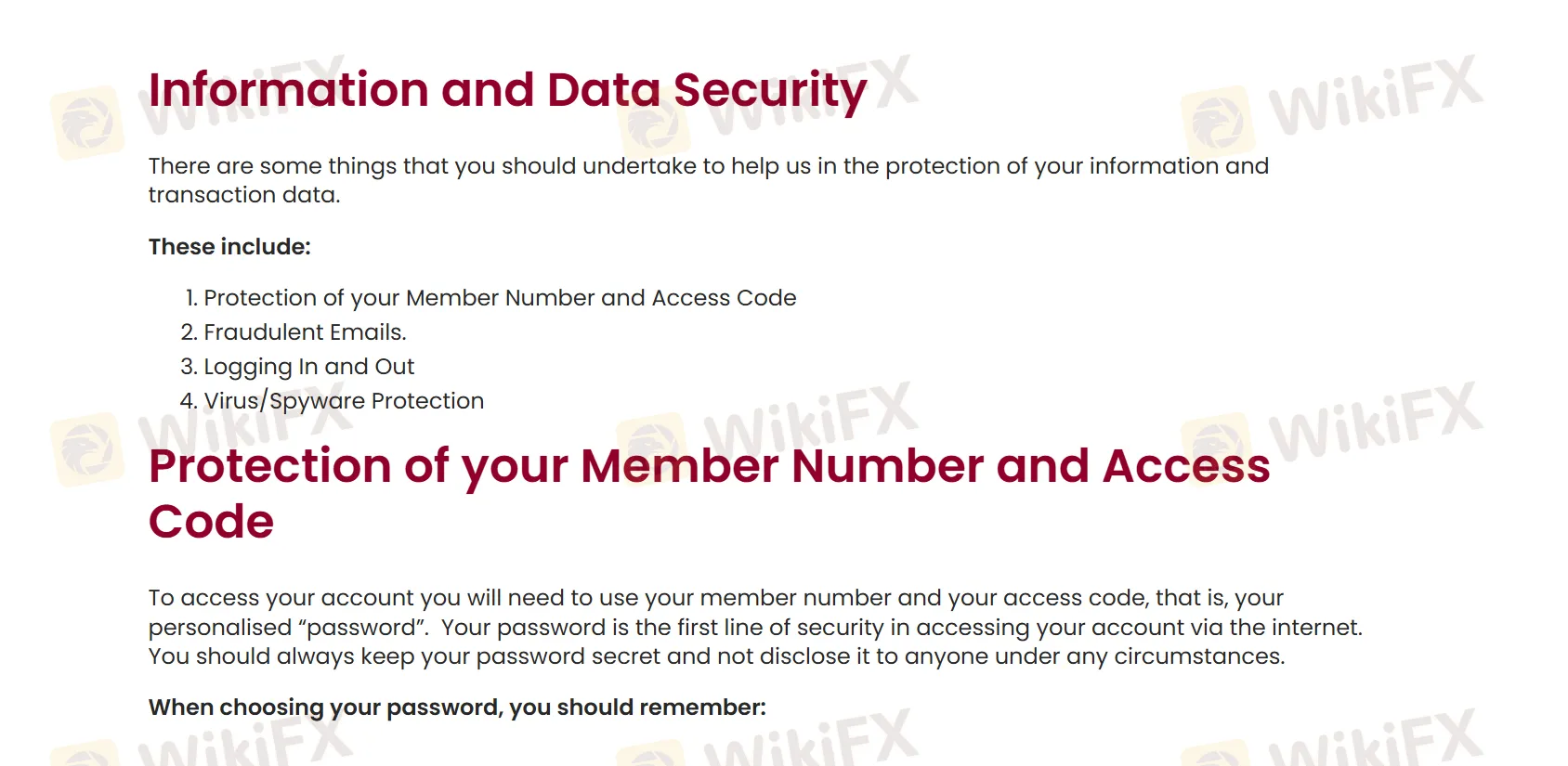

CMCU propose diverses façons d'assurer la sécurité de ses clients. Ces méthodes incluent la protection de votre Numéro de Membre et Code d'Accès, la vigilance contre les emails frauduleux, la connexion et déconnexion correctes du système, et la mise en place d'une protection contre les virus et les logiciels espions.

Cependant, la licence de CMCU de la Commission Australienne des Valeurs Mobilières et des Investissements (ASIC) (Licence de Conseiller en Investissement, No.239446) a été dépassée.

| Statut Réglementaire | Dépassé |

| Réglementé par | Australie |

| Institution Agréée | Central Murray Credit Union Limited |

| Type de Licence | Licence de Conseiller en Investissement |

| Numéro de Licence | 239446 |

Produits et Services

CMCU propose divers services financiers incluant l'épargne, les prêts, l'investissement, l'assurance, la planification financière et la gestion de vos produits de voyage tels que le passeport en espèces, les espèces étrangères de voyage et les transferts étrangers discrets.

Type de Compte

CMCU propose trois types de comptes pour les particuliers : comptes de transaction, d'épargne et pour les jeunes. En revanche, pour les courtiers d'affaires, il existe trois options disponibles : comptes d'entreprise, d'entreprise premium et de TVA. Ainsi, vous pouvez sélectionner le type de compte approprié en fonction de vos objectifs.

Frais de CMCU

CMCU facture des frais d'accès mensuels de 5 $ pour la plupart des types de comptes. De plus, il facture également d'autres frais pour chaque compte. Par exemple :

Comptes de transaction :

| Type de compte | Frais d'accès mensuels | Frais mensuels pour les sous-comptes | Transactions gratuites par mois |

| S8 (Compte quotidien (S10)) | $5.00 | 0 | Illimité |

| S10 (Compensation hypothécaire) | |||

| S65 (Compte de pension individuel) | |||

| S66 (Compte de pension conjoint) |

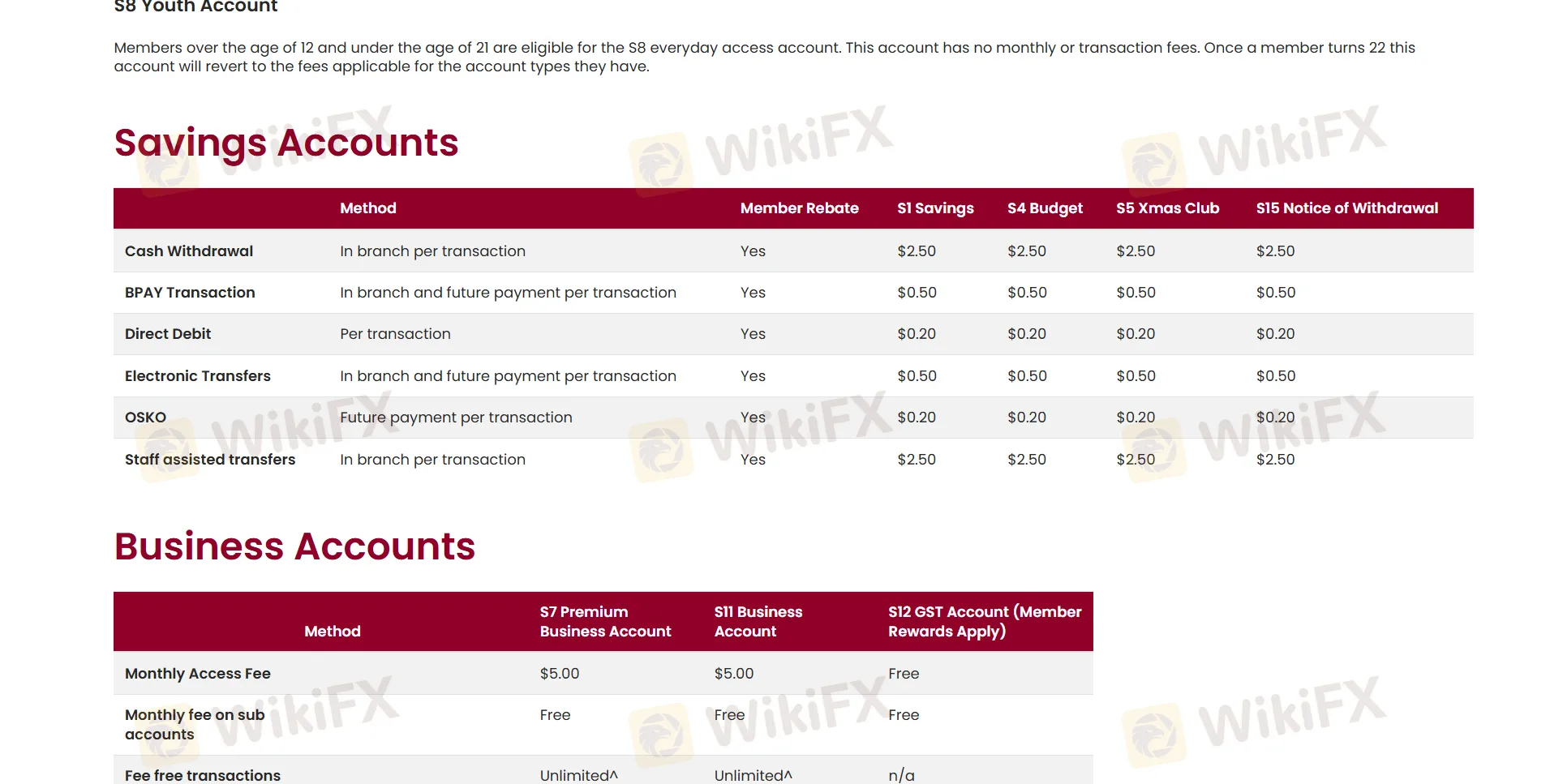

Comptes d'épargne :

| Méthode | Rabais membre | Épargne S1 | Budget S4 | Club de Noël S5 | Avis de retrait S15 |

| Retrait d'espèces (En agence par transaction) | ✔ | $2.50 | |||

| Transaction BPAY (En agence et paiement futur par transaction) | $0.50 | ||||

| Prélèvement automatique (Par transaction) | $0.20 | ||||

| Virements électroniques (En agence et paiement futur par transaction) | $0.50 | ||||

| OSKO (Paiement futur par transaction) | $0.20 | ||||

| Transferts assistés par le personnel (En agence par transaction) | $2.50 | ||||

Vous pouvez en apprendre davantage en cliquant sur : https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/