Buod ng kumpanya

| CMCU Buod ng Pagsusuri | |

| Itinatag | 2025 |

| Nakarehistrong Bansa/Rehiyon | Australia |

| Regulasyon | ASIC (Na-exceed) |

| Mga Produkto at Serbisyo | Savings, loans, at mga produkto kaugnay ng paglalakbay |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | / |

| Minimum na Deposit | $5 bawat buwan |

| Suporta sa Kustomer | Form ng Pakikipag-ugnayan |

| Telepono: 03 5744 3713/1800 648 027 | |

| Email: info@centralmurray.bank | |

| Address ng Lokasyon: 58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook, Instagram, Linkedin | |

CMCU, itinatag noong 2025 sa Australia, nag-aalok ng iba't ibang serbisyong pinansiyal tulad ng savings, loans, at mga produkto kaugnay ng paglalakbay. May iba't ibang uri ng account para sa mga indibidwal at negosyo. Gayunpaman, na-exceed ang lisensya nito mula sa ASIC. Bukod dito, maaaring makaapekto rin sa ilang kliyente ang kumplikadong istraktura ng bayad at bagong status bilang baguhan.

Narito ang home page ng opisyal na site ng broker:

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Iba't ibang uri ng account para sa target na mga kliyente | Na-exceed ang lisensya mula sa ASIC |

| Presensya sa social media | Bagong itinatag |

| Mga pamamaraan ng seguridad na inaalok | Kumplikadong istraktura ng bayad |

Tunay ba ang CMCU?

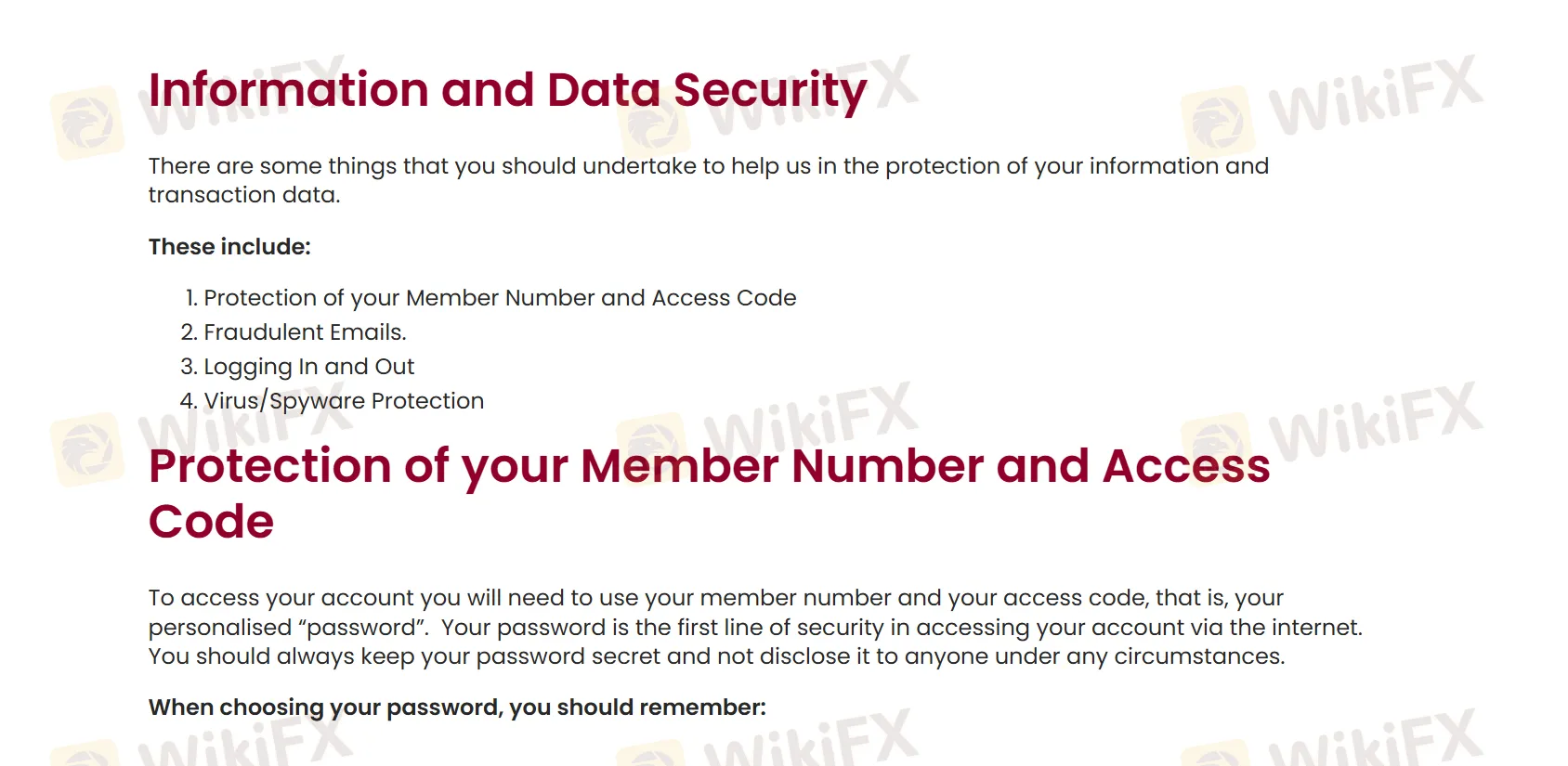

Nagbibigay si CMCU ng iba't ibang paraan upang siguruhing ligtas ang kanilang mga kliyente. Kasama sa mga paraang ito ang pangangalaga sa iyong Member Number at Access Code, pagiging mapanuri laban sa pekeng mga email, wastong pag-login at logout sa sistema, at pagpapatupad ng proteksyon laban sa virus at spyware.

Gayunpaman, na-exceed ang lisensya ng CMCU mula sa Australian Securities and Investments Commission (ASIC) (Lisensya sa Investment Advisory, No.239446 ).

| Status ng Pagganap | Na-exceed |

| Regulado ng | Australia |

| Lisensyadong Institusyon | Central Murray Credit Union Limited |

| Uri ng Lisensya | Lisensya sa Investment Advisory |

| Numero ng Lisensya | 239446 |

Mga Produkto at Serbisyo

Nag-aalok si CMCU ng iba't ibang serbisyong pinansiyal kabilang ang savings, loans, investment, insurance, financial planning at pag-aayos ng iyong mga produkto sa paglalakbay tulad ng cash passport, travelx foreign cash, at covert foreign transfers.

Uri ng Account

CMCU nagbibigay ng tatlong uri ng mga account para sa mga indibidwal: Transactional, Saving, at Youth accounts. Samantala, para sa mga business brokers, may tatlong opsyon na maaaring pagpilian: Business, Premium Business, at GST accounts. Kaya maaari mong pumili ng angkop na uri ng account batay sa iyong layunin.

Mga Bayarin ng CMCU

CMCU nagpapataw ng $5 buwanang bayad sa access para sa karamihan ng uri ng account. Bukod dito, may iba pang bayarin para sa bawat account. Halimbawa:

Mga Account sa Transaksyon:

| Uri ng Account | Buwanang Bayad sa Access | Buwanang Bayad para sa Sub - accounts | Libreng Transaksyon kada Buwan |

| S8 (Everyday Account (S10)) | $5.00 | 0 | Walang Limitasyon |

| S10 (Mortgage Offset) | |||

| S65 (Single Pension Account) | |||

| S66 (Joint Pension Account) |

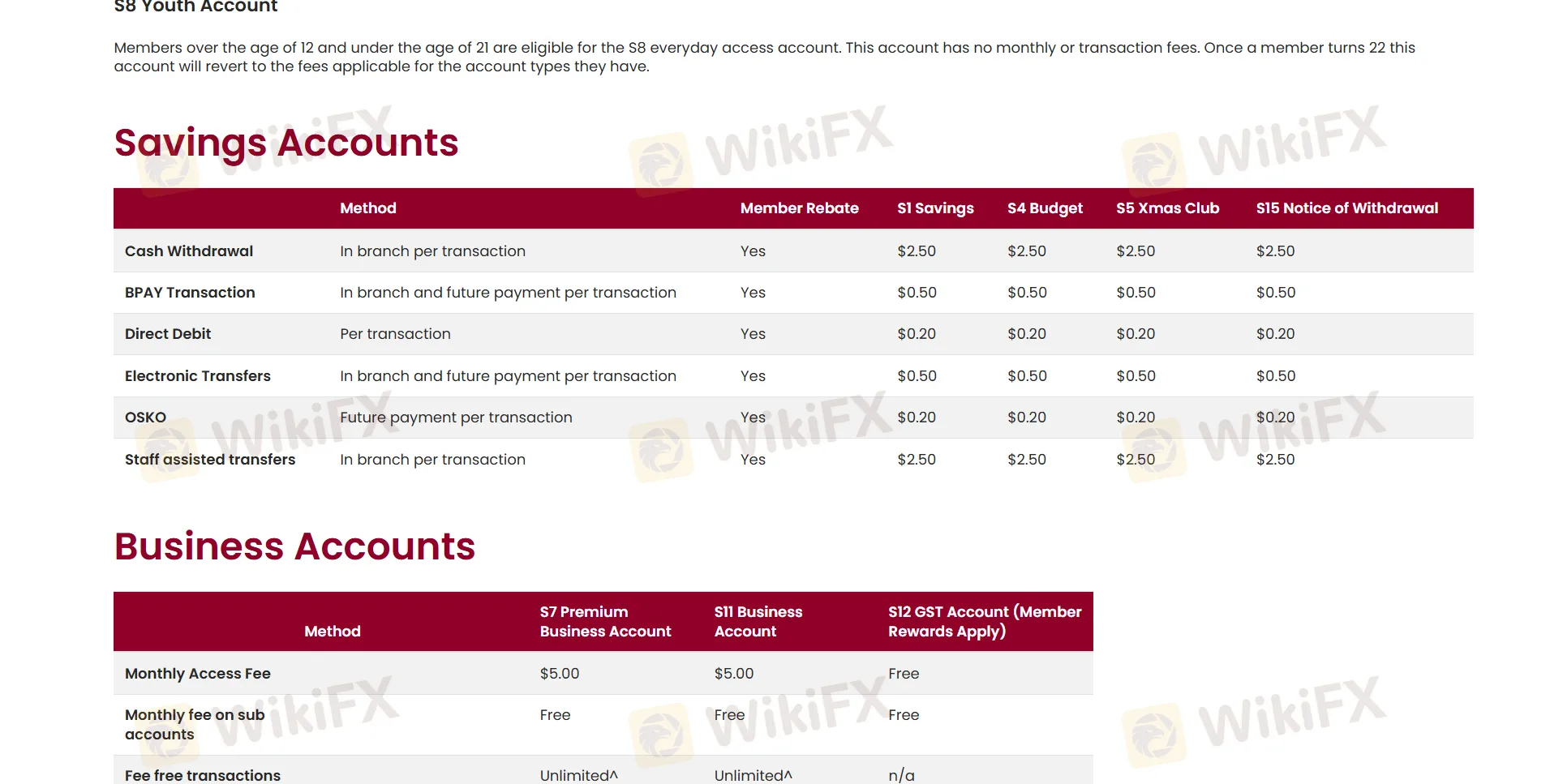

Mga Account sa Pag-iipon:

| Pamamaraan | Member Rebate | S1 Savings | S4 Budget | S5 Xmas Club | S15 Notice of Withdrawal |

| Cash Withdrawal (Sa branch kada transaksyon) | ✔ | $2.50 | |||

| BPAY Transaction (Sa branch at future payment kada transaksyon) | $0.50 | ||||

| Direct Debit (Bawat transaksyon) | $0.20 | ||||

| Electronic Transfers (Sa branch at future payment kada transaksyon) | $0.50 | ||||

| OSKO (Future payment kada transaksyon) | $0.20 | ||||

| Staff assisted transfers (Sa branch kada transaksyon) | $2.50 | ||||

Maaari kang mag-aral sa pamamagitan ng pag-click dito: https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/