Présentation de l'entreprise

| Metaverse Securities Résumé de l'examen | |

| Fondé | 2021 |

| Pays/Région Enregistré | Hong Kong |

| Régulation | SFC |

| Instruments de Marché | Actions, Forex, Fonds Communs, ETF, SCPI |

| Plateforme de Trading | MetaStock, Fuyuan Benben et Yisheng Polestar Futures |

| Support Client | Téléphone : 400-688-3187 (Voie Rapide) |

| Téléphone : (00852) 2523 8221 (Commande Téléphonique) | |

| Fax : (00852) 2810 7978, (0755) 2665 8431 | |

| Adresse : 4806-07, 48/F, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong | |

Informations sur Metaverse Securities

Metaverse Securities est un courtier basé à Hong Kong qui propose une variété d'instruments de trading tels que des actions, du forex, des ETF et des SCPI. Malgré la gamme étendue de produits et une exécution rapide, sa licence réglementaire (AAW177) a expiré et les investisseurs doivent être prudents. La plateforme est principalement destinée aux débutants, prenant en charge MetaStock, Fuyuan Benben et Yisheng Polestar Futures, mais ne fournit pas de plateformes de trading avancées telles que MT5. La plupart des services de base sont gratuits, mais des frais de 20 HK$ par mois sont facturés pour les comptes inactifs.

Avantages et inconvénients

| Avantages | Inconvénients |

| Régulé par la SFC | Méthodes de paiement limitées |

| Variétés de trading abondantes | |

| Interprétation intraday rapide |

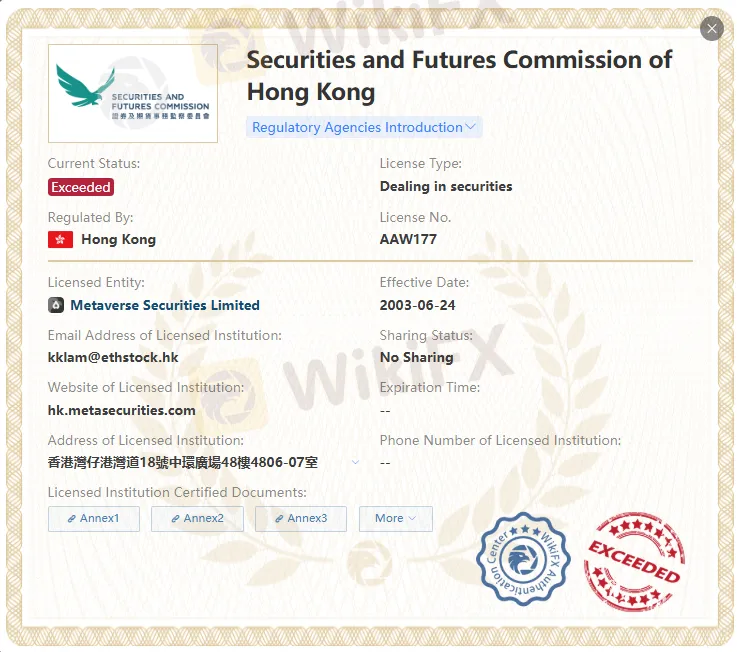

Metaverse Securities est-il légitime ?

Metaverse Securities dépasse le champ d'activité réglementé par la SFC de Hong Kong. Bien que Metaverse Securities prétende être réglementé par deux autorités, le certificat réglementaire avec le numéro de licence AAW177 a expiré. Veuillez être conscient du risque !

| Pays Réglementé | Autorité de Régulation | Statut Réglementaire | Entité Réglementée | Type de Licence | Numéro de Licence |

| Commission des Valeurs Mobilières et des Contrats à Terme de Hong Kong (SFC) | Réglementé | Meta Futures Limited | Négociation de contrats à terme | BSM300 |

| Commission des Valeurs Mobilières et des Contrats à Terme de Hong Kong (SFC) | Dépassé | Metaverse Securities Limited | Négociation de titres | AAW177 |

Que puis-je trader sur Metaverse Securities ?

Metaverse Securities propose plus de 30 000 produits d'investissement et à effet de levier. Les variétés de trading incluent : le forex, les actions, les ETF, les SCPI, les fonds communs de placement, etc.

| Actif de Trading | Disponible |

| Forex | ✔ |

| Actions | ✔ |

| Fonds Communs de Placement | ✔ |

| ETF | ✔ |

| SCPI | ✔ |

| Matieres Premieres | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

Frais

La plupart des services (tels que le dépôt de fonds, le retrait de fonds, le transfert d'actions, les frais de garde, etc.) sont gratuits.

Des frais spécifiques s'appliquent à des services spécifiques (par exemple, frais de transfert de timbres, frais d'enregistrement et de transfert, traitement des dividendes, etc.).

Les comptes inactifs sont soumis à des frais mensuels de HK$20.

Plateforme de Trading

| Plateforme de Trading | Pris en Charge | Appareils Disponibles |

| MetaStock | ✔ | Bureau, Mobile, Web |

| Fuyuan Benben | ✔ | Mobile |

| Yisheng Polestar Futures | ✔ | Bureau, Mobile |

Dépôt et Retrait

Metaverse Securities accepte les paiements via les banques suivantes : Bank of China (Hong Kong), Bank of Communications (Hong Kong), CMB Wing Lung Bank, China Minsheng Bank, Centron Bank, Nanyang Commercial Bank, Bank of East Asia, the Hongkong and Shanghai Banking Corporation Limited.