公司簡介

| CMCU 評論摘要 | |

| 成立年份 | 2025 |

| 註冊國家/地區 | 澳洲 |

| 監管 | ASIC(已超出) |

| 產品與服務 | 儲蓄、貸款和旅遊相關產品 |

| 模擬帳戶 | ❌ |

| 交易平台 | / |

| 最低存款 | $5 每月 |

| 客戶支援 | 聯絡表格 |

| 電話:03 5744 3713/1800 648 027 | |

| 電郵:info@centralmurray.bank | |

| 地址:58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook、Instagram、Linkedin | |

CMCU 成立於 2025 年,位於澳洲,提供多元化的金融服務,如儲蓄、貸款和旅遊相關產品。該公司為個人和企業提供各種帳戶類型。然而,其 ASIC 牌照已超出。此外,其複雜的費用結構和新進入者身份也可能會阻礙一些客戶。

以下是該經紀商官方網站的首頁:

優點與缺點

| 優點 | 缺點 |

| 針對客戶提供各種帳戶類型 | 超出 ASIC 牌照 |

| 社交媒體存在 | 新成立 |

| 提供安全方法 | 複雜的費用結構 |

CMCU 是否合法?

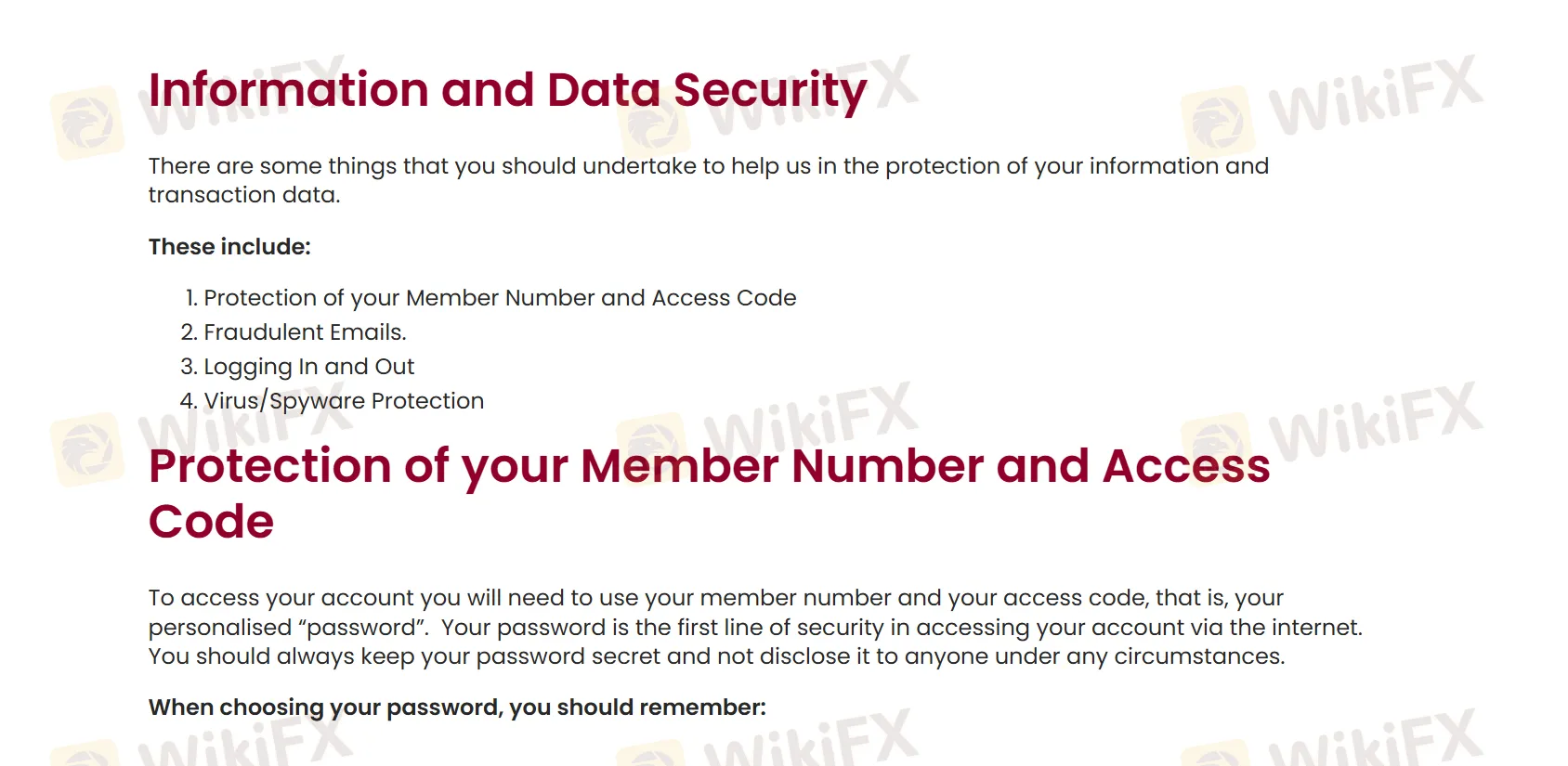

CMCU 提供多種方式來確保客戶的安全。這些方法包括保護您的會員編號和存取代碼、警惕詐騙電郵、正確登入和登出系統,以及實施病毒和間諜軟件保護。

然而,CMCU 的澳大利亞證券及投資委員會(ASIC)牌照(投資諮詢牌照,編號 239446)已超出。

| 監管狀態 | 已超出 |

| 受監管機構 | 澳洲 |

| 牌照機構 | Central Murray Credit Union Limited |

| 牌照類型 | 投資諮詢牌照 |

| 牌照編號 | 239446 |

產品與服務

CMCU 提供各種金融服務,包括儲蓄、貸款、投資、保險、財務規劃以及整理您的旅遊產品,如現金護照、travelx 外幣現金和隱藏的外幣轉帳。

帳戶類型

CMCU 為個人提供三種戶口類型:交易戶口、儲蓄戶口和青年戶口。同時,對於商業經紀人,有三個選擇:商業戶口、高級商業戶口和消費稅戶口。因此,您可以根據您的目標選擇適合的戶口類型。

CMCU 費用

CMCU 對大多數戶口類型收取每月 $5 的存取費。此外,它還對每個戶口收取其他費用。例如:

交易戶口:

| 戶口類型 | 每月存取費 | 附屬戶口每月費用 | 每月免費交易次數 |

| S8 (日常戶口 (S10)) | $5.00 | 0 | 無限制 |

| S10 (按揭抵銷) | |||

| S65 (單人養老金戶口) | |||

| S66 (共同養老金戶口) |

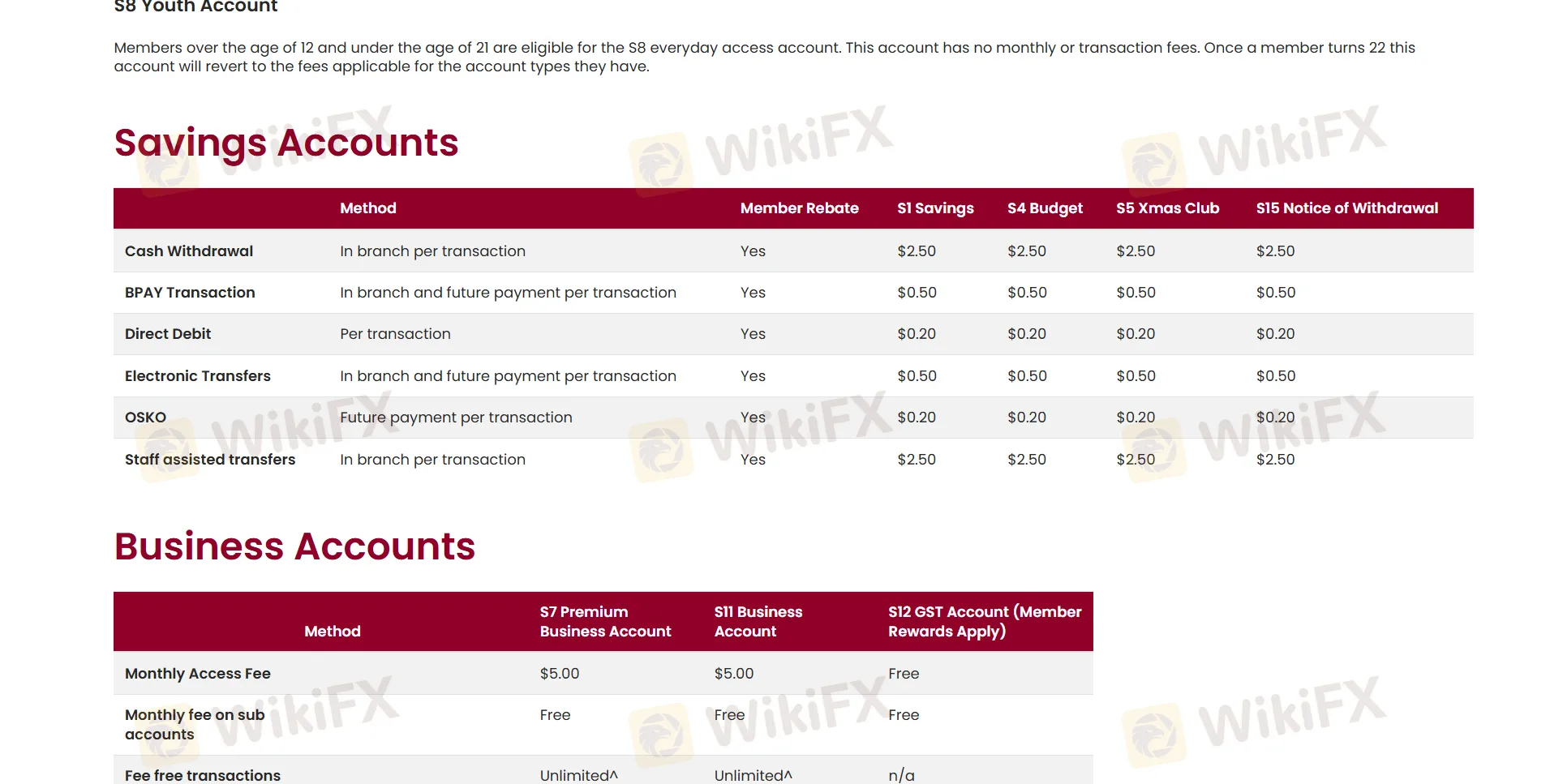

儲蓄戶口:

| 方法 | 會員回贈 | S1 儲蓄 | S4 預算 | S5 聖誕俱樂部 | S15 提款通知 |

| 現金提款 (每筆分行交易) | ✔ | $2.50 | |||

| BPAY 交易 (分行和未來付款每筆交易) | $0.50 | ||||

| 直接轉帳 (每筆交易) | $0.20 | ||||

| 電子轉帳 (分行和未來付款每筆交易) | $0.50 | ||||

| OSKO (未來付款每筆交易) | $0.20 | ||||

| 職員協助轉帳 (每筆分行交易) | $2.50 | ||||

您可以點擊了解:https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/