Présentation de l'entreprise

| Huajin International Résumé de l'examen | |

| Fondé | 2013 |

| Pays/Région d'enregistrement | Hong Kong |

| Régulation | SFC |

| Produits de Trading | Titres, Contrats à terme |

| Plateforme de Trading | Plateforme de Trading en Ligne ET Trade, Plateforme de Trading en Ligne TradeGo |

| Support Client | Heures d'ouverture : du lundi au vendredi (09h00 à 18h00), samedi, dimanche et jours fériés (fermé) |

| Téléphone : (852) 31 033 030 | |

| Email : csdept@hjfi.com.hk | |

| Adresse : Suite 1101, 11/F, Champion Tower, 3 Garden Road, Central, H.K. | |

Huajin International, fondé en 2013 et enregistré à Hong Kong, Chine, est une entreprise financière réglementée supervisée par la Commission des valeurs mobilières et des contrats à terme (SFC) avec le numéro de licence BFJ369. Il propose une gamme de titres et contrats à terme. La société propose trois principaux types de comptes : Compte Espèces Titres, Compte Marge Titres et Compte Contrats à Terme, adaptés aux clients individuels, conjoints et corporatifs. De plus, elle propose deux plateformes de trading en ligne : ET Trade et TradeGo.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC | Structure de frais complexe |

| Divers types de comptes |

Huajin International est-il Légitime ?

Oui, Huajin International est actuellement réglementé par la SFC, détenant une autorisation de négociation de contrats à terme.

| Pays Réglementé | Autorité de Régulation | Statut Actuel | Entité Agréée | Type de Licence | Numéro de Licence |

| Commission des valeurs mobilières et des contrats à terme (SFC) | Réglementé | Huajin Futures (International) Limited | Négociation de contrats à terme | BFJ369 |

Que Puis-je Trader sur Huajin International ?

Huajin International propose à ses clients des services de trading de titres et de contrats à terme.

| Produits de Trading | Pris en Charge |

| Titres | ✔ |

| Contrats à Terme | ✔ |

| Forex | ❌ |

| Matières Premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Type de Compte

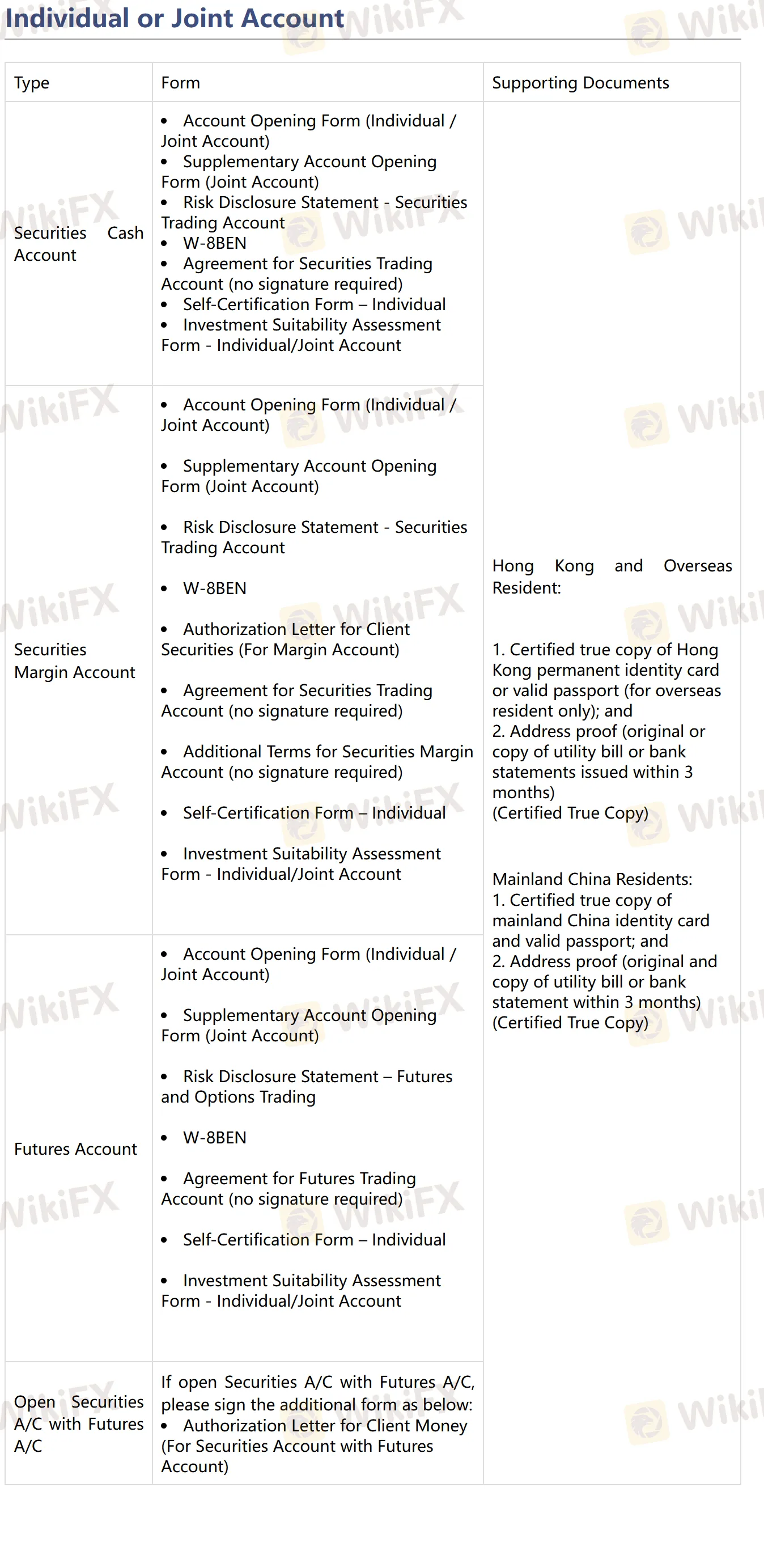

Huajin International propose trois principaux types de compte : Compte Titres au Comptant, Compte Titres sur Marge et Compte à Terme, ainsi que l'ouverture de comptes individuels, joints et d'entreprise.

Frais

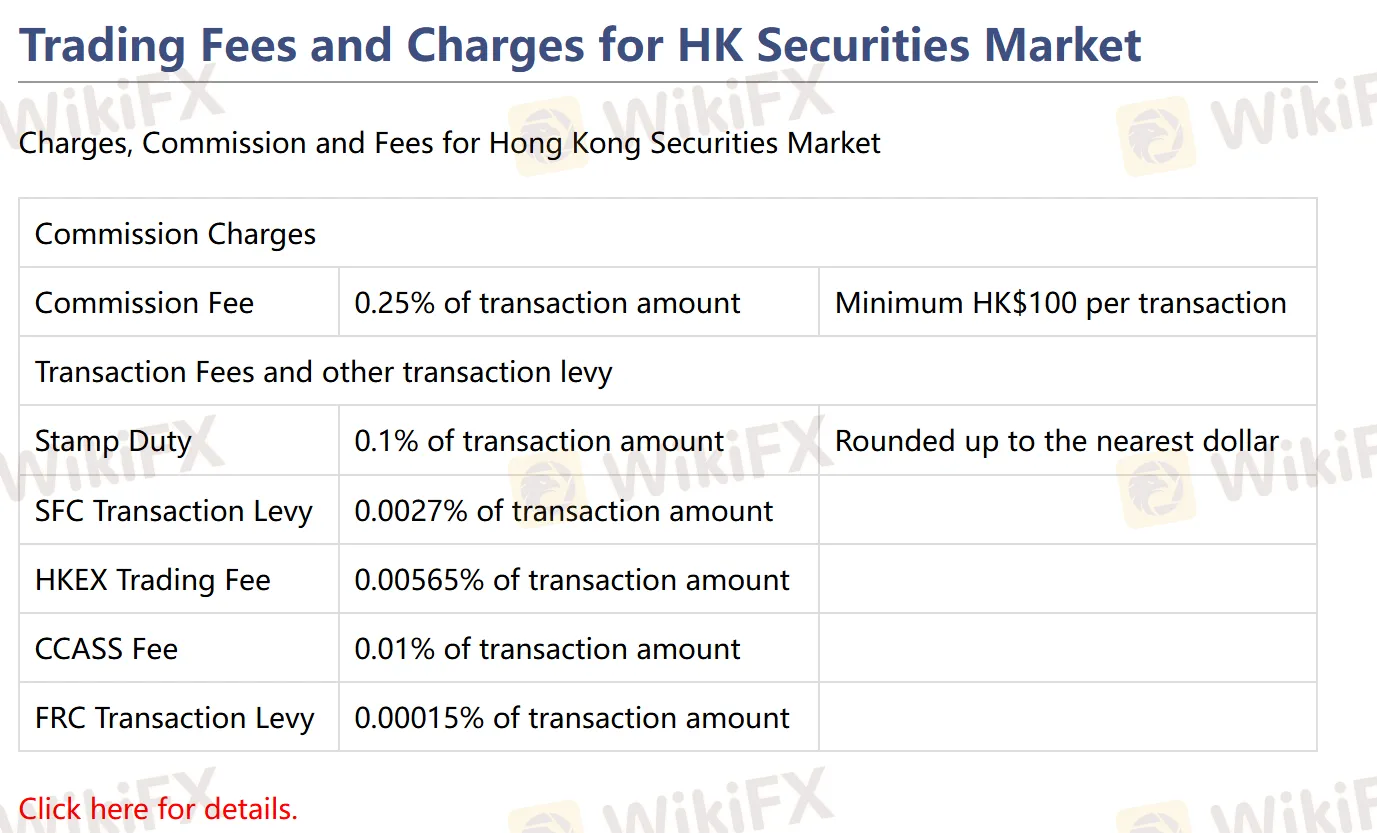

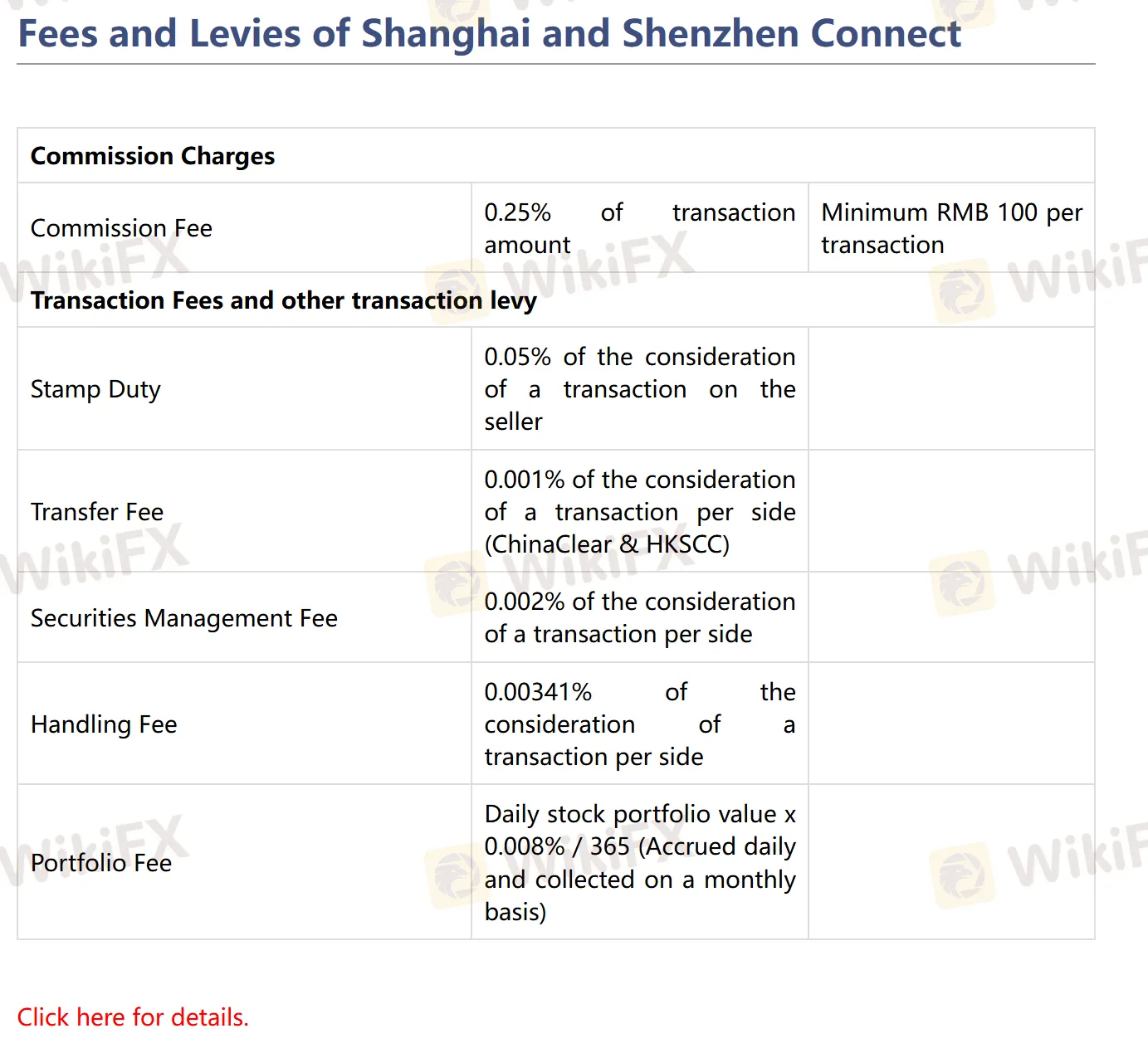

Commission : Selon le marché et le produit, le taux de commission varie de 0,15% à 0,25%, avec des frais minimum de HK$100 / RMB 100 / US$15.

Autres frais : y compris les droits de timbre, la taxe de la SFC, les frais de change, les frais de compensation, etc., les taux spécifiques et les minimums varient en fonction du marché et du produit.

Pour plus de détails, vous pouvez visiter leur site officiel : https://www.hjfi.hk/EN/ffssc.php

Plateforme de Trading

| Plateforme de Trading | Pris en Charge | Appareils Disponibles |

| Plateforme de Trading en Ligne ET Trade | ✔ | iPhone/iPad, Android |

| Plateforme de Trading en Ligne TradeGo | ✔ | iPhone/iPad, Android |

Dépôt et Retrait

| Type de Compte | Méthodes de Dépôt | Méthodes de Retrait |

| Compte Titres | Système de Paiement Rapide (FPS) | Système de trading en ligne |

| Virement Bancaire | Contacter le Service Client par email : csdept@hjfi.com.hk | |

| Dépôt par Chèque | ||

| Compte à Terme | Virement Bancaire | Contacter le Service Client par email : csdept@hjfi.com.hk |

| Dépôt par Chèque |