회사 소개

| CMCU 리뷰 요약 | |

| 설립 연도 | 2025 |

| 등록 국가/지역 | 호주 |

| 규제 | ASIC (초과) |

| 제품 및 서비스 | 저축, 대출 및 여행 관련 제품 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | / |

| 최소 입금액 | $5 매월 |

| 고객 지원 | 문의 양식 |

| 전화: 03 5744 3713/1800 648 027 | |

| 이메일: info@centralmurray.bank | |

| 위치 주소: 58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook, Instagram, Linkedin | |

CMCU은 2025년 호주에서 설립되어 저축, 대출 및 여행 관련 제품과 같은 다양한 금융 서비스를 제공합니다. 개인 및 기업을 위한 다양한 계정 유형을 보유하고 있습니다. 그러나 ASIC 라이선스가 초과되었으며, 복잡한 수수료 구조와 신규 진입 업체의 지위로 인해 일부 고객들을 매료시킬 수도 있습니다.

이 중개업체의 공식 홈페이지는 다음과 같습니다:

장단점

| 장점 | 단점 |

| 특정 고객을 위한 다양한 계정 유형 | ASIC 라이선스 초과 |

| 소셜 미디어 존재 | 신규 설립 |

| 제공되는 보안 방법 | 복잡한 수수료 구조 |

CMCU의 신뢰성

CMCU은 고객의 보안을 보장하기 위한 다양한 방법을 제공합니다. 이 방법에는 회원 번호 및 액세스 코드 보호, 사기성 이메일에 대한 주의, 시스템에 올바르게 로그인 및 로그아웃, 바이러스 및 스파이웨어 보호가 포함됩니다.

그러나 CMCU의 호주 증권 거래 위원회 (ASIC) (투자 자문 라이선스, 번호 239446) 가 초과되었습니다.

| 규제 상태 | 초과됨 |

| 규제 기관 | 호주 |

| 라이선스 기관 | Central Murray Credit Union Limited |

| 라이선스 유형 | 투자 자문 라이선스 |

| 라이선스 번호 | 239446 |

제품 및 서비스

CMCU은 현금 패스포트, 트래블엑스 외화, 비밀 외화 이체 등과 같은 여행 제품을 정리하고 저축, 대출, 투자, 보험, 재무 계획 등 다양한 금융 서비스를 제공합니다.

계정 유형

CMCU은 개인을 위한 세 가지 계정을 제공합니다: 거래 계정, 저축 계정 및 청소년 계정. 한편, 비즈니스 브로커를 위해 비즈니스, 프리미엄 비즈니스 및 GST 계정과 같이 세 가지 옵션이 있습니다. 따라서 목표에 따라 적합한 계정 유형을 선택할 수 있습니다.

CMCU 수수료

CMCU은 대부분의 계정 유형에 대해 매월 $5의 이용료를 부과합니다. 또한 각 계정에 대해 다른 수수료도 부과됩니다. 예를 들어:

거래 계정:

| 계정 유형 | 매월 이용료 | 하위 계정 매월 이용료 | 월별 수수료 면제 거래 |

| S8 (일상 계정 (S10)) | $5.00 | 0 | 무제한 |

| S10 (모기지 오프셋) | |||

| S65 (단일 연금 계정) | |||

| S66 (공동 연금 계정) |

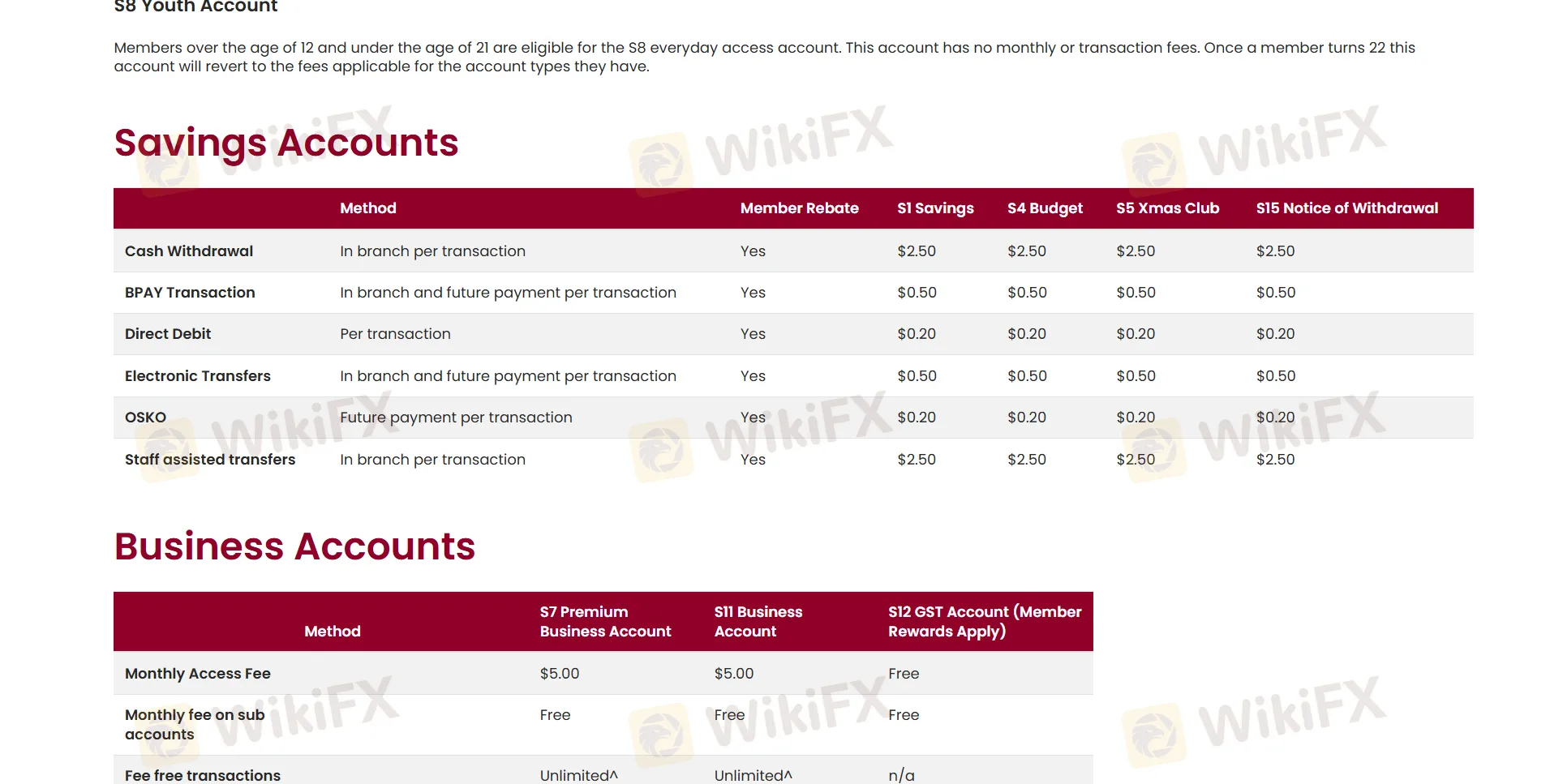

저축 계정:

| 방법 | 회원 할인 | S1 저축 | S4 예산 | S5 크리스마스 클럽 | S15 출금 통지 |

| 현금 인출 (지점 내 거래당) | ✔ | $2.50 | |||

| BPAY 거래 (지점 및 미래 결제당) | $0.50 | ||||

| 직불 (거래당) | $0.20 | ||||

| 전자 송금 (지점 및 미래 결제당) | $0.50 | ||||

| OSKO (미래 결제당) | $0.20 | ||||

| 직원 지원 이체 (지점 내 거래당) | $2.50 | ||||

자세한 내용은 여기를 클릭하십시오: https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/