Profil perusahaan

| CMCU Ringkasan Ulasan | |

| Didirikan | 2025 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | ASIC (Melebihi) |

| Produk & Layanan | Tabungan, pinjaman, dan produk terkait perjalanan |

| Akun Demo | ❌ |

| Platform Perdagangan | / |

| Deposit Minimum | $5 per bulan |

| Dukungan Pelanggan | Formulir kontak |

| Telepon: 03 5744 3713/1800 648 027 | |

| Email: info@centralmurray.bank | |

| Alamat Lokasi: 58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook, Instagram, Linkedin | |

CMCU, didirikan pada tahun 2025 di Australia, menawarkan beragam layanan keuangan seperti tabungan, pinjaman, dan produk terkait perjalanan. Perusahaan ini memiliki berbagai jenis akun untuk individu dan bisnis. Namun, lisensi ASIC-nya telah melebihi batas. Selain itu, struktur biaya yang kompleks dan status baru juga dapat menakut-nakuti beberapa klien.

Berikut adalah halaman utama situs resmi broker ini:

Pro dan Kontra

| Pro | Kontra |

| Berbagai jenis akun untuk klien yang ditargetkan | Melebihi lisensi ASIC |

| Kehadiran media sosial | Baru didirikan |

| Metode keamanan yang ditawarkan | Struktur biaya yang kompleks |

Apakah CMCU Legal?

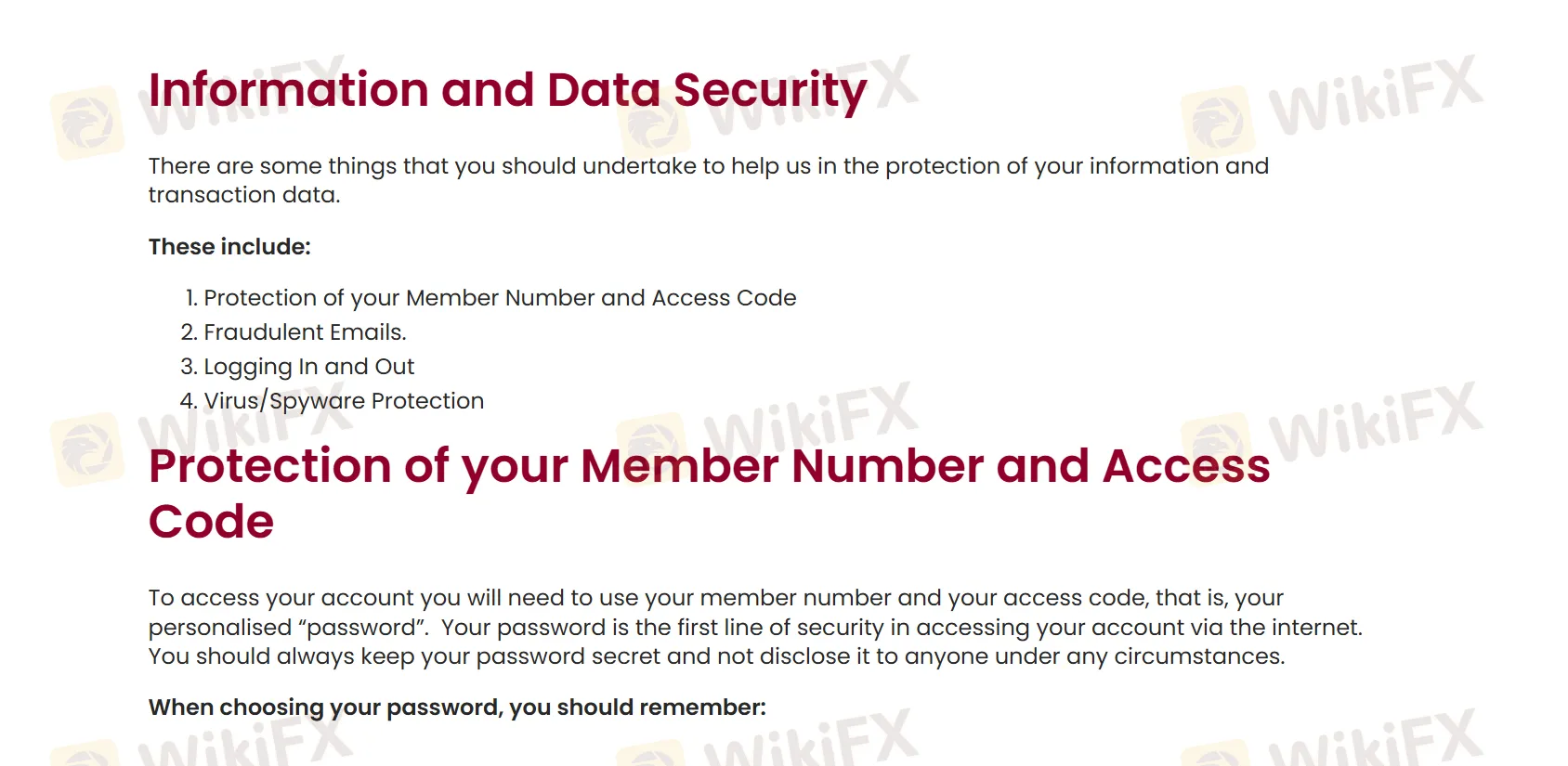

CMCU menyediakan berbagai cara untuk memastikan keamanan kliennya. Metode ini termasuk menjaga Nomor Anggota dan Kode Akses Anda, waspada terhadap email yang curang, masuk dan keluar dari sistem dengan benar, dan menerapkan perlindungan virus dan spyware.

Namun, lisensi CMCU dari Australian Securities and Investments Commission (ASIC) (Lisensi Penasihat Investasi, No.239446) telah melebihi batas.

| Status Regulasi | Melebihi |

| Diatur oleh | Australia |

| Institusi Berlisensi | Central Murray Credit Union Limited |

| Tipe Lisensi | Lisensi Penasihat Investasi |

| Nomor Lisensi | 239446 |

Produk dan Layanan

CMCU menawarkan berbagai layanan keuangan termasuk tabungan, pinjaman, investasi, asuransi, perencanaan keuangan, dan mengatur produk perjalanan seperti paspor tunai, uang asing travelx, dan transfer uang asing yang tersembunyi.

Jenis Akun

CMCU menyediakan tiga jenis akun untuk individu: Akun Transaksi, Tabungan, dan Akun Pemuda. Sementara itu, untuk broker bisnis, terdapat tiga opsi yang tersedia: Akun Bisnis, Bisnis Premium, dan Akun GST. Dengan demikian, Anda dapat memilih jenis akun yang sesuai berdasarkan tujuan Anda.

Biaya CMCU

CMCU mengenakan biaya akses bulanan sebesar $5 untuk sebagian besar jenis akun. Selain itu, juga dikenakan biaya lain untuk setiap akun. Sebagai contoh:

Akun Transaksi:

| Jenis Akun | Biaya Akses Bulanan | Biaya Bulanan untuk Sub-akun | Transaksi Gratis per Bulan |

| S8 (Akun Sehari-hari (S10)) | $5.00 | 0 | Tak terbatas |

| S10 (Pengurangan Hipotek) | |||

| S65 (Akun Pensiun Tunggal) | |||

| S66 (Akun Pensiun Bersama) |

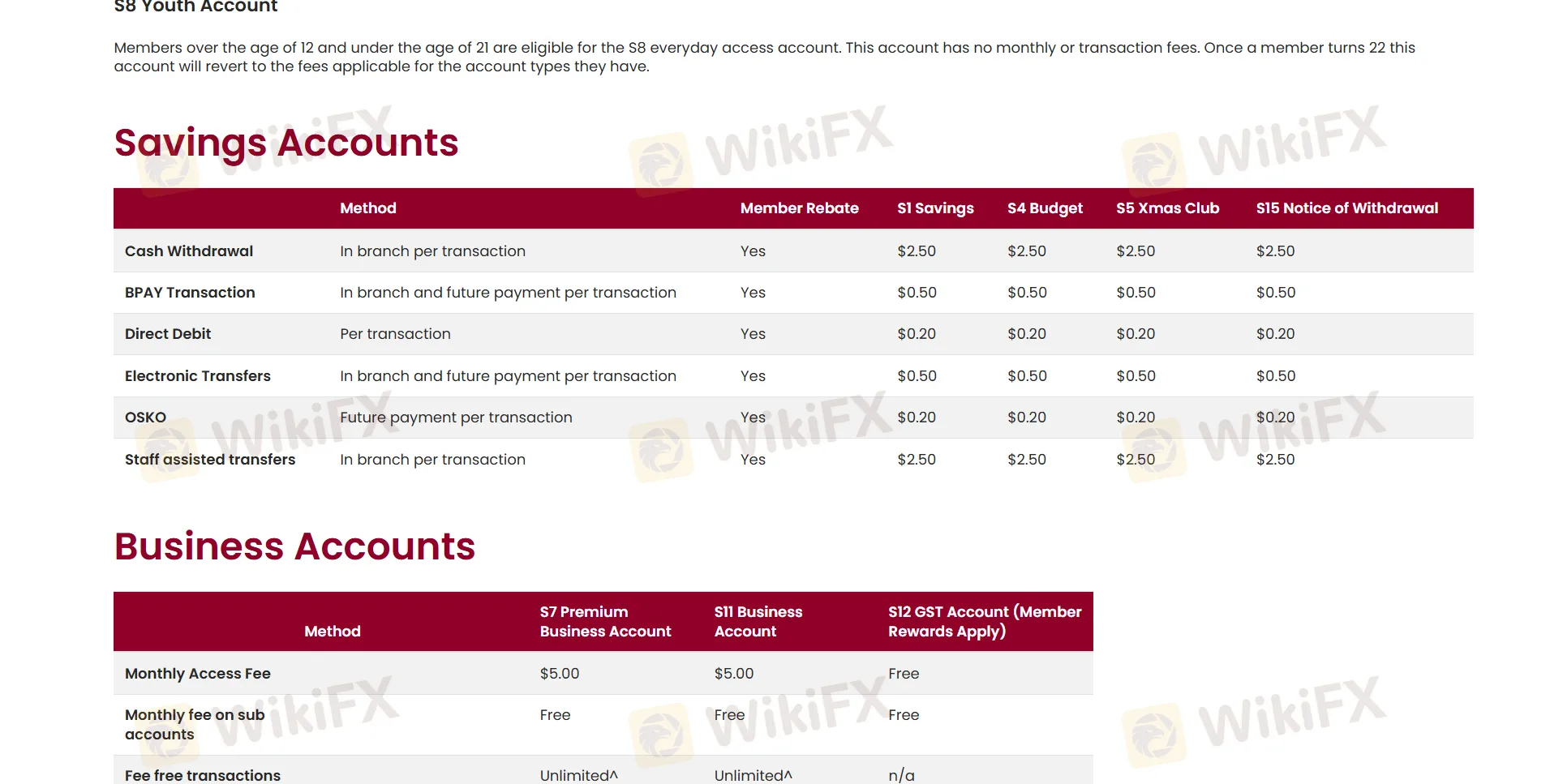

Akun Tabungan:

| Metode | Member Rebate | Tabungan S1 | Anggaran S4 | Klub Natal S5 | Pemberitahuan Penarikan S15 |

| Penarikan Tunai (Di cabang per transaksi) | ✔ | $2.50 | |||

| Transaksi BPAY (Di cabang dan pembayaran masa depan per transaksi) | $0.50 | ||||

| Debit Langsung (Per transaksi) | $0.20 | ||||

| Transfer Elektronik (Di cabang dan pembayaran masa depan per transaksi) | $0.50 | ||||

| OSKO (Pembayaran masa depan per transaksi) | $0.20 | ||||

| Transfer dibantu staf (Di cabang per transaksi) | $2.50 | ||||

Anda dapat mempelajari lebih lanjut dengan mengklik: https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/