公司简介

| CMCU 评论摘要 | |

| 成立时间 | 2025 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | ASIC(已超出) |

| 产品与服务 | 储蓄、贷款和与旅行相关的产品 |

| 模拟账户 | ❌ |

| 交易平台 | / |

| 最低存款 | 每月5美元 |

| 客户支持 | 联系表单 |

| 电话:03 5744 3713/1800 648 027 | |

| 电子邮件:info@centralmurray.bank | |

| 地址:58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook、Instagram、Linkedin | |

CMCU成立于2025年,总部位于澳大利亚,提供多样化的金融服务,如储蓄、贷款和与旅行相关的产品。该公司为个人和企业提供各种账户类型。然而,其ASIC许可已超出。此外,其复杂的费用结构和新进入者身份也可能会阻止一些客户。

以下是该经纪商官方网站的首页:

优点和缺点

| 优点 | 缺点 |

| 为目标客户提供各种账户类型 | 超出ASIC许可 |

| 社交媒体存在 | 新成立 |

| 提供的安全方法 | 复杂的费用结构 |

CMCU是否合法?

CMCU提供多种方式确保客户的安全。这些方法包括保护您的会员号码和访问代码,警惕欺诈性电子邮件,正确登录和退出系统,以及实施病毒和间谍软件保护。

然而,CMCU的澳大利亚证券和投资委员会(ASIC)(投资咨询许可证,编号239446)已超出。

| 监管状态 | 已超出 |

| 监管机构 | 澳大利亚 |

| 许可机构 | Central Murray Credit Union Limited |

| 许可类型 | 投资咨询许可证 |

| 许可编号 | 239446 |

产品和服务

CMCU提供各种金融服务,包括储蓄、贷款、投资、保险、财务规划以及整理您的旅行产品,如现金护照、旅行外币和隐秘的外汇转账。

账户类型

CMCU为个人提供三种账户:交易、储蓄和青年账户。同时,对于商业经纪人,有三种选择:商业、高级商业和GST账户。因此,您可以根据自己的目标选择适当的账户类型。

CMCU费用

CMCU对大多数账户类型收取每月$5的访问费。此外,它还针对每个账户收取其他手续费。例如:

交易账户:

| 账户类型 | 每月访问费 | 子账户每月费用 - 账户 | 每月免费交易次数 |

| S8(日常账户(S10)) | $5.00 | 0 | 无限制 |

| S10(按揭抵消) | |||

| S65(单人养老金账户) | |||

| S66(共同养老金账户) |

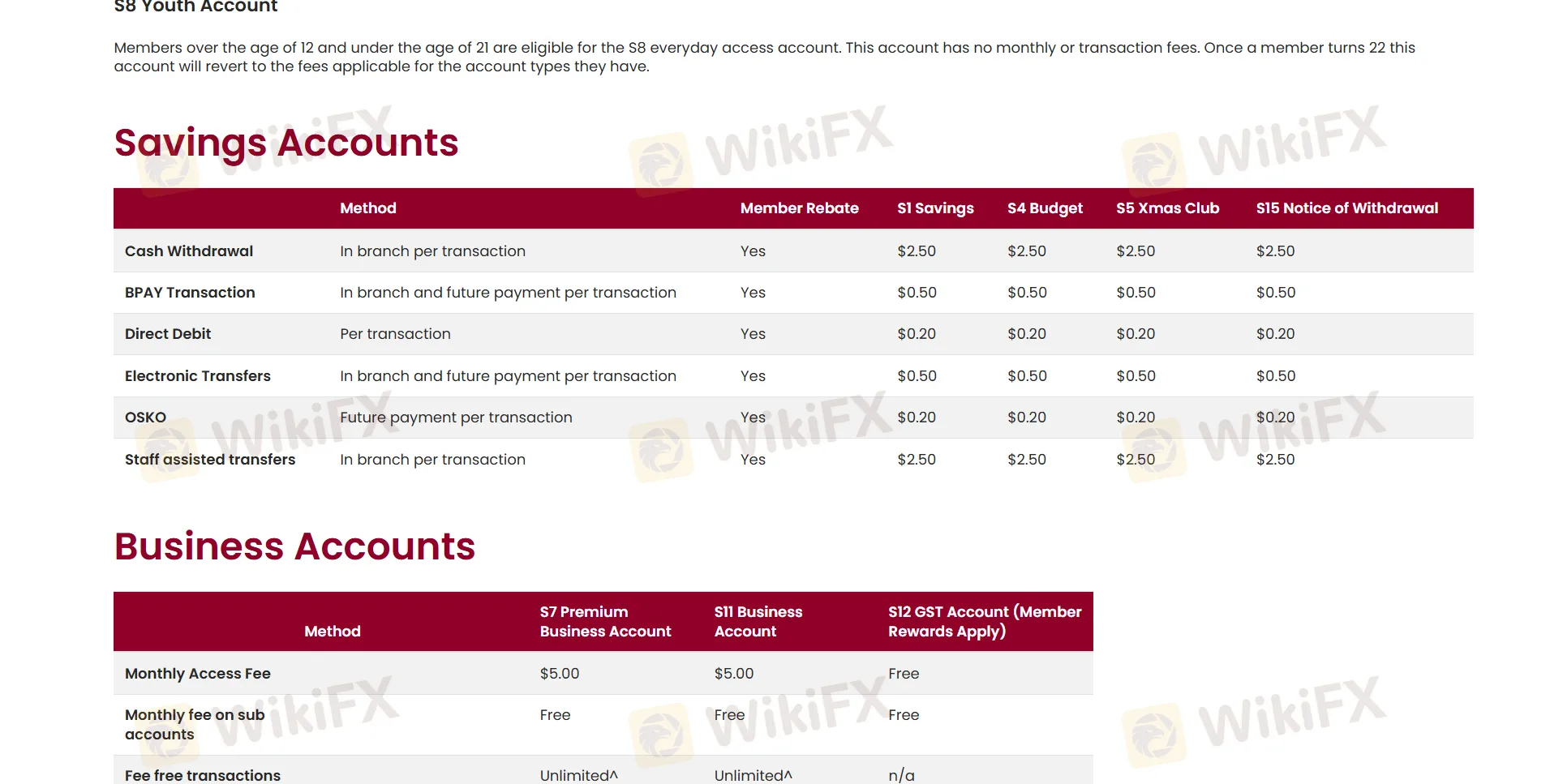

储蓄账户:

| 方式 | 会员返利 | S1储蓄 | S4预算 | S5圣诞俱乐部 | S15提款通知 |

| 现金提取(每笔分行交易) | ✔ | $2.50 | |||

| BPAY交易(分行和未来支付每笔交易) | $0.50 | ||||

| 直接借记(每笔交易) | $0.20 | ||||

| 电子转账(分行和未来支付每笔交易) | $0.50 | ||||

| OSKO(未来支付每笔交易) | $0.20 | ||||

| 员工协助转账(每笔分行交易) | $2.50 | ||||

您可以通过点击了解:https://www.centralmurray.bank/personal-banking/手续费-charges-and-rewards/