Şirket özeti

| CMCU İnceleme Özeti | ||

| Kuruluş Yılı | 2025 | |

| Kayıtlı Ülke/Bölge | Avustralya | |

| Regülasyon | ASIC (Aşıldı) | |

| Ürünler ve Hizmetler | Tasarruf, kredi ve seyahatle ilgili ürünler | |

| Deneme Hesabı | ❌ | |

| İşlem Platformu | / | |

| Minimum Yatırım | Müşteri Desteği | İletişim formu |

| Telefon: 03 5744 3713/1800 648 027 | ||

| E-posta: info@centralmurray.bank | ||

| Konum Adresi: 58 Belmore Street, Yarrawonga Vic 3730 | ||

| Facebook, Instagram, Linkedin | ||

CMCU, 2025 yılında Avustralya'da kurulmuş olup tasarruf, kredi ve seyahatle ilgili çeşitli finansal hizmetler sunmaktadır. Bireyler ve işletmeler için çeşitli hesap türleri bulunmaktadır. Bununla birlikte, ASIC lisansı aşılmıştır. Ayrıca, karmaşık ücret yapısı ve yeni giriş statüsü bazı müşterileri de caydırabilir.

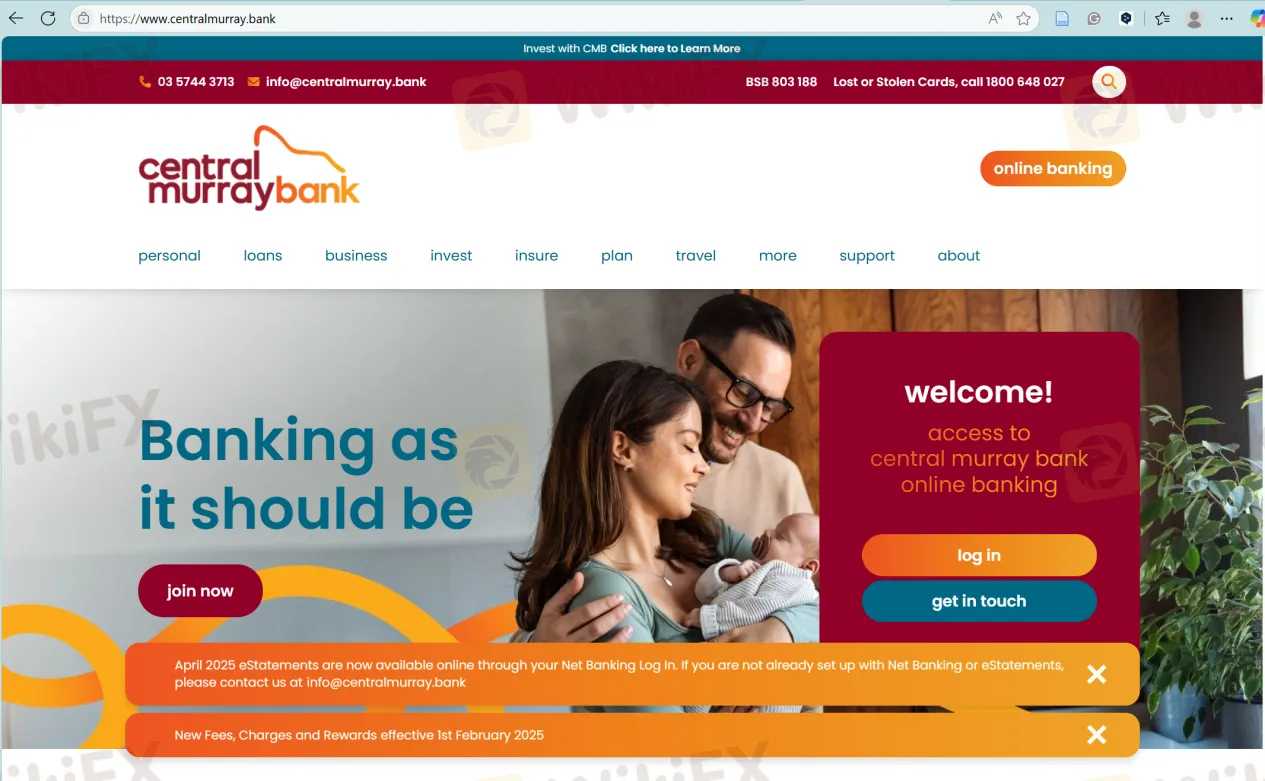

İşte bu aracı kurumun resmi sitesinin ana sayfası:

Artıları ve Eksileri

| Artılar | Eksiler |

| Hedeflenen müşteriler için çeşitli hesap türleri | Aşılmış ASIC lisansı |

| Sosyal medya varlığı | Yeni kurulmuş |

| Sunulan güvenlik yöntemleri | Karmaşık ücret yapısı |

CMCU Güvenilir mi?

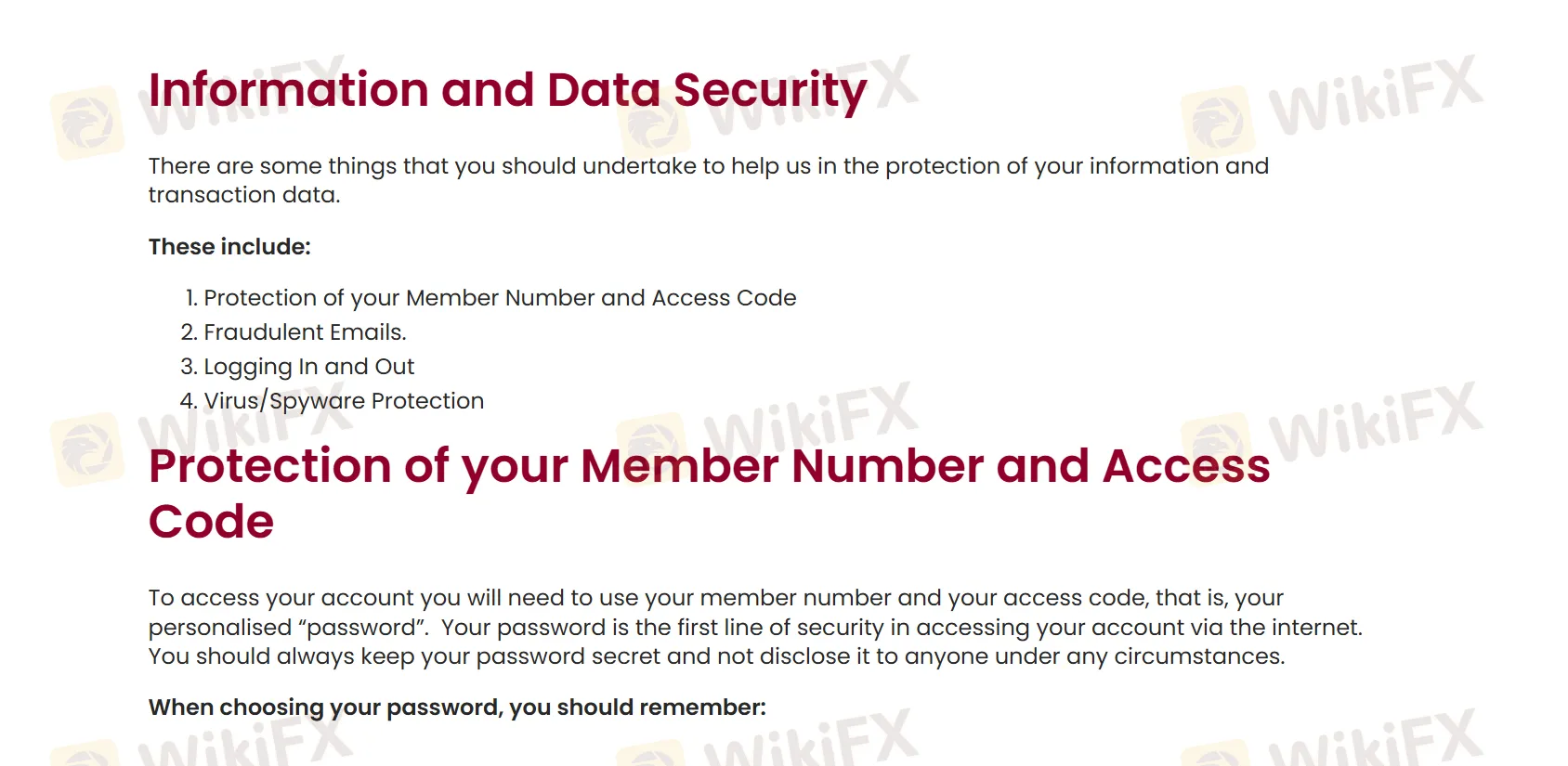

CMCU, müşterilerinin güvenliğini sağlamak için çeşitli yöntemler sunmaktadır. Bu yöntemler arasında Üye Numaranızı ve Erişim Kodunuzu korumak, sahte e-postalara karşı dikkatli olmak, sisteme doğru şekilde giriş yapmak ve çıkış yapmak, virüs ve casus yazılım koruması uygulamak bulunmaktadır.

Ancak, CMCU'nin Avustralya Menkul Kıymetler ve Yatırım Komisyonu (ASIC) (Yatırım Danışmanlığı Lisansı, No.239446 ) aşılmıştır.

| Regülatif Durum | Aşılmış |

| Tarafından Düzenlenmiştir | Avustralya |

| Lisanslı Kuruluş | Central Murray Credit Union Limited |

| Lisans Türü | Yatırım Danışmanlığı Lisansı |

| Lisans Numarası | 239446 |

Ürünler ve Hizmetler

CMCU, tasarruf, kredi, yatırım, sigorta, finansal planlama ve nakit pasaport, travelx yabancı para, ve gizli yabancı transferler gibi seyahat ürünlerinizi düzenlemenize yardımcı olacak çeşitli finansal hizmetler sunmaktadır.

Hesap Türü

CMCU bireylere üç tür hesap sunar: İşlem, Tasarruf ve Gençlik hesapları. Öte yandan, işletme komisyoncuları için üç seçenek mevcuttur: İşletme, Premium İşletme ve KDV hesapları. Dolayısıyla, hedeflerinize bağlı olarak uygun hesap türünü seçebilirsiniz.

CMCU Ücretleri

CMCU çoğu hesap türü için aylık 5 dolarlık erişim ücreti alır. Ayrıca, her hesap için diğer ücretler de alır. Örneğin:

İşlem Hesapları:

| Hesap Türü | Aylık Erişim Ücreti | Aylık Alt Hesap Ücreti | Aylık Ücretsiz İşlem Sayısı |

| S8 (Günlük Hesap (S10)) | 5.00 dolar | 0 | Sınırsız |

| S10 (Mortgage Offset) | |||

| S65 (Tek Kişilik Emeklilik Hesabı) | |||

| S66 (Ortak Emeklilik Hesabı) |

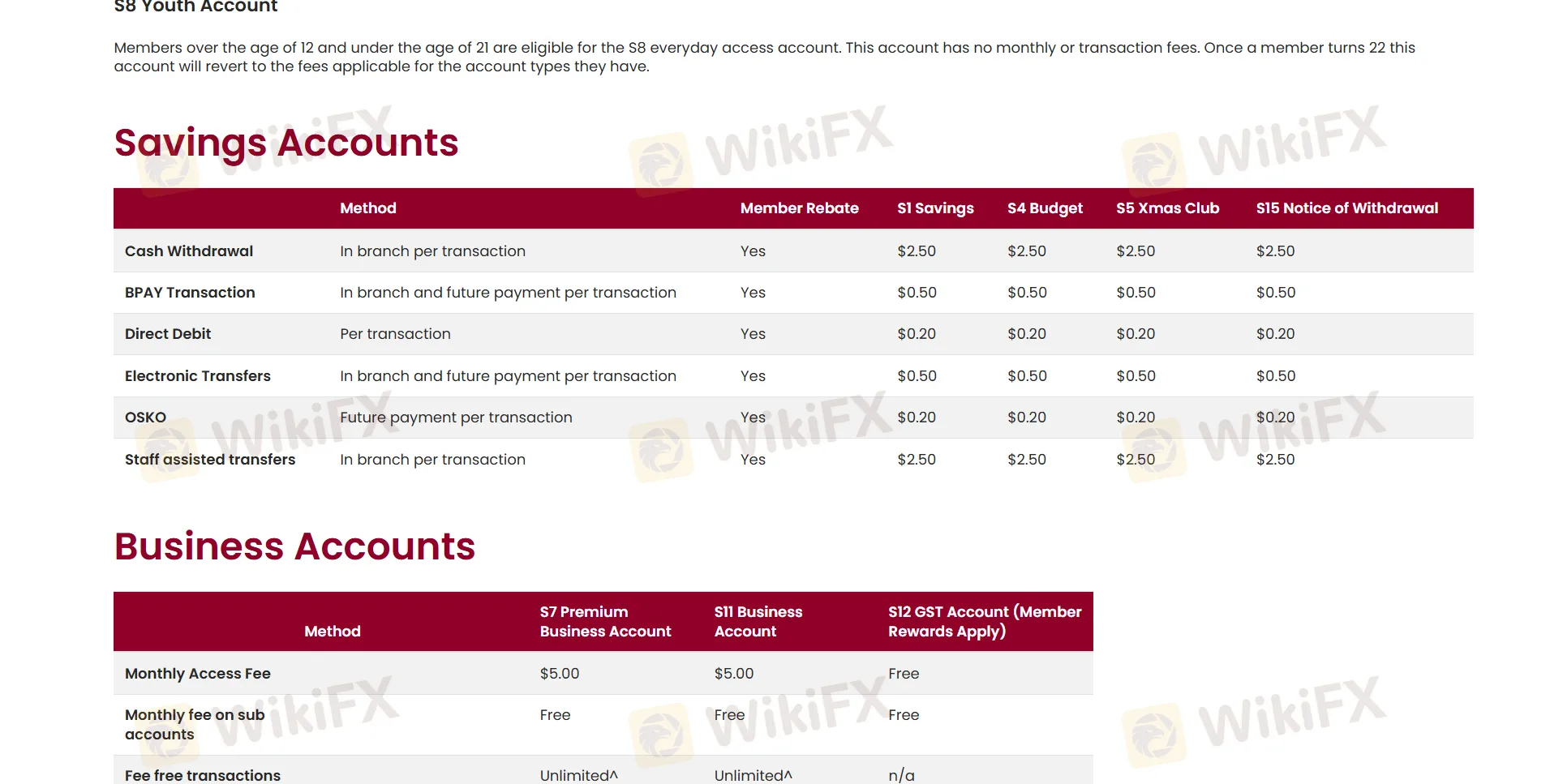

Tasarruf Hesapları:

| Yöntem | Üye İndirimi | S1 Tasarruf | S4 Bütçe | S5 Yılbaşı Kulübü | S15 Çekilme Bildirimi |

| Nakit Çekme (Şubede işlem başına) | ✔ | 2.50 dolar | |||

| BPAY İşlemi (Şubede ve gelecekteki ödemelerde işlem başına) | 0.50 dolar | ||||

| Otomatik Ödeme (İşlem başına) | 0.20 dolar | ||||

| Elektronik Transferler (Şubede ve gelecekteki ödemelerde işlem başına) | 0.50 dolar | ||||

| OSKO (Gelecekteki ödemelerde işlem başına) | 0.20 dolar | ||||

| Personel yardımlı transferler (Şubede işlem başına) | 2.50 dolar | ||||

Öğrenmek için tıklayabilirsiniz: https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/